Wage Report Templates

Are you a business owner or an employer? Are you looking for information on how to accurately track and report wages? Look no further! Our wage report documentation is here to provide you with all the guidance and resources you need.

Our comprehensive collection of wage reports covers everything from quarterly contribution and wage reports to annual contribution and wage reports. We have forms specifically tailored to various states like South Carolina, New York, North Carolina, Washington, D.C., and Illinois, ensuring that you have access to the right information for your location.

Whether you are a for-profit organization or a nonprofit organization, our wage reporting documentation has got you covered. We have detailed instructions on how to complete the necessary forms, along with information on the specific requirements and guidelines for each state.

With the alternate names like "wage reports" and "wage reporting forms," you can easily navigate through our documentation to find the specific information you need. Our aim is to simplify the wage reporting process for you, so you can focus on running your business and ensuring compliance with the relevant regulations.

Don't let wage reporting be a headache. Let our wage report documentation guide you through the process, providing you with the knowledge and resources you need to accurately track and report wages. Trust us to be your go-to source for all your wage reporting needs.

Documents:

93

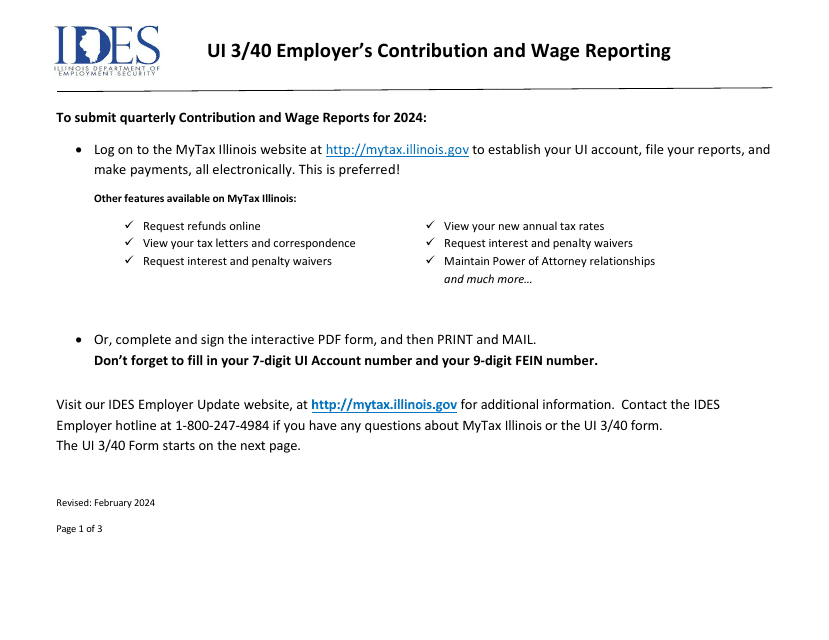

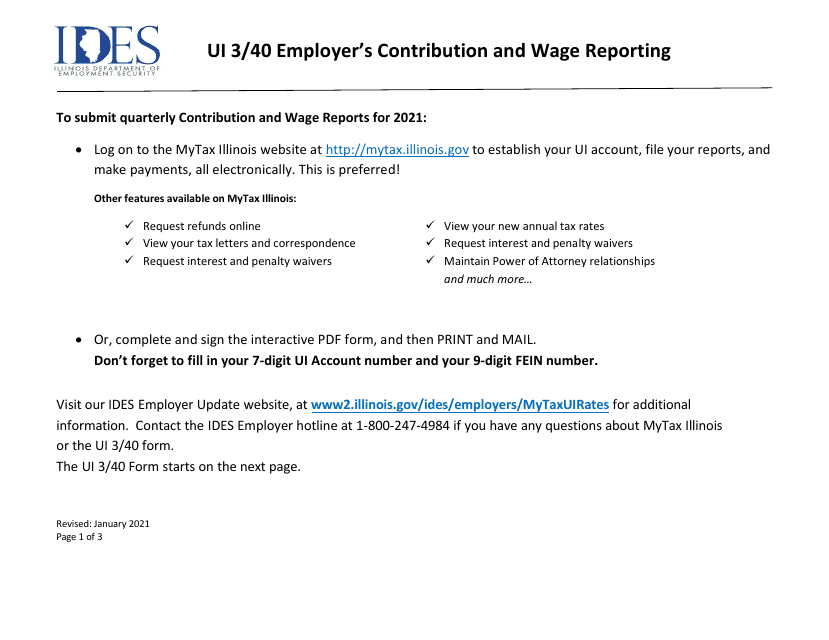

This is an Illinois state form filed quarterly by each employer subject to the Illinois Unemployment Insurance Act. All employers are to file who have had one or more employees located in Illinois that worked any day during each of 20 or more weeks within a calendar year.

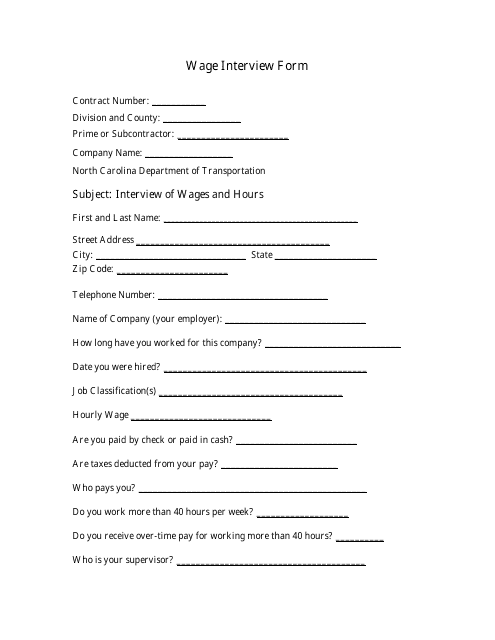

This Form is used for conducting wage interviews in North Carolina.

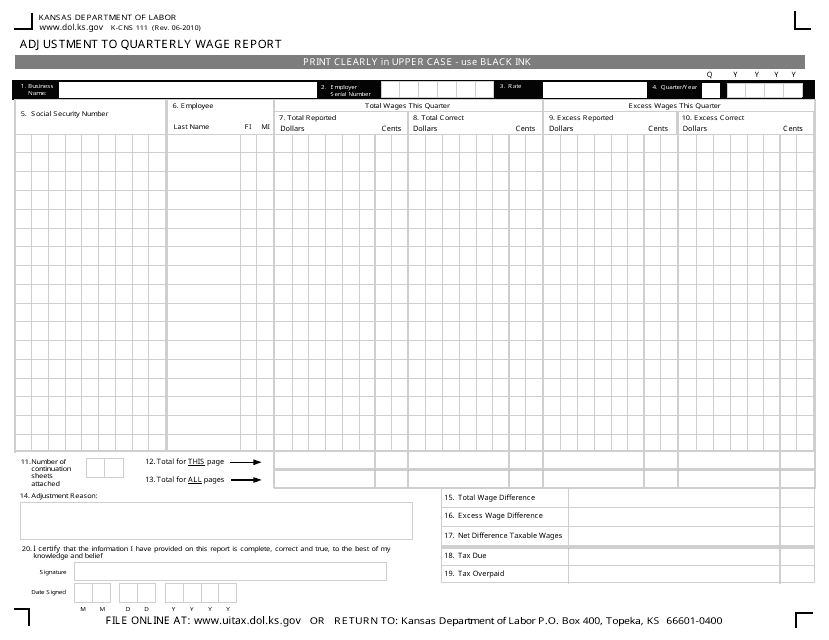

This form is used for making adjustments to the quarterly wage report in Kansas.

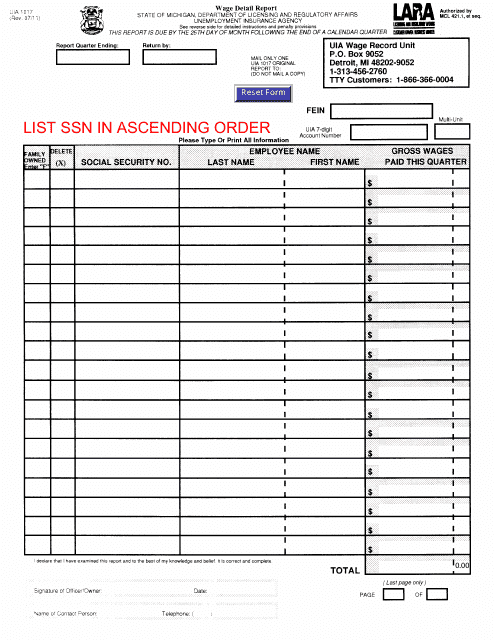

This form is used for reporting wage details in the state of Michigan.

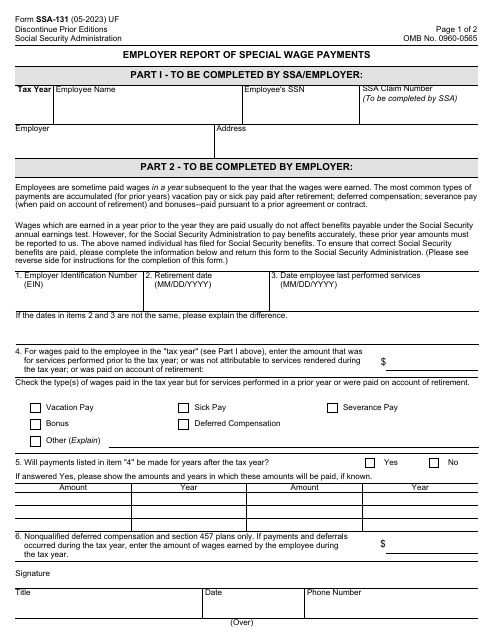

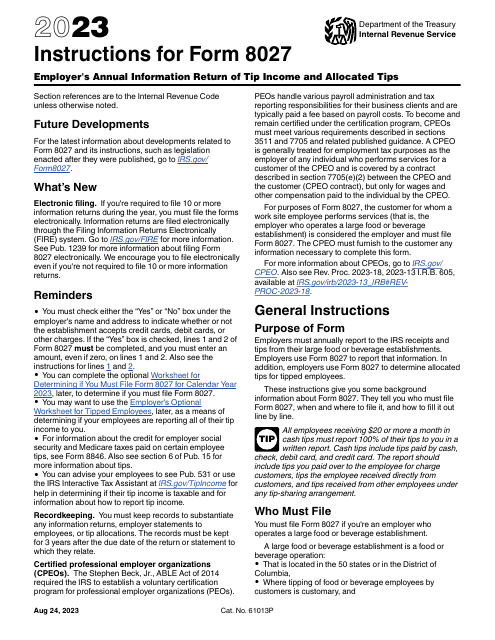

Download this form if you are an employer and need to report the special wages you pay to an employee.

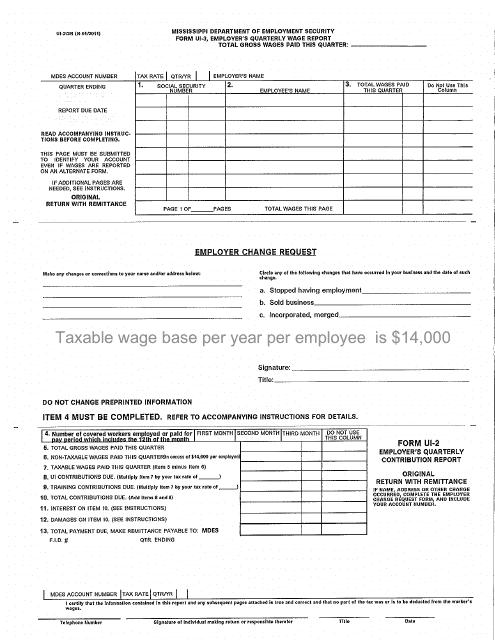

This form is used for employers in Mississippi to report quarterly wages and contributions.

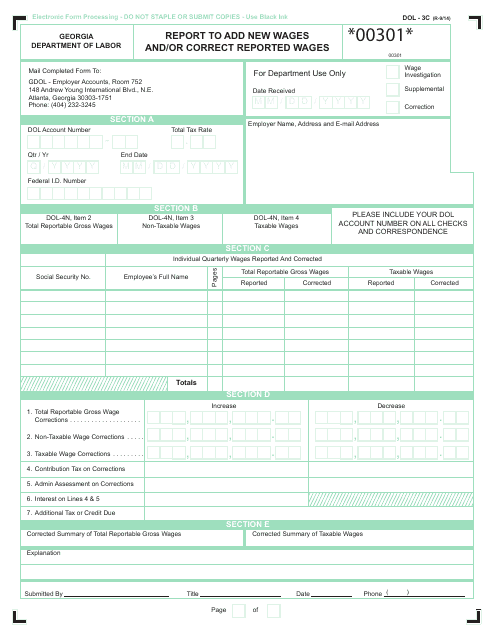

This Form is used for reporting new wages or correcting the reported wages in Georgia. It is called DOL-3C Report.

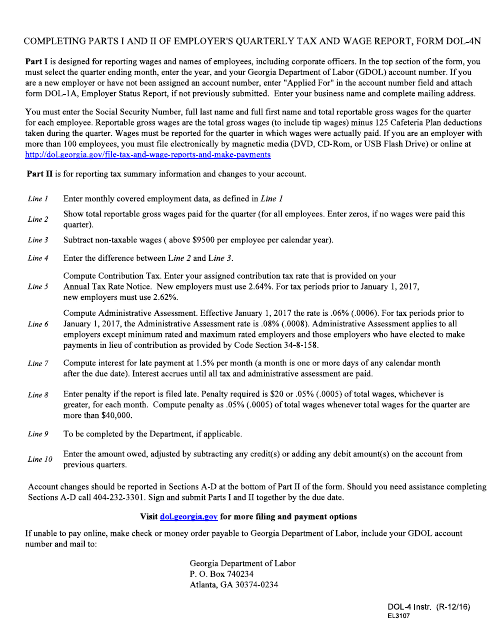

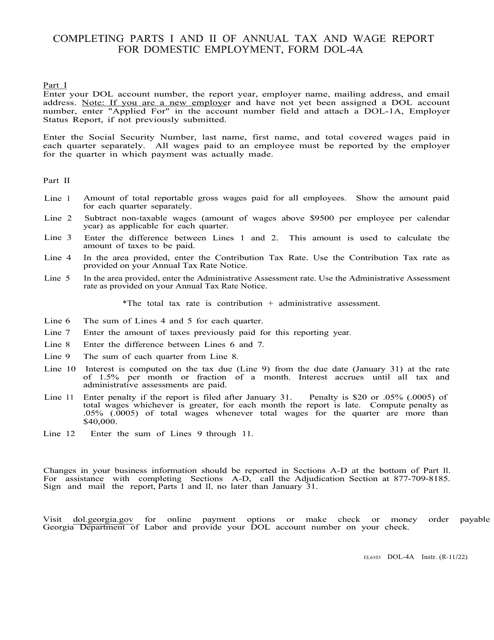

This is a formal document for the state of Georgia that all employers must file each quarter if their business is active to inform the authorities about the wages they have paid to their employees.

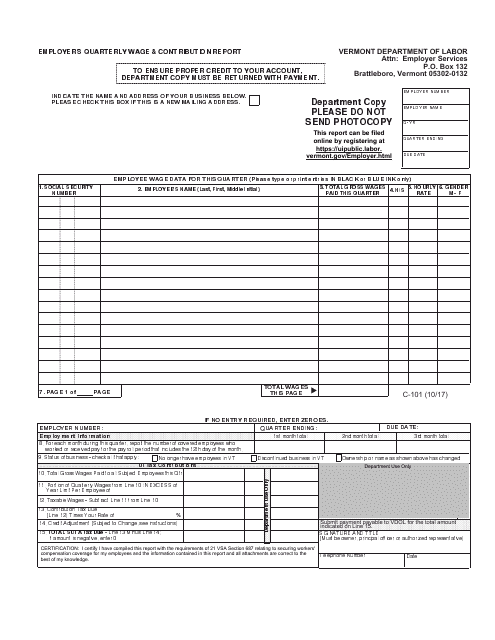

This form is used for employers in Vermont to report quarterly wages and contributions to the Department of Labor.

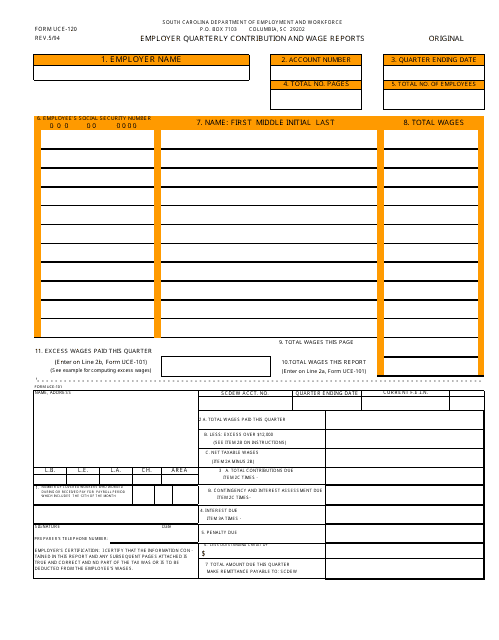

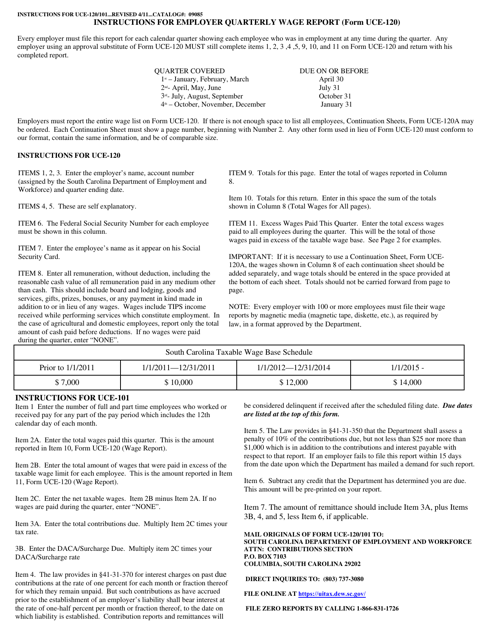

This form is used for employers in South Carolina to report their quarterly contributions and wages.

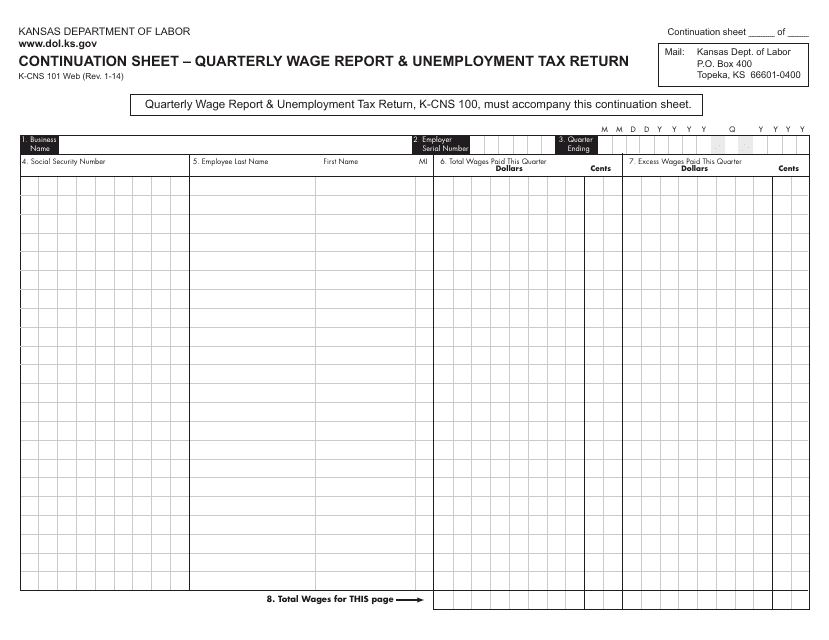

This form is used for reporting quarterly wages and unemployment taxes in the state of Kansas. It serves as a continuation sheet for the K-CNS101 form.

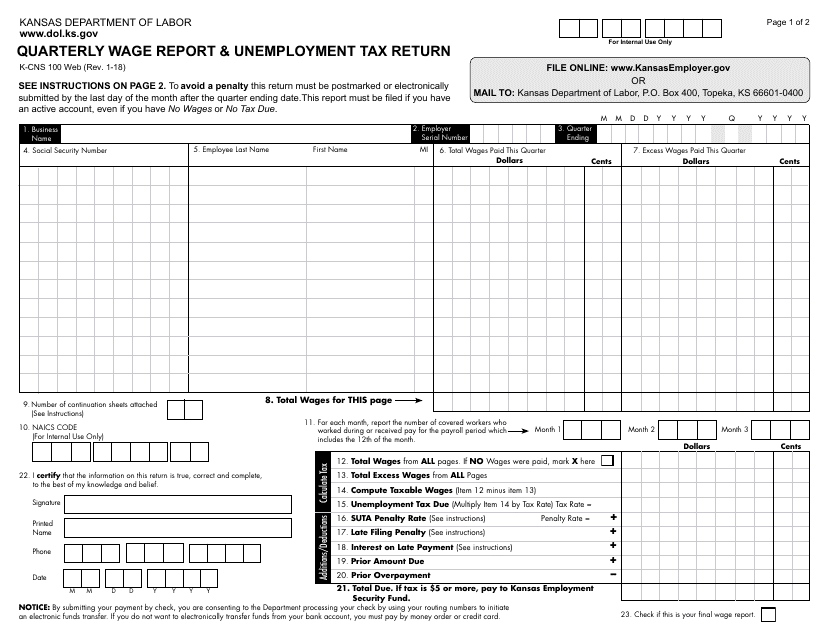

This form is used for reporting quarterly wages and paying unemployment tax in the state of Kansas.

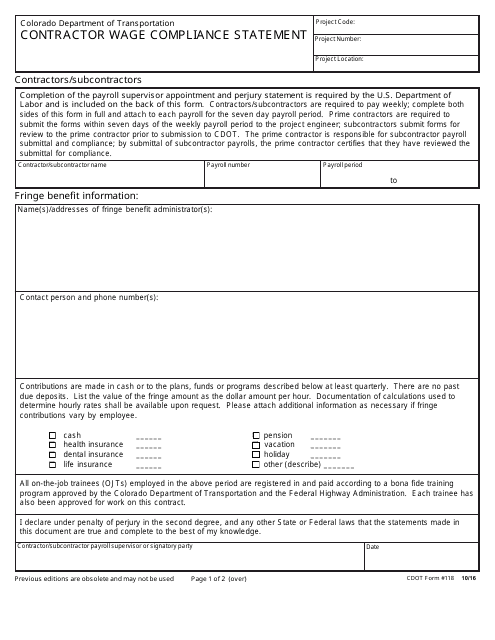

This Form is used for contractors in Colorado to provide a wage compliance statement.

This form is used for reporting an employee's wages for fifty-two weeks in the state of Hawaii.

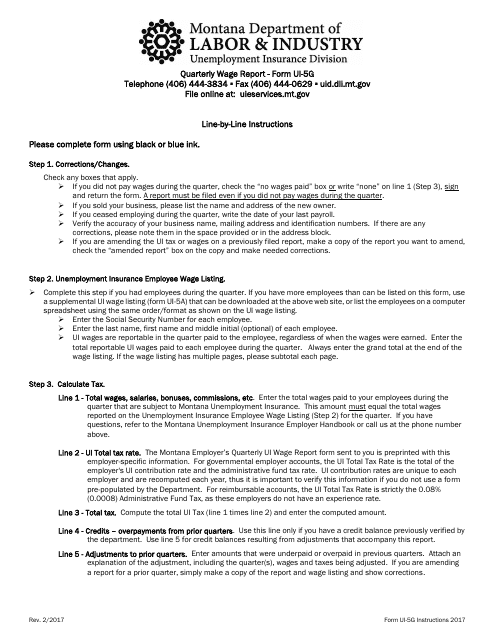

This Form is used for employers in Montana to report their quarterly wage information for unemployment insurance purposes. It is required by the Montana Department of Labor and Industry.

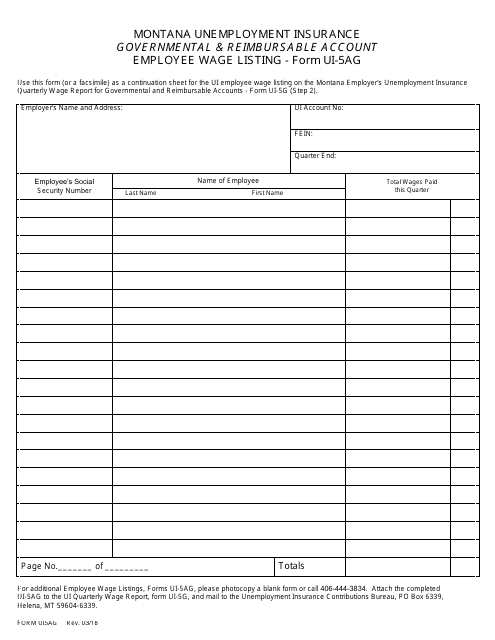

This Form is used for reporting employee wages for a Governmental & Reimbursable Account in Montana.

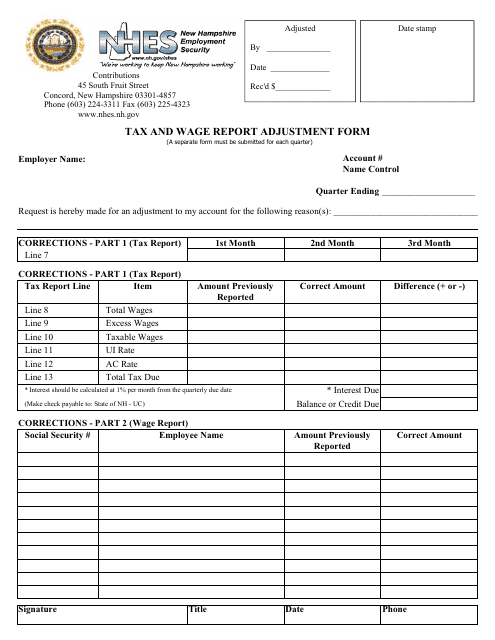

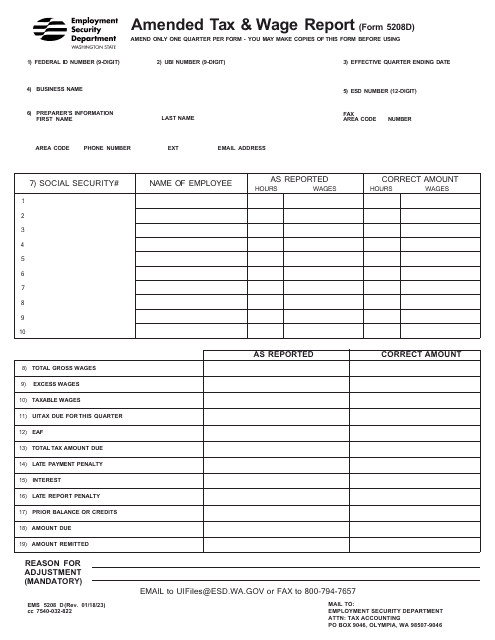

This Form is used for adjusting tax and wage reports in the state of New Hampshire.

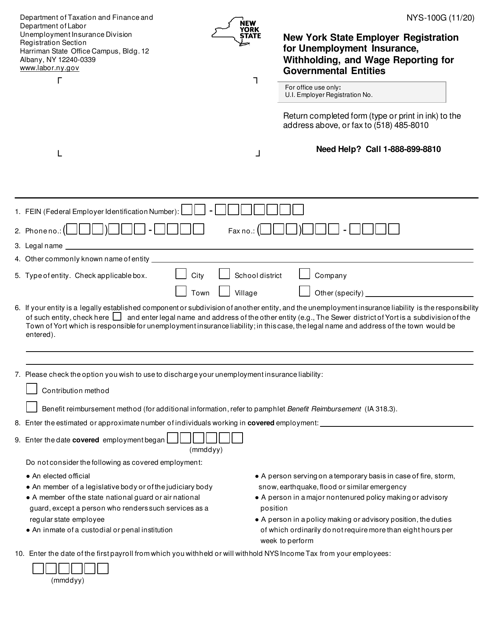

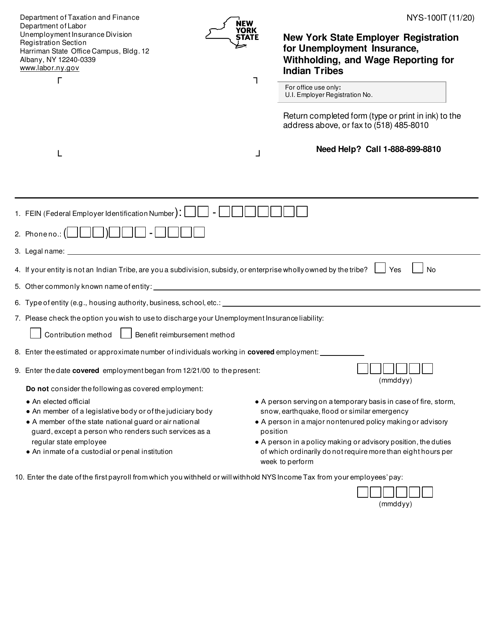

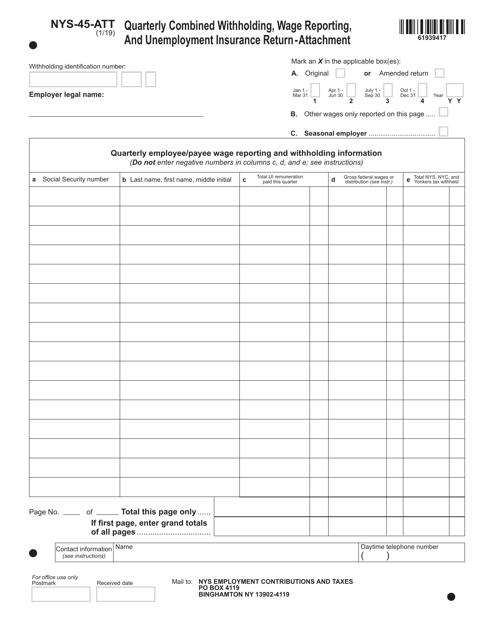

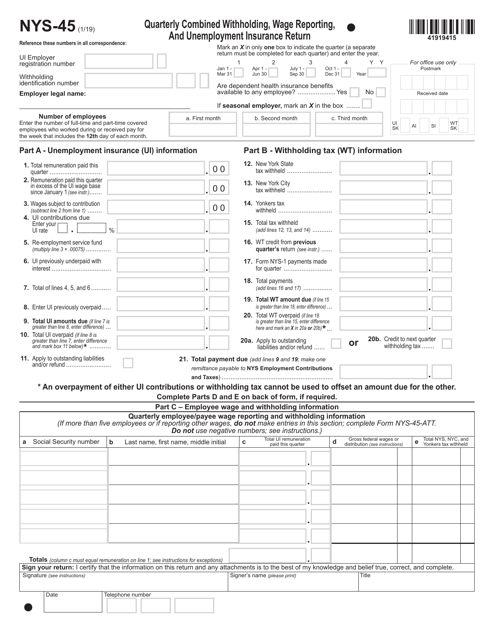

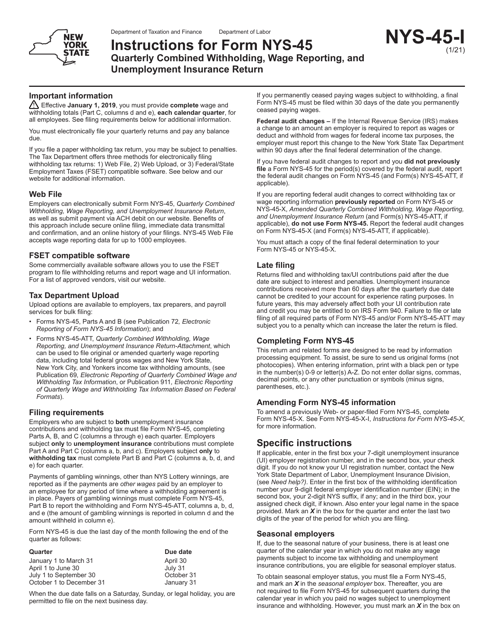

This document provides instructions for Form NYS-45-ATT, which is used for quarterly combined withholding, wage reporting, and unemployment insurance return in New York.

This form is used for quarterly reporting and payment of withholding taxes, wage information, and unemployment insurance in the state of New York.

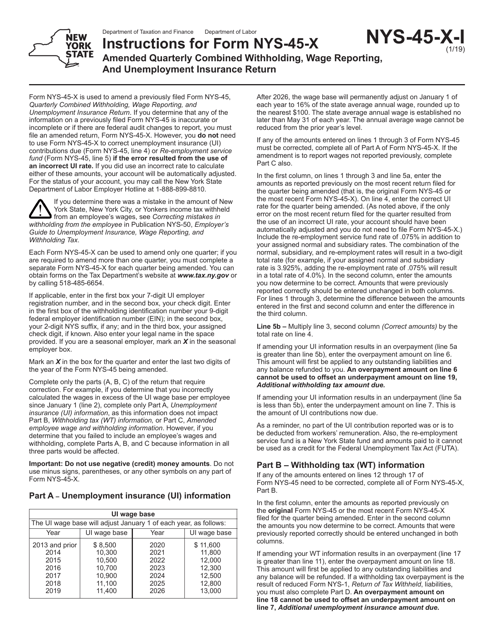

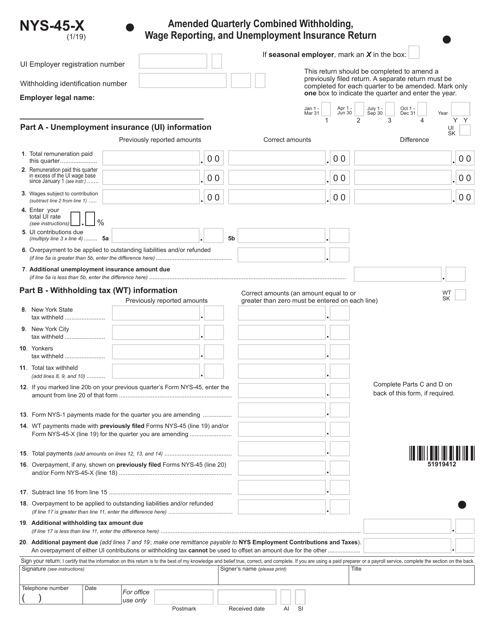

This form is used for amending the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return in the state of New York. It provides instructions for how to correctly complete and submit the amended return.

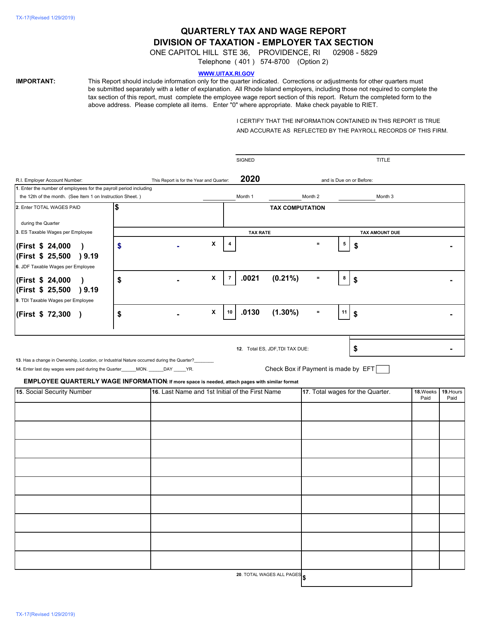

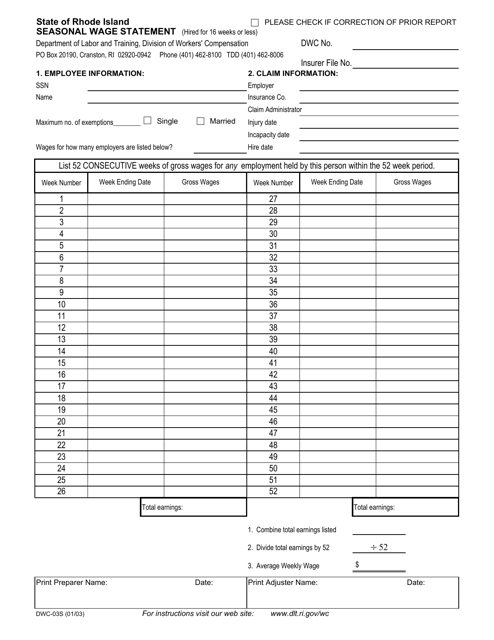

This form is used for reporting seasonal wages in Rhode Island. It is used by employers to provide a statement of wages paid to seasonal workers.

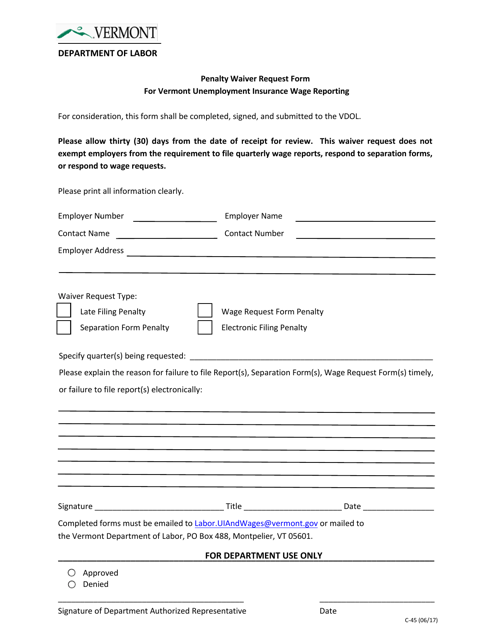

This form is used for requesting a penalty waiver for Vermont Unemployment Insurance wage reporting.

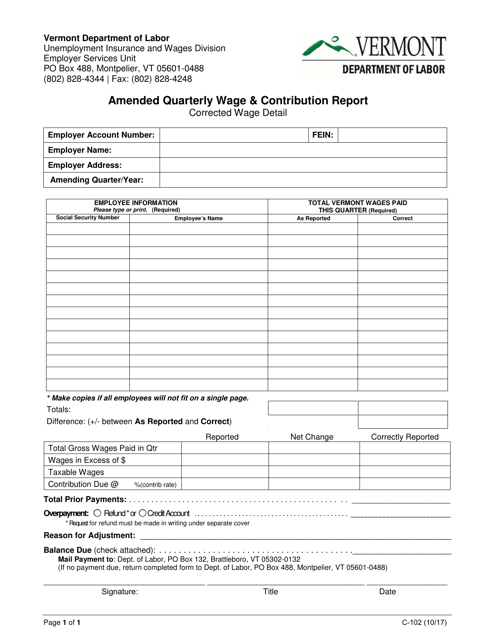

This form is used for reporting amended quarterly wages and contributions in Vermont.

This form is used for submitting quarterly wage reports by employers in South Carolina. It provides instructions on how to fill out Form UCE-120 accurately and submit it to the appropriate authorities.

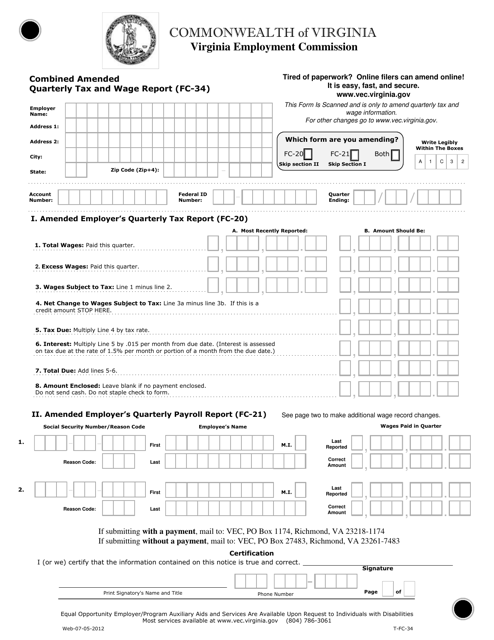

This form is used for submitting an amended quarterly report for withholding taxes, wage reporting, and unemployment insurance in the state of New York.

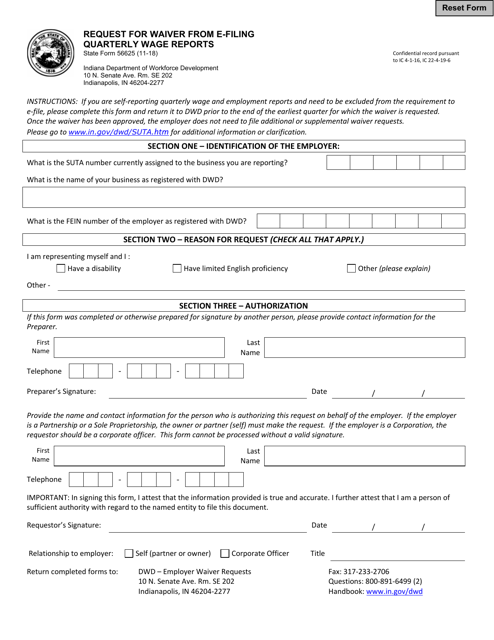

This document is used for requesting a waiver from electronically filing quarterly wage reports in the state of Indiana.

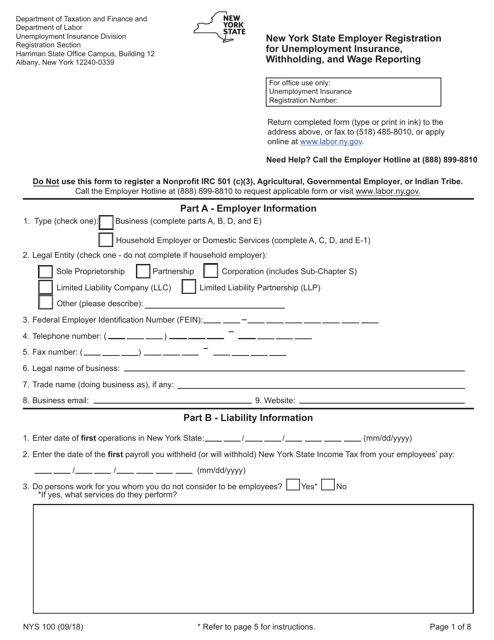

This is a form that should be completed by business employers or household employers of domestic services to register for Unemployment Insurance.

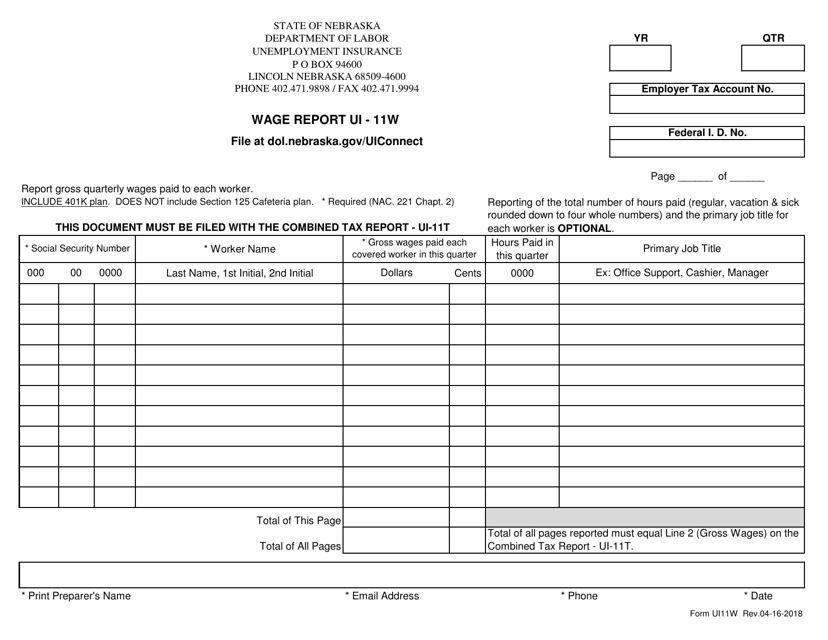

This Form is used for reporting wages in the state of Nebraska. It is used by employers to provide information on their employees' earnings for tax purposes.