IRS Guidelines Templates

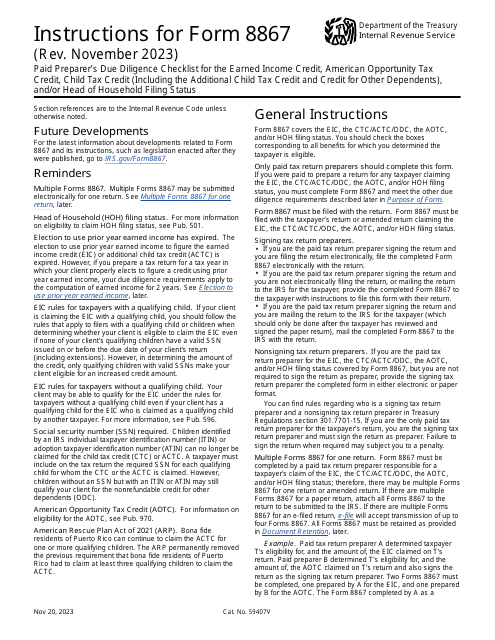

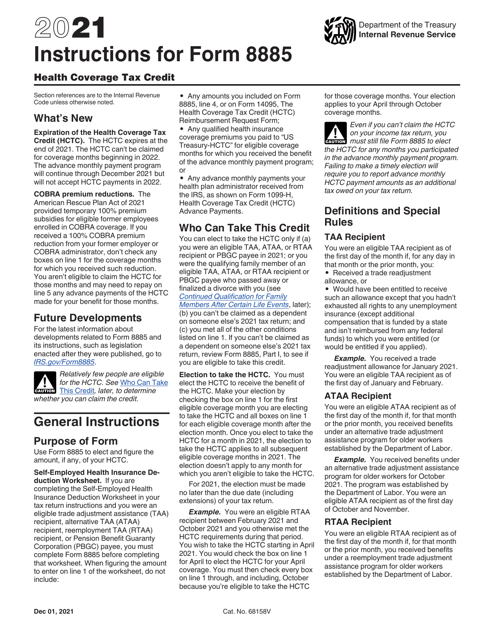

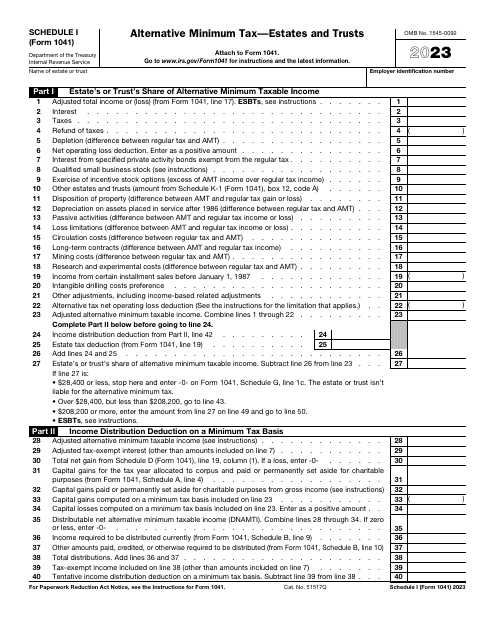

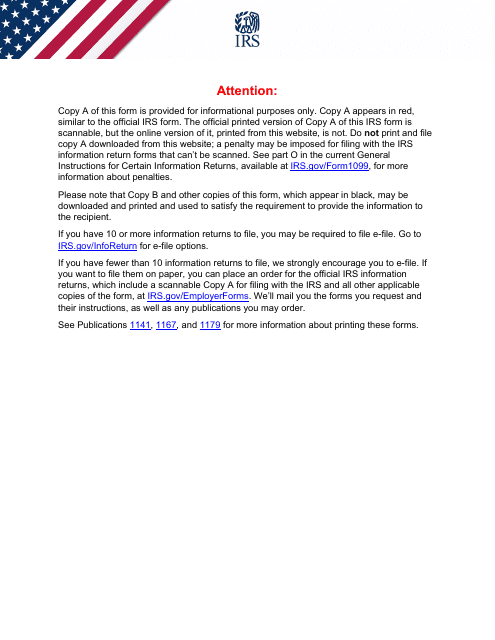

Are you looking for guidance on navigating the complex world of IRS forms and regulations? Our collection of IRS guidelines is here to help. Whether you're filing your taxes or trying to make sense of a specific form, our comprehensive guide covers everything you need to know. From instructions for popular forms like the 1099 and W-2G to guidance on alternative minimum tax and health coveragetax credits, we've got you covered. Our alternate names for this collection include IRS form guidelines and guidelines for completing IRS forms. Let us simplify the process and ensure you're filing accurately and efficiently. Don't get lost in a sea of confusing tax forms – let our IRS guidelines be your compass.

Documents:

90

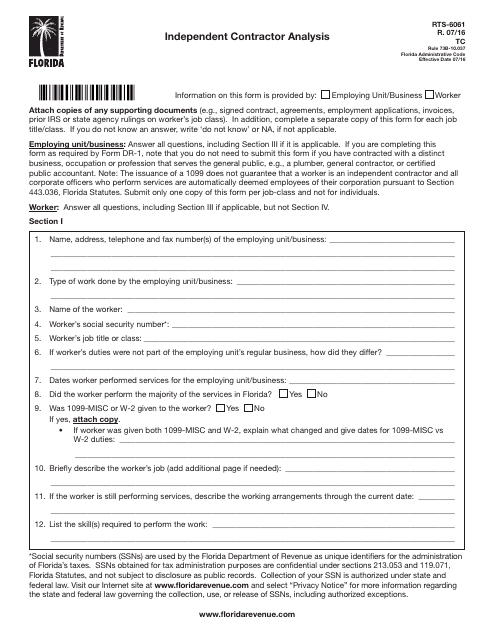

This form is used for conducting an independent contractor analysis in the state of Florida.

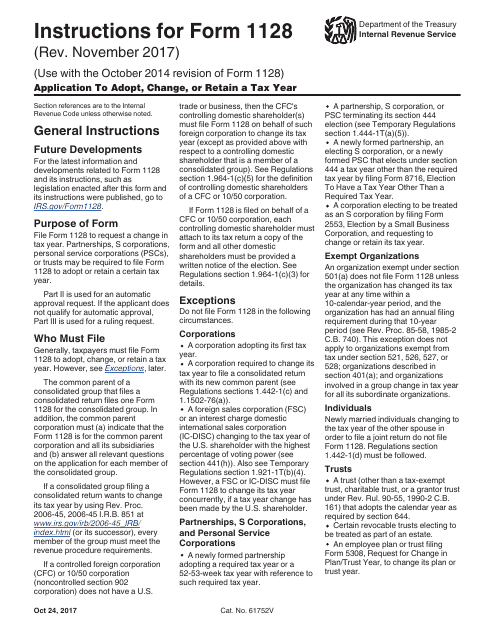

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

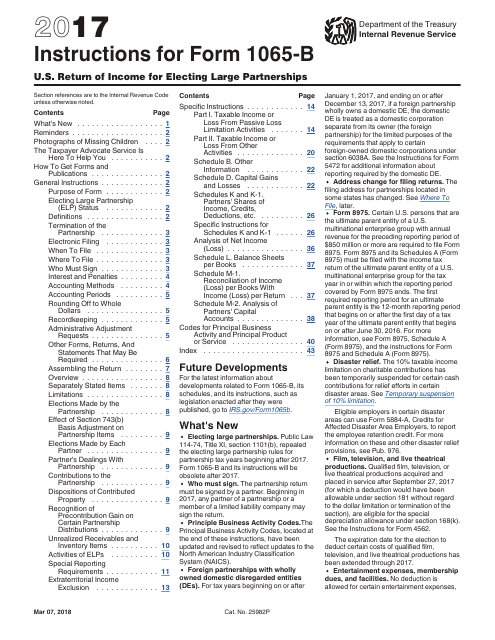

This Form is used for reporting income and expenses of electing large partnerships in the United States.

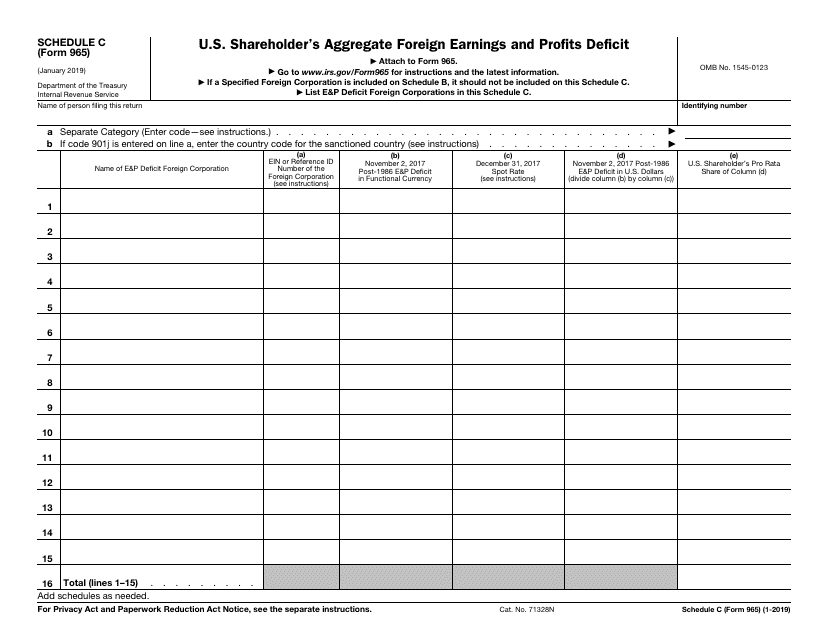

This Form is used for reporting the U.S. shareholder's aggregate foreign earnings and profits deficit to the IRS.

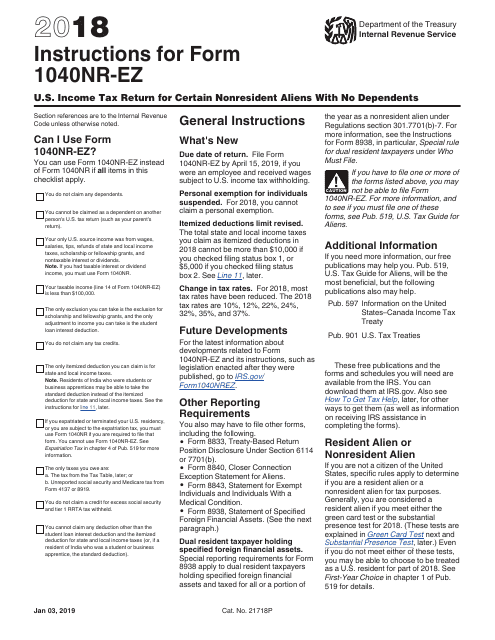

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This document is used for reporting contributions of motor vehicles, boats, and airplanes to qualifying organizations.

This document provides instructions for various IRS forms including 1096, 1097, 1098, 1099, 3821, 3822, 5498, and W-2G. The instructions guide individuals or organizations on how to fill out these specific information returns required by the IRS.

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

This is a document you may use to figure out how to properly complete IRS Form 6765

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

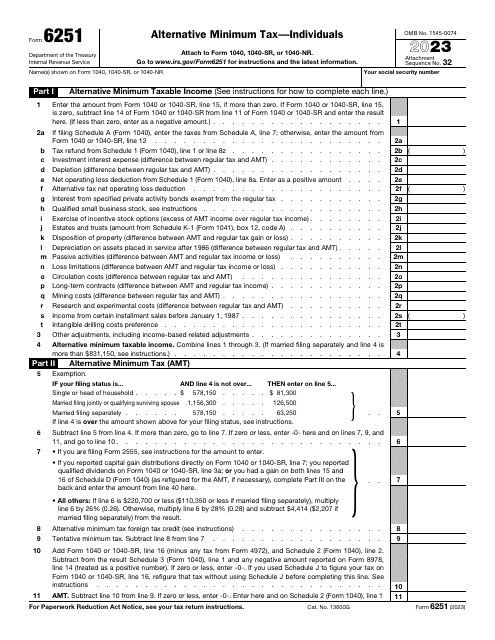

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

This form is used for claiming the Additional Child Tax Credit on your federal tax return. It provides instructions on how to fill out Form 1040 or Form 1040-SR if you qualify for this tax credit.