Tax Liability Templates

Are you unsure about your tax liabilities? Need help understanding and managing your tax liability? Look no further! Our comprehensive collection of tax liability documentation and forms will provide you with all the information you need to navigate the complex world of taxes.

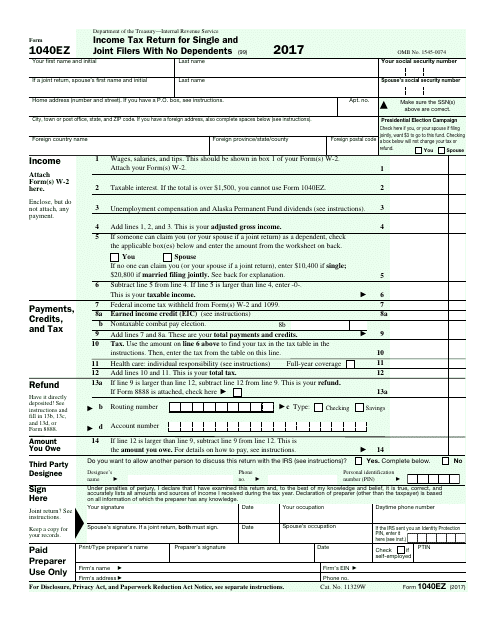

Whether you're an individual or a business entity, our extensive range of resources will guide you through the process of calculating and reporting your tax liabilities accurately. From state-specific forms like the Instructions for Form M-990T Unrelated Business Income Tax Return in Massachusetts, to IRS forms such as Form 8991 Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, we've got you covered.

Our tax liability documentation is designed to assist individuals and businesses in understanding the intricacies of tax law and compliance. By providing clear instructions and guidance, we aim to make the tax filing process as seamless as possible.

In addition to forms and instructions, we also offer informative resources like the Form GEN-BR Surety Bond Rider - Tax Liability Rider or Name Change Rider in North Carolina and the Individual Tax Return - Calculating guide in the City of Blue Ash, Ohio. These resources can help you navigate specific tax situations and ensure that you're taking advantage of any applicable deductions and credits.

Don't let tax season stress you out. With our comprehensive collection of tax liability documentation and forms, you'll have all the tools you need to confidently manage your tax liabilities. Explore our resources today and take control of your tax obligations.

Documents:

496

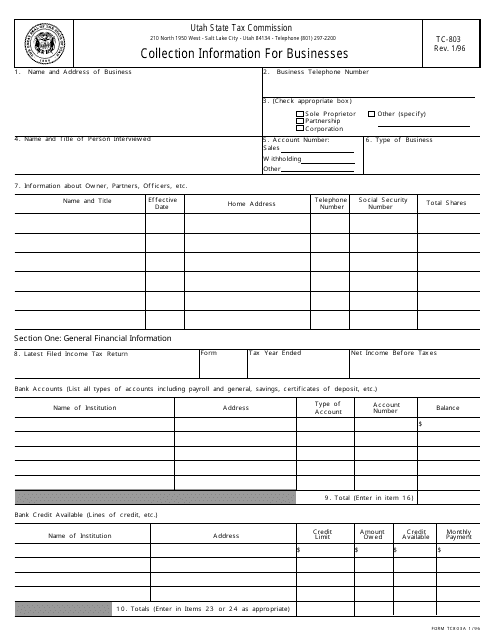

This form is used for businesses in Utah to provide collection information.

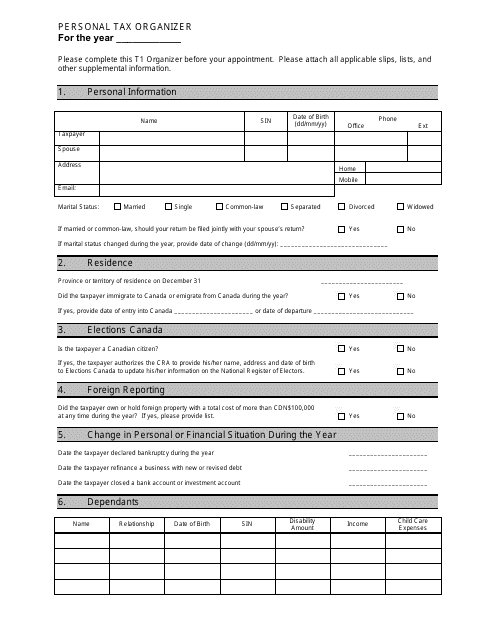

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

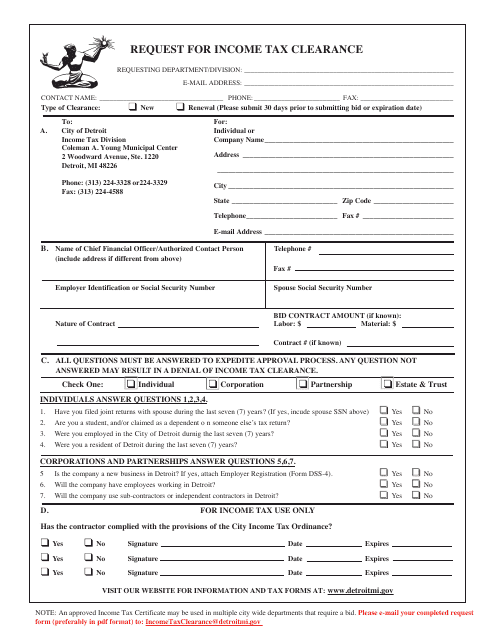

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

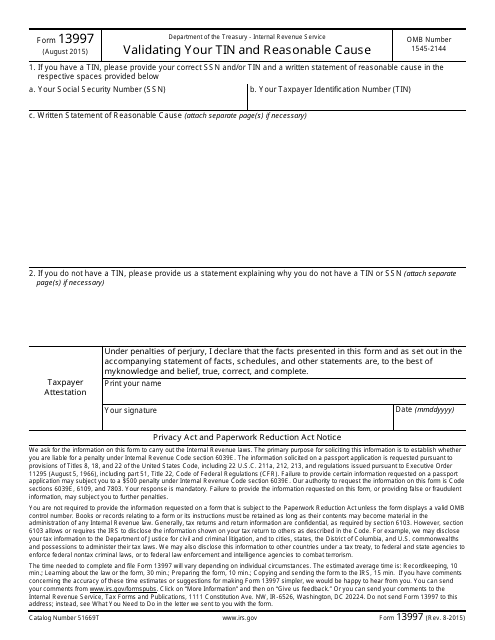

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

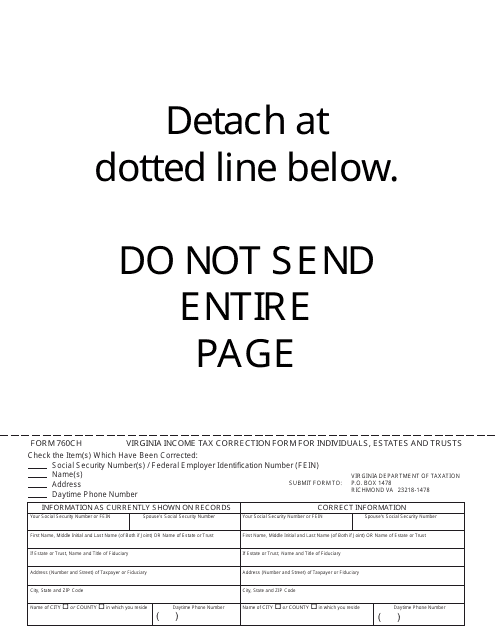

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

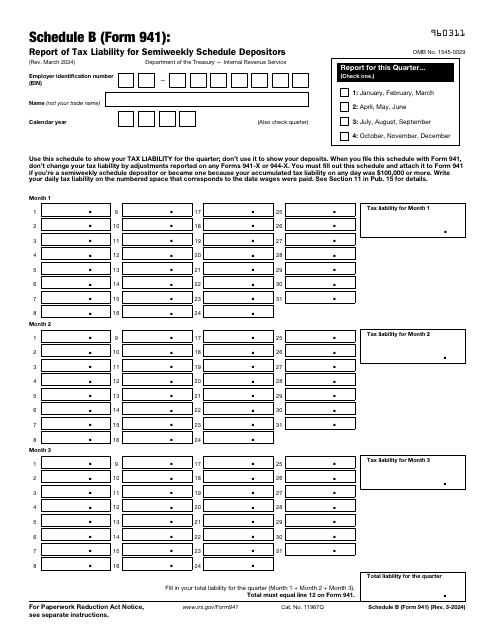

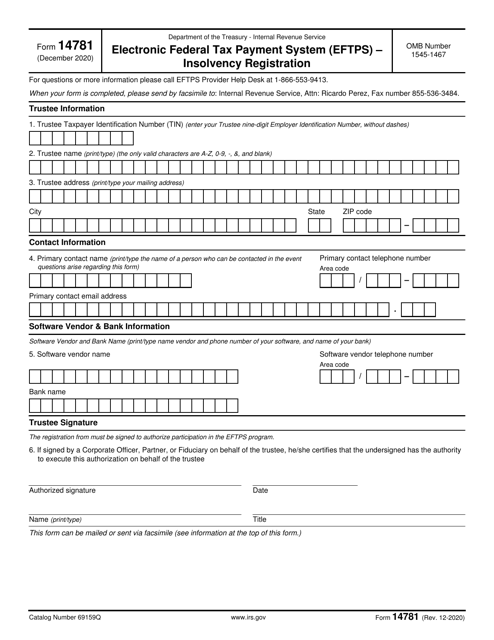

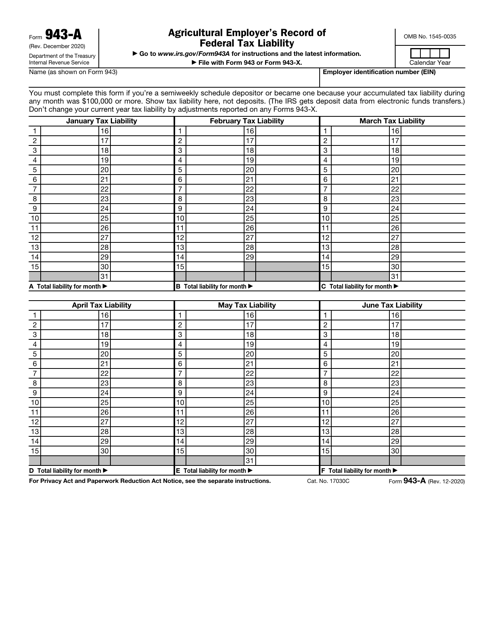

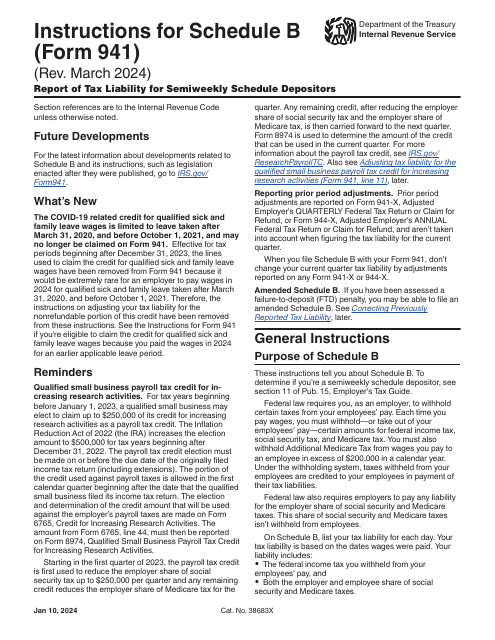

This is an IRS form used by agricultural employers that deposit schedules every two weeks or whose tax liability equals or exceeds $100,000 during any month of the year.

This is an IRS form that includes the details of an installment sale.

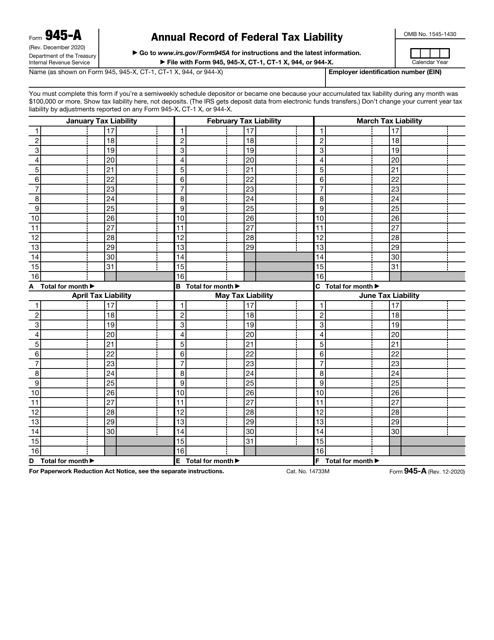

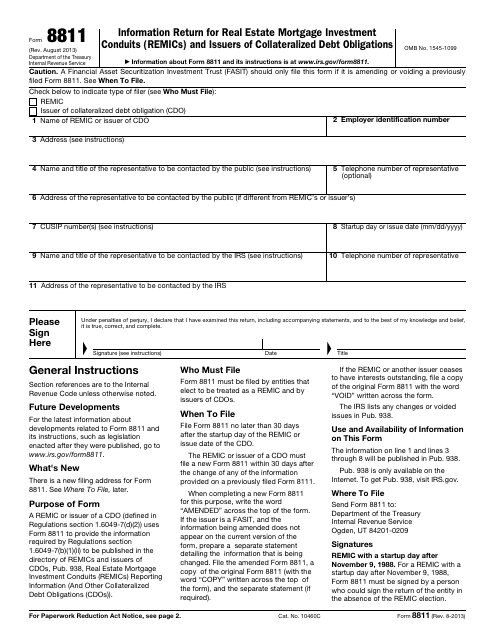

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

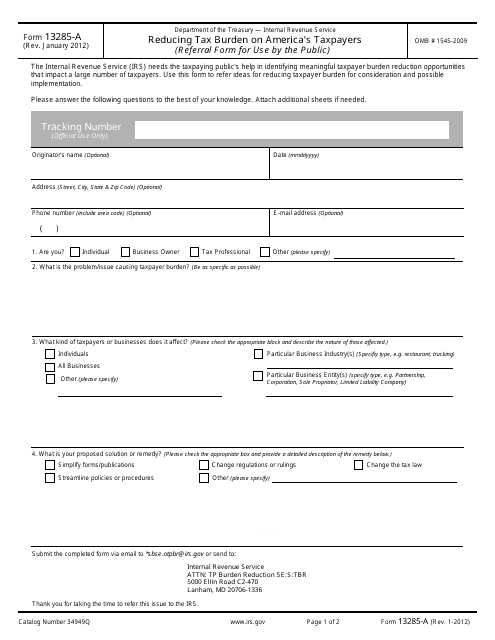

This Form is used for reducing the tax burden on American taxpayers. It provides eligible taxpayers with options to reduce their overall tax liability.

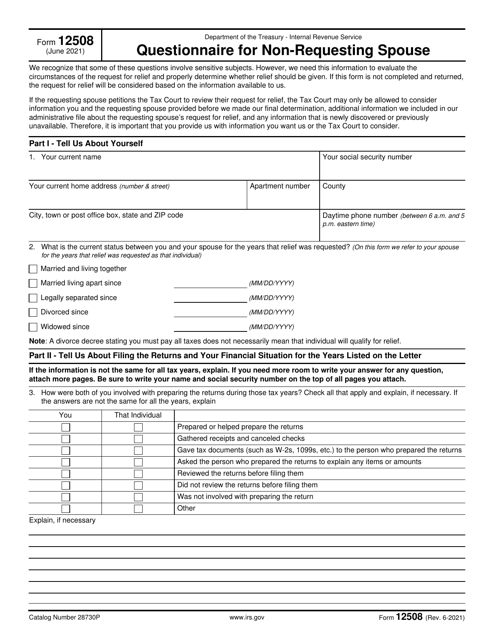

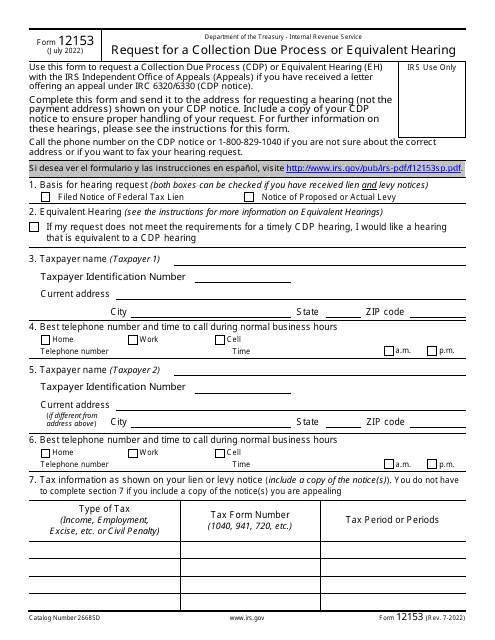

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

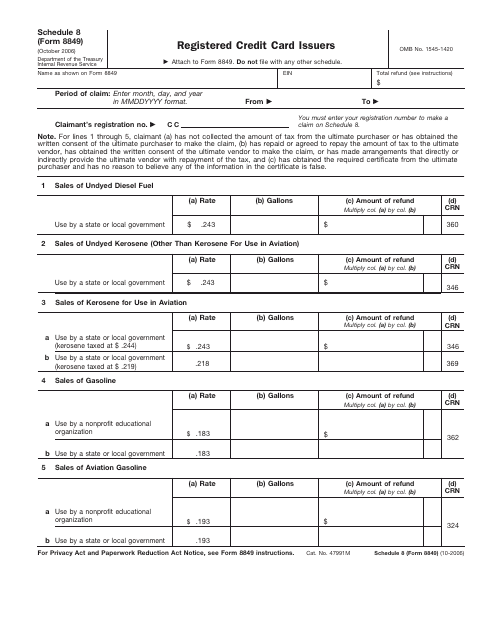

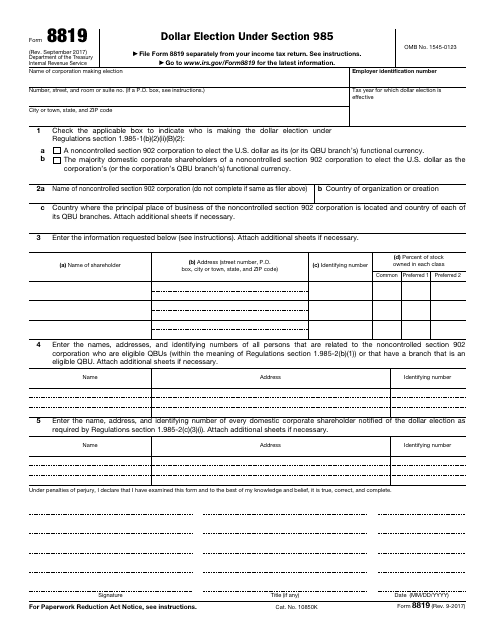

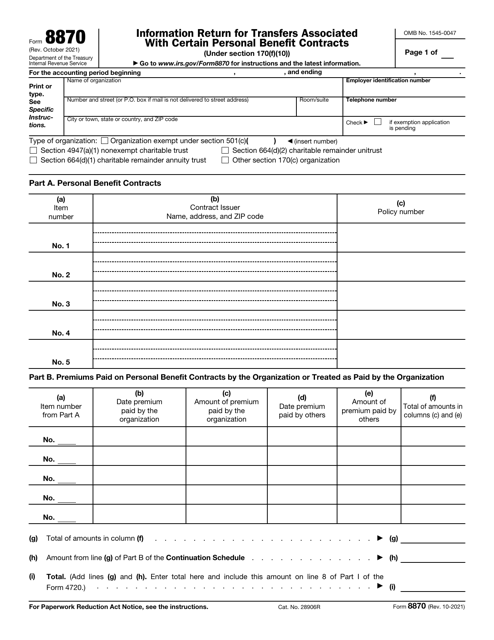

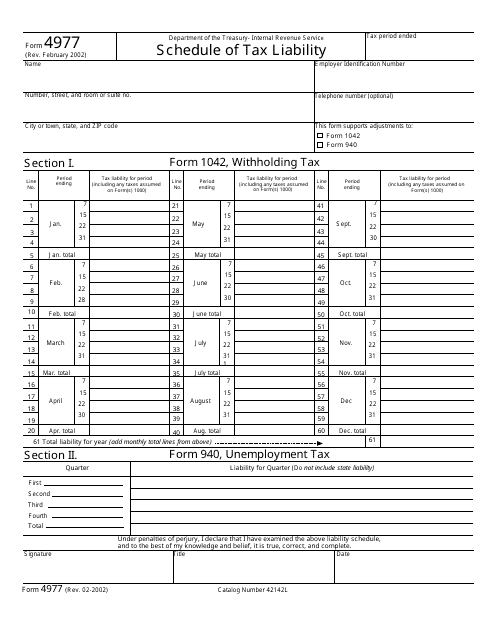

This form is used for reporting tax liability to the Internal Revenue Service (IRS). It provides a comprehensive schedule of the various taxes owed by an individual or organization.

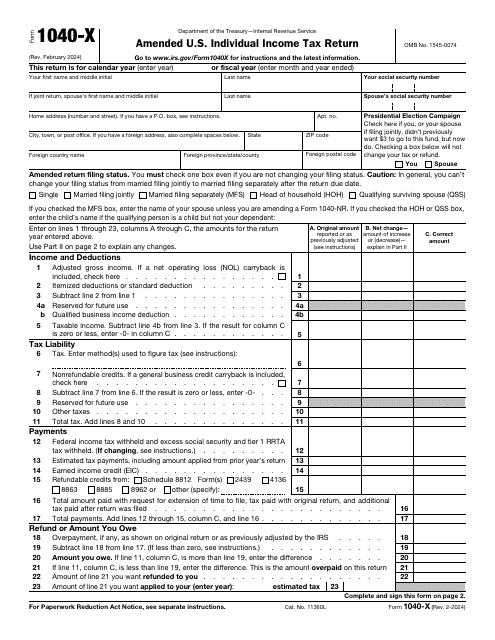

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

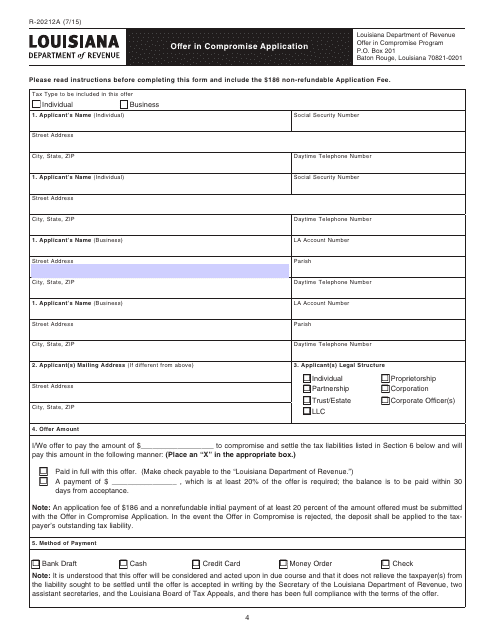

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

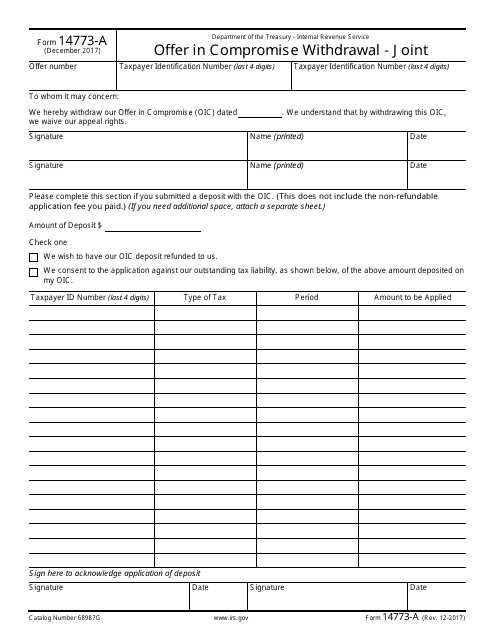

This form is used for withdrawing a joint offer in compromise submission to the IRS.

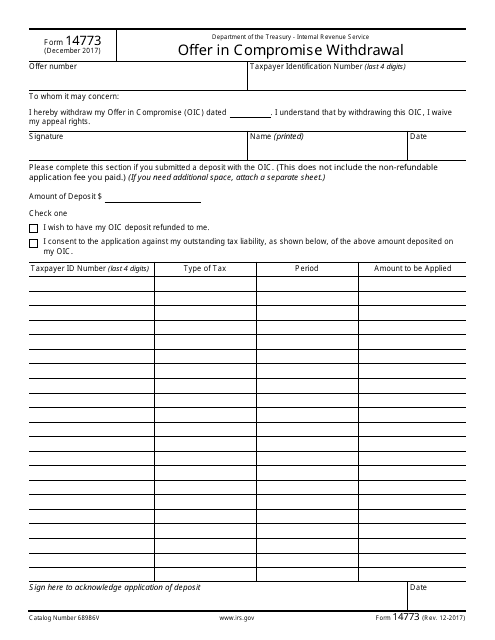

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

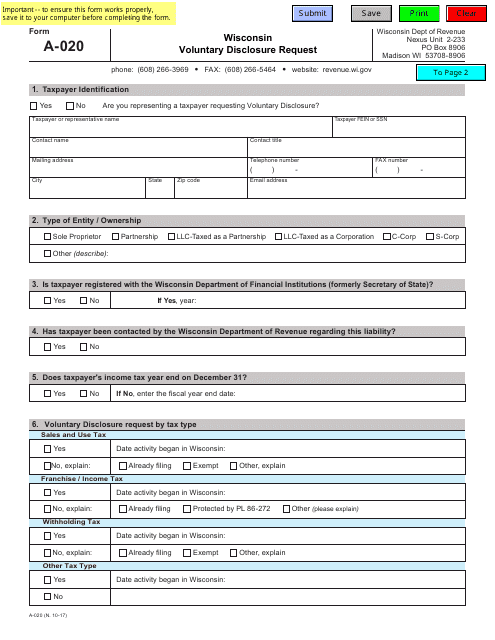

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

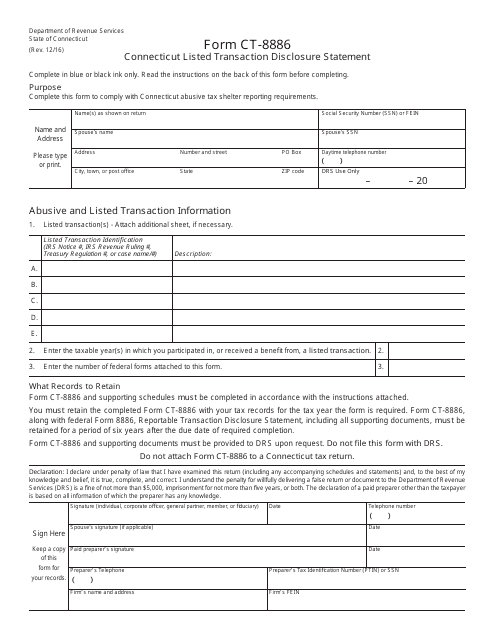

This Form is used for disclosing listed transactions in Connecticut.

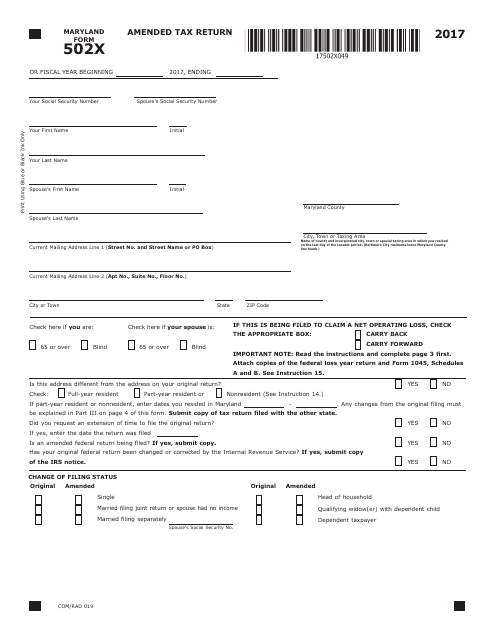

This form is used for filing an amended tax return in the state of Maryland.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

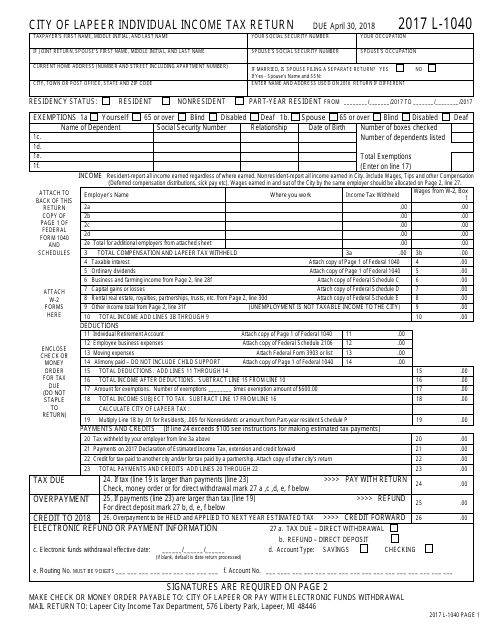

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

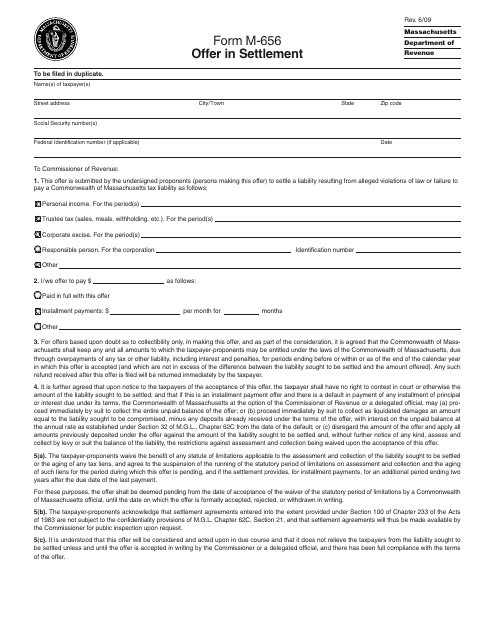

This form is used for making an offer in settlement in the state of Massachusetts.

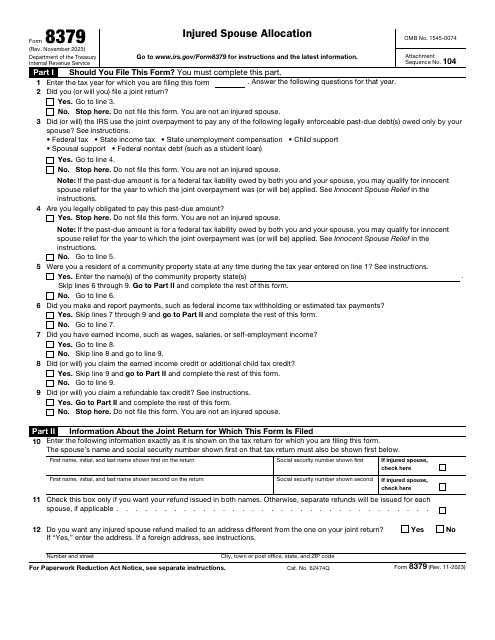

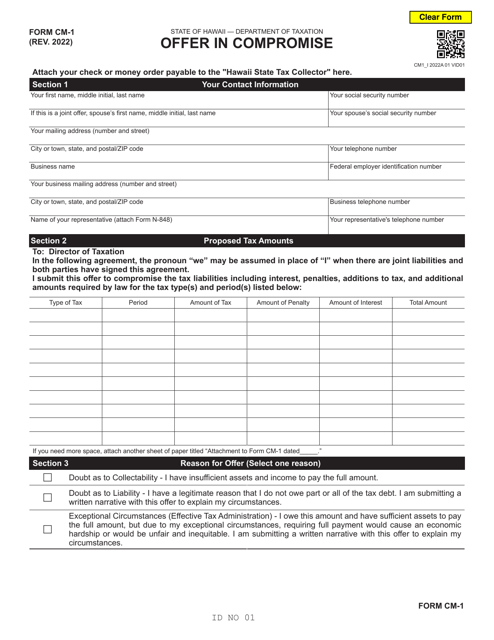

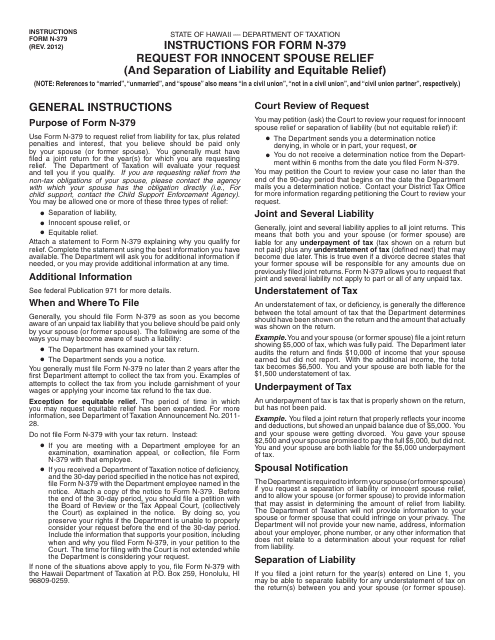

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

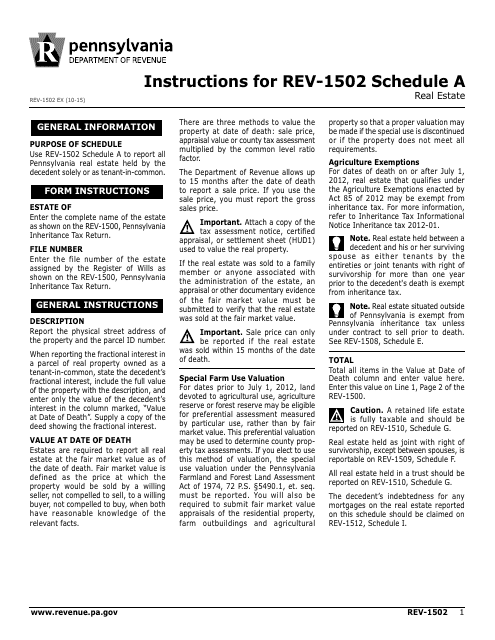

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

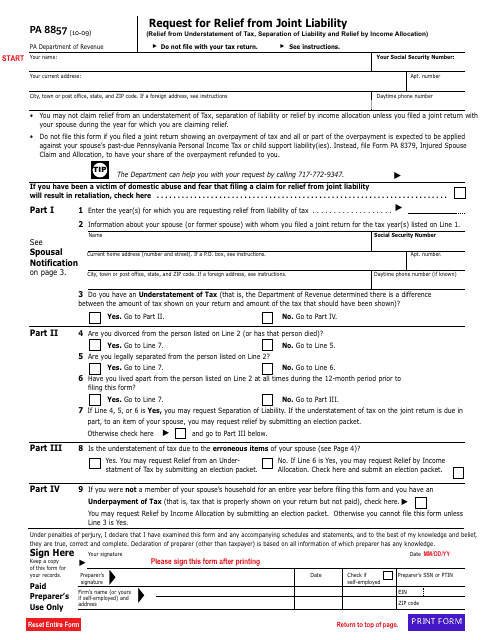

This form is used for requesting relief from joint liability for tax obligations in the state of Pennsylvania.

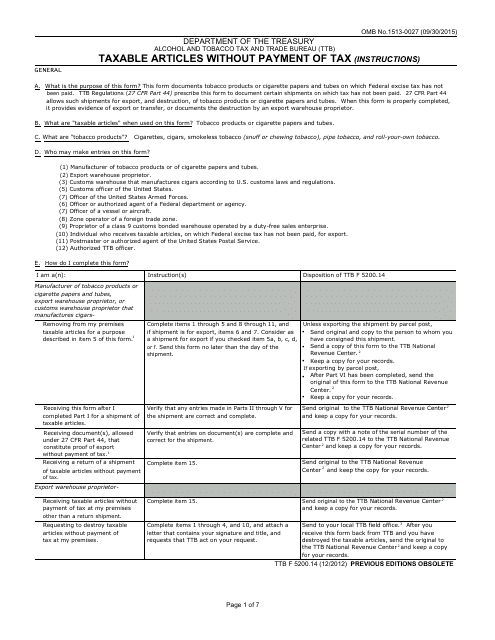

This document is used for reporting the taxable articles that are not paid for with tax.

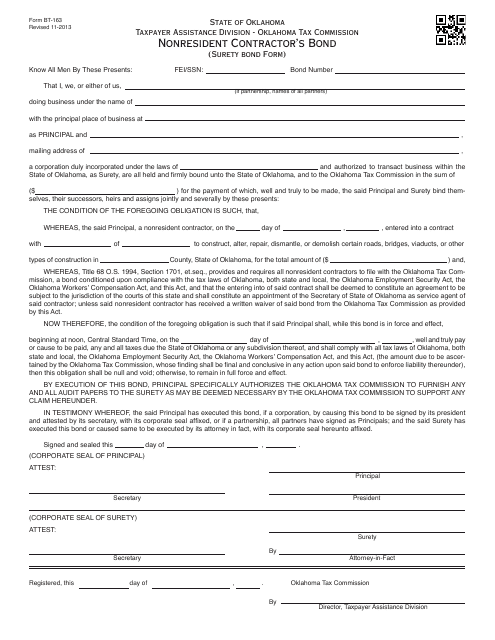

This type of document is used for obtaining a nonresident contractor's bond in Oklahoma. It is for contractors who are not residents of Oklahoma but want to work on construction projects in the state. The bond ensures that the contractor will fulfill their obligations and responsibilities as outlined in their contract.