Tax Liability Templates

Documents:

496

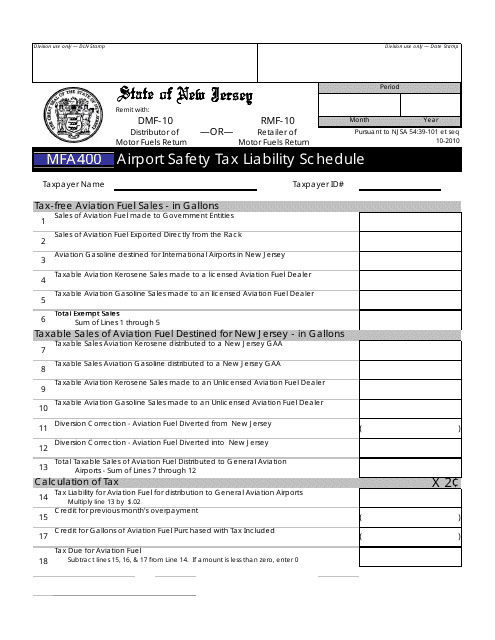

This form is used for reporting and calculating the airport safety tax liability in the state of New Jersey.

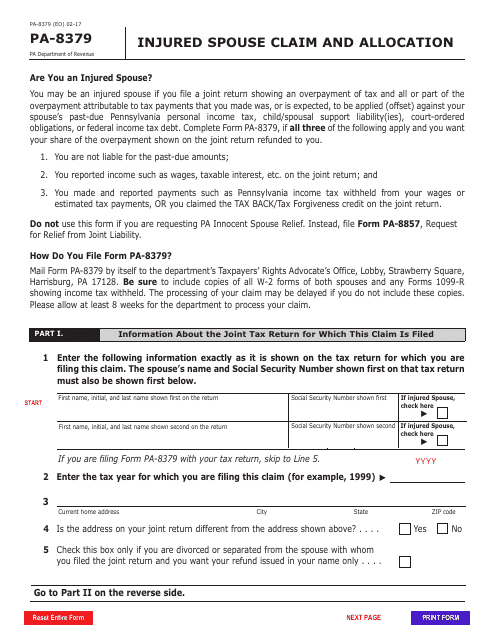

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.

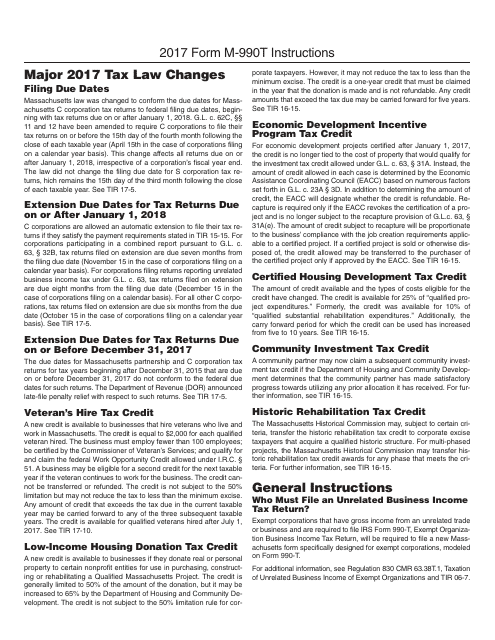

This Form is used for reporting and paying the Massachusetts Unrelated Business Income Tax. It applies to tax-exempt organizations that engage in unrelated business activities in Massachusetts. The form provides instructions on how to report and calculate the taxable income, exemptions, and credits for the tax year.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

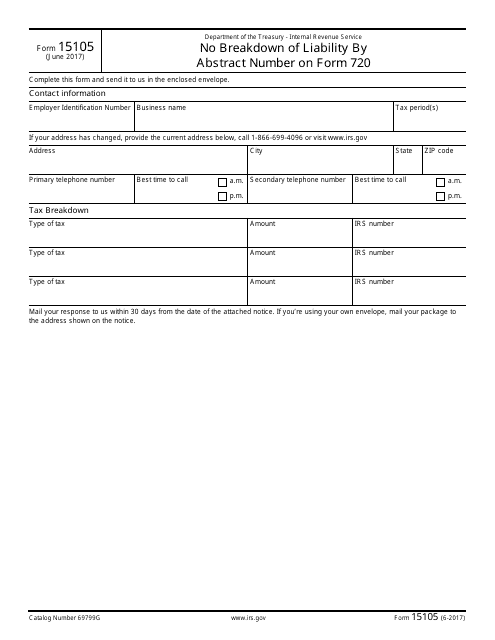

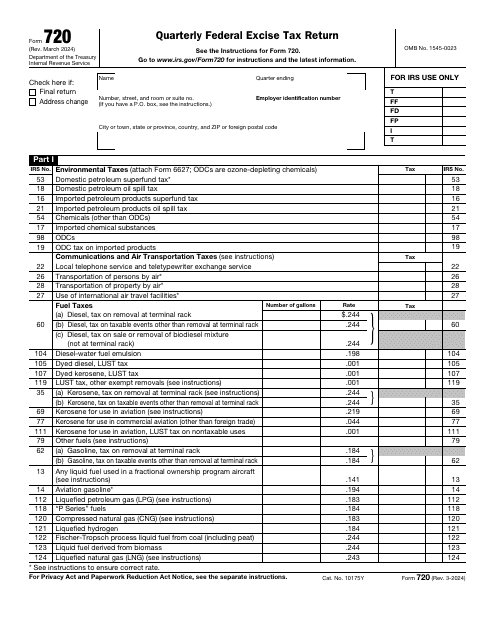

This type of document, IRS Form 15105, does not provide a breakdown of liability by abstract number on Form 720.

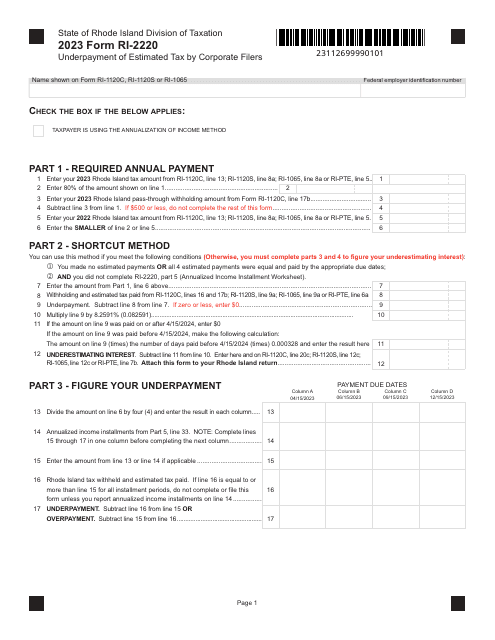

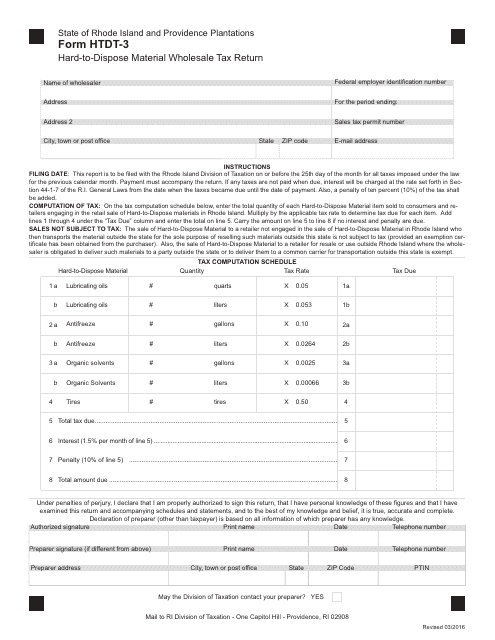

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

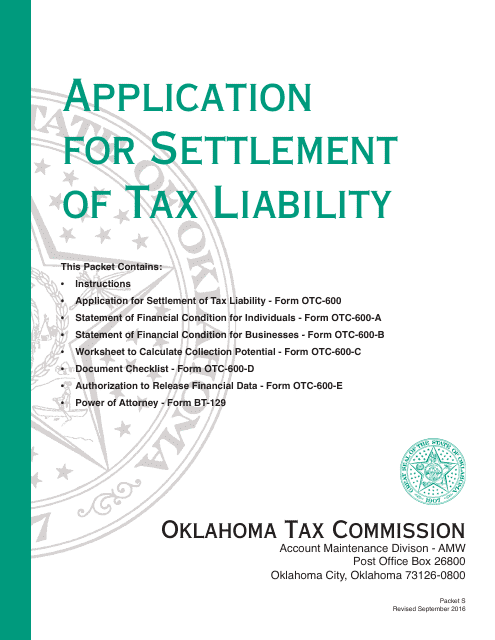

This type of document is used for applying to settle tax liability in the state of Oklahoma.

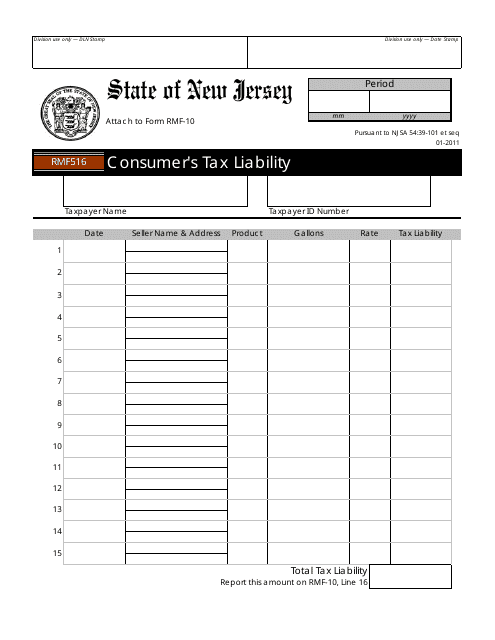

This form is used for reporting a consumer's tax liability in the state of New Jersey.

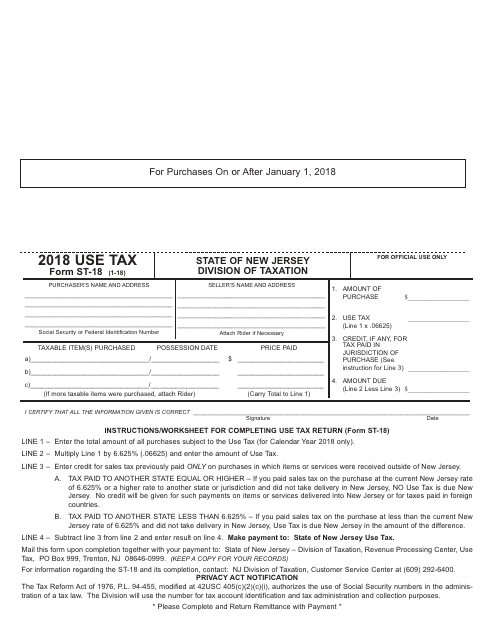

This form is used for reporting and paying use tax in the state of New Jersey. Use tax is a tax on goods purchased out-of-state and used within New Jersey. Use this form to calculate and remit the appropriate tax amount.

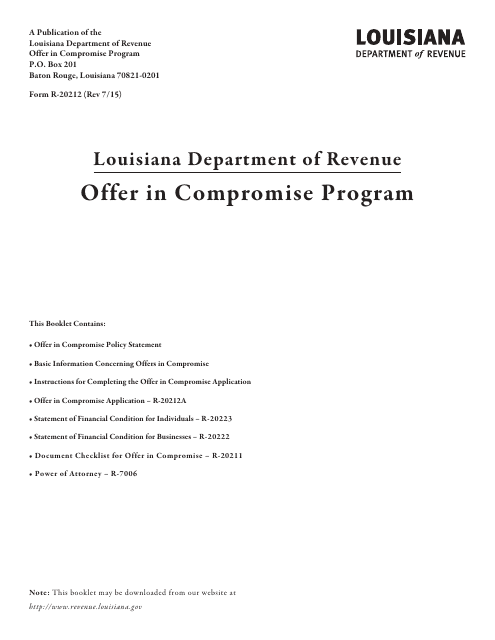

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

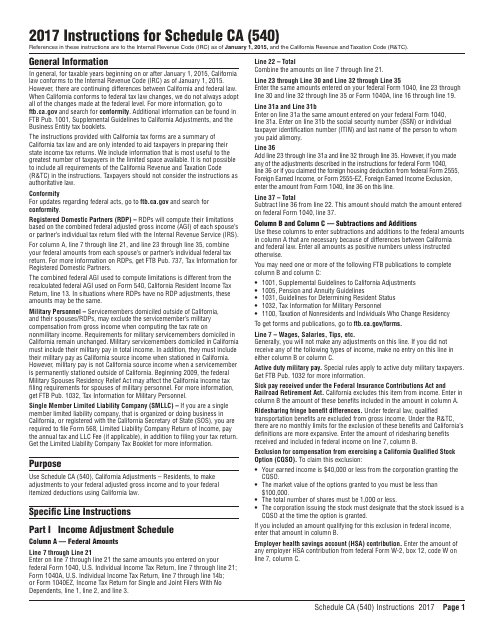

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

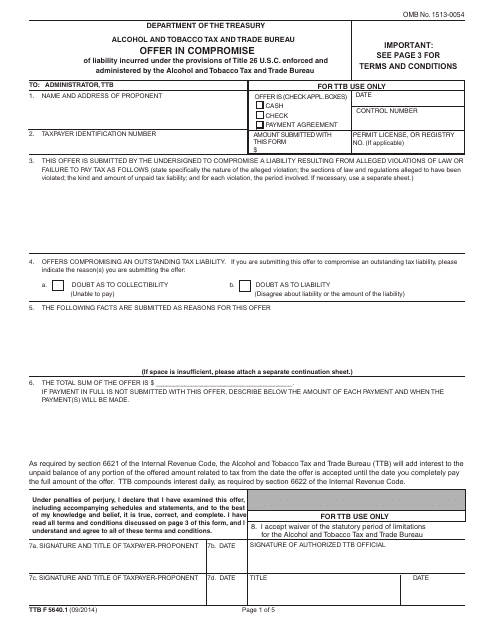

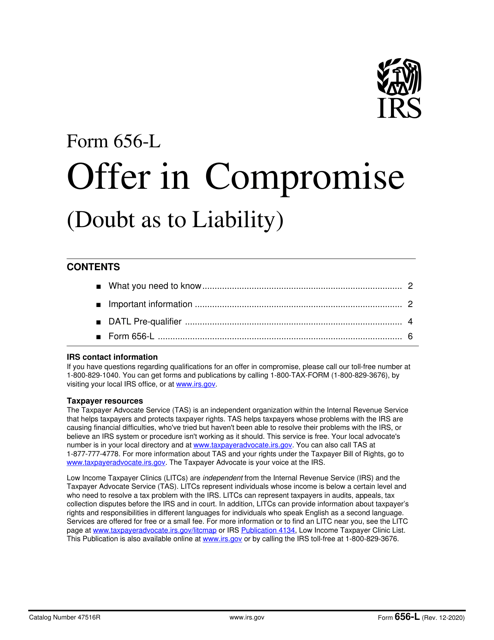

This document is used for making an offer in compromise to the Internal Revenue Service (IRS) for violations of the Internal Revenue Code (IRC).

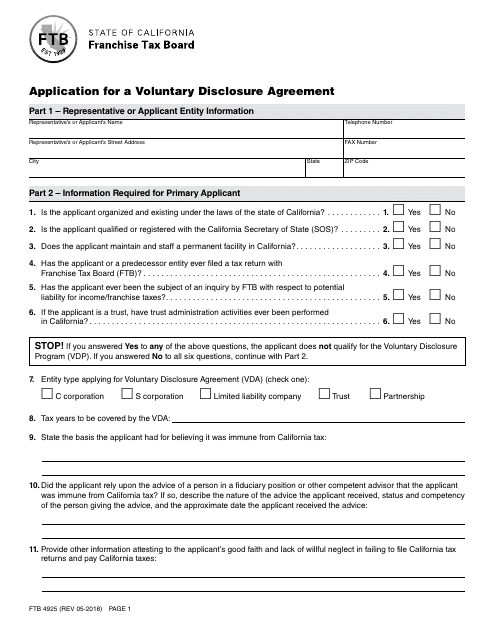

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

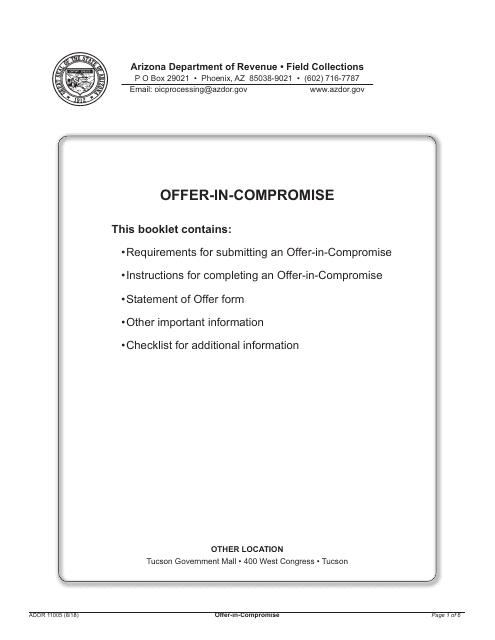

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

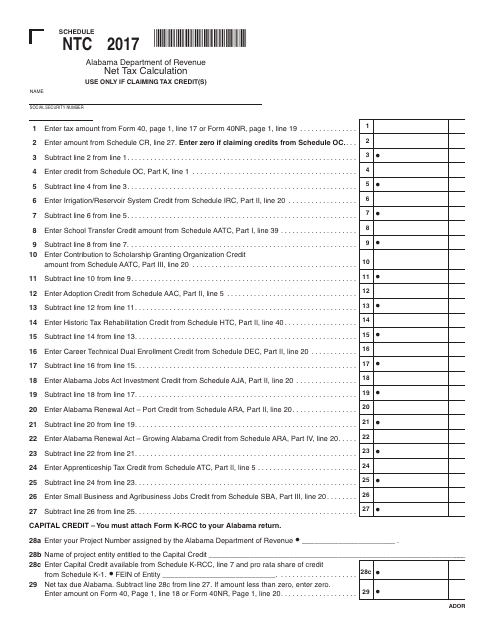

This document is used for calculating the net tax in Alabama using Schedule NTC.

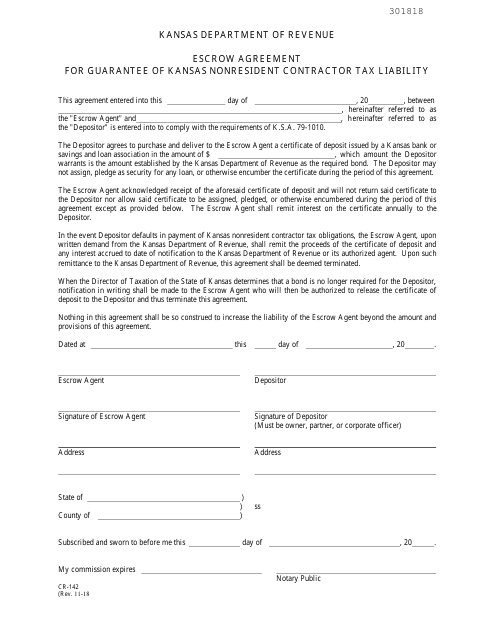

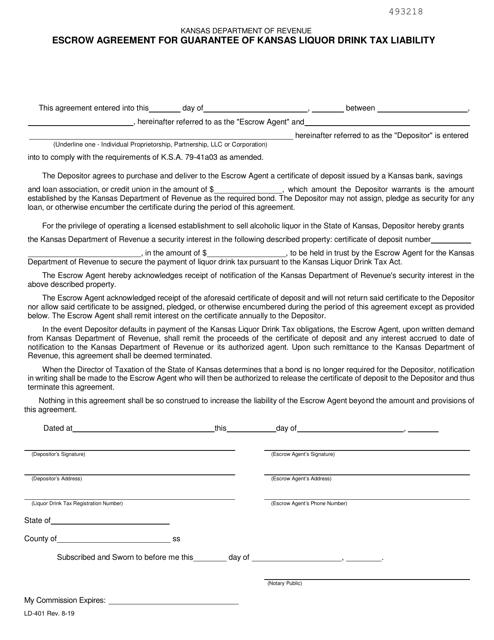

This form is used for establishing an escrow agreement to guarantee the tax liability of a nonresident contractor in Kansas.

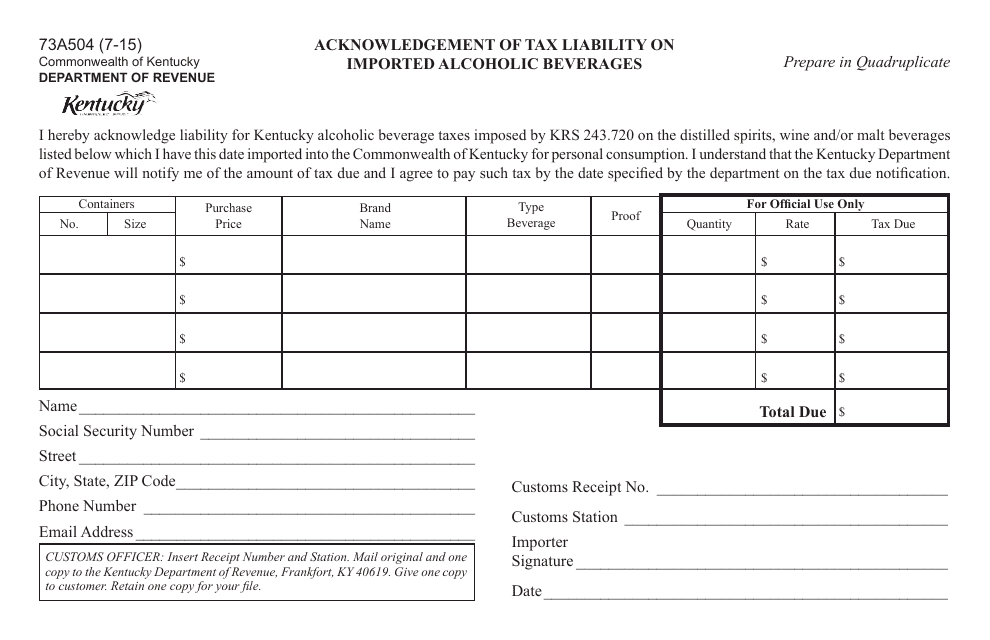

This form is used for acknowledging tax liability on imported alcoholic beverages in the state of Kentucky.

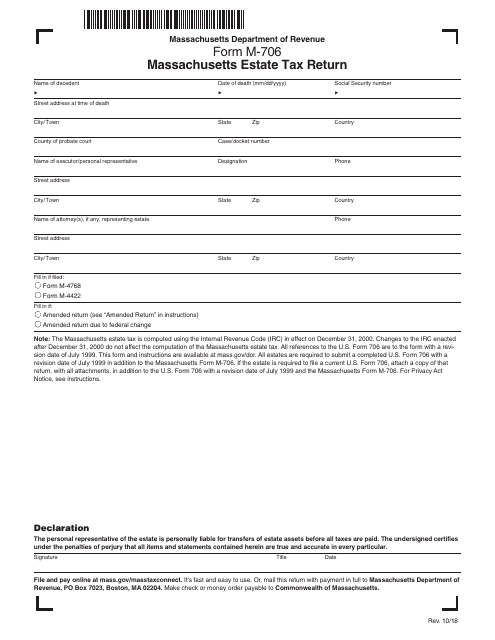

This form is used for filing an estate tax return in the state of Massachusetts.

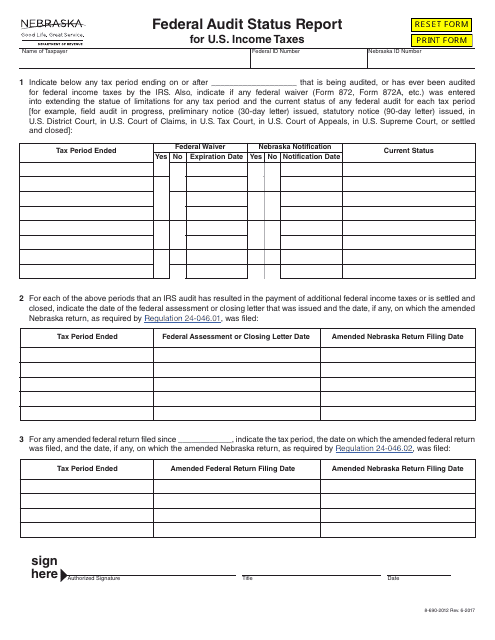

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

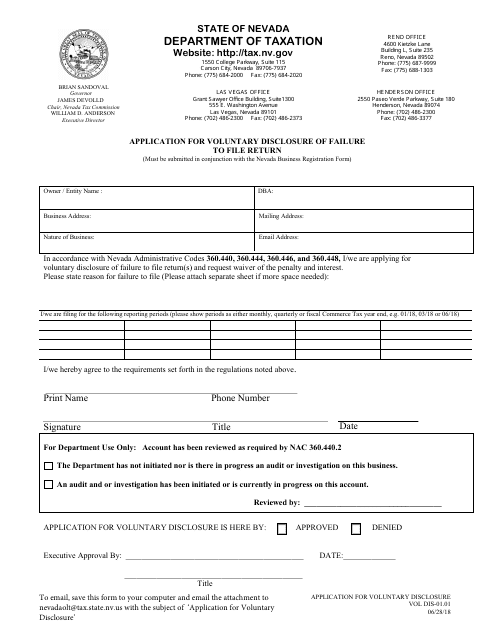

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

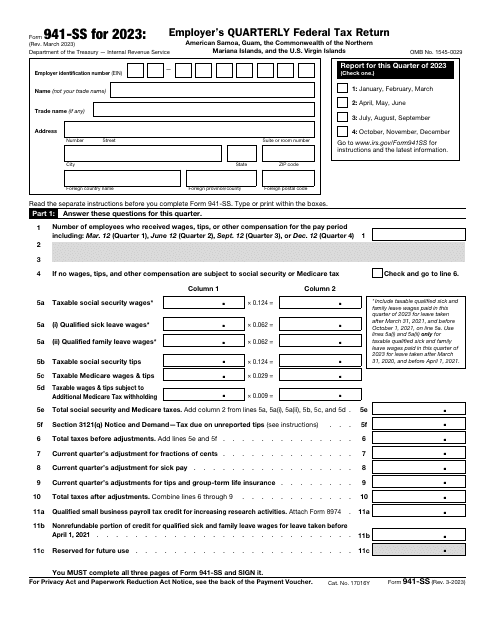

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

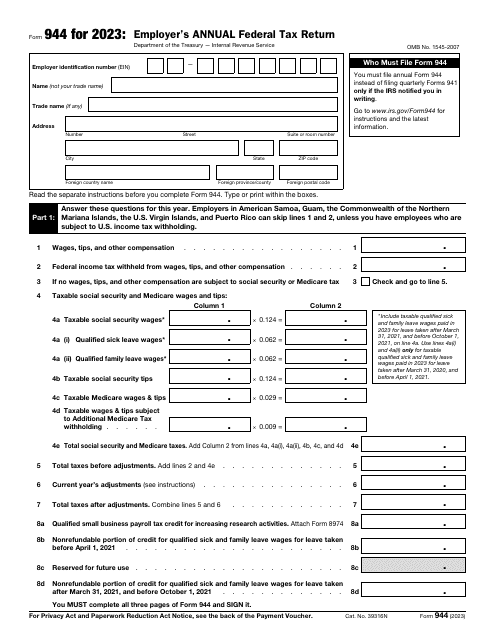

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

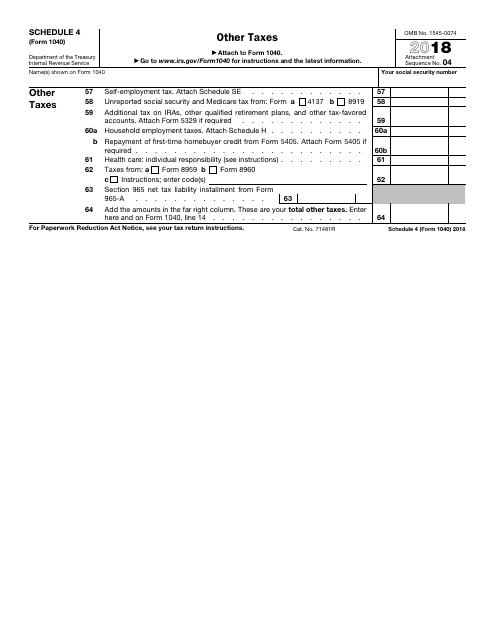

This Form is used for reporting other types of taxes that do not fit on the main IRS Form 1040.

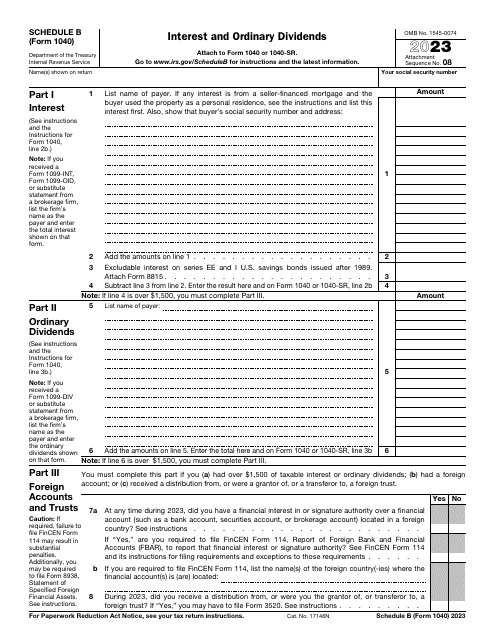

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.