Income Report Templates

Documents:

167

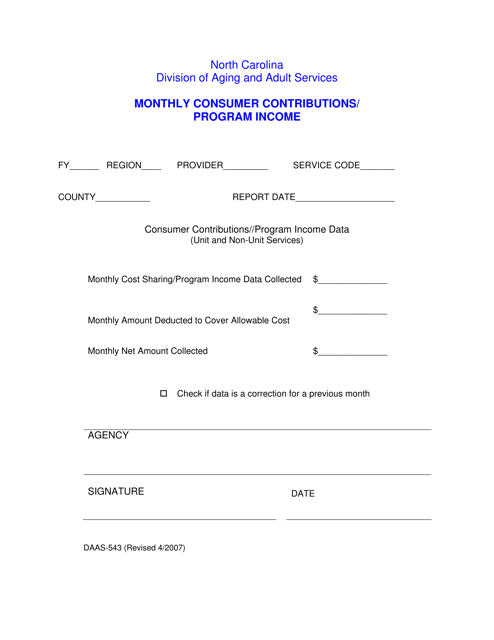

This Form is used for reporting monthly consumer contributions and program income in the state of North Carolina.

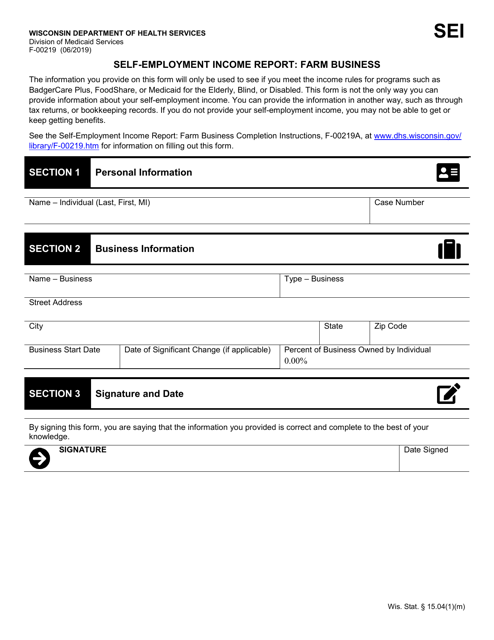

This form is used for reporting self-employment income from a farm business in Wisconsin.

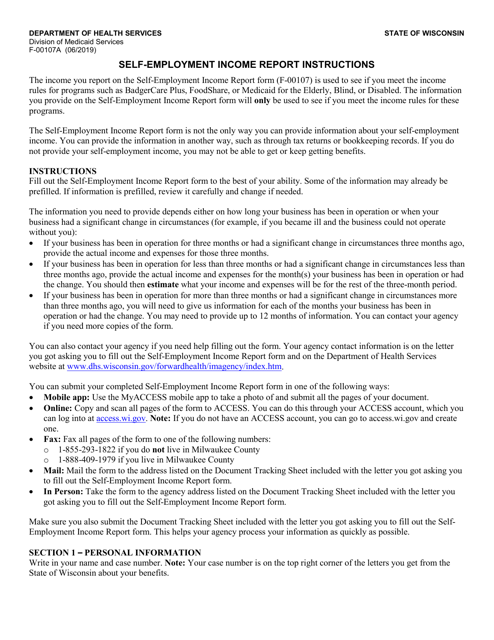

This Form is used for self-employed individuals in Wisconsin to report their income. It provides instructions on how to accurately fill out and submit the Form F-00107.

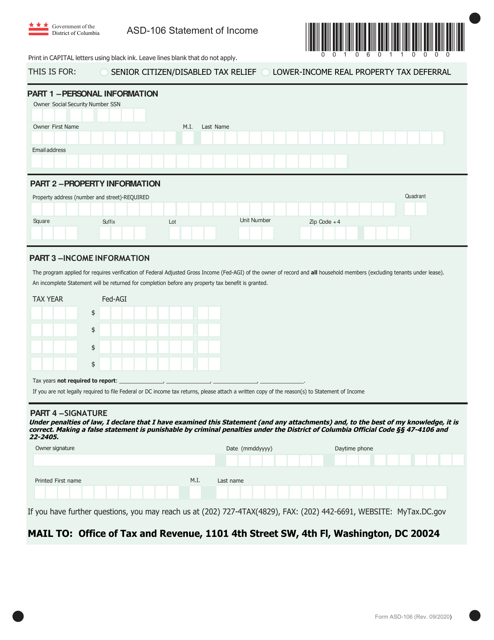

This form is used for reporting and documenting income in the Washington, D.C. area. It may be required for various purposes such as applying for loans, tax filings, or other financial transactions.

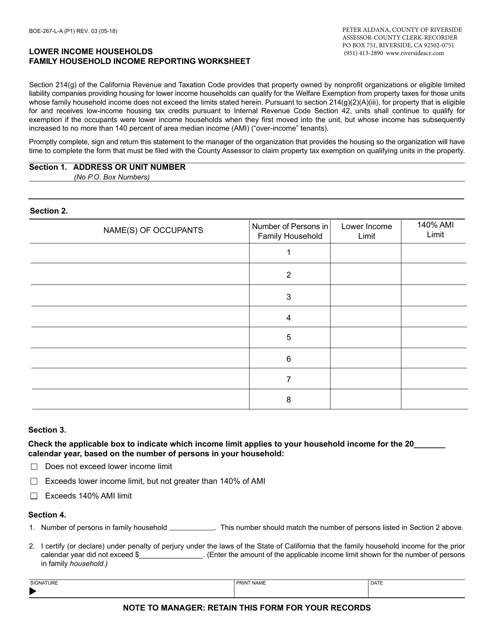

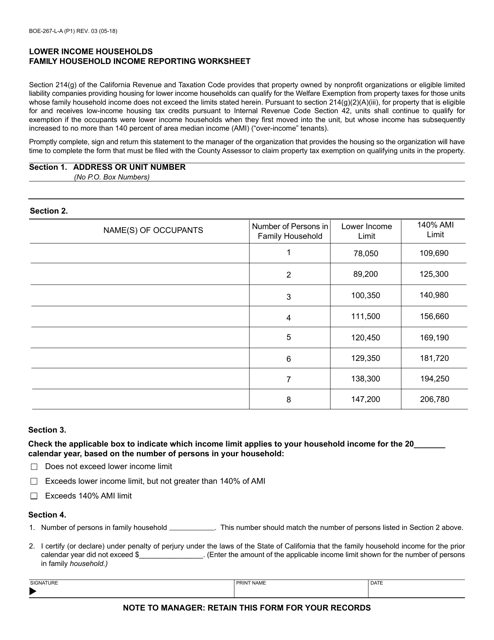

This form is used for lower income households in Riverside County, California to report their family household income. It is a worksheet specifically designed to help them track and report their income accurately.

This Form is used for reporting family household income for lower income households in California.

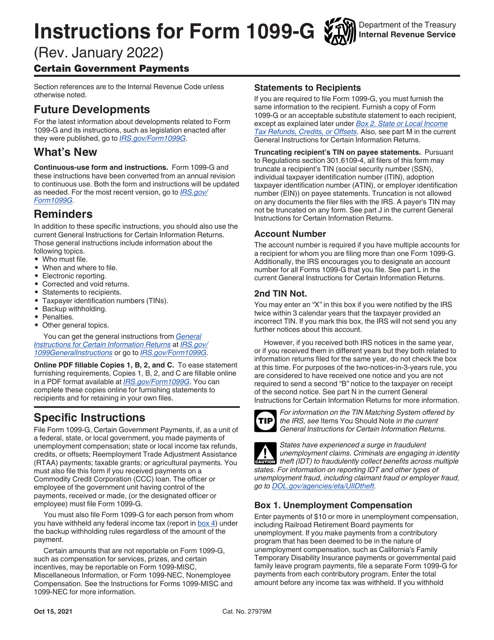

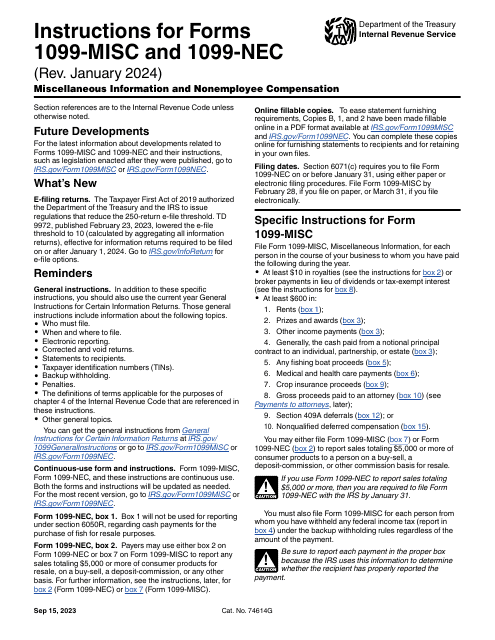

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

This form is used for reporting income and assets in Lake County, Illinois.

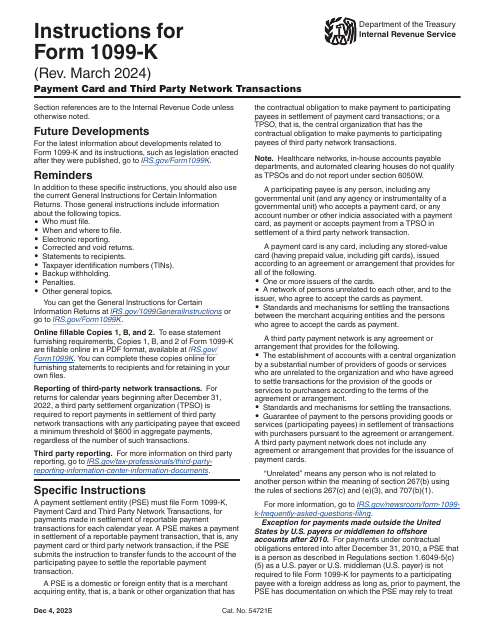

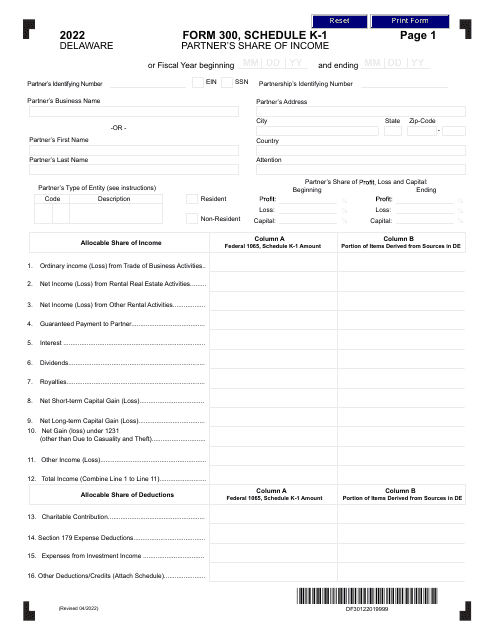

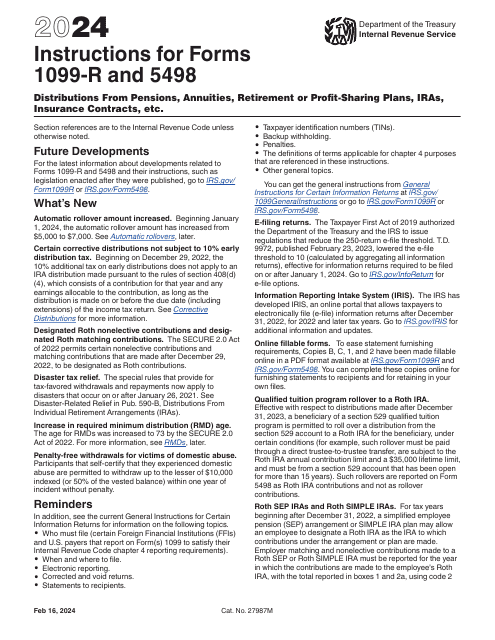

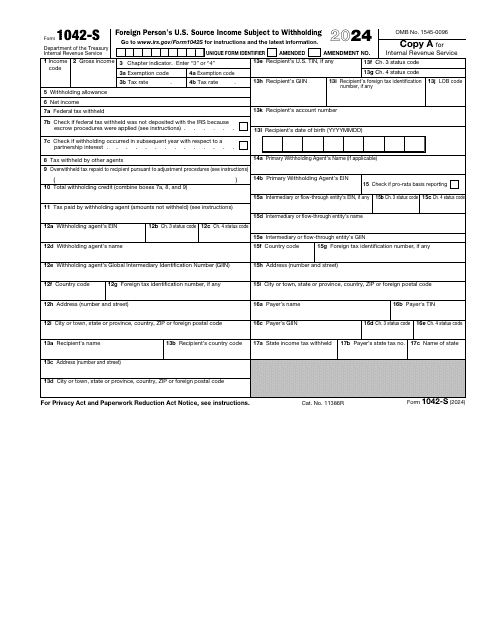

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

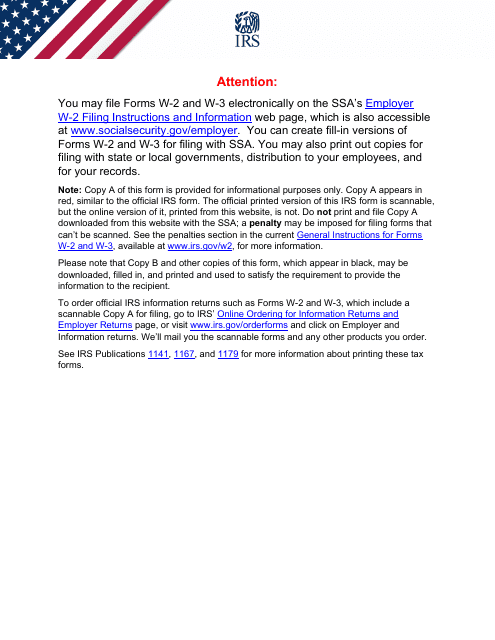

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

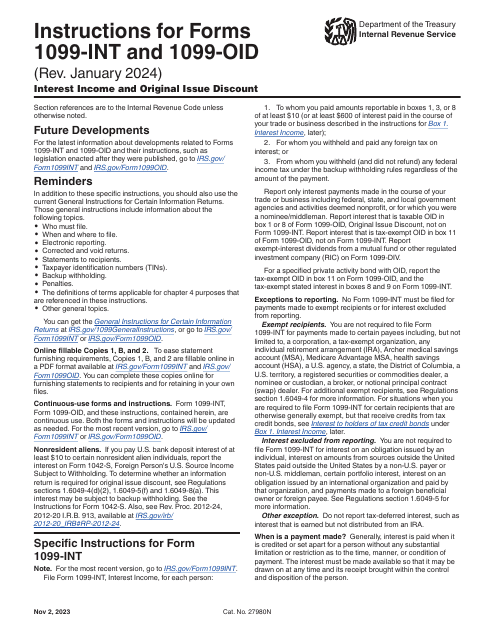

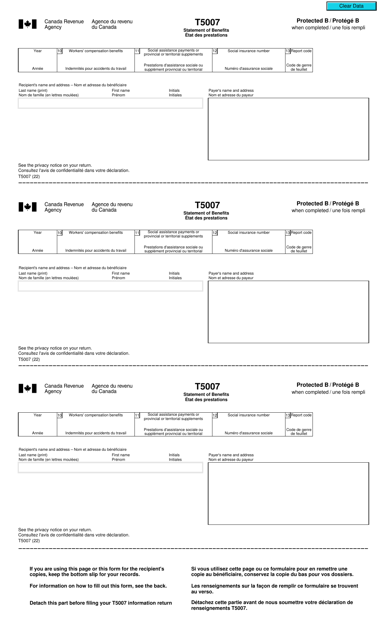

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

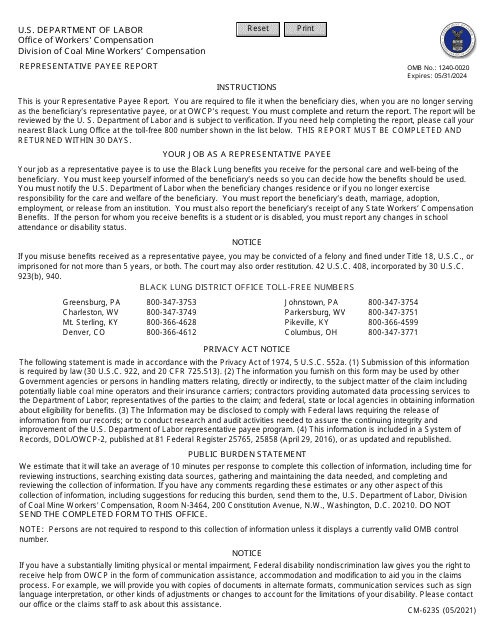

This document is used for reporting the activities and finances of a representative payee who manages funds for someone receiving Social Security or Supplemental Security Income.

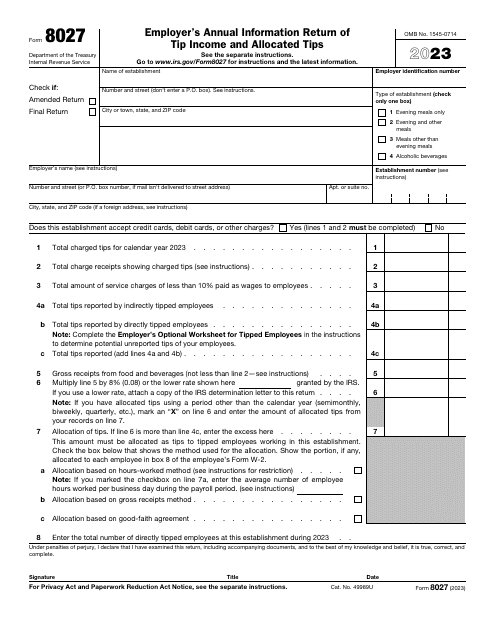

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.