Foreign Income Templates

Are you an individual or business with foreign income? Understanding how to navigate the complexities of reporting and filing taxes on your foreign income can be overwhelming. But don't worry, we're here to help.

At Templateroller.com, we specialize in providing resources and guidance on foreign income matters. Whether you're an expat living abroad, a multinational corporation, or someone with foreign investments, our comprehensive collection of documents and forms will ensure that you stay compliant with the tax laws in your jurisdiction.

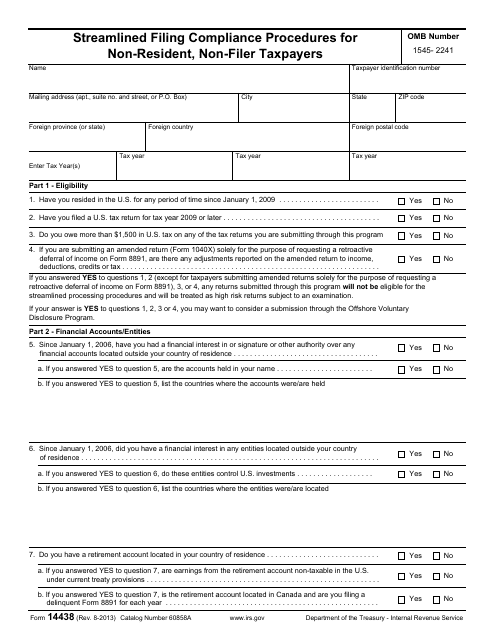

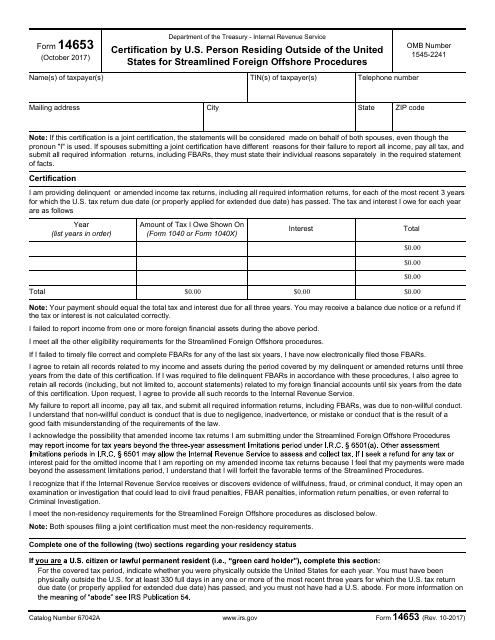

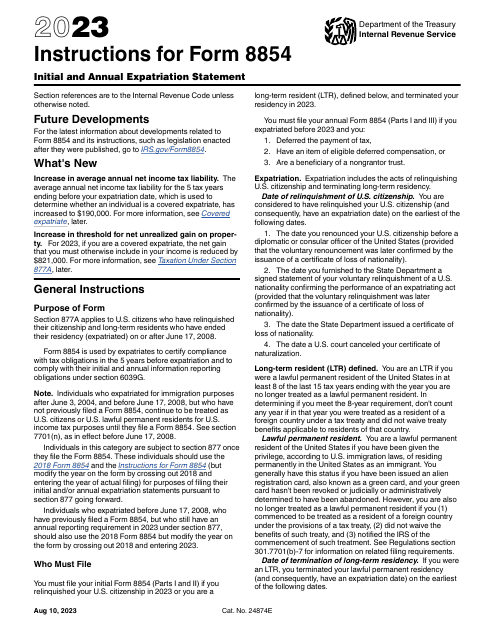

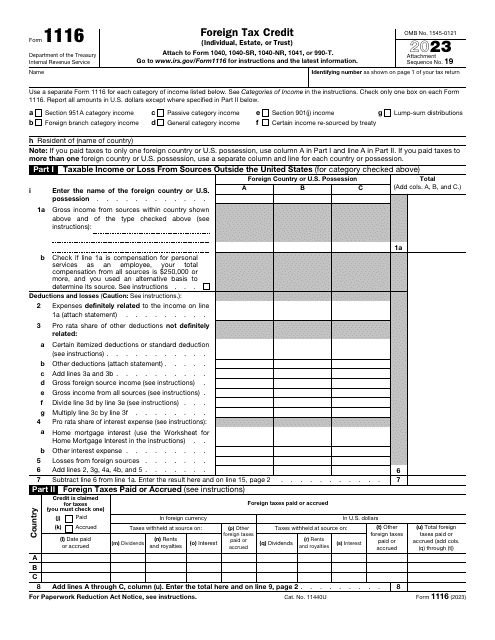

Our collection includes a range of documents such as IRS Form 14653, which certifies your status as a U.S. person residing outside of the United States for streamlined foreign offshore procedures. We also offer helpful instructions for IRS Form 1118, which is designed specifically for corporations seeking to claim a foreign tax credit.

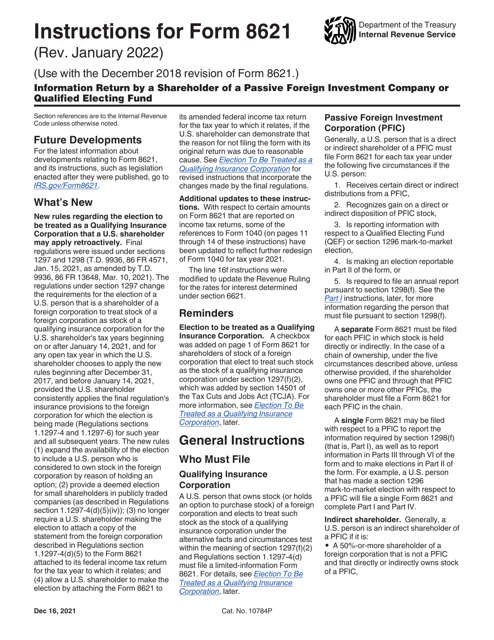

Another essential document within our collection is IRS Form 8621, which is an information return required by shareholders of passive foreign investment companies or qualified electing funds. It's crucial to accurately complete this form to avoid penalties and compliance issues.

If you're a shareholder of an international corporation, IRS Form 1120-S Schedule K-2 will be of interest to you. This form allows you to report your pro rata share items related to international activities accurately.

And for individuals filing as non-resident aliens, IRS Form 1040-NR Schedule OI provides a platform to disclose other relevant information about your foreign income.

We understand that tax regulations surrounding foreign income can be complex and challenging. That's why our collection of documents and instructions is designed to simplify the process and ensure that you meet all requirements in a timely and accurate manner.

At Templateroller.com, we're committed to providing you with the resources you need to navigate the world of foreign income. Our extensive collection of documents and forms, including the IRS Form 14653, Form 1118, Form 8621, Form 1120-S Schedule K-2, and Form 1040-NR Schedule OI, will help you stay compliant and minimize the risk of potential penalties.

Don't let the complexities of foreign income tax filings overwhelm you. Let us assist you in managing your tax obligations and achieving peace of mind.

Documents:

112

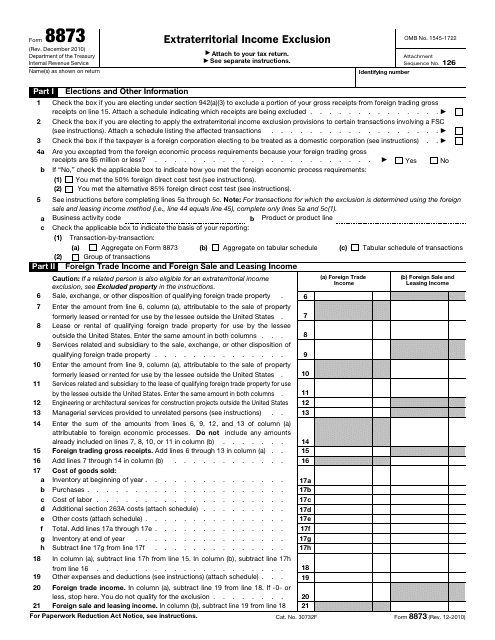

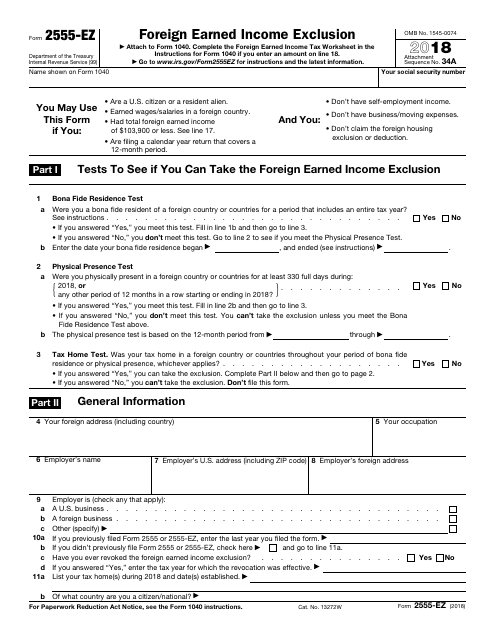

This Form is used for claiming the exclusion of certain foreign-earned income from your taxable income.

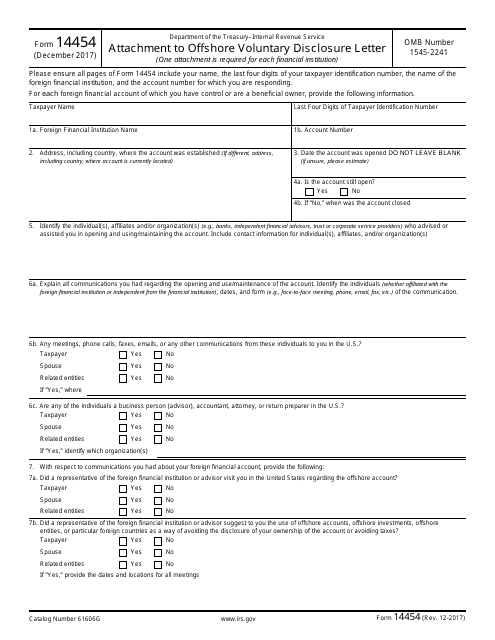

This form is used as an attachment to the Offshore Voluntary Disclosure Letter, which is submitted to the IRS. It provides additional information and documentation related to offshore accounts and income.

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

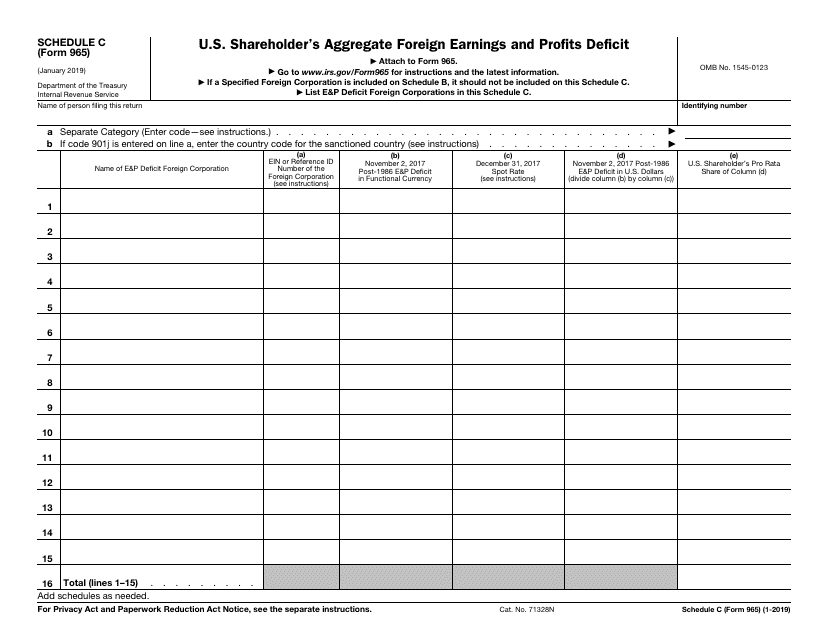

This Form is used for reporting the U.S. shareholder's aggregate foreign earnings and profits deficit to the IRS.

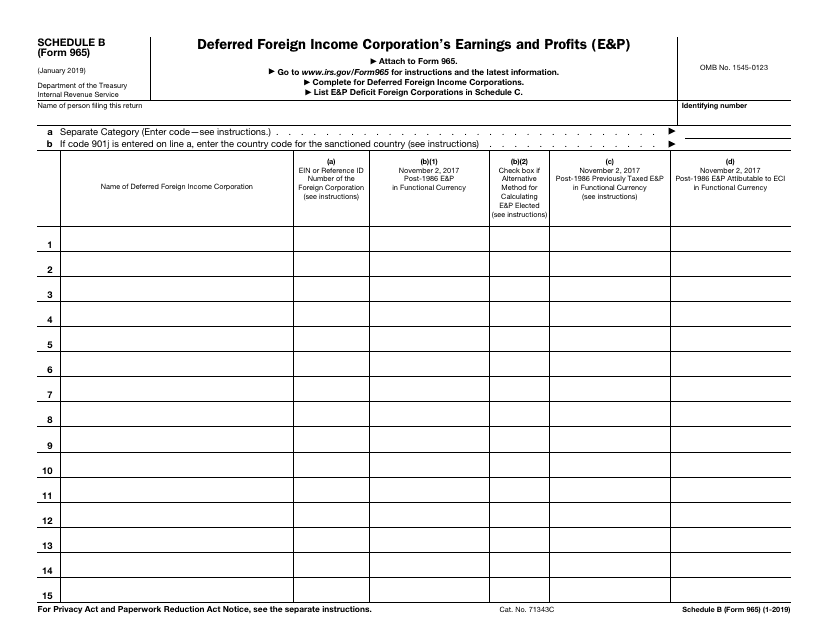

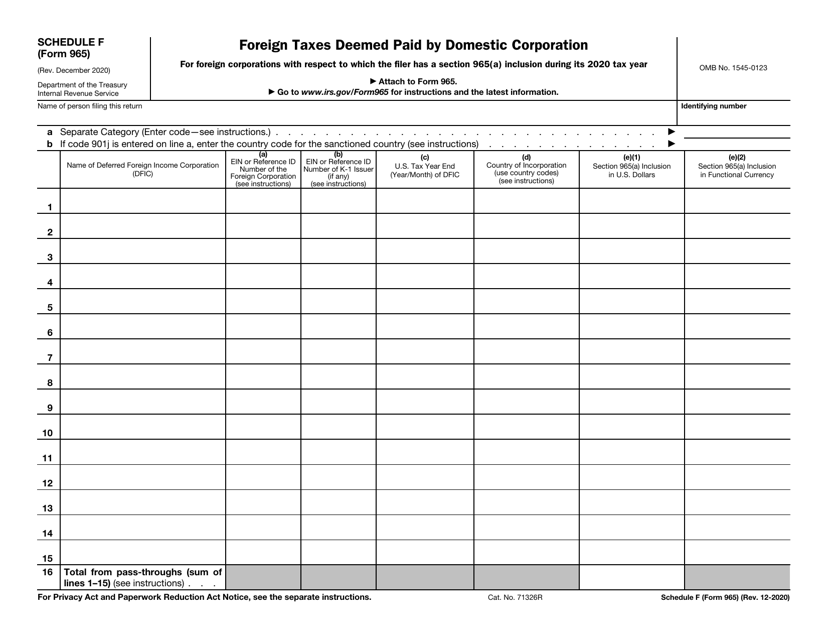

This Form is used for reporting the deferred foreign income and the earnings and profits of a foreign corporation.

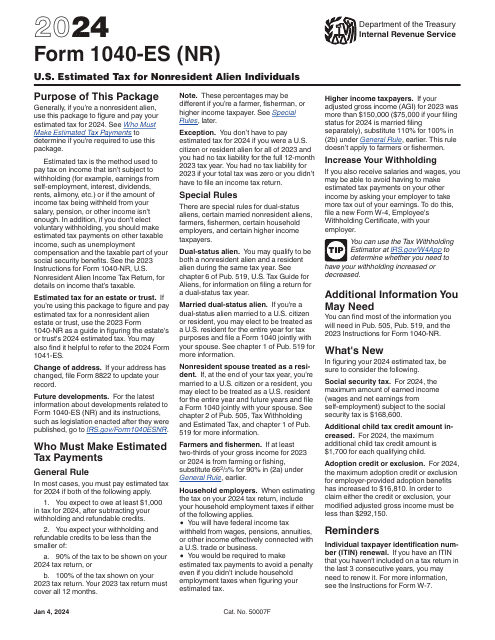

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

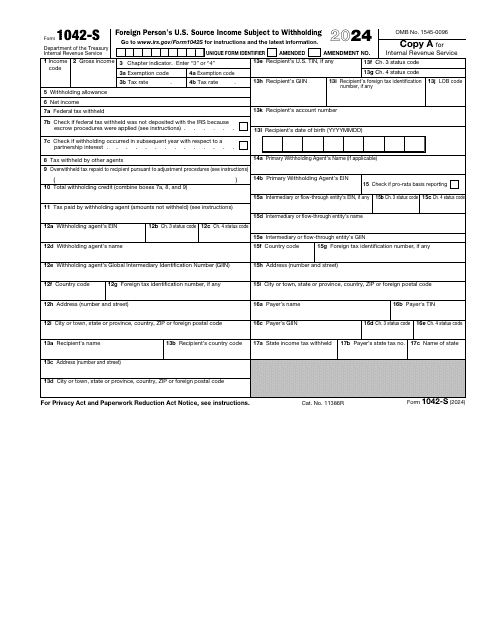

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

This document provides instructions for completing IRS Form 2555-EZ, which is used to report and claim the foreign earned income exclusion for taxpayers who qualify.

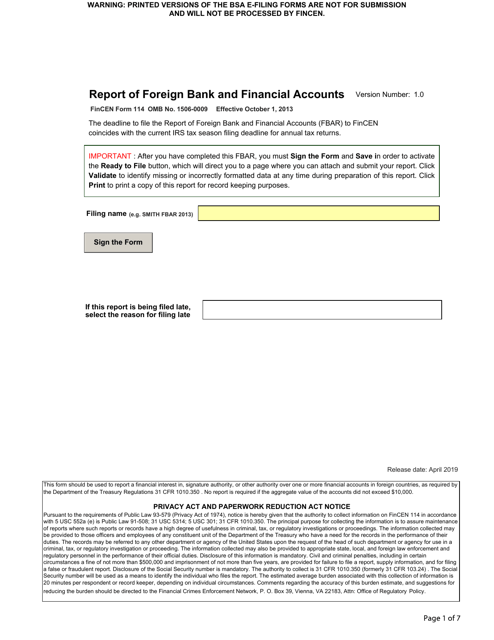

Use this document if you have a financial interest in any foreign financial account or signature authority over it. The term "financial account" includes a brokerage account, bank account, trust, mutual fund, or any other foreign financial account.

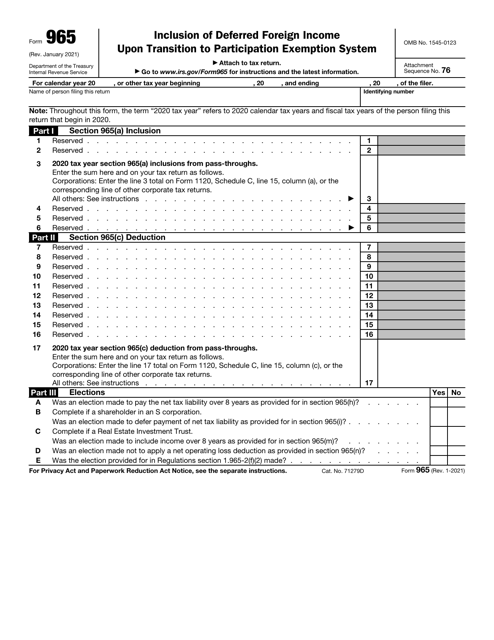

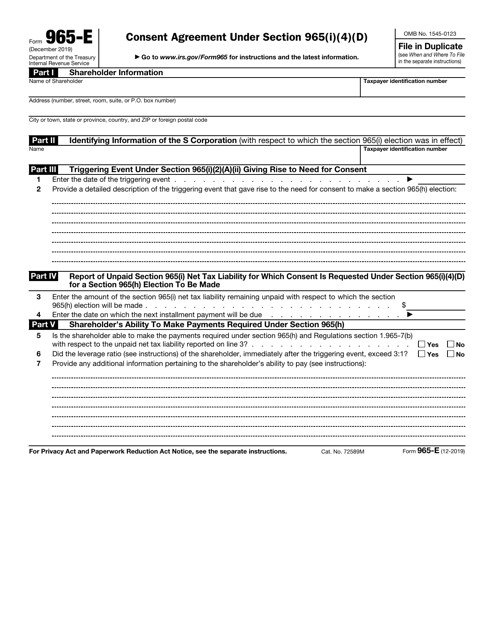

This form is used for entering into a consent agreement under Section 965(I)(4)(D) of the Internal Revenue Code.

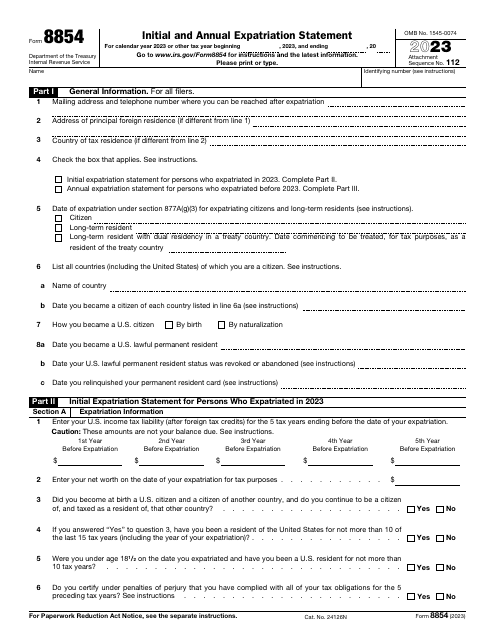

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.