Tax Assistance Templates

Looking for tax assistance? We've got you covered! Our comprehensive collection of tax assistance forms and resources will help you navigate the complexities of tax filing. Whether you're looking for guidance on filling out specific tax forms or need assistance with tax credits, our tax assistance forms are designed to simplify the process for you.

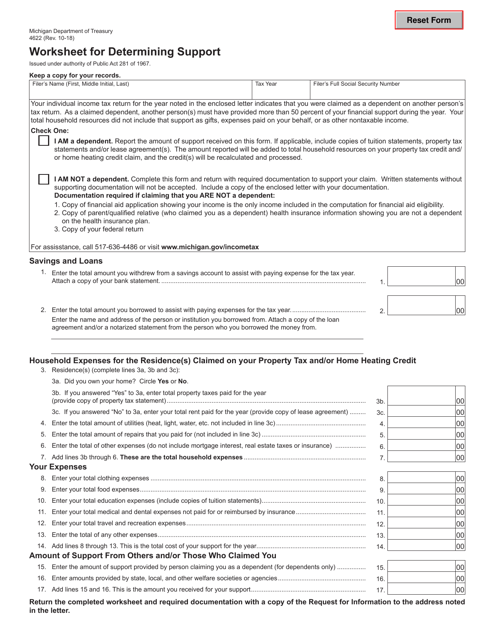

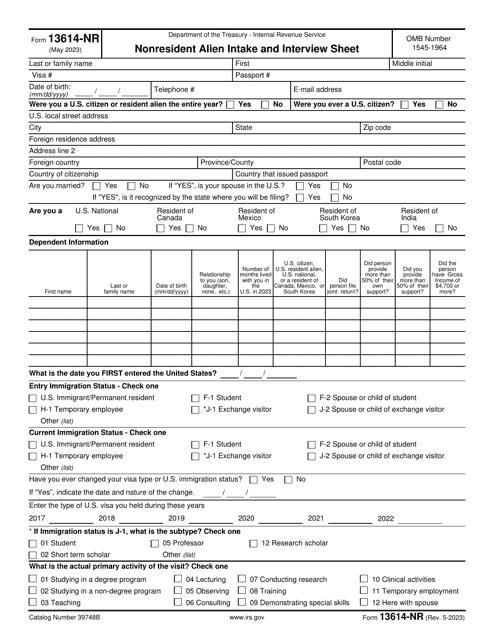

Our tax assistance documents include a variety of resources, such as IRS hardship letter templates and worksheets for calculating earned income credits. We understand that taxes can be challenging, particularly when it comes to intricate tax forms like Form Y-203 Yonkers Nonresident Earnings Tax Return in New York or Form MO-PTS Property Tax Credit Schedule in Missouri. That's why our tax assistance forms provide step-by-step instructions and clarifications to ensure accurate and efficient tax filing.

We also offer resources specific to certain states, such as Form 511-EIC Earned Income Credit Worksheet in Oklahoma. Our goal is to provide comprehensive tax assistance that covers a range of tax scenarios and requirements.

Trust our tax assistance forms to simplify your tax filing process. With our user-friendly documents, you can confidently navigate the world of taxes and ensure that you're taking advantage of all available credits and deductions. Don't let tax season overwhelm you – let our tax assistance forms be your guide.

Documents:

110

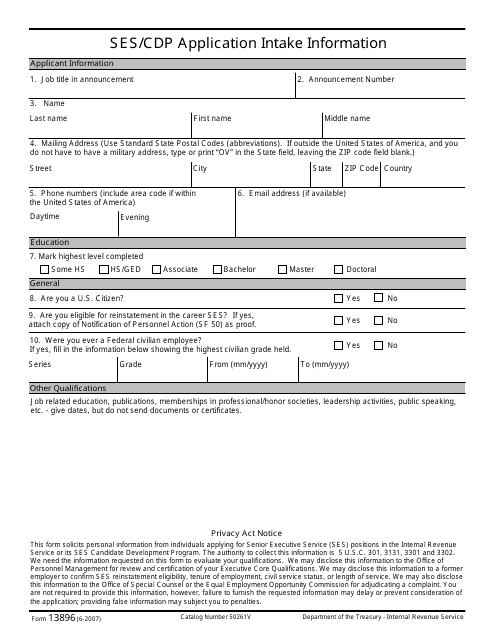

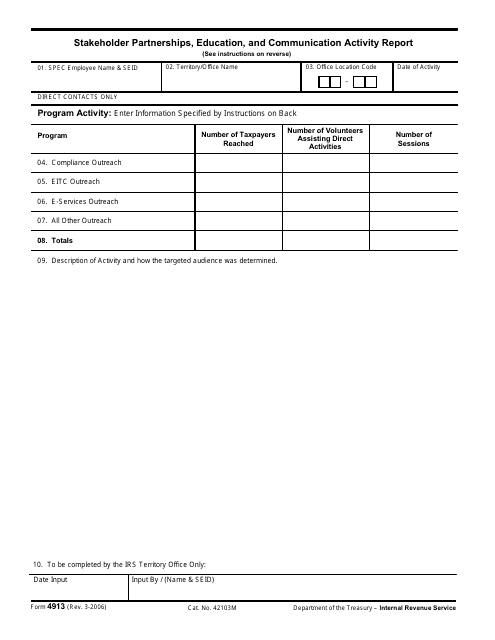

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

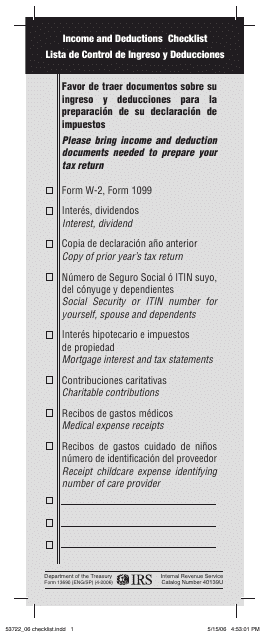

This form is used for checking income and deductions. It is available in both English and Spanish.

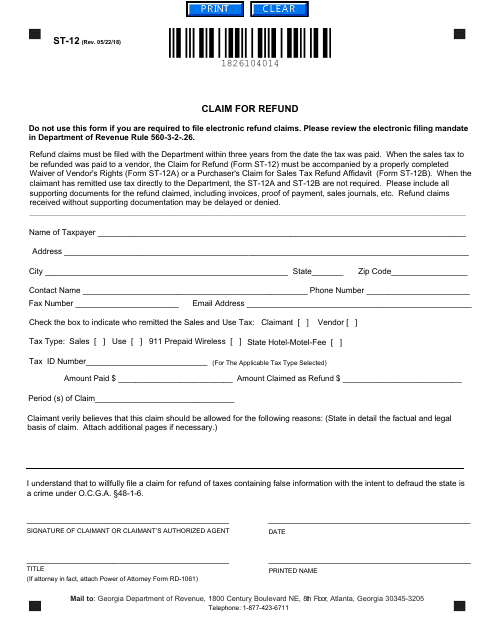

This Form is used for claiming a refund in the state of Georgia, United States.

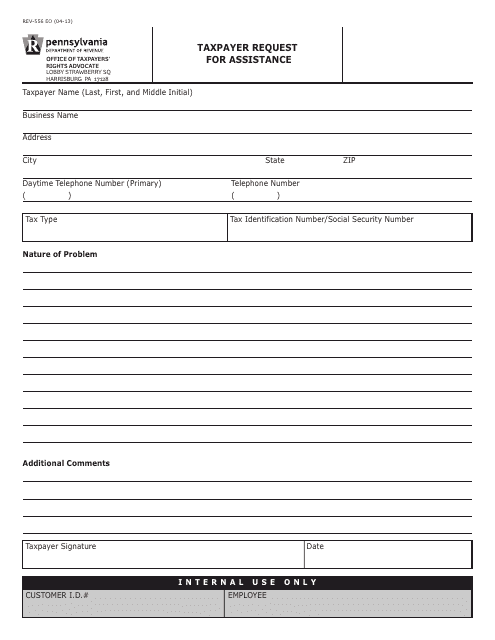

This form is used for Pennsylvania taxpayers to request assistance from the state tax authority.

This is a document you may use to figure out how to properly complete IRS Form 6765

This form is used for requesting a suspension of the statute of limitations in California due to being financially disabled. It helps individuals who are unable to pay their taxes to temporarily stop collections activities.

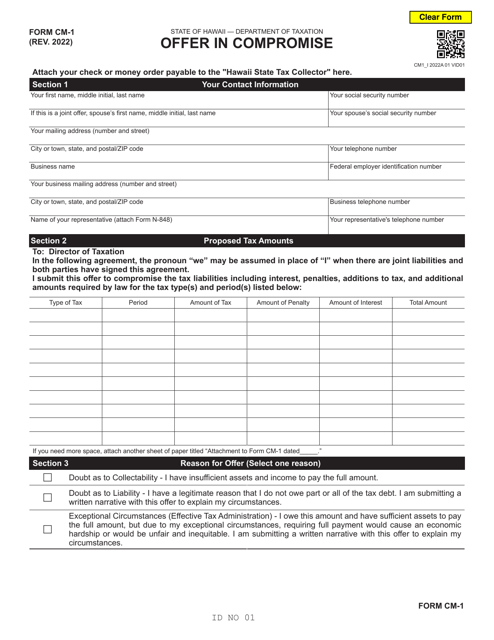

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

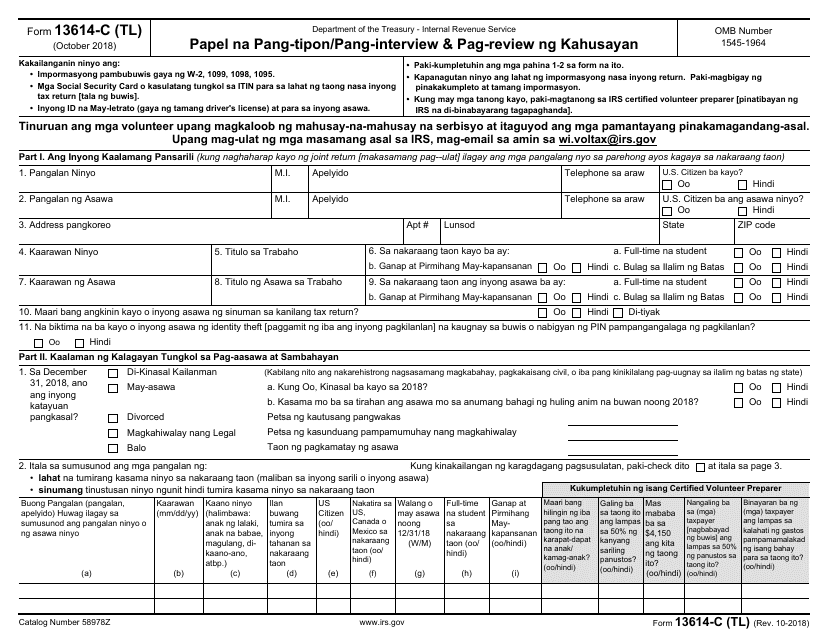

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This document is a test for volunteers who assist with tax preparation through the IRS Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

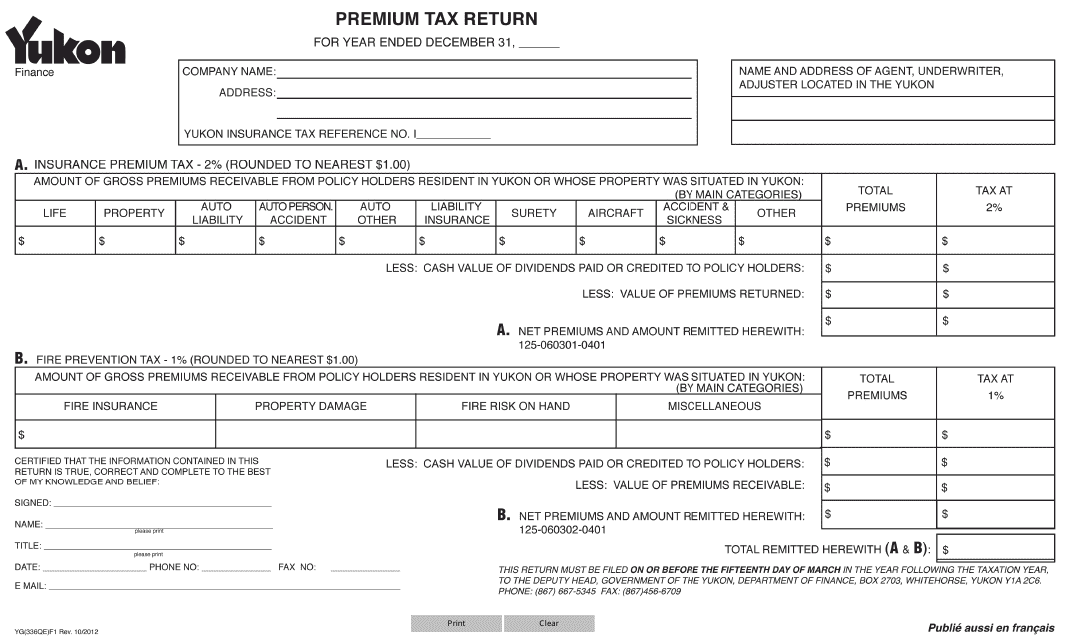

This form is used for filing premium tax returns in Yukon, Canada.

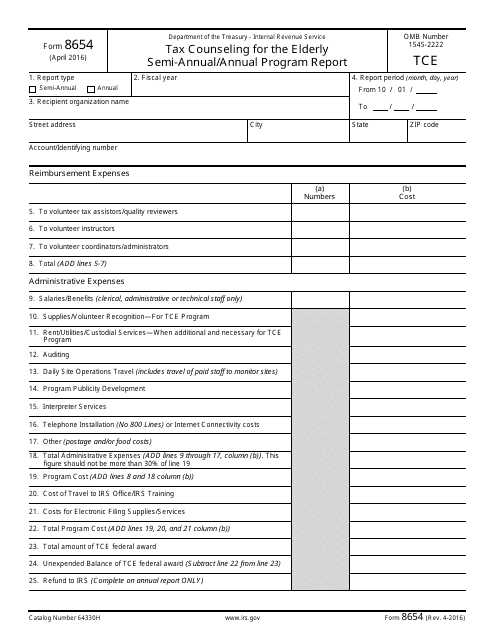

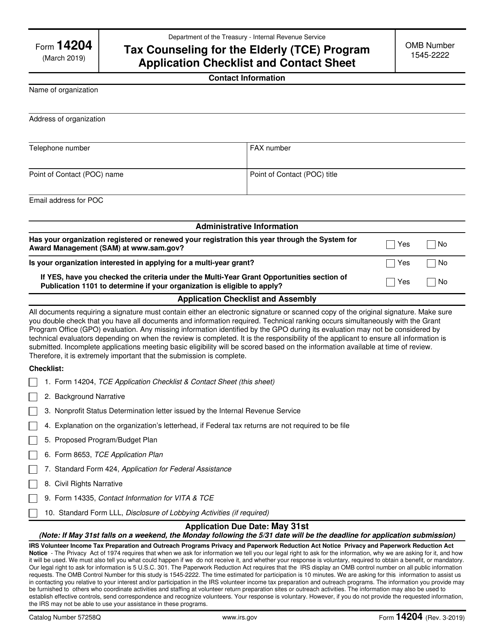

This document is a checklist for applying to the Tax Counseling for the Elderly (TCE) program. It includes a contact sheet for additional information.

This form is used for requesting innocent spouse relief in the state of Illinois.

This document provides information about the Taxpayer Advocate Service, a resource available to help individuals with their tax-related issues.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.