Tax Liability Templates

Documents:

496

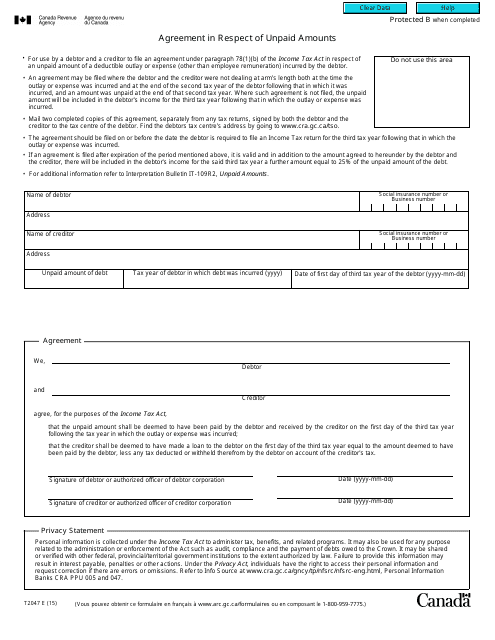

This form is used for an agreement in Canada regarding unpaid amounts.

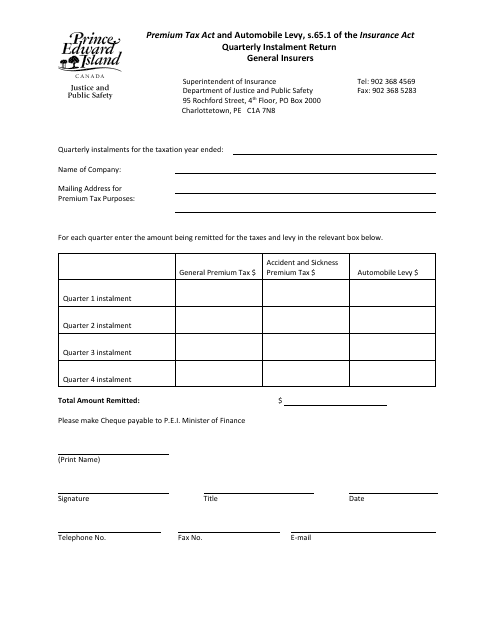

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.

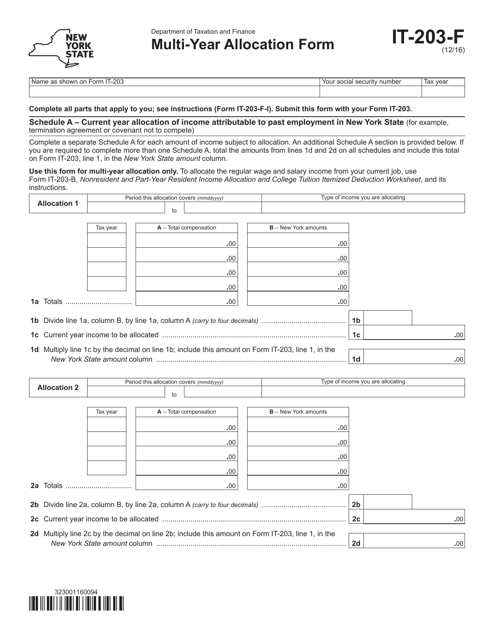

This Form is used for allocating income and deductions for multiple years in New York.

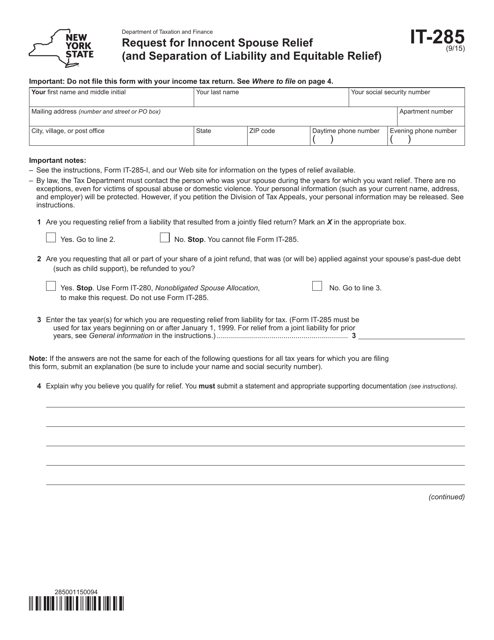

This form is used for residents of New York who are seeking innocent spouse relief, as well as separation of liability and equitable relief. It allows taxpayers to request relief from certain tax liabilities that were caused by their spouse or former spouse.

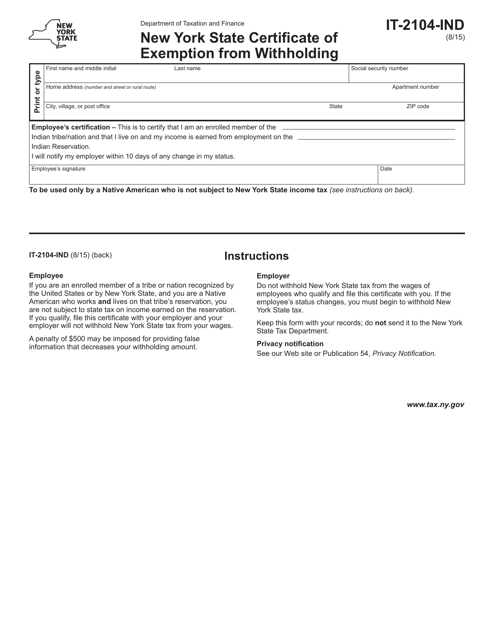

This Form is used for exempting individuals in New York State from income tax withholding. Individuals can use this form to claim an exemption from having taxes withheld from their wages.

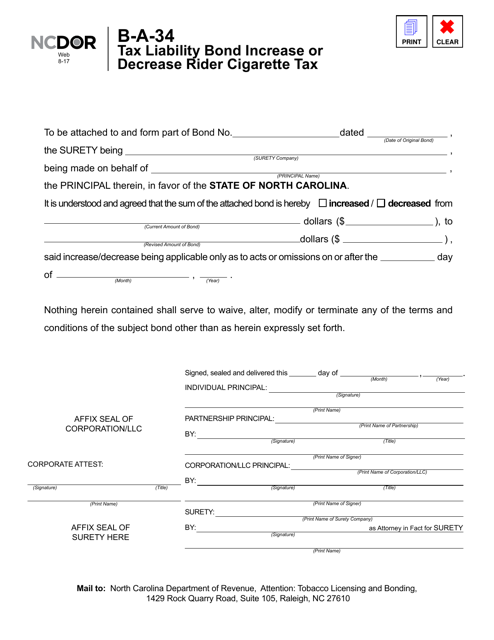

This form is used for increasing or decreasing the tax liability bond for cigarette taxes in North Carolina.

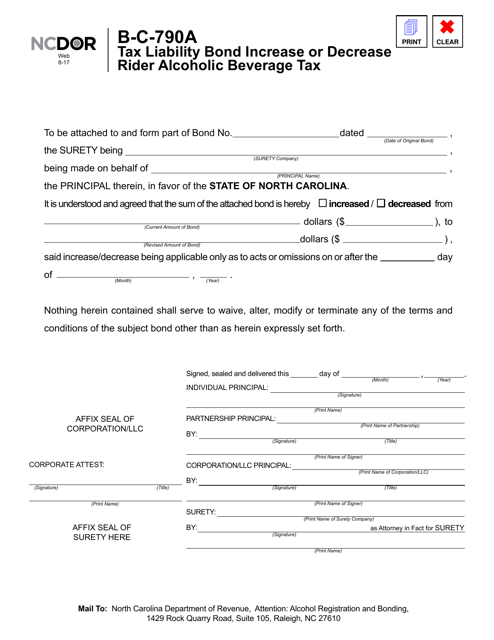

This form is used for increasing or decreasing the tax liability bond for alcoholic beverages in North Carolina.

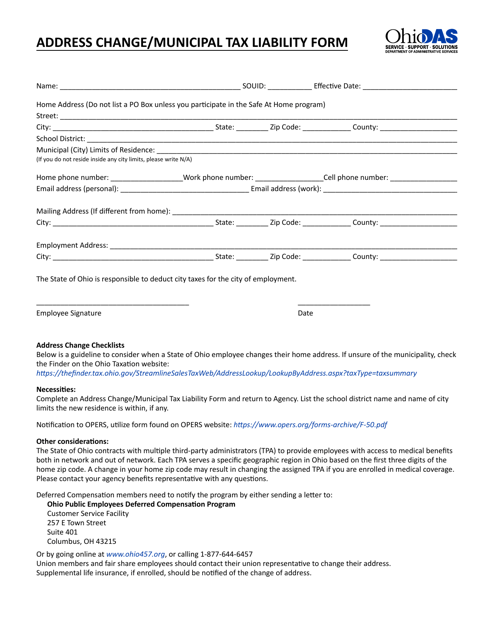

This form is used for changing your address and reporting your municipal tax liability in Ohio.

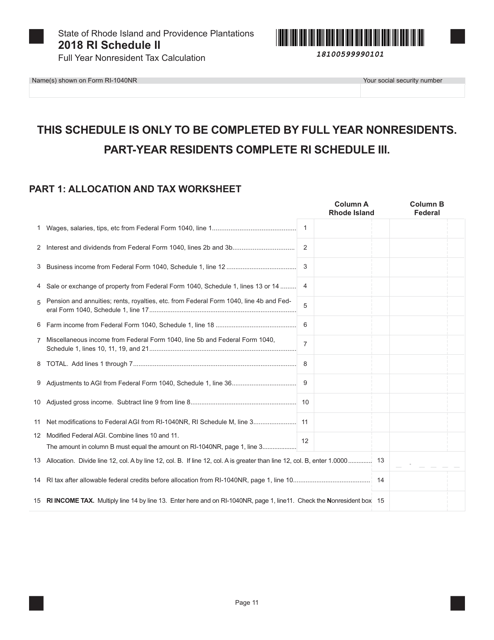

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

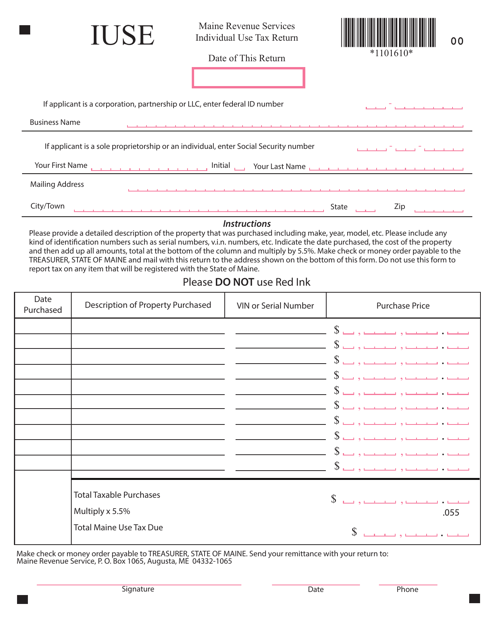

This form is used for reporting and paying individual use tax in the state of Maine. Individual use tax is owed on items purchased outside of Maine that would have been subject to sales tax if purchased in the state.

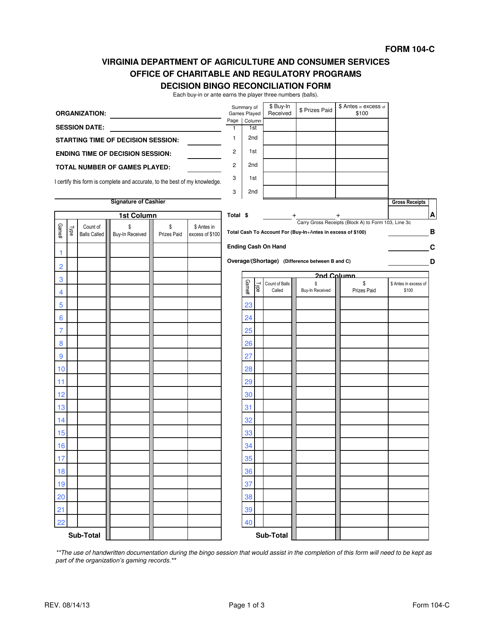

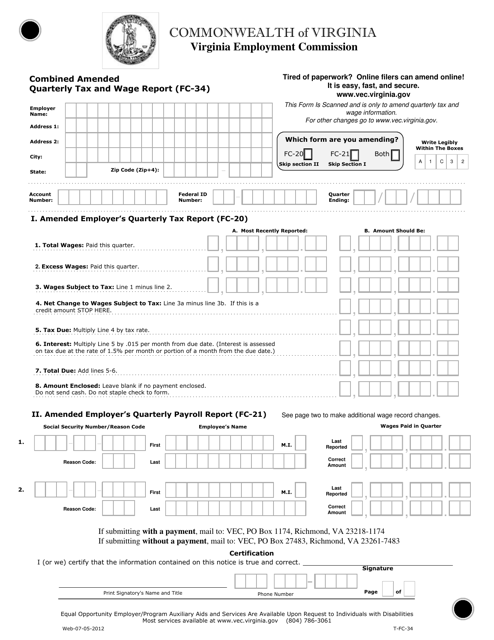

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

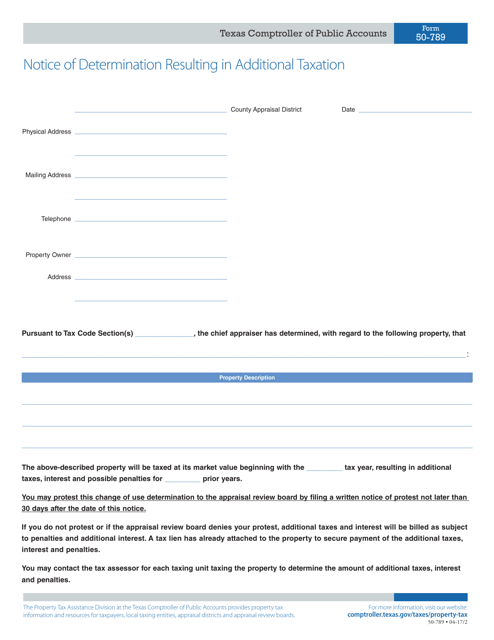

This form is used for notifying taxpayers in Texas of a determination resulting in additional taxation.

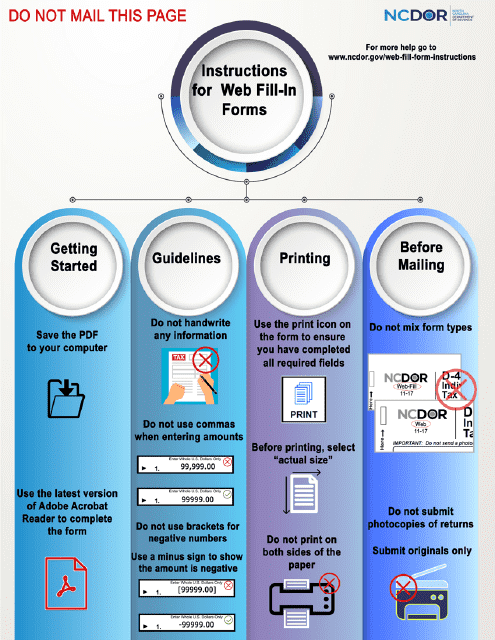

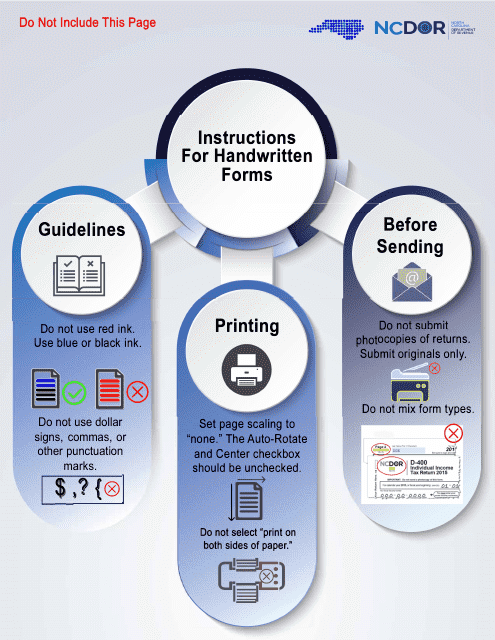

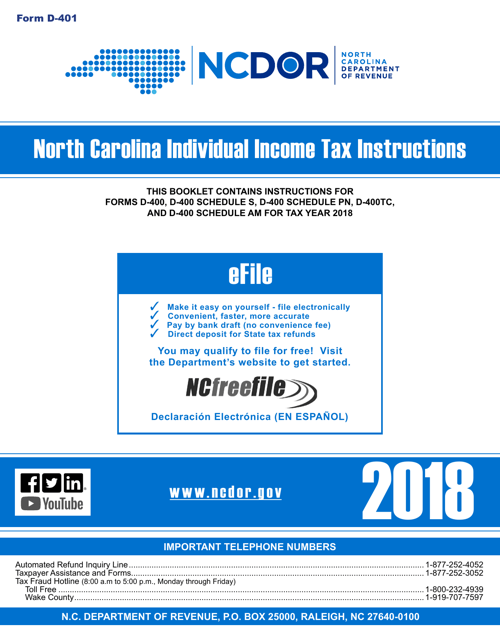

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

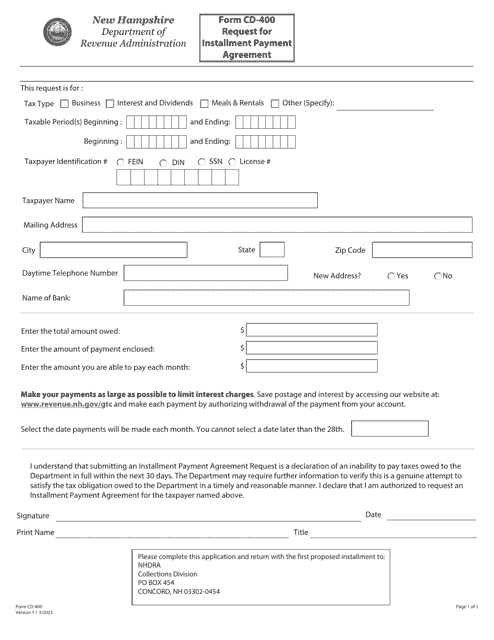

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

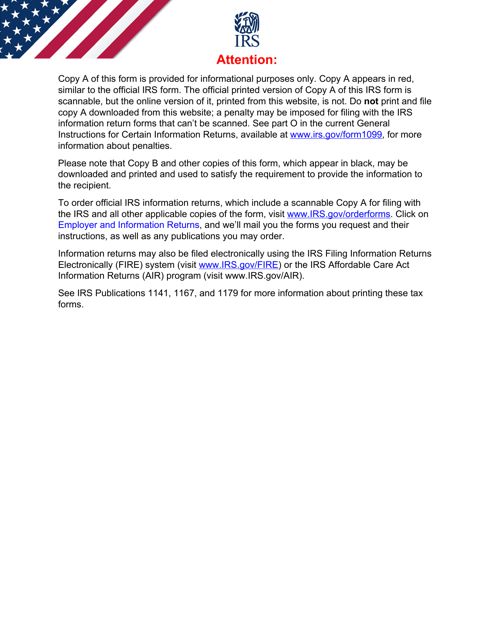

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

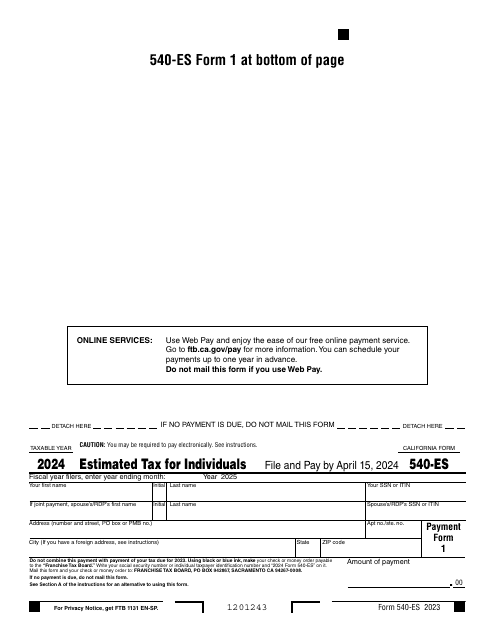

Fill out this form over the course of a year to pay your taxes in the state of California.

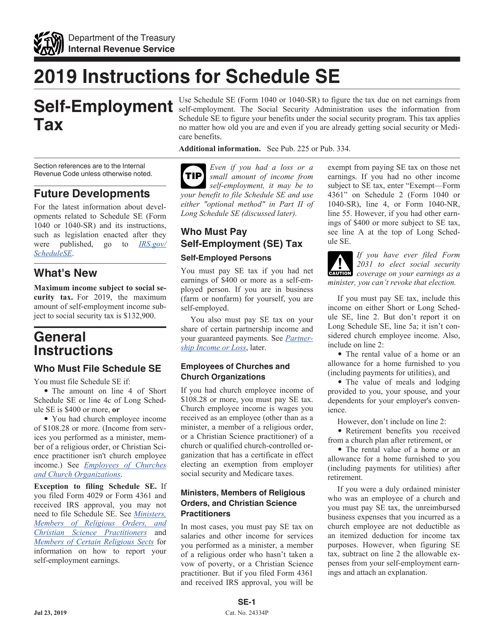

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.