IRS Guidelines Templates

Documents:

90

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

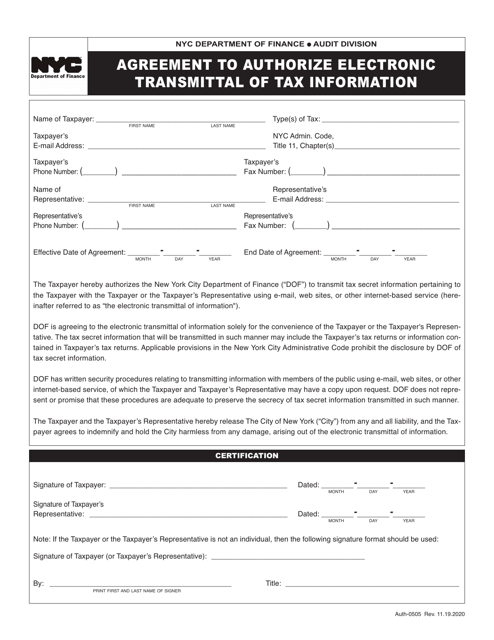

This form is used for authorizing the electronic transmittal of tax information in New York City.

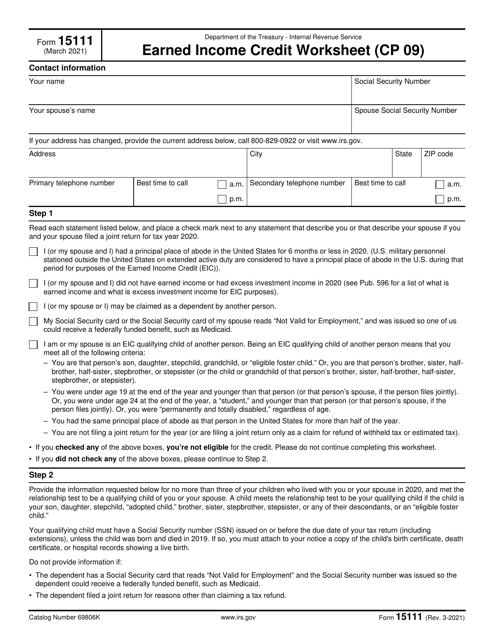

This form is used to calculate the Earned Income Credit for eligible taxpayers.

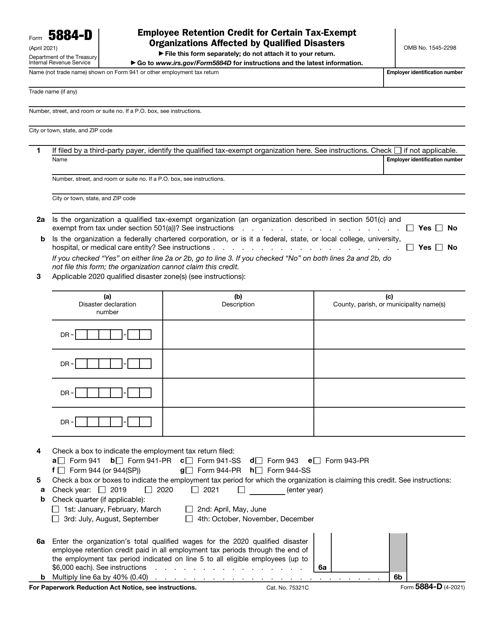

This form is used for claiming the Employee Retention Credit by certain tax-exempt organizations that have been affected by qualified disasters. The credit is meant to provide financial relief to these organizations in order to retain their employees.

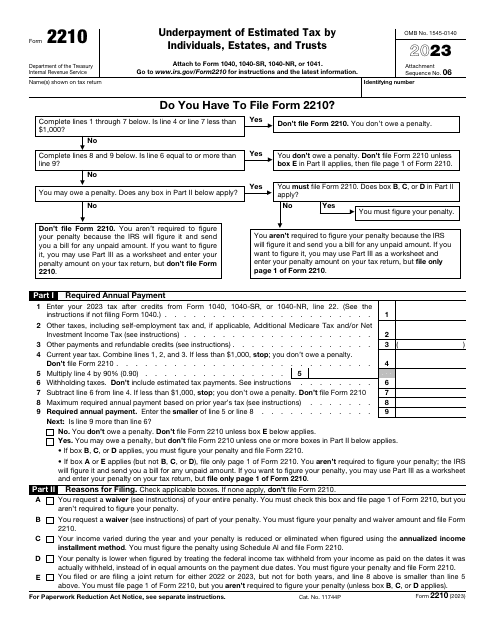

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

Instructions for IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts