Tax Obligation Templates

Are you unsure about your tax obligations? Wondering what forms and documents you need to file? Look no further! Our tax obligation document knowledge system provides you with all the information you need to navigate the complex world of taxes.

From Form HTDT-3 Hard-To-Dispose Material Wholesale Tax Return in Rhode Island to IRS Form 1040 Schedule H for Household Employment Taxes, we have a comprehensive collection of tax documents that cover a wide range of tax obligations. Whether you're a business owner, a fiduciary, or an individual taxpayer, our extensive library of tax forms will help ensure that you meet your tax responsibilities.

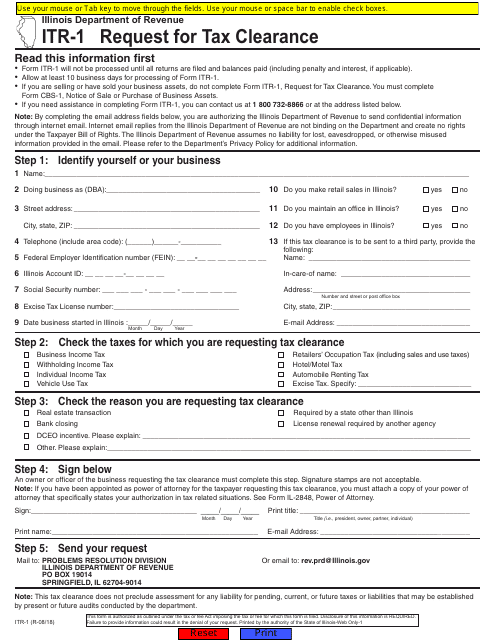

In addition to the popular IRS forms, we also provide instructions for various state-specific tax obligations. For example, Instructions for Form IL-1120 Schedule INS cover tax obligations for foreign insurers in Illinois. We understand that tax laws can vary from state to state, and our collection reflects this diversity.

Don't let the complexity of tax obligations overwhelm you. With our tax obligation document knowledge system, you can easily access the forms and instructions you need. Take the guesswork out of taxes and stay in compliance with our user-friendly resource.

So whether you're a small business owner, an individual taxpayer, or a fiduciary, our tax obligation document knowledge system is your one-stop resource for navigating your tax obligations. Let us help simplify your tax filing process and ensure that you meet all your tax obligations accurately and on time.

Documents:

442

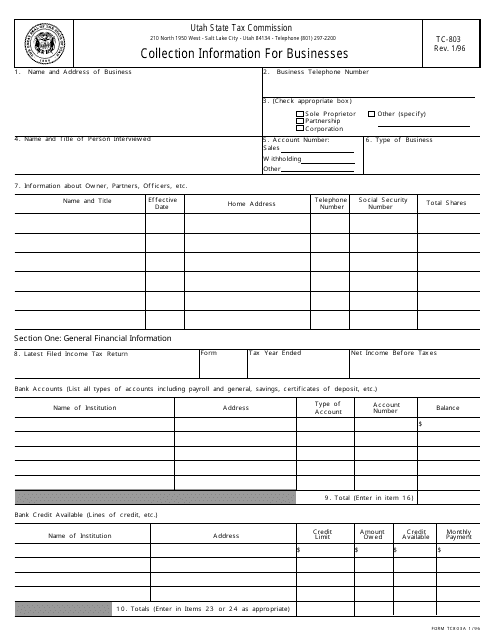

This form is used for businesses in Utah to provide collection information.

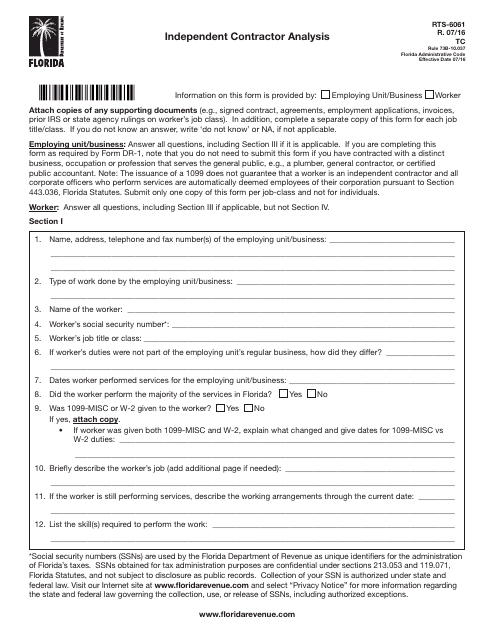

This form is used for conducting an independent contractor analysis in the state of Florida.

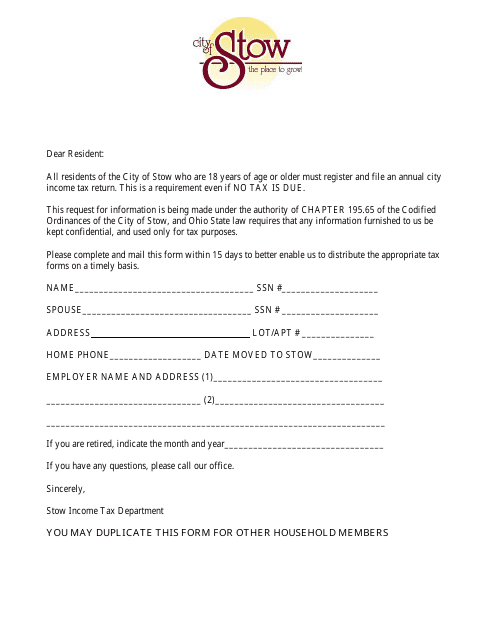

This Form is used for filing your income tax return in the City of Stow, Ohio.

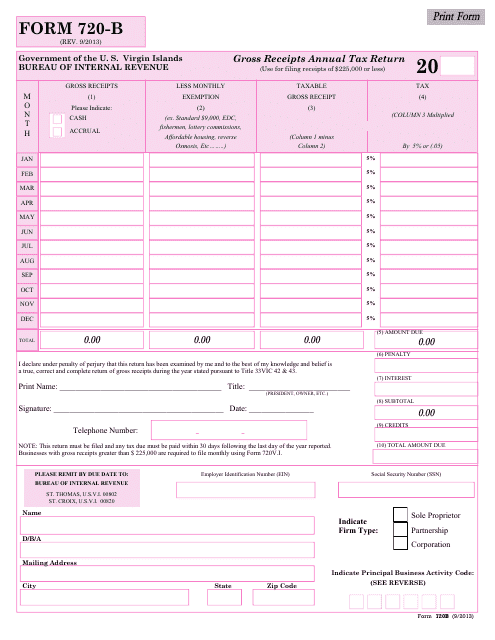

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

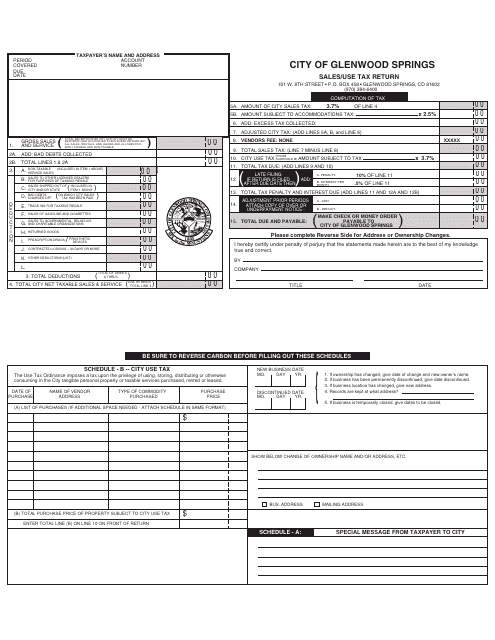

This Form is used for reporting and paying sales and use taxes to the City of Glenwood Springs, Colorado.

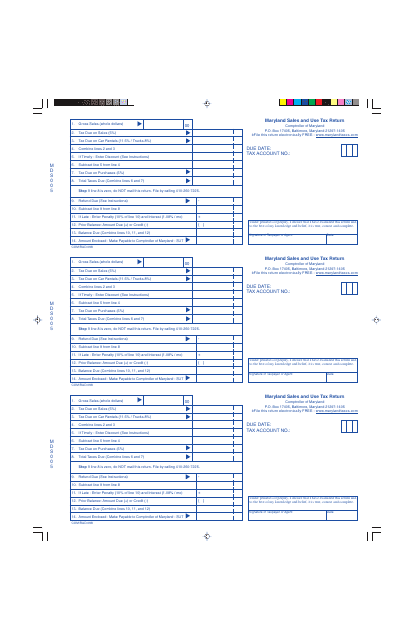

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

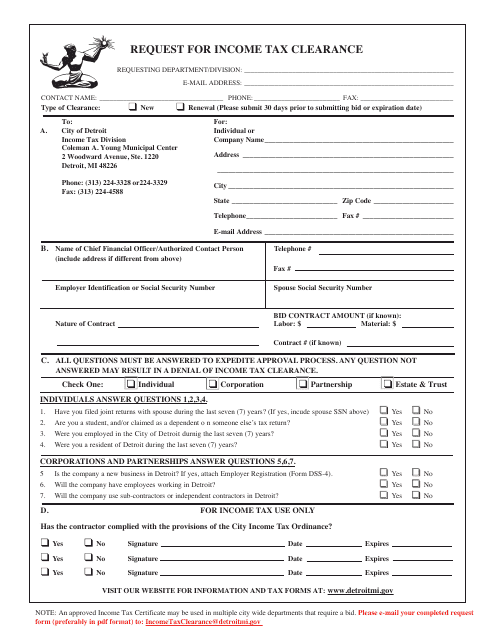

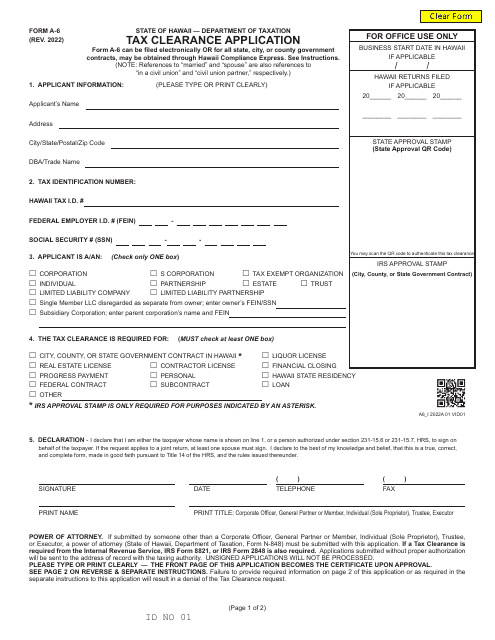

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

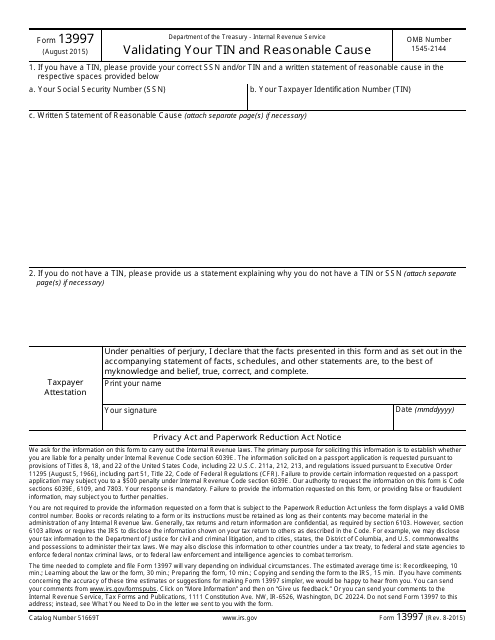

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

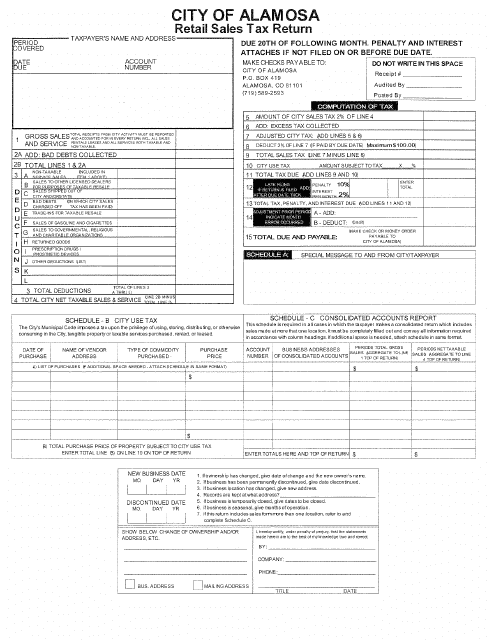

This Form is used for reporting and paying retail sales tax in the City of Alamosa, Colorado.

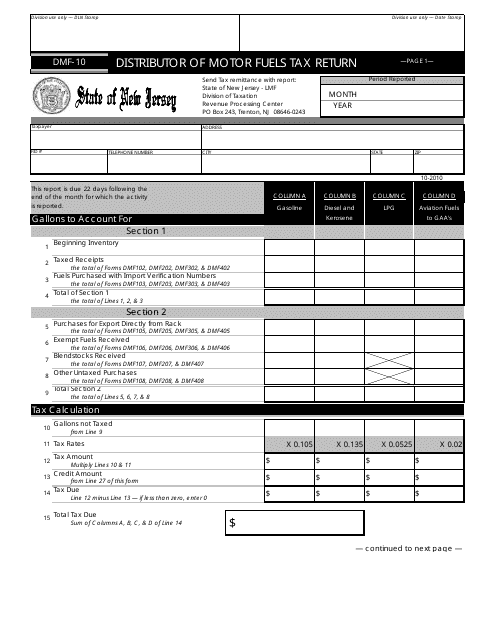

This form is used for filing the Motor Fuels Tax Return for distributors in the state of New Jersey.

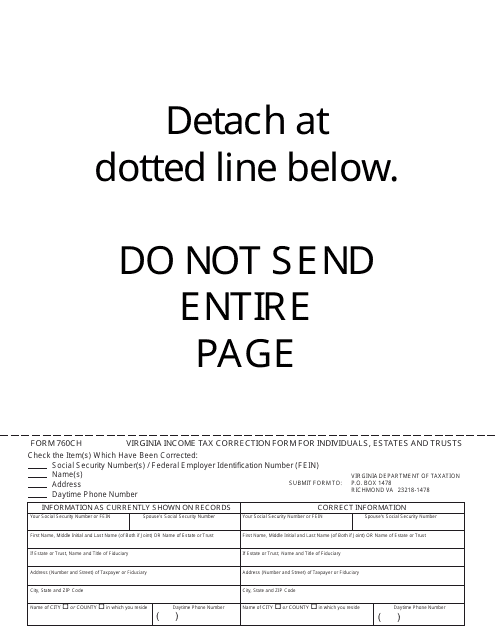

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

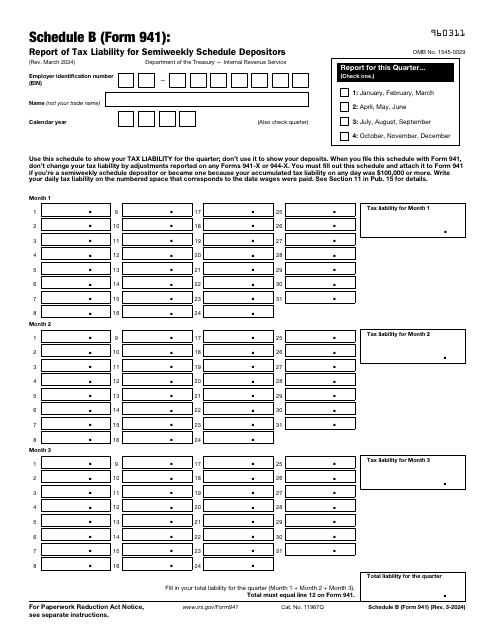

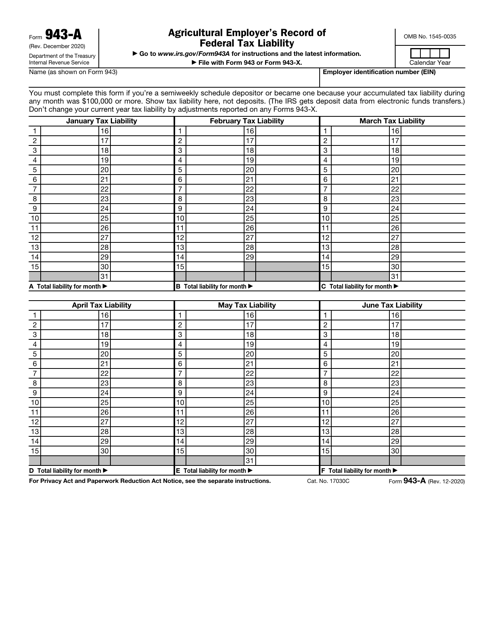

This is an IRS form used by agricultural employers that deposit schedules every two weeks or whose tax liability equals or exceeds $100,000 during any month of the year.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

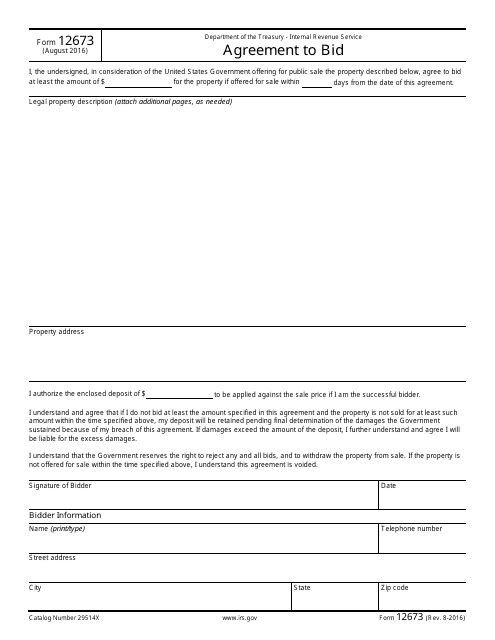

This form is used for taxpayers who want to enter into an agreement with the Internal Revenue Service (IRS) to participate in an auction or bidding process.

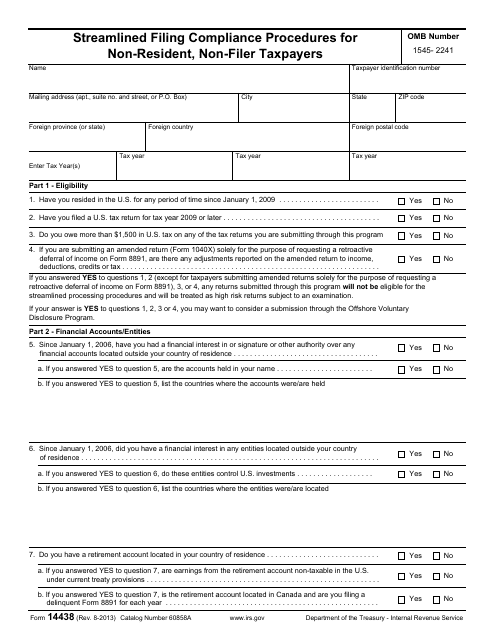

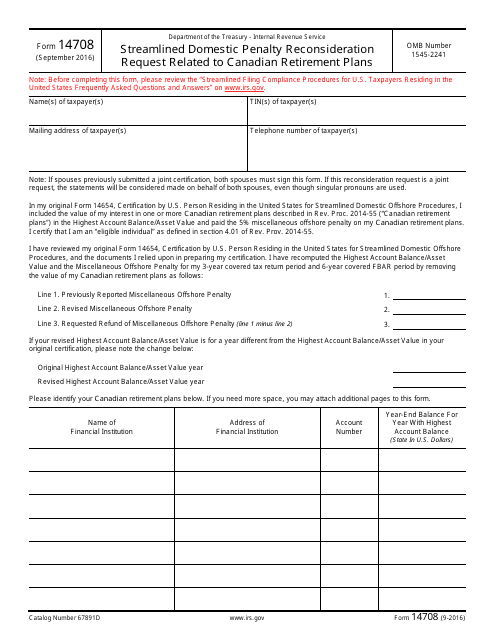

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

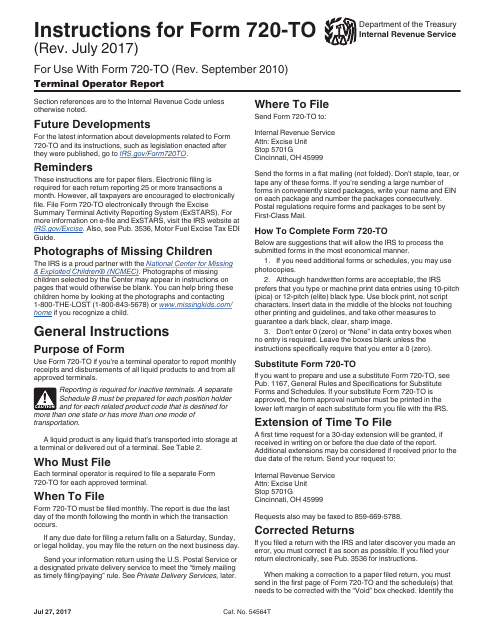

This document is for reporting activities of terminal operators to the IRS.

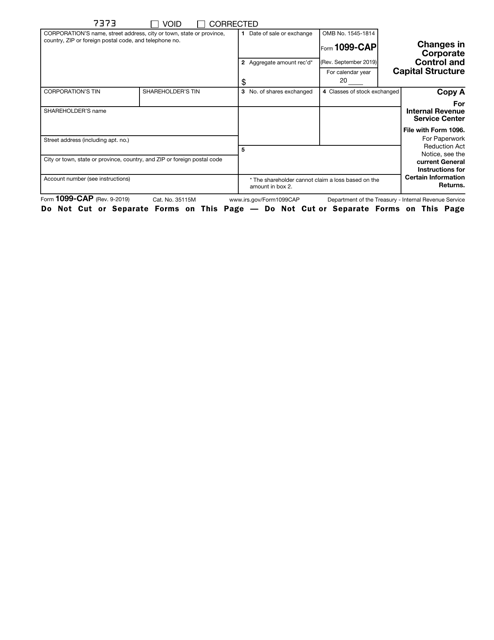

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

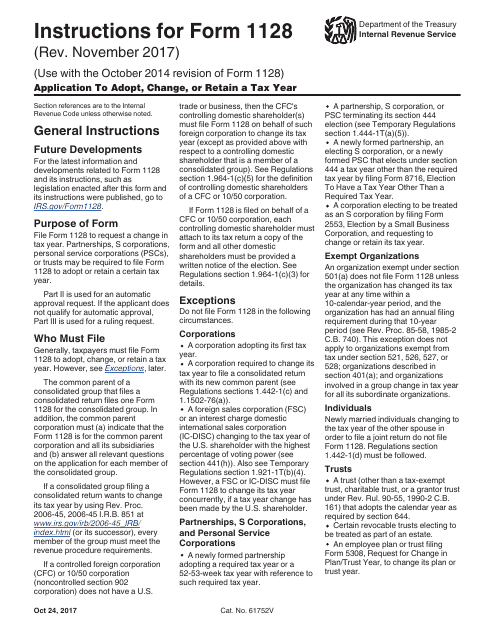

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

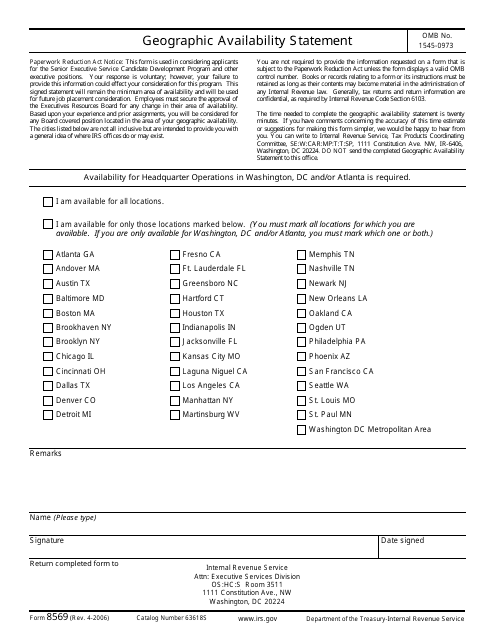

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

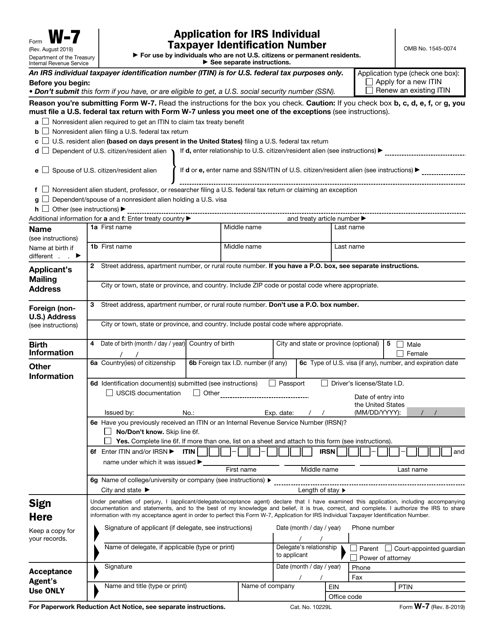

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

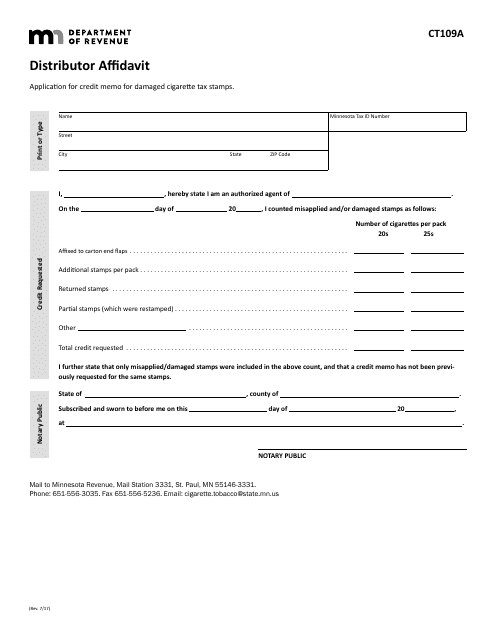

This Form is used for distributors in Minnesota to provide an affidavit.

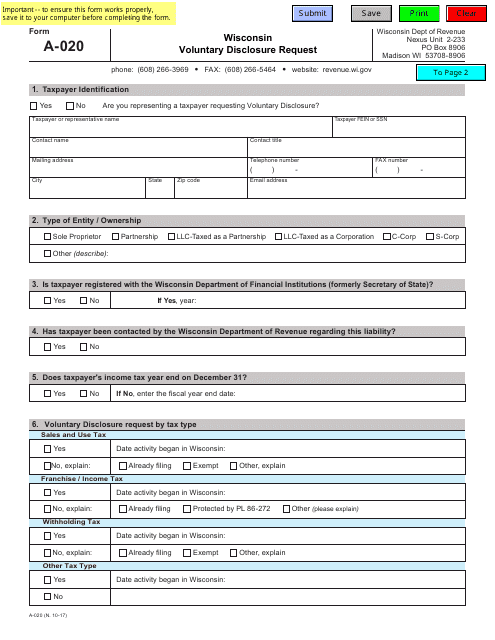

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

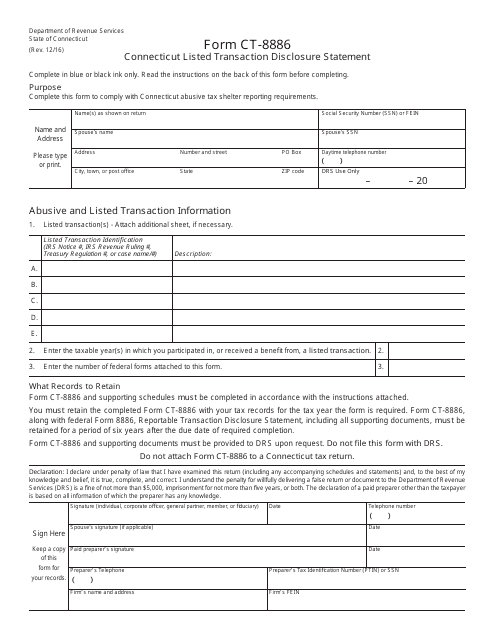

This Form is used for disclosing listed transactions in Connecticut.

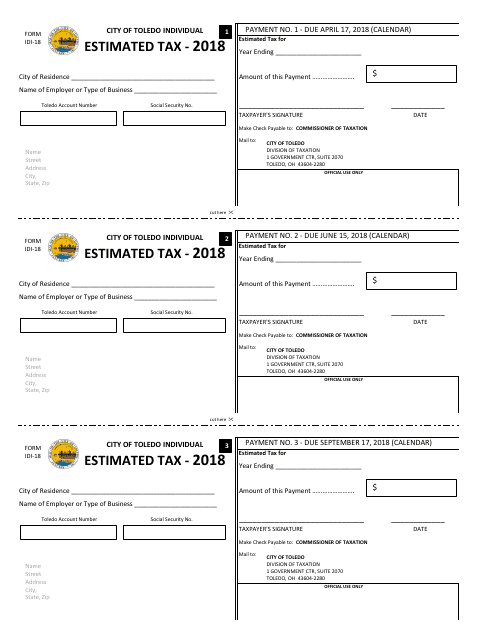

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

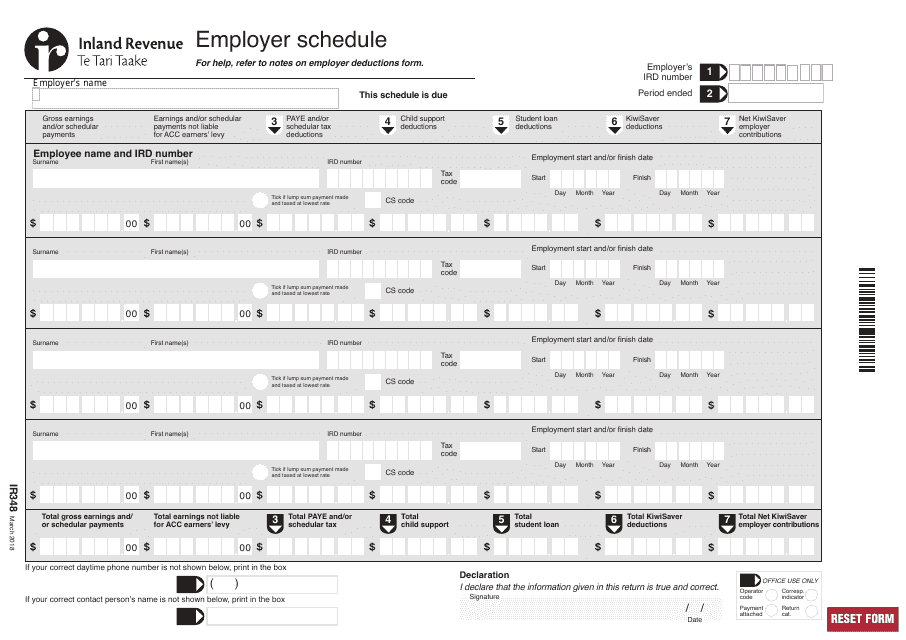

This form is used for employers in New Zealand to report employee details and pay information to the tax authorities.

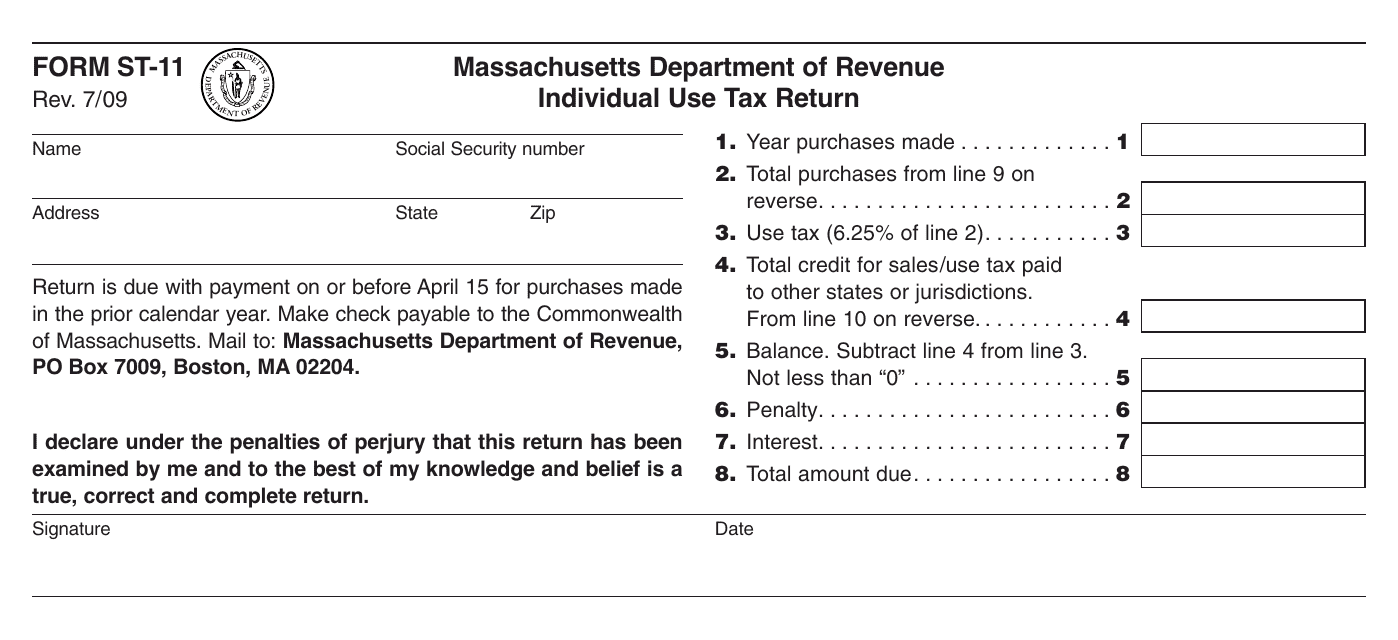

This form is used for reporting and paying use tax by individuals in Massachusetts. Use tax is a tax on goods purchased outside the state of Massachusetts for use within the state.

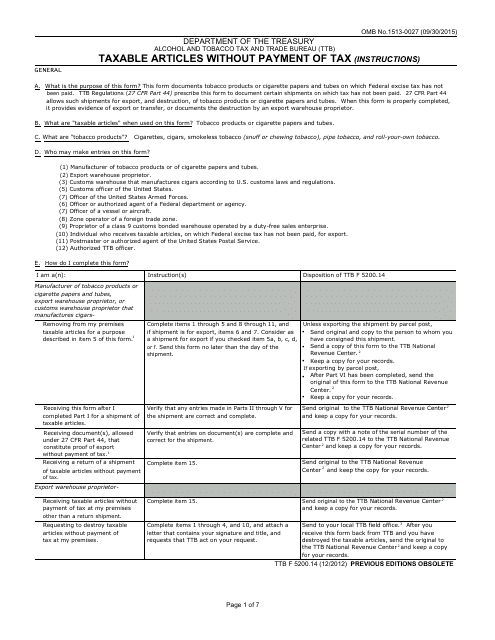

This document is used for reporting the taxable articles that are not paid for with tax.

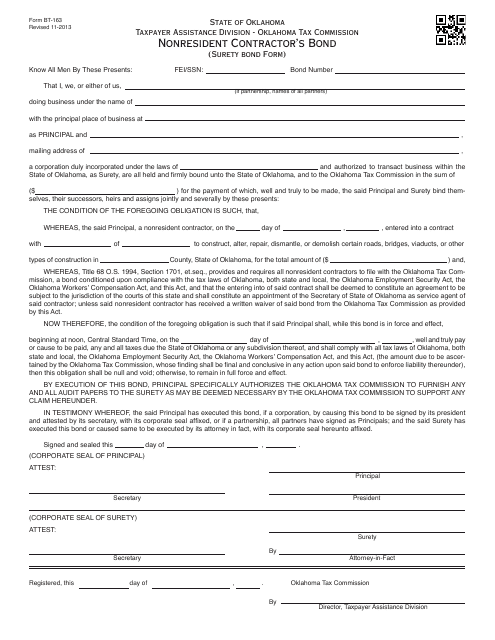

This type of document is used for obtaining a nonresident contractor's bond in Oklahoma. It is for contractors who are not residents of Oklahoma but want to work on construction projects in the state. The bond ensures that the contractor will fulfill their obligations and responsibilities as outlined in their contract.