Tax Liability Templates

Documents:

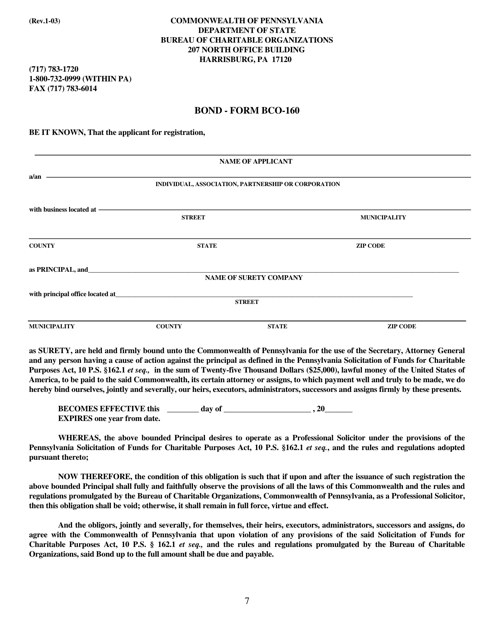

496

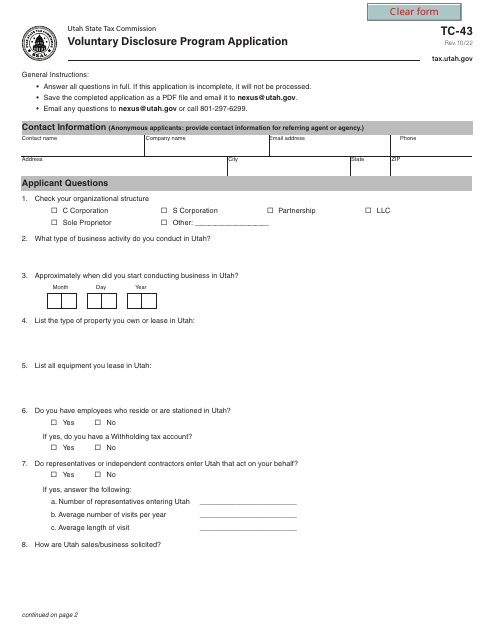

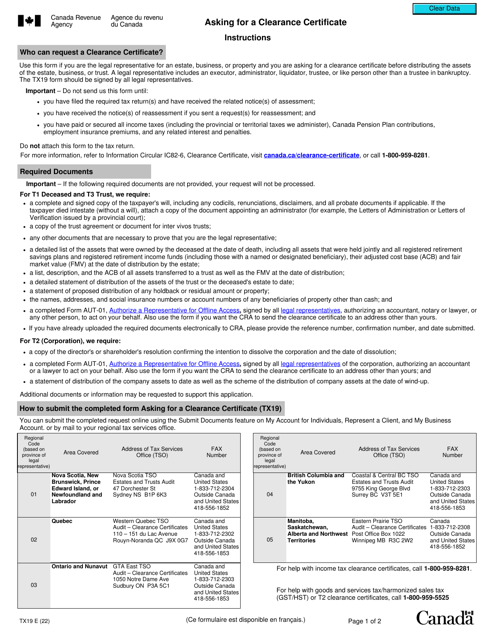

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

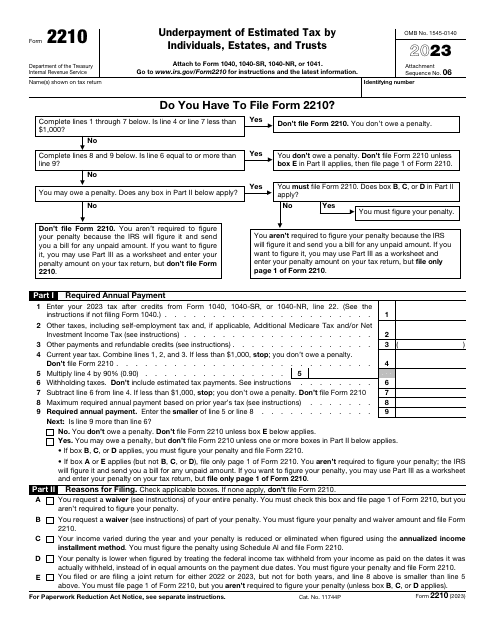

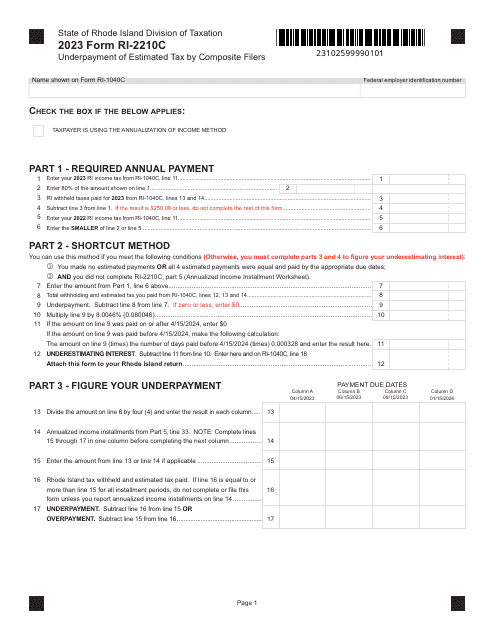

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

This is an IRS form that includes the details of an installment sale.

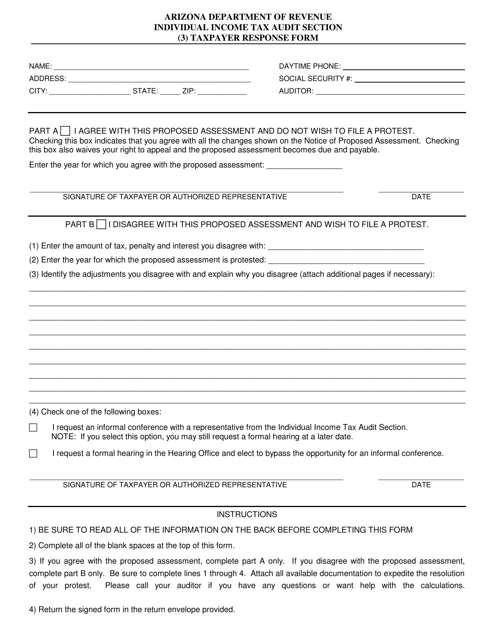

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

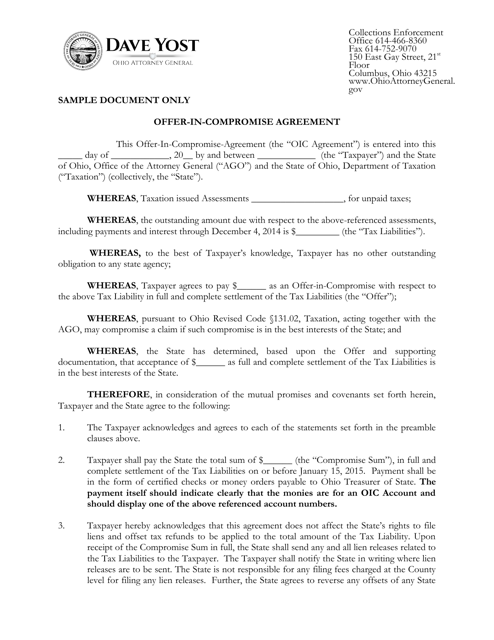

This document is a sample agreement for an offer-in-compromise in the state of Ohio. It outlines the terms and conditions for settling a tax debt with the Ohio Department of Taxation.

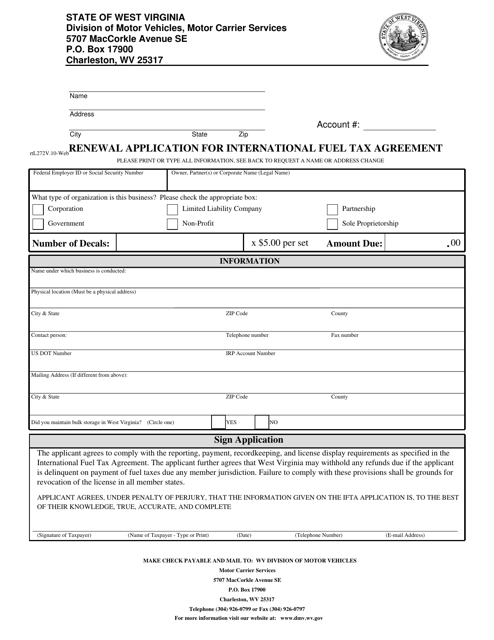

This form is used for renewing the International Fuel Tax Agreement in the state of West Virginia.

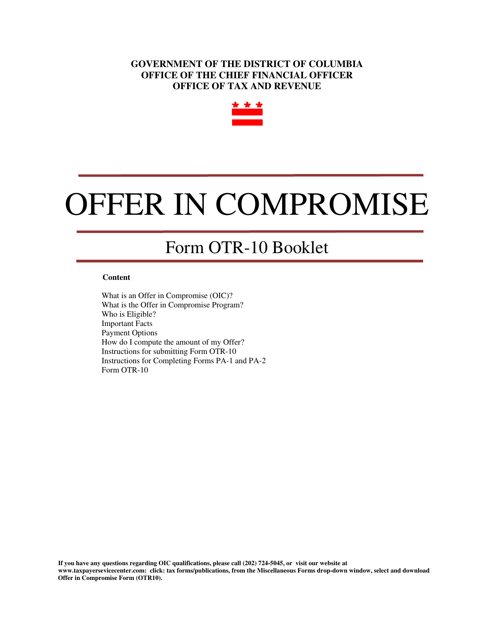

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

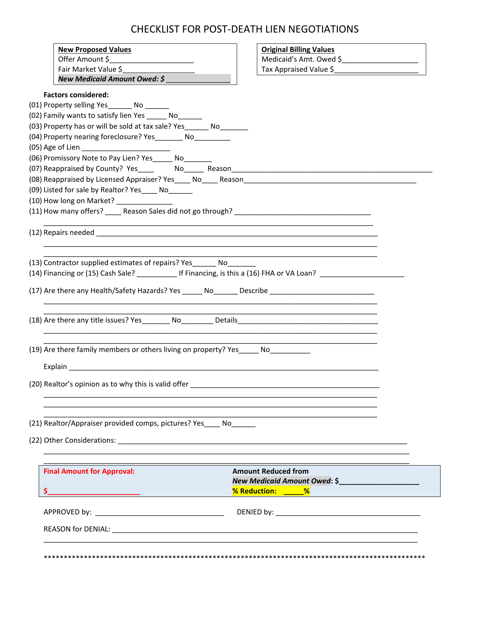

This checklist is used for post-death lien negotiations in Alabama. It provides a guide for handling liens and negotiating with creditors after a person's death.

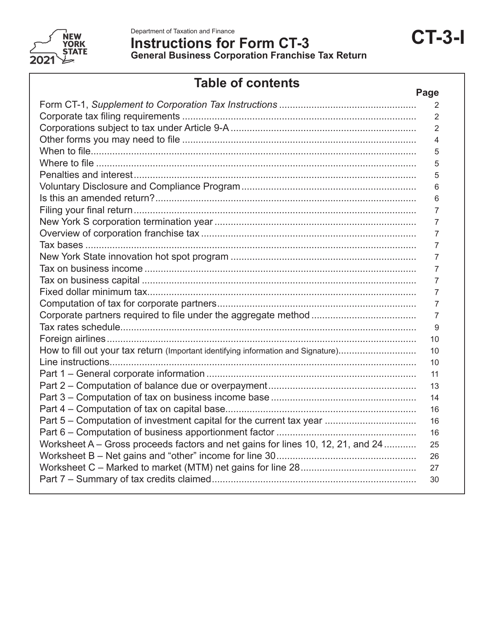

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

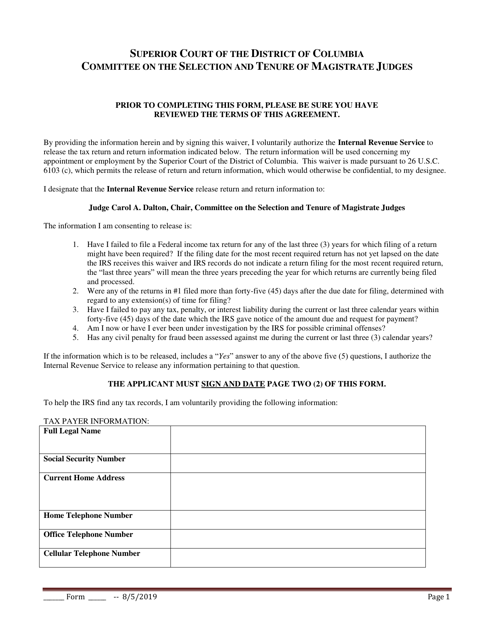

This document is used for requesting a waiver of taxes in Washington, D.C.

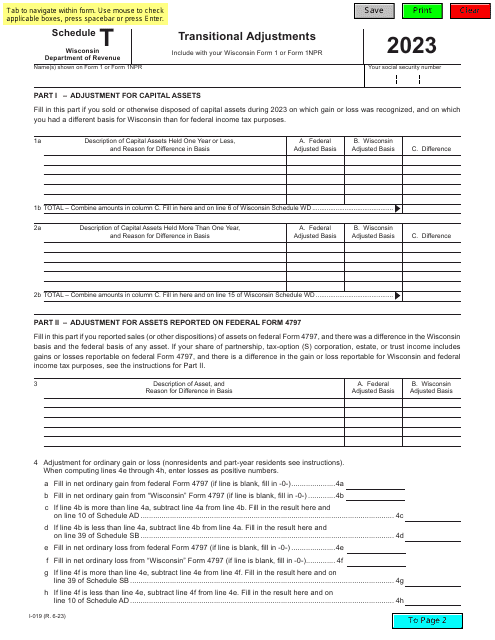

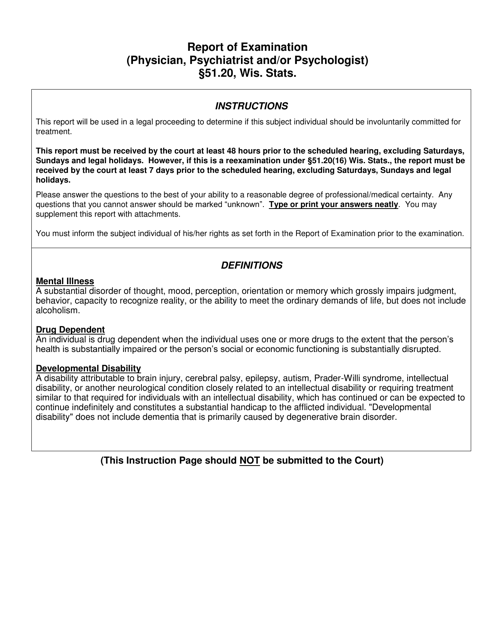

This form is used for reporting the results of an examination conducted under Section 51.20 of the Wisconsin Statutes in Wisconsin.

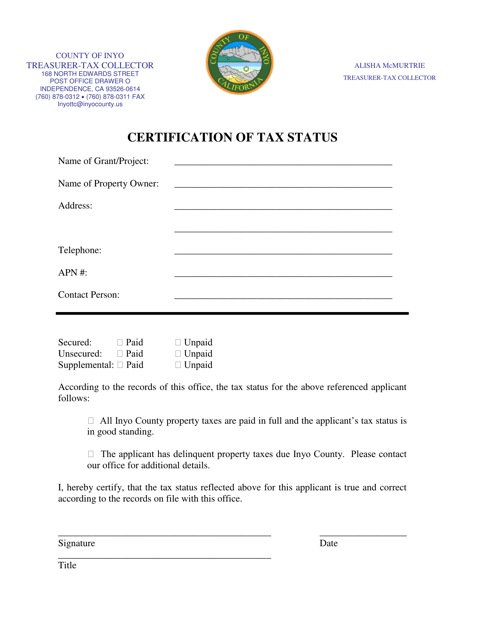

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

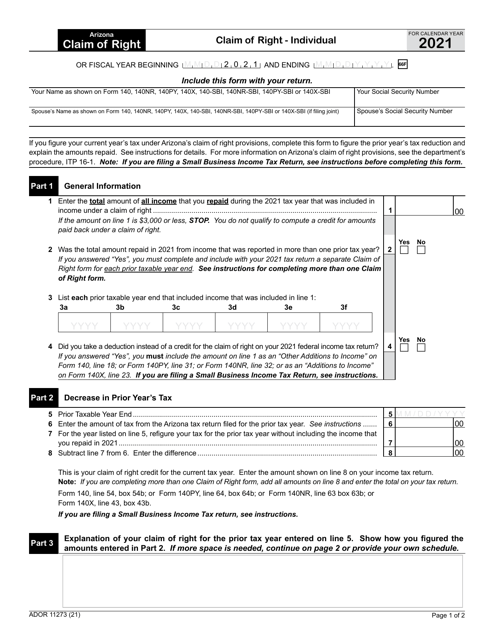

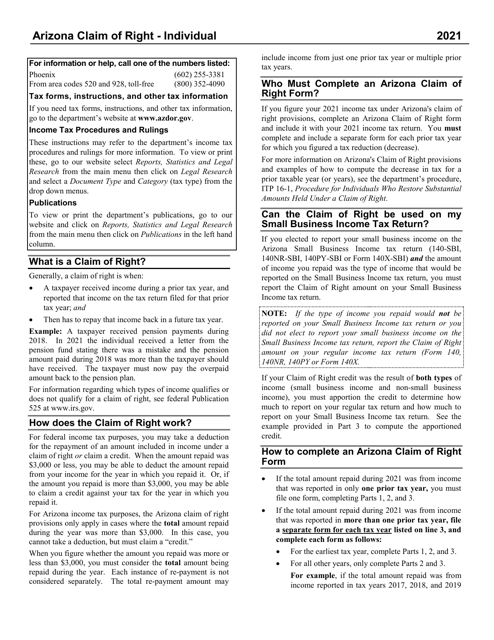

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

This Form is used for claiming the right to a refund on individual taxes paid in Arizona. It provides instructions for completing and filing Form ADOR11273.

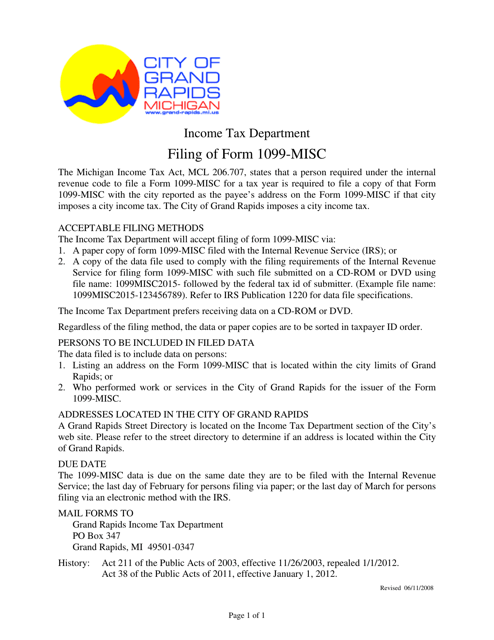

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

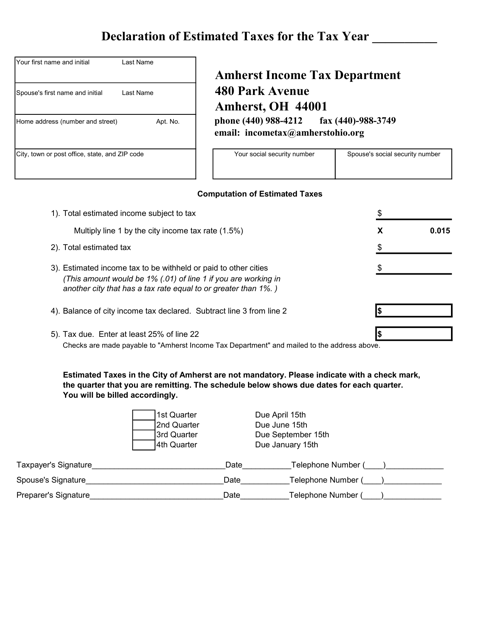

This document is used for declaring estimated taxes in Amherst, Ohio.

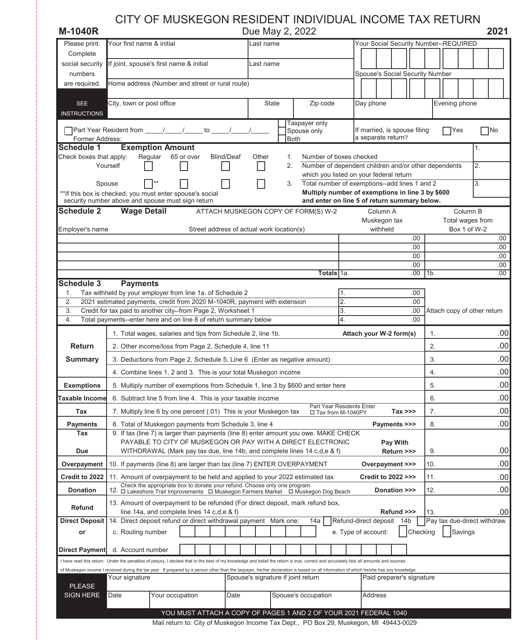

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.

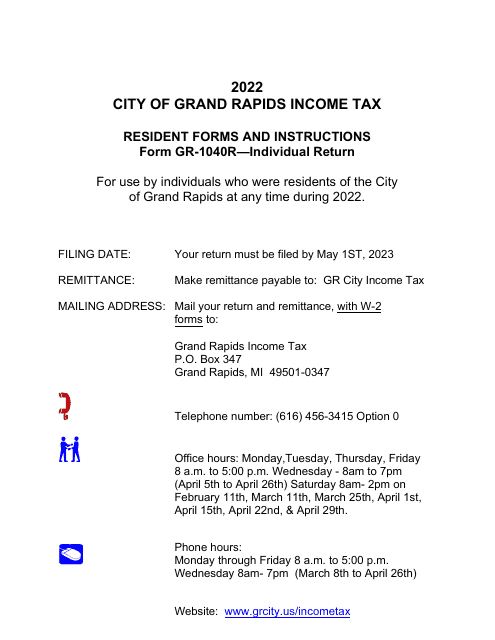

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

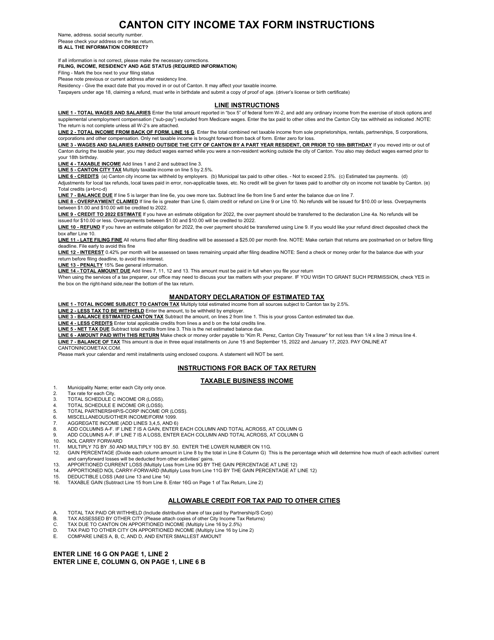

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

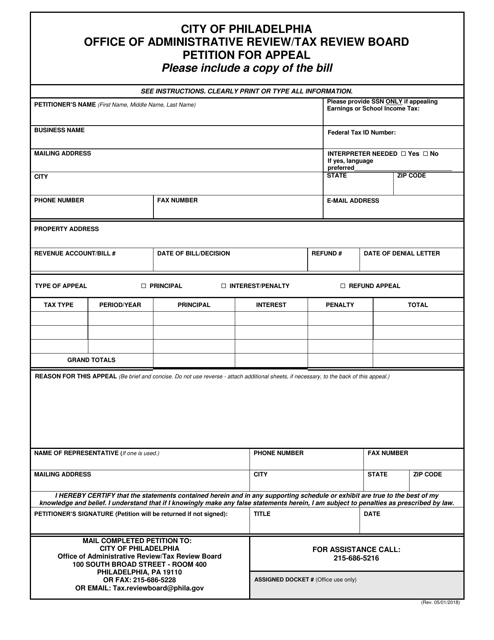

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

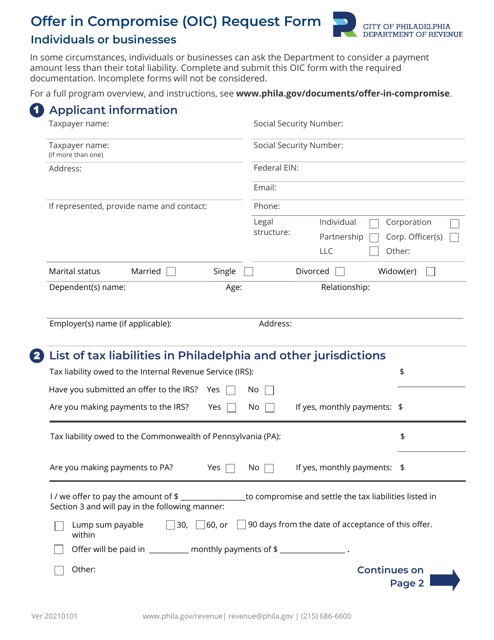

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

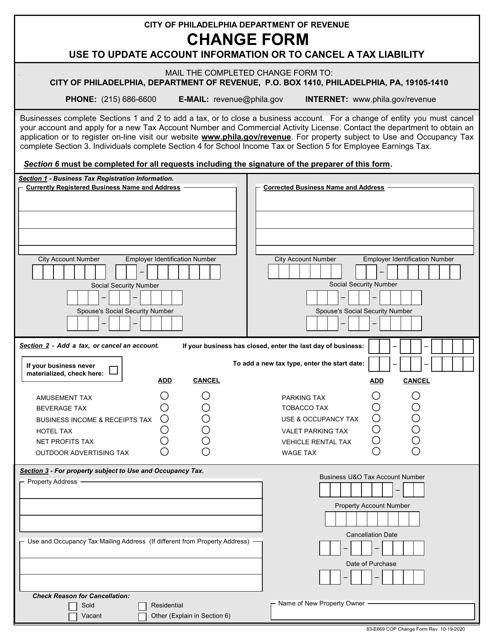

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

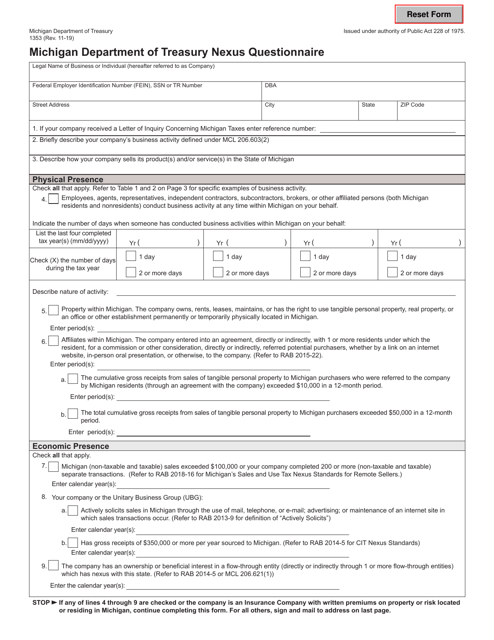

This form is used for the Nexus Questionnaire required by the Michigan Department of Treasury to determine if a business has sufficient presence in Michigan to be subject to state taxes.

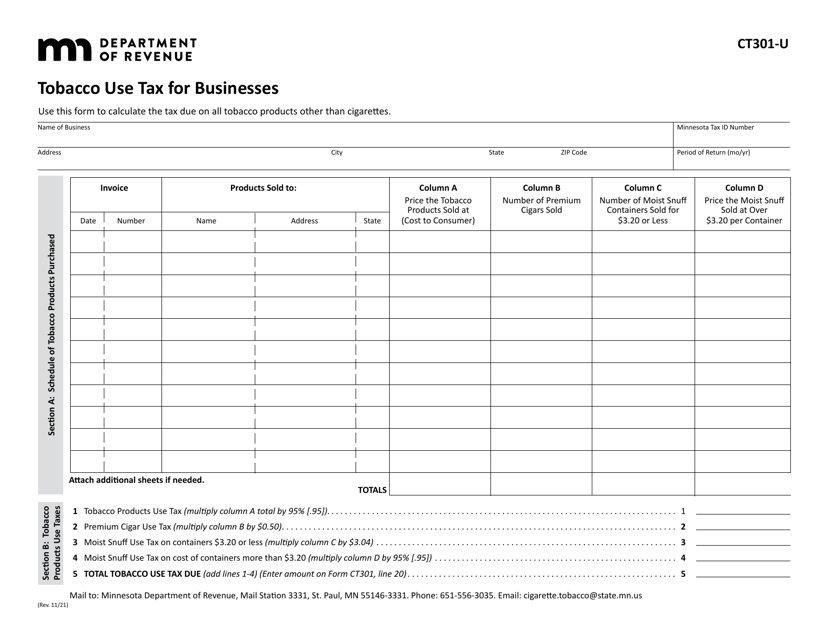

This form is used for businesses in Minnesota to report and pay tobacco use tax.

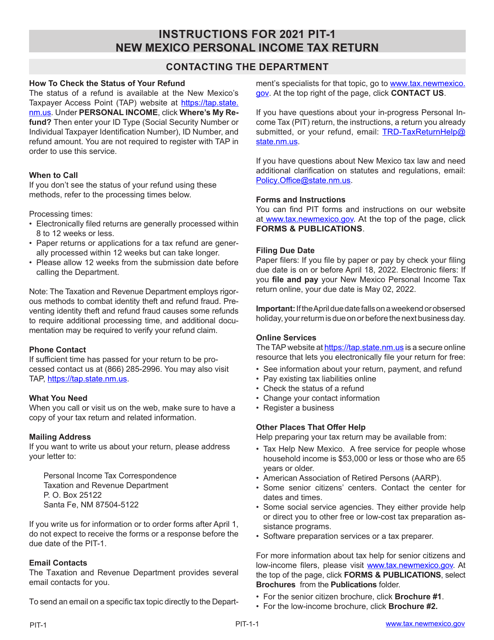

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

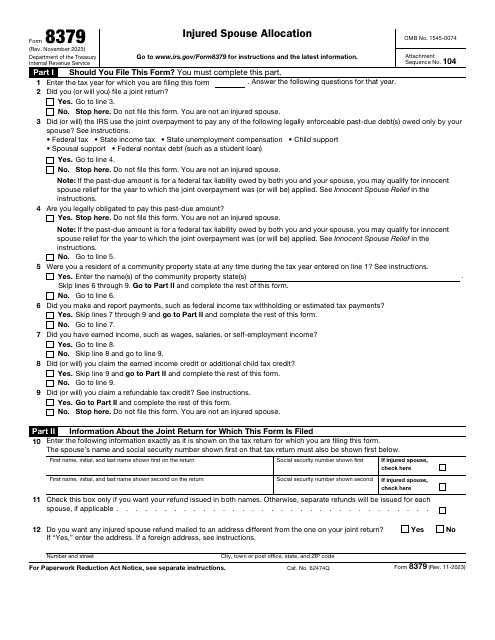

This document is a request form used in Mississippi to request the release of a joint tax refund by the IRS for an injured spouse.

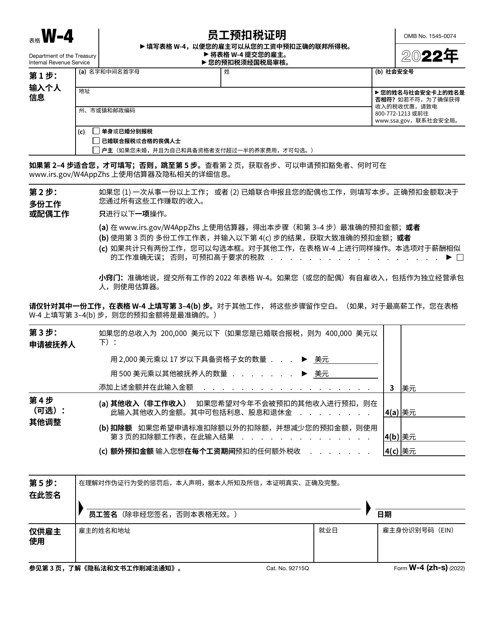

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

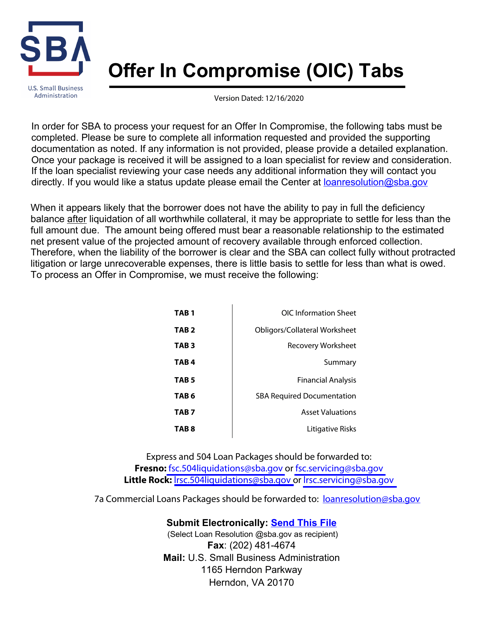

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.