Term Loan Templates

A term loan, also referred to as a loan term or loan terms, is a type of loan that provides borrowers with a specific amount of money that is to be repaid over an agreed-upon period of time. This type of loan is commonly used by businesses and individuals alike for various purposes such as financing business operations, purchasing assets, or undertaking major personal expenses.

A term loan offers borrowers the flexibility to choose a repayment period that suits their financial needs and goals. Whether it's a short-term loan to finance immediate business needs or a long-term loan for a major investment, term loans provide a structured approach to borrowing.

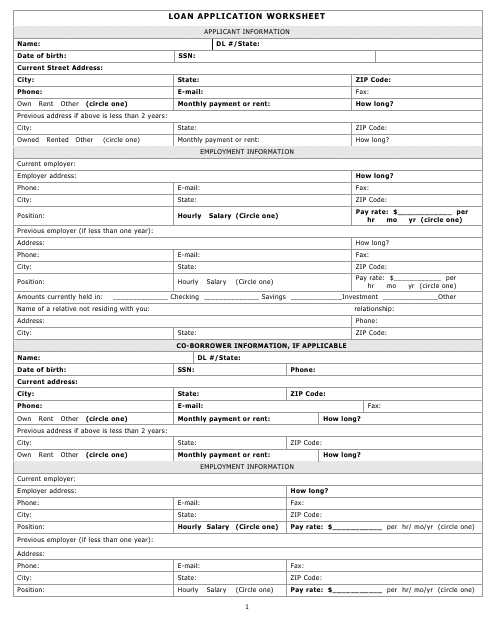

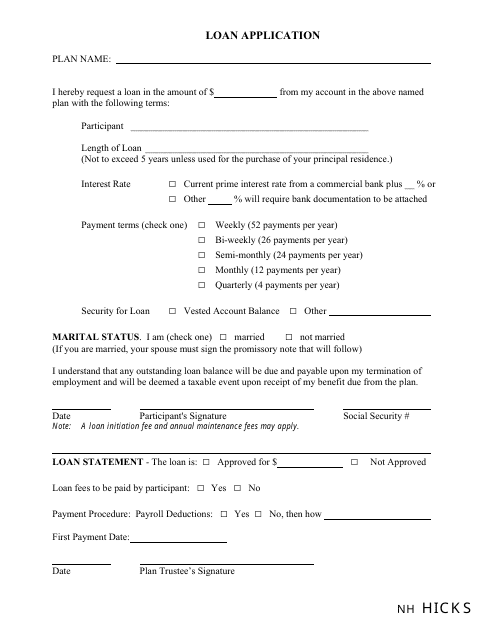

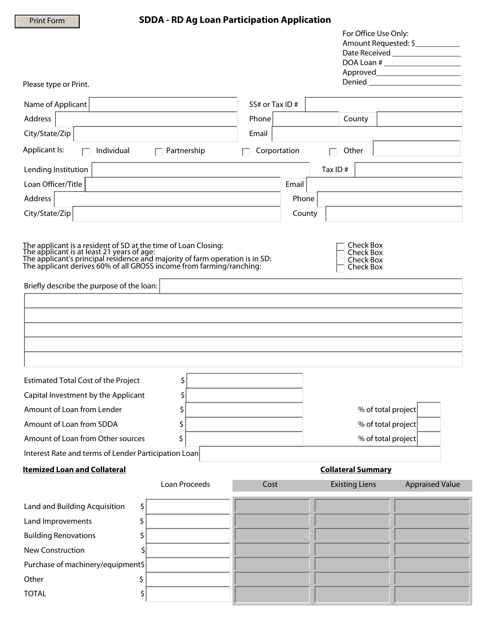

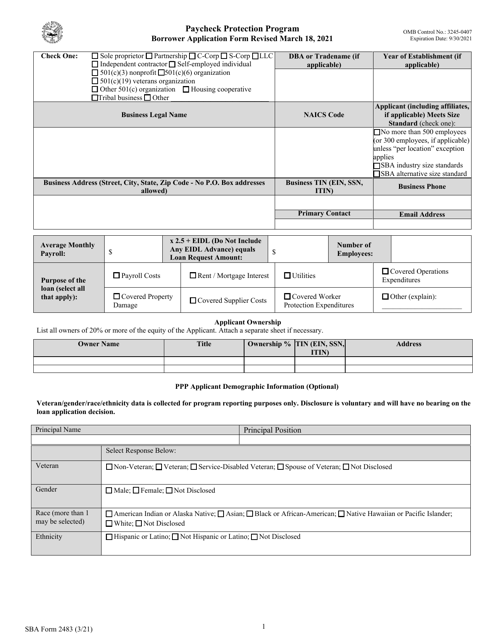

When applying for a term loan, borrowers typically need to complete a loan application form. This form gathers important information about the borrower's financial situation, purpose of the loan, and repayment abilities. It helps lenders assess the borrower's creditworthiness and determine whether they qualify for the loan.

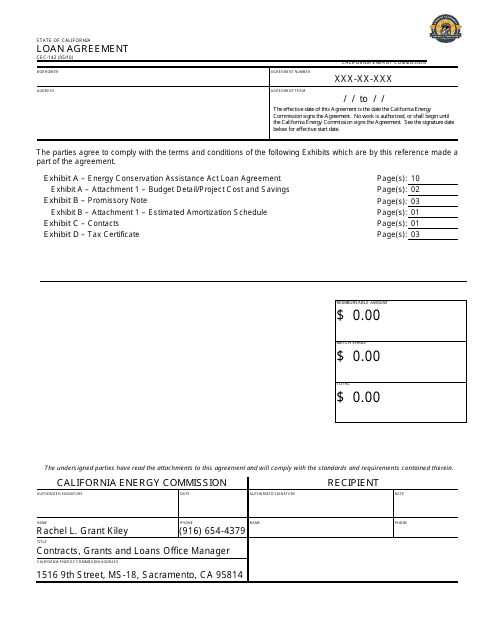

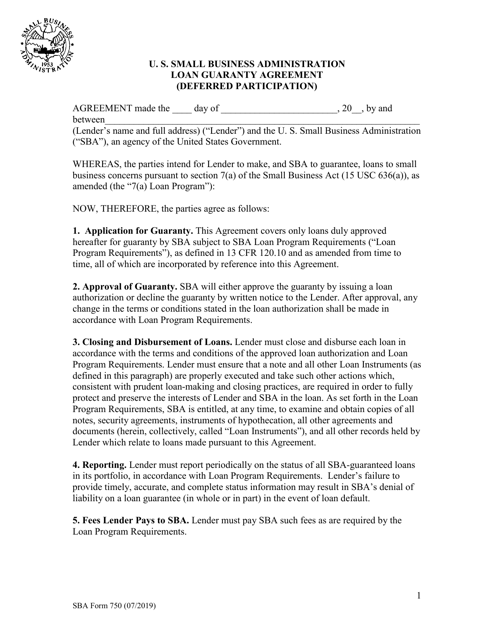

Once approved, borrowers and lenders enter into a legally binding agreement, commonly known as a loan agreement. This agreement outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any additional fees or charges. It serves as a vital document that protects the interests of both parties involved.

In some cases, borrowers may need to submit a request for loan disbursement to access the funds they have been approved for. This document serves as a formal request to release the loan proceeds and is often required to ensure proper documentation and record-keeping.

Additionally, if a borrower wishes to refinance their loan and obtain cash from the equity they have built, they may need to provide a letter of explanation for cash-out refinances. This letter helps lenders understand the purpose behind the refinancing and ensures transparency in the borrowing process.

Term loans, also known as loan terms or loan terms, offer borrowers a structured approach to financing their needs. By completing a loan application, entering into a loan agreement, and following proper procedures for disbursement and refinancing, borrowers can access the funds they need to achieve their financial goals.

Documents:

86

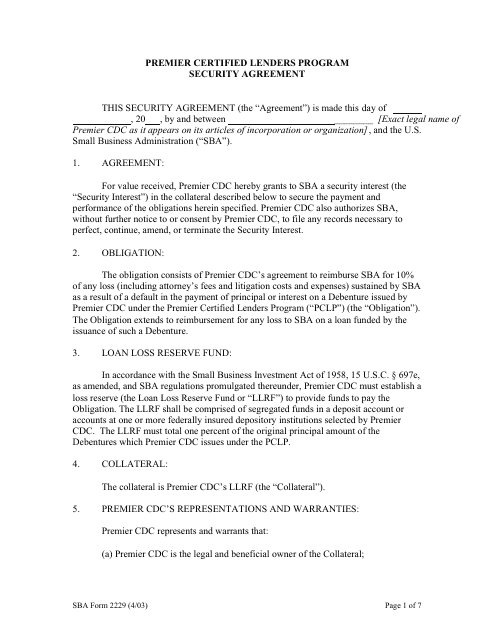

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

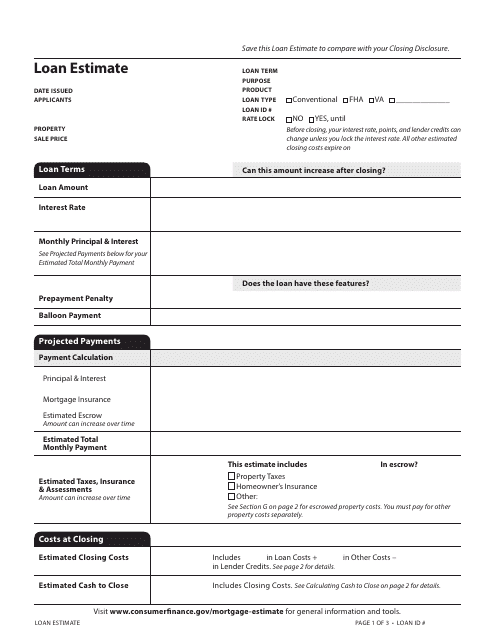

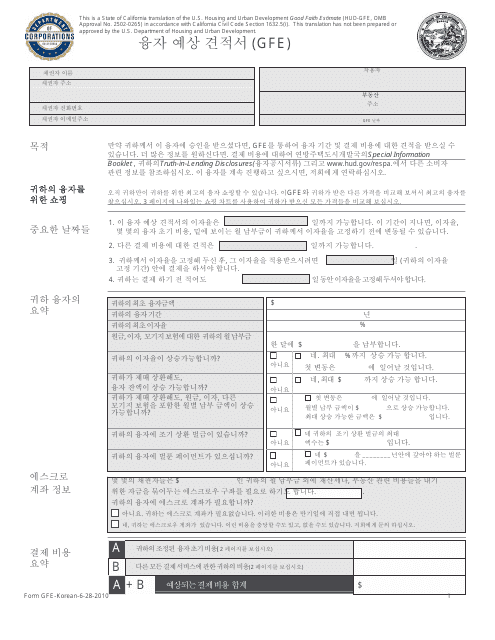

This document is used for providing borrowers with an estimate of the costs and terms associated with a mortgage loan. It includes details on interest rate, closing costs, and monthly payments.

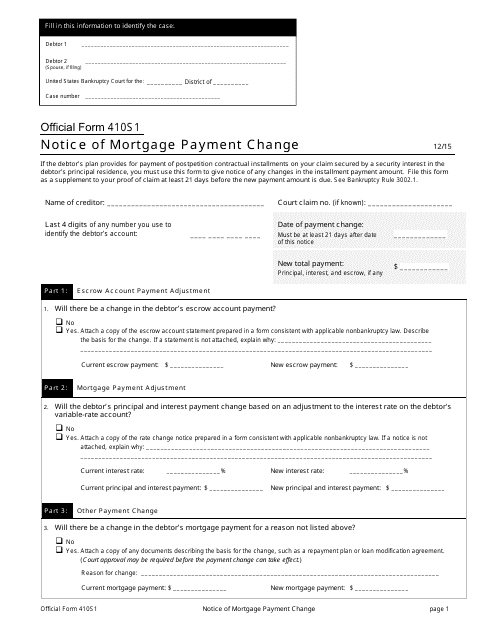

This Form is used for notifying the borrower of any changes in their mortgage payment.

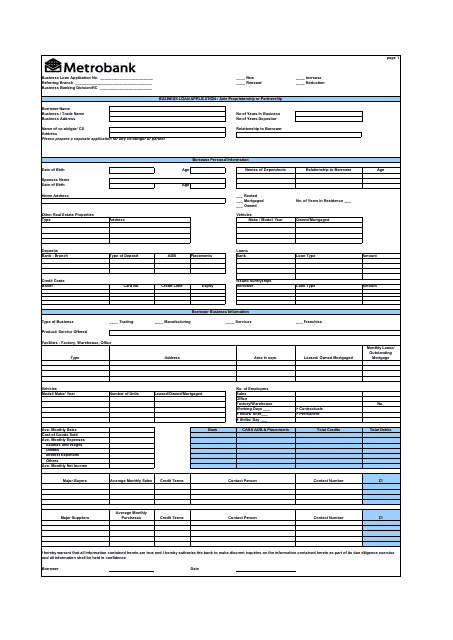

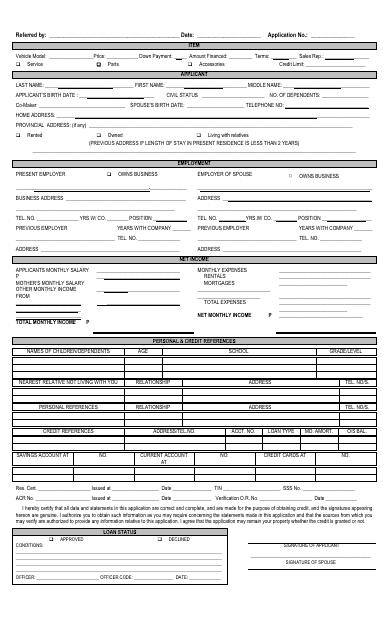

This document is used for applying for a business loan with Metrobank.

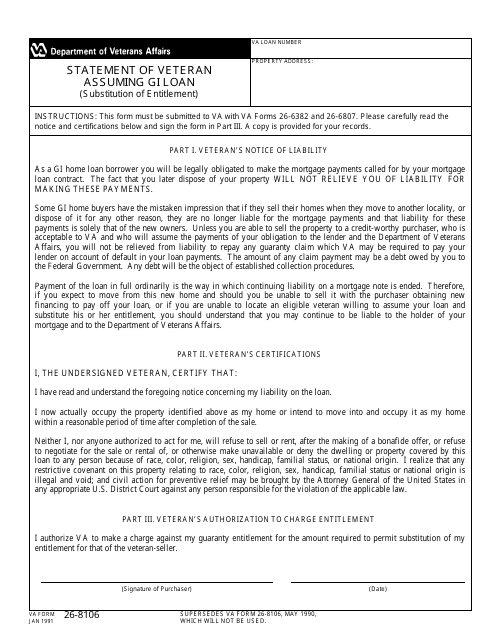

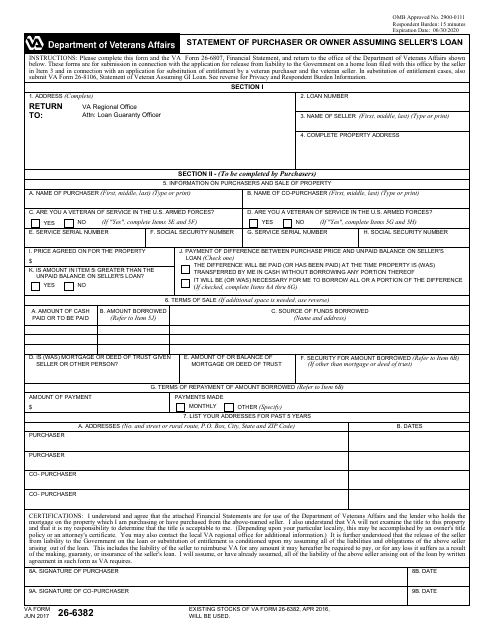

This Form is used for veterans assuming GI loans to provide a statement confirming their intention to assume the loan.

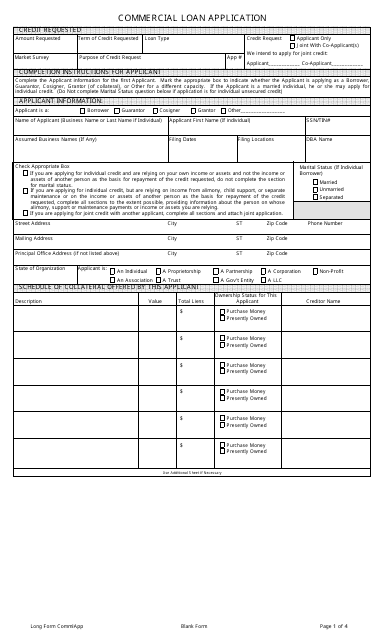

This Form is used for applying for a commercial loan in the United States. It collects important information about the borrower's business and financials.

This form is used for creating a loan agreement in the state of California. It outlines the terms and conditions of the loan, including the amount borrowed, interest rates, and repayment terms.

This Form is used for applying for a loan from Nh Hicks. It is a document that collects the necessary information and details for the loan application process.

This Form is used for buyers or owners who are assuming the seller's loan.

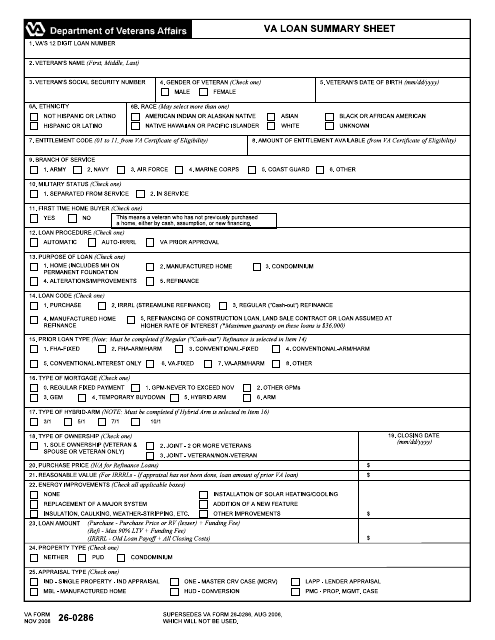

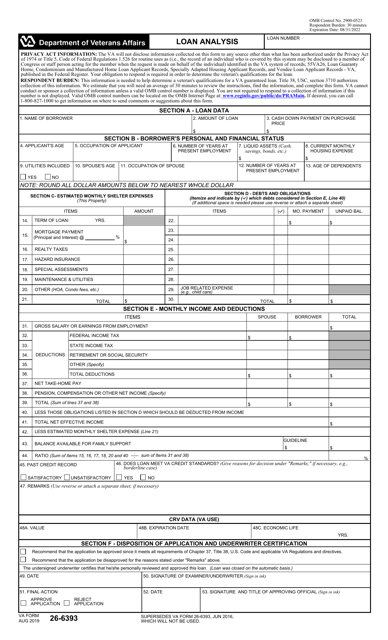

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

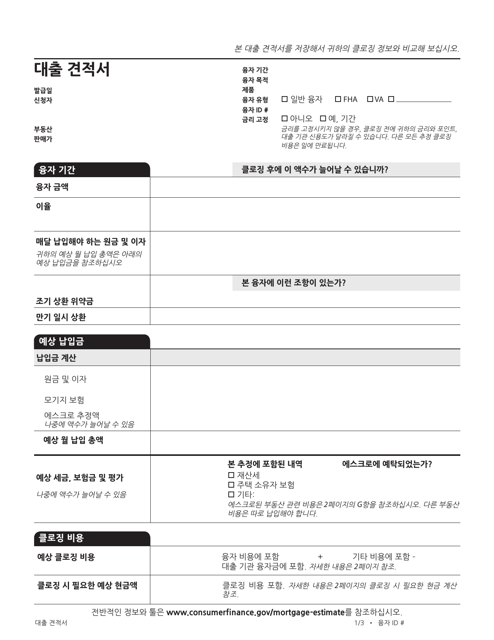

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

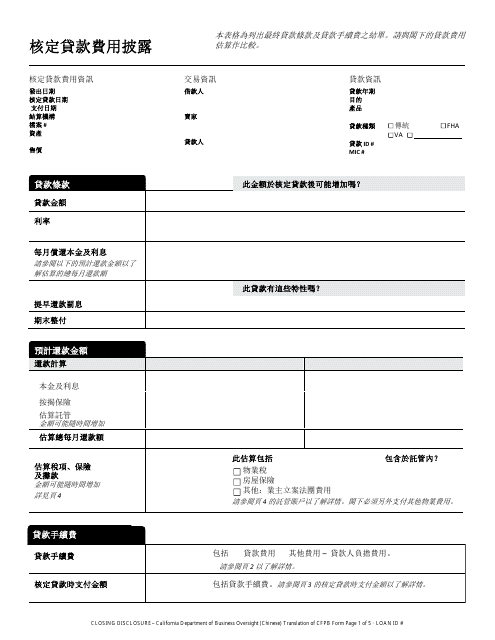

This document is used for providing closing details in a real estate transaction in California. It is available in Chinese language for convenience.

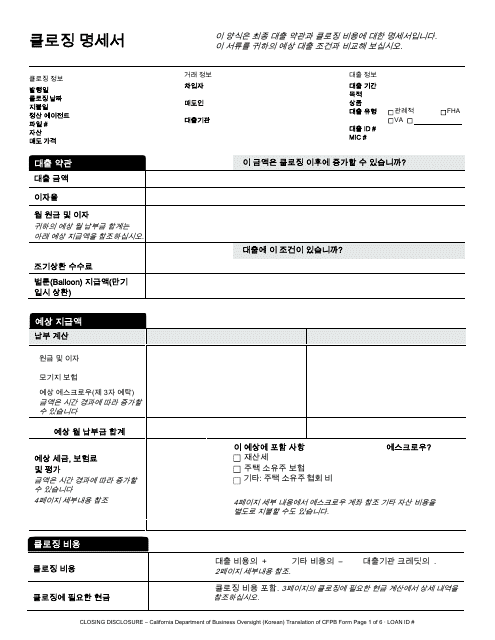

This document is used for providing the final details of a mortgage loan to a borrower in California who speaks Korean. It is required by law and outlines the terms and costs associated with the loan.

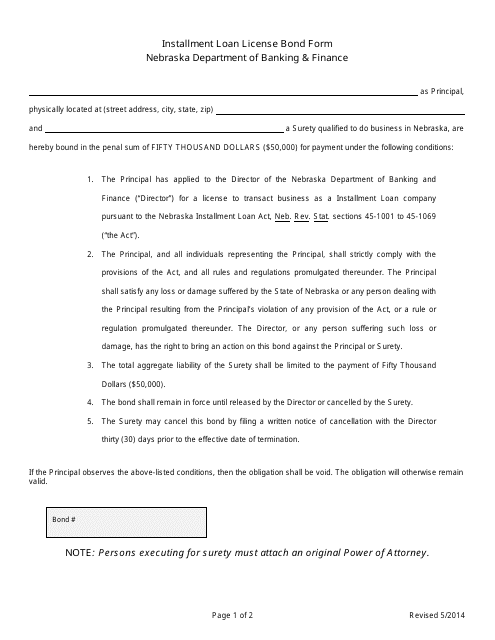

This document is for obtaining an installment loan license bond in the state of Nebraska.

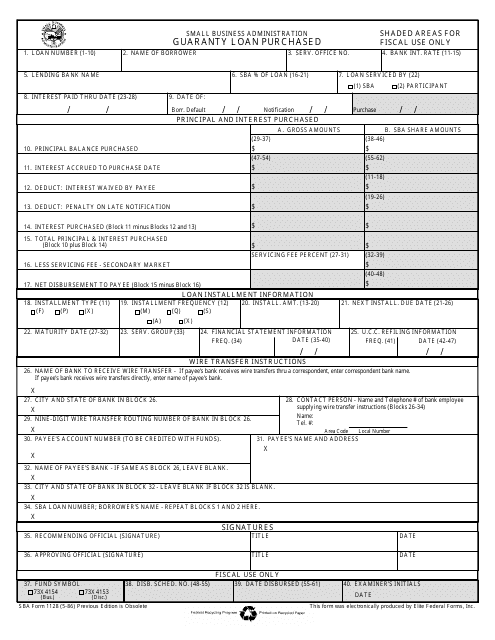

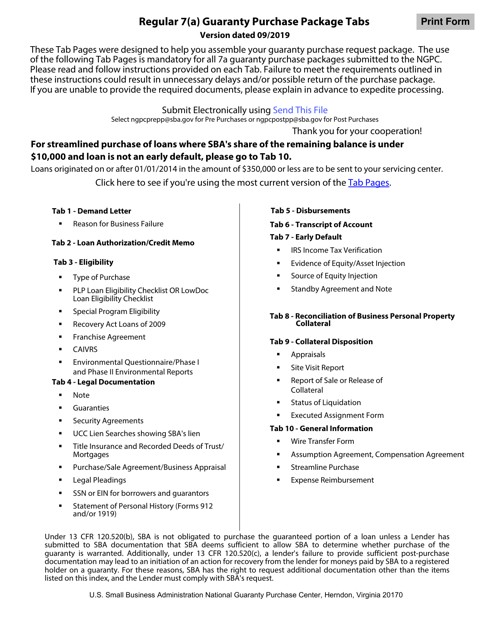

This Form is used for purchasing a guaranteed loan through the Small Business Administration (SBA).

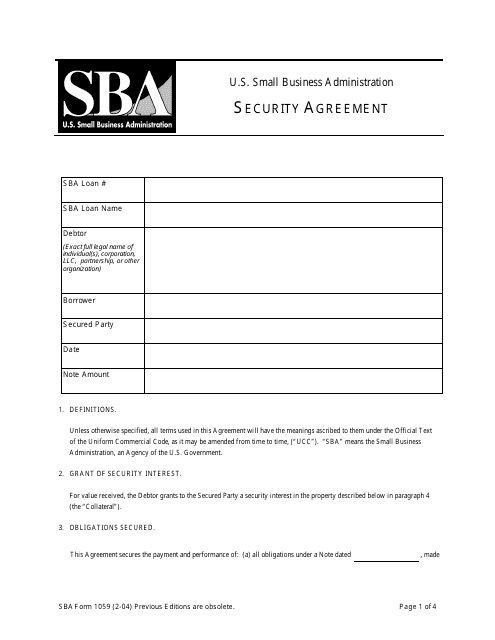

This form is used for creating a legally binding agreement between a borrower and a lender to secure a loan or credit with specified collateral.

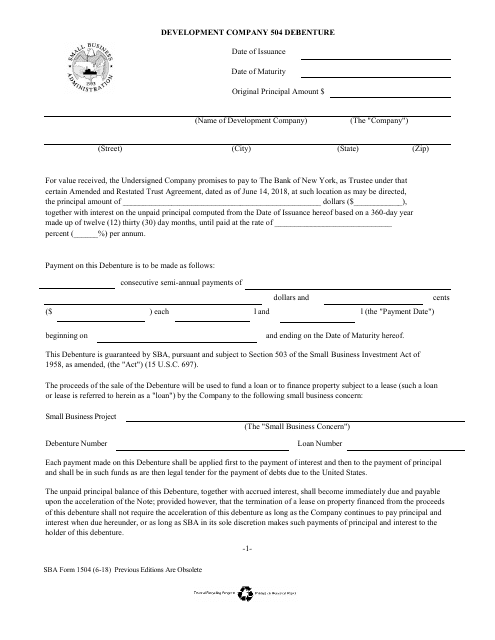

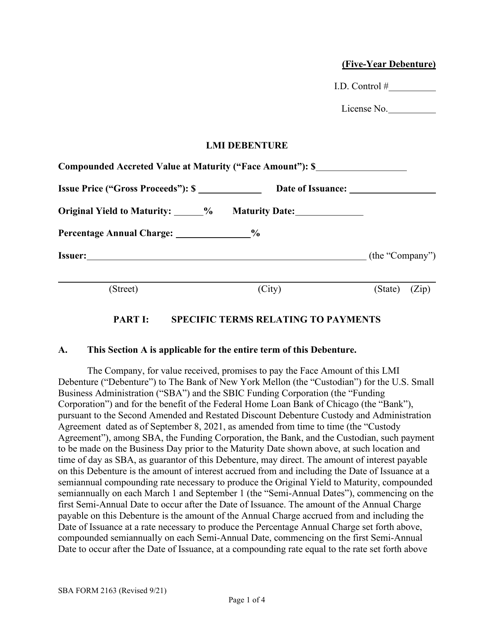

This form is required to be filled out by the Certified Development Company (CDC) to report the debenture payment schedule of development companies.

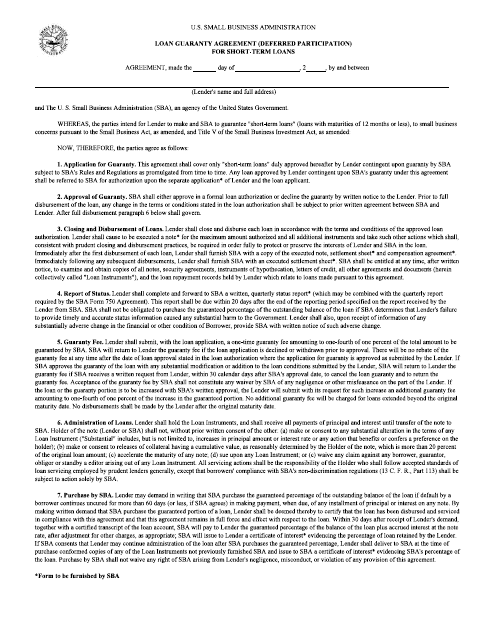

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

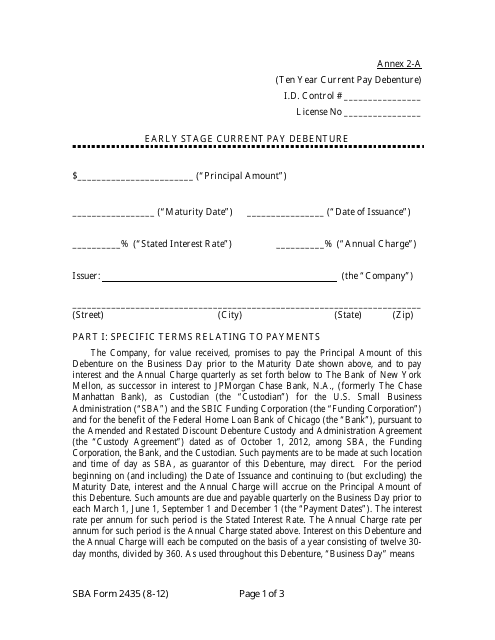

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

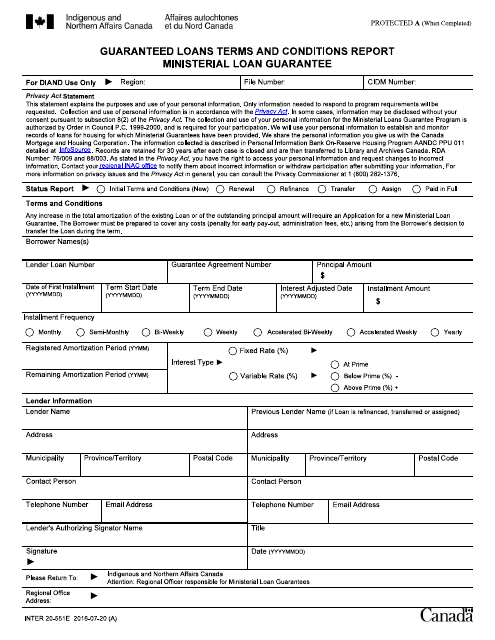

This form is used for reporting the terms and conditions of Ministerial Loan Guarantee for guarantee loans in Canada.

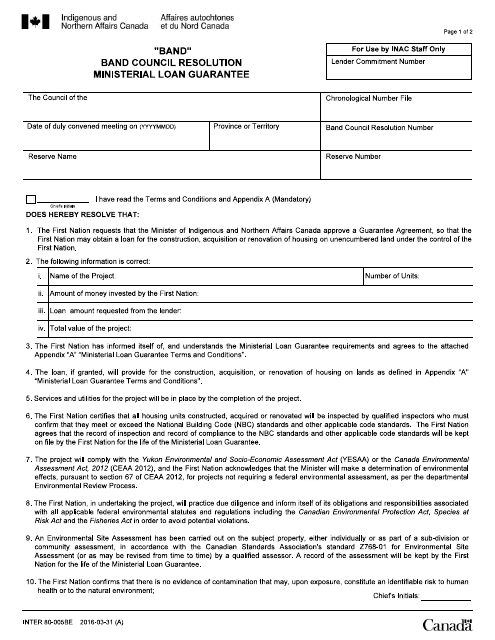

This Form is used for a Band Council Resolution in Canada to obtain a Ministerial Loan Guarantee.

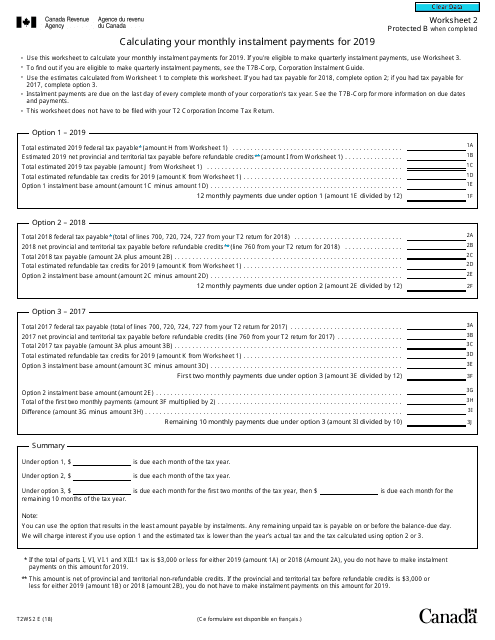

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

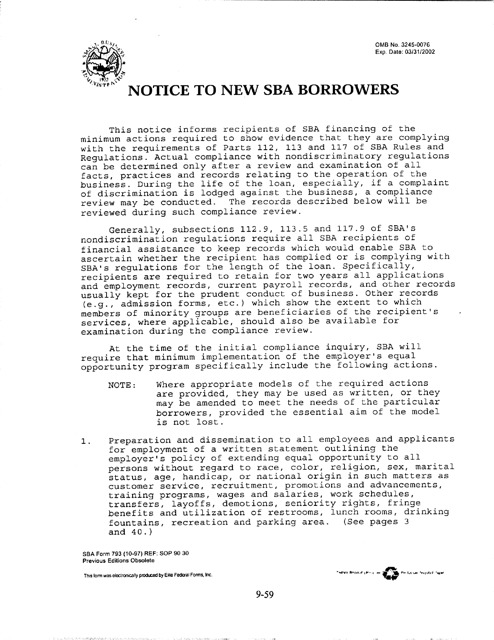

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

This form is used for applying for a loan participation program in South Dakota specifically for agricultural purposes.

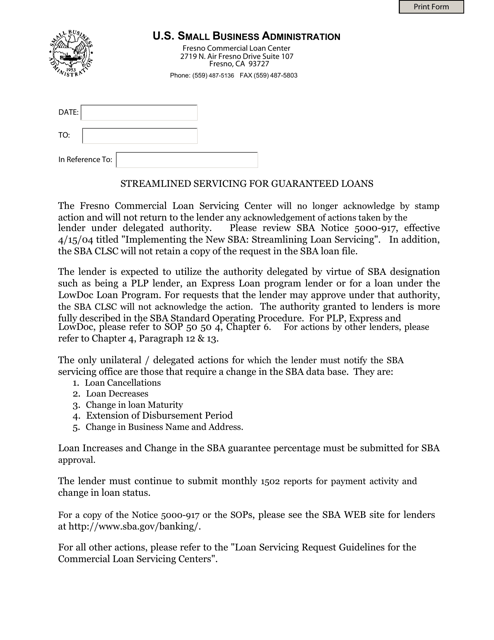

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

This document provides a loan estimate form from the Consumer Financial Protection Bureau specifically for residents of California who speak Korean. The form is used to understand the terms and costs associated with a loan.

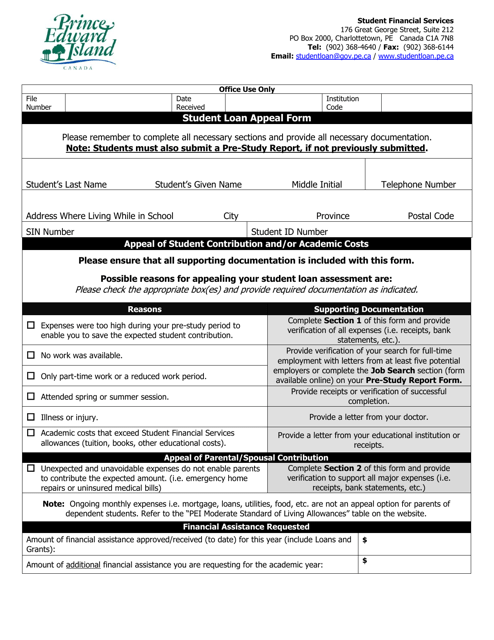

This document is used for appealing a student loan decision in Prince Edward Island, Canada.

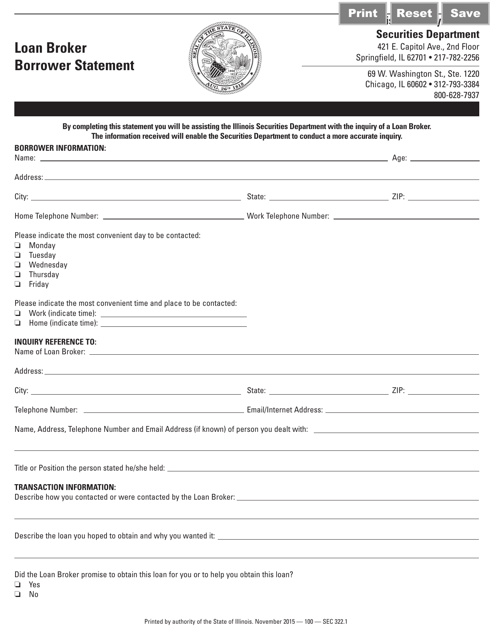

This form is used for borrowers in Illinois who are working with a loan broker. It is a statement that includes important information about the borrower's financial situation and their agreement with the loan broker.

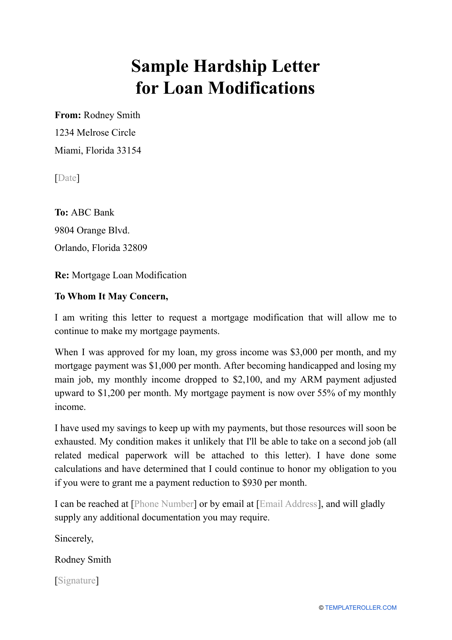

Individuals use this letter to explain the reasons why they are applying for a loan modification and offer possible loan modifications in order to make it easier for them to pay it back.

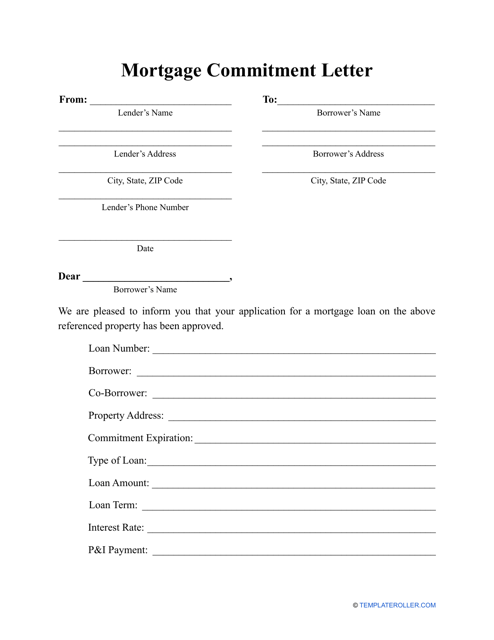

This letter is sent to the borrower after their mortgage application is accepted.

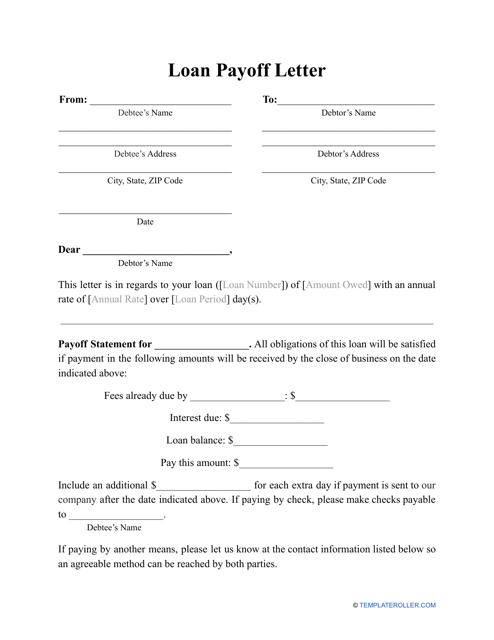

This letter provides detailed instructions on how to pay off a loan.