Foreign Income Templates

Documents:

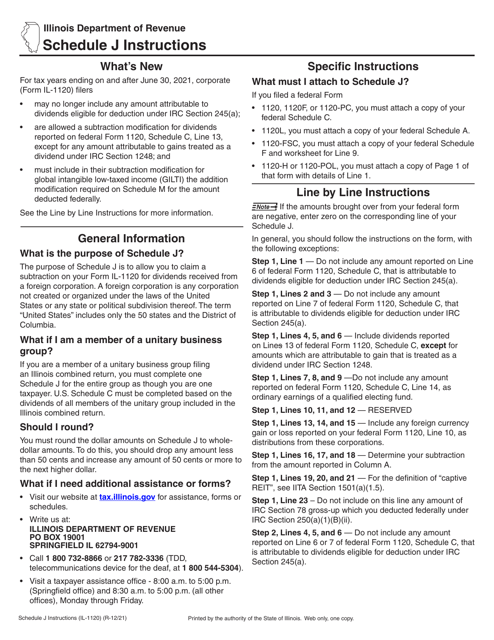

112

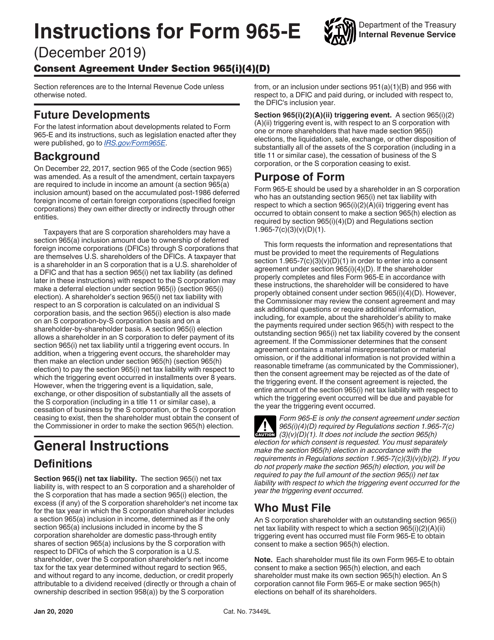

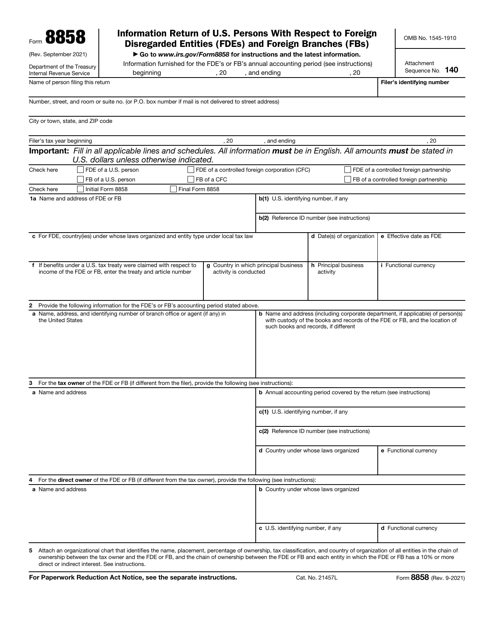

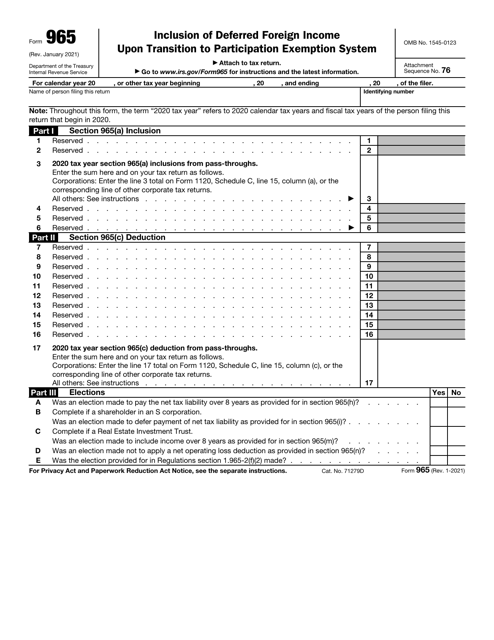

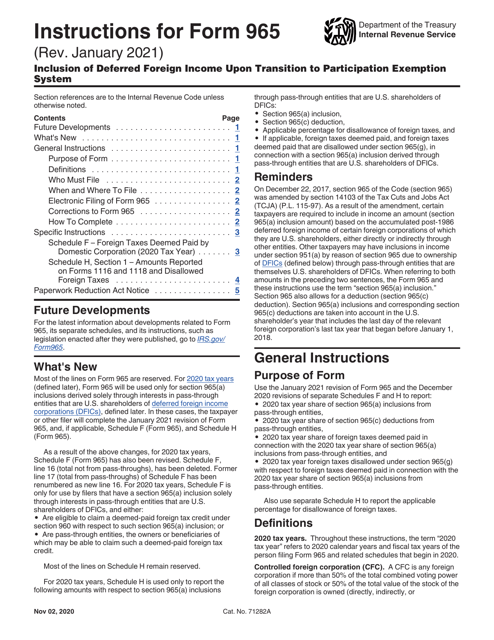

This document is used for completing the IRS Form 965-E Consent Agreement under Section 965(I)(4)(D). It provides instructions on how to properly fill out the form and comply with the requirements.

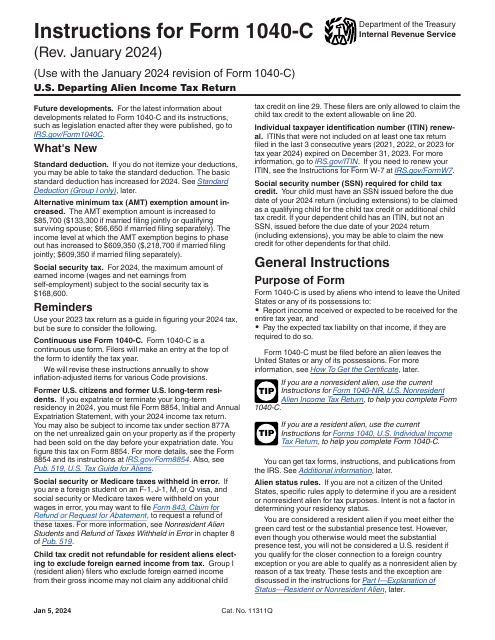

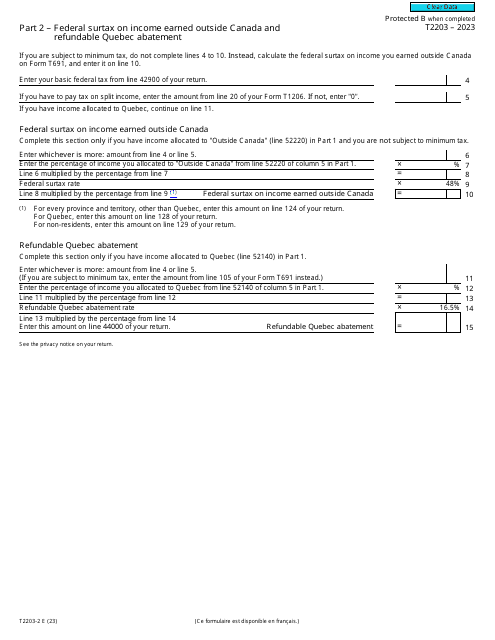

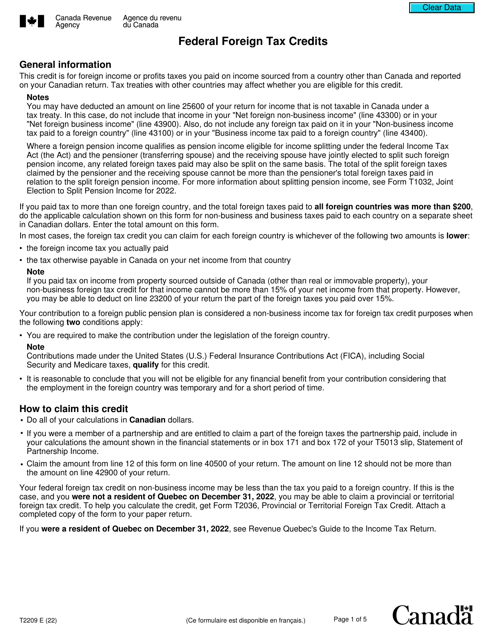

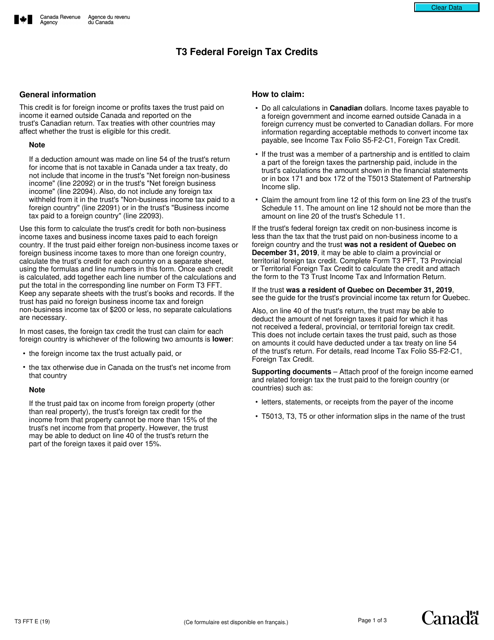

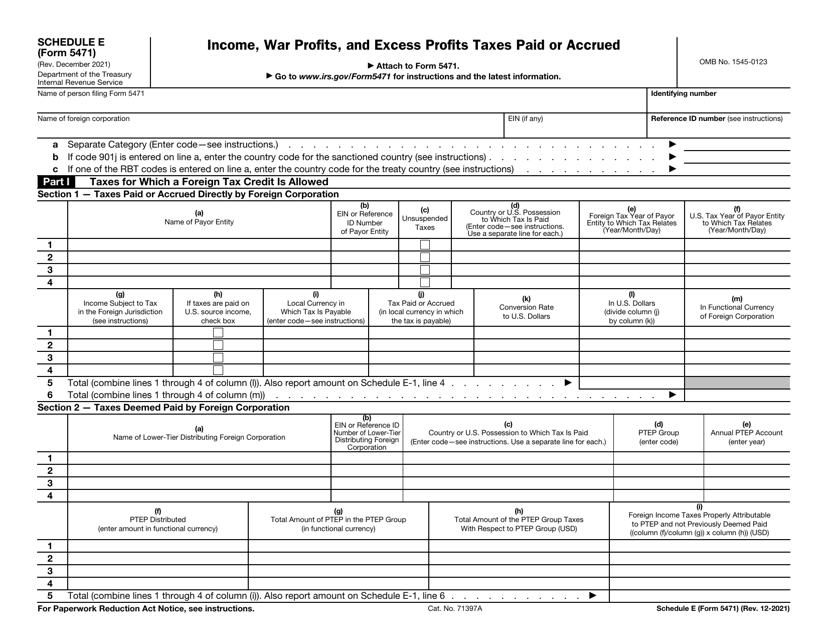

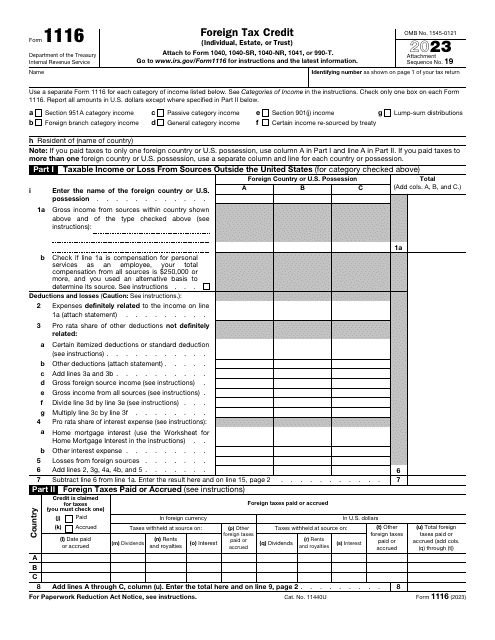

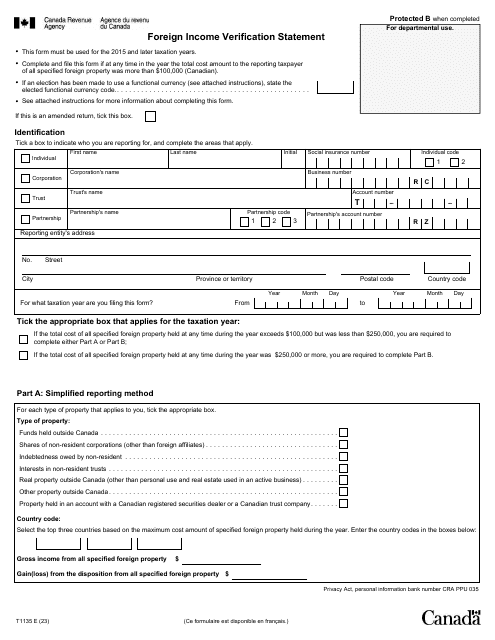

This form is used for claiming foreign tax credits on your Canadian federal tax return.

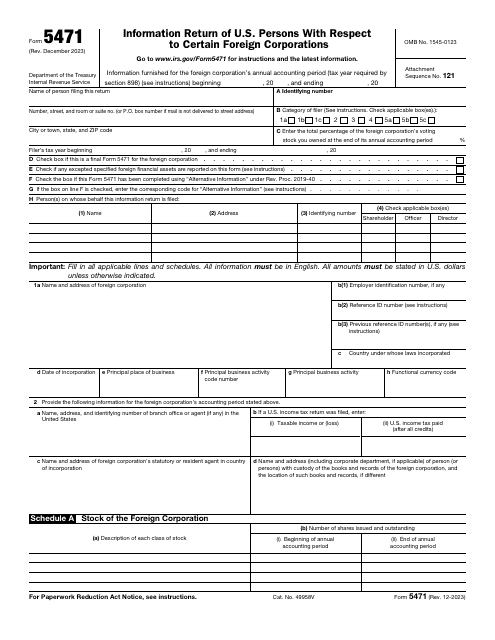

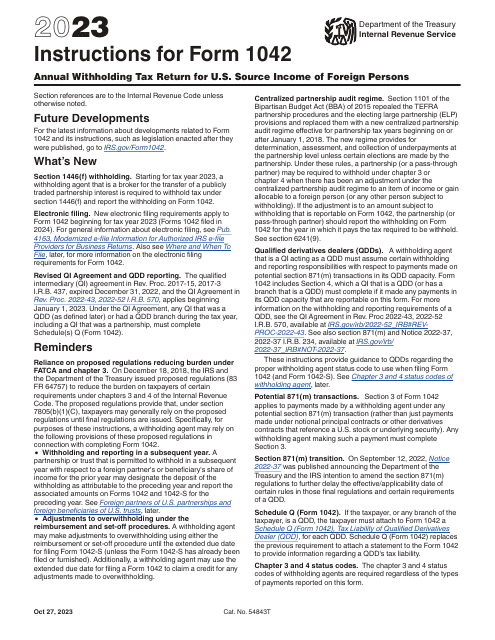

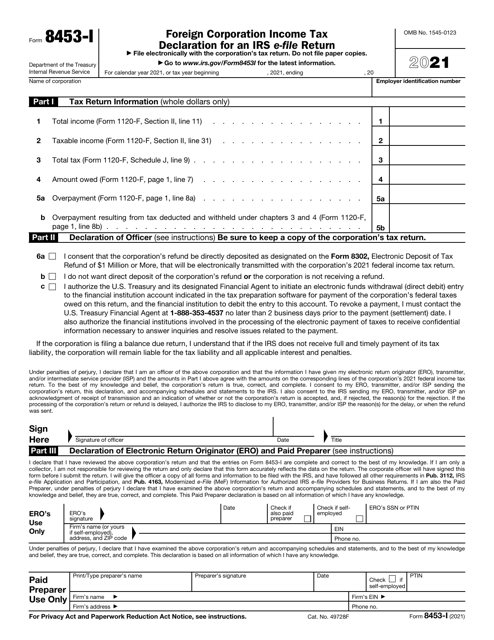

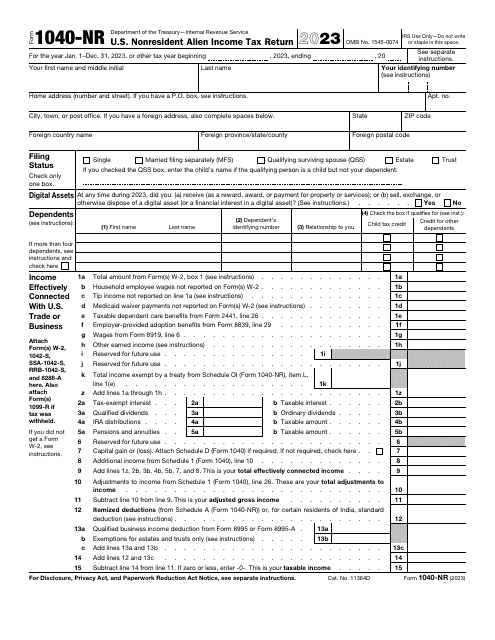

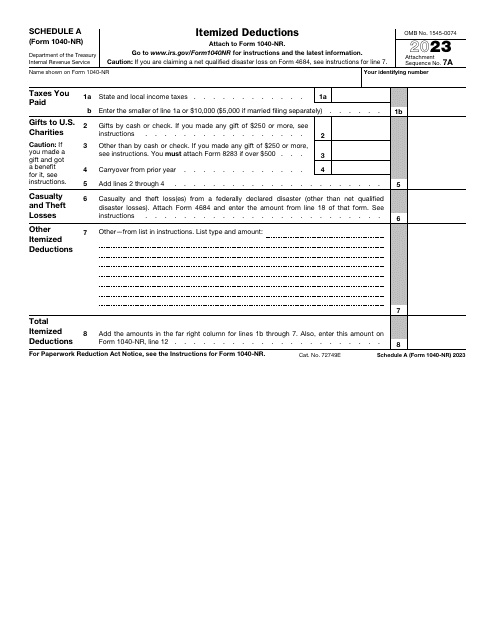

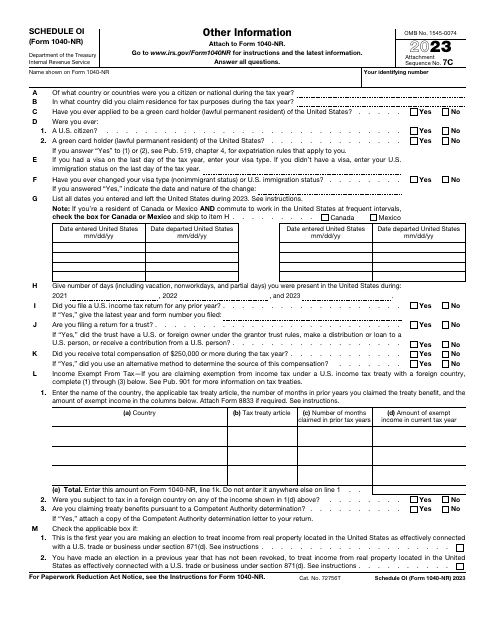

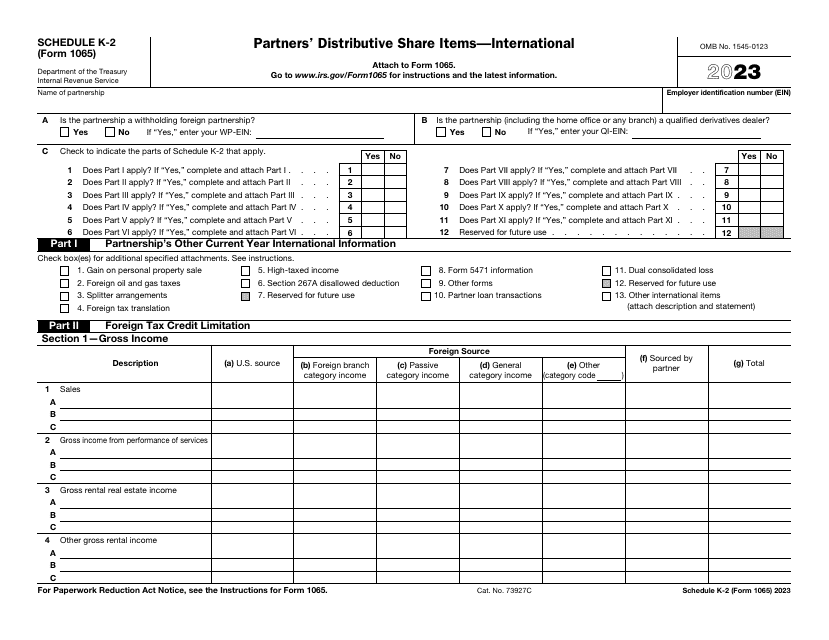

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

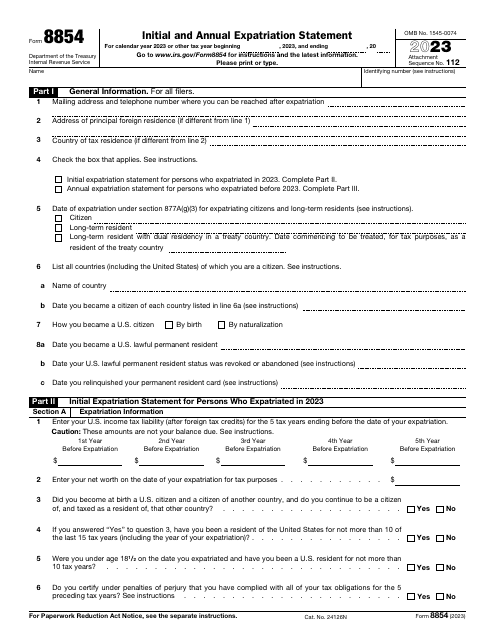

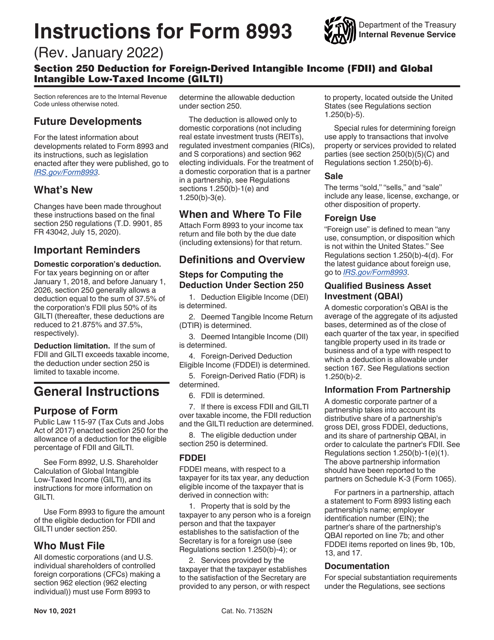

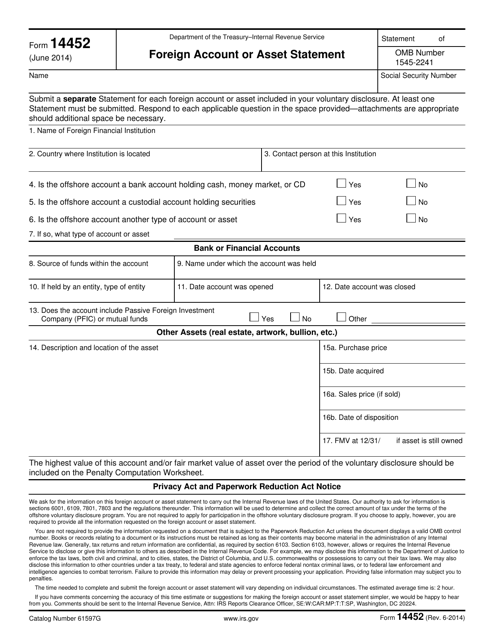

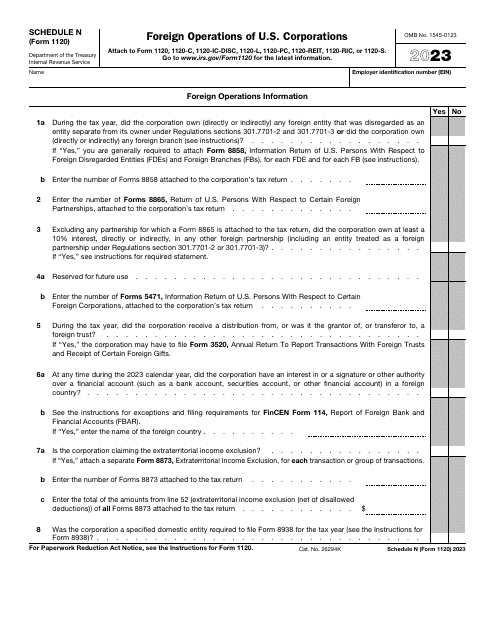

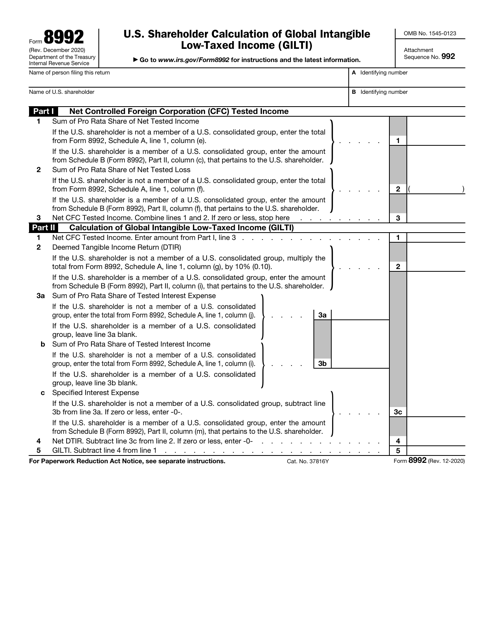

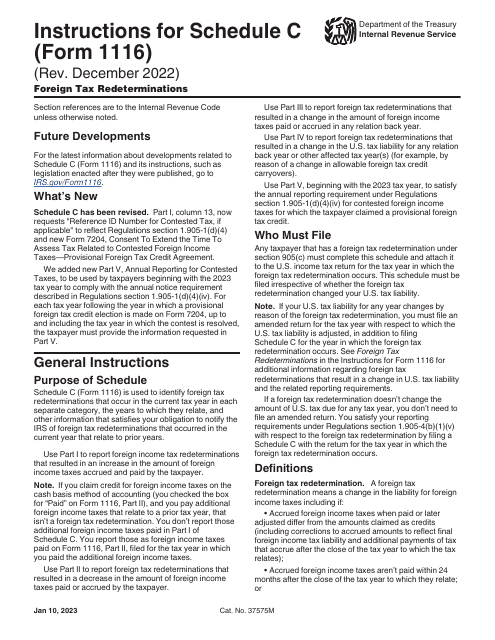

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.