Net Operating Loss Templates

Are you looking for information on net operating losses? Our website is your go-to resource for all things related to net operating loss, also known as NOL. Whether you're a business owner, tax professional, or individual taxpayer, understanding net operating losses is crucial for managing your finances and maximizing your tax benefits.

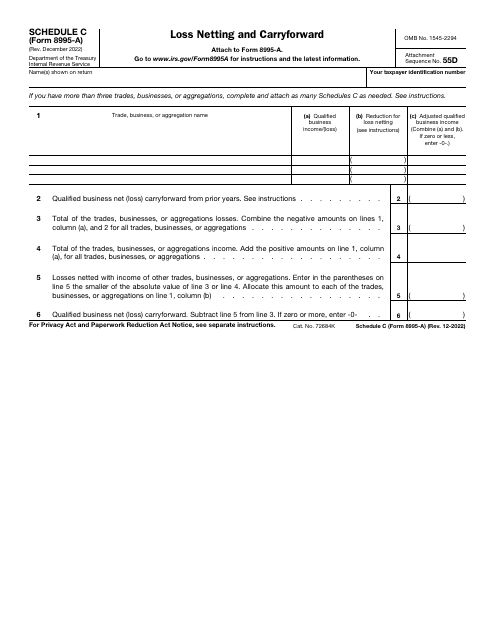

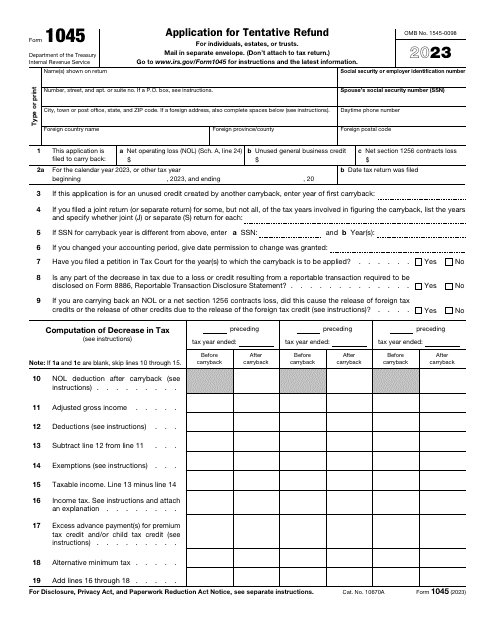

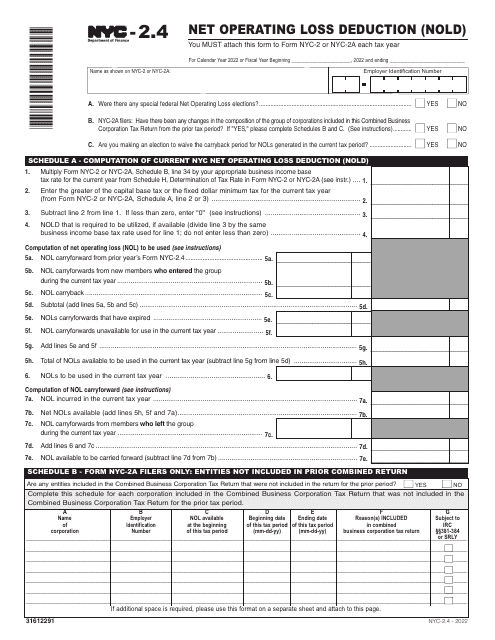

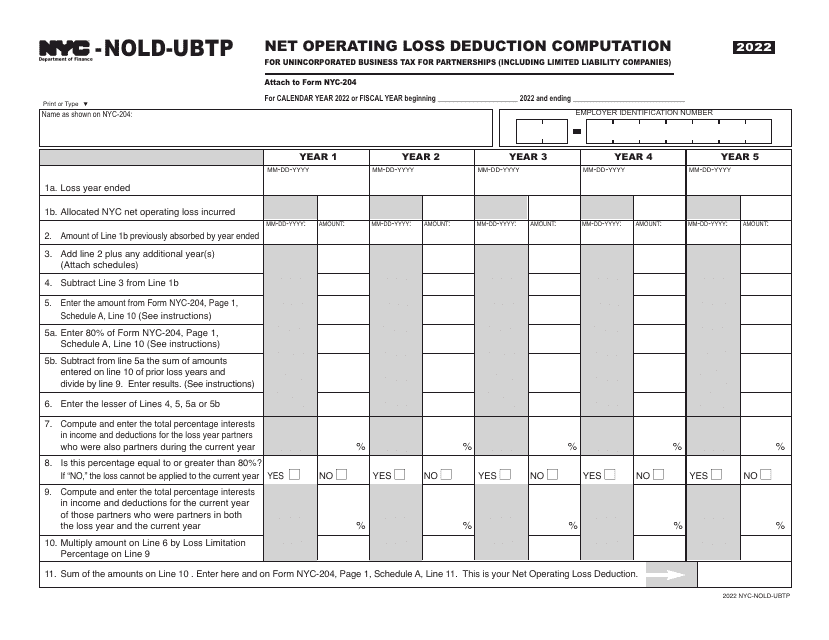

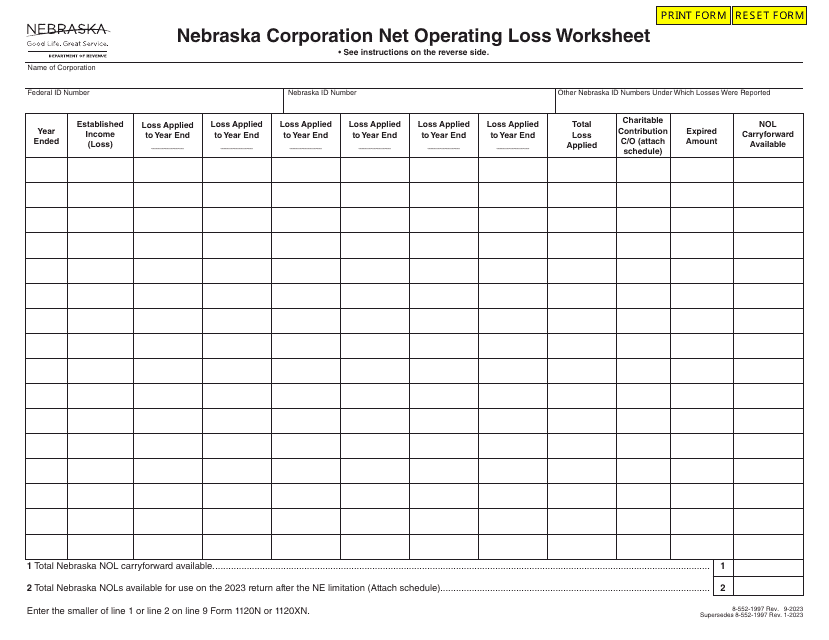

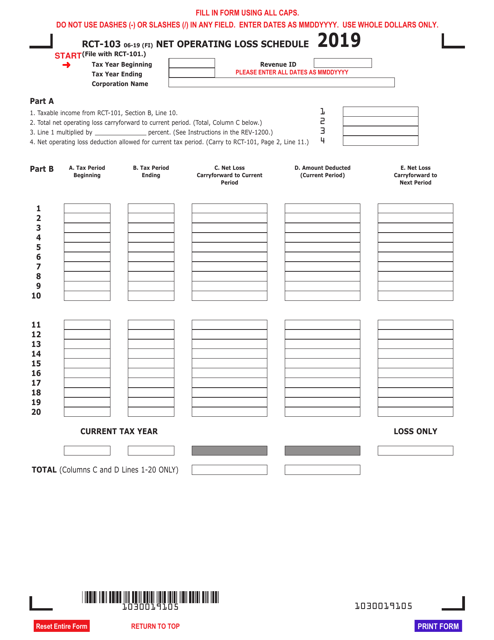

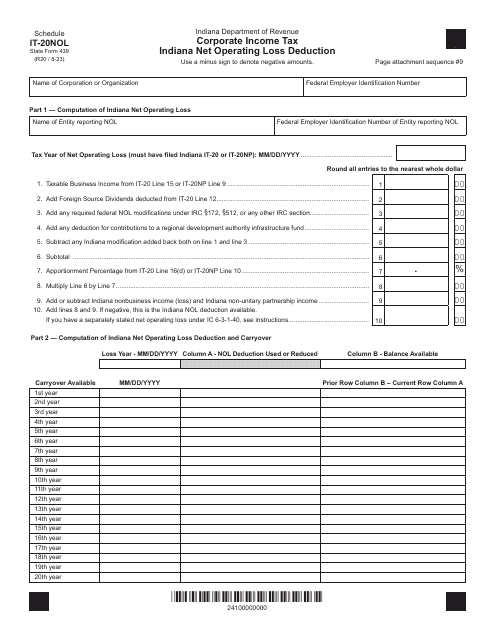

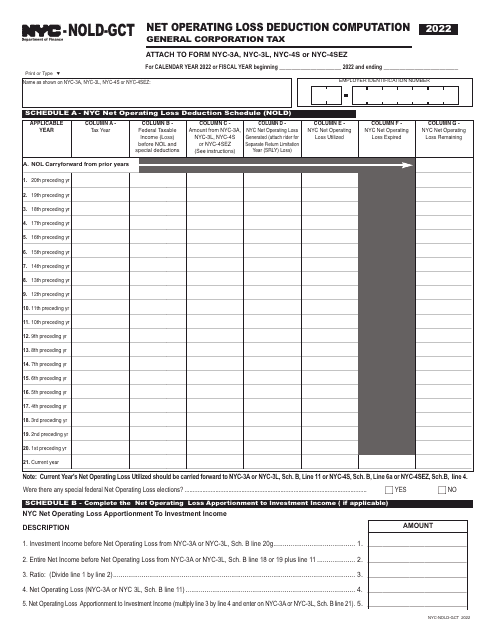

Net operating losses occur when a company's deductible expenses exceed its taxable income. This loss can be carried forward or carried back to offset future or past taxable income. Our website provides detailed information on how to calculate, apply, and report net operating losses, ensuring that you take full advantage of this valuable tax benefit.

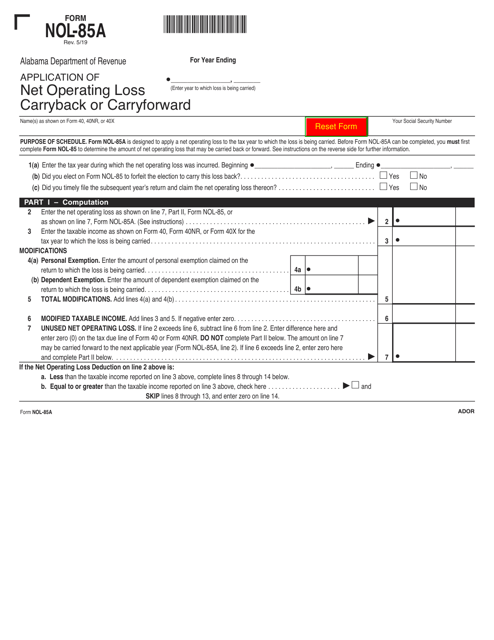

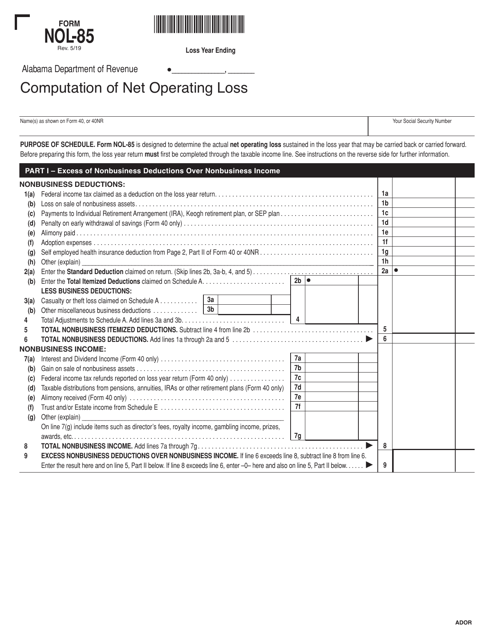

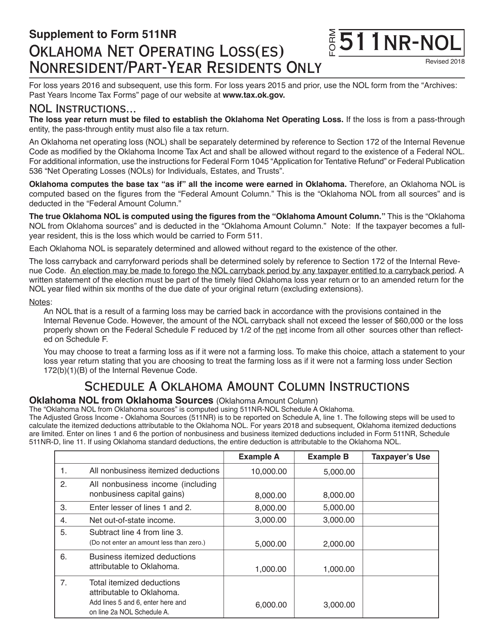

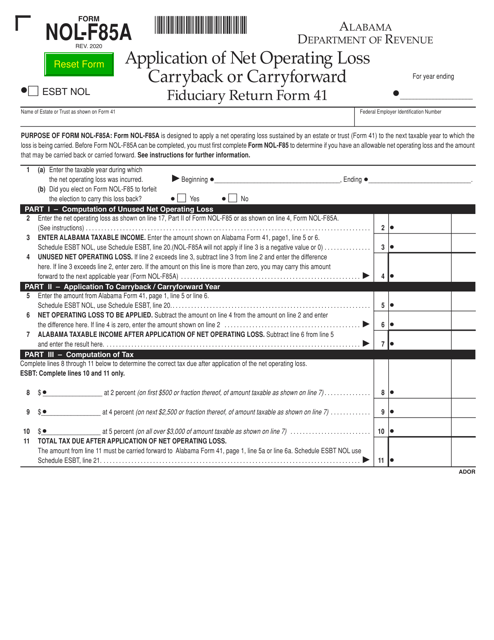

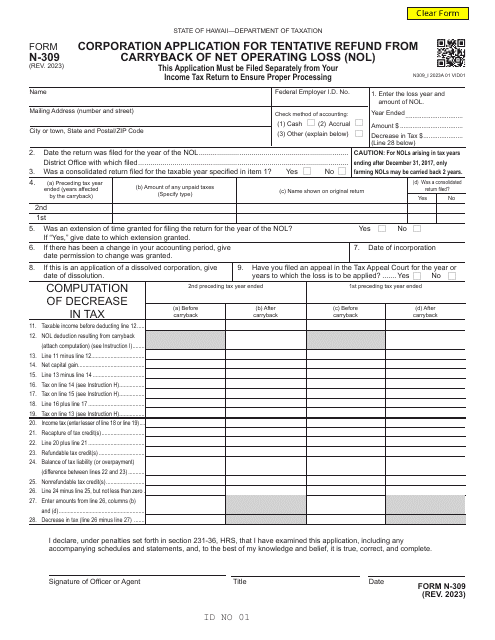

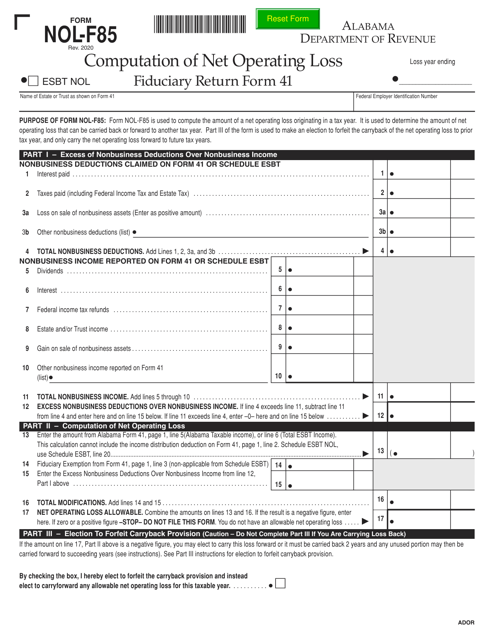

We offer a variety of resources, including forms and schedules specific to each state. For instance, you can find Form NOL-F85A, which is used to apply for the net operating loss carryback or carryforward on fiduciary returns in Alabama. Similarly, we provide Form AR1000NOL for reporting net operating losses in Arkansas. These state-specific forms are critical for accurately reporting your net operating losses and claiming the available deductions.

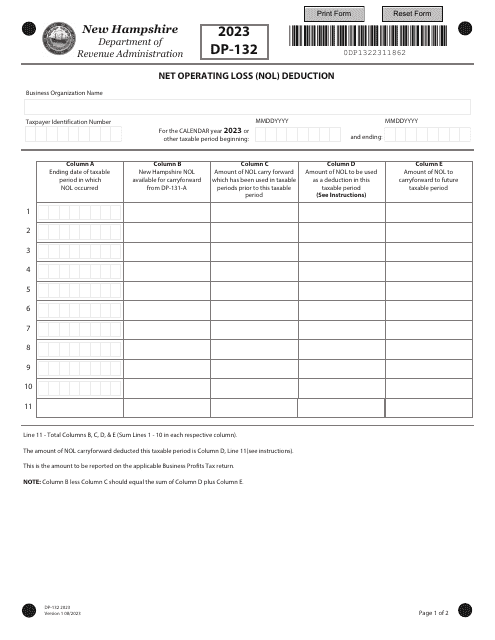

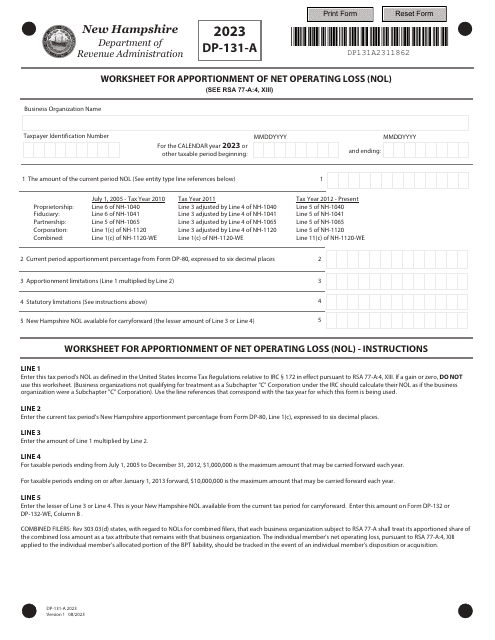

If you're a business operating in New Hampshire, you'll find Form DP-132 and Form DP-132-WE particularly useful. Form DP-132 is used to claim the net operating loss deduction for individuals, while Form DP-132-WE is for combined groups. These forms ensure that your business takes advantage of the net operating loss deduction offered by the state of New Hampshire.

Additionally, we have resources for businesses in Wisconsin, such as Form X-NOL (I-002I). This form allows companies to carry back their net operating losses and claim deductions specific to the state of Wisconsin.

Navigating the complexities of net operating losses can be challenging, but with our comprehensive resources and easy-to-understand explanations, you can confidently calculate and utilize this tax benefit to your advantage. Whether you need information on carrybacks, carryforwards, or specific state requirements, our website has you covered.

Stay ahead of the game and make informed financial decisions by exploring our collection of documents related to net operating losses. Don't miss out on the opportunity to minimize your tax liability and maximize your financial success. Start exploring our net operating loss resources today!

Documents:

92

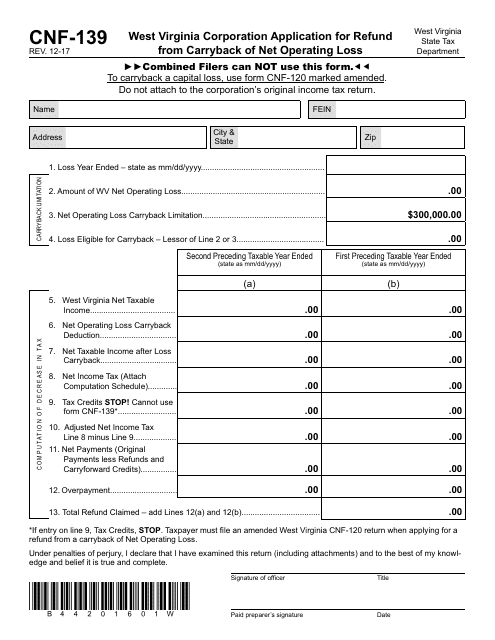

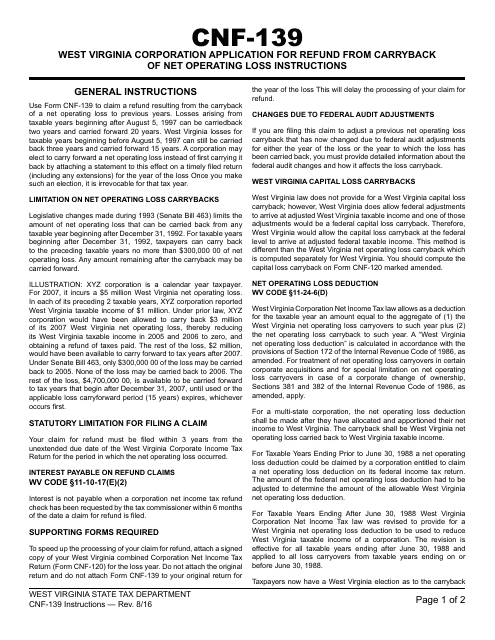

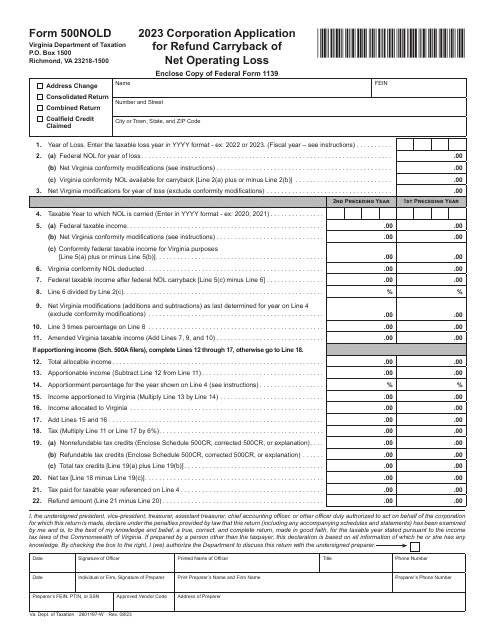

This form is used for West Virginia corporations to apply for a refund of excess net operating losses that have been carried back.

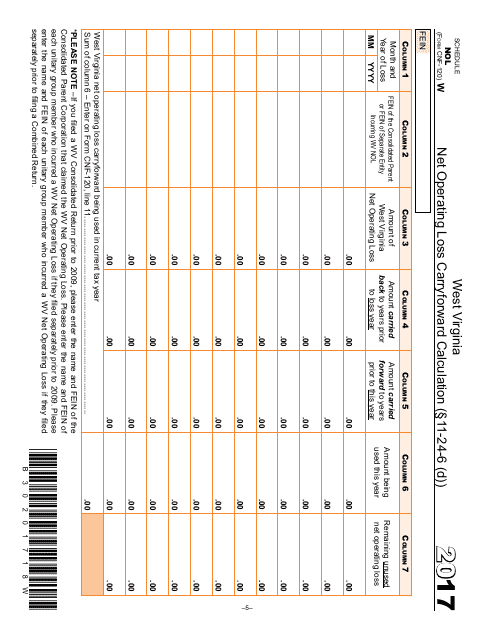

This form is used for calculating the Net Operating Loss (NOL) carryforward for individuals and businesses in West Virginia.

This Form is used for West Virginia corporations to apply for a refund from carryback of net operating losses. It provides instructions on how to complete the form and submit the application.

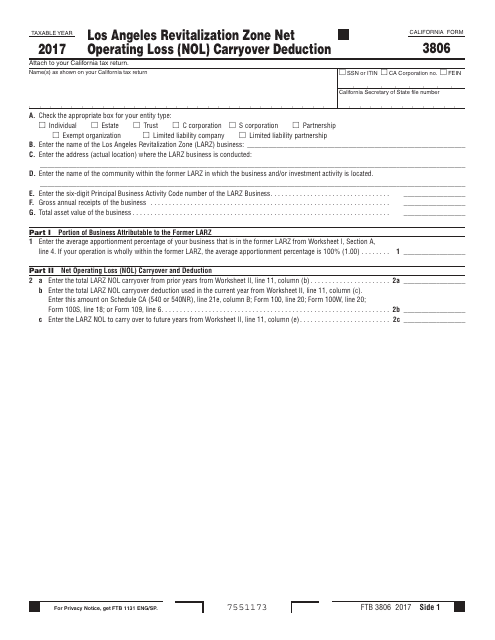

This Form is used for claiming the Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction in California.

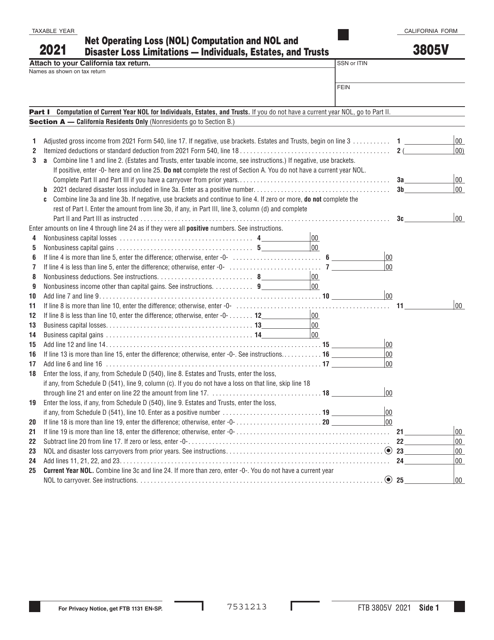

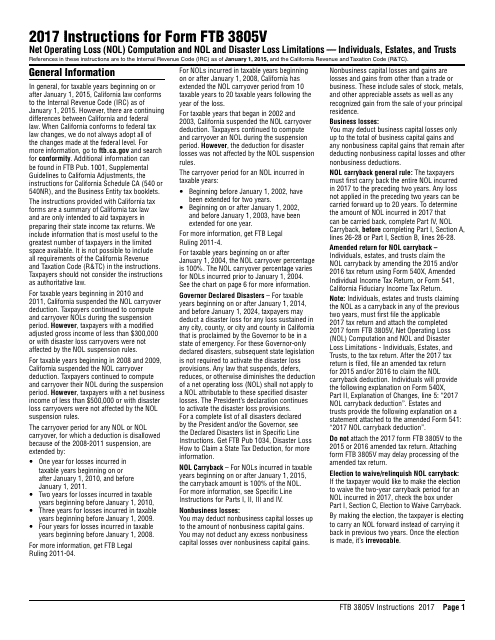

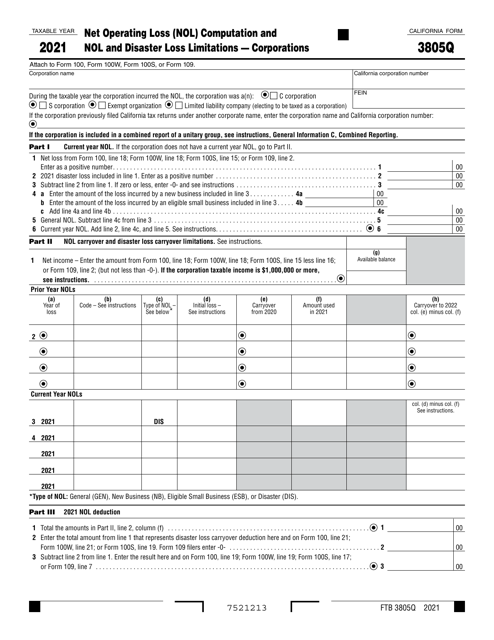

This Form is used to calculate the net operating loss (NOL) and determine the limitations on NOL and disaster losses for individuals, estates, and trusts in California.

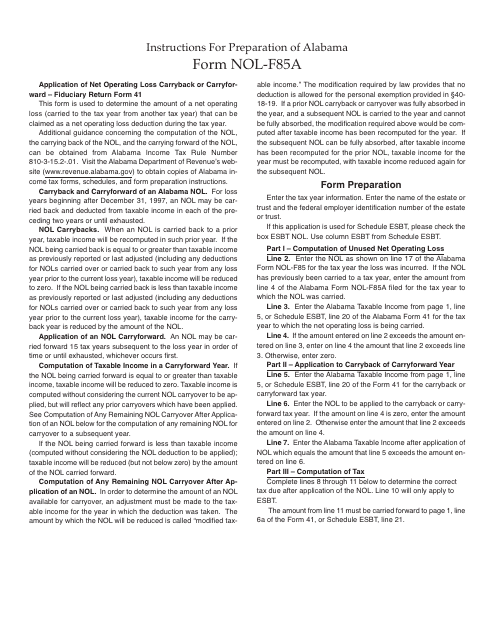

This document provides instructions for completing Form NOL-F85A, which is used to apply for a net operating loss carryback or carryforward on a Fiduciary Return Form 41 in the state of Alabama.

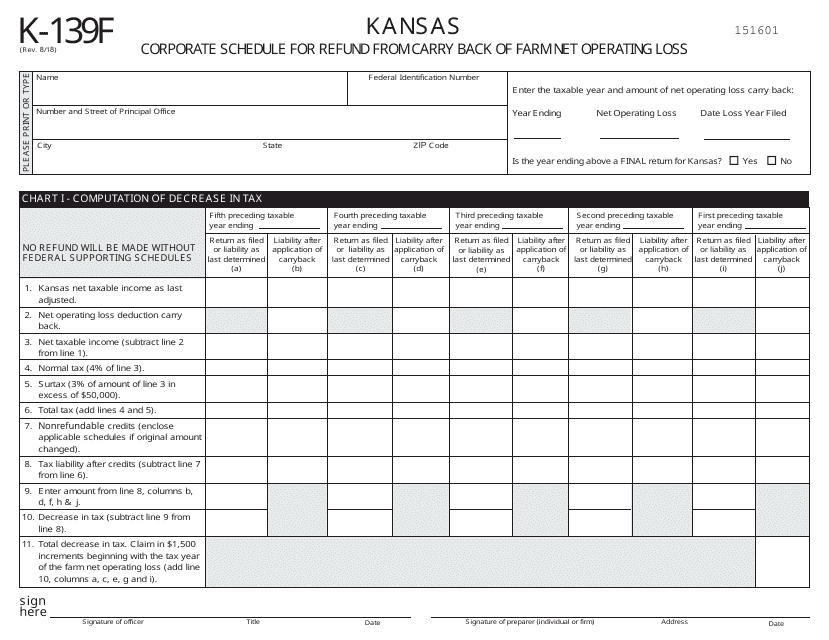

This form is used for Kansas corporations to claim a refund from carrying back farm net operating losses.

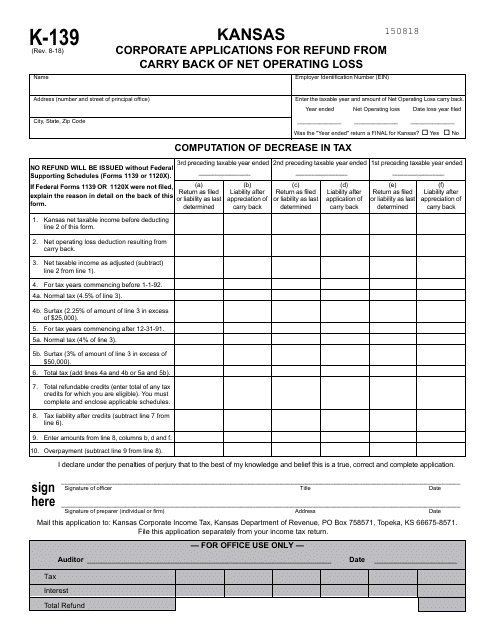

This form is used by corporations in Kansas to apply for a refund resulting from carrying back a net operating loss.

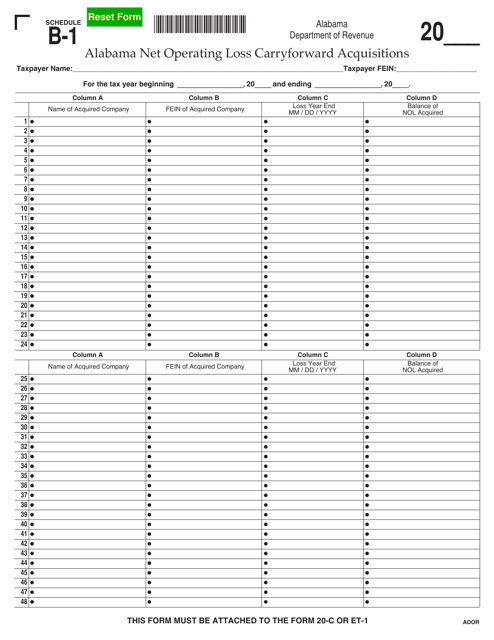

This document provides information about the Schedule B-1 form specific to Alabama, which is used to report net operating loss carryforwards resulting from acquisitions in the state.

This form is used for reporting net operating losses in the state of Pennsylvania.

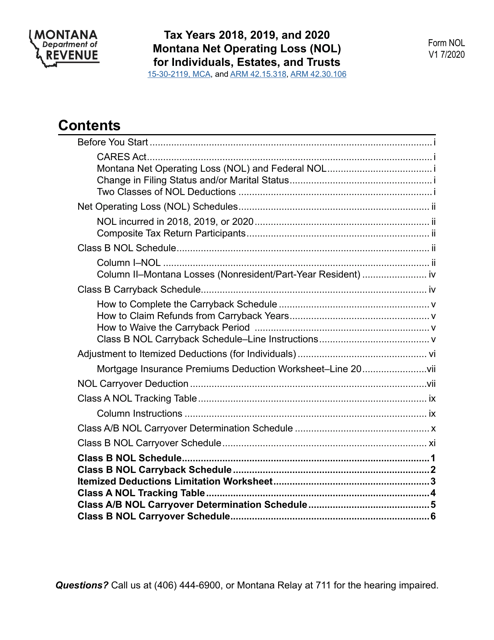

This form is used for reporting net operating losses (NOL) in Montana for individuals, estates, and trusts. It helps calculate the amount of NOL that can be carried forward or back to future or past tax years.