Tax Assistance Templates

Documents:

110

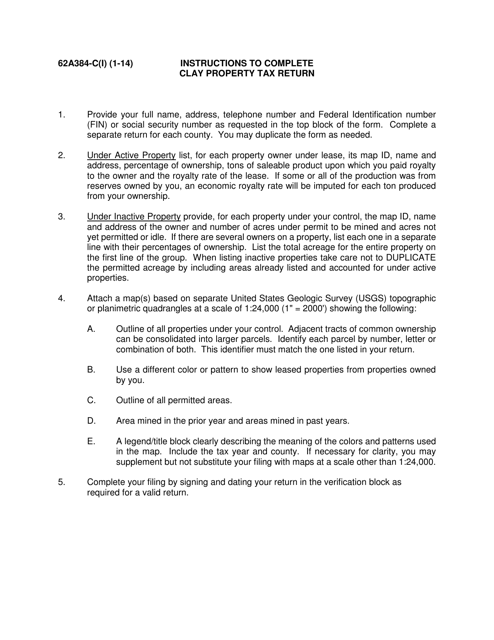

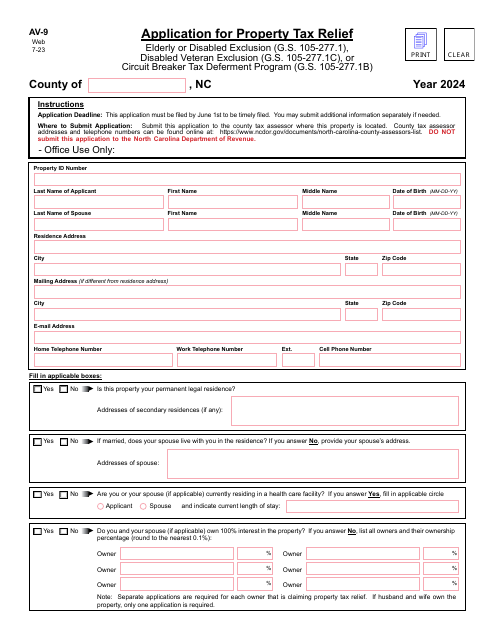

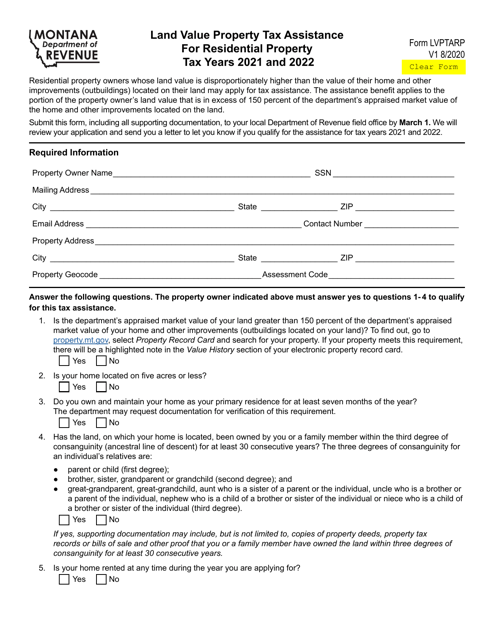

This Form is used for reporting property tax return for Clay County, Kentucky. It provides instructions for filling out Form 62A384-C.

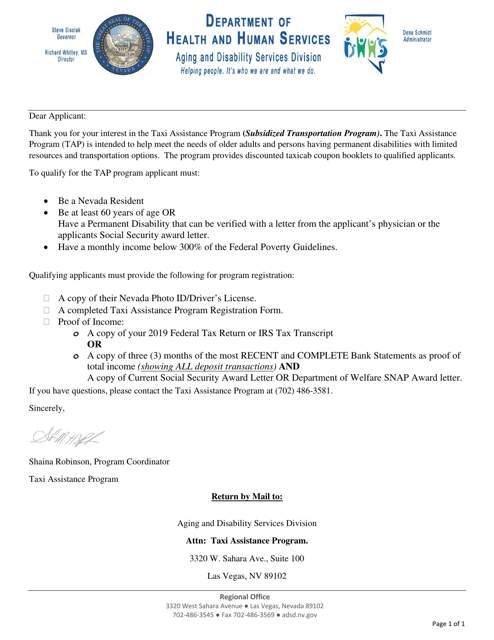

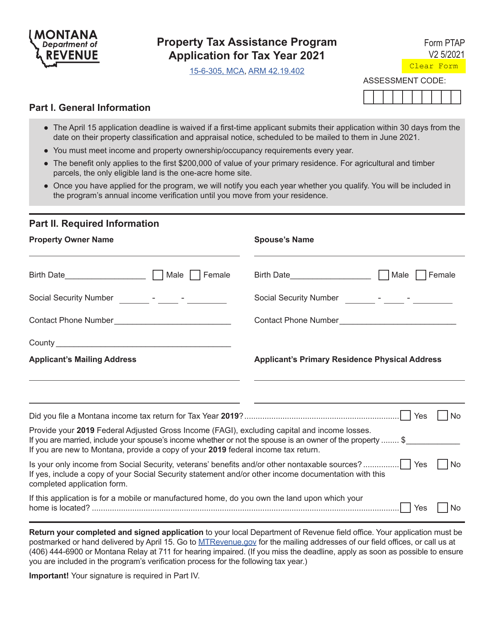

This document is used for registering for the Tax Assistance Program in the state of Nevada.

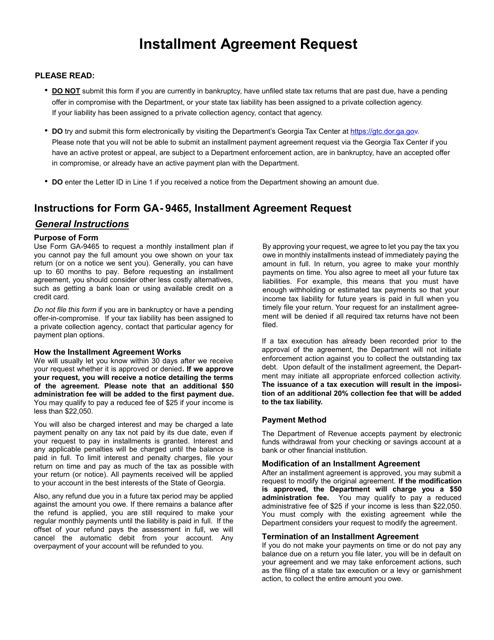

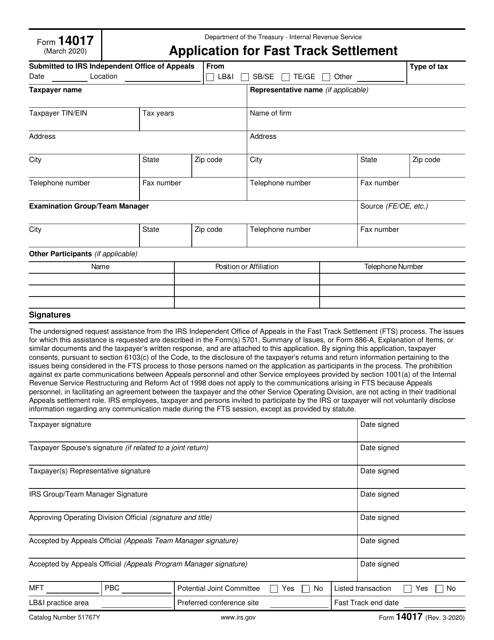

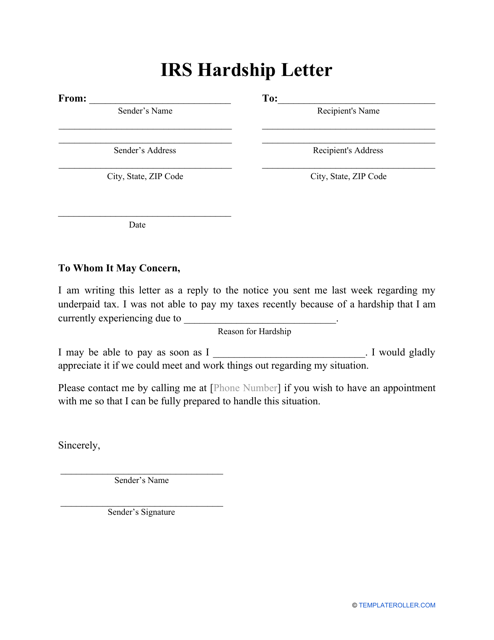

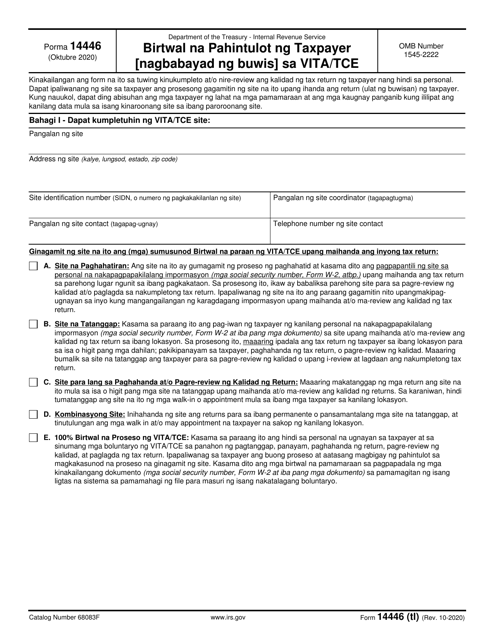

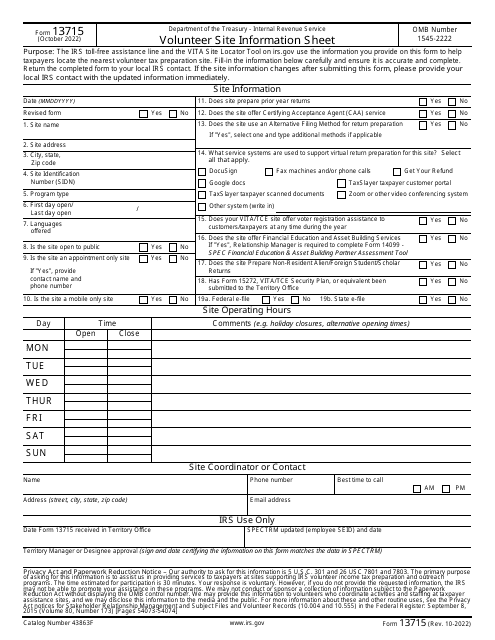

Complete this template and send it to the Internal Revenue Service (IRS) in order to describe a difficult financial situation you're experiencing, ask the IRS for leniency, or request a new payment deadline.

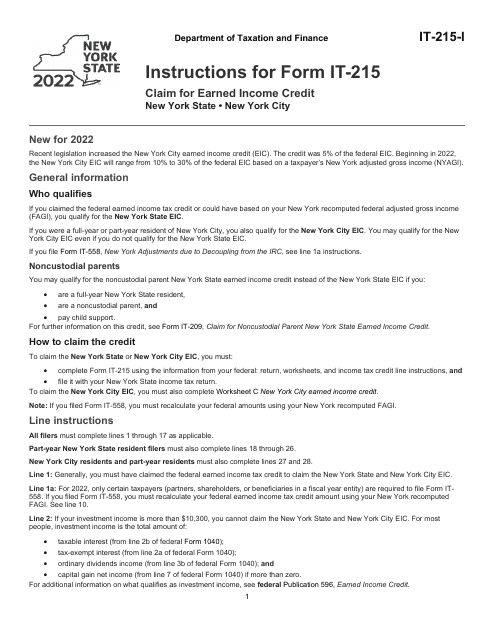

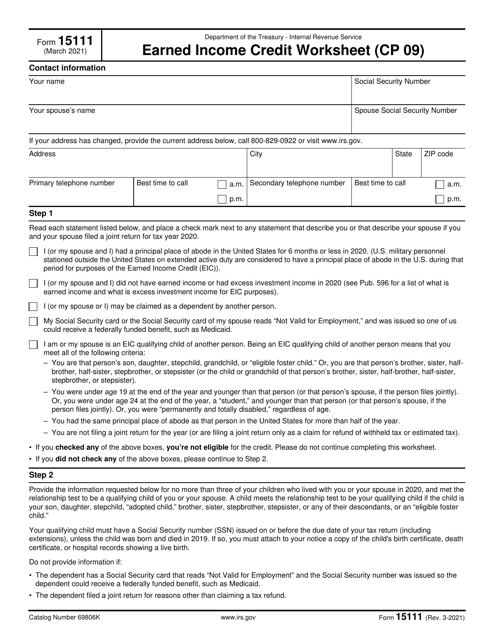

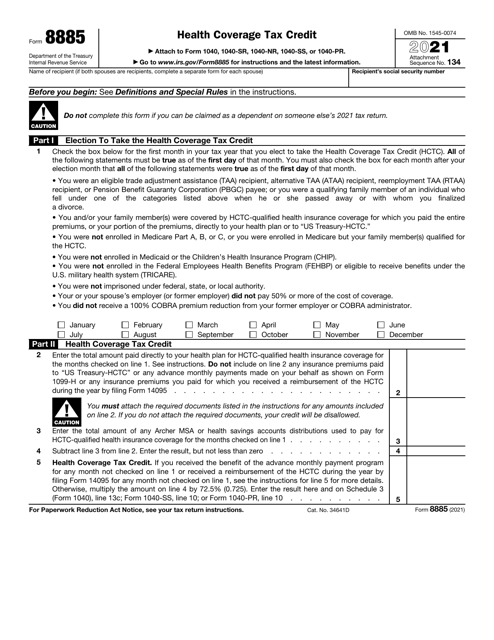

This form is used to calculate the Earned Income Credit for eligible taxpayers.

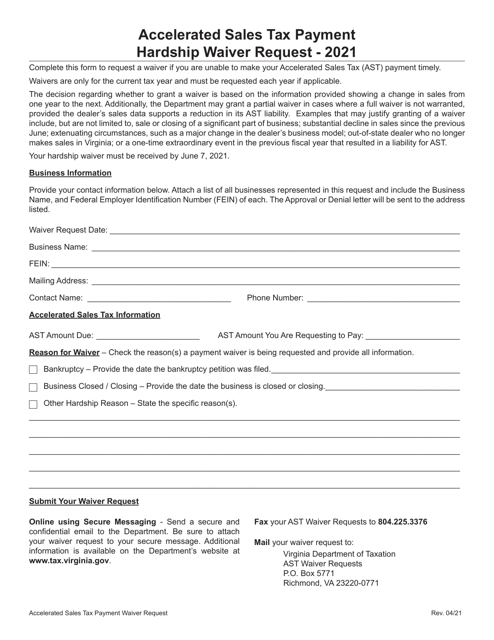

This document is a request to waive the hardship requirement for accelerated sales tax payment in Virginia.

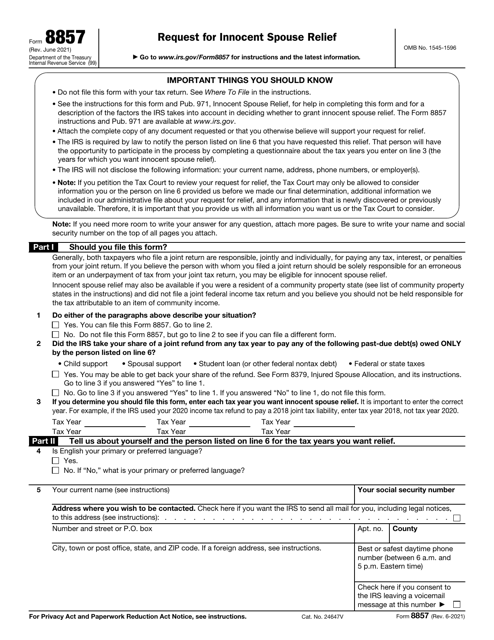

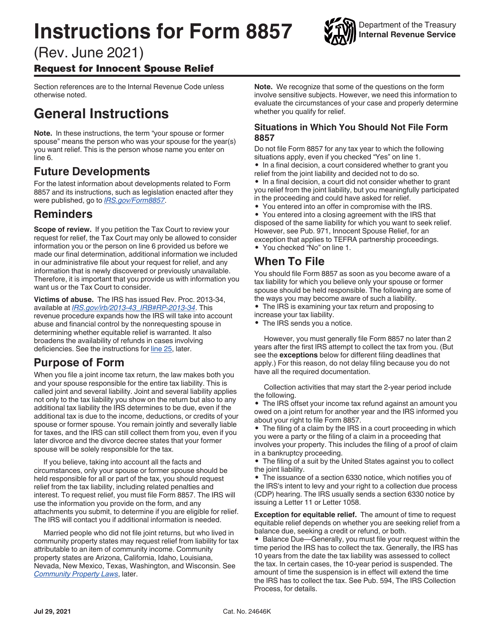

This Form is used for requesting Innocent Spouse Relief from the Internal Revenue Service (IRS). It is intended for individuals who believe they should not be held responsible for the tax liability owed by their spouse or former spouse.

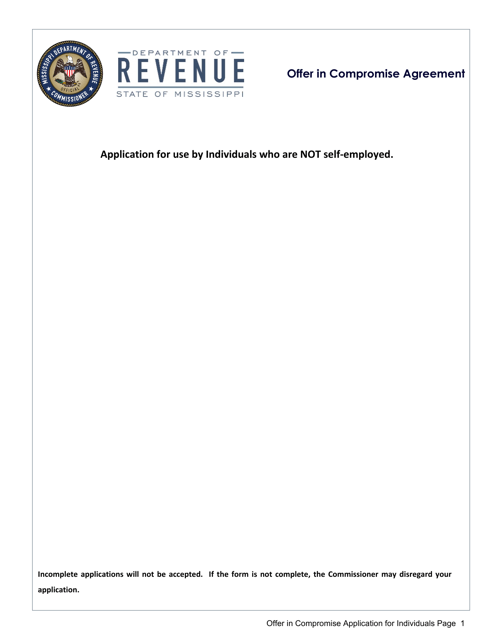

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

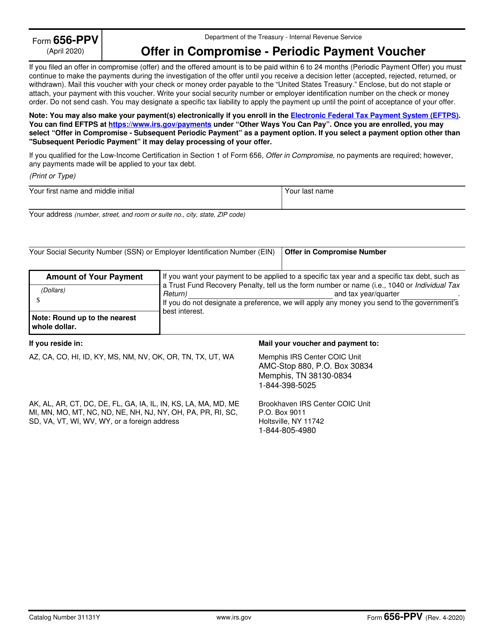

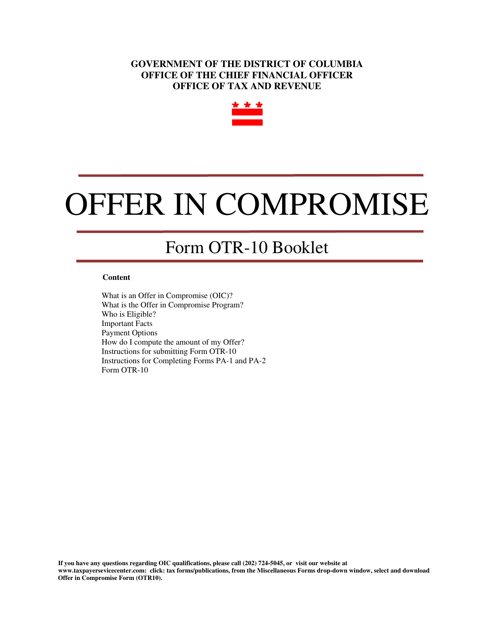

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

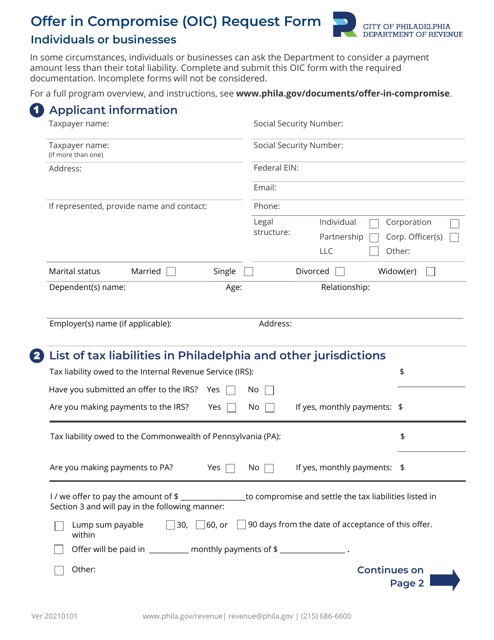

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.