Net Operating Loss Templates

Documents:

92

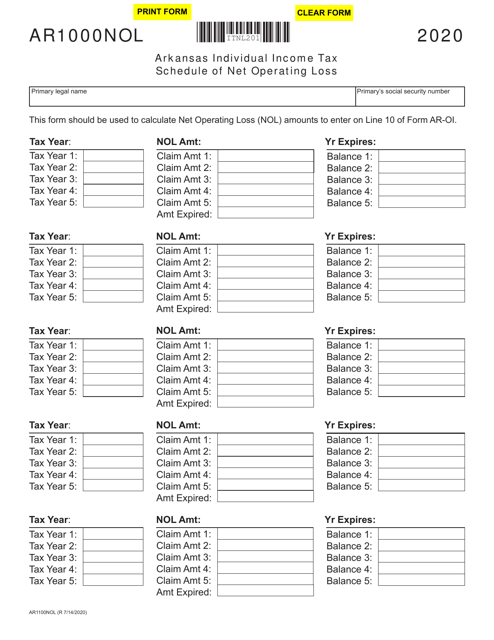

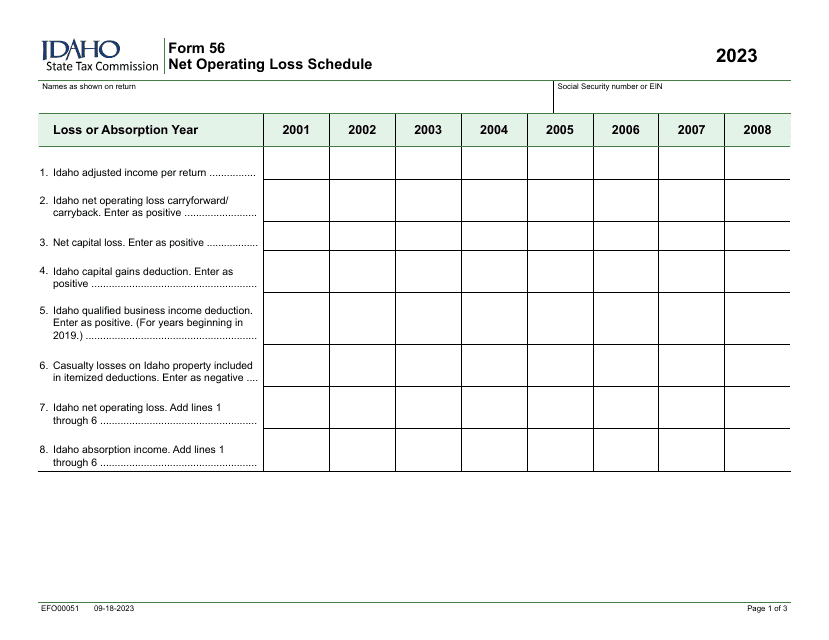

This form is used for reporting net operating losses in the state of Arkansas.

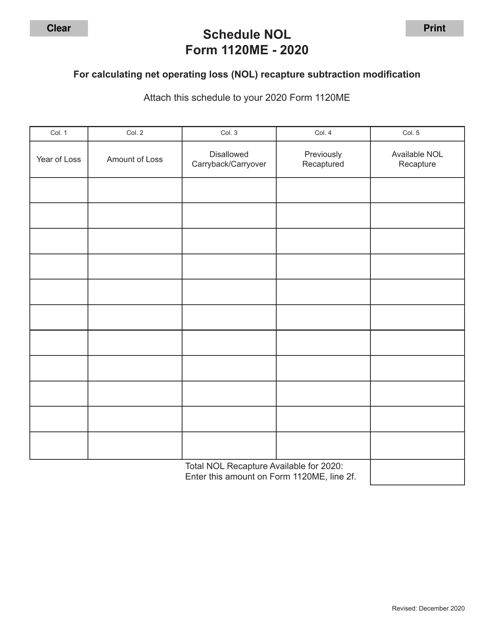

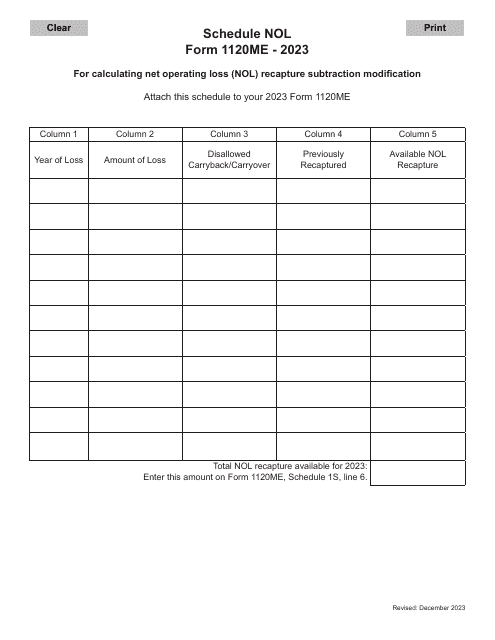

This form is used for calculating the Net Operating Loss (NOL) recapture subtraction modification in the state of Maine for businesses filing Form 1120ME.

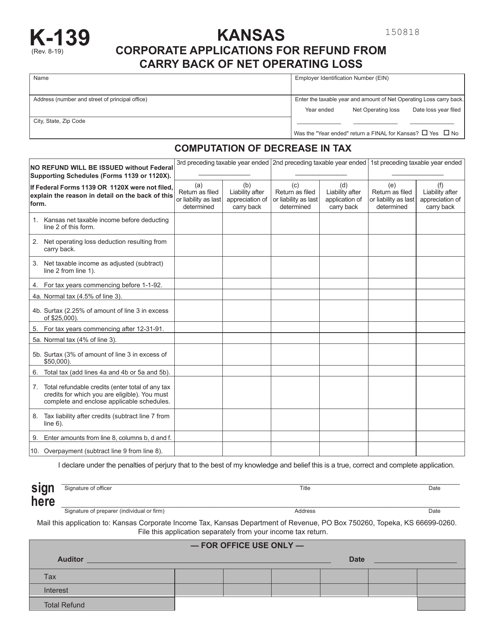

This form is used for Kansas corporations to apply for a refund by carrying back a net operating loss.

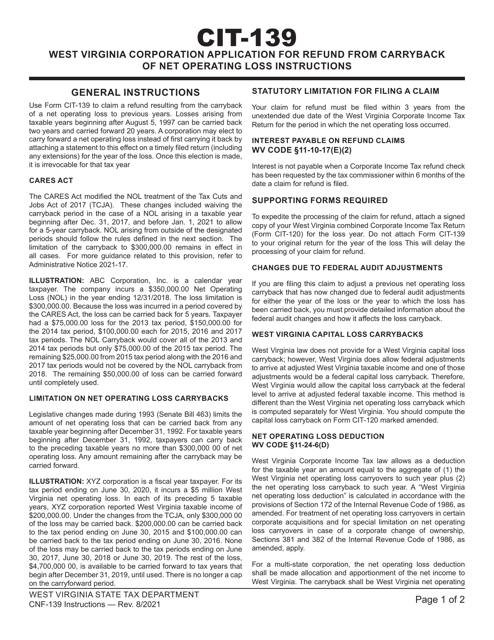

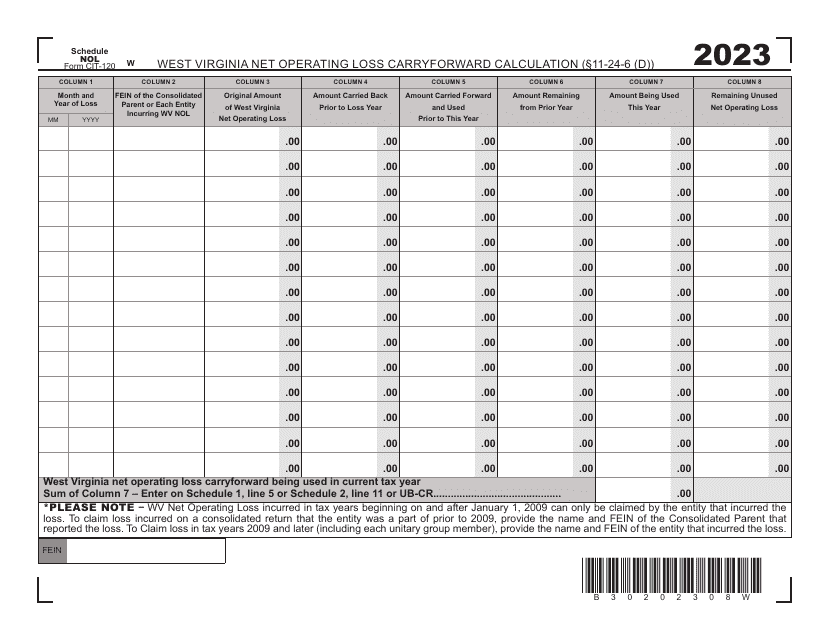

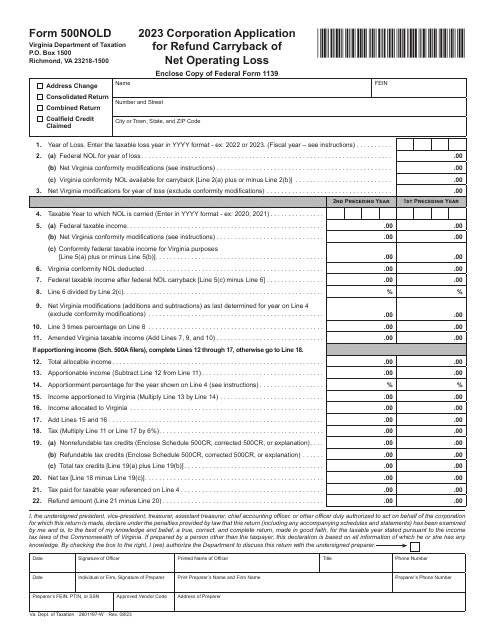

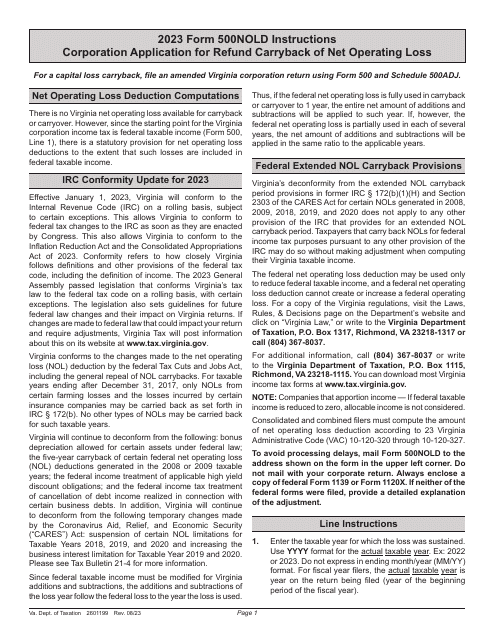

This form is used for West Virginia corporations to apply for a refund from the carryback of a net operating loss. It provides instructions on how to complete the form and apply for the refund.

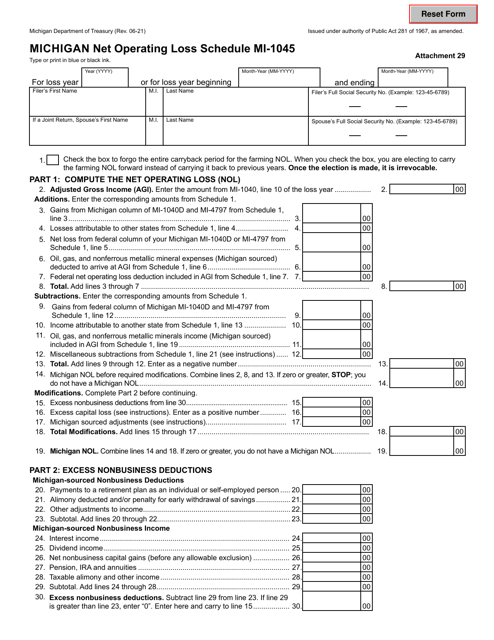

This document is used for reporting net operating losses in the state of Michigan. It is a schedule that taxpayers must complete and submit along with their Michigan income tax return.

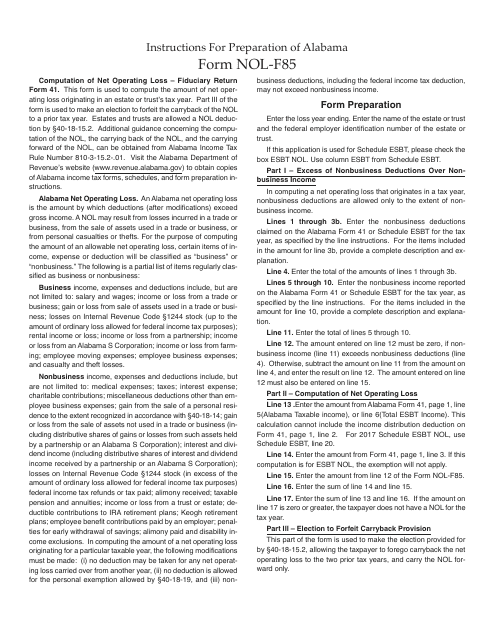

This document is used for calculating the net operating loss for fiduciary returns in Alabama. It provides instructions on how to complete Form NOL-F85.