Tax Deductions Templates

Documents:

1801

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

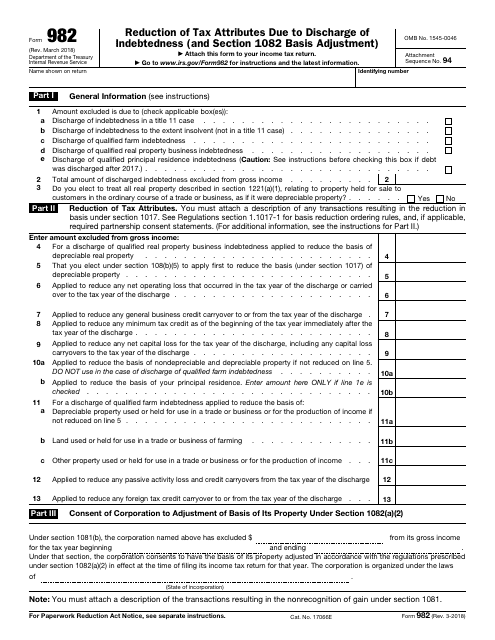

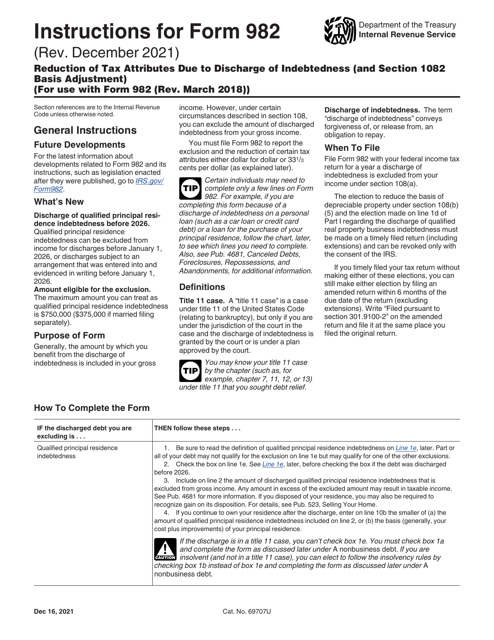

This is a formal instrument used by taxpayers to explain to fiscal authorities why certain debts should not be taken into account as a part of their income.

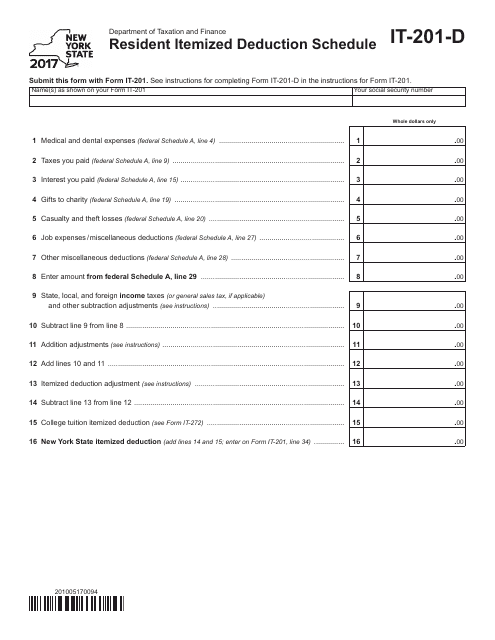

This form is used for reporting itemized deductions for residents of New York on their state tax return.

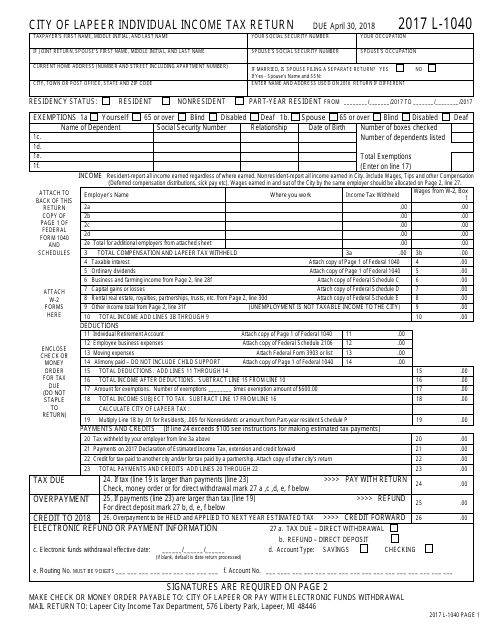

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

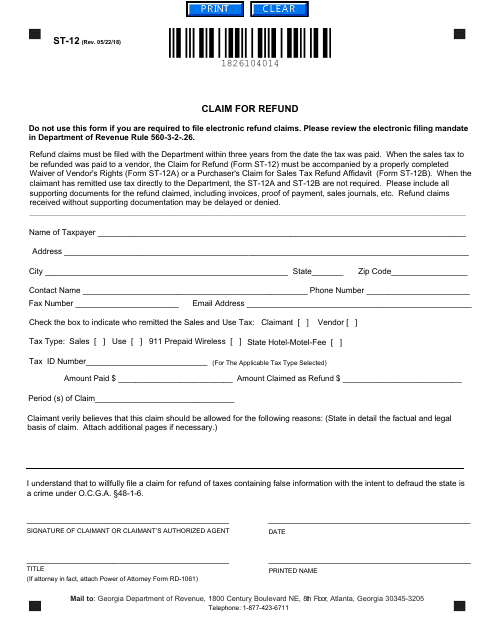

This Form is used for claiming a refund in the state of Georgia, United States.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

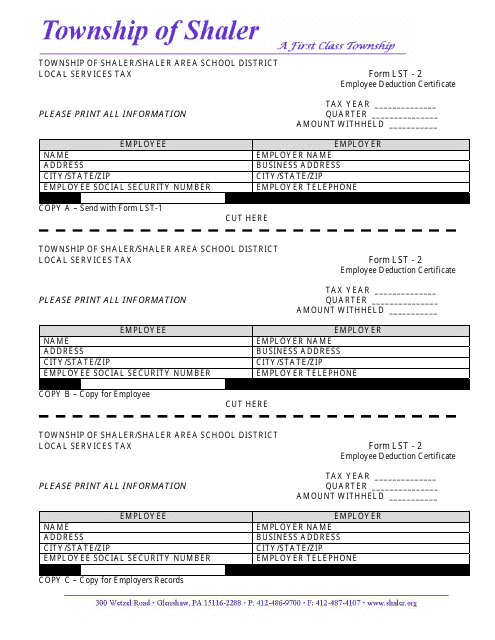

This form is used for obtaining an Employee Deduction Certificate from the Township of Shaler, Pennsylvania.

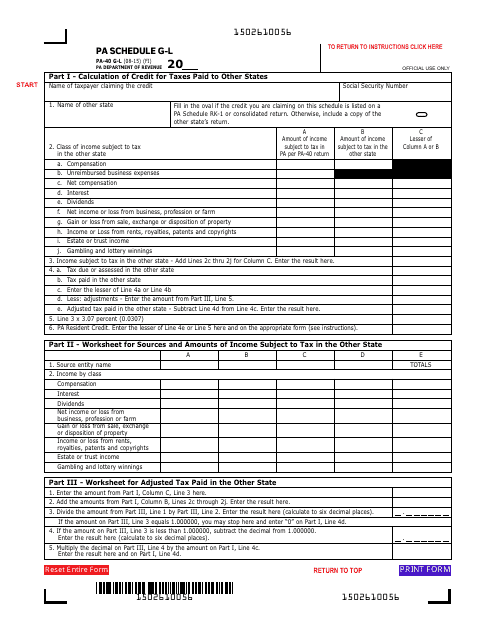

This form is used for claiming the Resident Credit for Taxes Paid in Pennsylvania for individuals filing their Pennsylvania state income tax return.

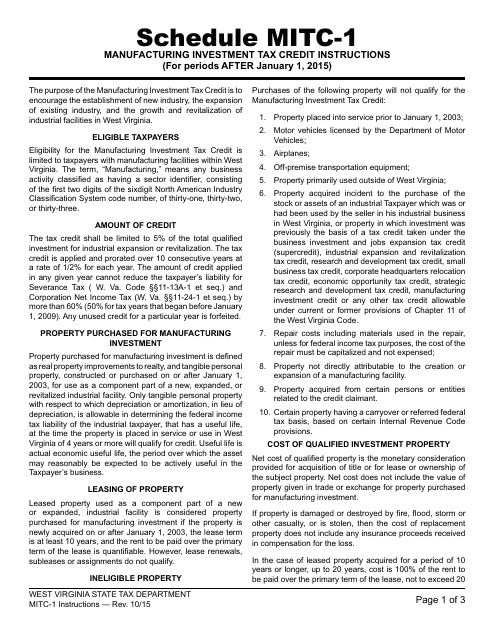

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

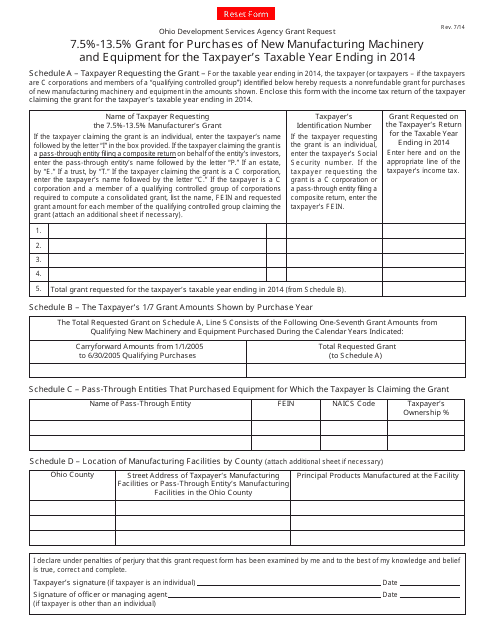

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

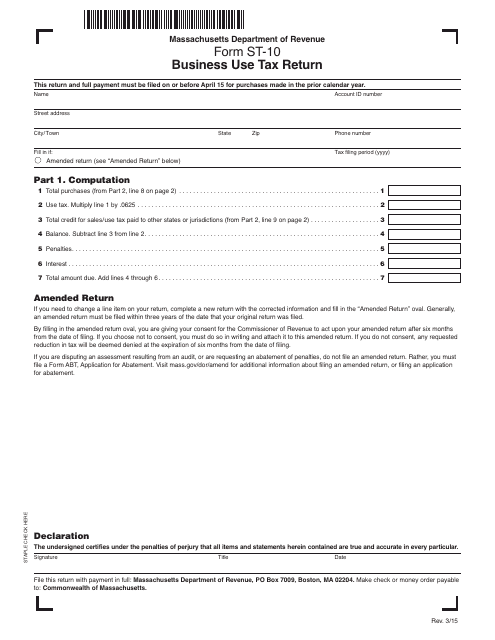

This form is used for reporting and paying business use tax in the state of Massachusetts.

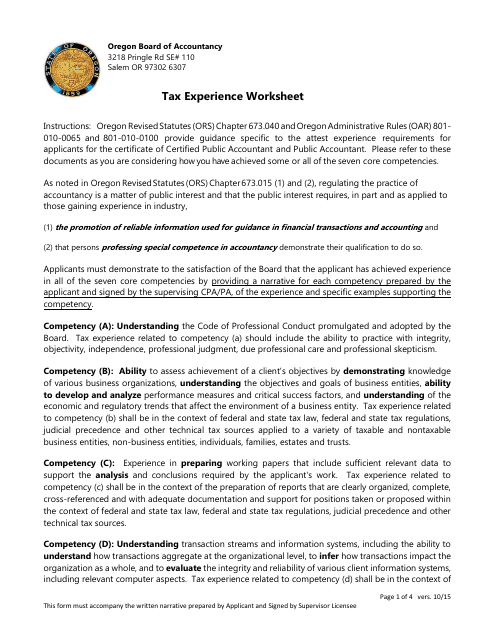

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

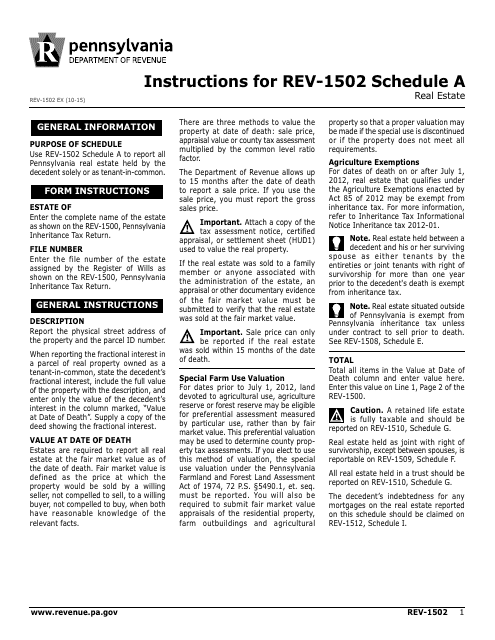

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

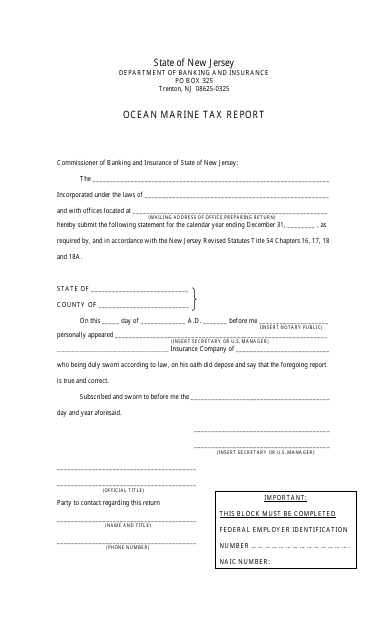

This document is used for reporting taxes related to ocean marine activities in the state of New Jersey.

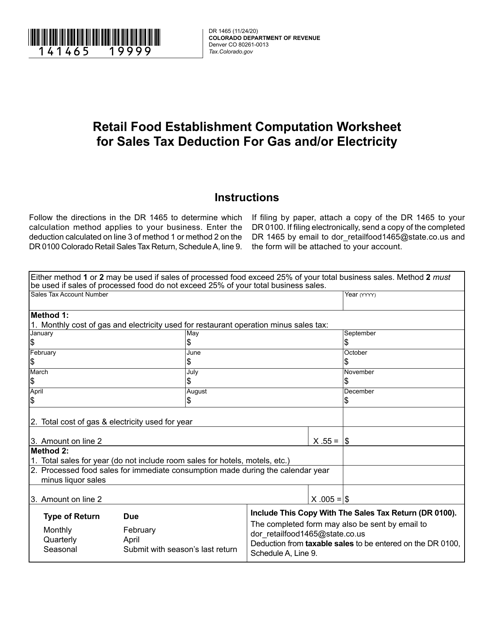

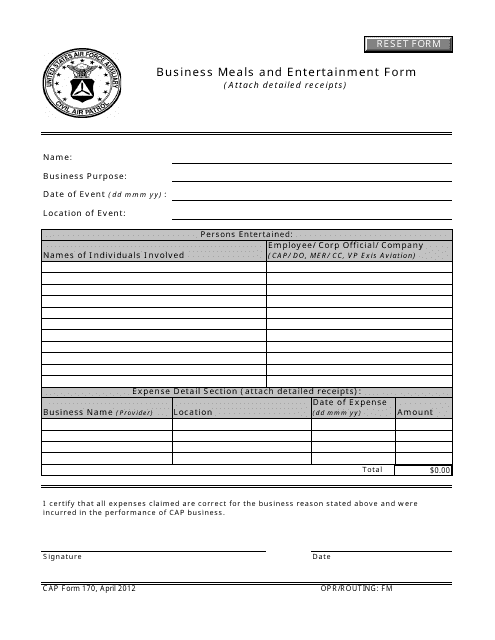

This Form is used for reporting business meals and entertainment expenses for tax purposes. It helps determine the deductible amount for these expenses.

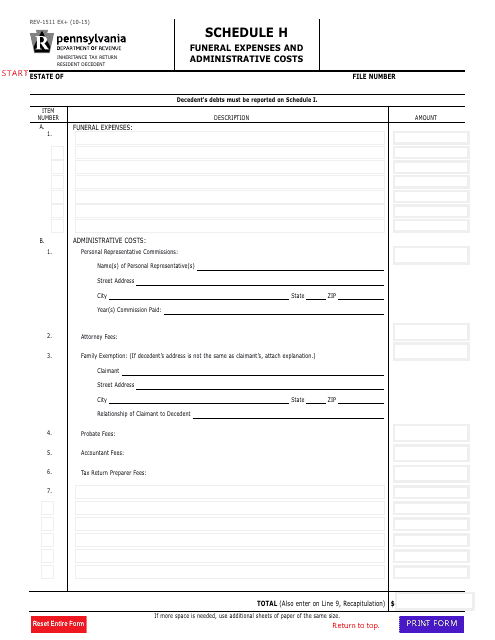

This Form is used for reporting funeral expenses and administrative costs in Pennsylvania.

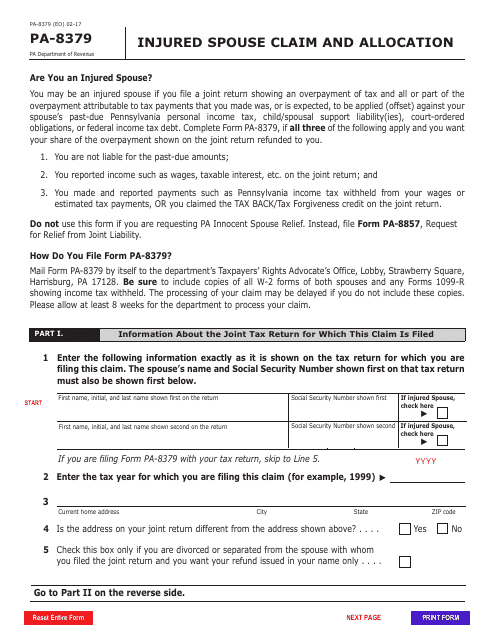

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.

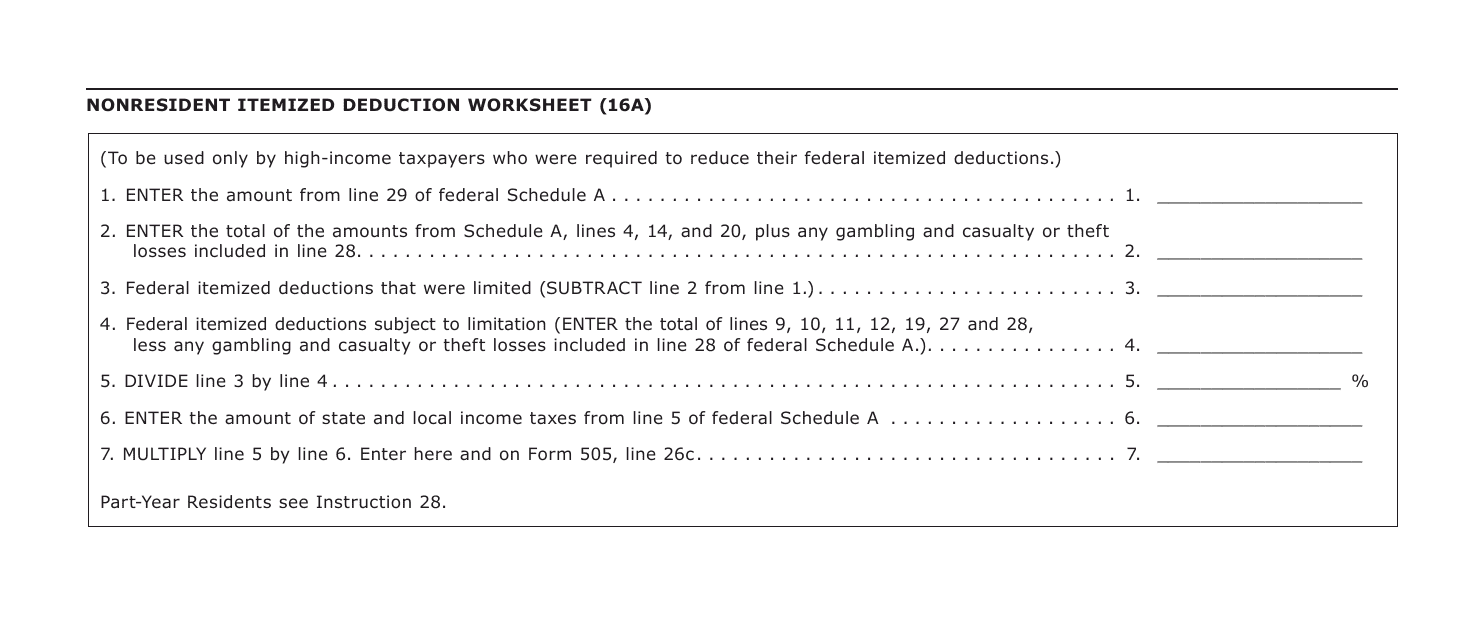

This form is used for calculating nonresident itemized deductions for Maryland state taxes.

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

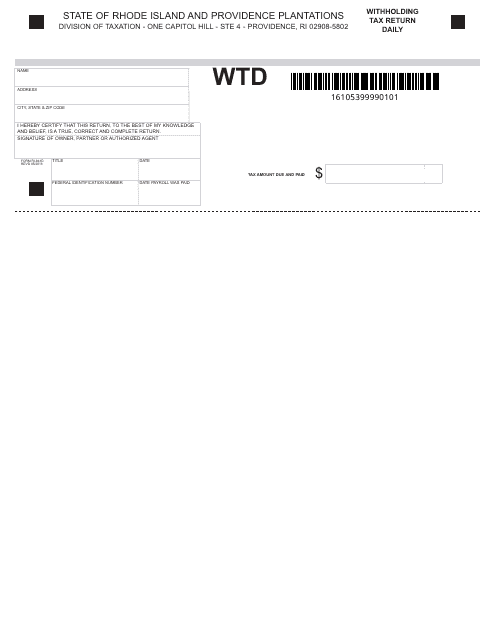

This Form is used for reporting and remitting the withholding tax withholdings made on a daily basis in the state of Rhode Island.

This is a document you may use to figure out how to properly complete IRS Form 6765