Tax Liability Templates

Documents:

496

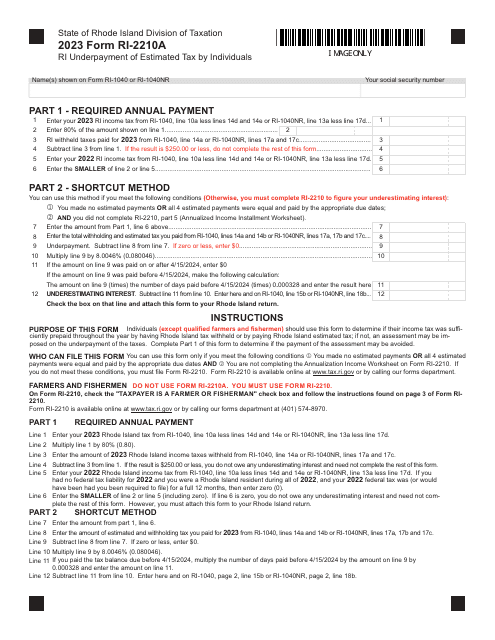

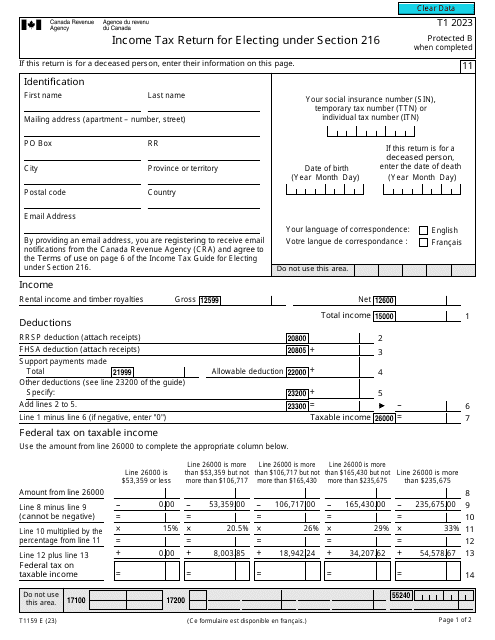

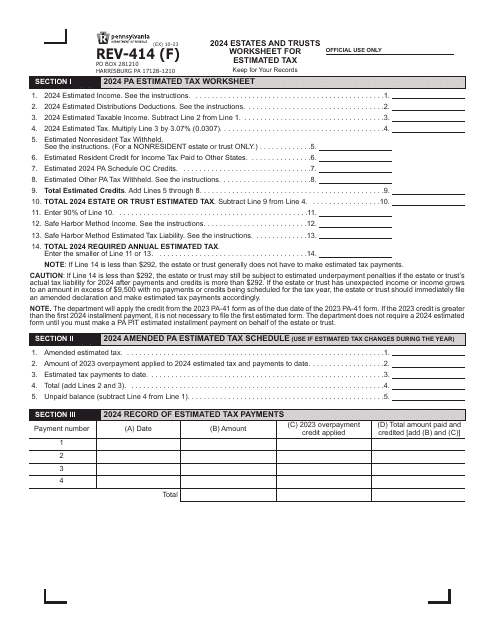

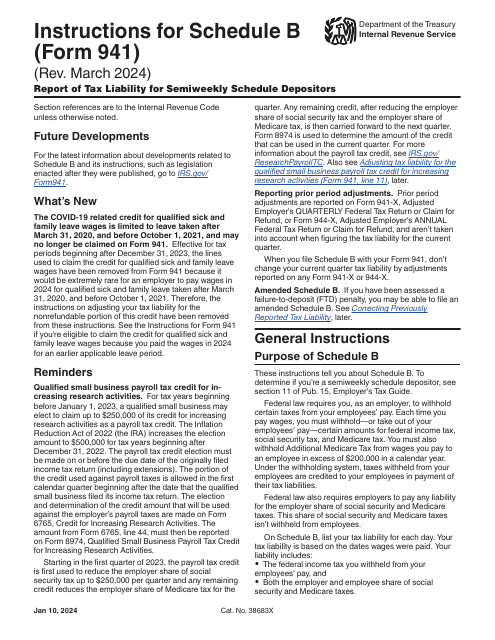

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

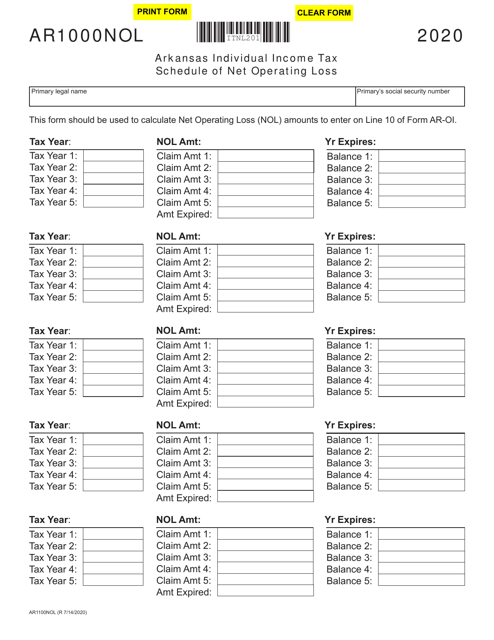

This form is used for reporting net operating losses in the state of Arkansas.

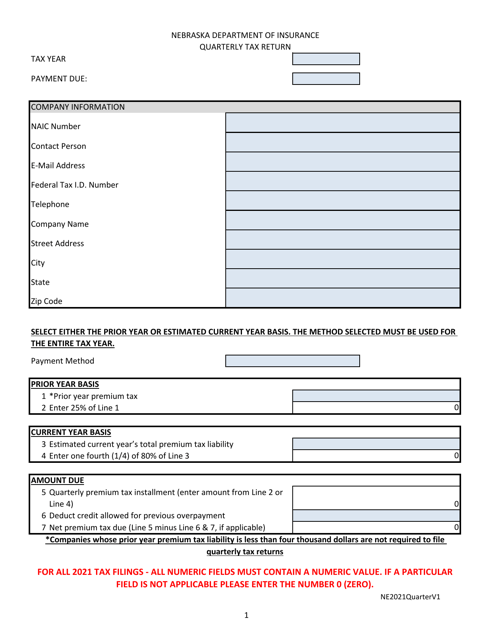

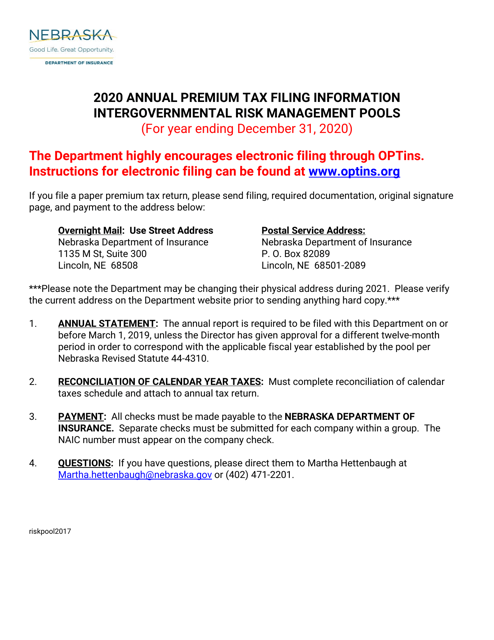

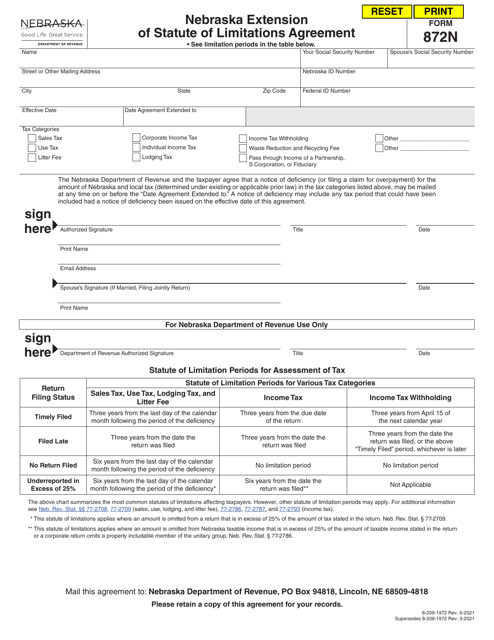

This document is used for reconciling calendar year taxes in Nebraska. It helps taxpayers ensure that their tax payments and credits are accurately recorded for the previous year.

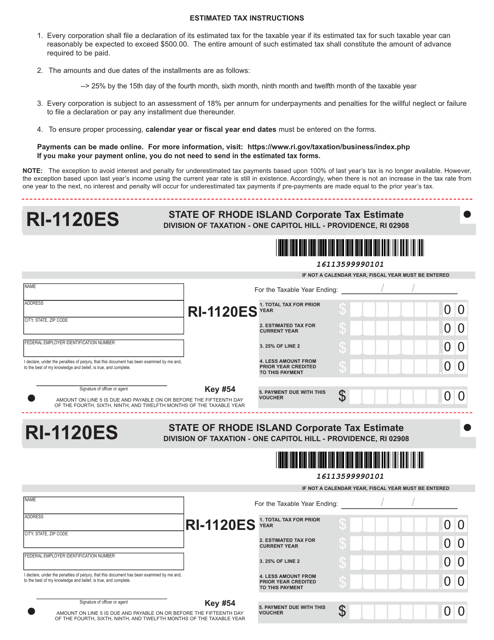

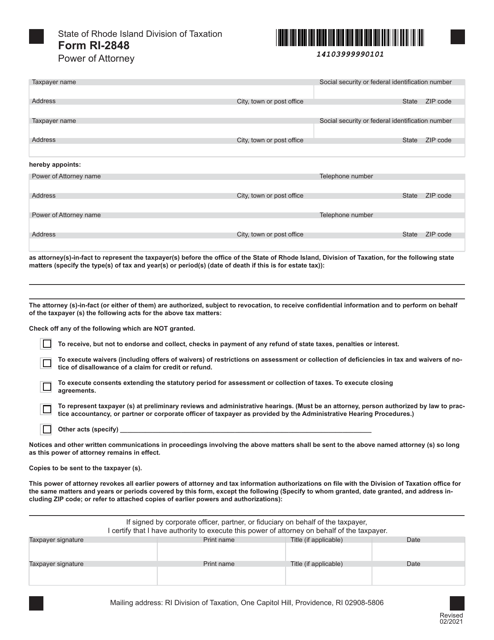

This Form is used for businesses in Rhode Island to estimate and pay their corporate taxes.

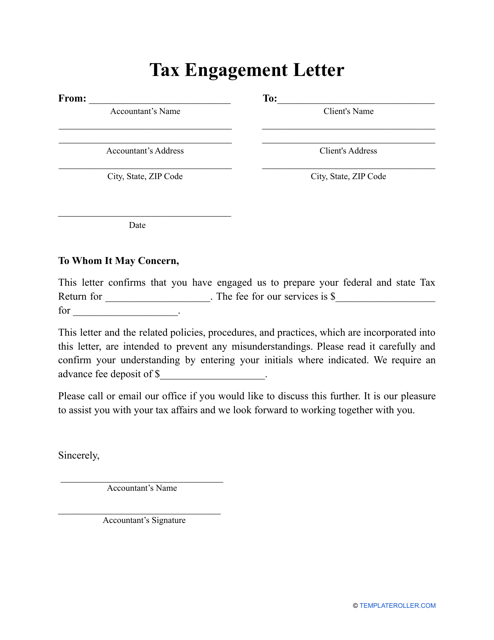

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

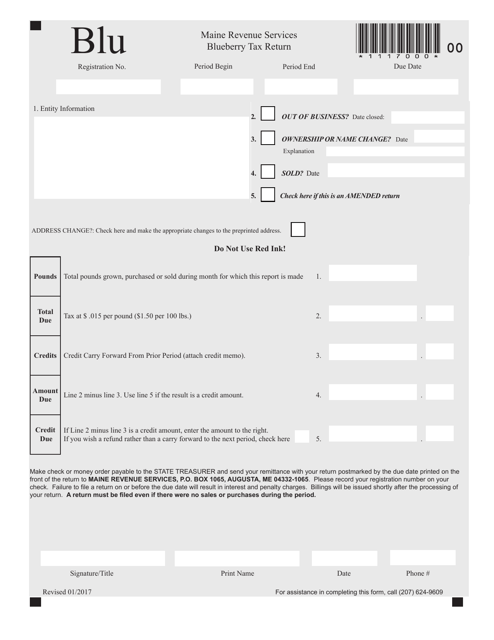

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

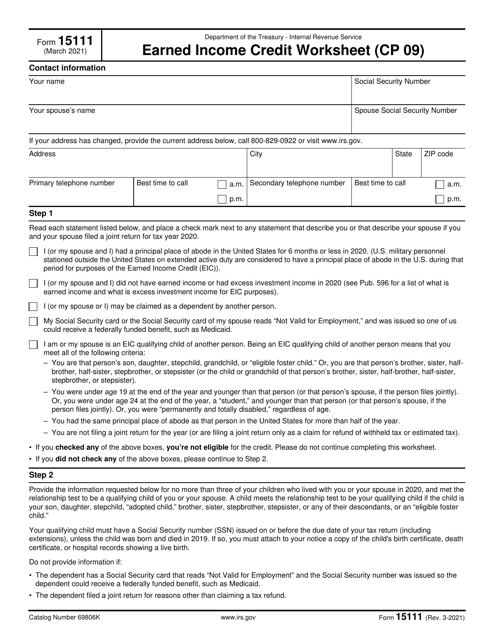

This form is used to calculate the Earned Income Credit for eligible taxpayers.

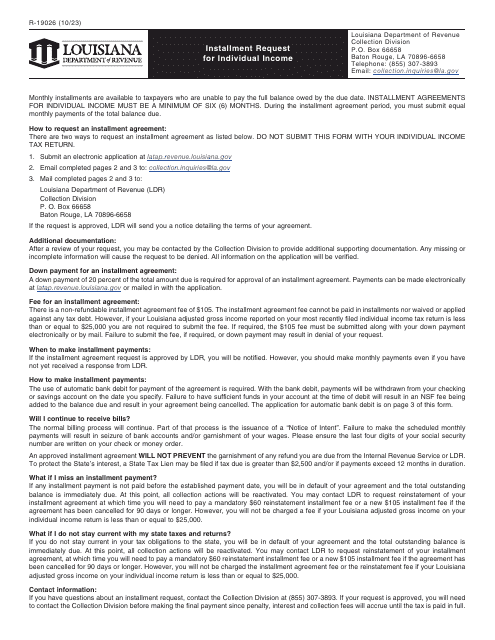

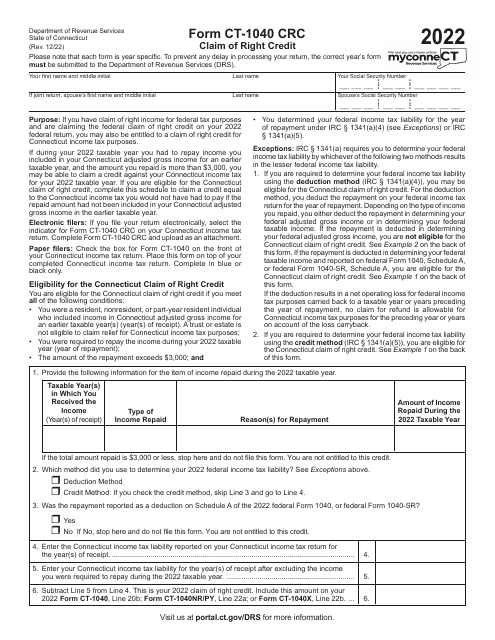

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

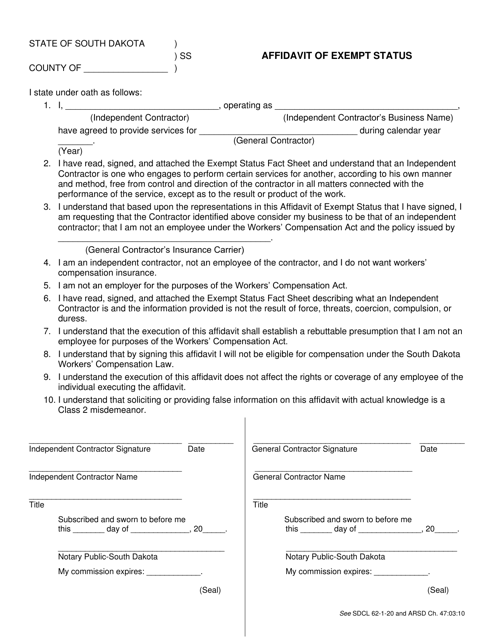

This form is used to declare exempt status for tax purposes in South Dakota.

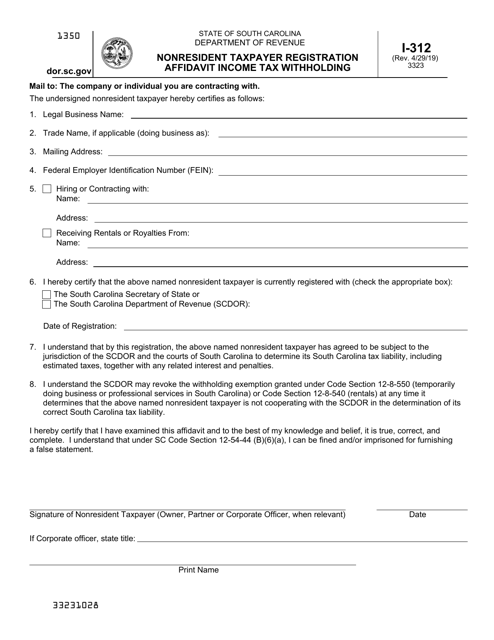

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

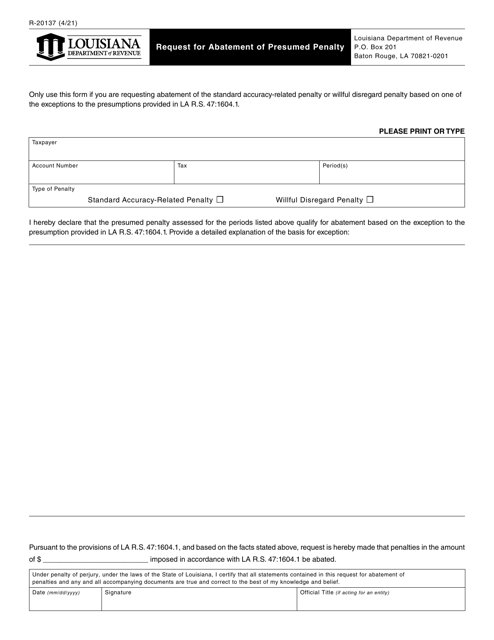

This form is used for requesting the abatement of a presumed penalty in the state of Louisiana.

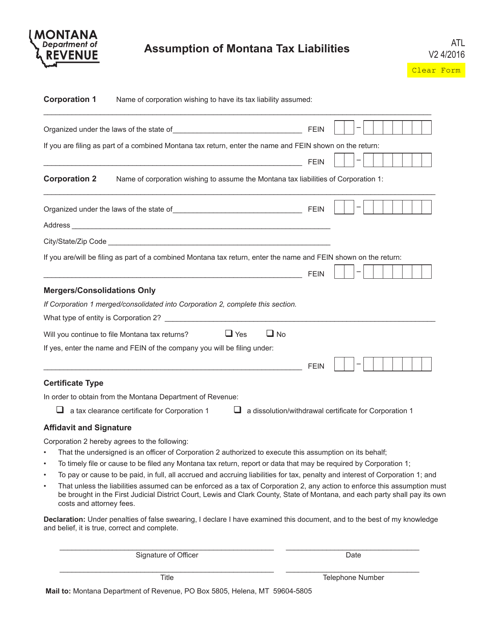

This form is used for assuming the tax liabilities of Montana.

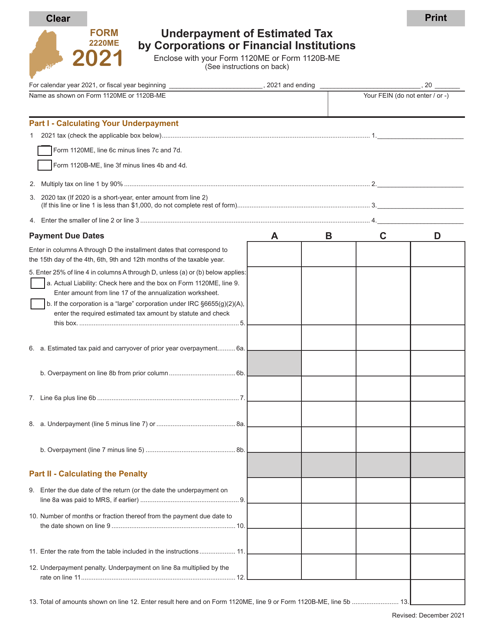

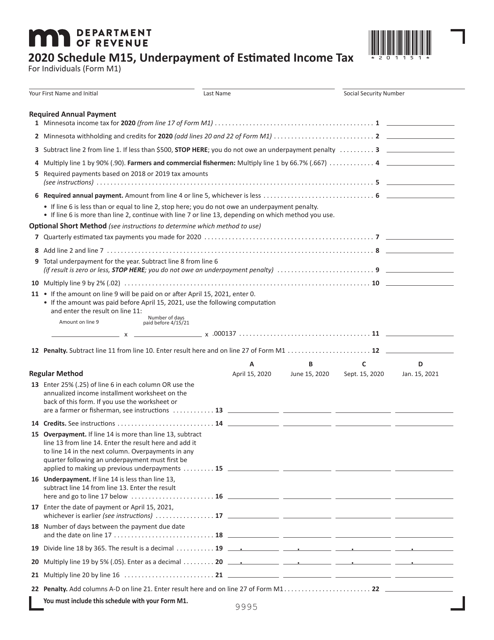

This form is used for calculating underpayment of estimated income tax in the state of Minnesota.

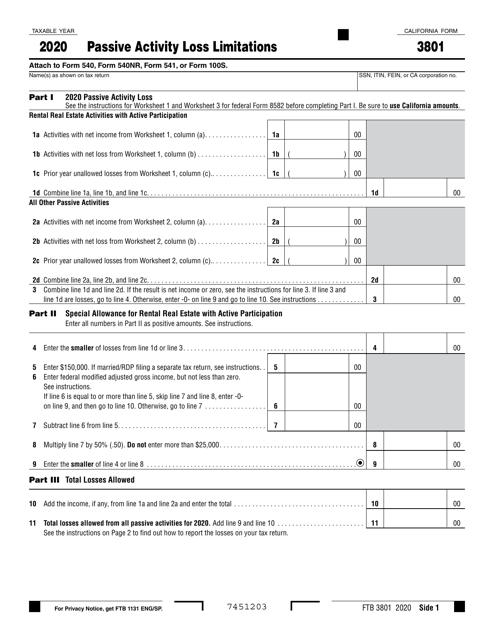

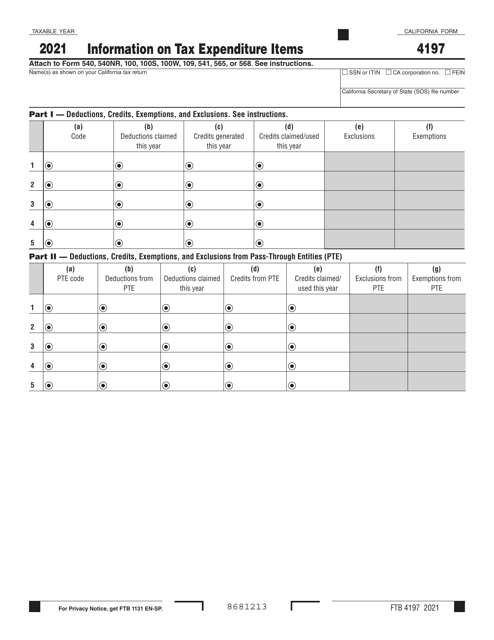

This form is used for reporting passive activity loss limitations in California.

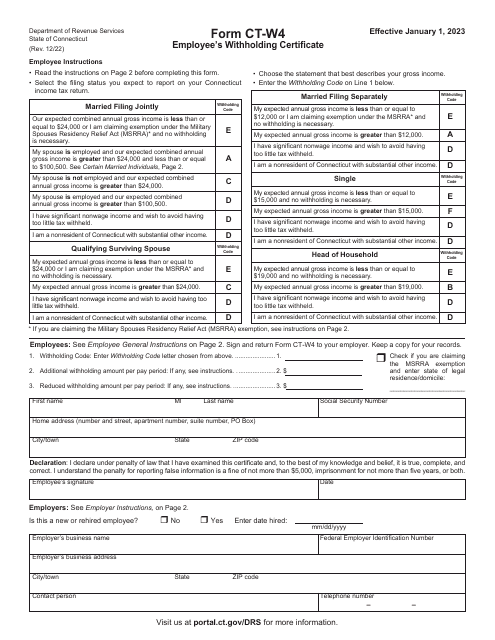

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

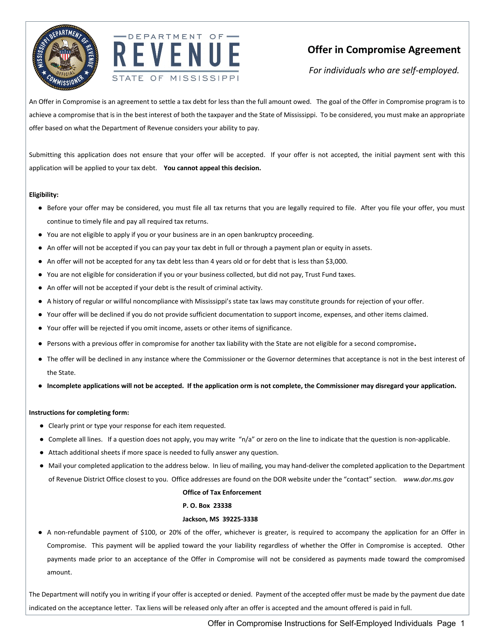

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.