Term Loan Templates

Documents:

86

According to a Revolving Credit Agreement, a seller allows a buyer to make purchases under this account on the terms and conditions established in the agreement.

This document is a Loan Guaranty Agreement specific to the state of Virginia. It outlines the terms and conditions of a loan guarantee between the borrower and the guarantor.

This Form is used for requesting a deferment of outstanding loan payments in New York City due to IRS Notice 2020-23.

This is a contract used to document and formalize all obligations that regulate receiving the loan and paying it back.

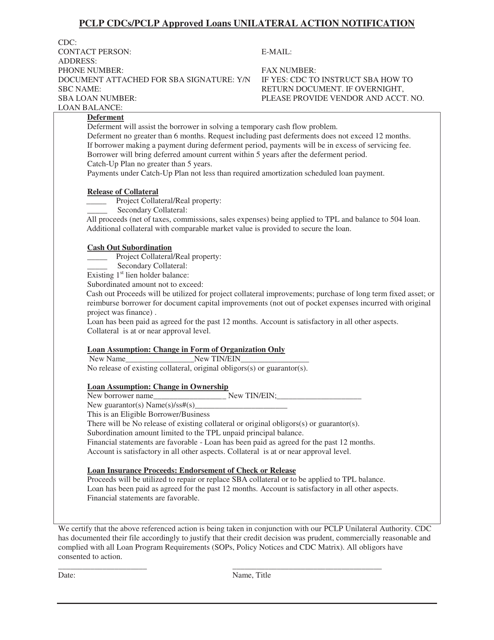

This document is for notifying individuals about unilateral actions taken in regards to PCLP CDCs/PCLP approved loans.

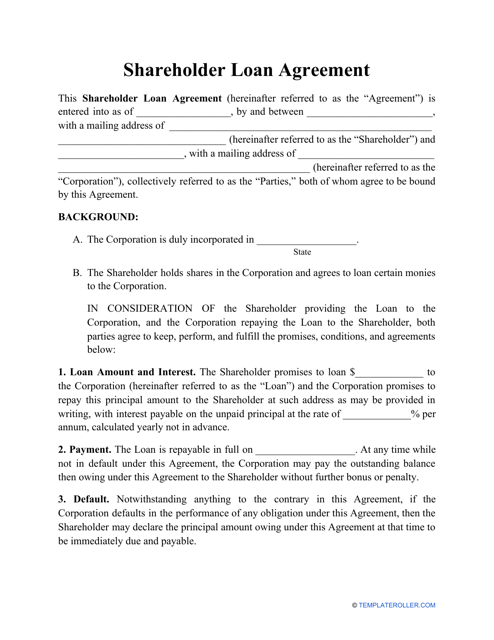

This type of agreement is used when a corporation borrows money from a shareholder in order to explain the details of the loan and to serve as evidence of the debt.

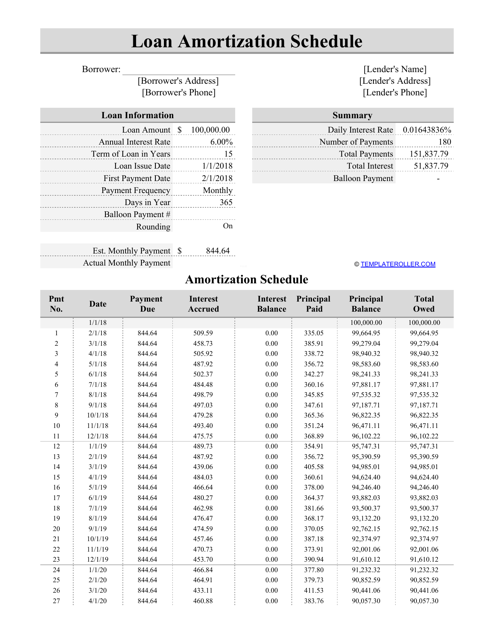

An individual can use this spreadsheet to outline payments for a loan, to calculate the money that goes towards the lender and to the interest until the borrower has paid off the entire amount of a loan.

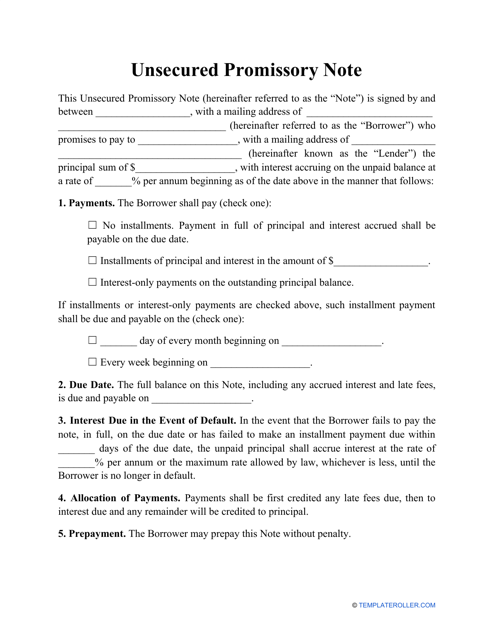

This template establishes the basic terms of the agreement between a lender and a borrower regarding the money the former has provided the latter with.

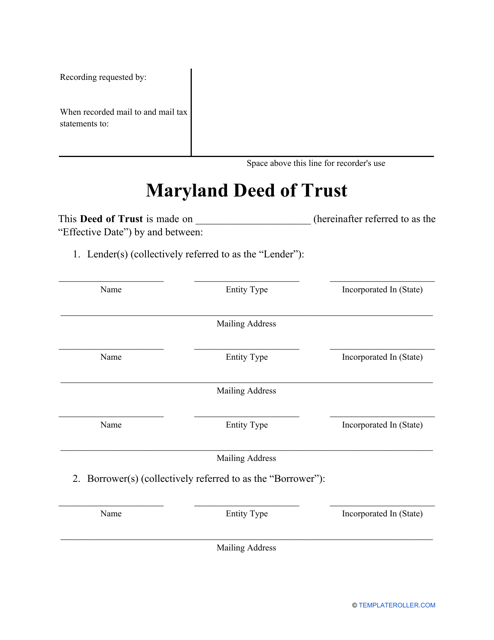

Complete this printable Deed of Trust template when making your own Deed in the state of Maryland.

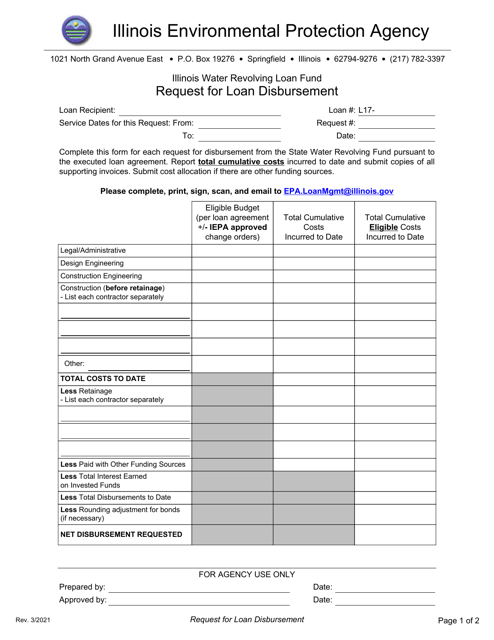

This document is used for requesting the disbursement of a loan in the state of Illinois.

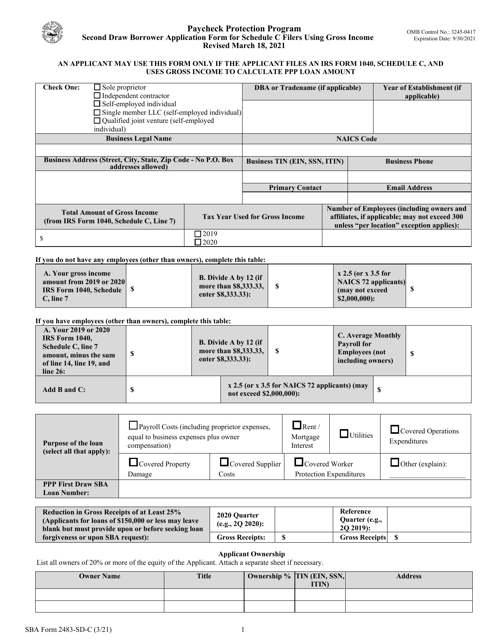

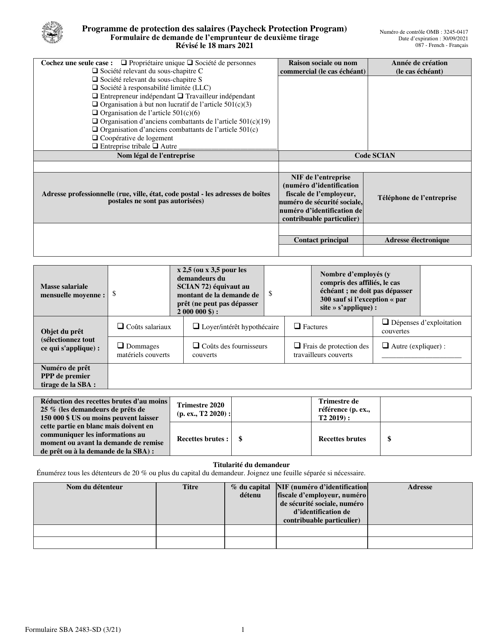

This form is used for small business owners who file their taxes with a Schedule C form and are applying for a second draw loan through the Small Business Administration. The form specifically caters to those who calculate eligibility based on gross income.

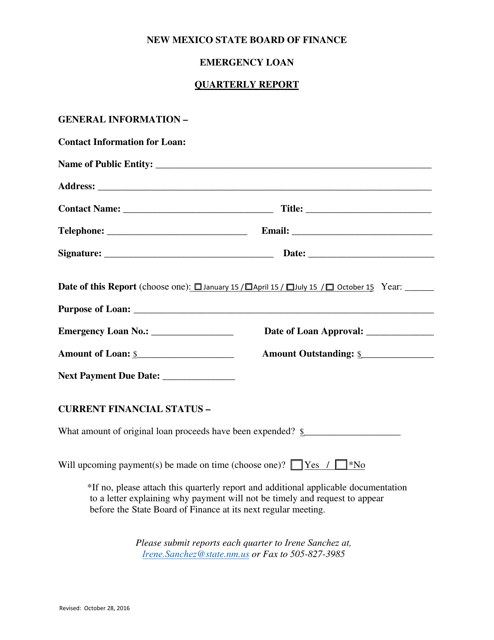

This document provides a quarterly report on emergency loans in the state of New Mexico.

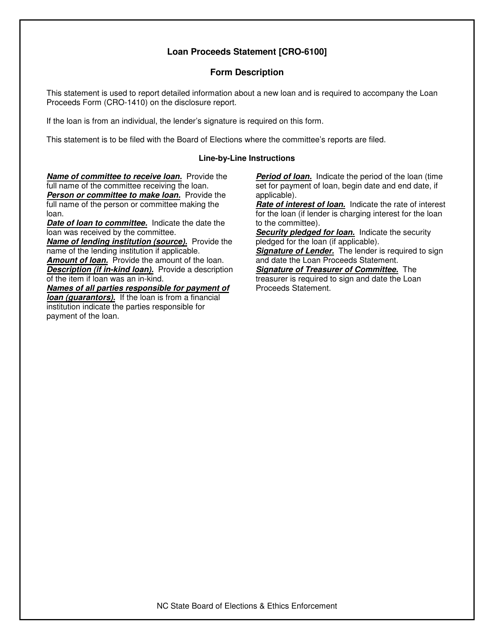

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

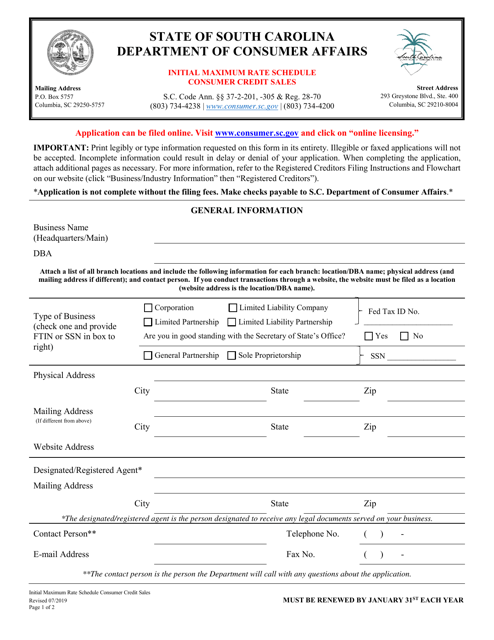

This document provides the maximum interest rates for consumer credit sales in South Carolina.

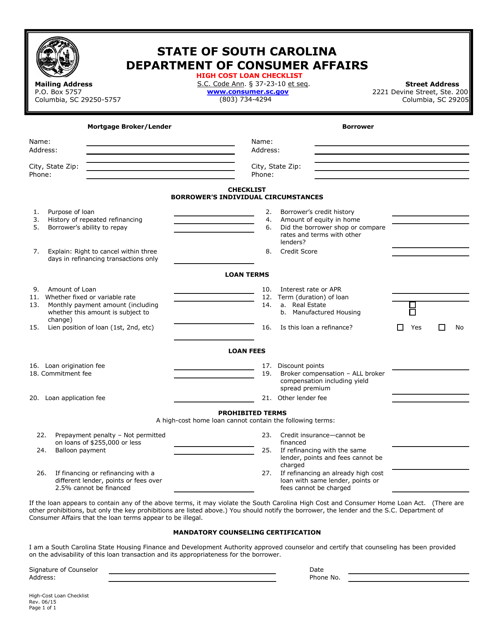

This document is a checklist that helps South Carolina residents assess the expenses and terms associated with high-cost loans in order to make informed decisions.

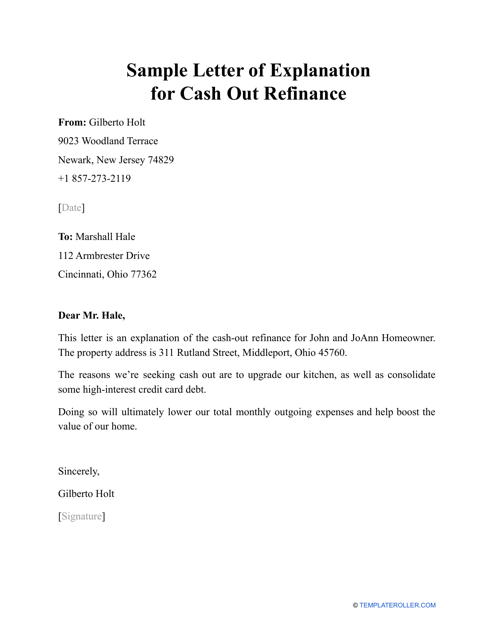

A mortgage borrower may draft a request such as this when they are looking to use the equity they have built for their advantage and replace their old mortgage with a new one.

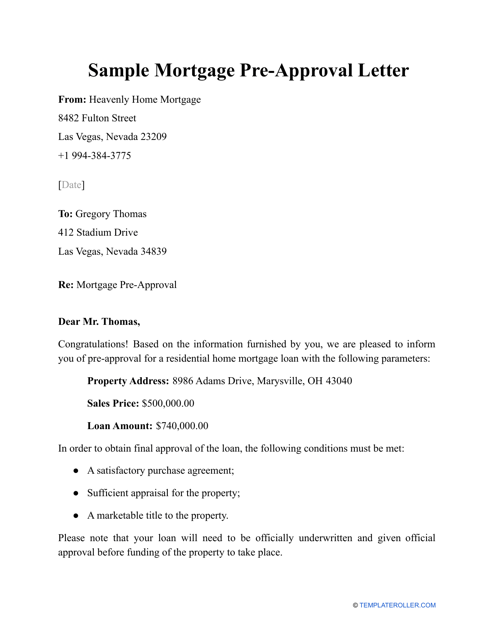

This letter can be used as a reference to show that a customer has maintained a good credit history and has saved the necessary funds that will later help them qualify for a mortgage loan.

This form is used by the Small Business Administration (SBA) to determine a loan applicant's creditworthiness, indebtedness, and overall eligibility for the SBA Section 504 loan.

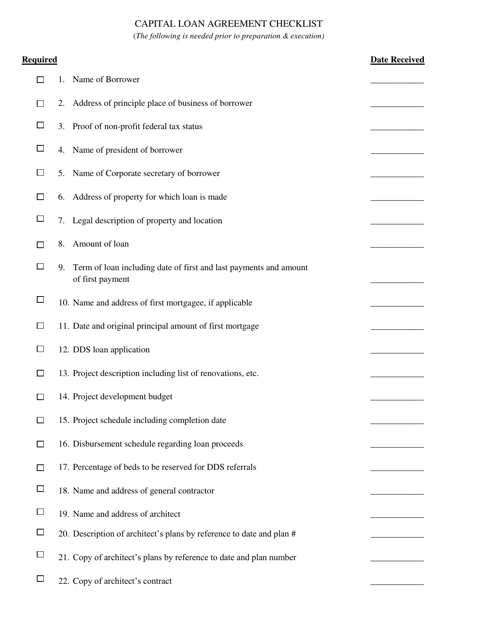

This document provides a checklist for a capital loan agreement in Connecticut. It outlines the necessary steps and requirements for obtaining a capital loan in the state.

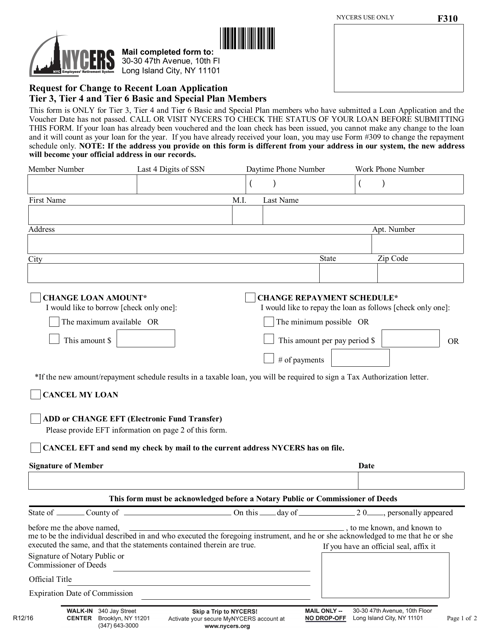

This Form is used for requesting a change to a recent loan application for Tier 3, Tier 4, and Tier 6 Basic and Special Plan Members in New York City.

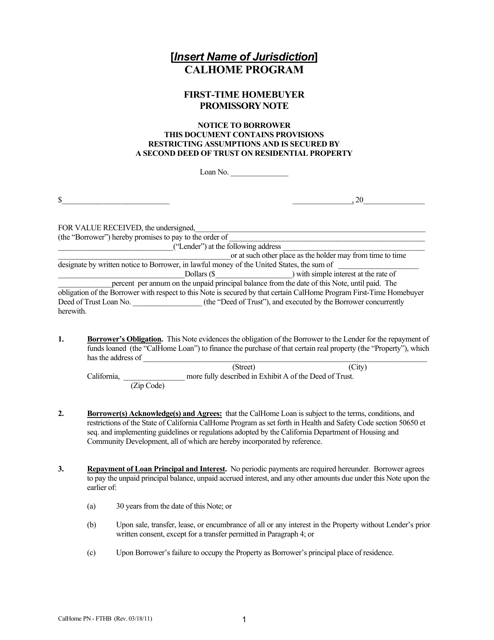

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

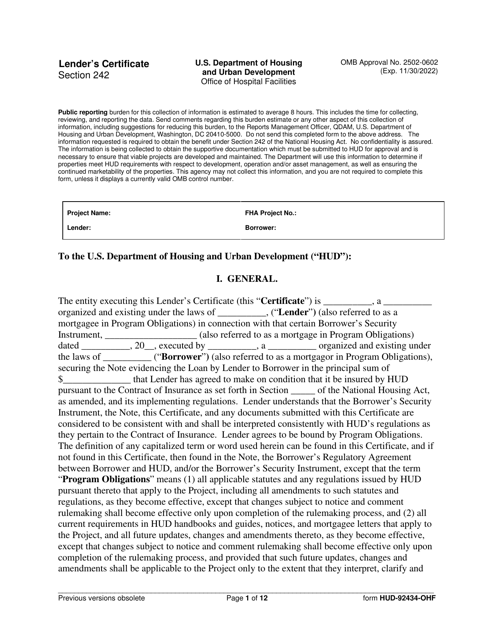

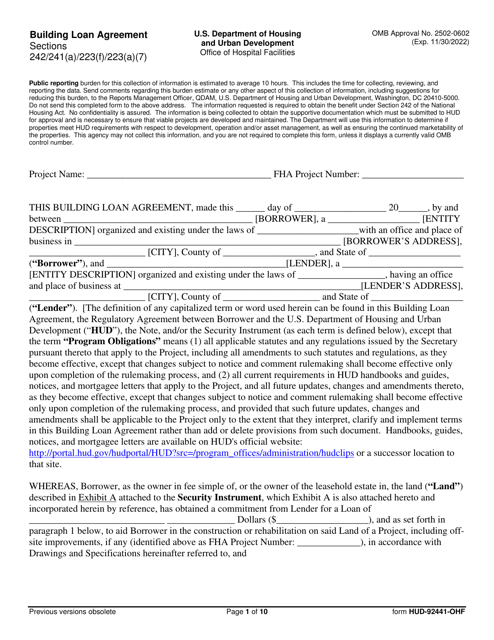

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

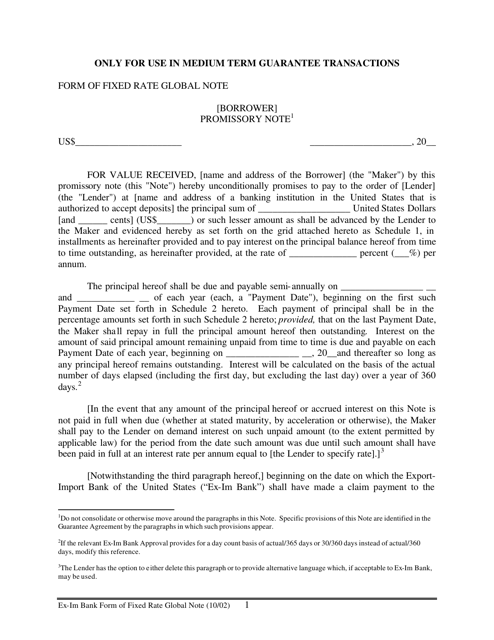

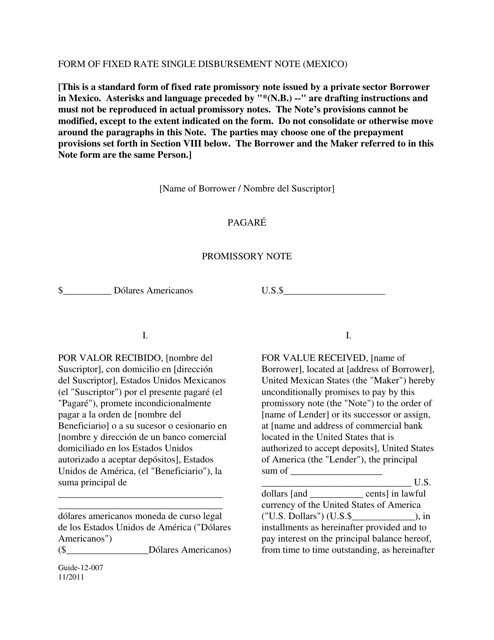

This document is a form that can be used in Mexico for a fixed rate single disbursement note. It is available in both English and Spanish.

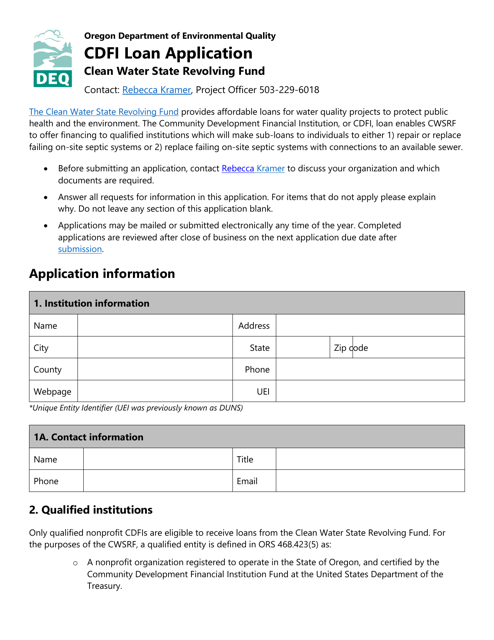

This document is for applying for a CDFI loan from the Clean Water State Revolving Fund in Oregon.

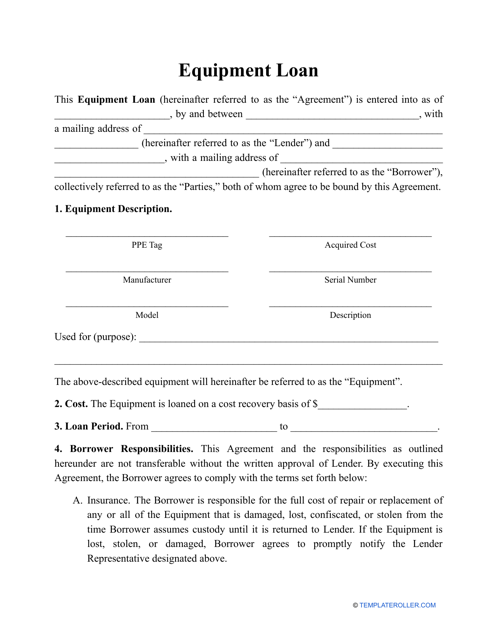

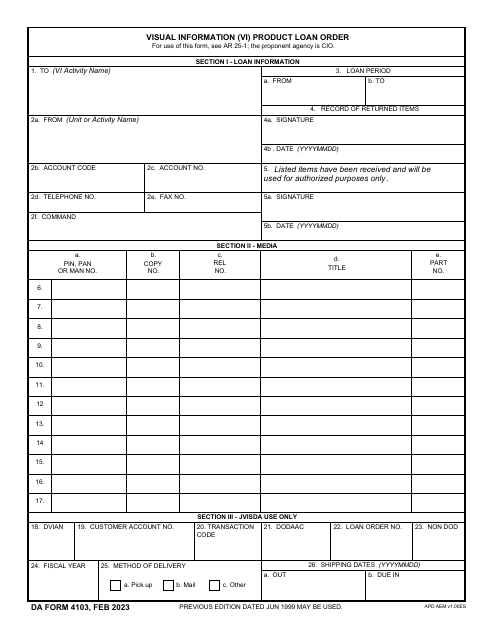

An individual or organization may use this type of template to loan out specific equipment to colleagues in various departments.

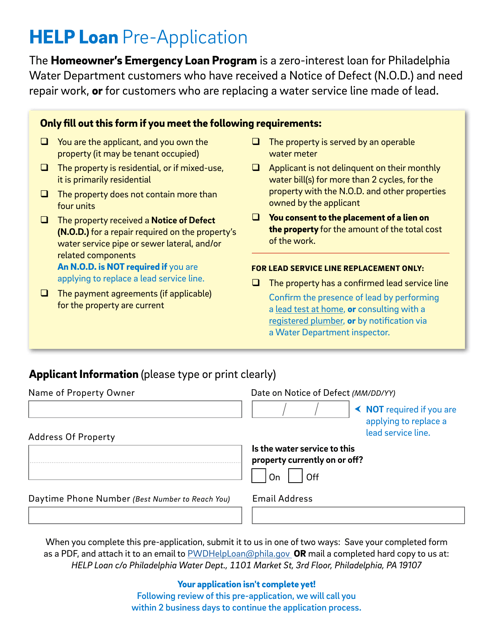

This document is a pre-application form for a loan assistance program offered by the City of Philadelphia in Pennsylvania. It helps residents of Philadelphia apply for financial assistance for various purposes, such as home repairs or small business development.

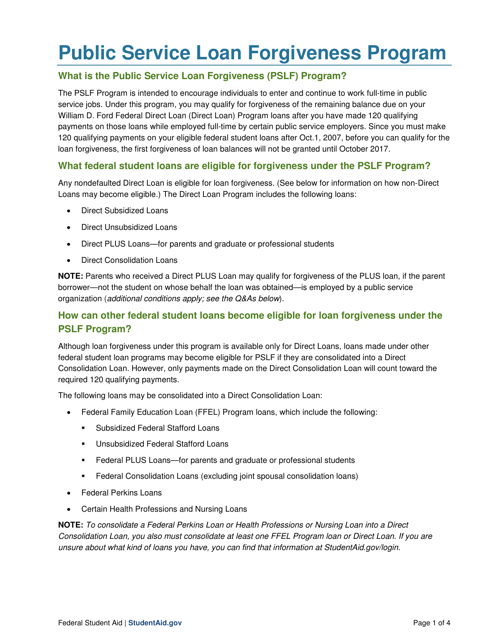

This fact sheet provides information about the Public Service Loan Forgiveness program, including eligibility requirements, application process, and benefits. It is designed to help borrowers understand how they may qualify for loan forgiveness through public service employment.

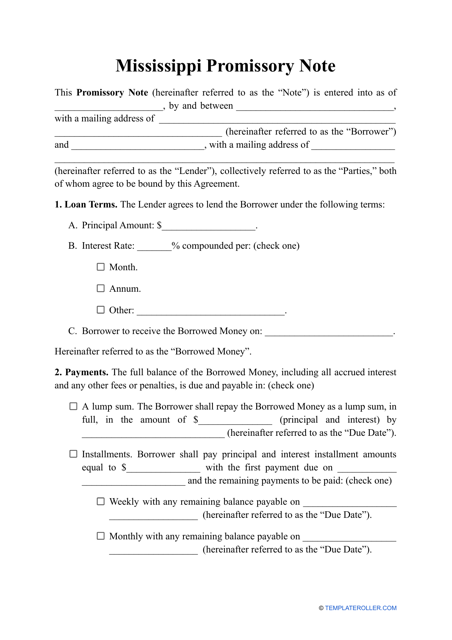

This document is a promissory note template specific to the state of Mississippi. It outlines the details and terms of a loan agreement.

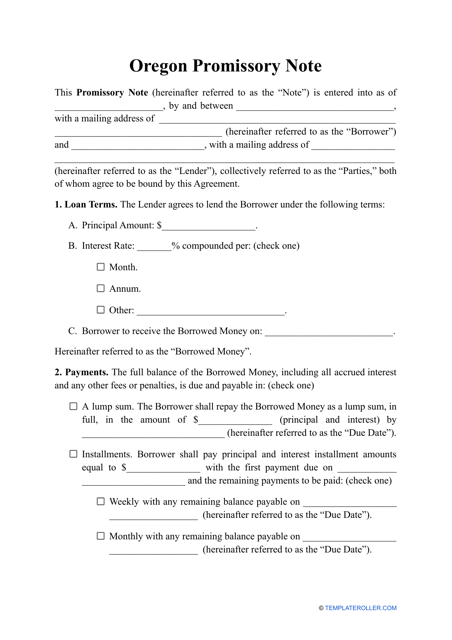

This document is used for creating a legally binding agreement between a borrower and a lender in the state of Oregon. It outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

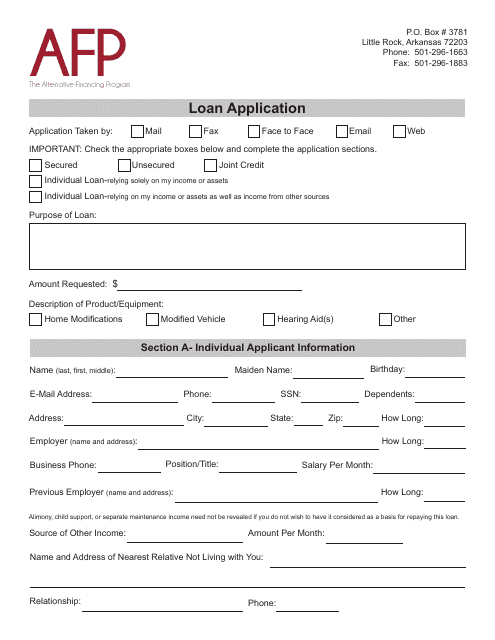

This document is used for applying for a loan through the Alternative Financing Program in the state of Arkansas.

This document provides guidance and important information for borrowers of federal student loans who are preparing to exit or finish their loan repayment. It helps borrowers understand their rights and responsibilities and provides tips for managing their student loan debt after graduation.

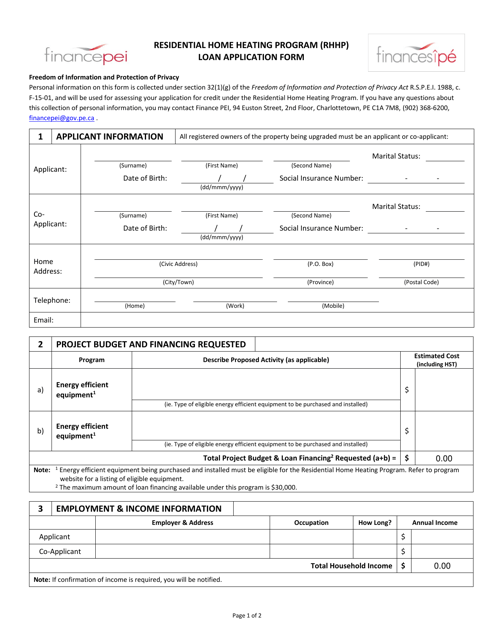

This form is used for applying for a loan under the Residential Home Heating Program (RHHP) in Prince Edward Island, Canada.

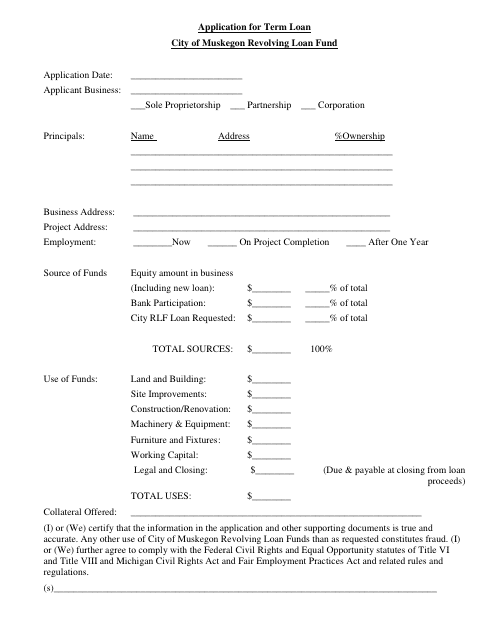

This document is an application for a term loan from the Revolving Loan Fund in the City of Muskegon, Michigan.

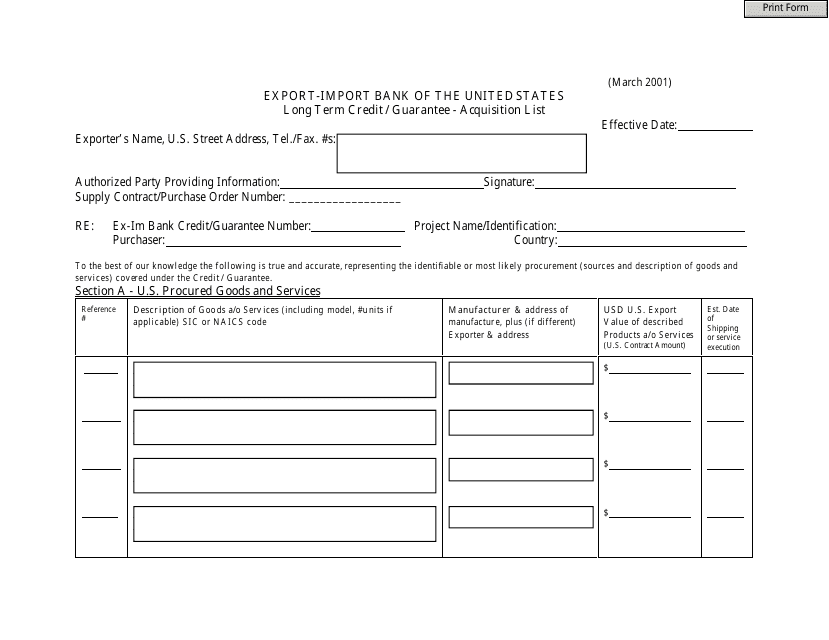

This document is a list of acquisitions that have been made with long-term credit or guarantee. It outlines the purchases or investments that have been financed through this method.