Tax Deductions Templates

Tax Deductions: Maximize Your Savings

Are you looking for ways to save on your taxes? Look no further! Our comprehensive collection of documents on tax deductions is here to help you maximize your savings. Whether you're an individual taxpayer, a business owner, or a freelancer, understanding which expenses can be deducted can make a significant difference in your annual tax bill.

Our tax deductions resources provide clear and concise instructions to help you navigate the often complex world of tax deductions. Discover how to claim deductions for various expenses, such as alternative fuel vehicle refueling property credits, rehabilitation expenses, organic foods production tax credits, and more. With our easy-to-follow guides, you'll gain a better understanding of the tax deductibility of these expenses and ensure you're not leaving any money on the table.

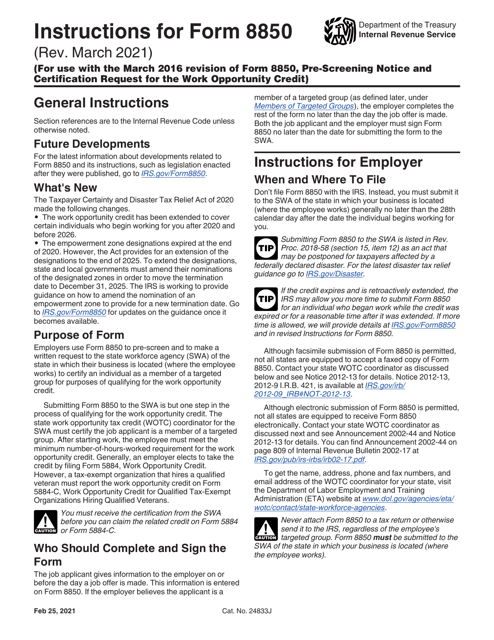

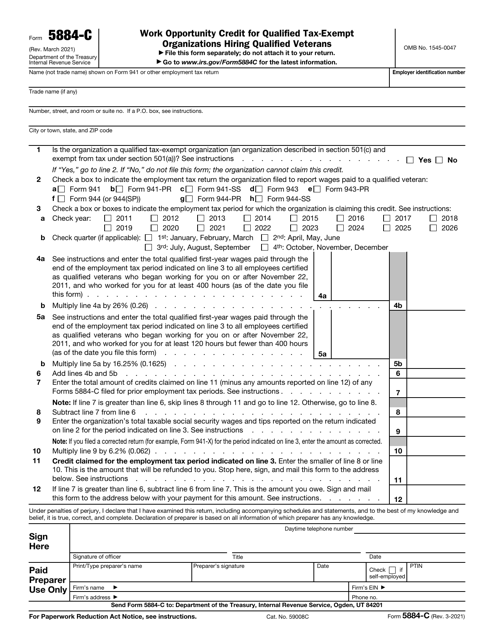

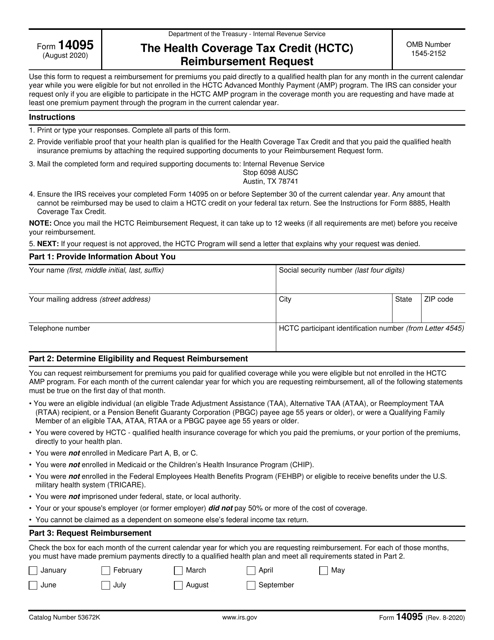

Our tax deduction documents collection includes a range of forms that will assist you in accurately reporting your deductions to the appropriate tax authorities. Whether it's the IRS form 8911 or the Canada-specific Form T2200S, we have the resources you need to complete these forms correctly, ensuring compliance while maximizing your tax savings.

Understanding tax deductions can be challenging, but with our expertly curated collection of documents, you'll have all the information and resources you need at your fingertips. Say goodbye to confusion and hello to a more substantial tax refund or reduced tax liability.

If you're seeking comprehensive guidance on tax deductions, you've come to the right place. Our tax deduction knowledge base is your one-stop shop for all your tax-saving needs. Start exploring our collection now and take the first step towards optimizing your finances.

Documents:

1801

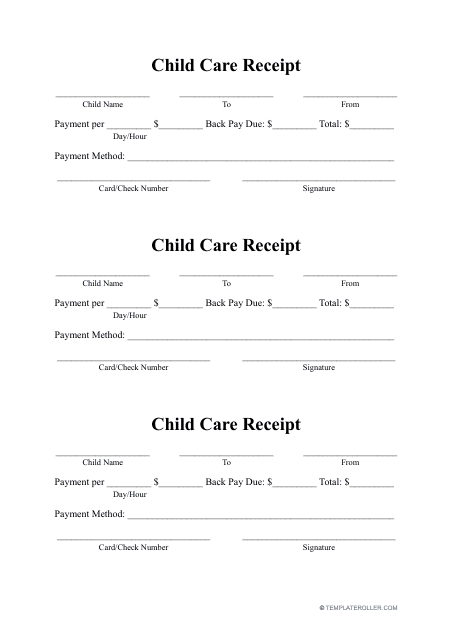

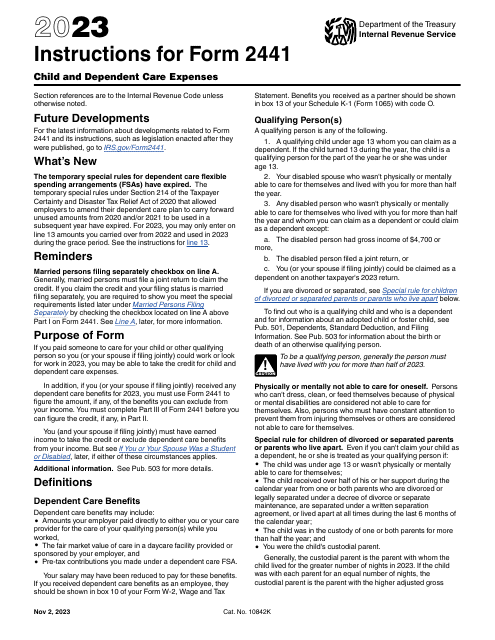

This is a formal document that confirms a payment has been received for child care services.

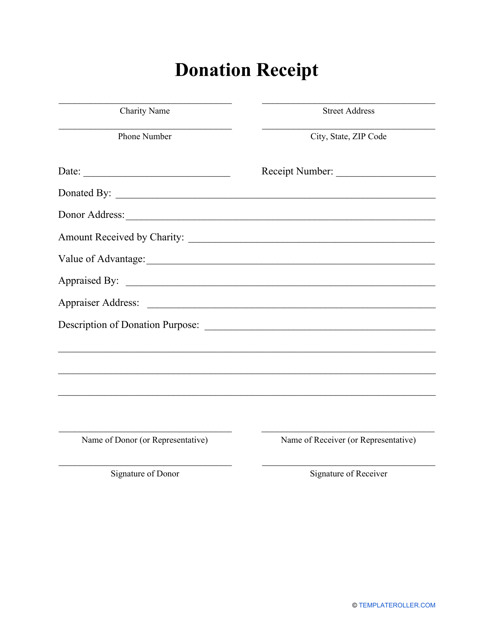

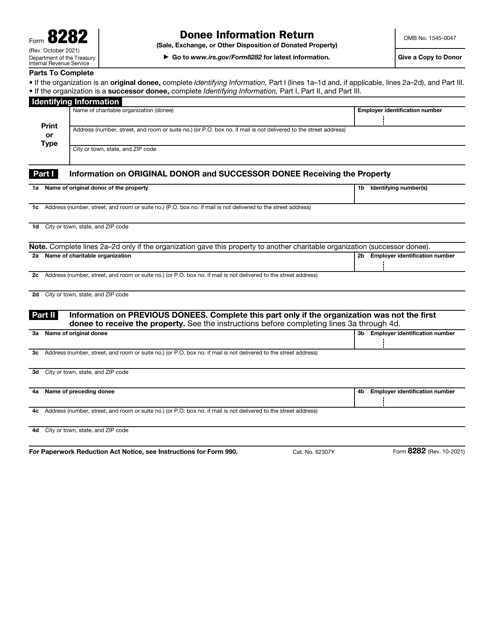

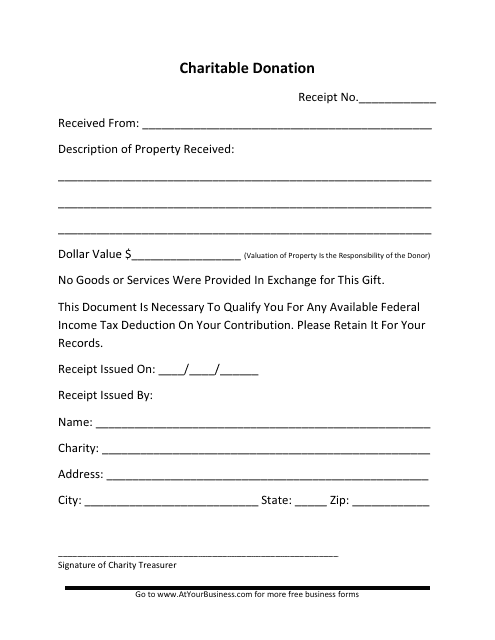

This is a document used to provide a record of a gift being donated to a charitable organization.

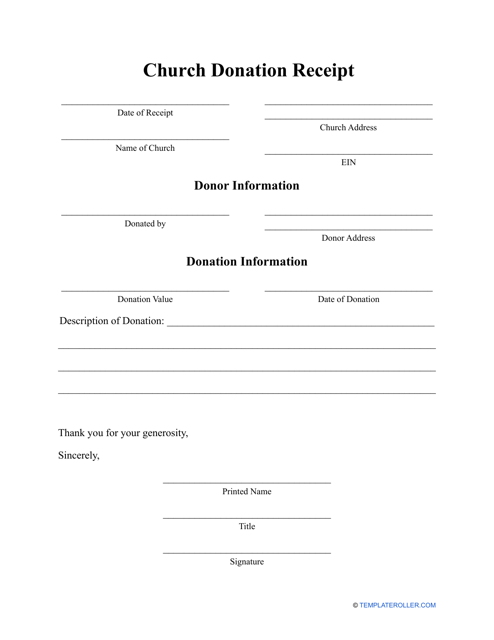

This type of template acts as a document that keeps a note of any donations that have been gifted to a church.

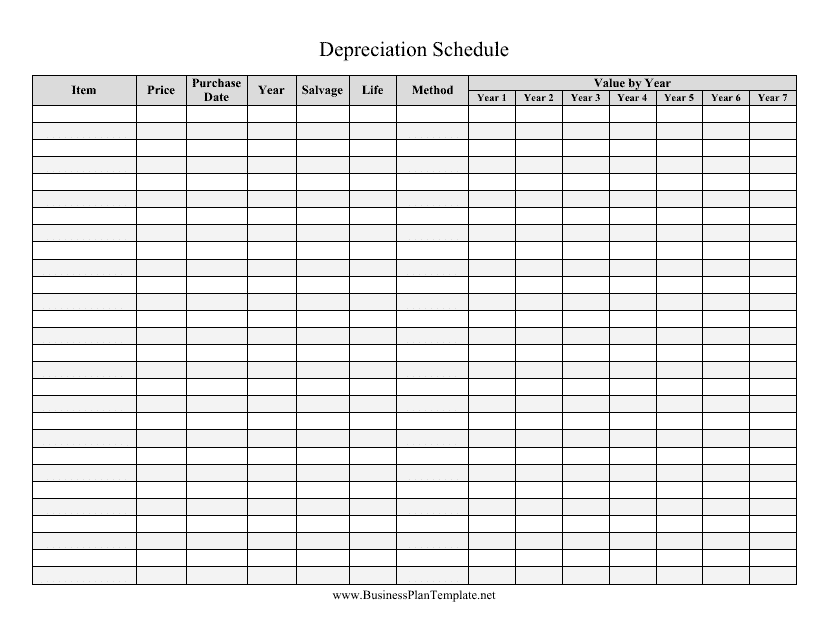

This document provides a template for creating a schedule that determines the depreciation of assets over time. It is useful for businesses to track the decrease in value of their assets for accounting and tax purposes.

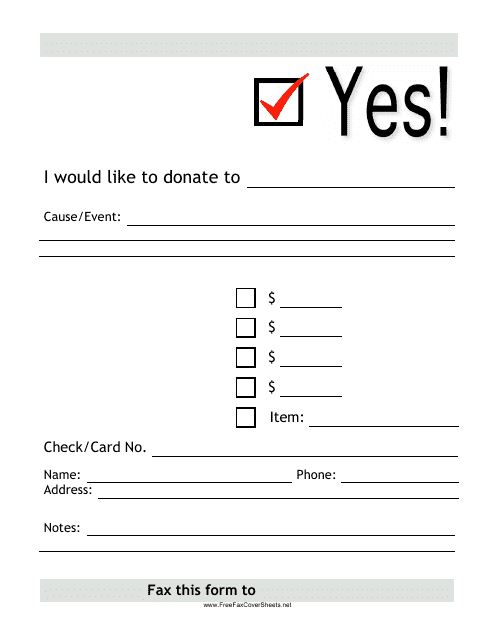

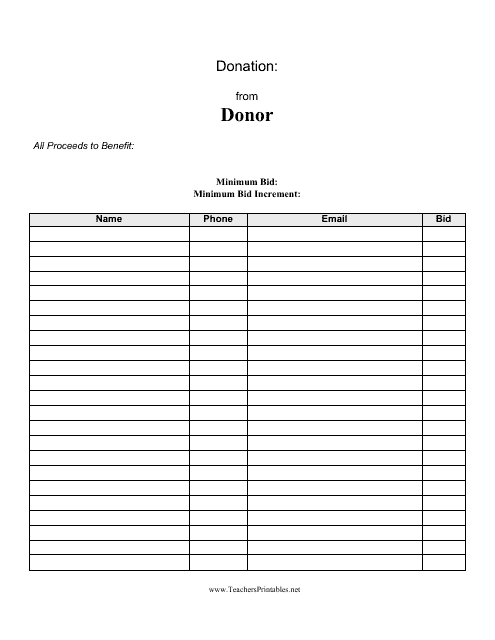

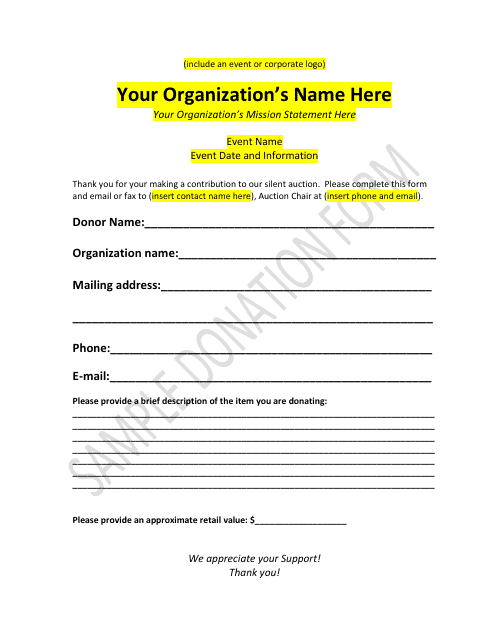

This document is for collecting donations. Use it to provide necessary details and allow individuals to contribute to your cause.

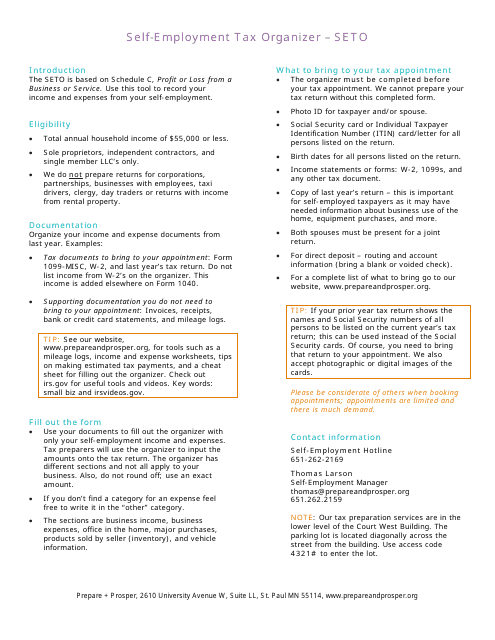

This document is a template used for organizing self-employment taxes. It helps self-employed individuals keep track of their income, expenses, and deductions for tax reporting purposes.

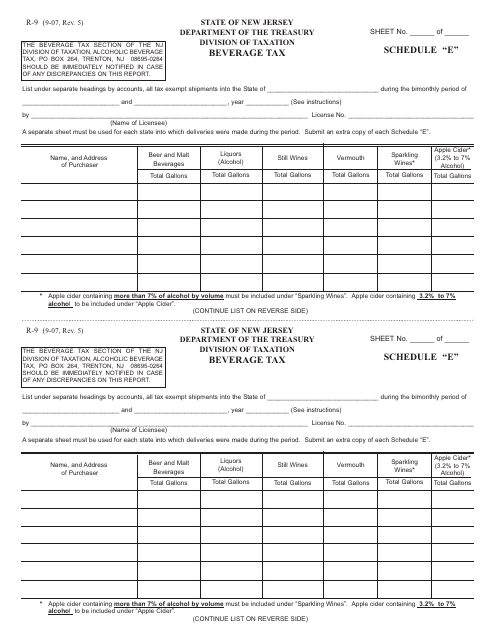

This form is used for reporting and paying beverage tax in the state of New Jersey.

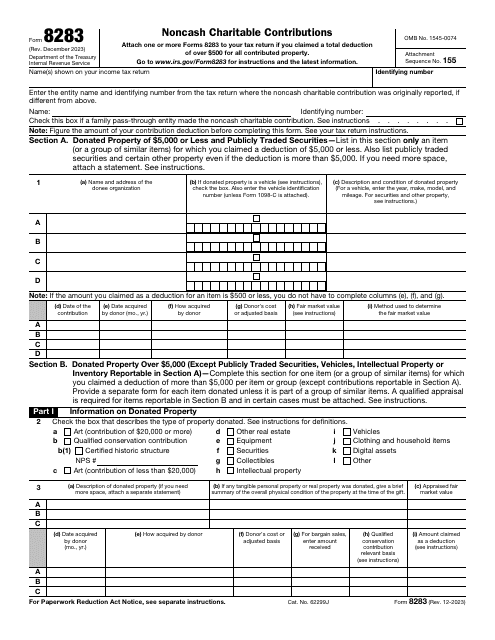

This Form is used for making charitable donations to non-profit organizations.

This document is used for collecting donations. It provides a sample template that can be used for individuals or organizations to gather information and contributions from donors.

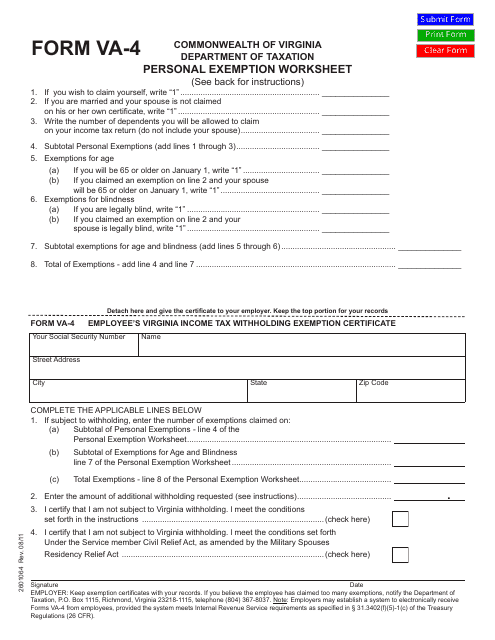

This form is used for calculating personal exemptions for tax purposes in the state of Virginia.

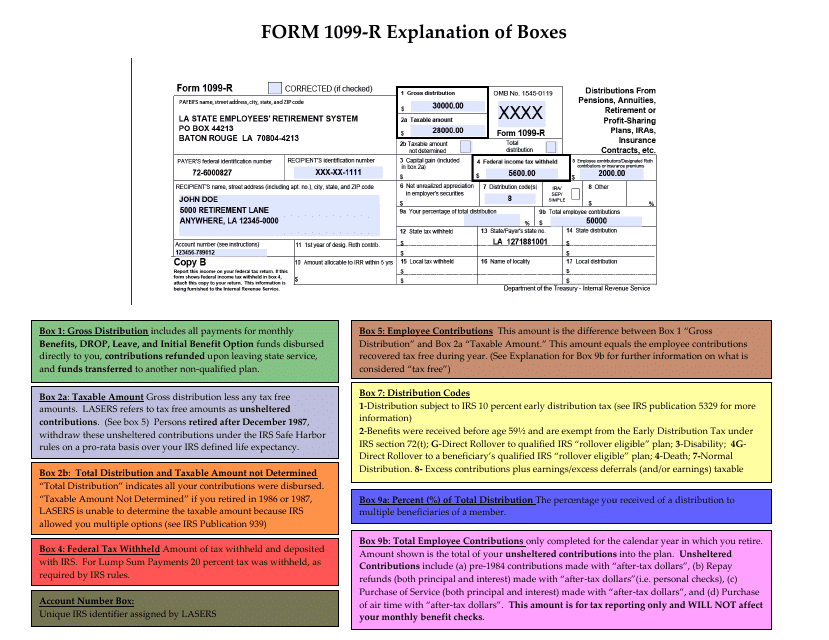

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

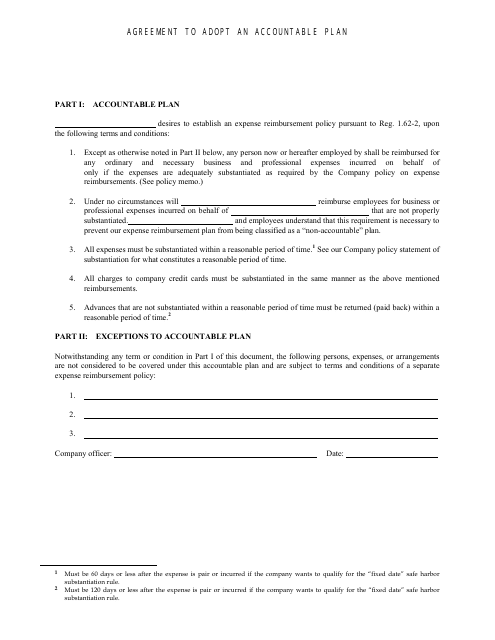

This document is used to establish an accountable plan for reimbursing business expenses incurred by employees.

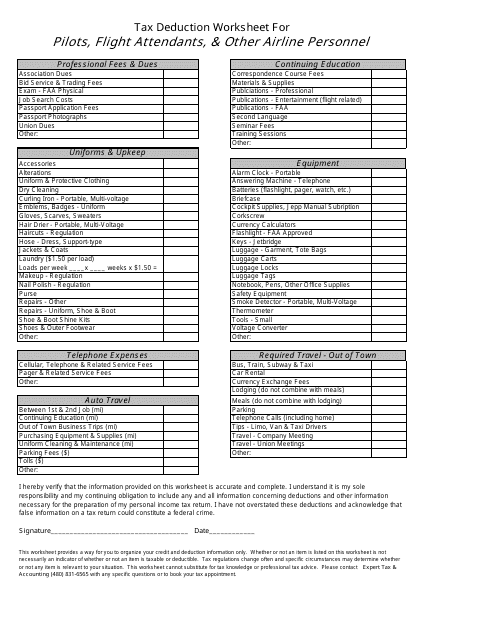

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

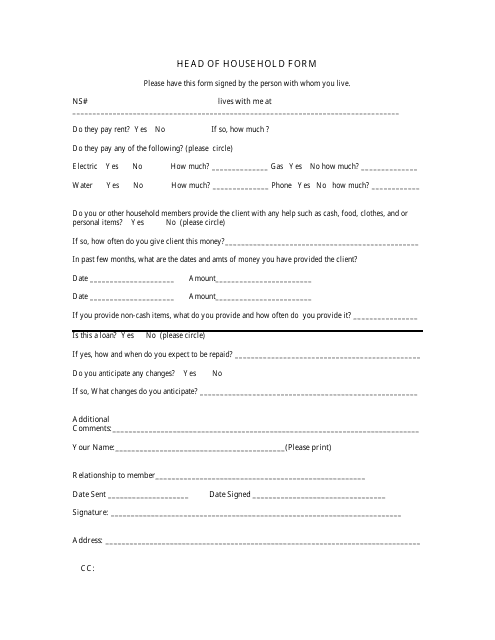

This form is used for individuals who qualify as a "head of household" for tax purposes. It helps determine your filing status and eligibility for certain tax credits and deductions.

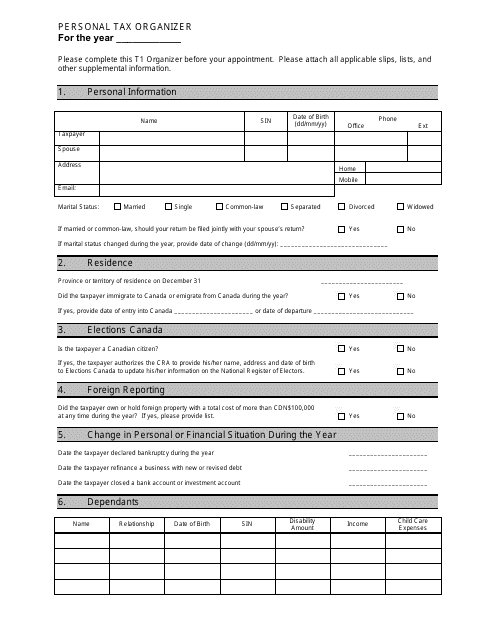

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

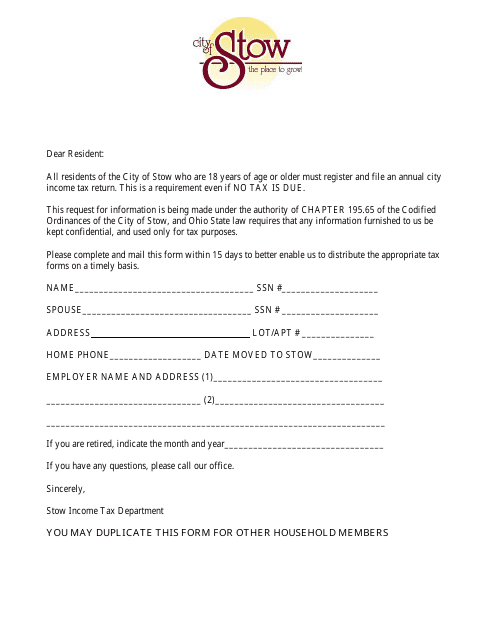

This Form is used for filing your income tax return in the City of Stow, Ohio.

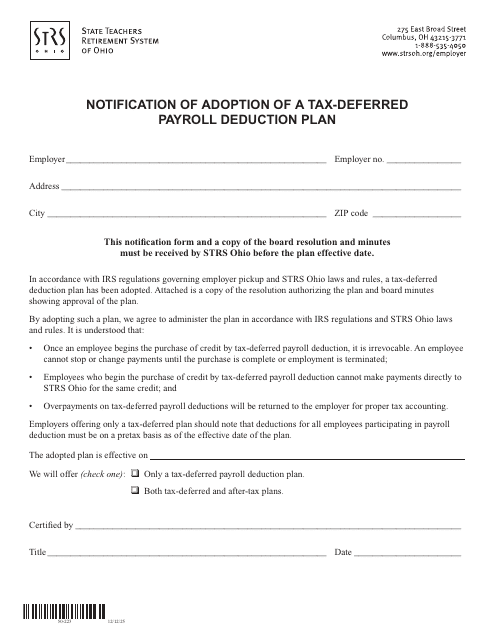

This document is a notification of the adoption of a tax-deferred payroll deduction plan by the State Teachers Retirement System of Ohio. It provides information about the plan and how it will affect Ohio teachers' retirement savings.

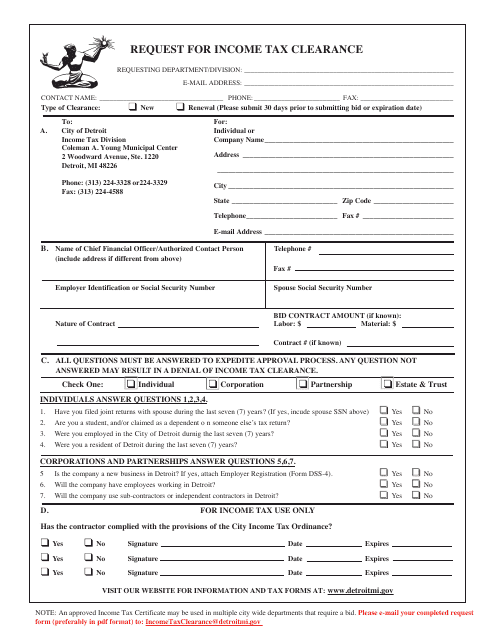

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

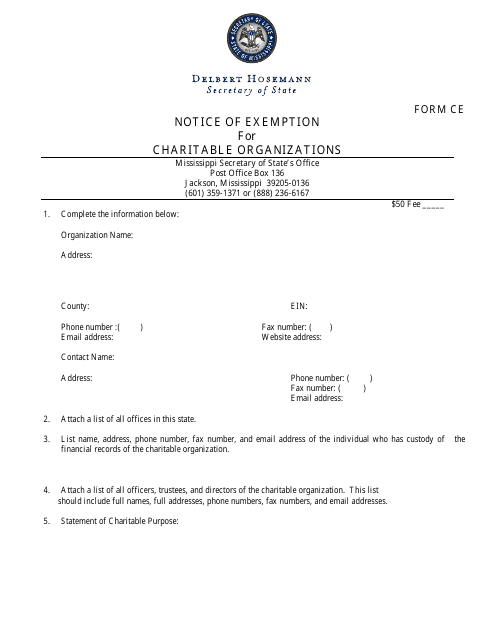

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

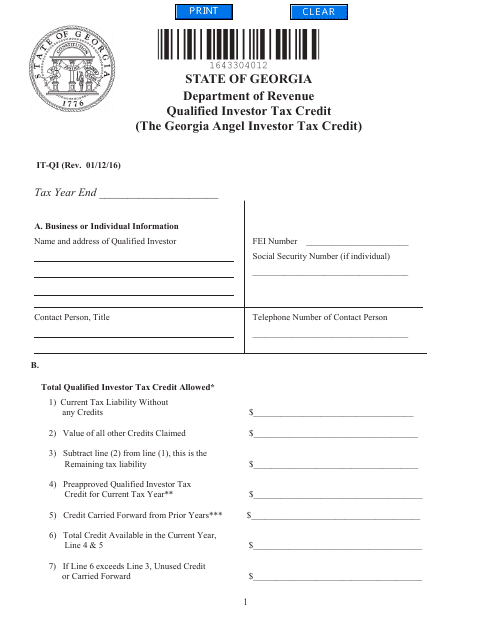

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

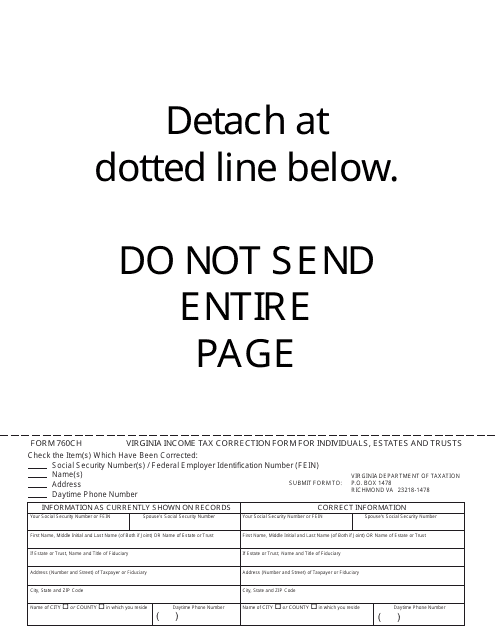

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

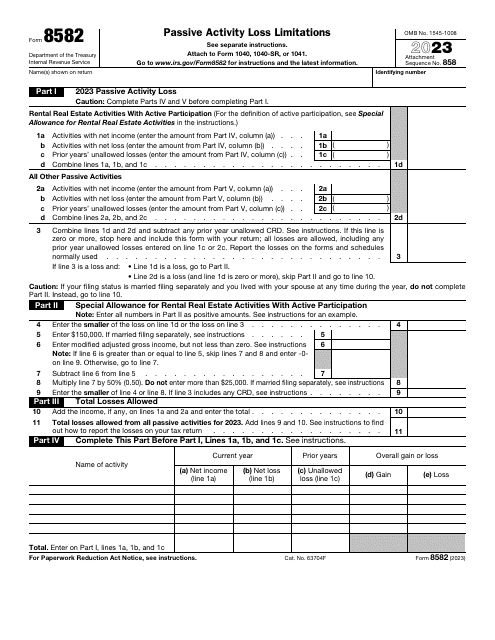

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

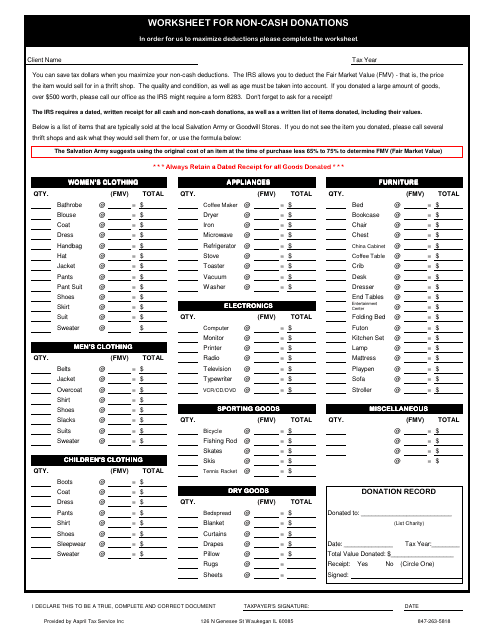

This document is a non-cash donations worksheet template provided by Aapril Tax Service Inc. It helps individuals track their non-cash donations for tax purposes.