Sales Tax Templates

Documents:

663

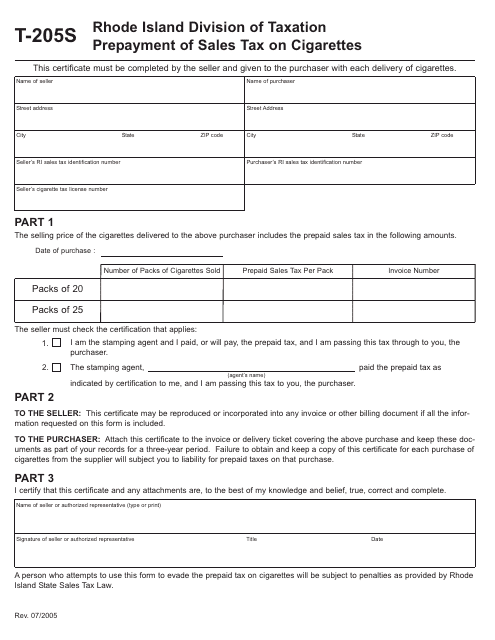

This form is used for prepaying sales tax on cigarettes in Rhode Island.

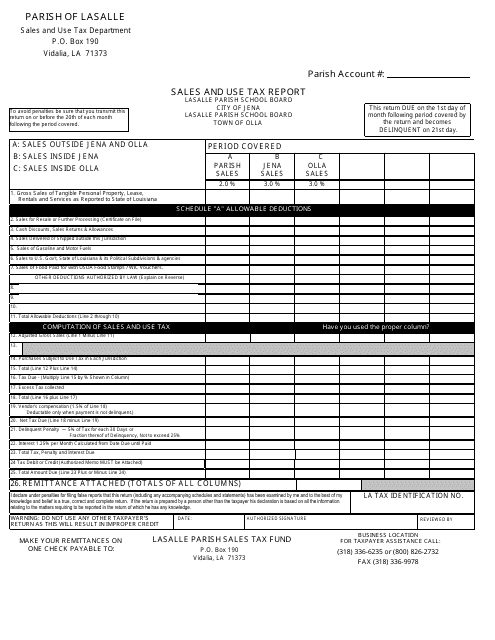

This document is used for reporting sales and use tax in LaSalle Parish, Louisiana.

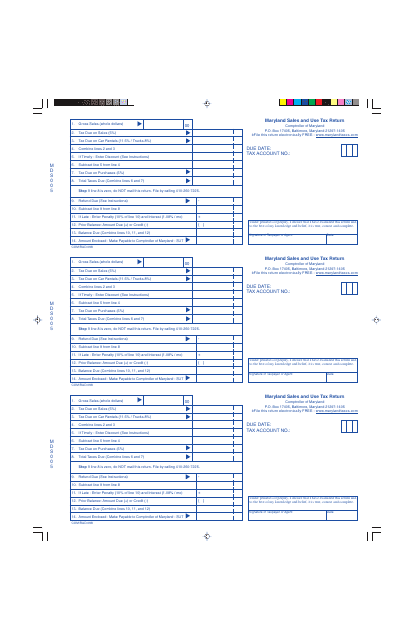

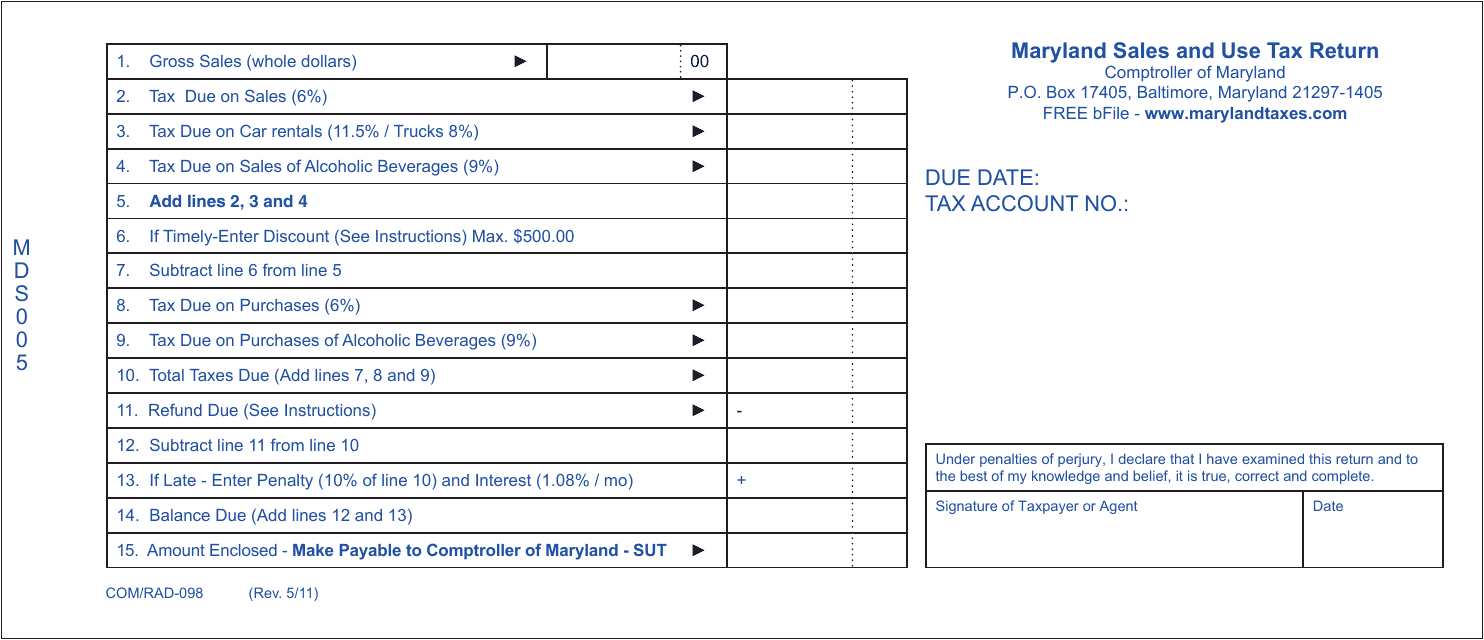

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

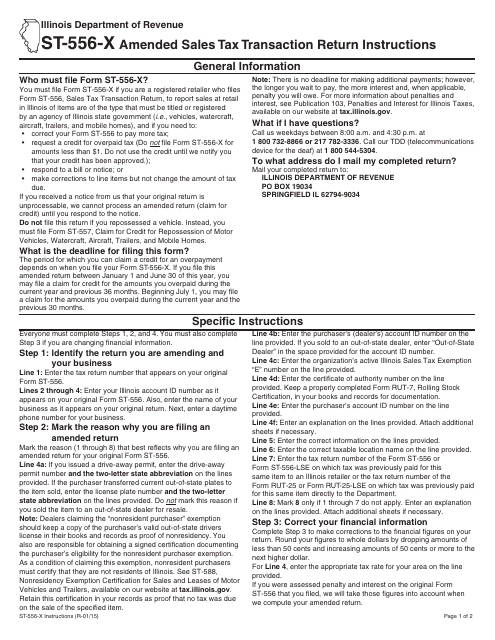

This document is used for filing an amended sales tax transaction return in the state of Illinois. It provides instructions on how to correct any errors or omissions on the original return.

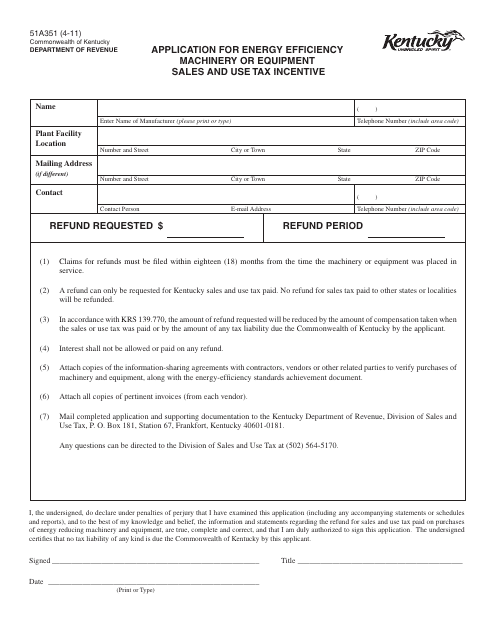

This form is used for applying for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.

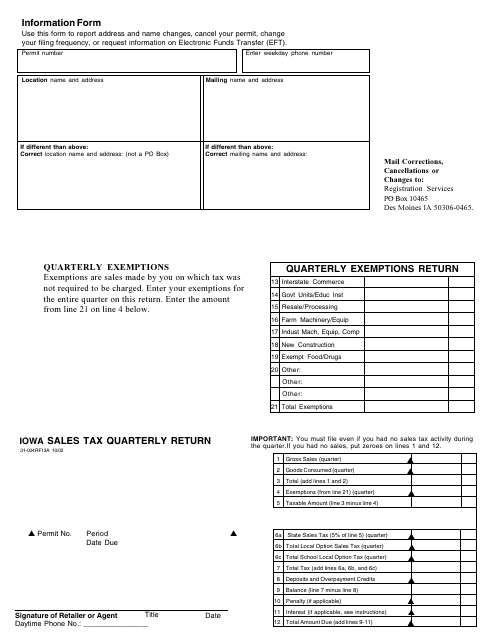

This Form is used for submitting Iowa sales tax quarterly return.

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

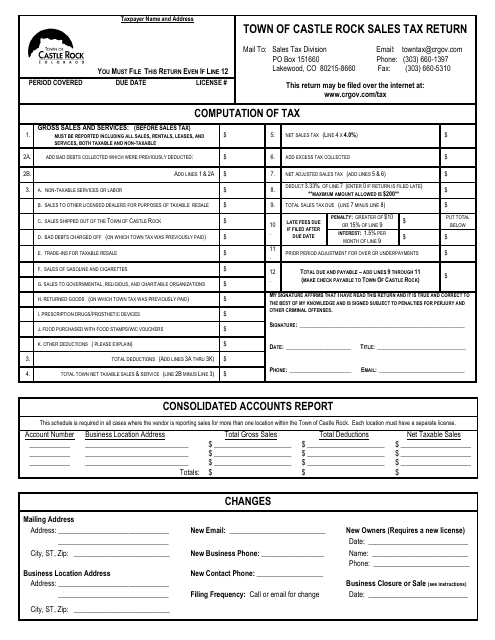

This document is used for reporting and remitting sales tax in the Town of Castle Rock, Colorado. Businesses must submit this form to the town's tax department on a regular basis to comply with local tax regulations.

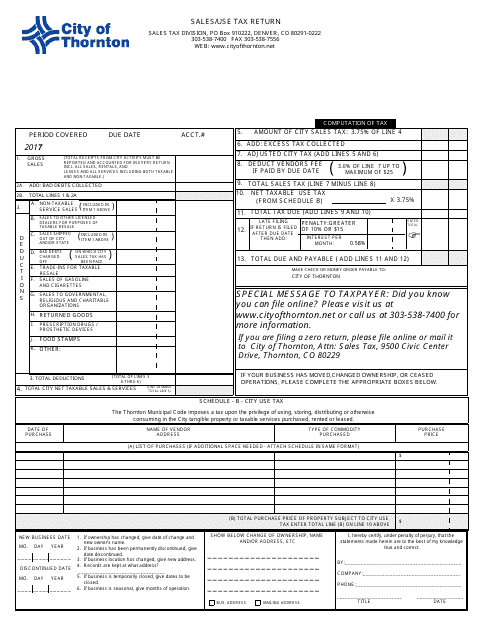

This form is used for reporting and remitting sales or use tax to the City of Thornton, Colorado.

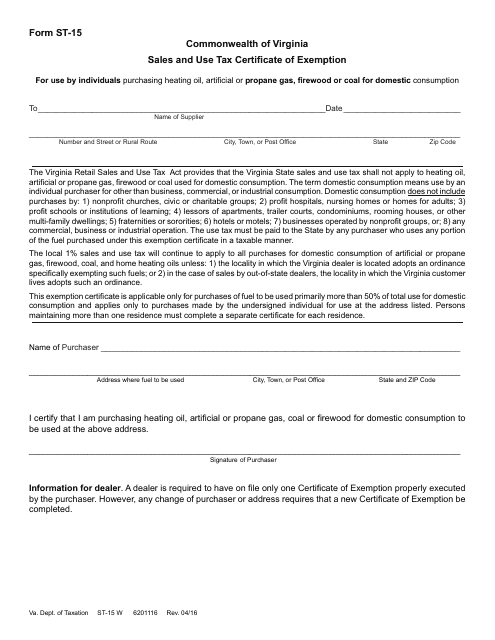

This form is used for claiming sales and use tax exemption in the state of Virginia.

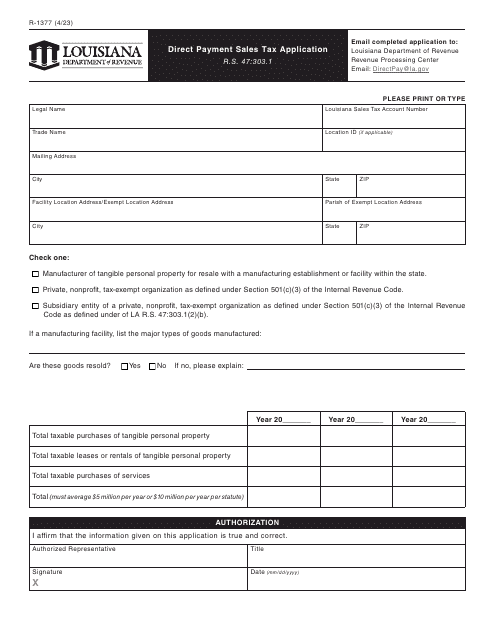

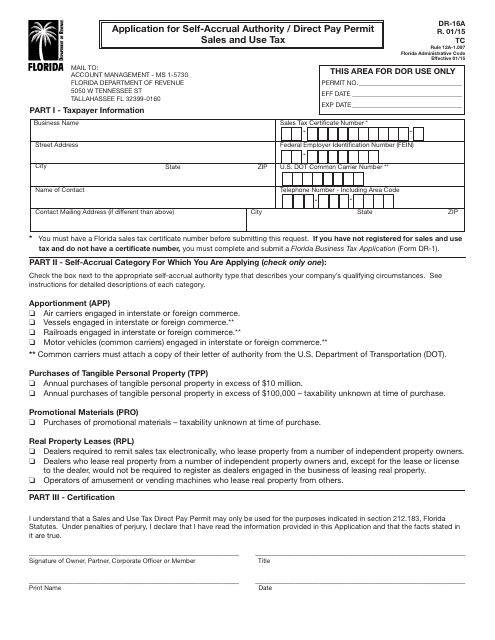

This Form is used for applying for self-accrual authority or a direct pay permit for sales and use tax in Florida.

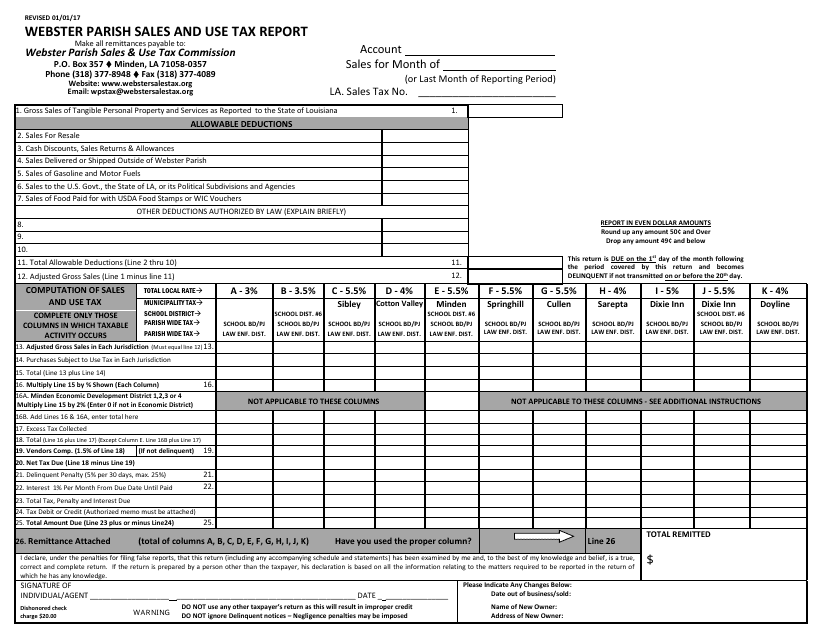

This document is used for reporting sales and use tax in Webster Parish, Louisiana.

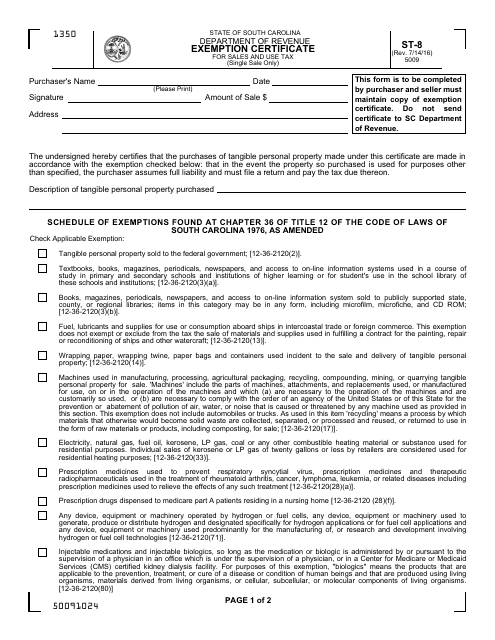

This form is used for requesting an exemption from sales and use tax in South Carolina. It is for individuals or businesses who qualify for certain exemptions.

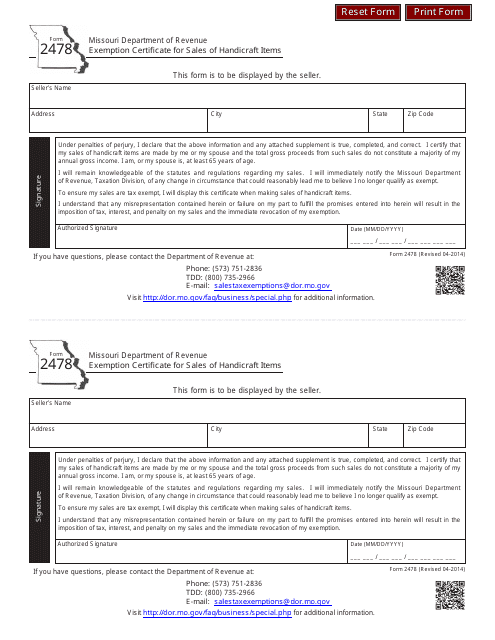

This document is used for obtaining an exemption certificate in Missouri for sales of handicraft items.

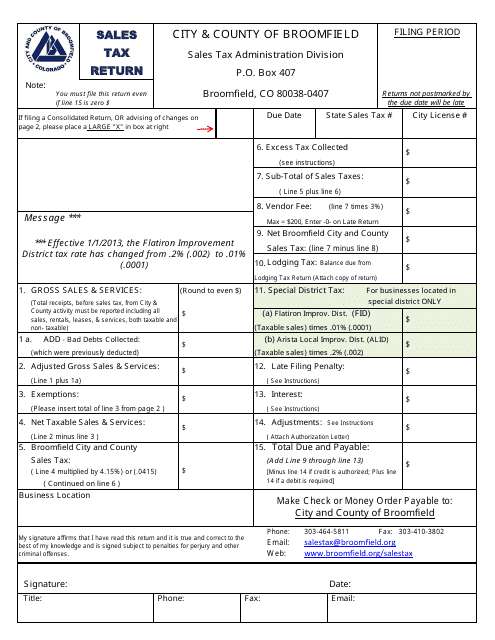

This form is used for filing sales tax returns for the City and County of Broomfield, Colorado.

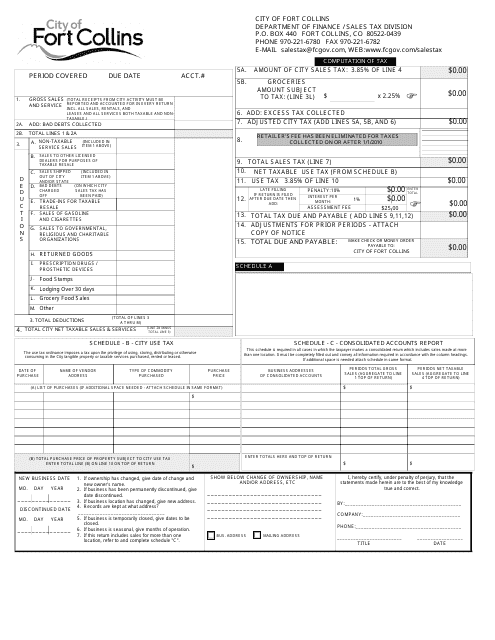

This form is used for reporting sales and use tax to the City of Fort Collins, Colorado. Businesses in the city are required to fill out this form to remit their tax obligations.

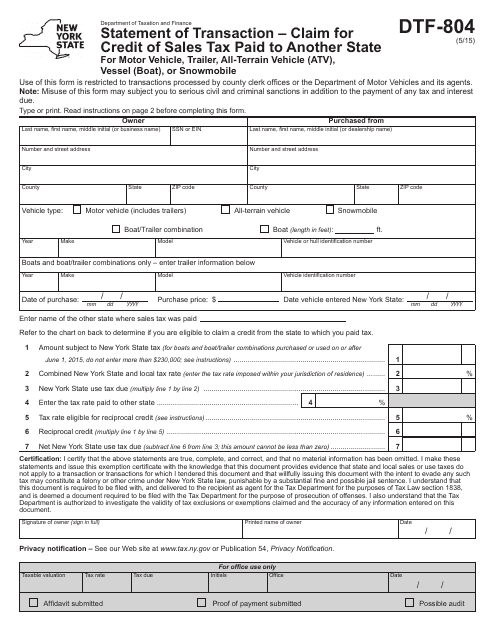

This Form is used for claiming credit of sales tax paid in another state for purchasing motor vehicles, trailers, all-terrain vehicles (ATV), vessels (boat), or snowmobiles in New York.

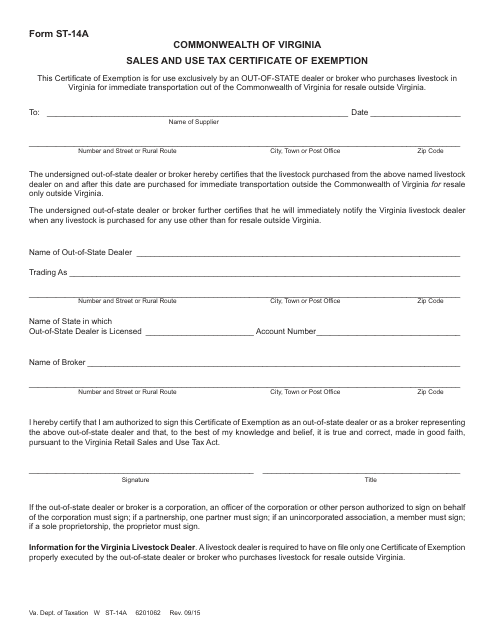

This Form is used for claiming exemption from sales and use tax in the state of Virginia.

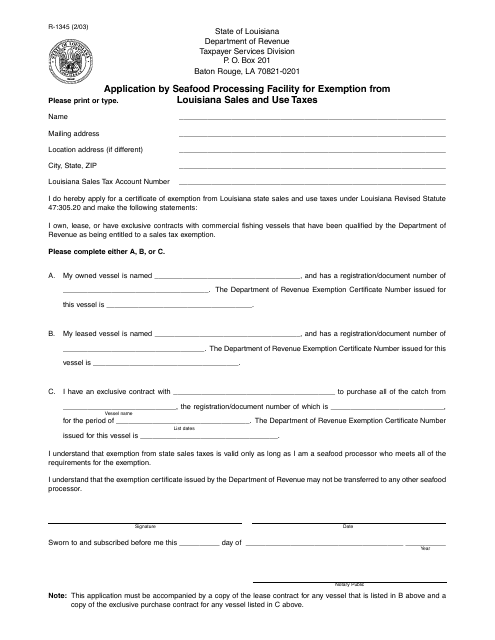

This form is used for seafood processing facilities in Louisiana to apply for an exemption from sales and use taxes. It helps these facilities save on taxes and streamline their business operations.

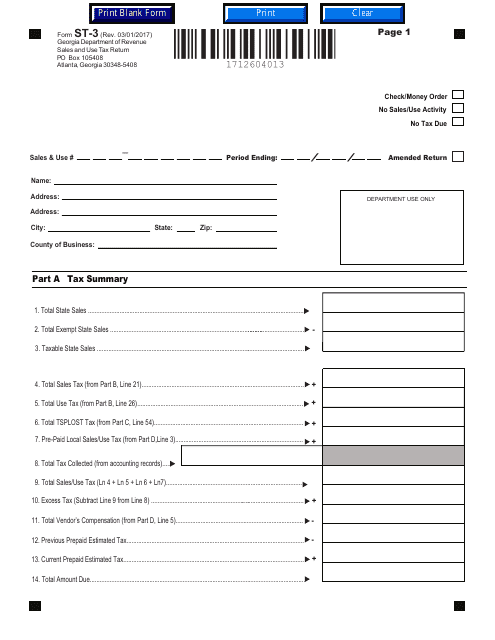

Georgia-registered organizations may use this form to report the sales and use tax they owe in the state of Georgia.

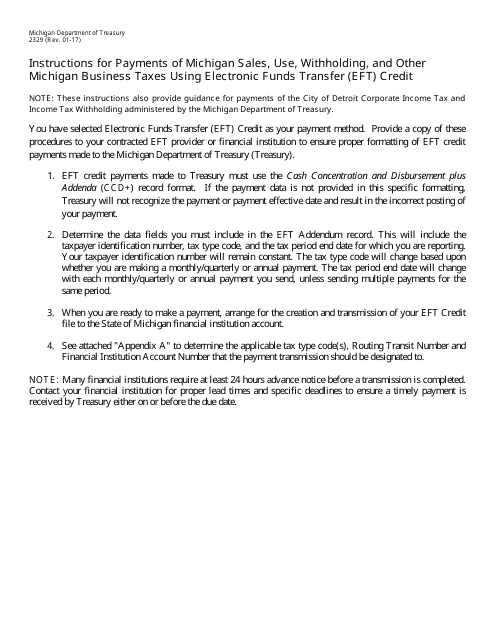

This form provides instructions for making electronic payments for various types of Michigan business taxes, including sales tax, use tax, withholding tax, and other taxes. It explains how to use the Electronic Funds Transfer (EFT) credit method for submitting these payments.

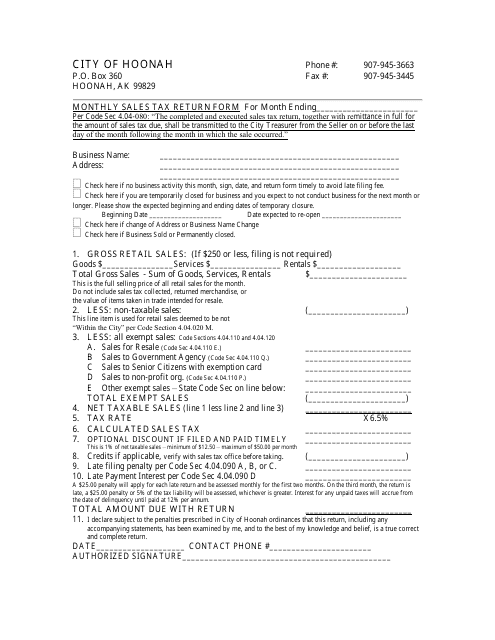

This form is used for reporting and paying monthly sales tax to the City of Hoonah, Alaska.

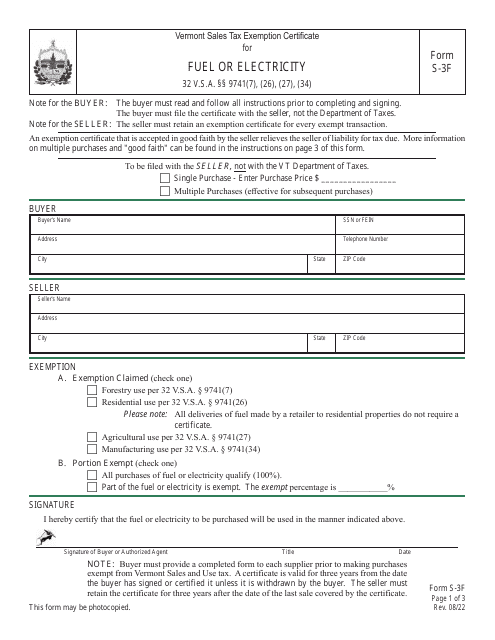

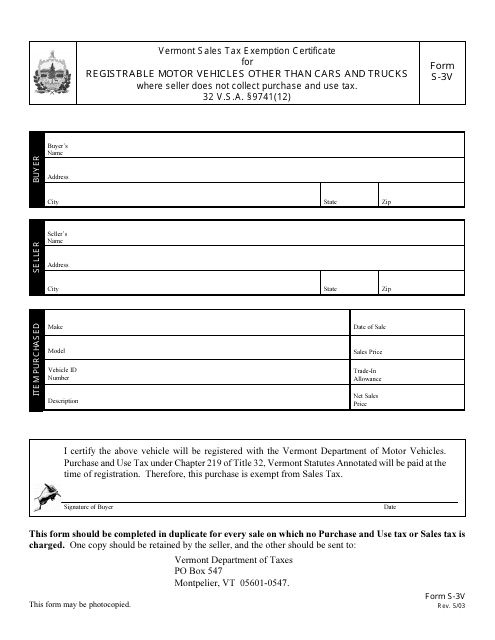

This Form is used for obtaining a sales tax exemption on motor vehicles in Vermont that are not cars or trucks. It is applicable for registration purposes.

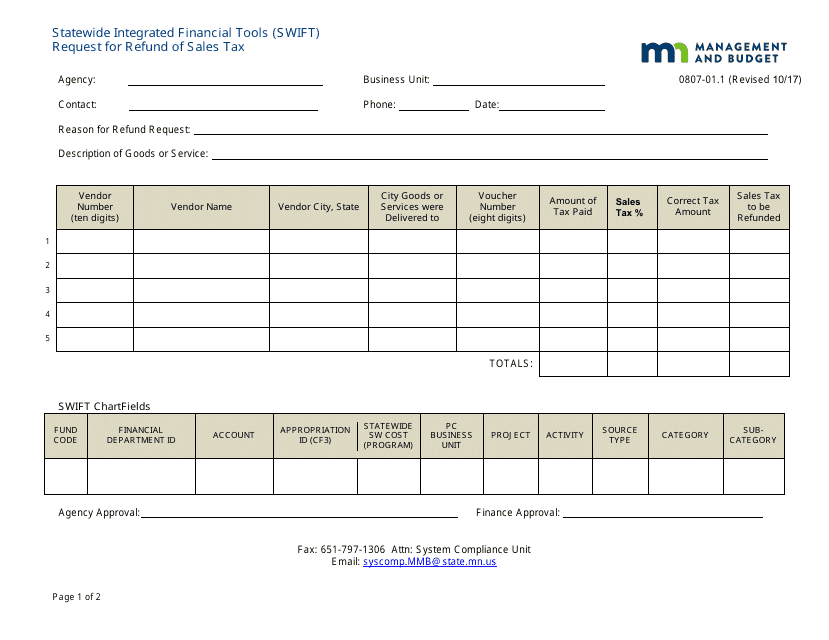

This form is used for Minnesota residents to request a refund of sales tax through the Statewide Integrated Financial Tools (Swift) system.

This form is used for claiming sales tax exemption on purchases of machinery and machine tools in Colorado.

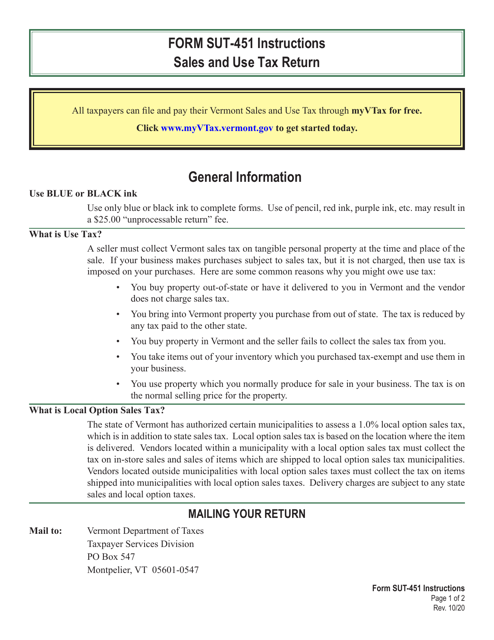

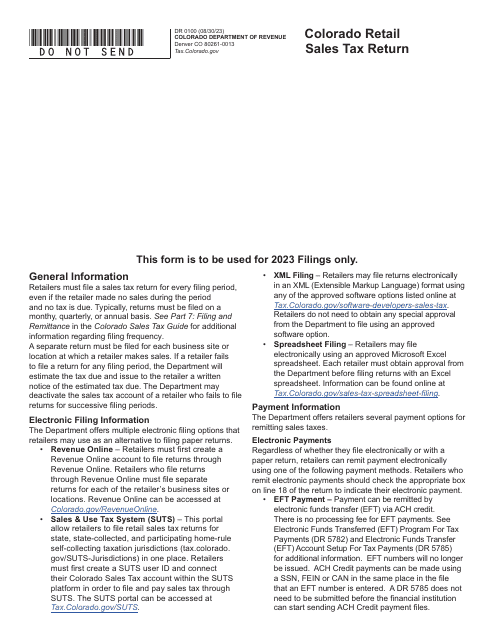

This form is required for any retail establishment within the state of Colorado and must be filed every quarter, even if no tax has been collected or no tax is due.

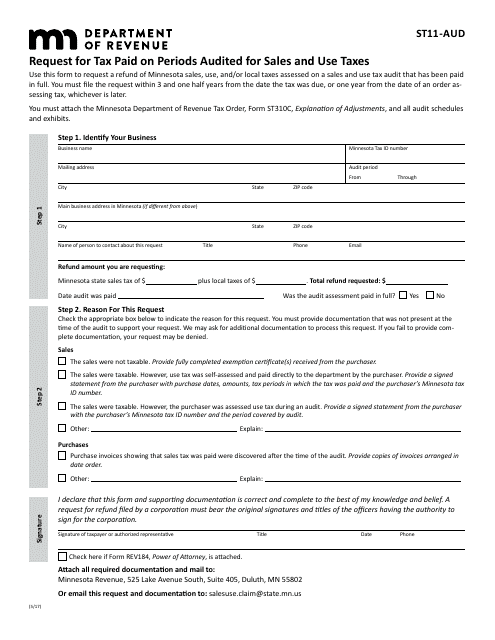

This form is used for requesting tax paid on periods that were audited for sales and use taxes in the state of Minnesota.

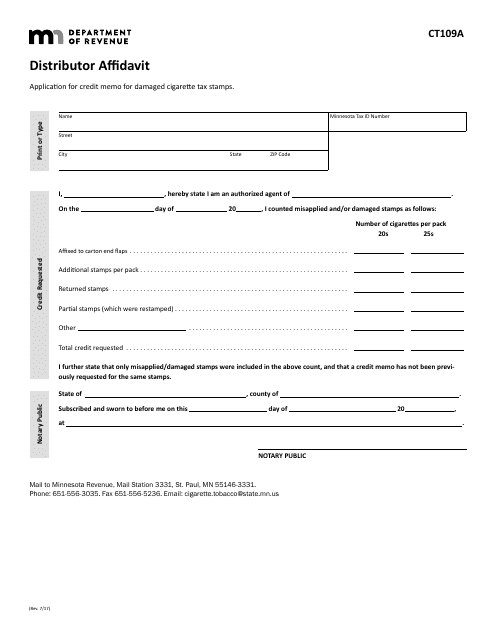

This Form is used for distributors in Minnesota to provide an affidavit.

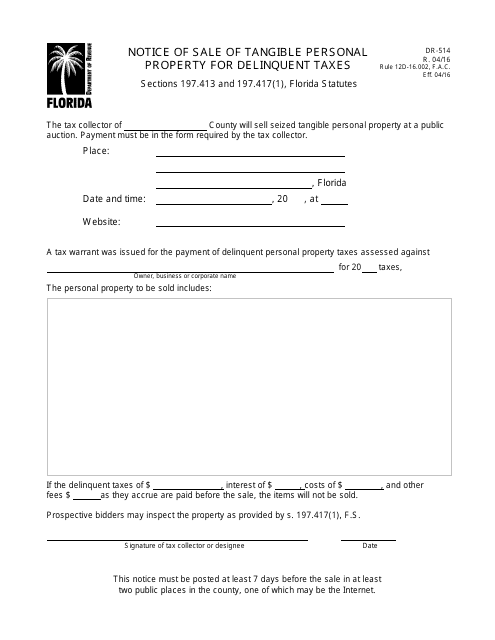

This form is used for notifying the sale of tangible personal property for delinquent taxes in the state of Florida.