Motor Fuel Tax Templates

Documents:

99

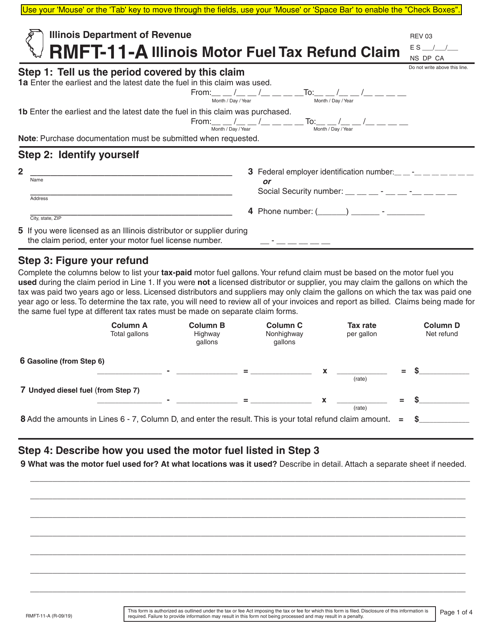

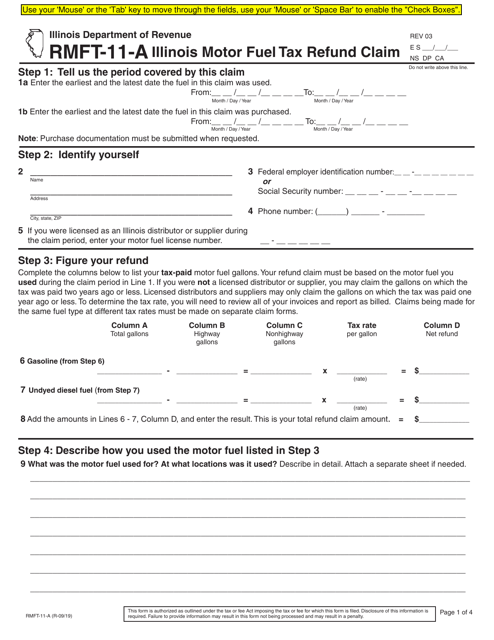

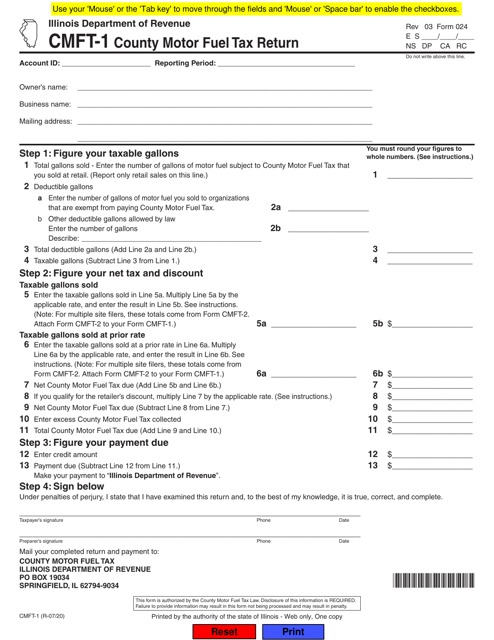

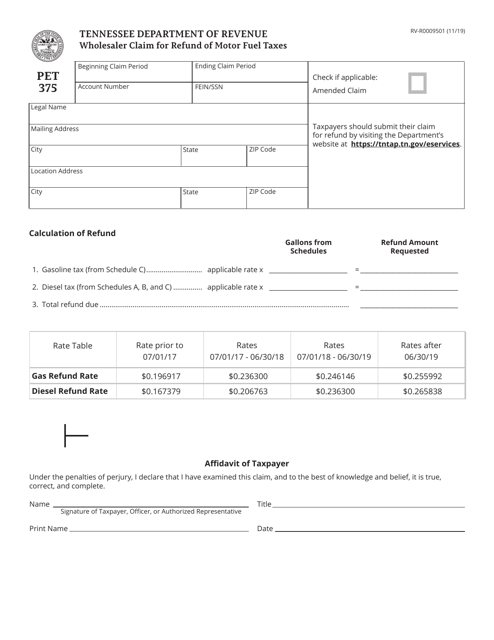

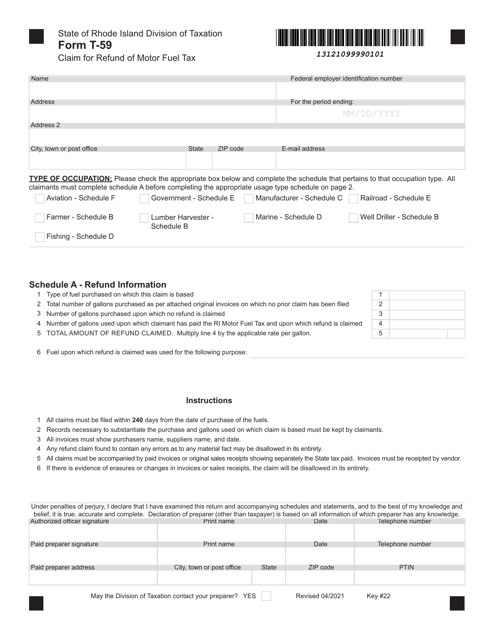

This form is used for claiming a refund of motor fuel tax in Illinois.

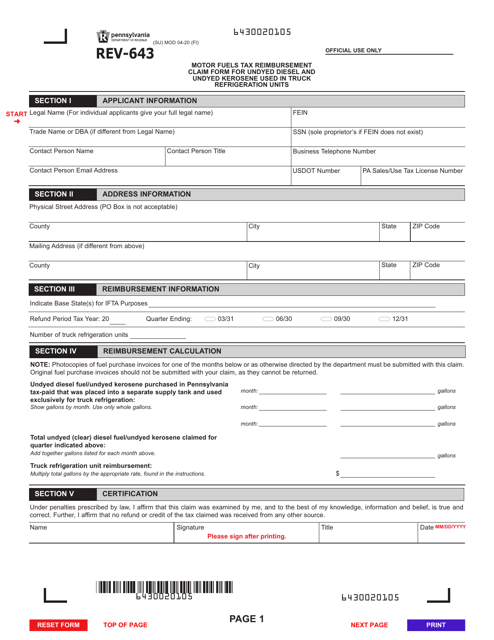

This Form is used for claiming reimbursement of motor fuels tax on undyed diesel and undyed kerosene used in truck refrigeration units in Pennsylvania.

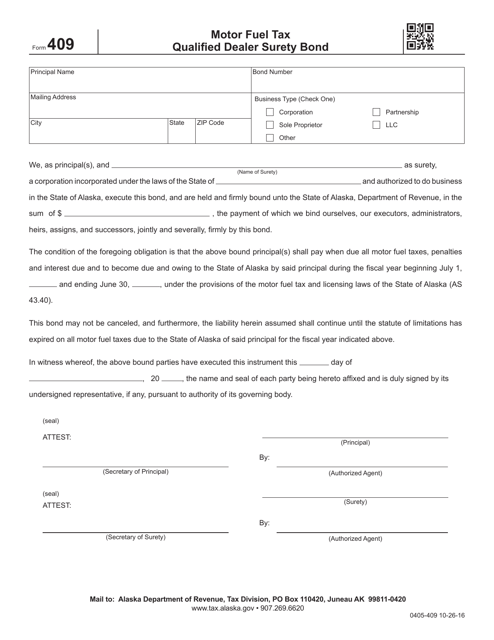

This form is used for obtaining a surety bond for motor fuel tax dealers in Alaska.

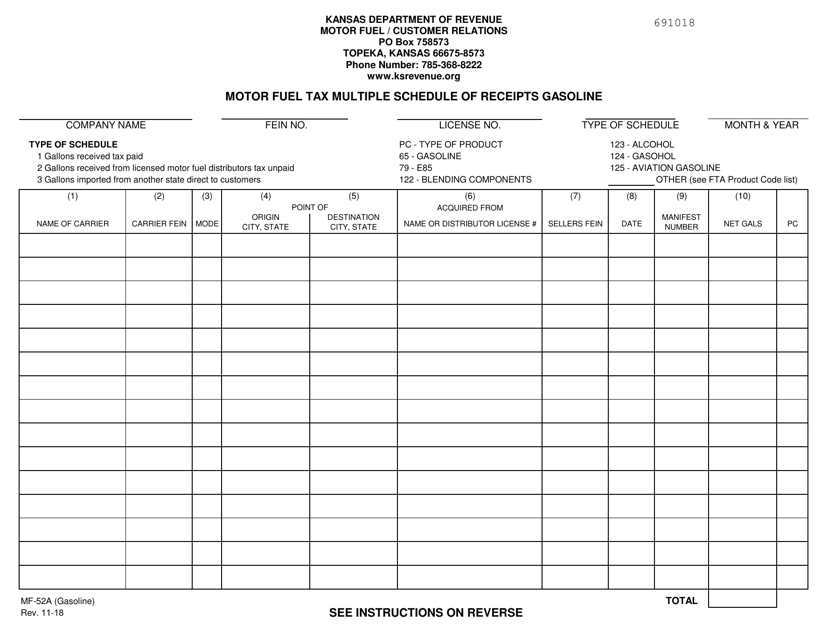

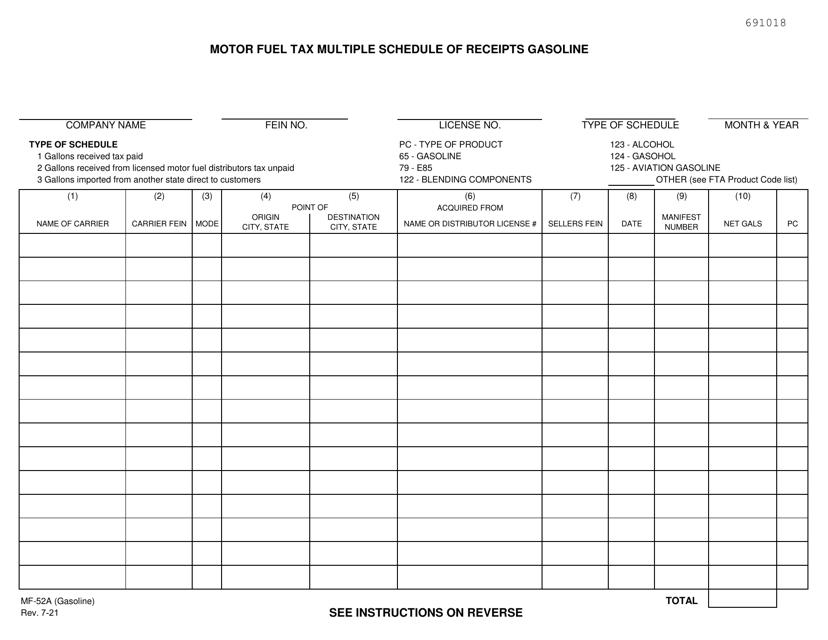

This document is a form used in Kansas to report multiple receipts of gasoline for the purpose of calculating and paying motor fuel tax.

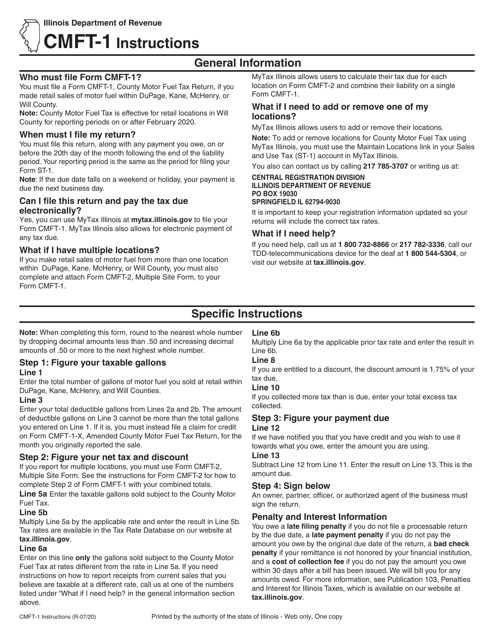

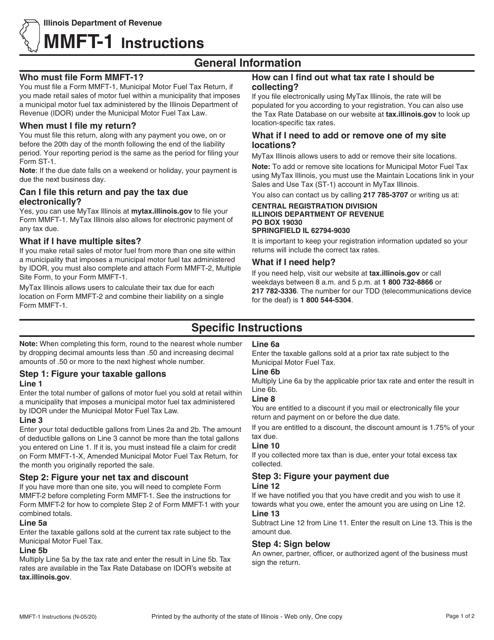

This type of document provides instructions for completing Form MMFT-1, which is used to file the Municipal Motor Fuel Tax Return in the state of Illinois.

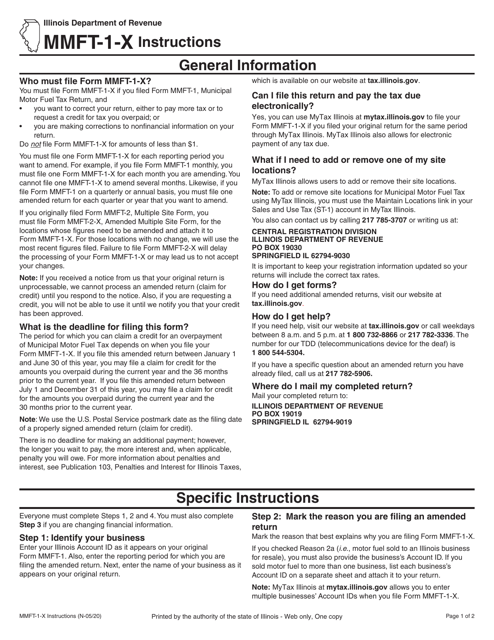

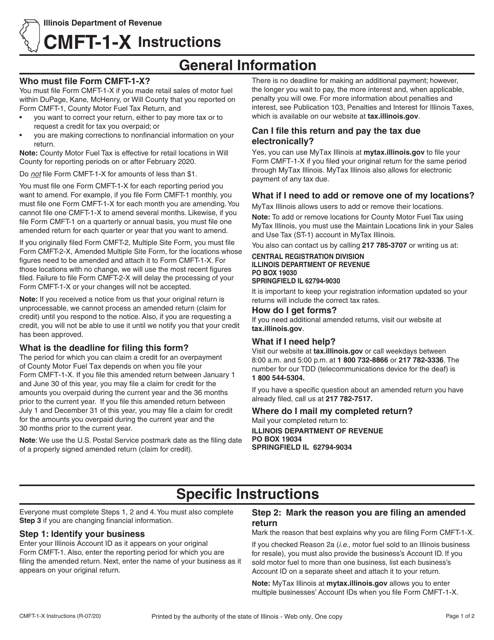

This Form is used for filing an amended Municipal Motor Fuel Tax Return in the state of Illinois.

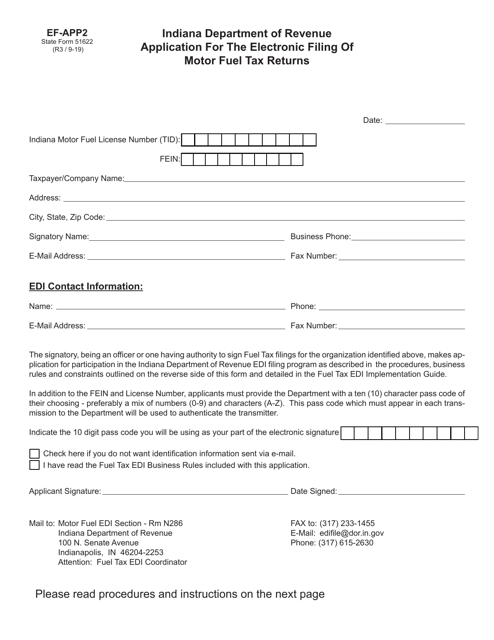

This Form is used for applying for the electronic filing of motor fuel tax returns in the state of Indiana.

This form is used for calculating monthly taxes for motor fuel tankwagon importers in Oklahoma when filing returns after July 1, 2018.

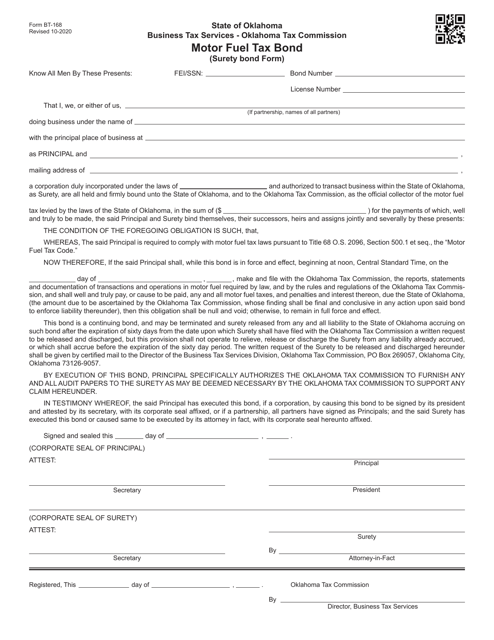

This form is used for obtaining a motor fuel tax bond in Oklahoma. It is a surety bond form that ensures the payment of motor fuel taxes by the person or entity responsible.

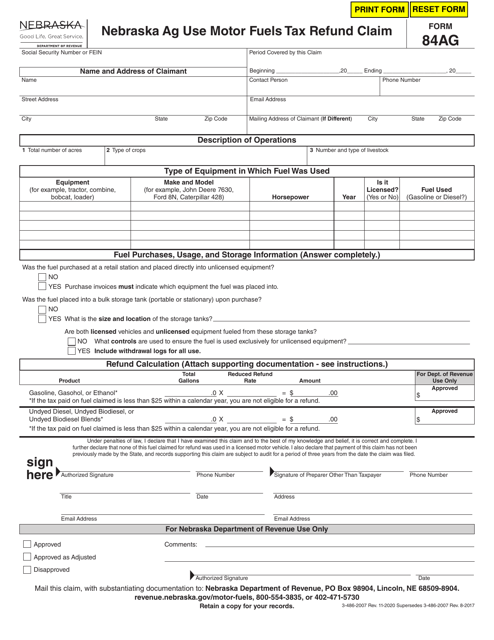

This Form is used for claiming a refund of motor fuels tax paid on ag use in Nebraska.

This Form is used for filing an amended County Motor Fuel Tax Return in the state of Illinois. It provides instructions on how to properly complete and submit the form for any necessary changes or corrections.

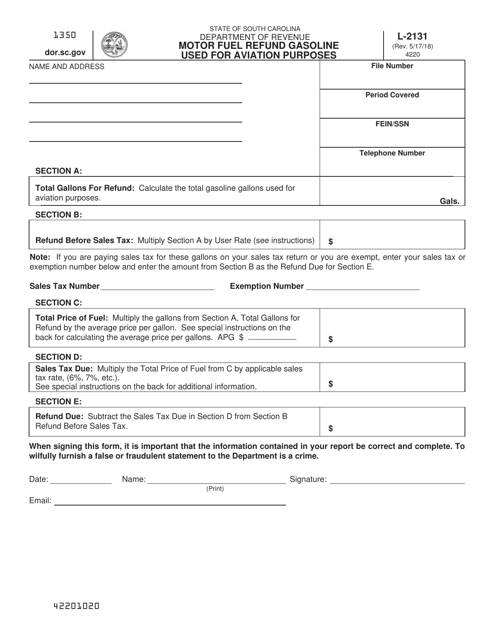

This form is used for claiming a refund for gasoline used for aviation purposes in South Carolina.

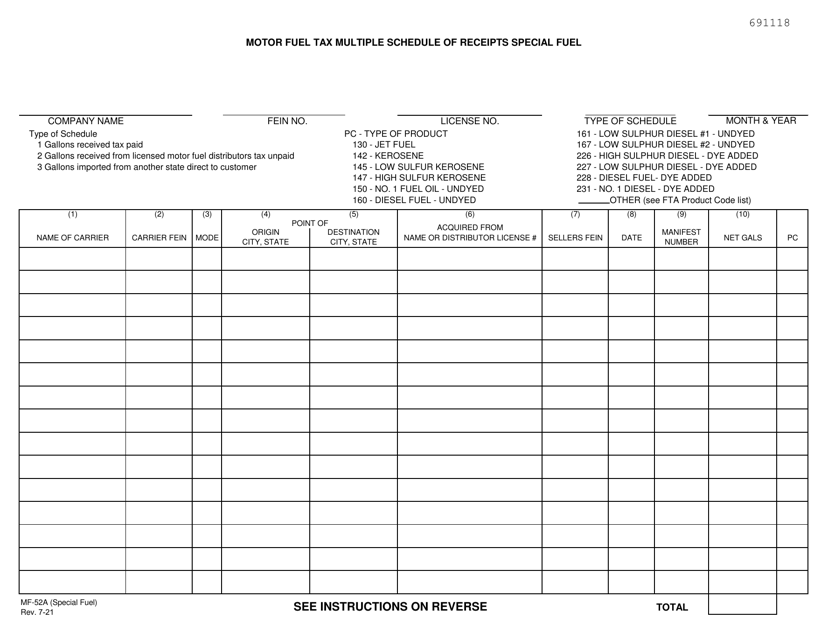

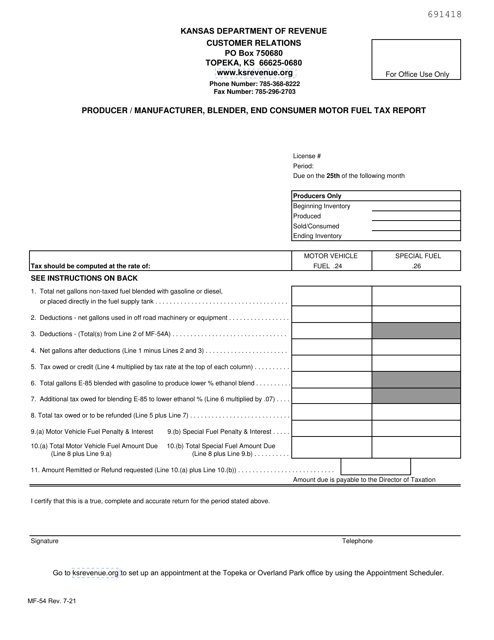

This form is used for reporting multiple receipts of gasoline for the purpose of Motor Fuel Tax in the state of Kansas.

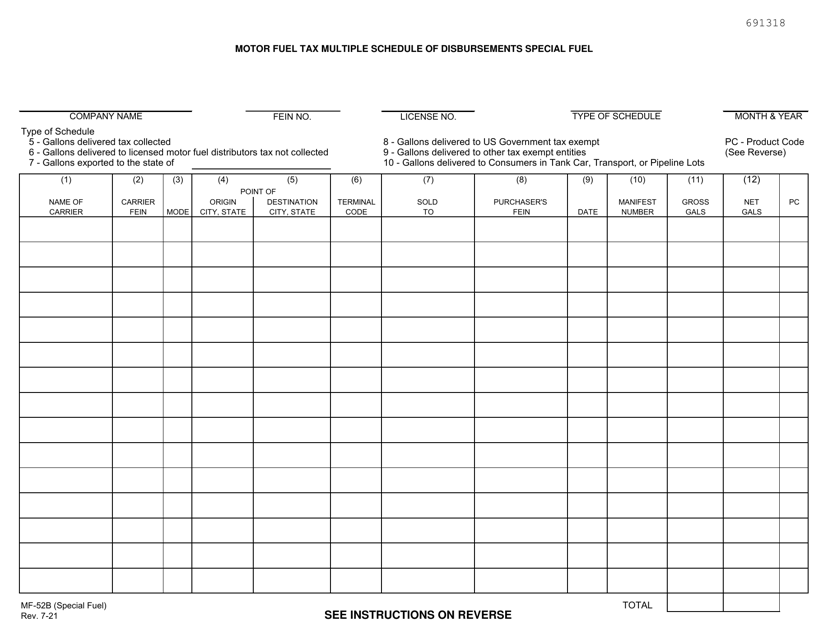

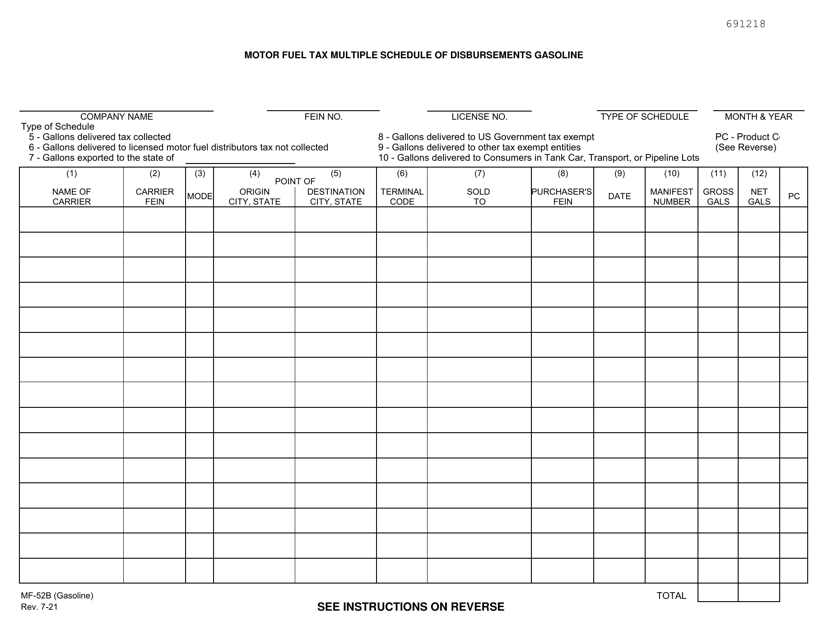

This form is used for reporting multiple disbursements of gasoline motor fuel tax in the state of Kansas.

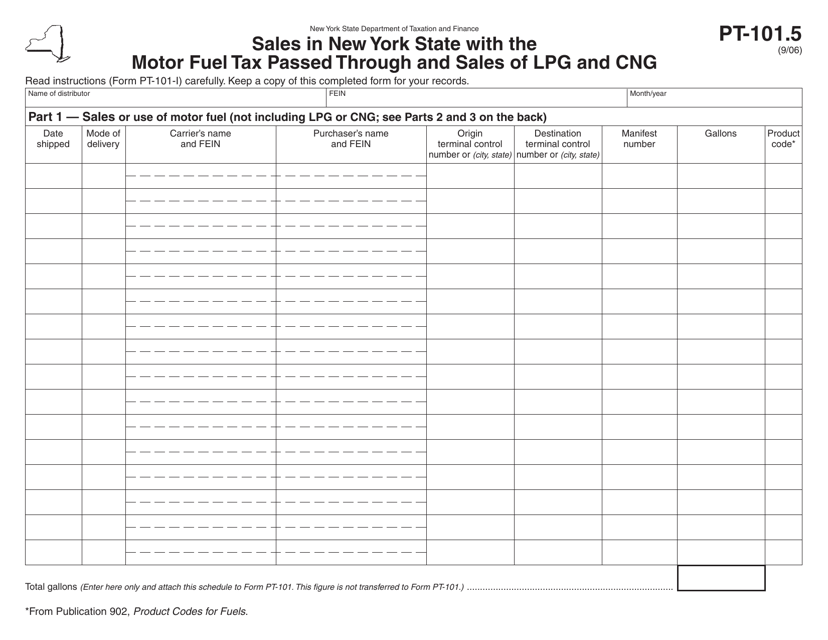

This form is used for reporting sales in New York State that includes the motor fuel tax passed through and sales of LPG and CNG.

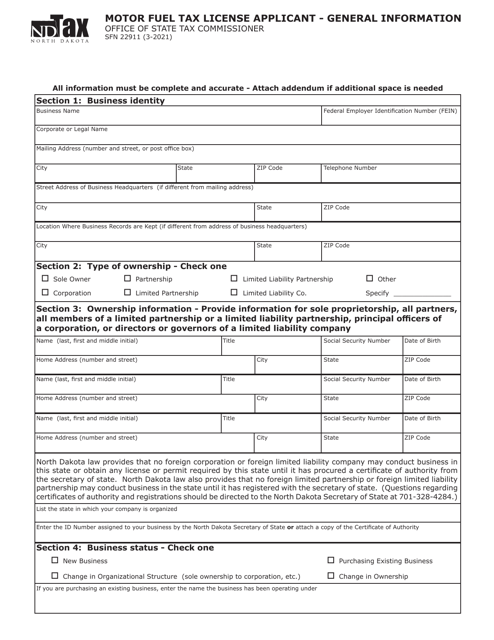

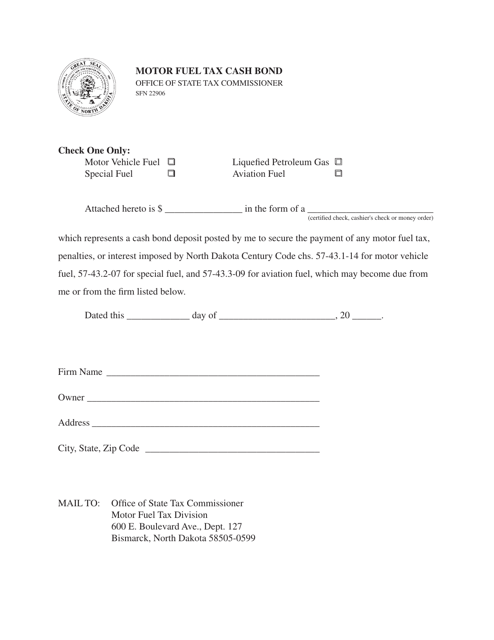

This form is used for submitting a cash bond for motor fuel tax in North Dakota. It is required for businesses in the state that need to post a bond as a guarantee for paying their motor fuel tax obligations.