Sales Tax Templates

Sales tax is a mandatory tax imposed on the sale of goods and services. It is an important source of revenue for governments that fund various public services. If you are a business owner or an individual who has engaged in taxable transactions, understanding and complying with sales tax regulations is crucial.

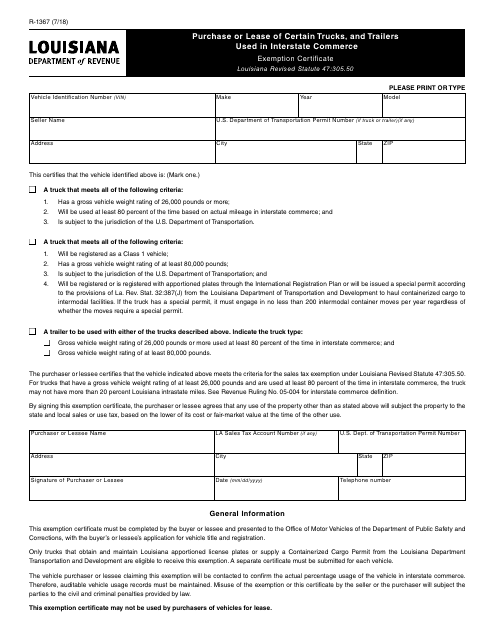

At times, it can be challenging to navigate through the complex world of sales tax. That's where our comprehensive collection of sales tax documents comes in handy. Whether you are looking for sales tax forms, sales tax documentation, or sales tax templates, our extensive library has got you covered.

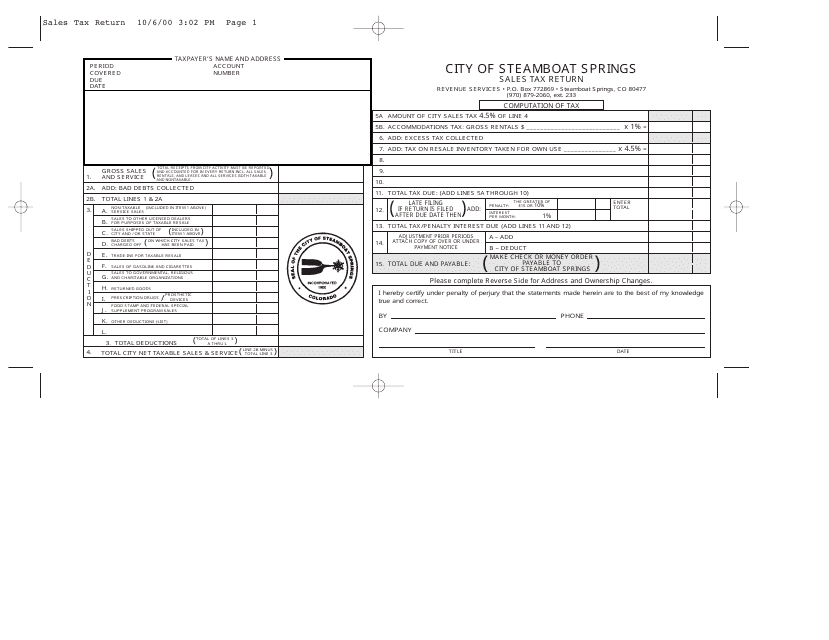

Our collection includes a wide range of documents that cater to different jurisdictions and requirements. For instance, you will find forms like the Sales Tax Return Form, which is specific to the City of Steamboat Springs, Colorado. We also provide instructions for forms such as Form AU-12 Application for Credit or Refund of Sales or Use Tax - Qualified Empire Zone Enterprise (Qeze) in New York.

Additionally, we have documents issued by the Internal Revenue Service (IRS) such as Form 8849 Sales by Registered Ultimate Vendors, which helps businesses claim credits or refunds for certain sales taxes. If you operate in Wisconsin, our library features Form S-012CT Schedule CT County Sales and Use Tax Schedule, ensuring you stay compliant with the state's sales tax regulations.

Furthermore, our collection includes essential documents like Form REG-1E Application for ST-5 Exempt Organization Certificate for Nonprofit Exemption from Sales Tax in New Jersey, which is crucial for tax-exempt organizations.

With our comprehensive sales tax document collection, you'll have the necessary resources to file your taxes accurately, claim credits or refunds, and ensure compliance with the applicable laws and regulations. Take advantage of our extensive library of sales tax documents, which includes sales tax forms, tax sale documents, and tax sale forms, to streamline your tax processes and avoid costly penalties.

Don't let sales tax become a burden - let our comprehensive collection of sales tax documents simplify the process for you. Access our library today and stay on top of your sales tax obligations.

Documents:

663

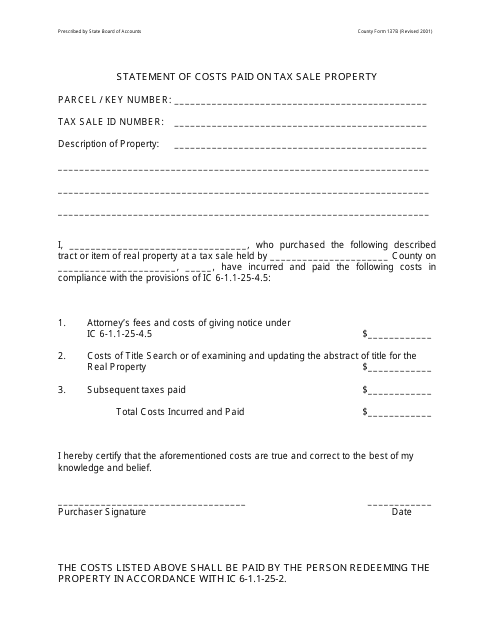

This Form is used for reporting the costs paid on a tax sale property in Ripley County, Indiana. It provides a summary of the expenses incurred during the tax sale process.

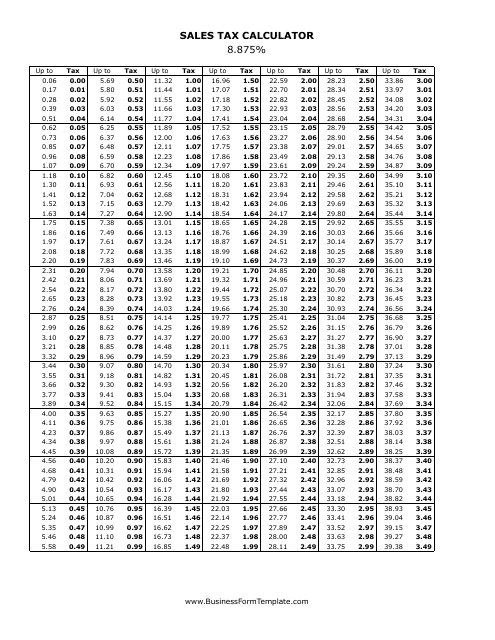

This document provides a tool to calculate sales tax at a rate of 8.875%.

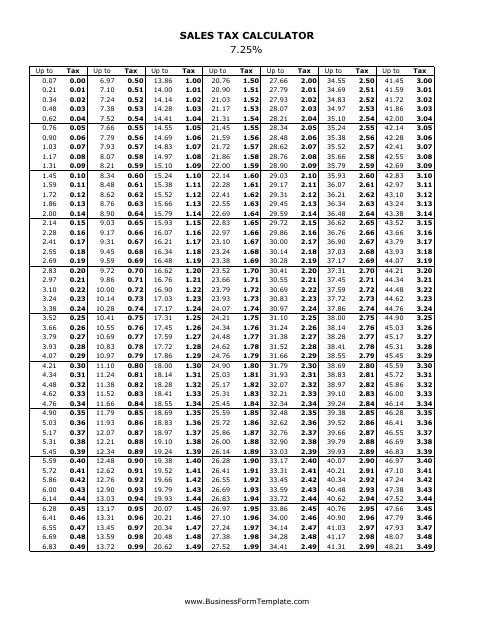

This document provides a calculator to determine the sales tax amount at a rate of 7.25%.

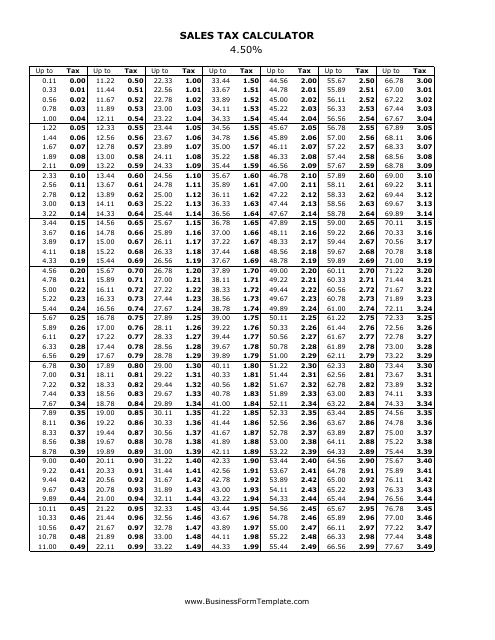

This document is a sales tax calculator that helps you determine the amount of sales tax you need to pay based on a 4.5% tax rate.

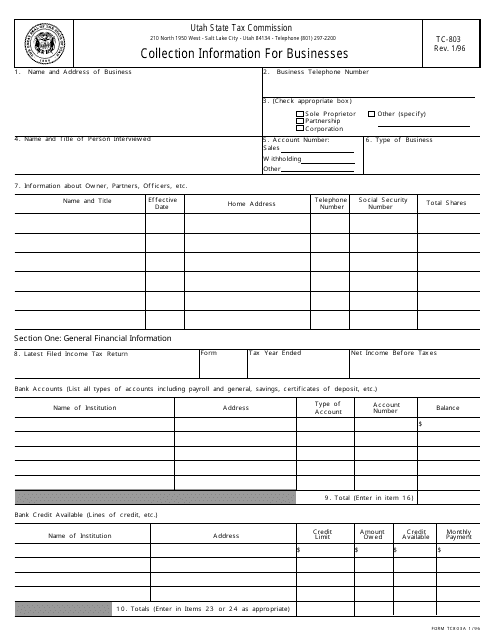

This form is used for businesses in Utah to provide collection information.

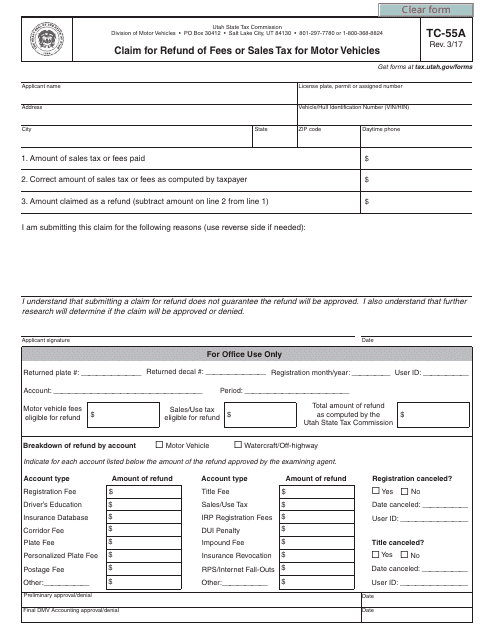

This form is used for claiming a refund of fees or sales tax paid for motor vehicles in Utah.

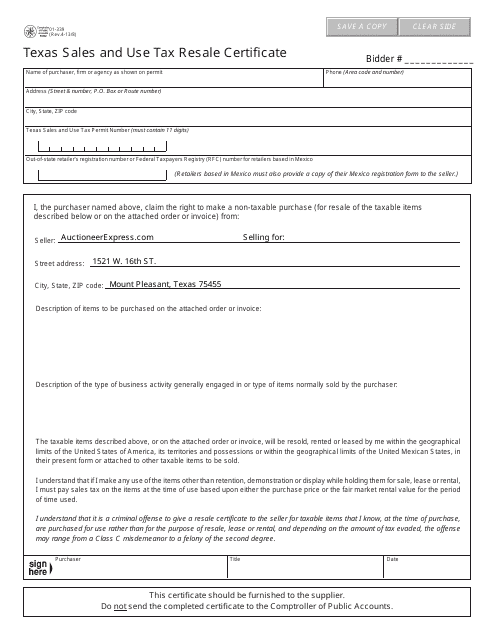

This is a legal form presented by a purchaser to a seller from whom the purchaser buys the goods with the purpose of resale in the state of Texas.

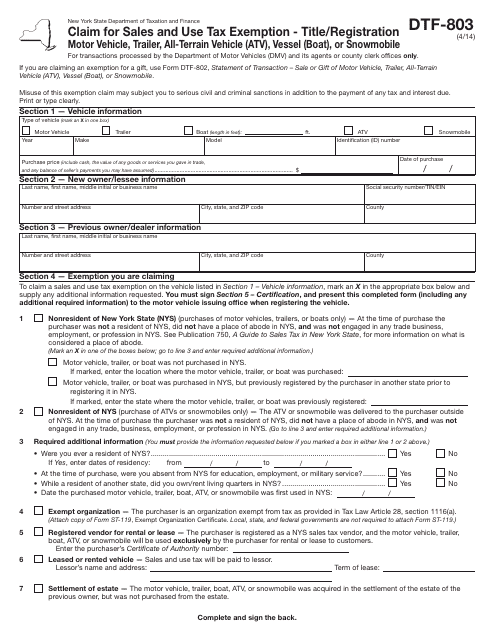

This form is used for claiming sales and use tax exemption when registering a title in New York.

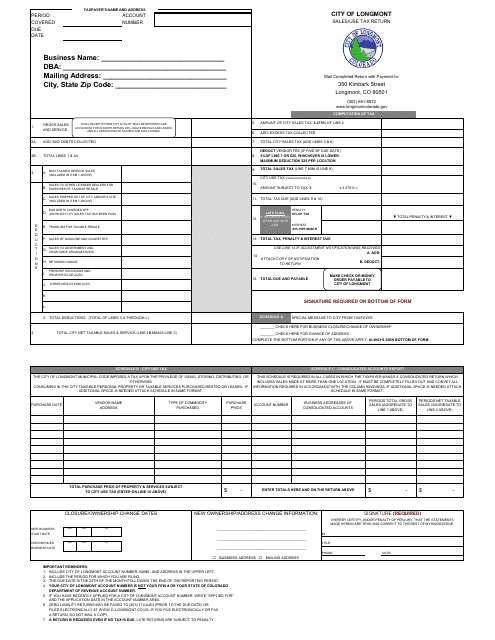

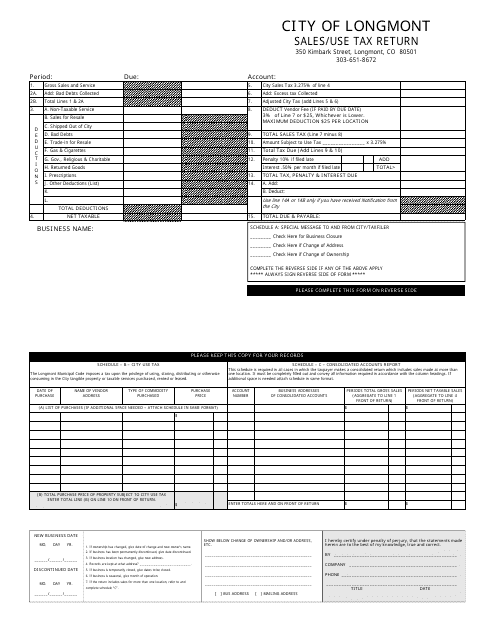

This form is used to report and pay sales and use taxes to the City of Longmont, Colorado. It is used by businesses and individuals who have made taxable sales or purchases within the city.

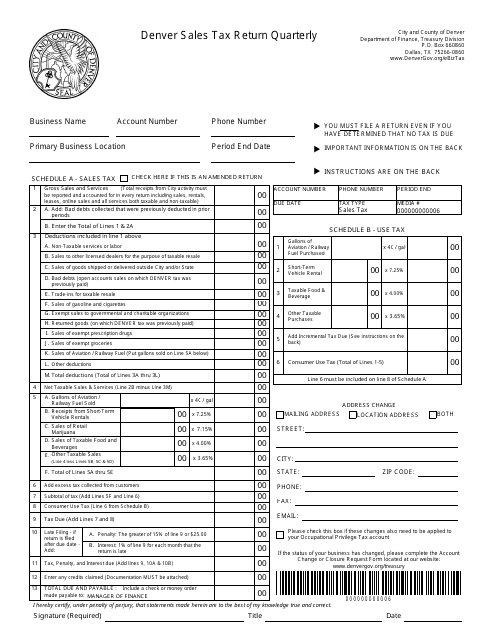

This document is used for reporting and paying sales tax on a quarterly basis for businesses operating in the City and County of Denver, Colorado.

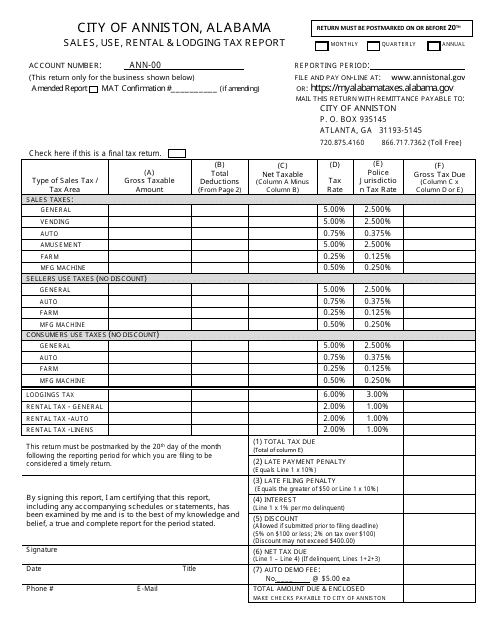

This document is used for reporting sales, use, rental, and lodging taxes in the City of Anniston, Alabama.

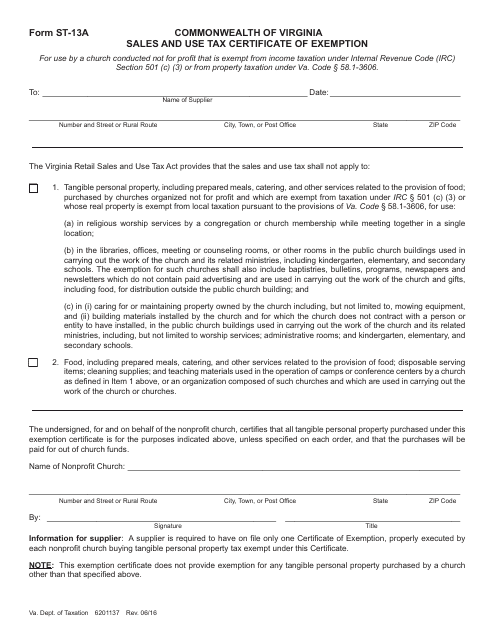

This document is used for claiming exemption from sales and use tax in Virginia. It is commonly used by individuals and organizations purchasing goods or services for certain exempt purposes.

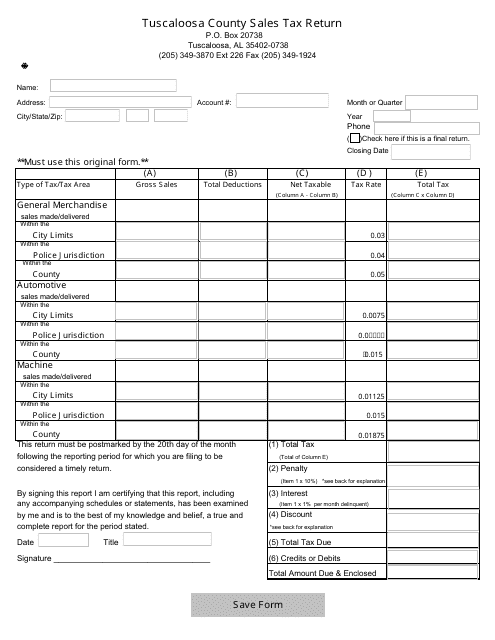

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

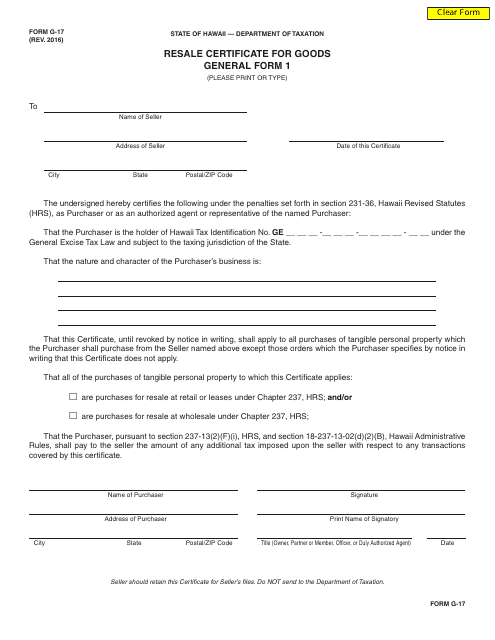

This form is used for applying for a resale certificate for goods in the state of Hawaii. It allows businesses to purchase goods for resale without paying sales tax.

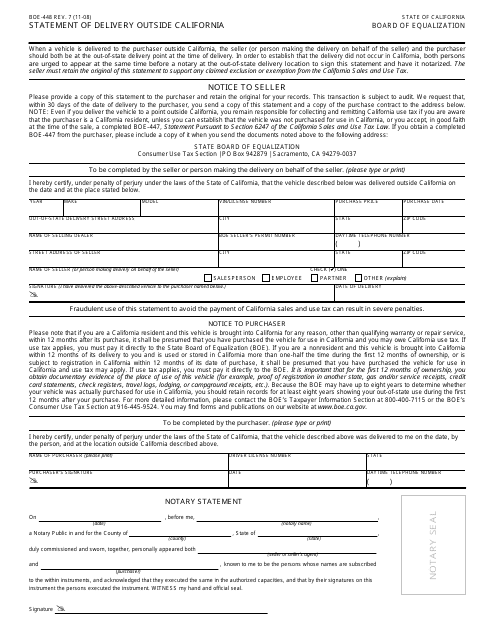

This form is used for reporting deliveries made outside of California for businesses based in California.

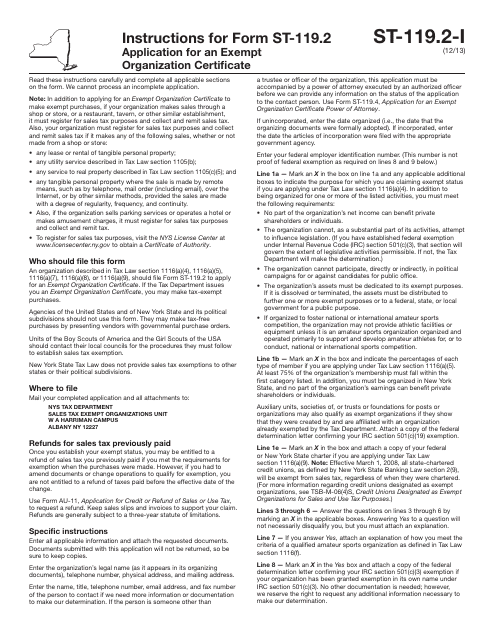

This document is used for applying for an Exempt Organization Certificate in New York.

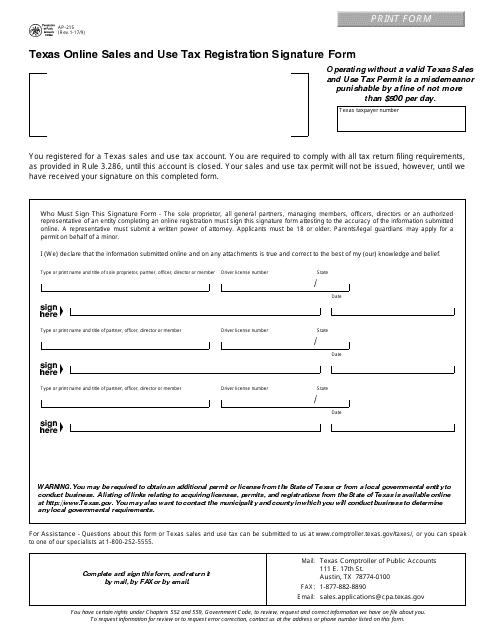

This document is used for registering for sales and use tax in Texas, and it requires your signature.

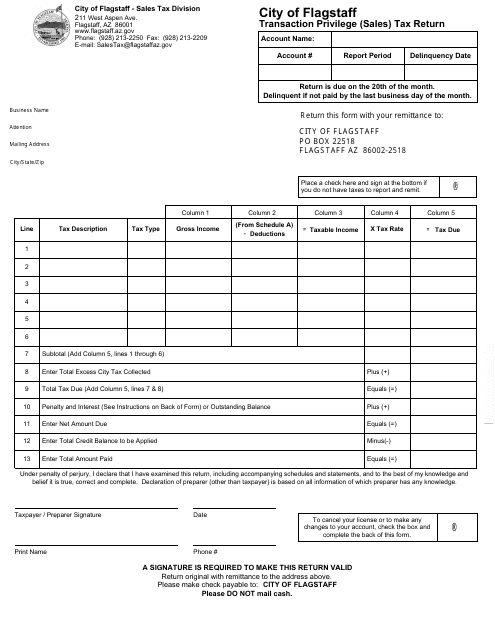

This document is used for filing sales tax returns with the City of Flagstaff, Arizona.

This Form is used for filing sales and use tax returns in LONGMONT, Colorado.

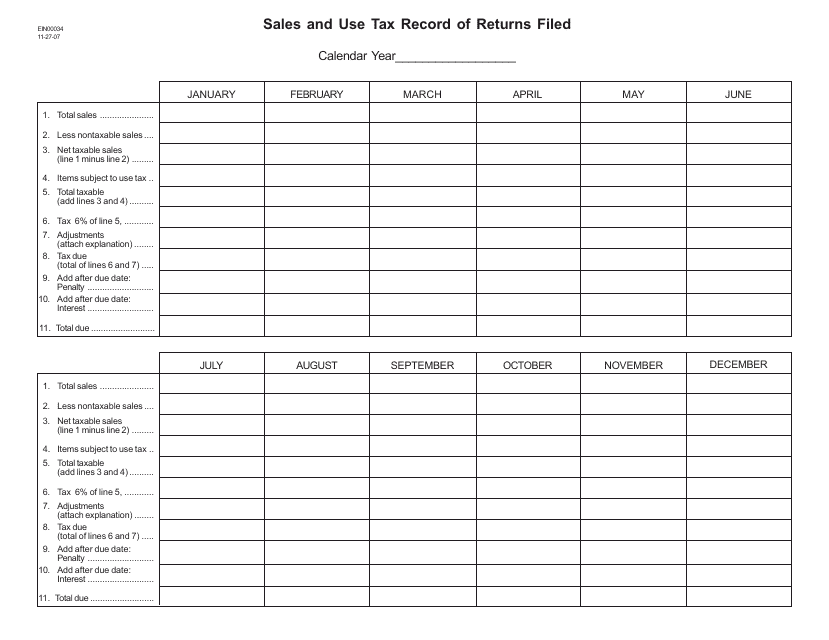

This form is used for recording sales and use tax returns filed in the state of Idaho.

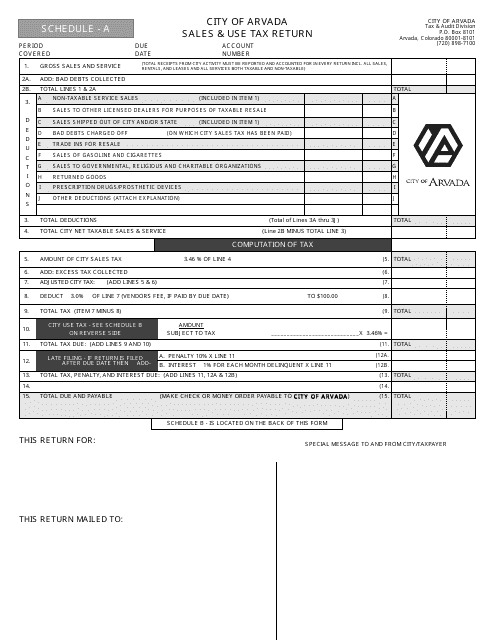

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

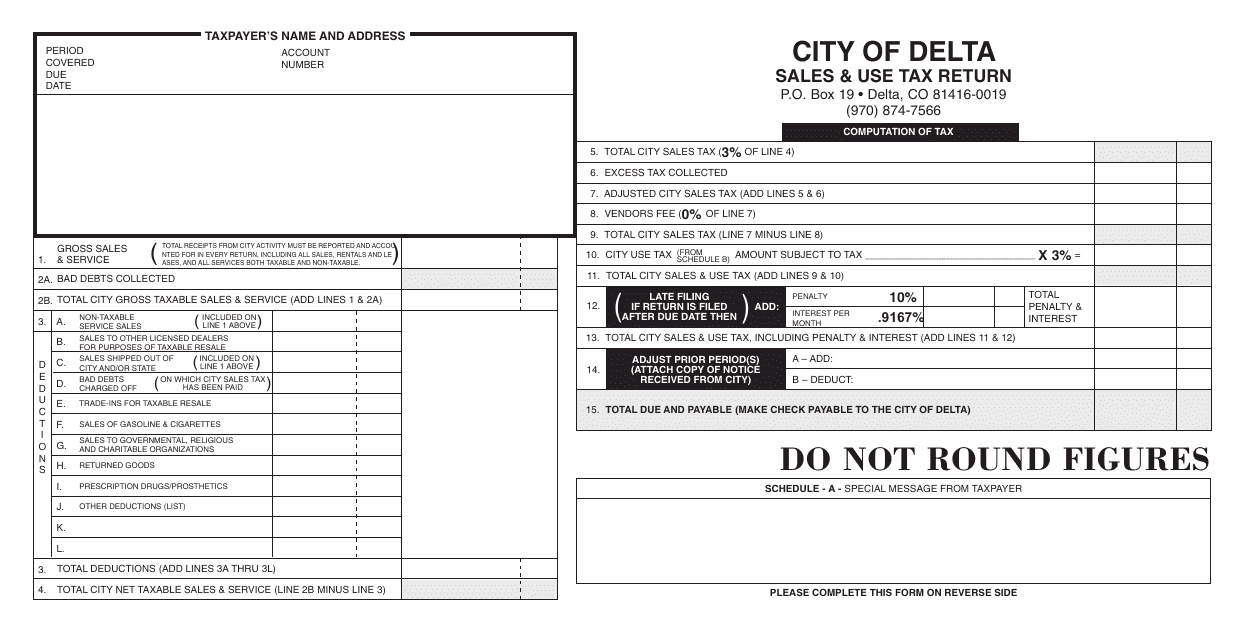

This form is used for reporting and submitting sales and use tax to the City of Delta, Colorado.

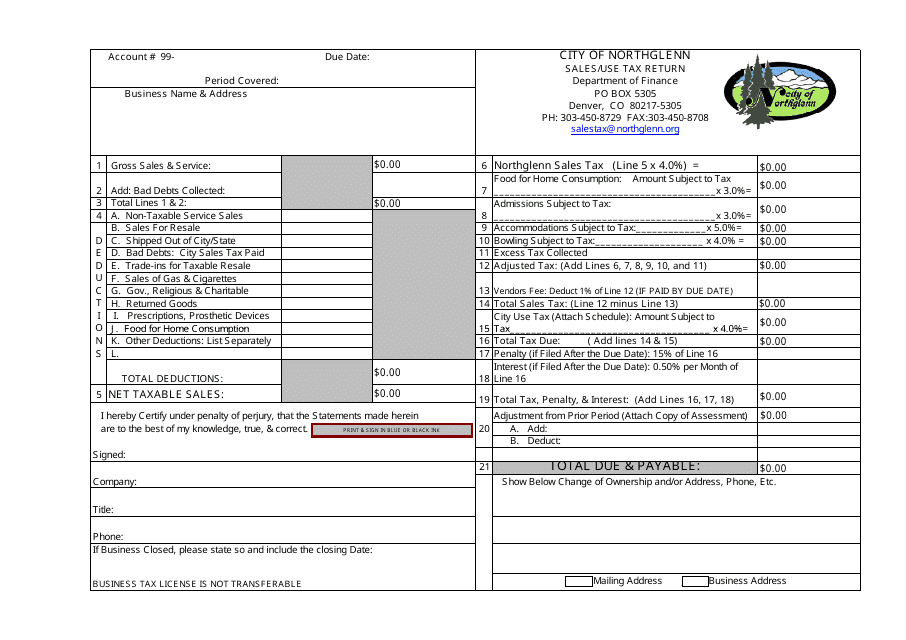

This form is used for reporting and remitting sales and use tax to the City of Northglenn, Colorado.

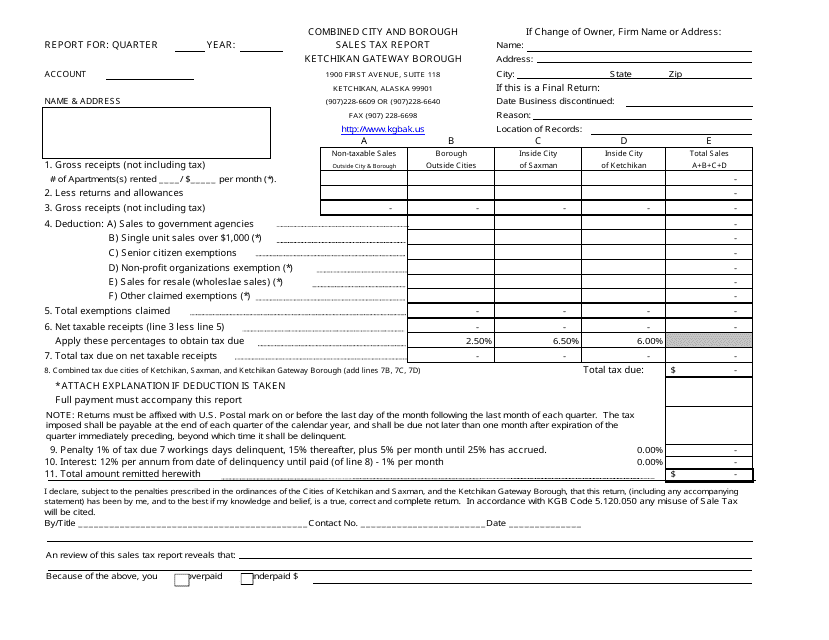

This document is a combined sales tax report for the Ketchikan Gateway Borough in Alaska. It includes information on the sales tax collected from both the city and borough within the area.

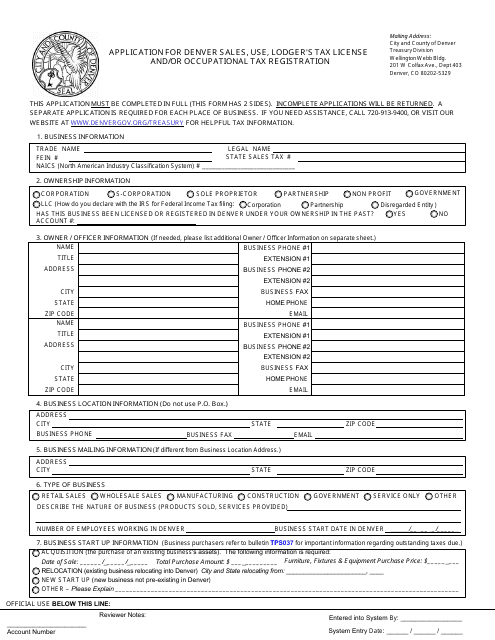

This form is used for applying for a sales, use, lodger's tax license, and/or occupational tax registration in the City and County of Denver, Colorado.

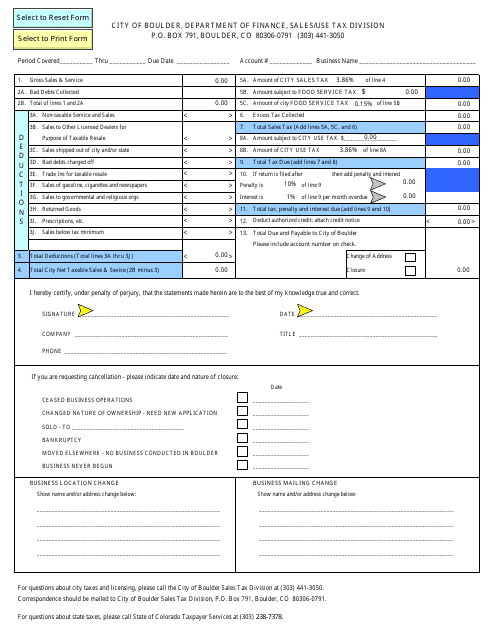

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

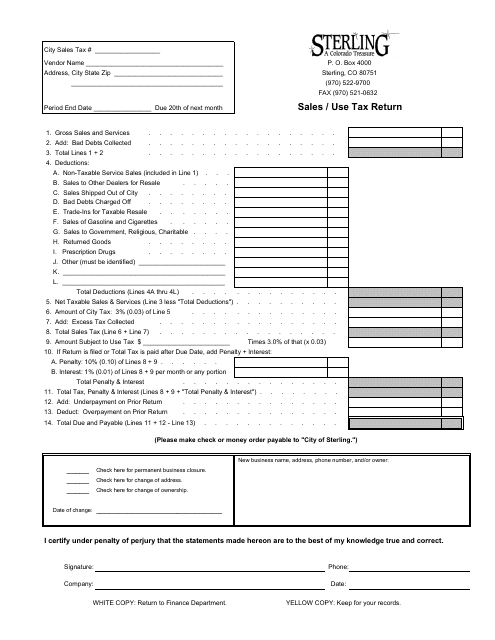

This form is used for reporting and remitting sales and use tax to the City of Sterling, Colorado. It is mandatory for businesses operating within the city limits to file this return on a regular basis.

This document is used for filing sales tax returns with the City of Steamboat Springs, Colorado.

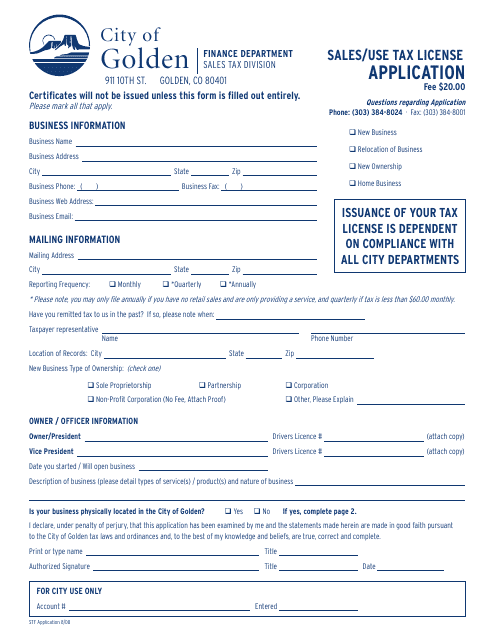

This form is used for applying for a sales/use tax license in the city of Golden, Colorado.

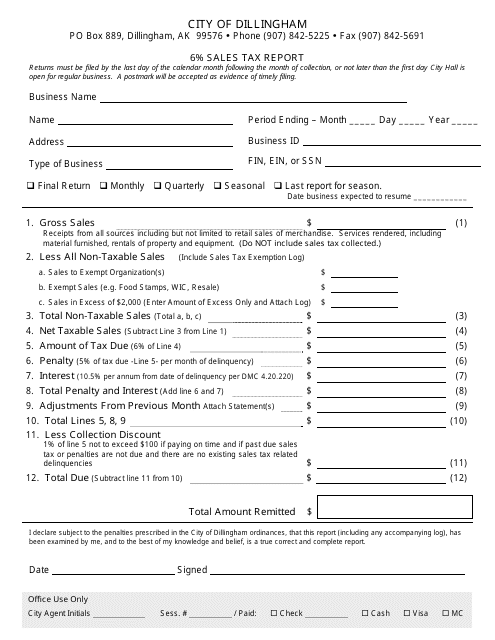

This form is used for reporting sales tax in Dillingham, Alaska. Businesses are required to fill out this form to show their sales tax amount, which is typically 6% of their total sales.

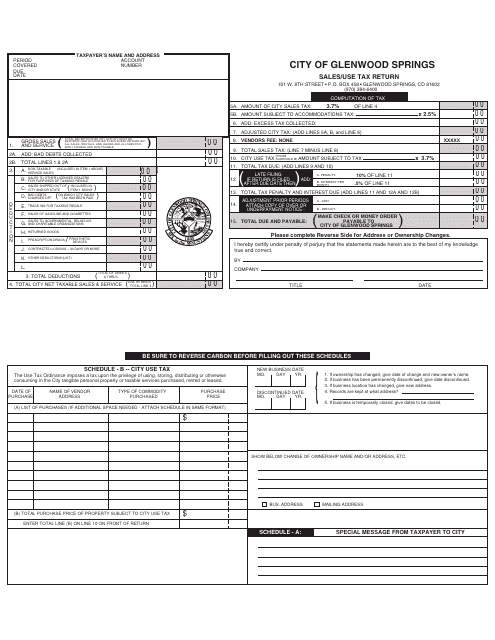

This Form is used for reporting and paying sales and use taxes to the City of Glenwood Springs, Colorado.

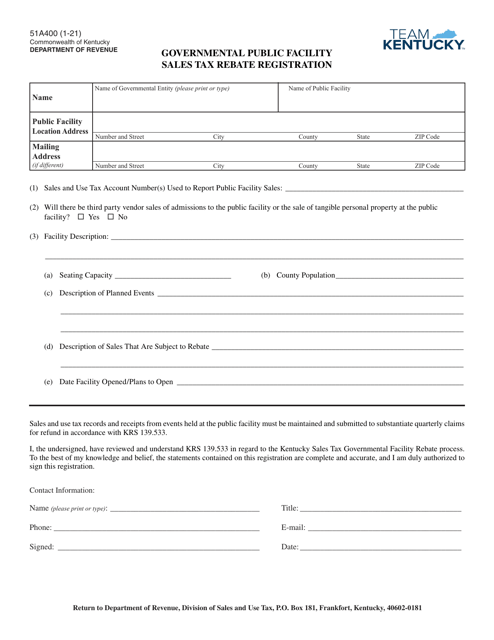

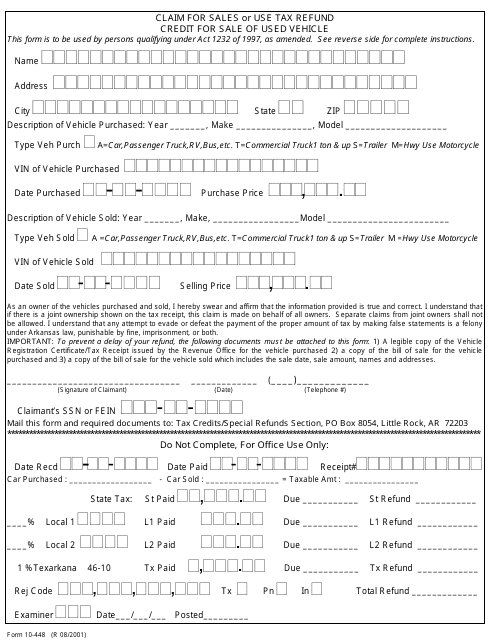

This form is used for applying for a sales tax exemption on the sales of certain medical equipment in Massachusetts.

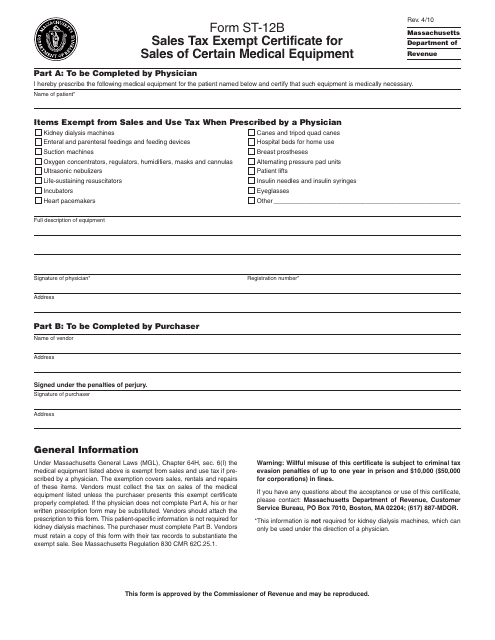

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.

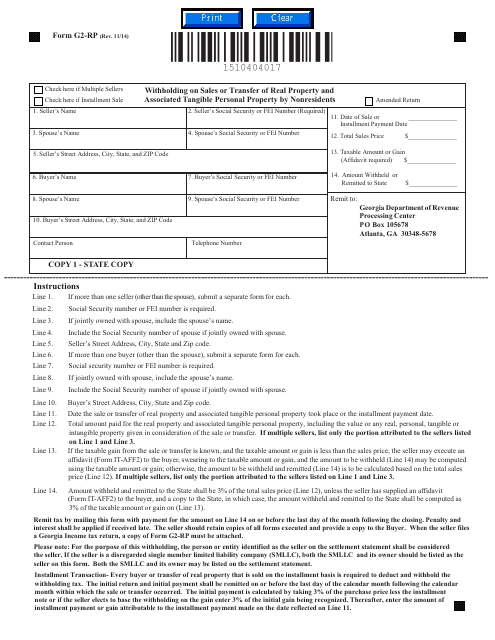

This form is used for claiming a sales or use tax refund in Arkansas when you have sold a used vehicle.

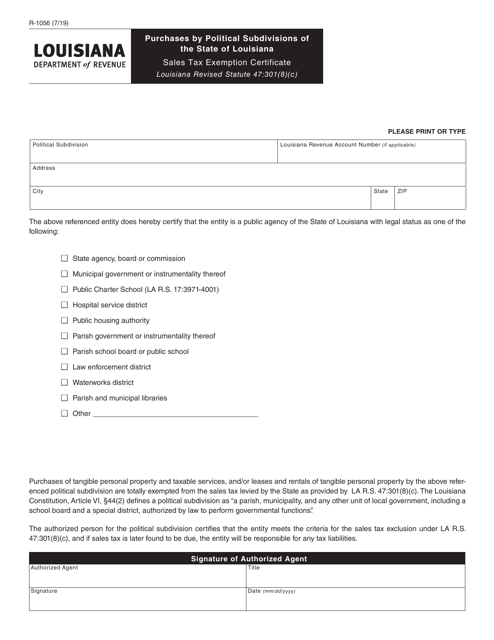

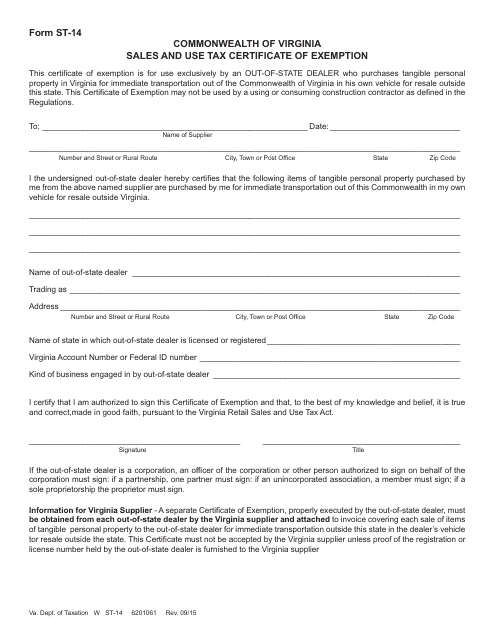

This form is used for Virginia residents who are out-of-state resale dealers to claim exemption from sales tax when purchasing goods for resale out of state.

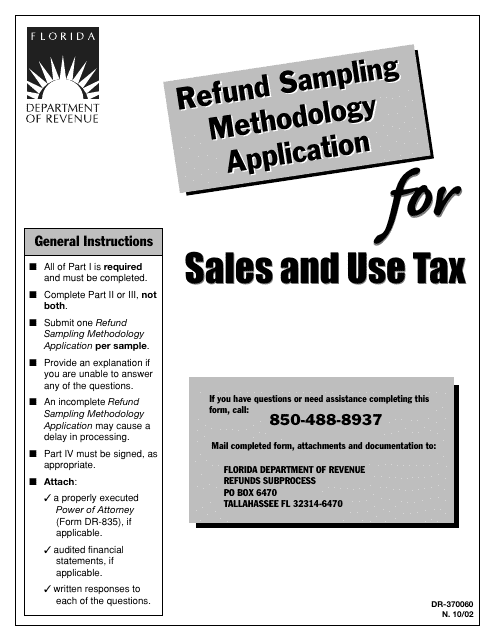

This Form is used for applying for a refund of sales and use tax in Florida. It specifically pertains to the sampling methodology that will be used to determine the amount of the refund.

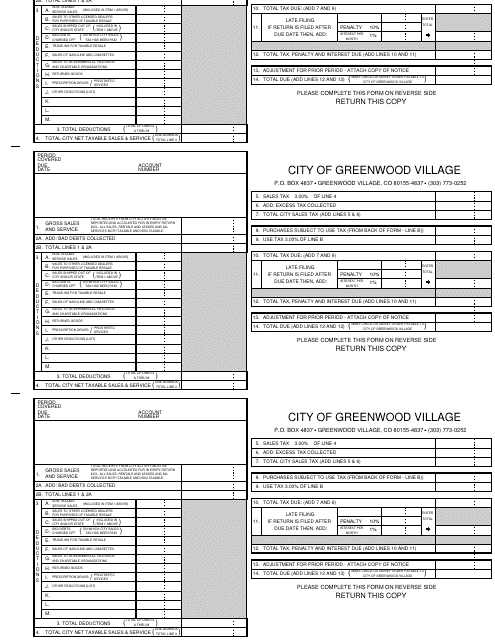

This form is used for reporting sales tax collected in the City of Greenwood Village, Colorado. It helps businesses comply with local tax regulations and submit the required payment to the city.