Income Report Templates

Documents:

167

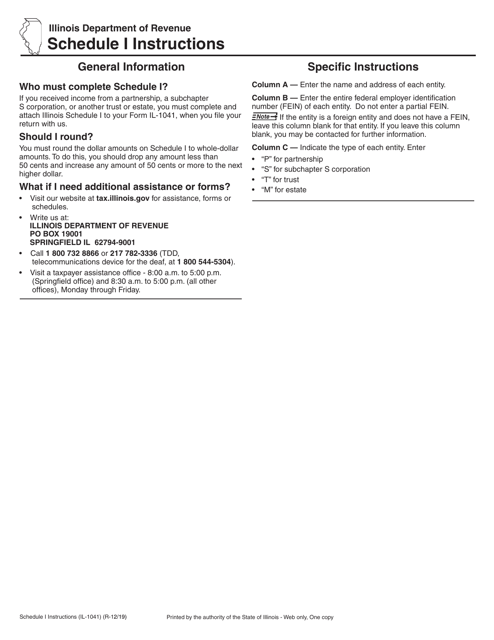

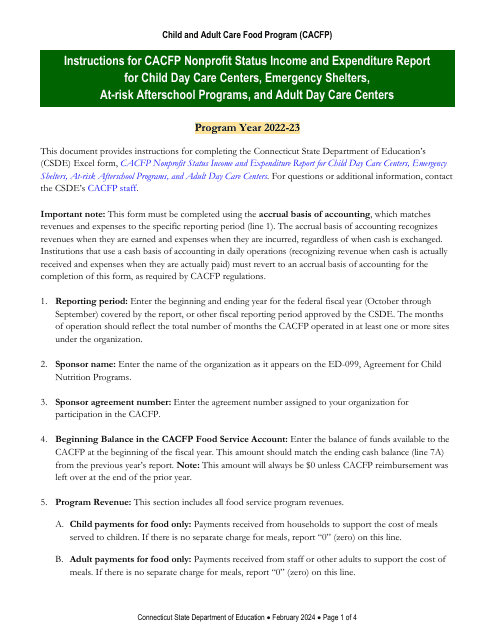

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.

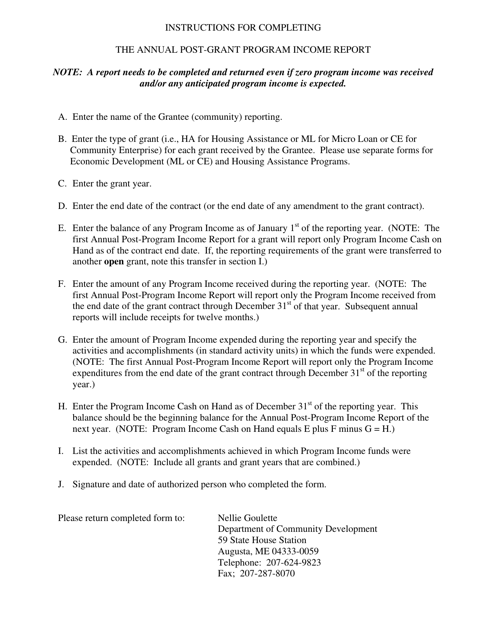

This form is used for reporting annual post-grant program income in the state of Maine. It provides instructions on how to accurately report and document program income for the specified timeframe.

This type of document is used for reporting wages and taxes withheld for employees. It is required by the Internal Revenue Service (IRS) for employers to file annually. The different variations of the form (W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C) correspond to specific circumstances and requirements.

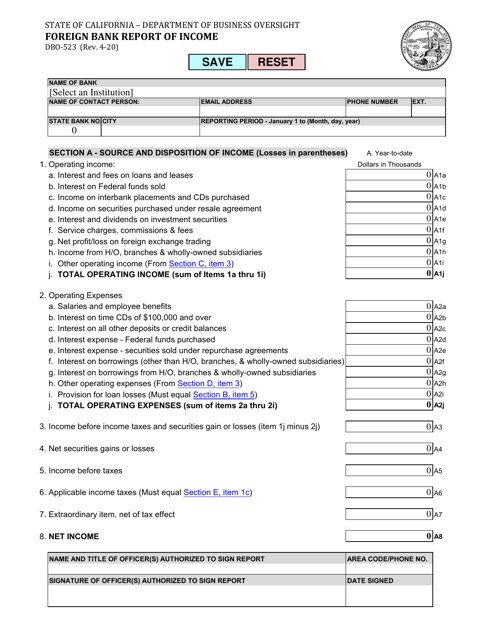

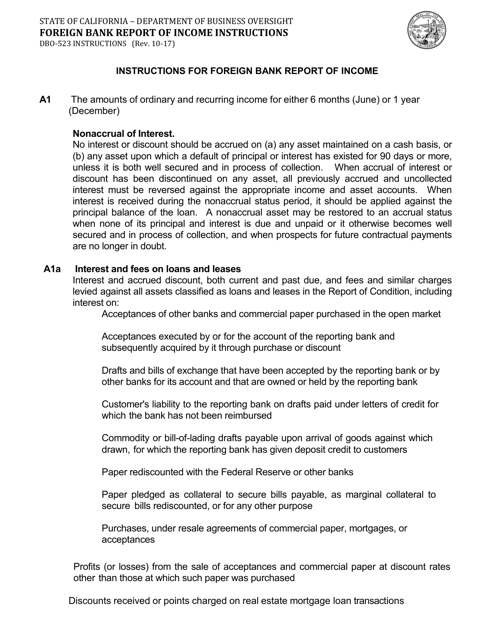

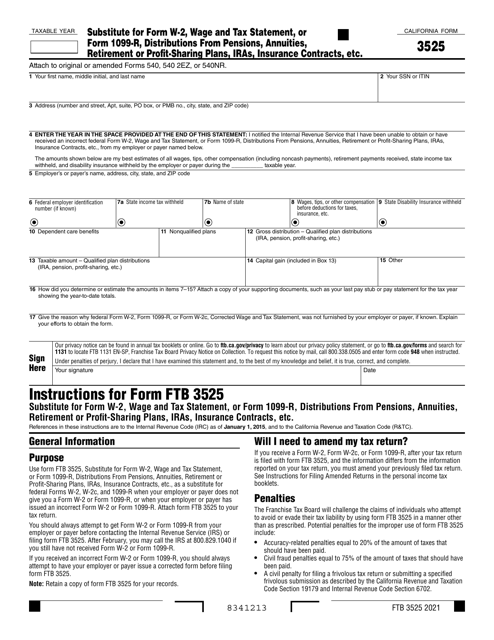

This form is used for reporting foreign bank income to the state of California.

This Form is used for reporting income from foreign banks in California.

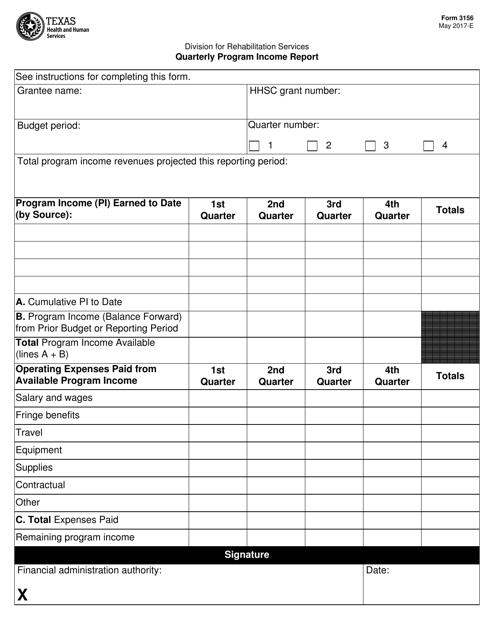

This form is used for reporting program income on a quarterly basis in the state of Texas.

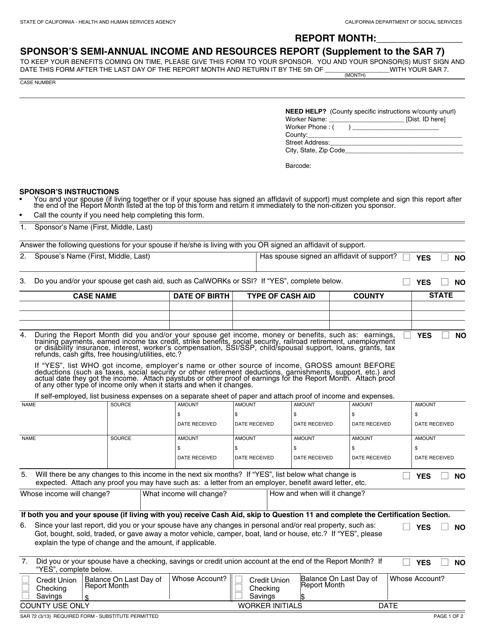

This form is used for reporting the sponsor's income and resources semi-annually in the state of California.

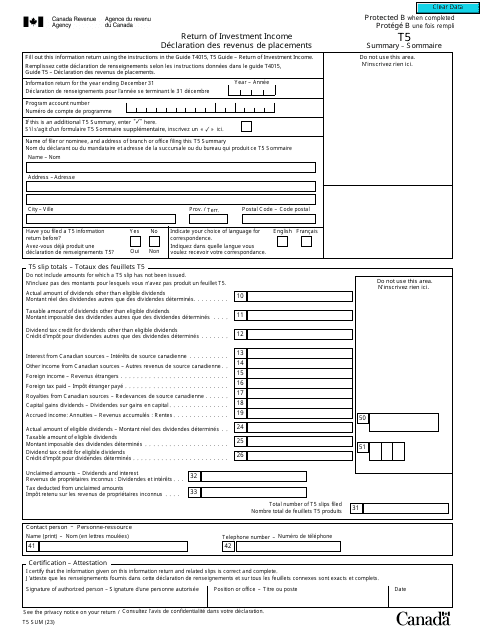

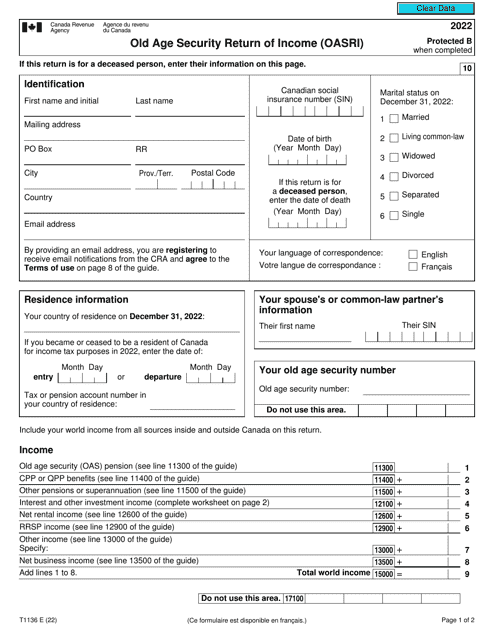

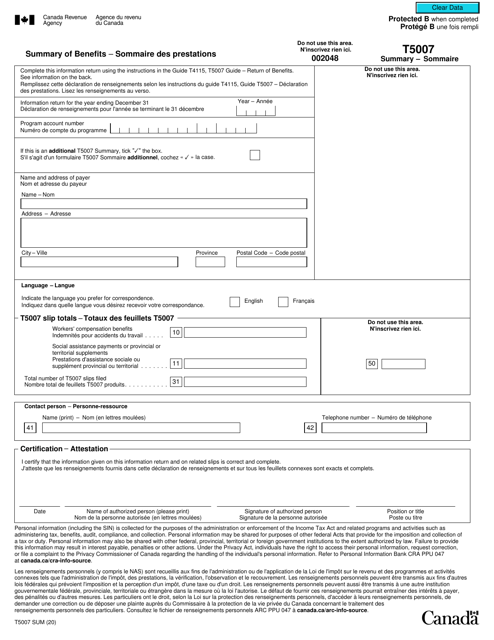

This document is a summary of benefits received in Canada. It is available in both English and French.

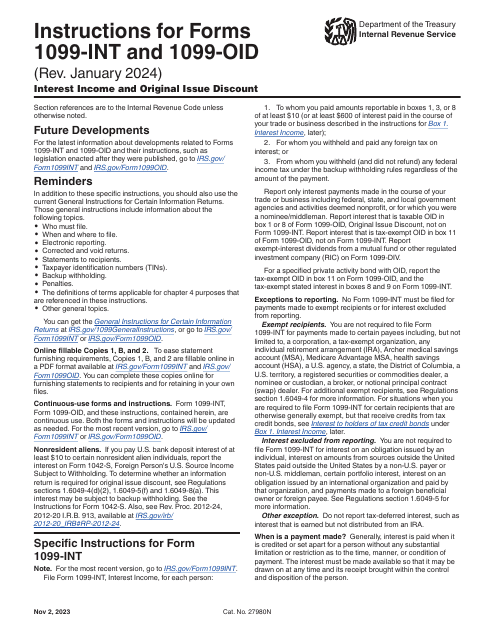

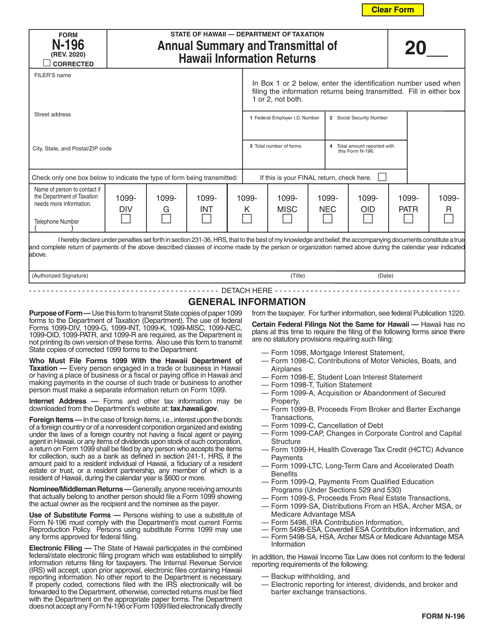

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

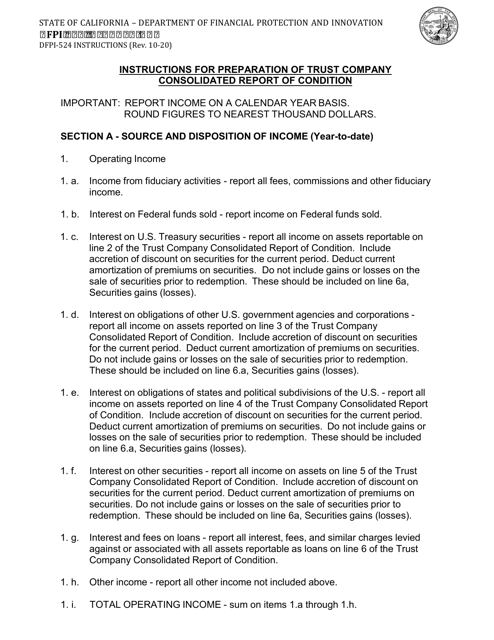

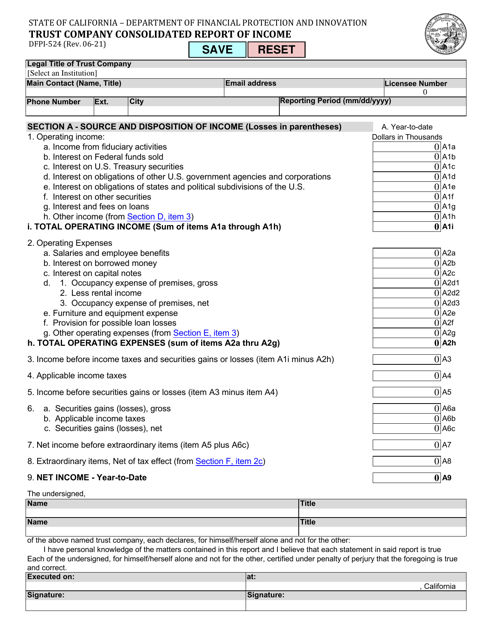

This Form is used for reporting the consolidated income of trust companies in California. It provides instructions on how to complete and submit the Form DFPI-524.

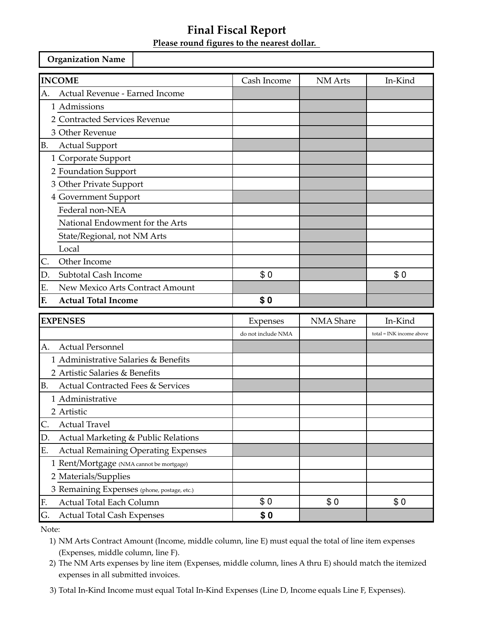

This document provides a detailed report on the financial activities and performance of the state of New Mexico for the previous fiscal year. It includes information on revenue, expenses, investments, and any other relevant financial data.

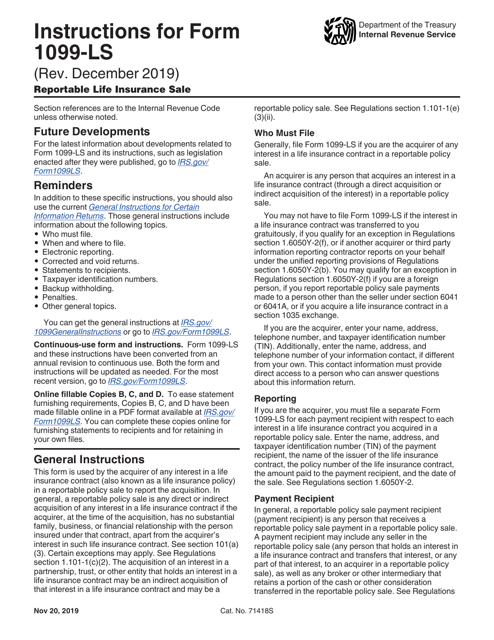

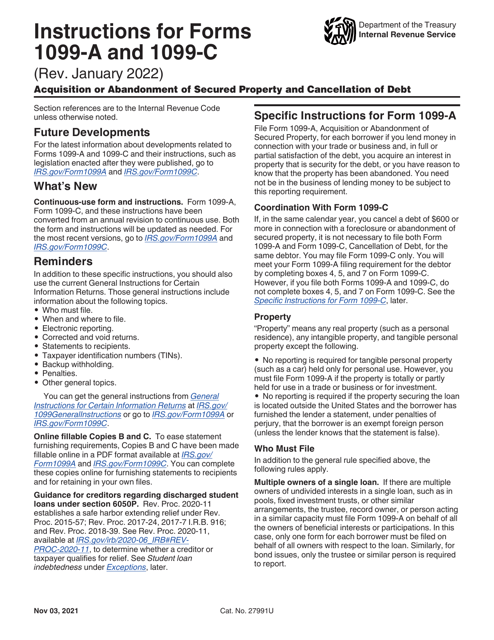

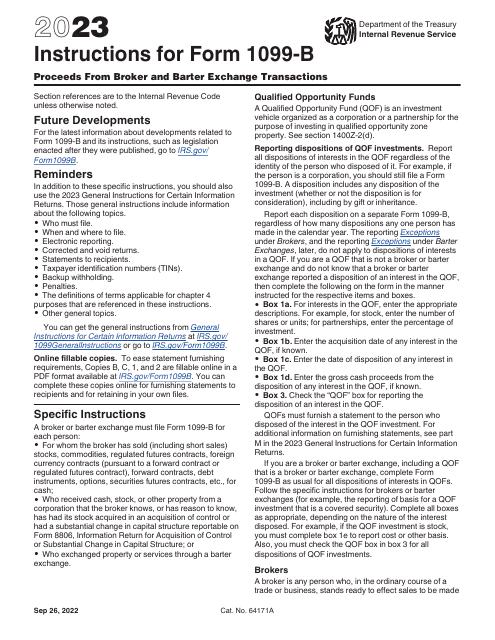

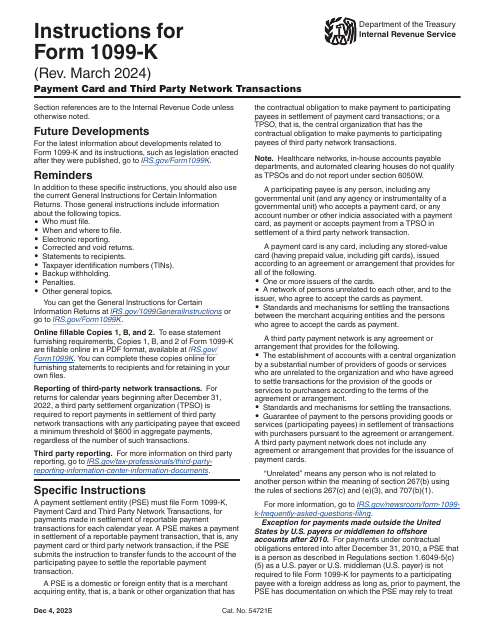

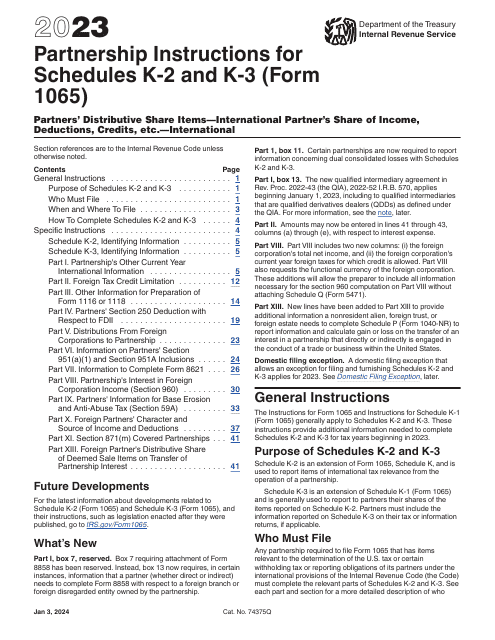

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

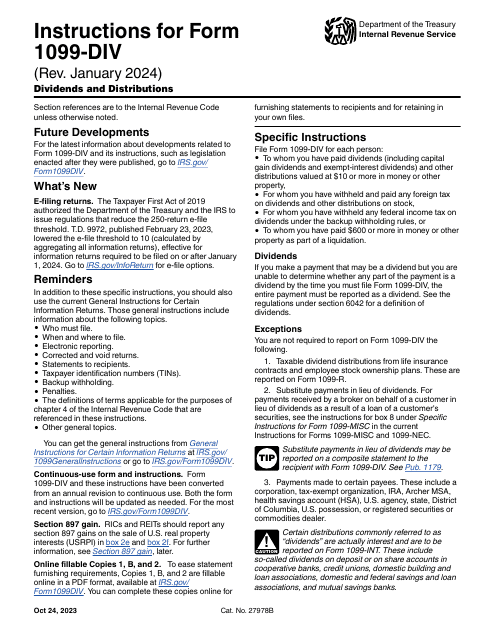

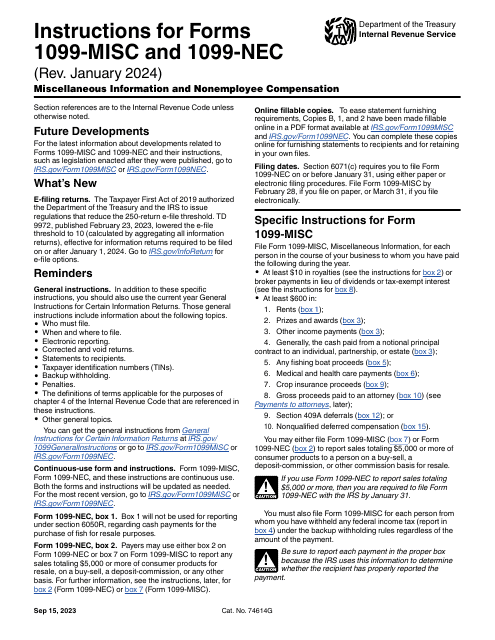

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

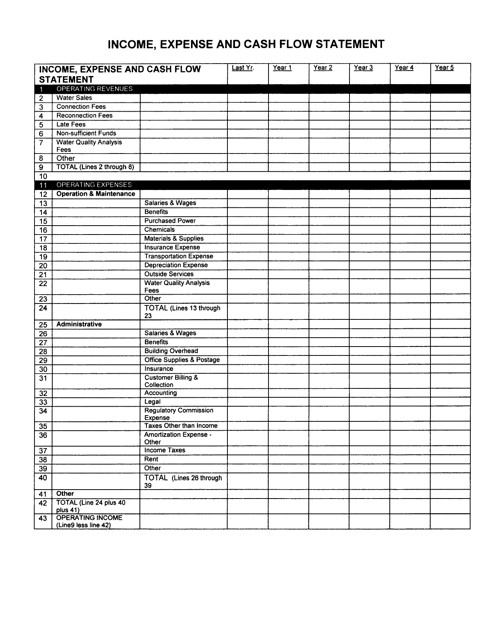

This document displays the income, expenses, and cash flow of an individual or business located in Mississippi. It provides a clear breakdown of the financial transactions and helps in analyzing the overall financial health.

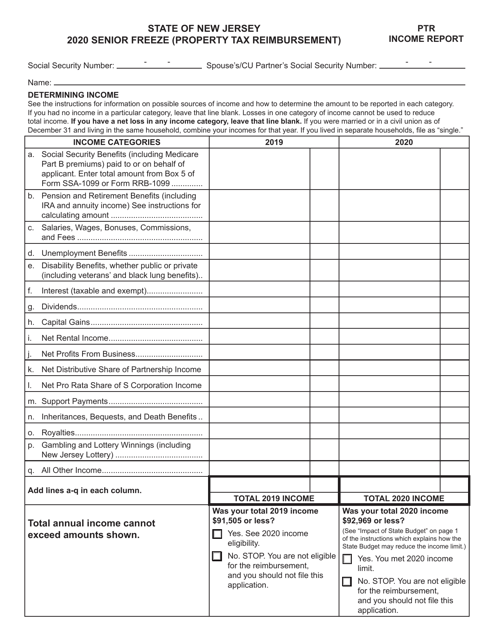

This Form is used for reporting property tax reimbursement income in New Jersey. It is used by taxpayers to report their income earned from property tax reimbursements and calculate any potential tax liability.

This form is used for trust companies in California to report their consolidated income. It helps regulators monitor the financial health and compliance of these companies.

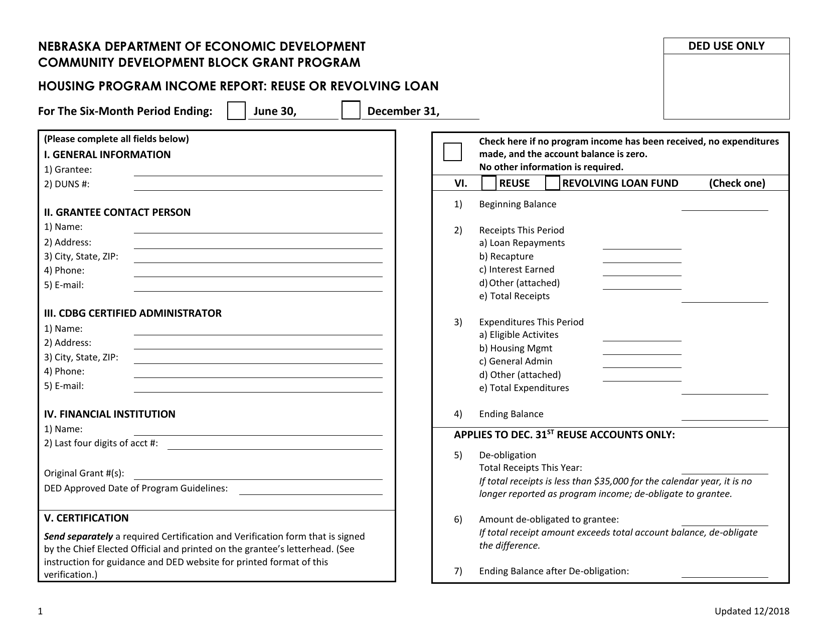

This document is a report on the income of the Housing Program for Reuse or Revolving Loan in Nebraska. It provides information on the funds generated through this program.

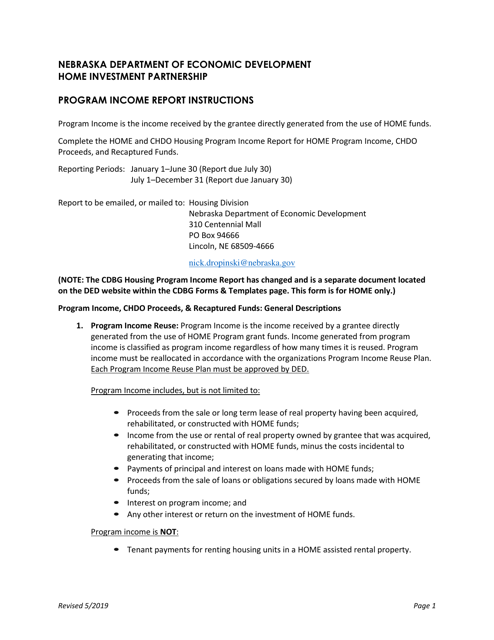

This document reports the income generated by the Home Program in Nebraska.

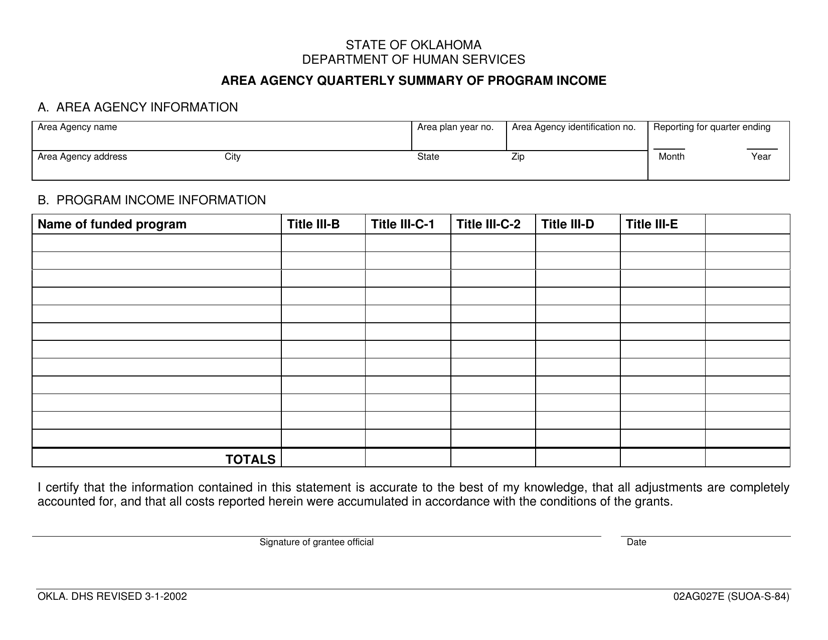

This form is used for the Area Agency in Oklahoma to report their quarterly summary of program income.

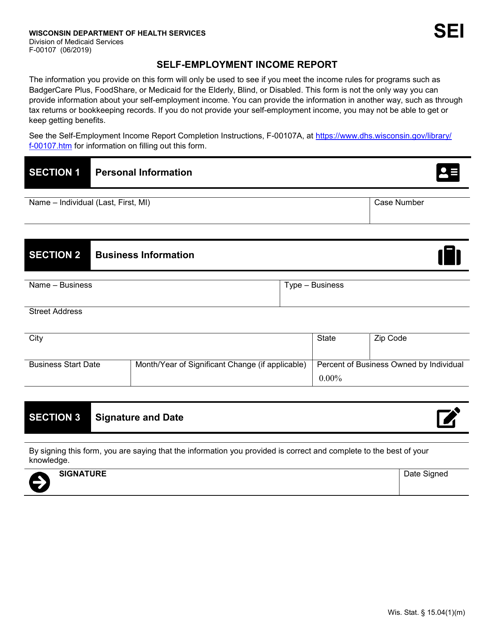

This form is used for reporting self-employment income in the state of Wisconsin.