Claim Refund Templates

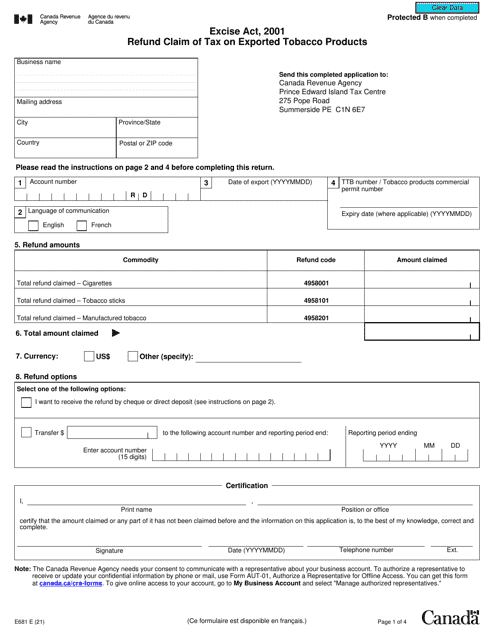

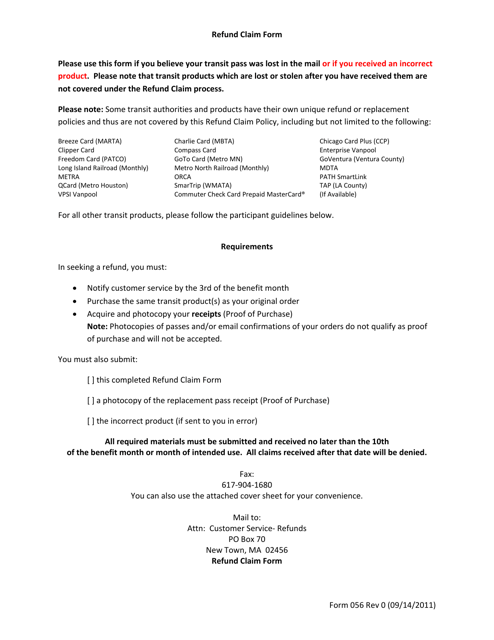

Are you looking to submit a claim for a refund? We understand that the process can sometimes be confusing and time-consuming. That's why we have created a comprehensive collection of documents to help you with your refund claim. Whether you are claiming a refund for motor fuel tax, vendor's compensation, fermented malt beverage tax, or any other type of refund, our collection has got you covered.

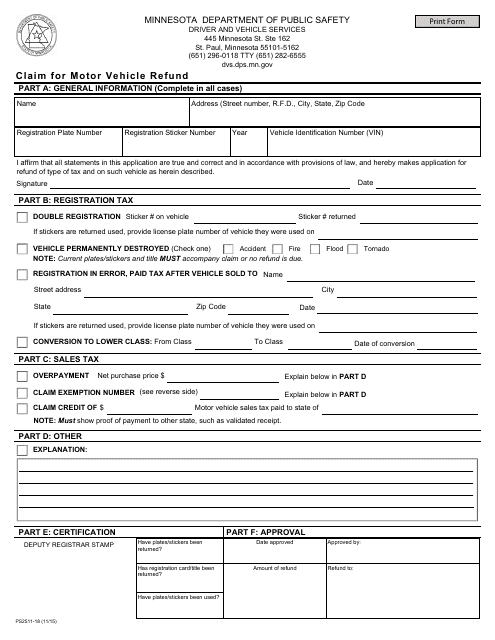

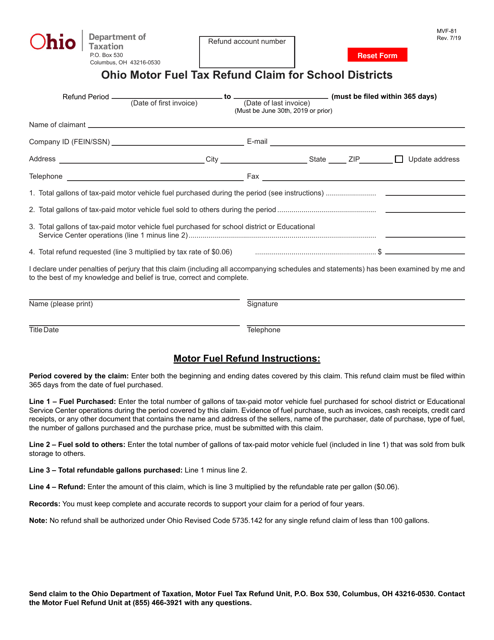

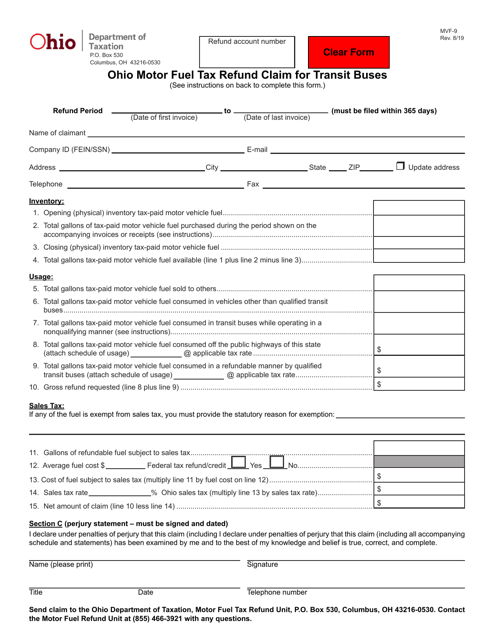

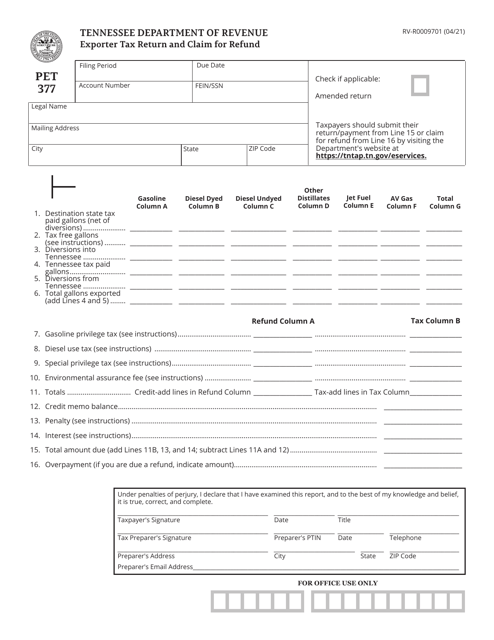

Our collection includes various forms, such as the Ohio Motor Fuel Tax Refund Claim for School Districts, the Indiana Claim for Refund form, the Louisiana Motor Vehicle Dealers Vendor's Compensation Claim for Refund form, the Wisconsin Refund Claim for Fermented Malt Beverage Tax form, and the Minnesota Refund Claim Form. These forms are designed to simplify the refund claim process and ensure that you have all the necessary documentation to support your claim.

No matter which state you are in, our collection of refund claim forms will assist you in navigating the refund process smoothly. Our easy-to-use forms will guide you through the necessary steps and provide detailed instructions to ensure that you submit a complete and accurate refund claim.

So, if you are looking to claim a refund and need the right documentation, look no further. Our collection of refund claim forms is here to help you get the refund you deserve. Don't let the refund process overwhelm you - let our documents make it a breeze.

Documents:

89

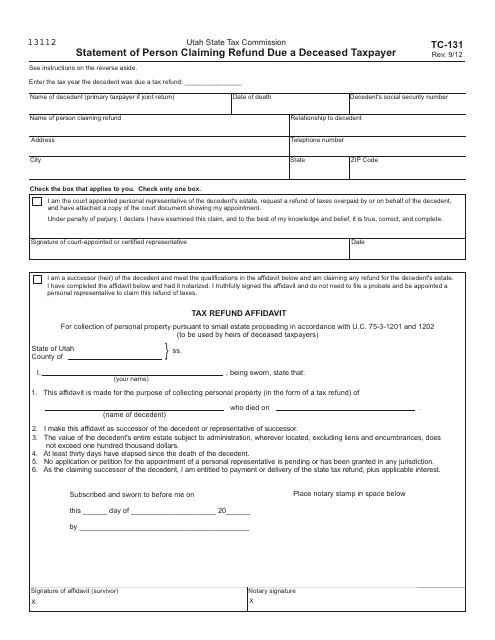

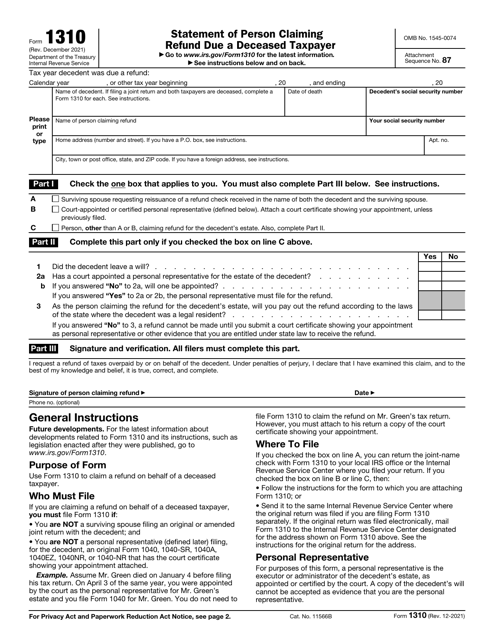

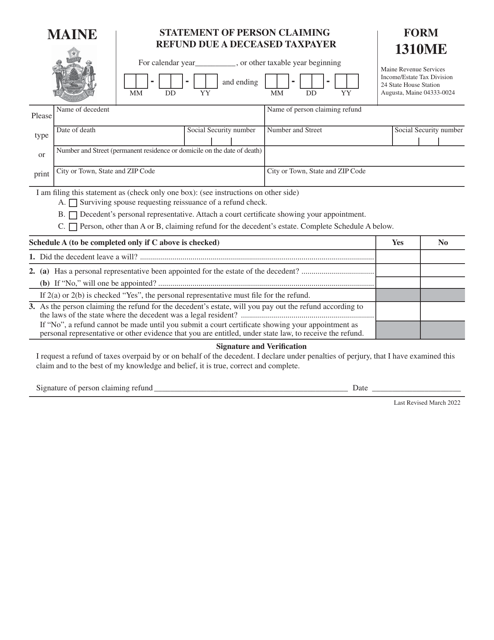

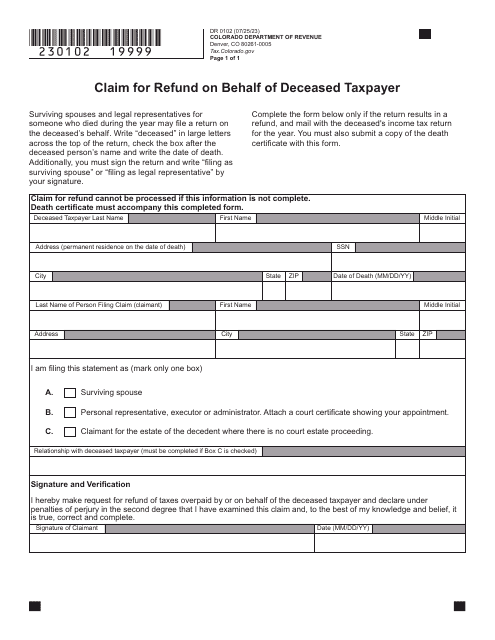

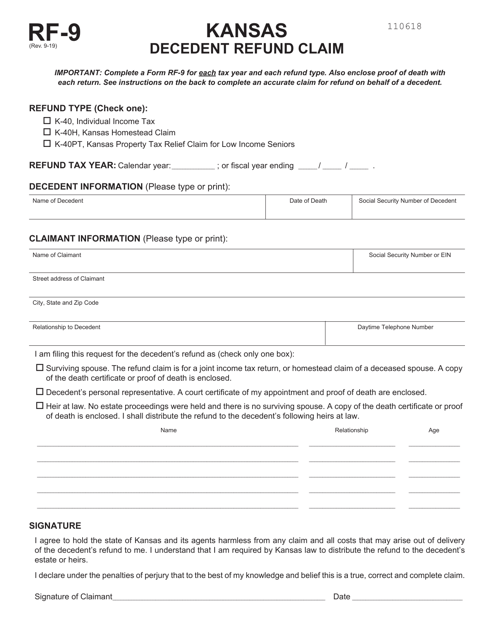

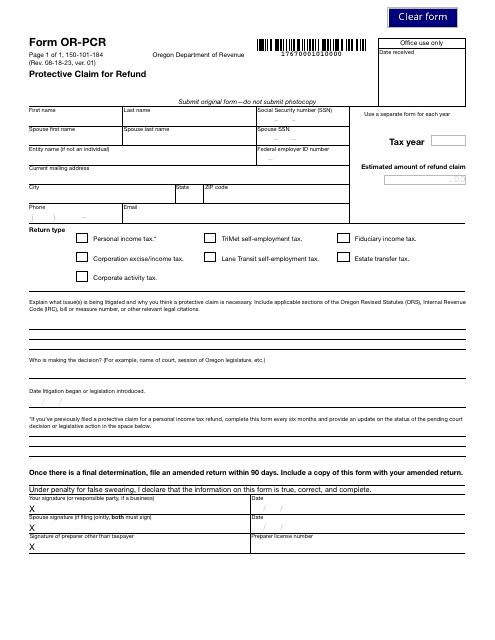

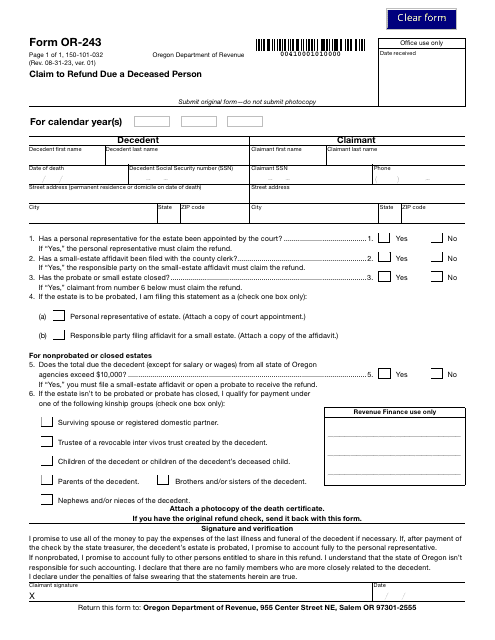

This form is used for individuals claiming a refund on behalf of a deceased taxpayer in the state of Utah.

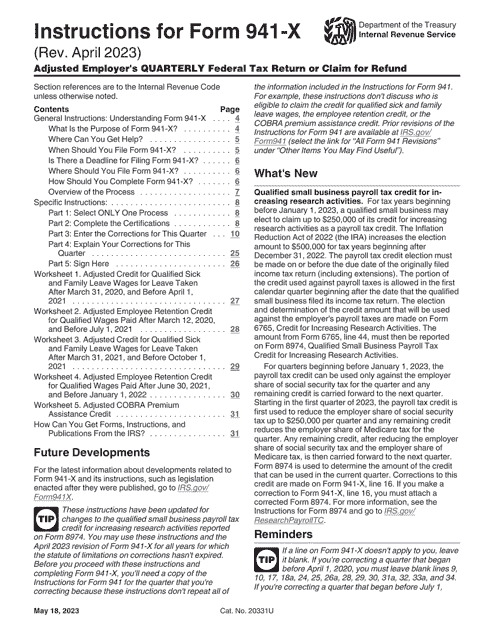

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

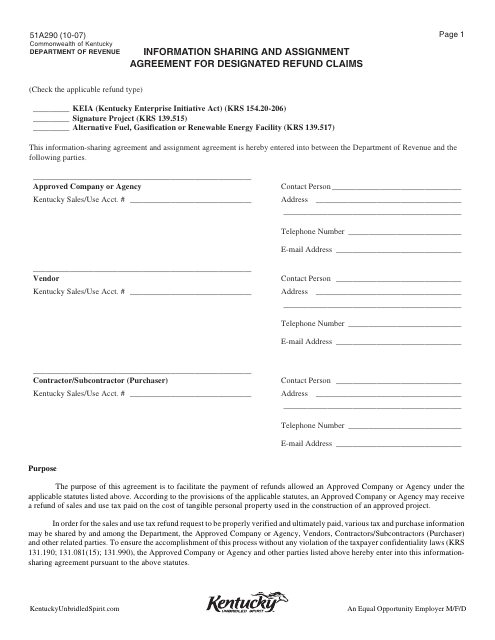

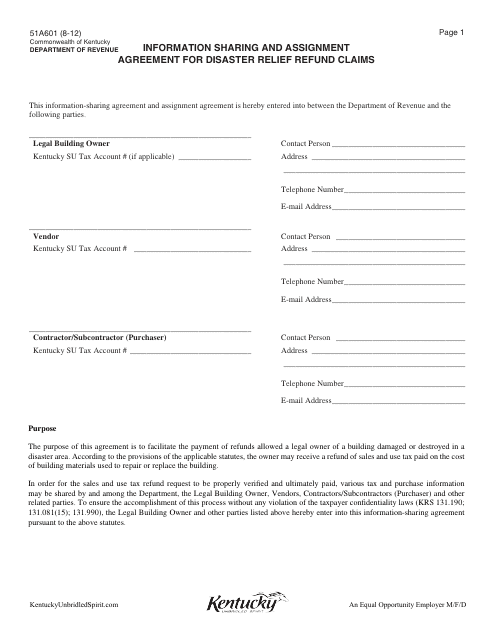

This form is used for sharing information and assigning refund claims in the state of Kentucky.

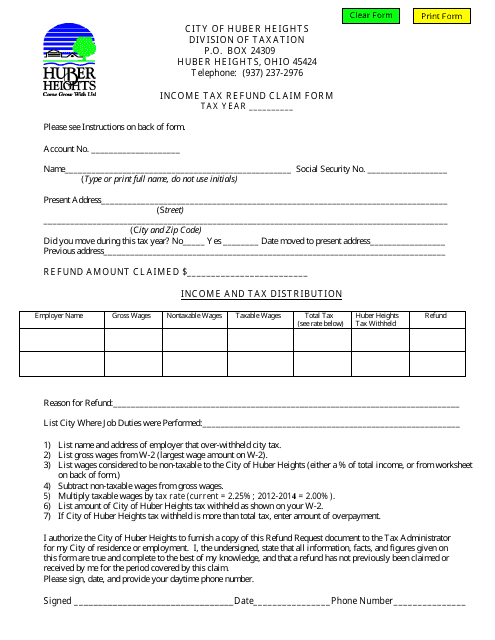

This form is used for claiming an income tax refund in Huber Heights, Ohio.

This form is used for sharing information and assigning responsibilities related to disaster relief refund claims in Kentucky.

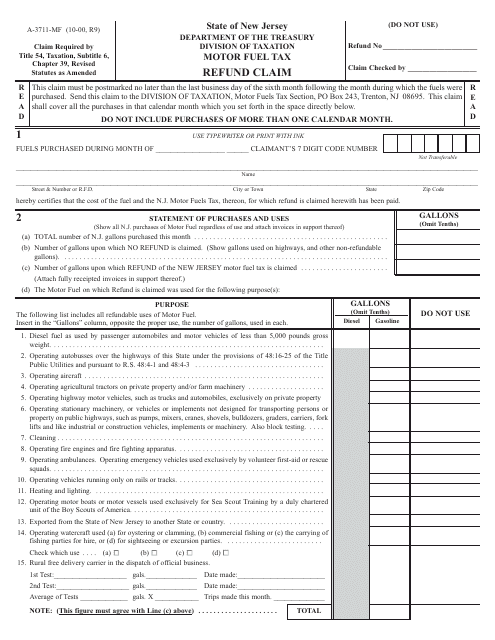

This form is used for claiming a refund on motor fuel tax in the state of New Jersey.

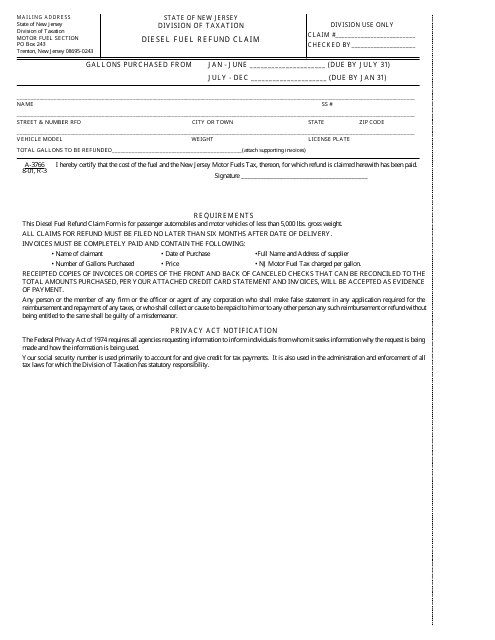

This form is used for claiming a refund on diesel fuel taxes paid in the state of New Jersey.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

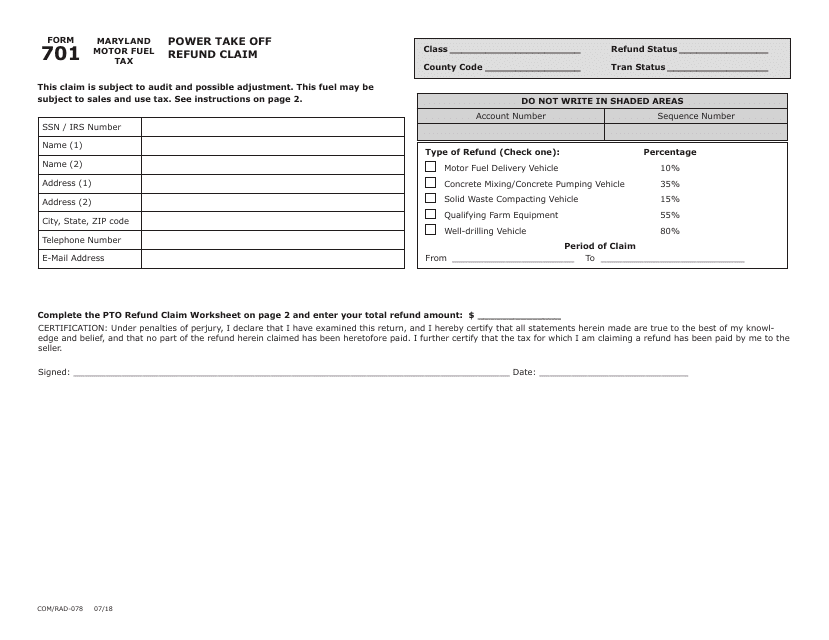

This form is used for claiming a refund for power take-off (PTO) equipment in the state of Maryland.

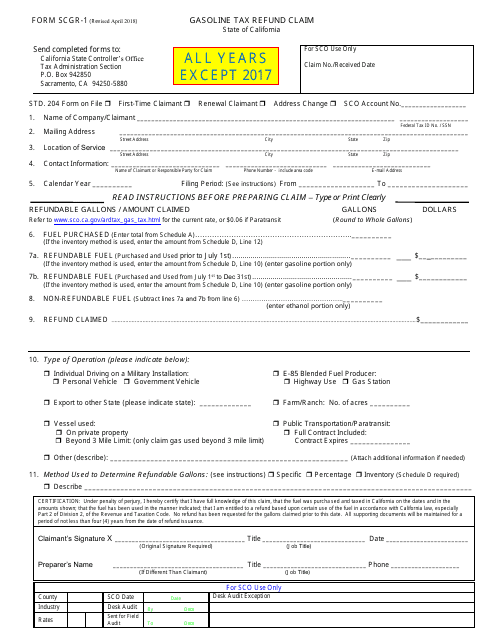

This Form is used for claiming a refund of gasoline tax in California.

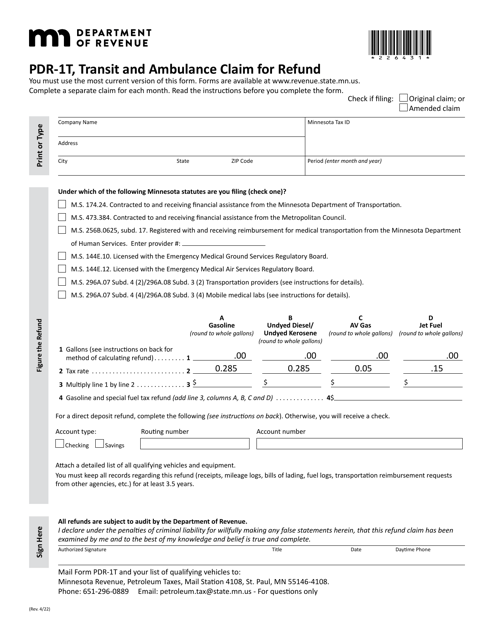

This form is used for claiming a refund for motor vehicle related expenses in the state of Minnesota.

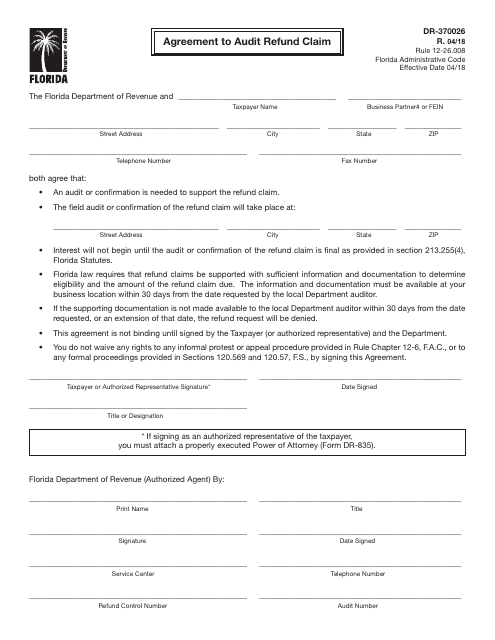

This Form is used for agreeing to audit a refund claim in the state of Florida.

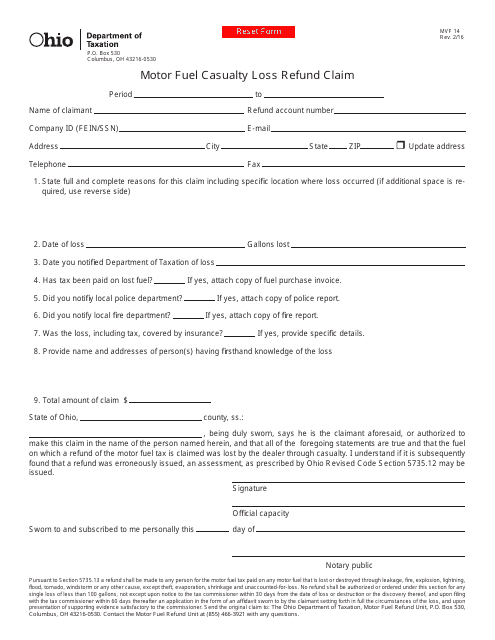

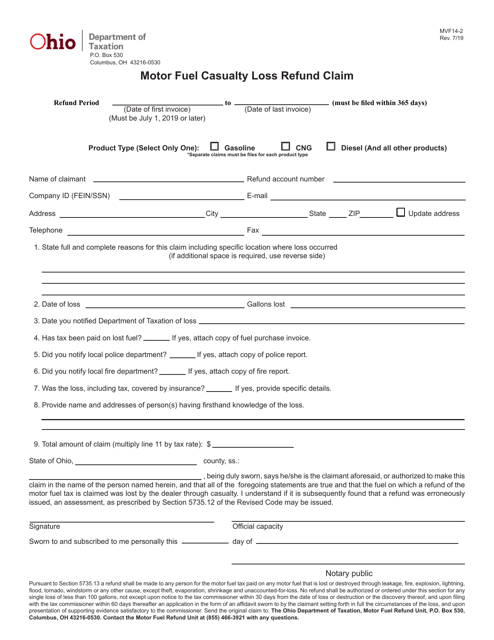

This form is used for claiming a refund for motor fuel lost due to accidents or spills in Ohio.

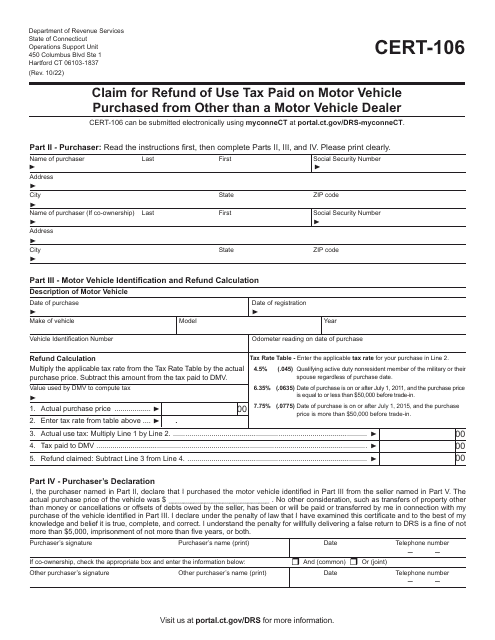

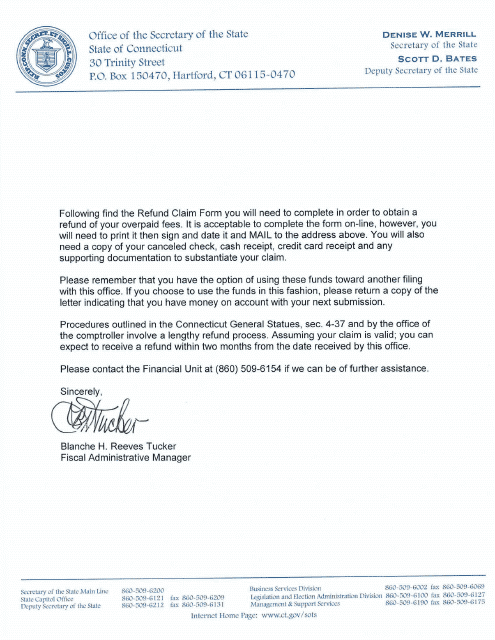

This form is used for filing a refund claim for overpaid fees in the state of Connecticut.

This form is used for claiming a refund of the White Goods Disposal Tax in North Carolina.

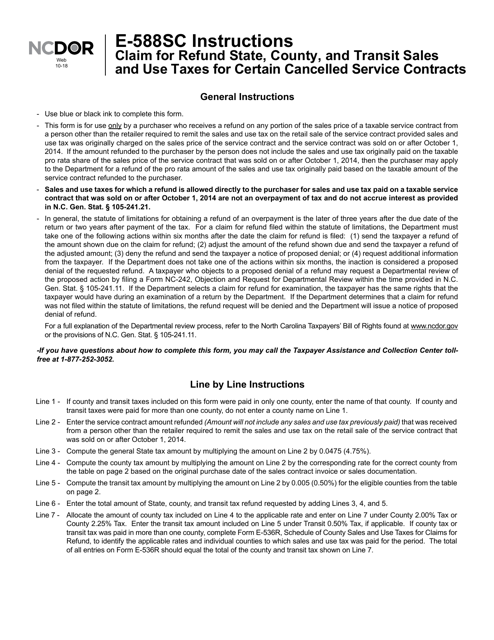

This form is used for claiming a refund for state, county, and transit sales and use taxes for certain cancelled service contracts in North Carolina. It provides instructions on how to fill out and submit the form to request a refund.

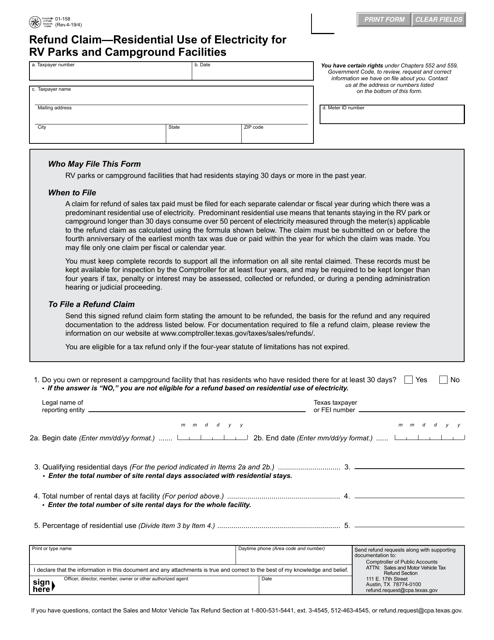

This form is used for claiming a refund for the residential use of electricity in RV parks and campground facilities located in Texas.

This form is used for filing a motor fuel casualty loss refund claim in the state of Ohio.

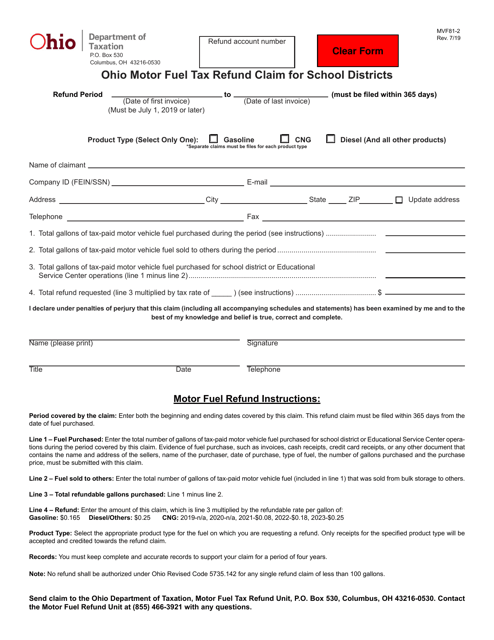

This Form is used for Ohio school districts to claim a refund for motor fuel taxes.

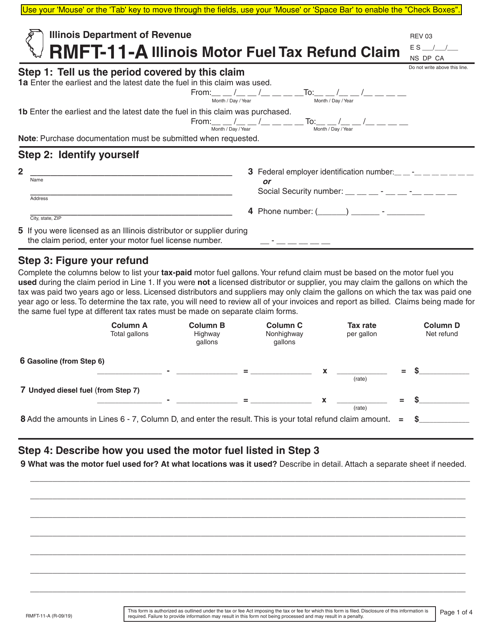

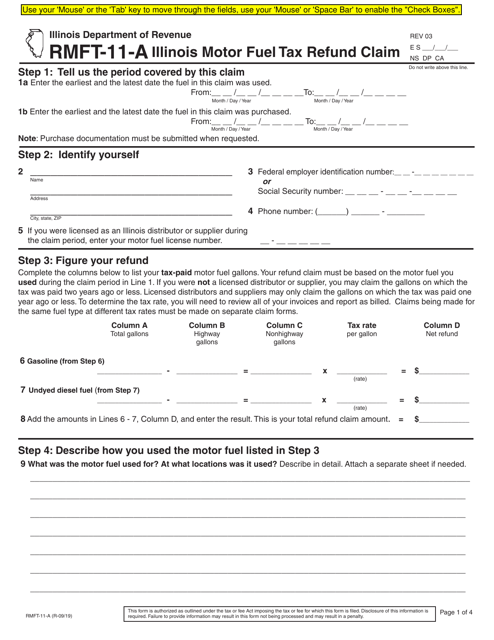

This Form is used for claiming a refund in the state of Illinois.

This form is used for claiming a refund of motor fuel tax in Illinois.