Wage Report Templates

Documents:

93

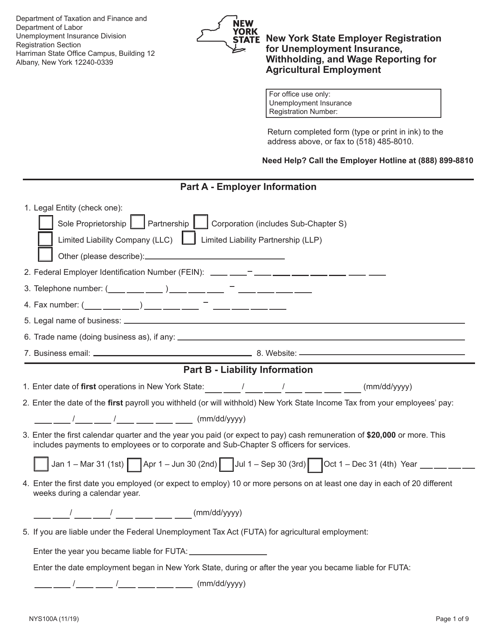

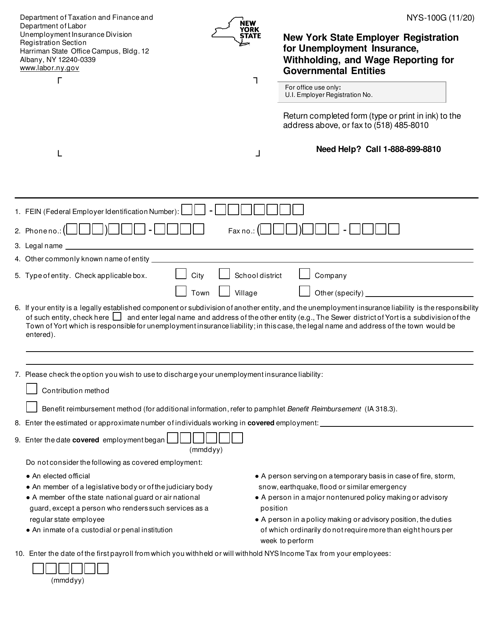

This form is used for employers in New York State to register for unemployment insurance, withholding taxes, and wage reporting specifically for agricultural employment.

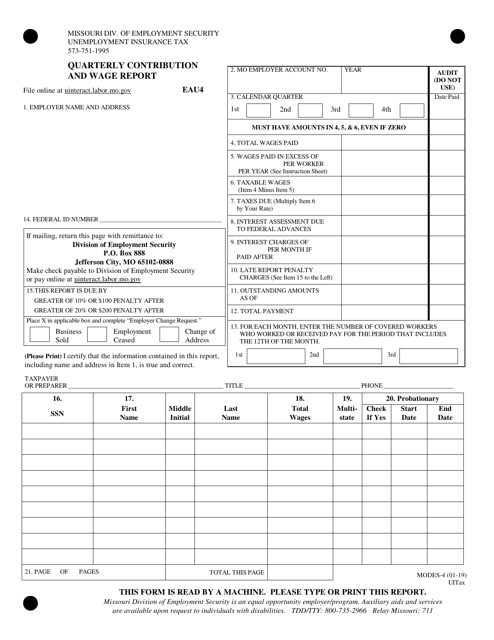

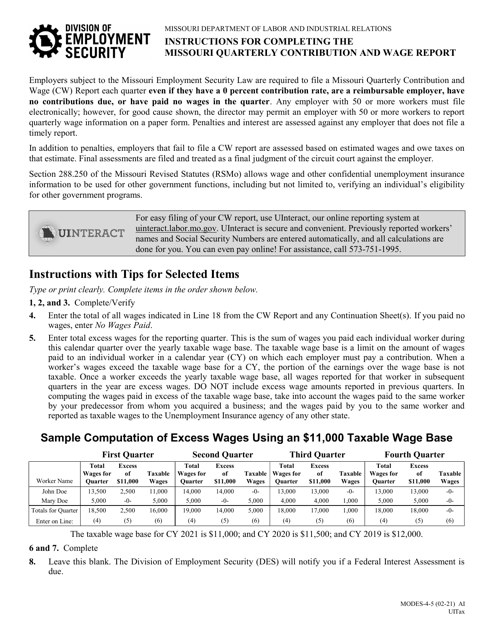

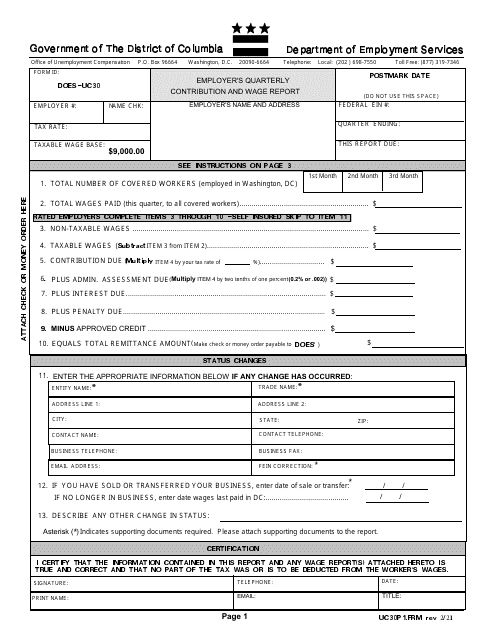

This form is used for reporting quarterly contributions and wages in Missouri

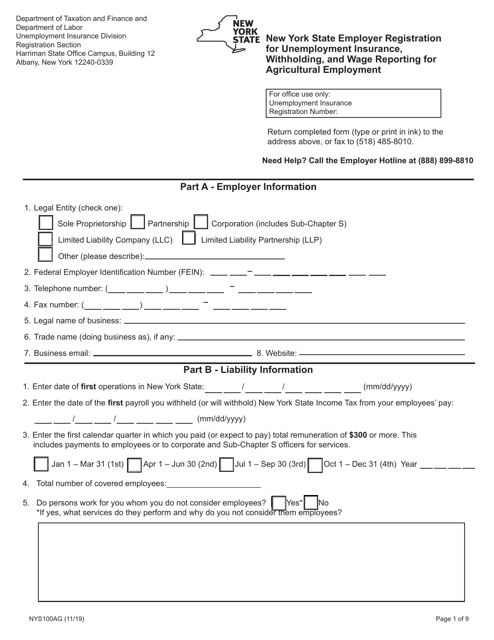

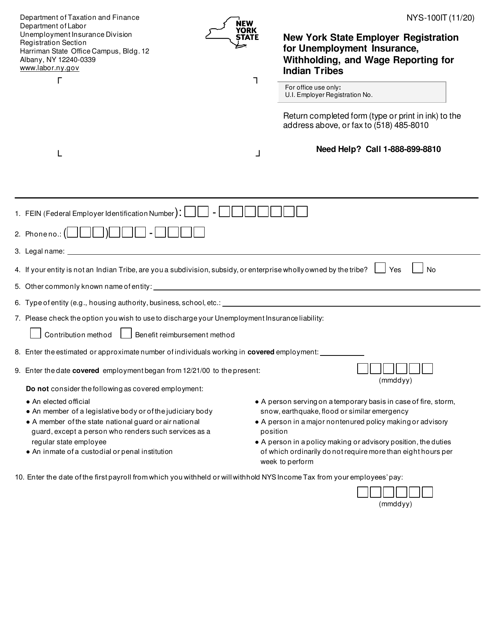

This form is used for registering agricultural employers in New York State for unemployment insurance, withholding, and wage reporting.

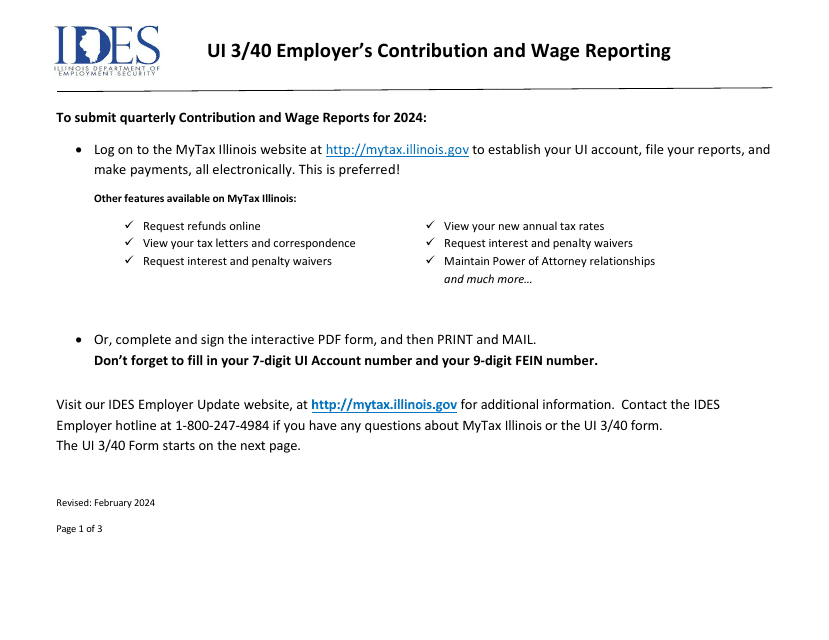

This is an Illinois state form filed quarterly by each employer subject to the Illinois Unemployment Insurance Act. All employers are to file who have had one or more employees located in Illinois that worked any day during each of 20 or more weeks within a calendar year.

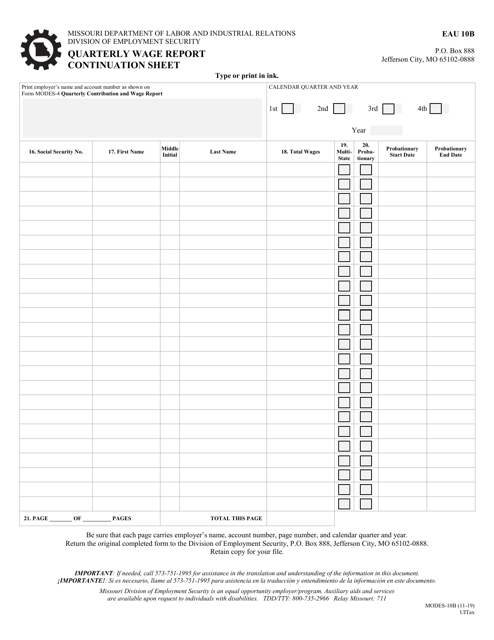

This Form is used for reporting quarterly wages in Missouri. It is a continuation sheet for the MODES-10B Quarterly Wage Report.

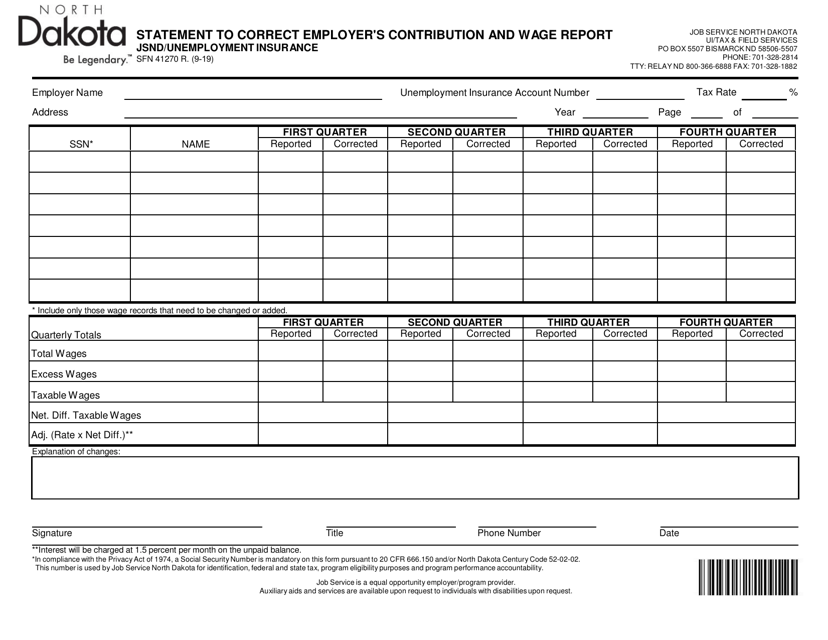

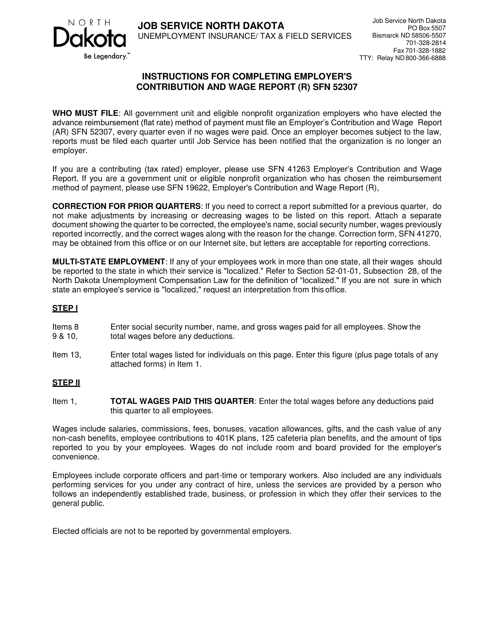

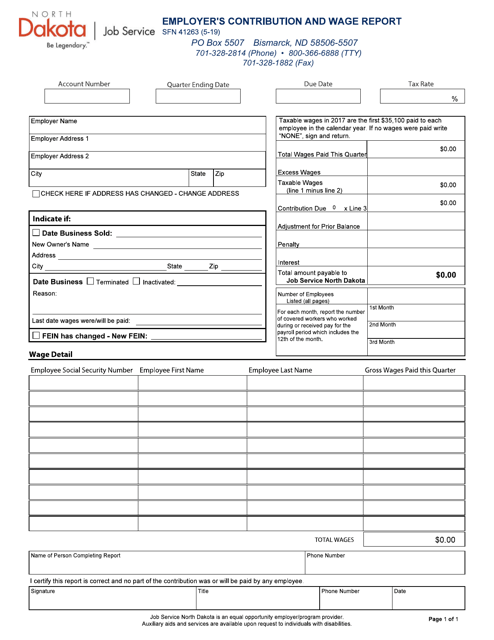

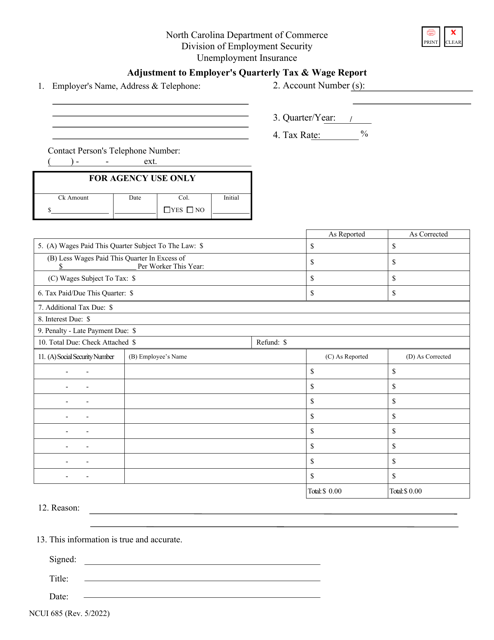

This form is used for individuals to correct their employer's contribution and wage report in North Dakota.

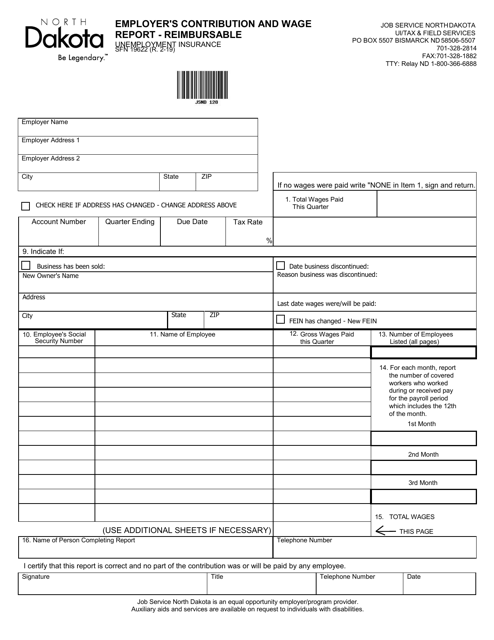

This Form is used for reporting employer's contributions and wages in North Dakota for the reimbursable program.

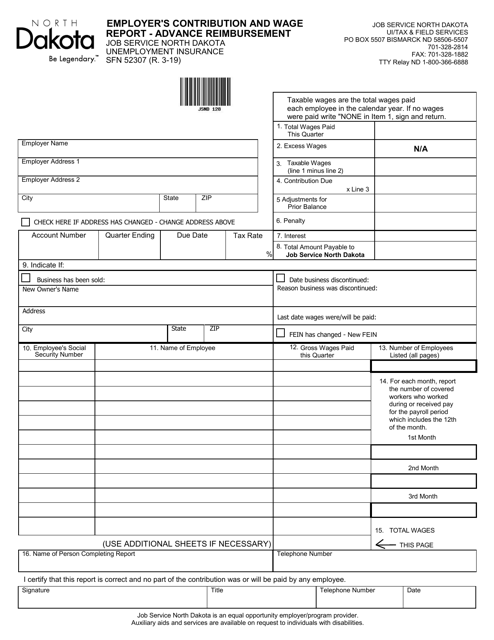

This form is used for employers in North Dakota to report their contributions and wages for advance reimbursement.

This form is used for employers in North Dakota to report their contributions and wages.

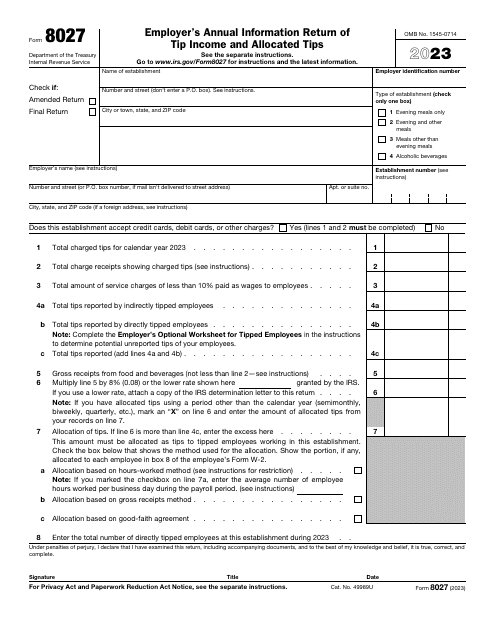

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

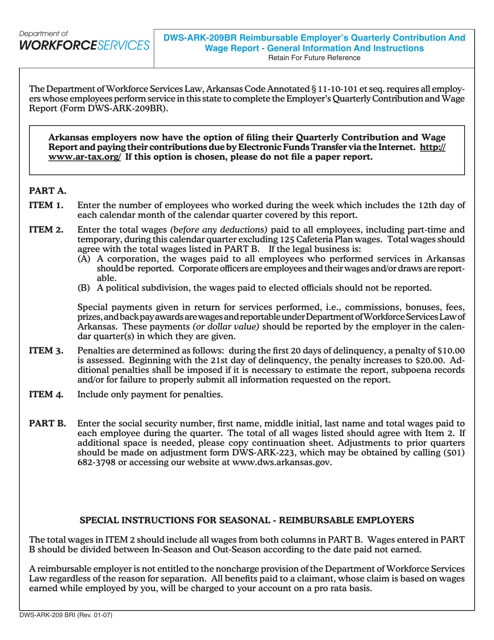

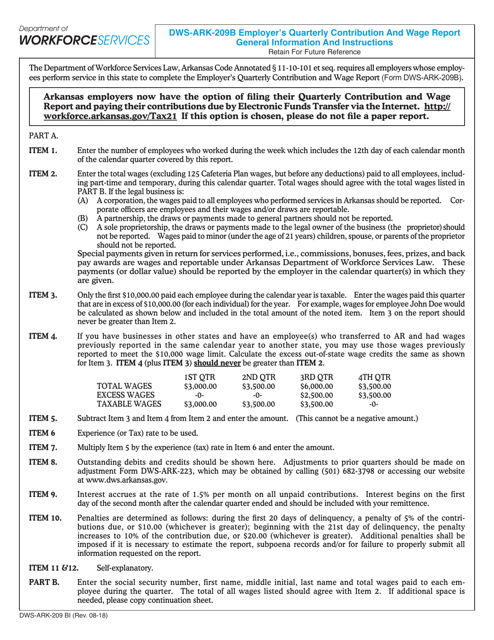

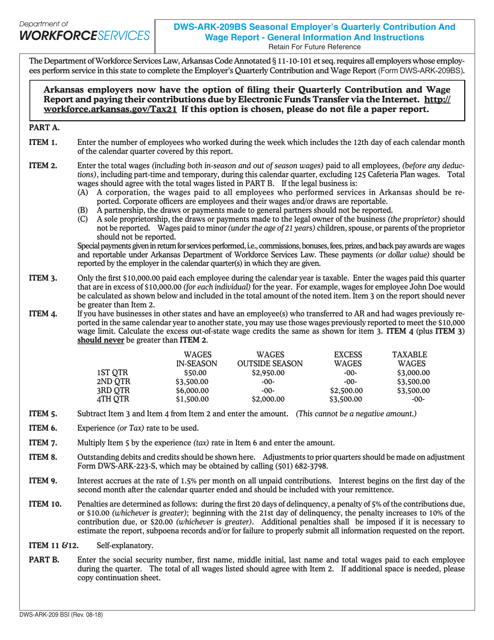

This document is used by employers in Arkansas to report their quarterly contributions and wages. It provides detailed instructions on how to fill out Form DWS-ARK-209B.

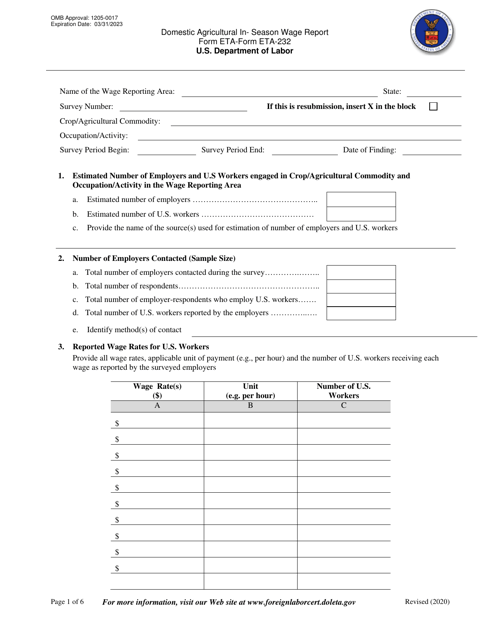

This form is used for reporting wages for domestic agricultural workers during the growing season. It is used to document and track the wages paid to agricultural workers in the United States.

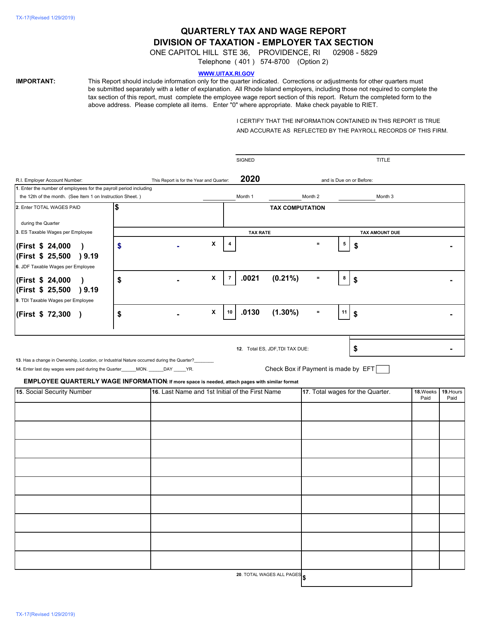

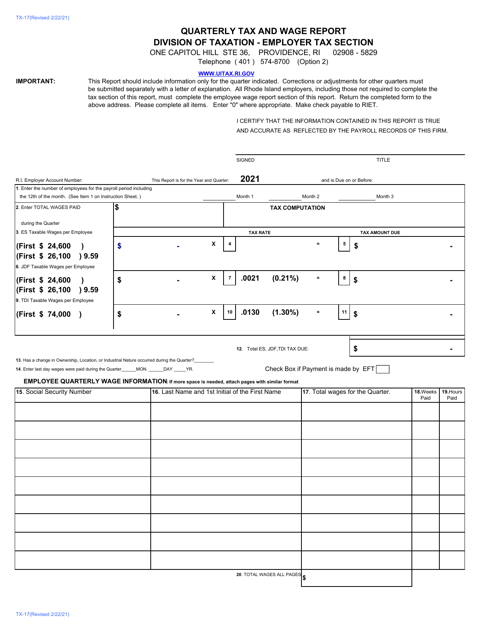

This form is used for reporting quarterly taxes and wages in the state of Rhode Island. It is required for employers to accurately report their payroll information to the state's tax agency.

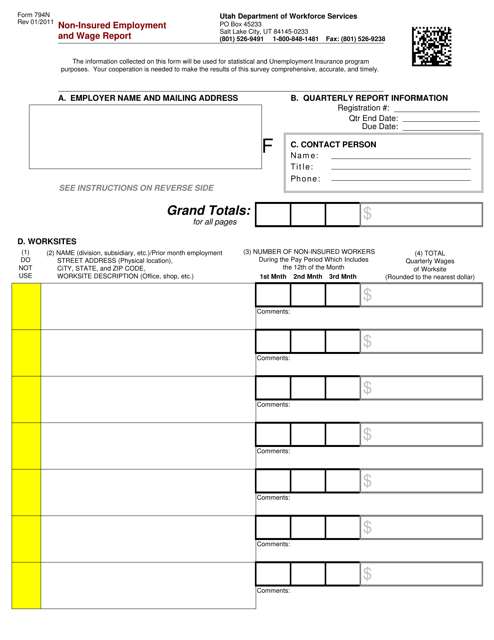

This Form is used for reporting employment and wage information for non-insured individuals in Utah.

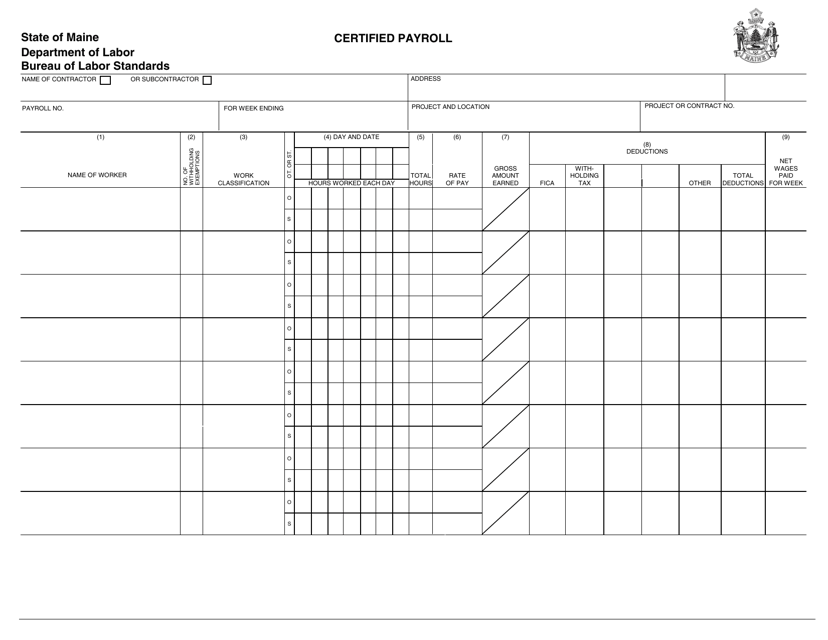

This document is used for certified payroll in the state of Maine. It provides a record of wages and benefits paid to employees on a specific project, ensuring compliance with prevailing wage laws.

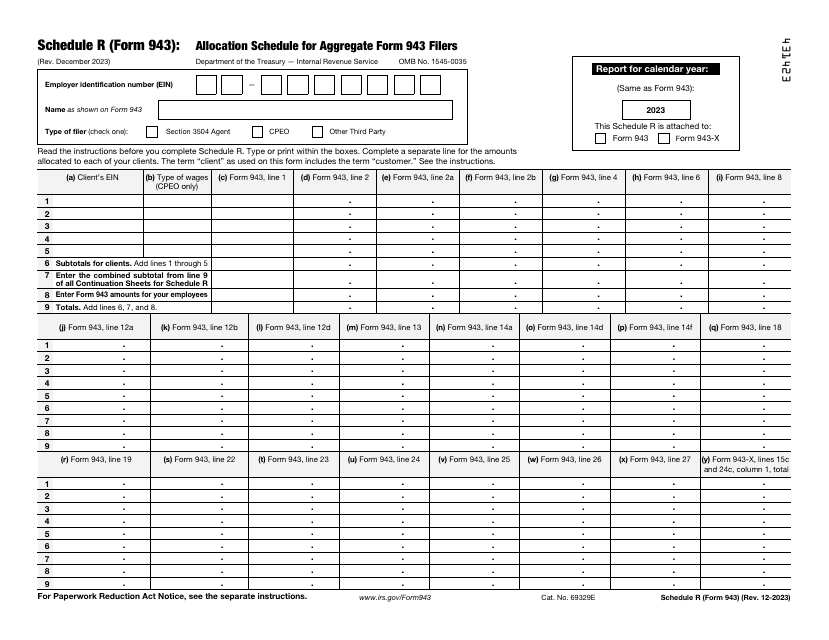

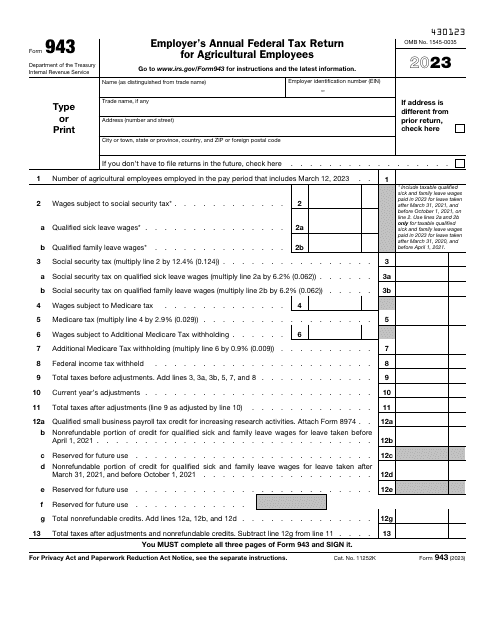

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

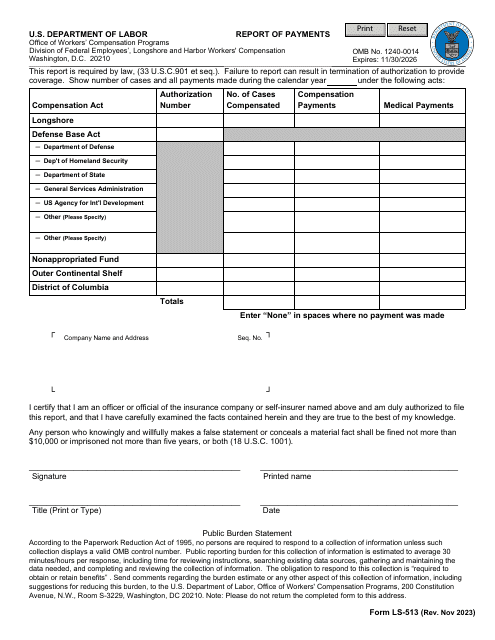

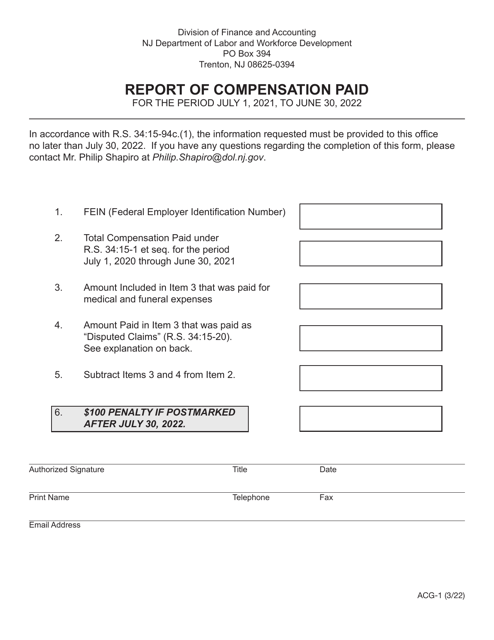

This form is used for reporting compensation paid in the state of New Jersey.

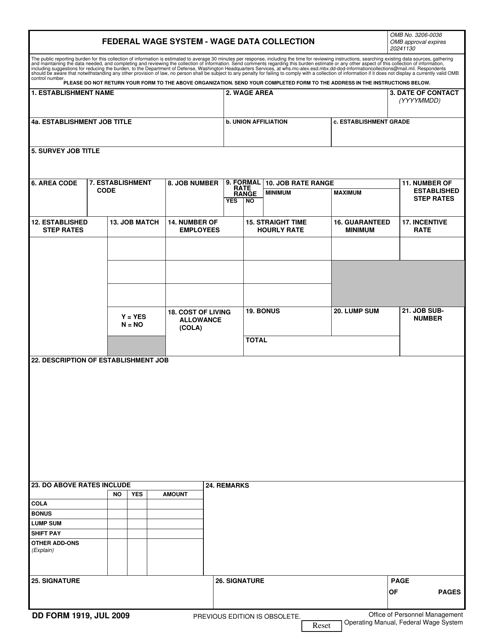

This Form is used for collecting wage data under the Federal Wage System. It helps to maintain accurate and up-to-date information about employee wages for federal jobs.

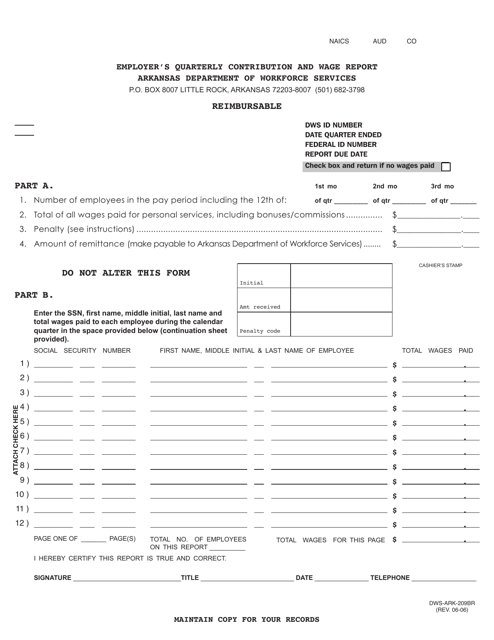

This form is used for Arkansas employers to report their quarterly contributions and wages for reimbursable unemployment insurance.

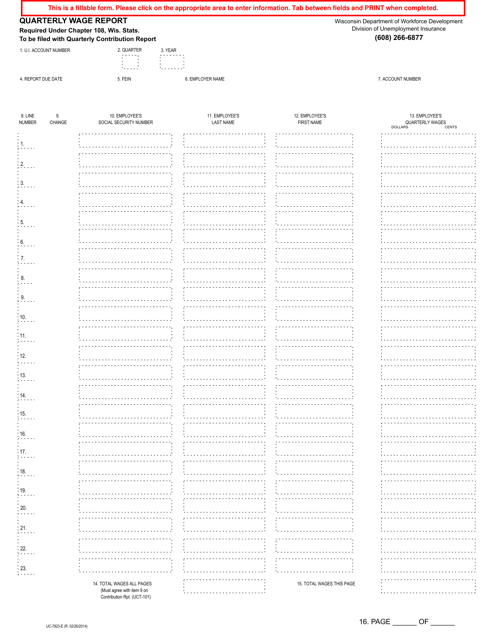

This Form is used for Quarterly Wage Report in Wisconsin.