Claim Refund Templates

Documents:

89

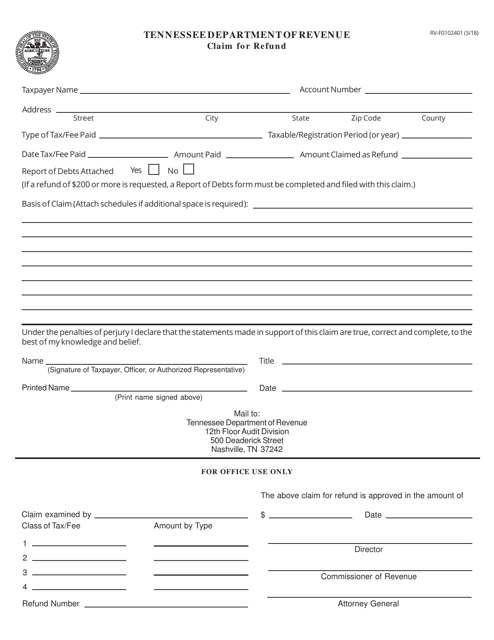

This form is used for claiming a refund in the state of Tennessee.

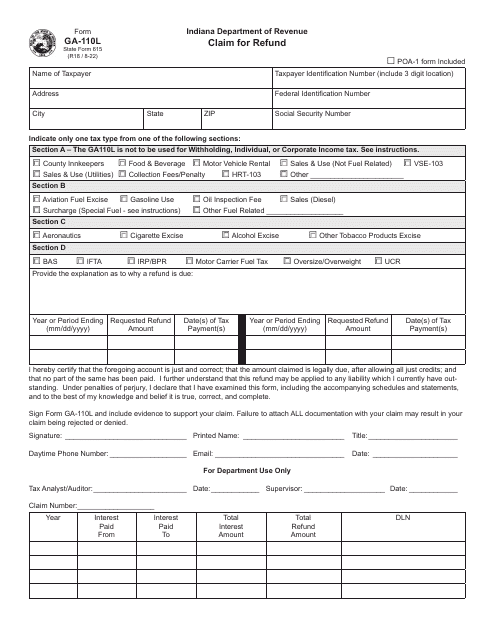

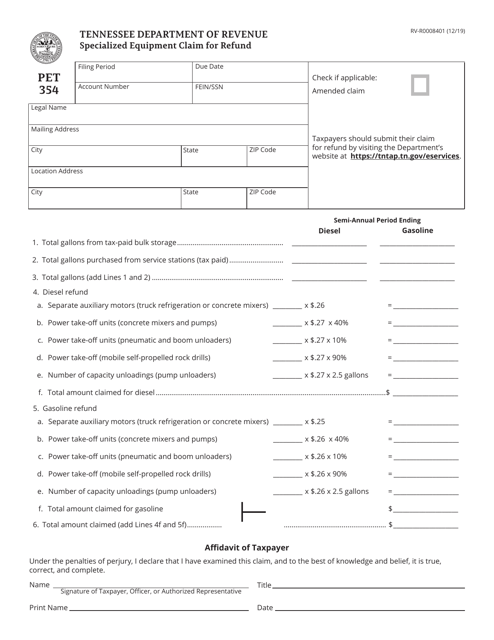

This form is used for filing a claim for refund for specialized equipment in Tennessee.

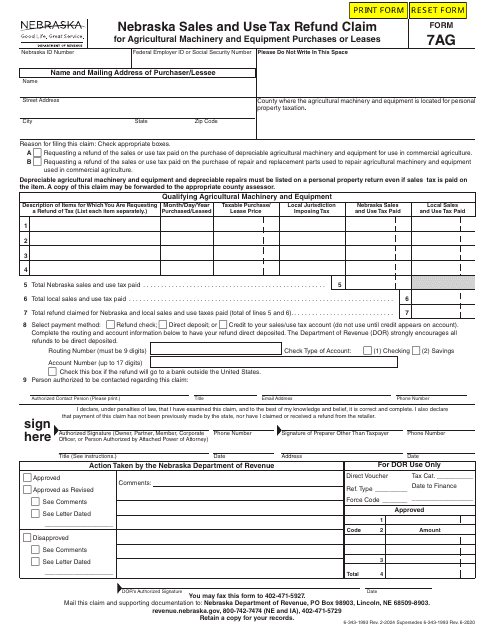

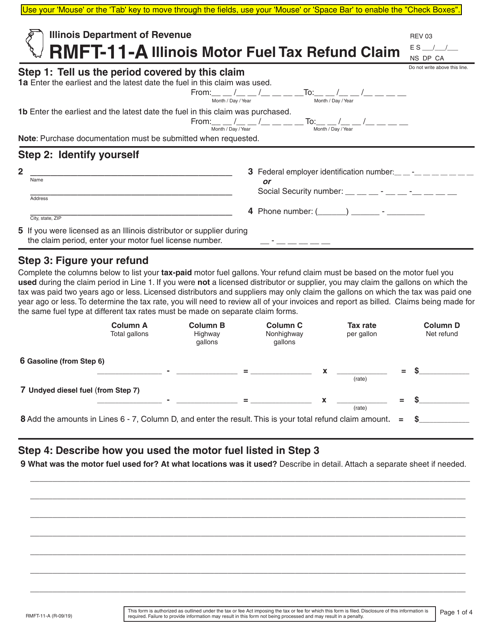

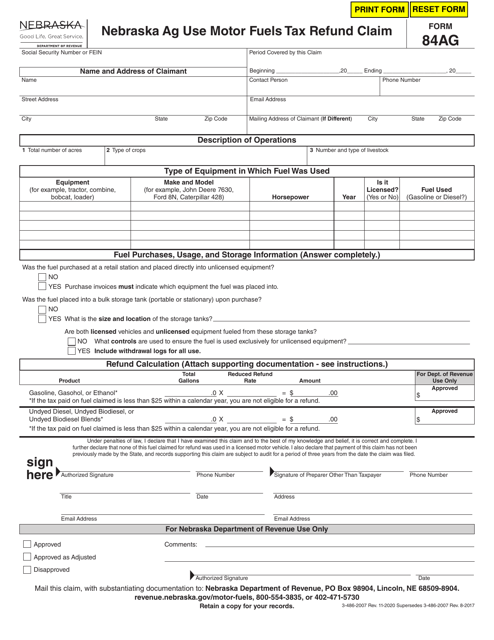

This Form is used for claiming a refund of motor fuels tax paid on ag use in Nebraska.

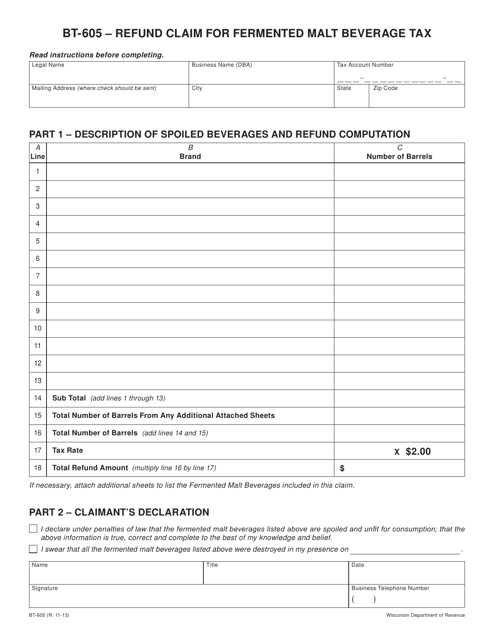

This form is used for claiming a refund for the fermented malt beverage tax in Wisconsin. It is for individuals or businesses who have paid this tax and are eligible for a refund.

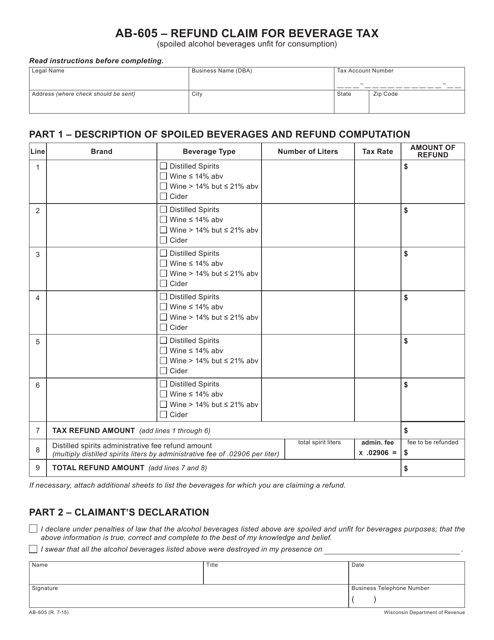

This form is used for claiming a refund of beverage tax in the state of Wisconsin.

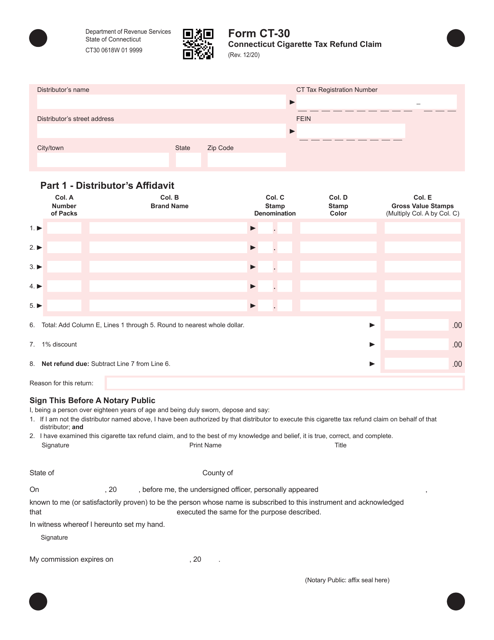

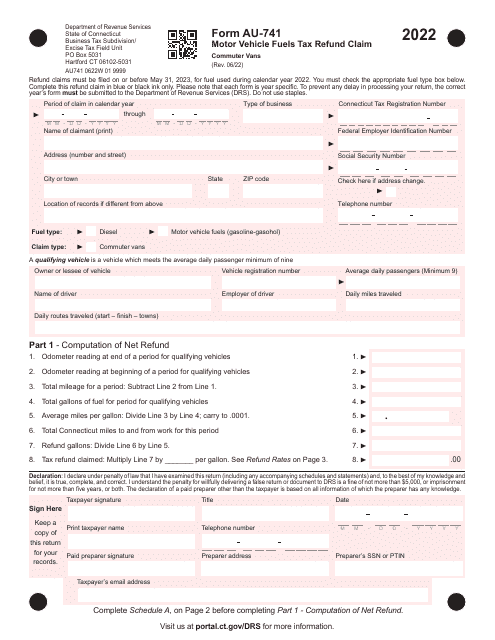

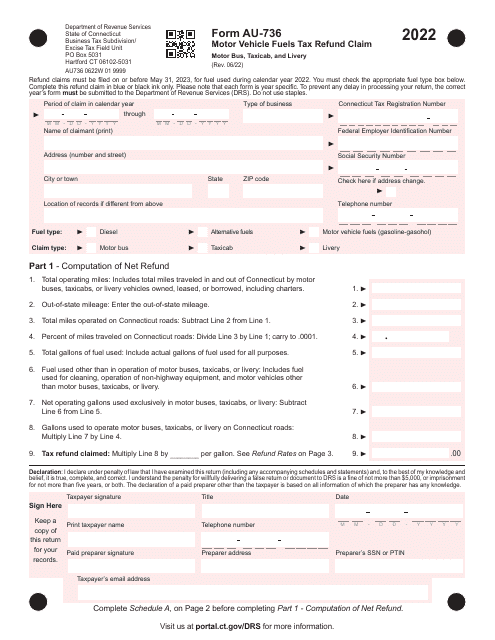

This form is used for claiming a refund of cigarette taxes paid in the state of Connecticut.

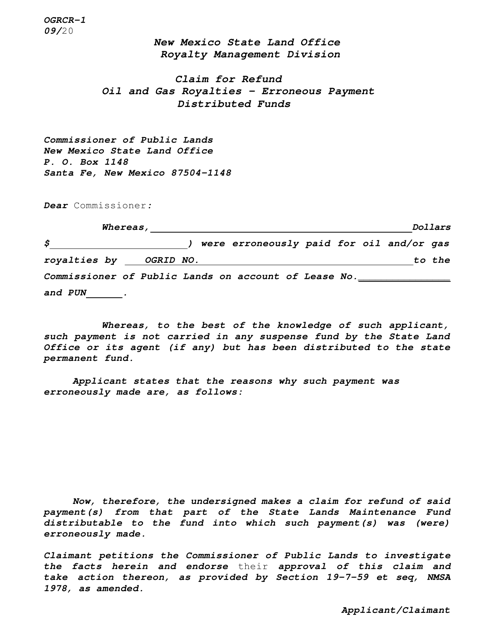

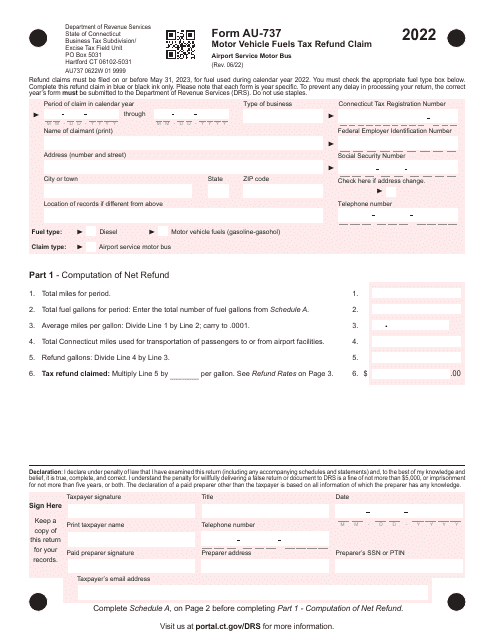

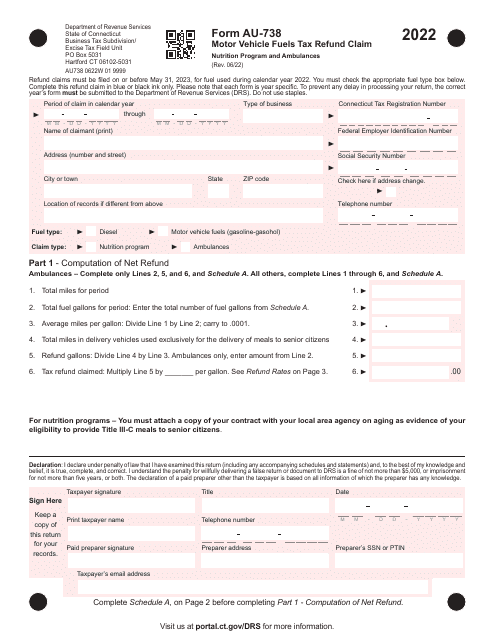

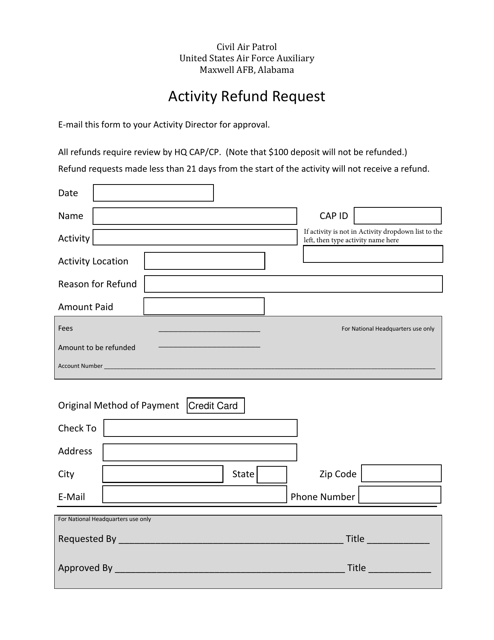

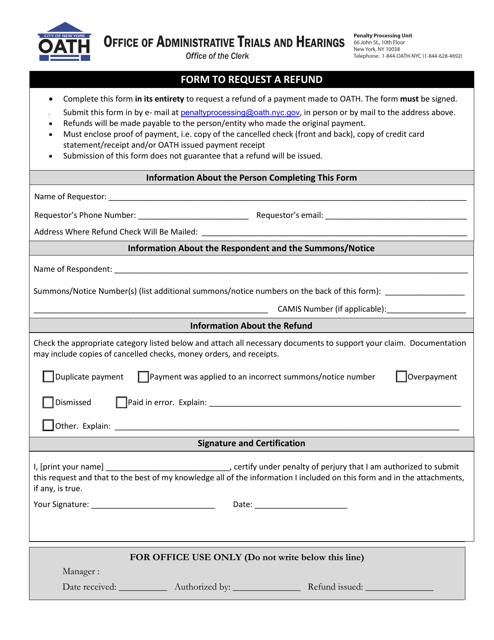

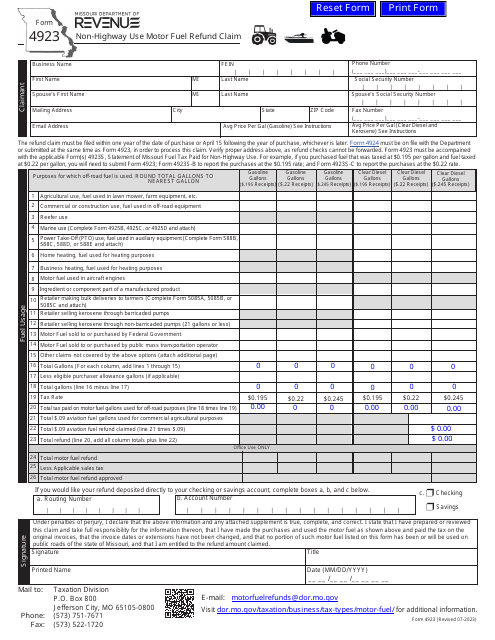

This document is used for requesting a refund for a certain activity or event.

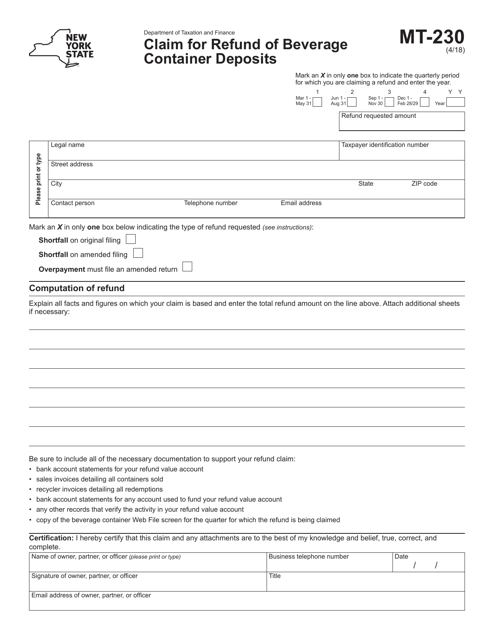

This form is used for claiming a refund of beverage container deposits in New York.

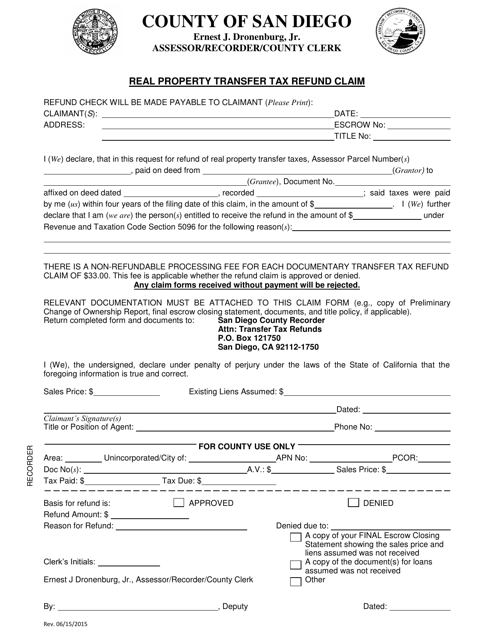

This form is used for requesting a refund of the real property transfer tax paid in San Diego County, California.

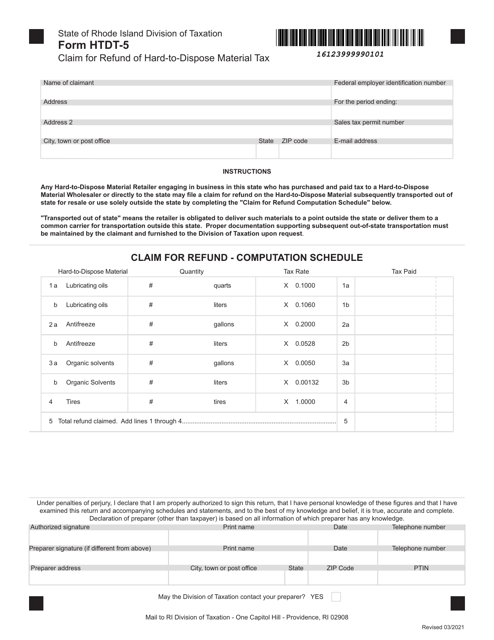

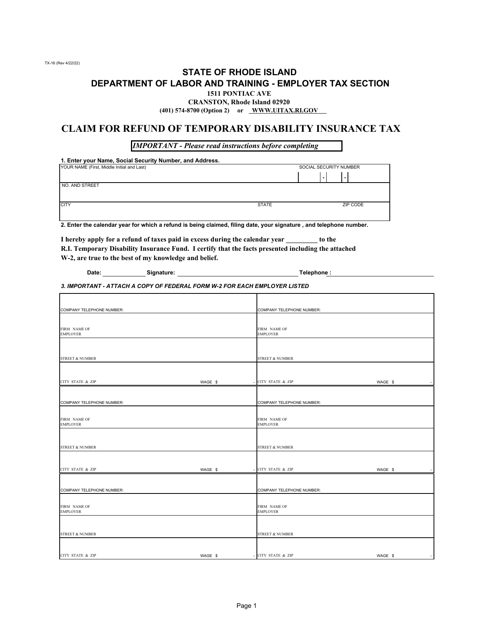

This form is used for claiming a refund of temporary disability insurance tax in Rhode Island.

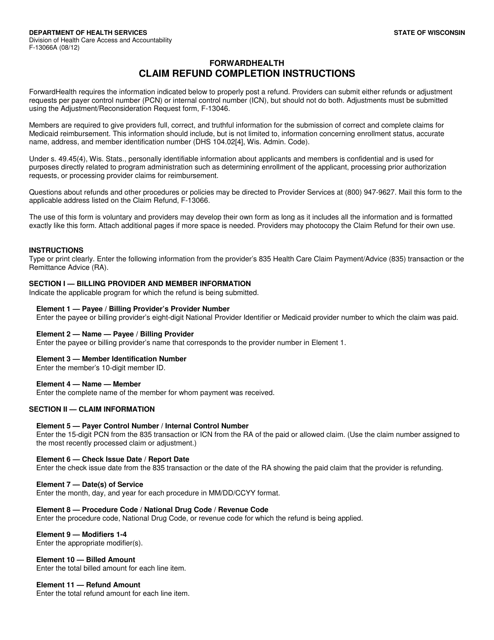

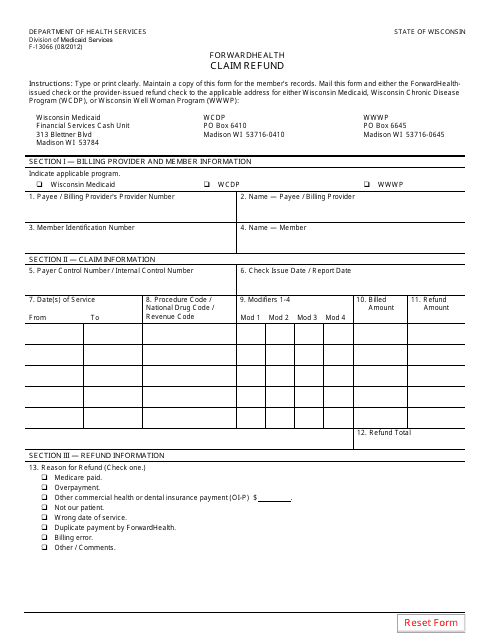

This type of document, Form F-13066 Claim Refund, is used for filing a refund claim in the state of Wisconsin. It provides instructions on how to complete and submit the form to claim a refund for overpaid taxes or other eligible reasons.

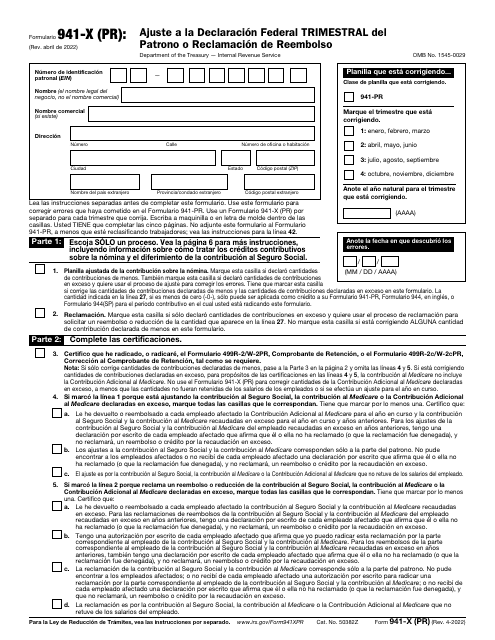

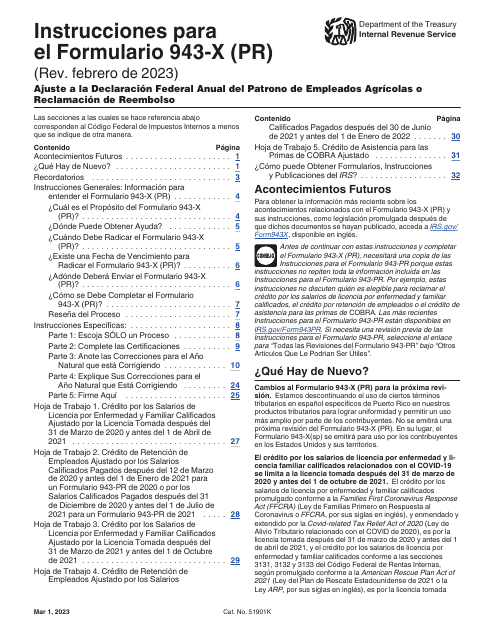

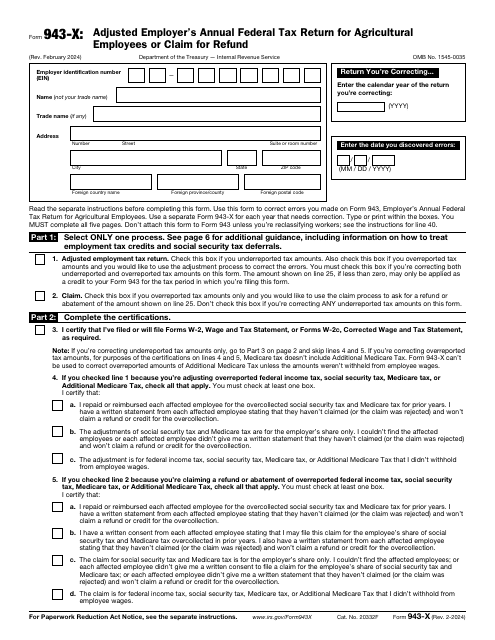

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

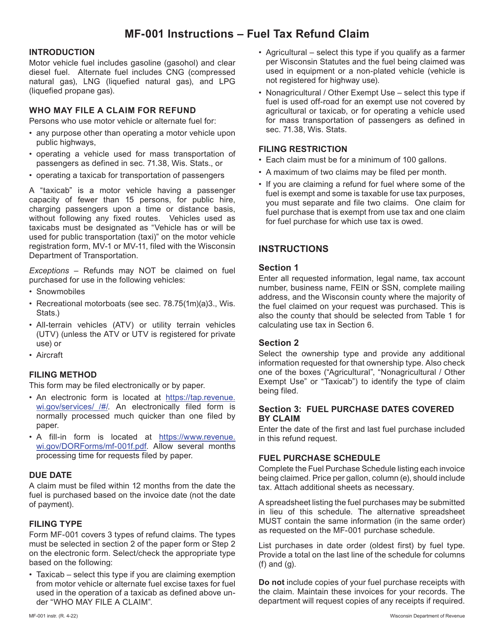

This Form is used for claiming a refund in the state of Wisconsin.

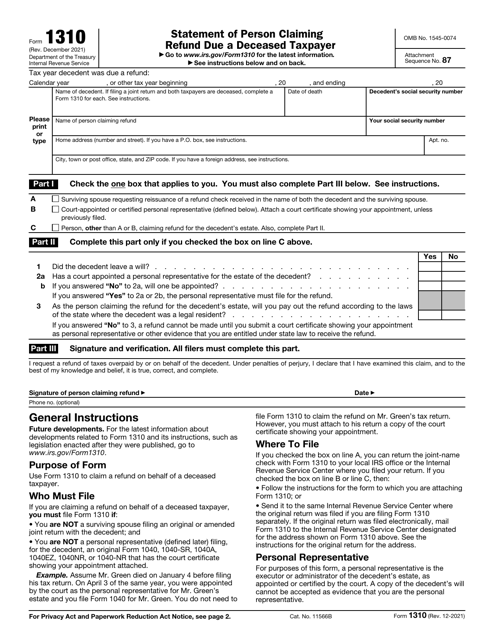

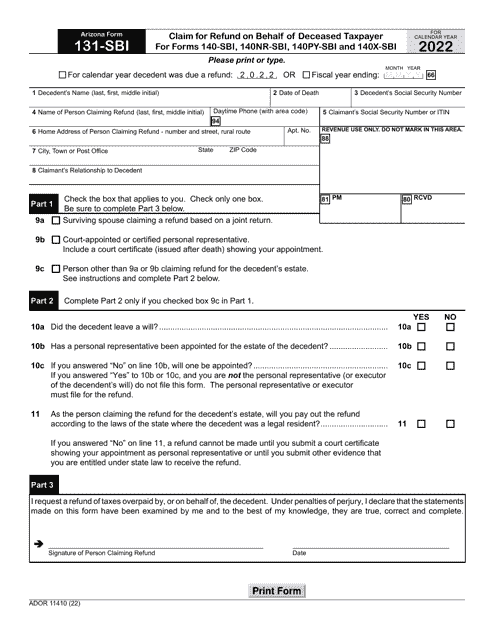

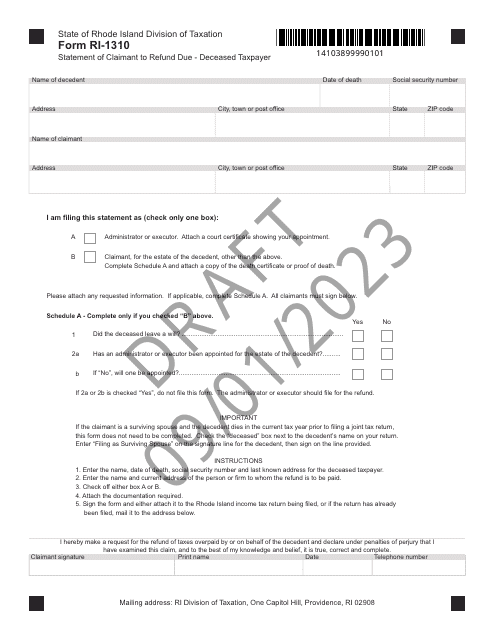

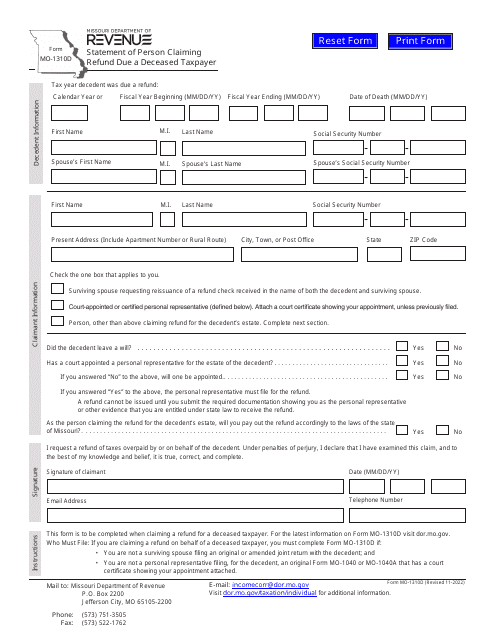

This Form is used for claiming a refund on behalf of a deceased taxpayer in the state of Missouri.

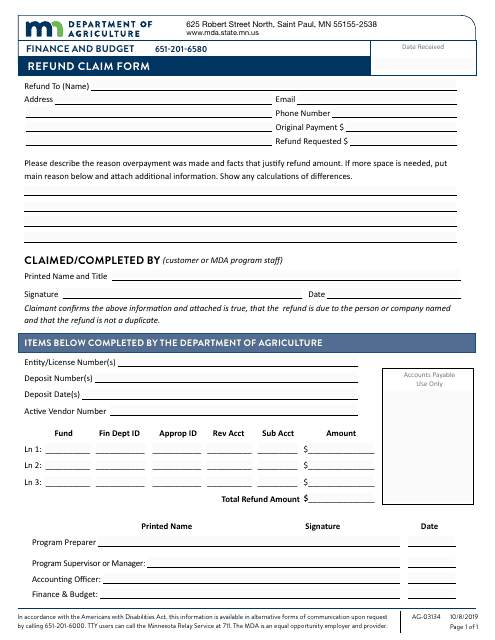

This form is used for claiming a refund in Minnesota.