Tax Preparer Templates

Documents:

1288

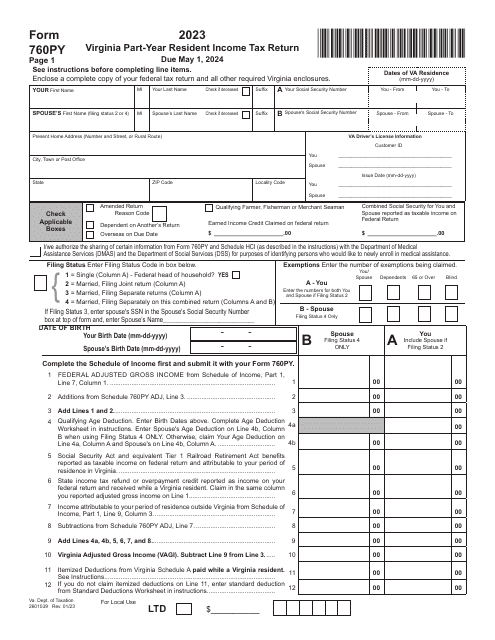

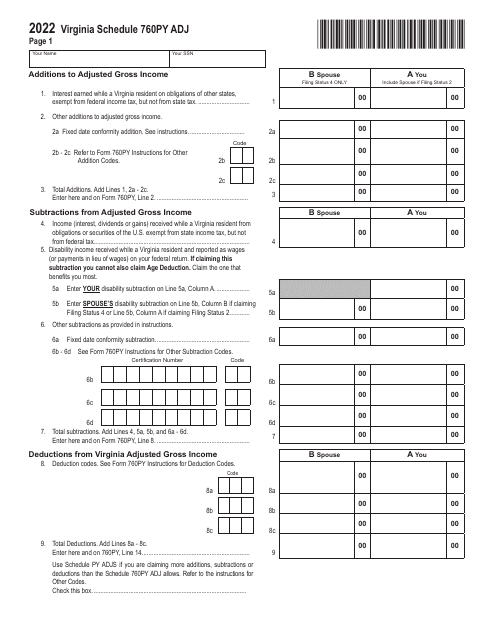

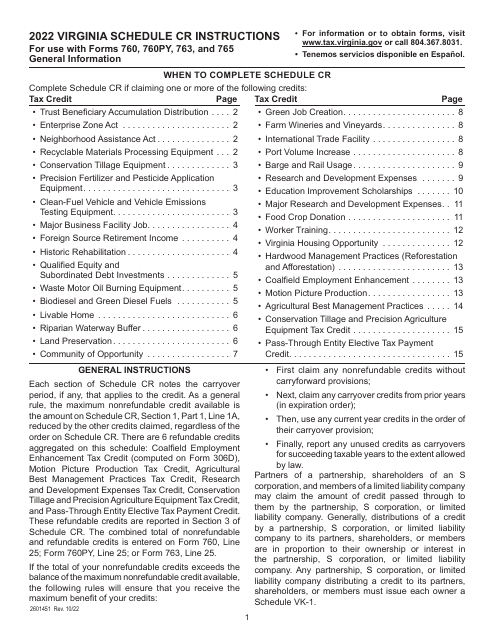

This form is used for part-year residents in Virginia to report adjustments to their income and deductions.

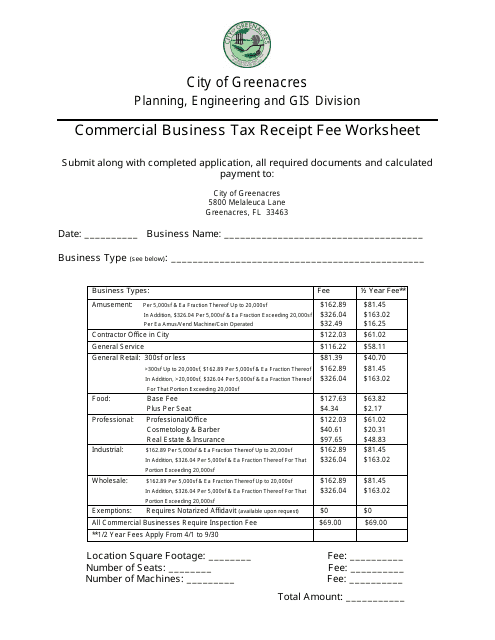

This document is used for calculating the fee for a commercial business tax receipt in the City of Greenacres, Florida.

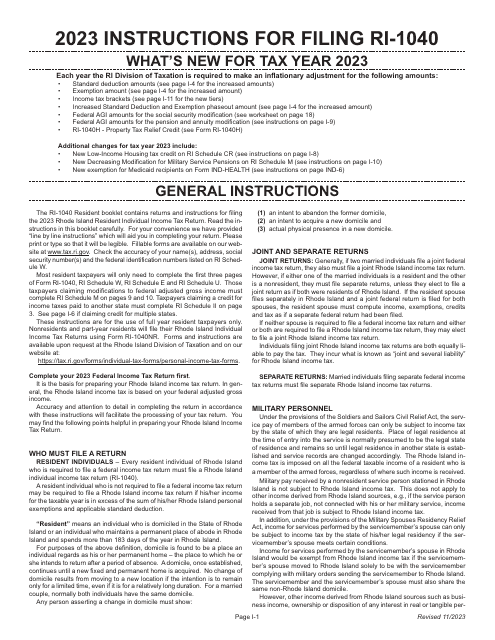

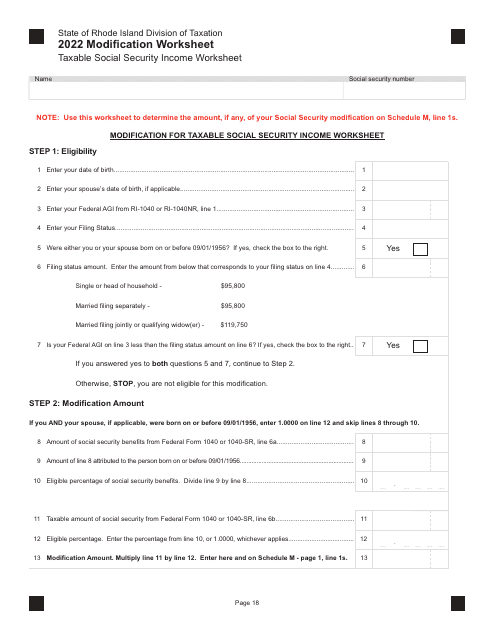

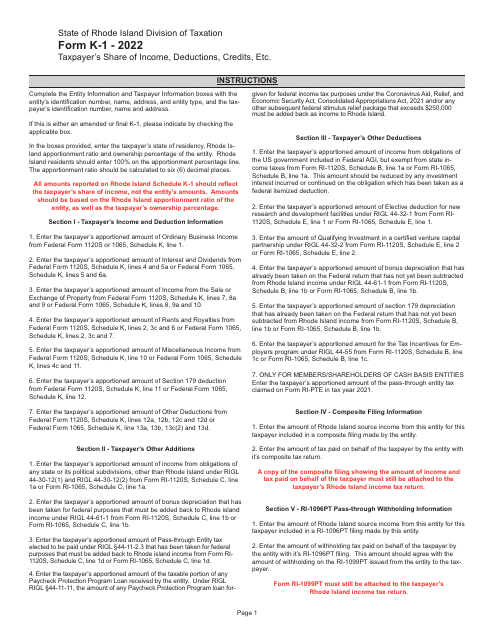

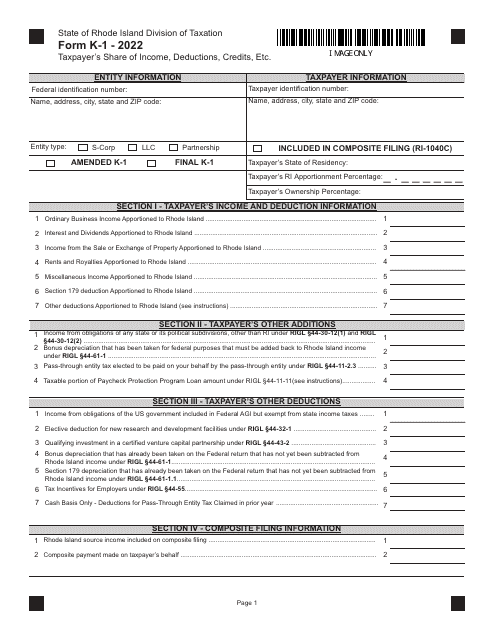

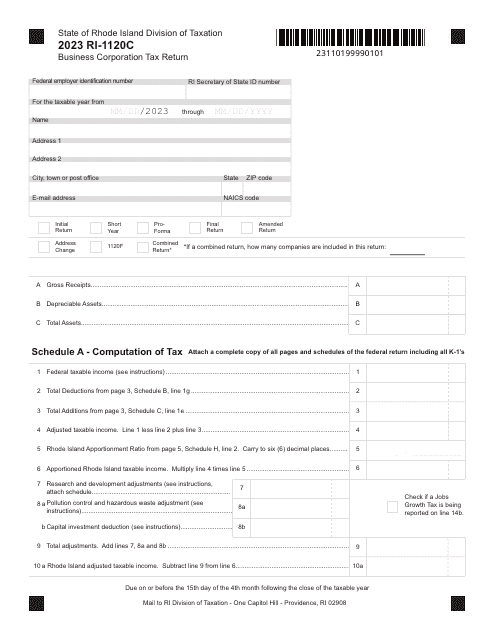

Instructions for Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island, 2022

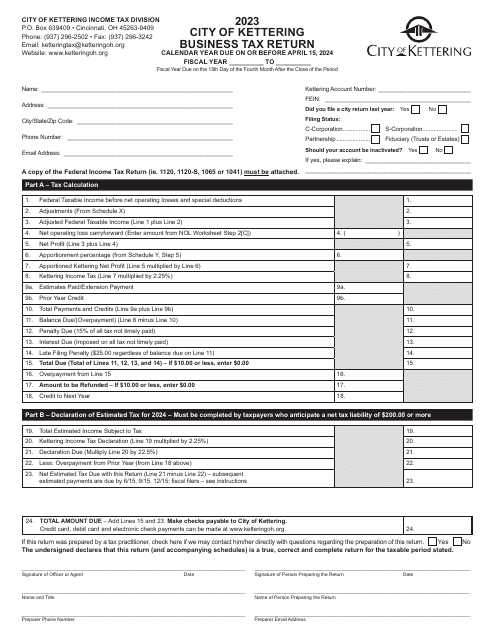

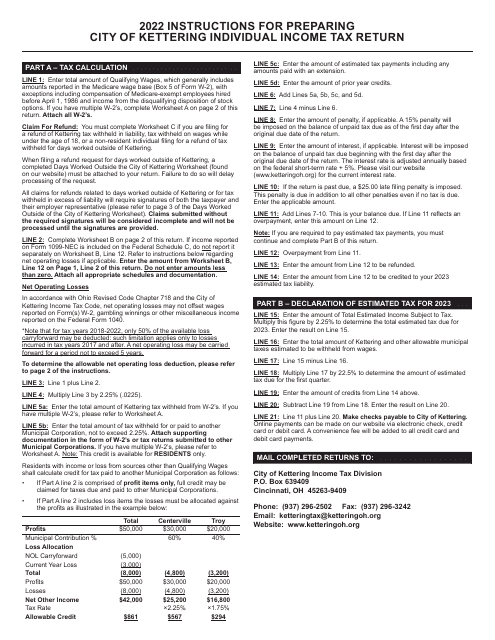

This document is used for filing the individual income tax return in the City of Kettering, Ohio. It provides instructions on how to accurately file your taxes and comply with the city's tax regulations.

This document is used for reporting additions and deductions for pass-through entities, estates, and trusts in North Carolina. It is a form that taxpayers can use to accurately report their income, expenses, and deductions related to these entities.

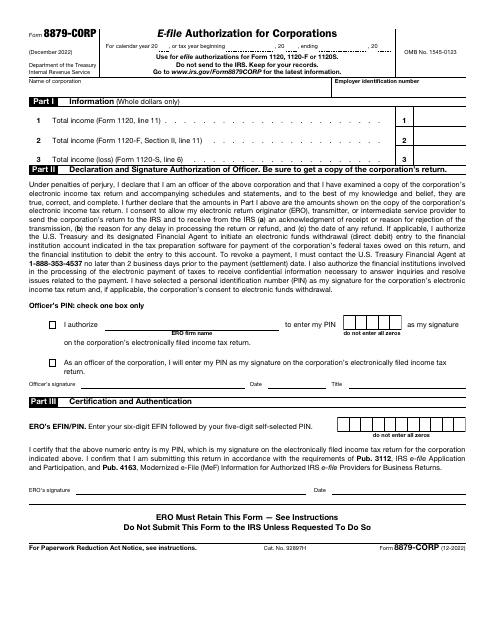

This Form is used for authorizing corporations to e-file their tax returns with the IRS.