Tax Preparer Templates

Documents:

1288

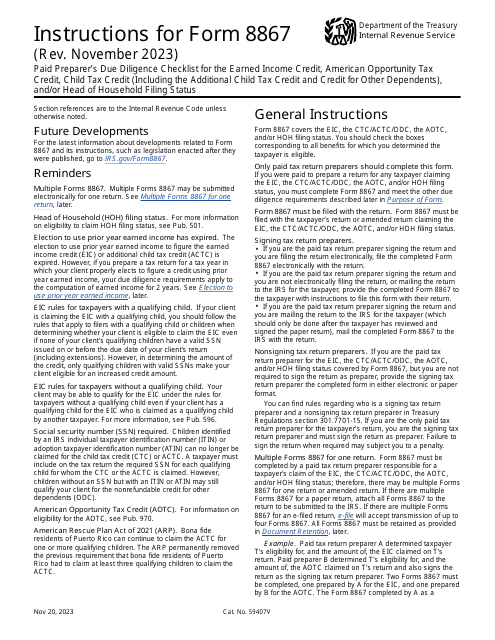

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

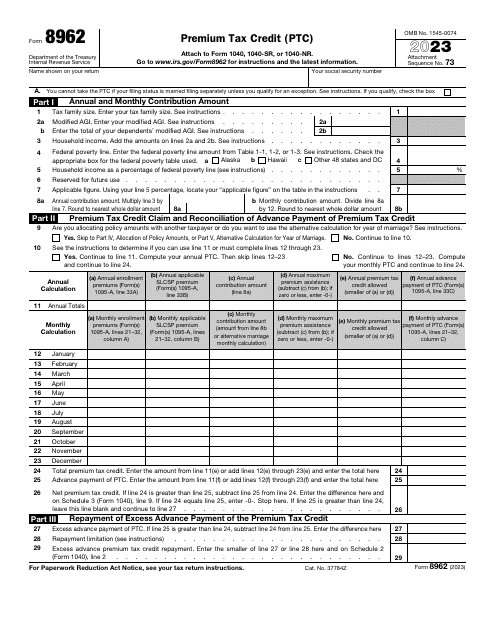

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

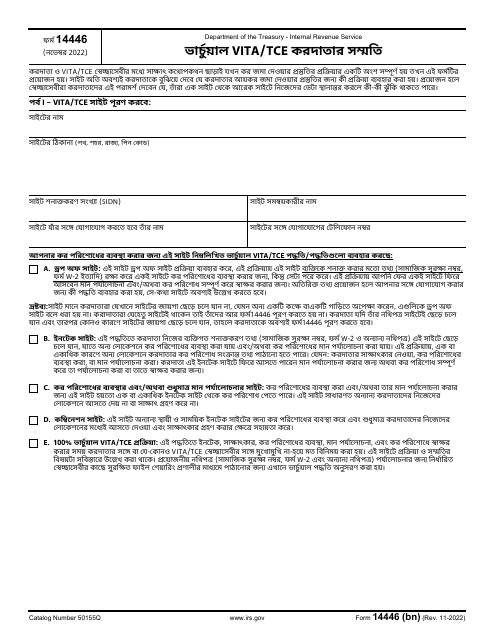

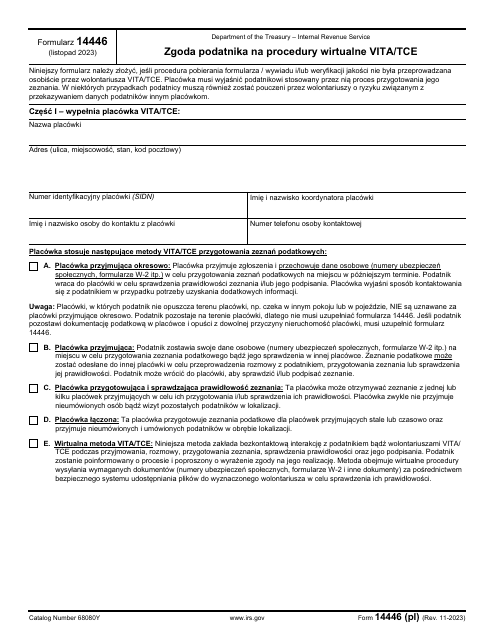

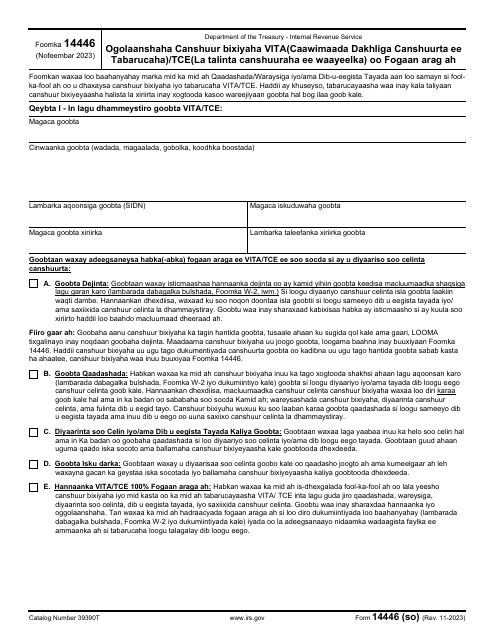

This form is used for obtaining taxpayer consent in Bengali language for the Virtual Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs conducted by the IRS.

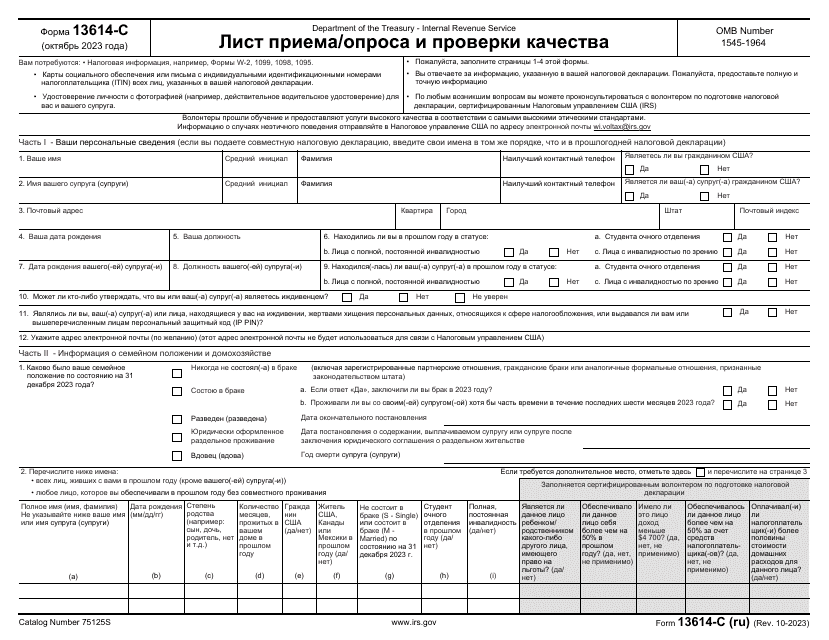

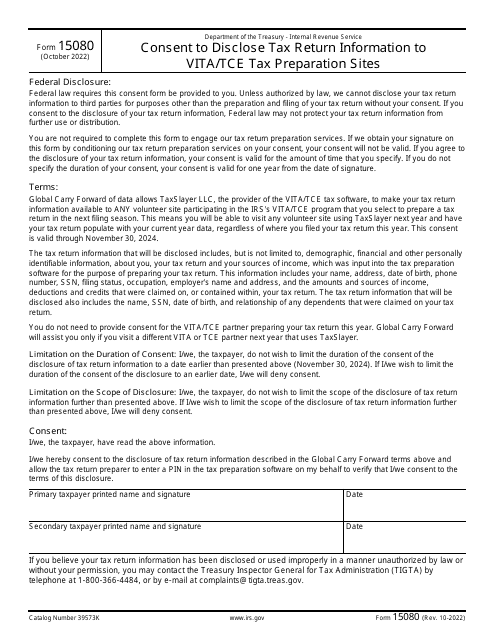

This form is used for granting consent to share tax return information with Vita/Tce tax preparation sites.

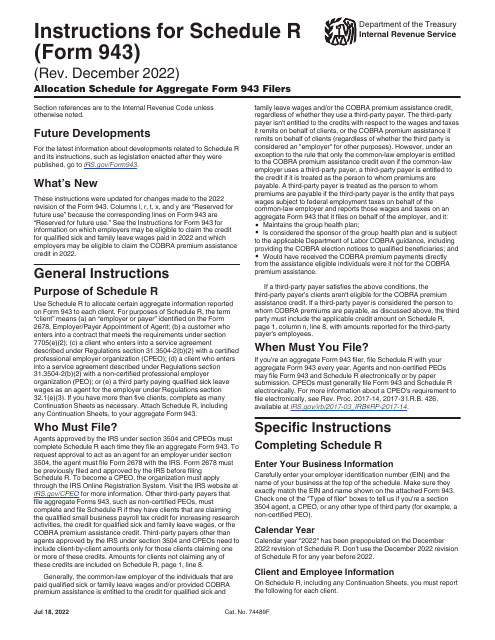

This form is used for allocating wages and taxes for employers who file an Aggregate Form 943 with the IRS. It provides instructions on how to accurately report employee wages and taxes for agricultural workers.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

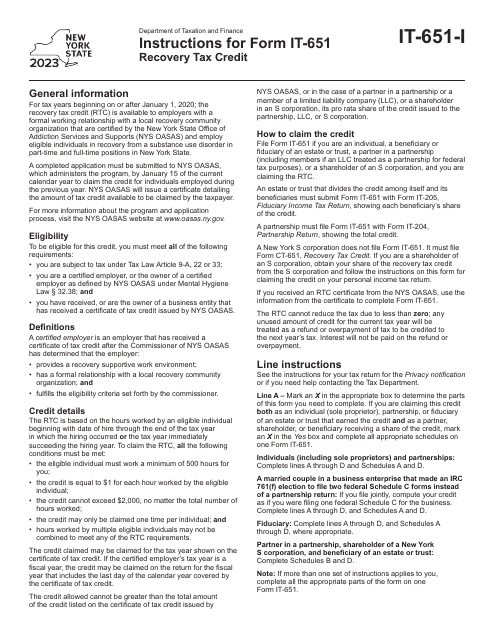

This Form is used for claiming the QETC Employment Credit in the state of New York. It provides instructions on how to fill out and submit the form to receive the credit.

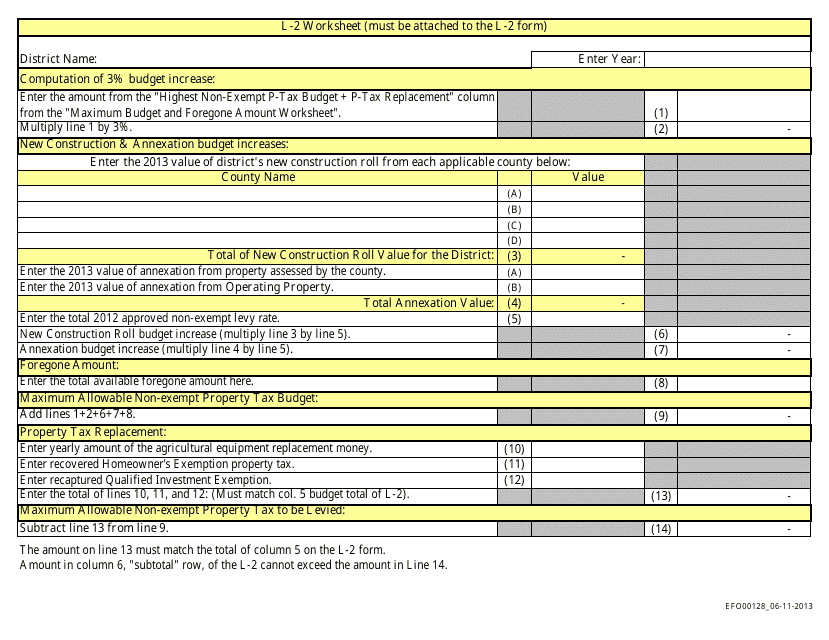

This Form is used for completing the L-2 worksheet in Idaho. It is used for recording and calculating financial information for tax purposes.

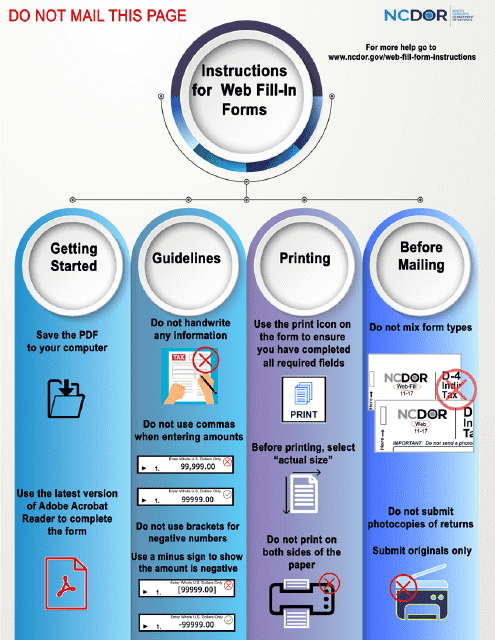

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.