Property Assessment Forms and Templates

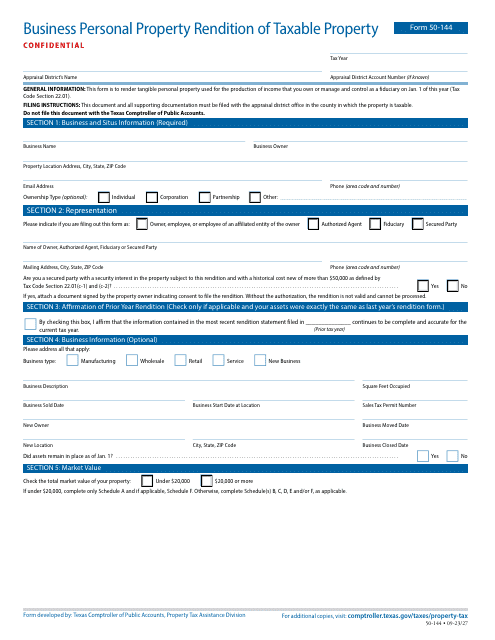

Property Assessment Forms are used to assess the value of a property for tax purposes. These forms are typically filled out by property owners or appraisers and provide information about the property's characteristics, such as its size, condition, and any improvements or changes made to the property. The data collected on these forms helps determine the property's assessed value, which is used to calculate property taxes. By filling out these forms accurately, property owners ensure that their property is assessed fairly and that they pay the correct amount of taxes based on its value.

Documents:

237

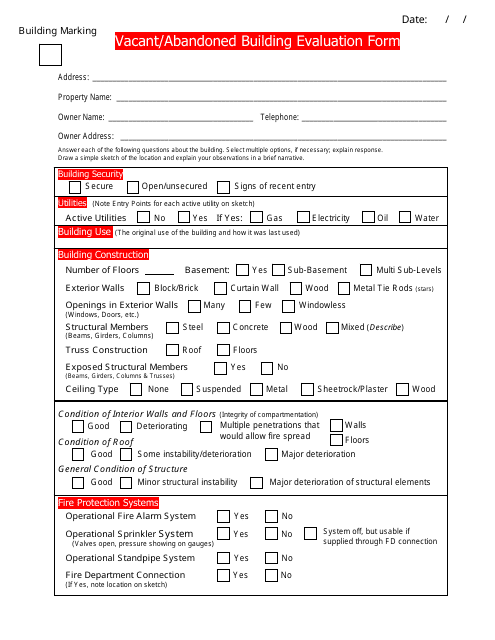

This form is used for evaluating vacant or abandoned buildings. It helps assess the condition and potential risks associated with these structures.

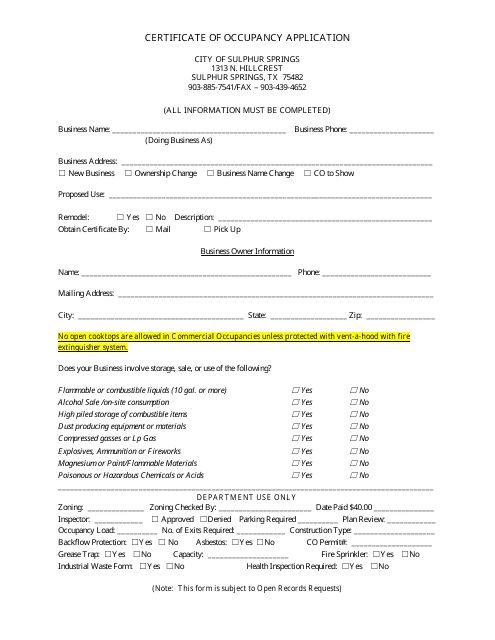

This form is used for applying for a Certificate of Occupancy in the City of Sulphur Springs, Texas.

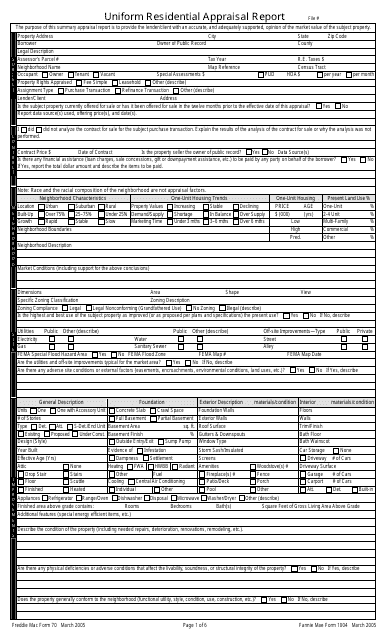

This Form is used for completing a residential appraisal report for Fannie Mae. It provides a detailed evaluation of a property's value and condition.

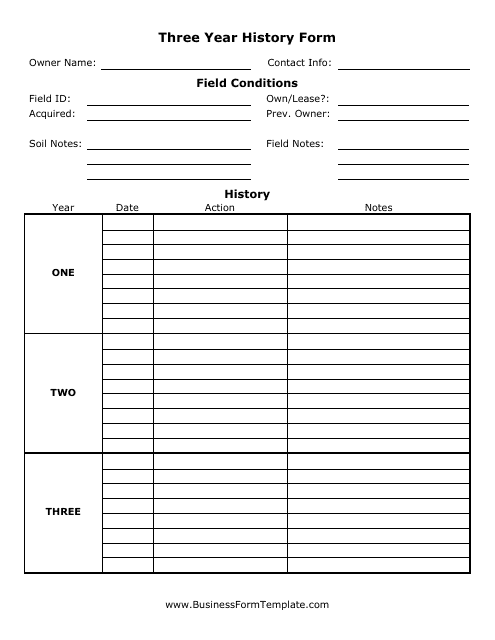

This form is used for documenting the three-year history of a property. It includes information about previous owners, maintenance and repairs, and any changes made to the property during that time.

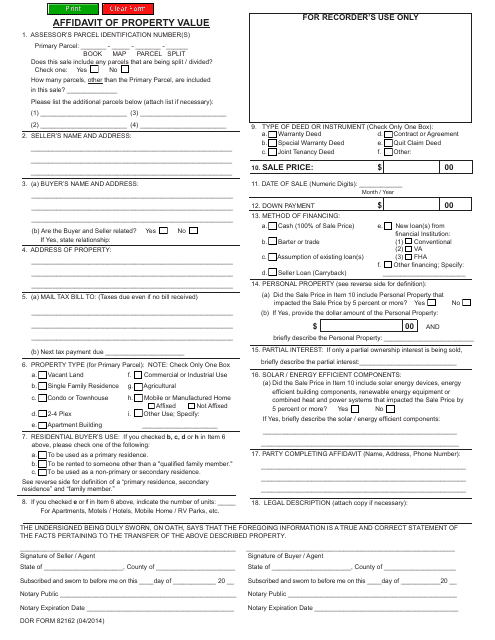

This form is used for declaring the value of property in the state of Arizona. It is an affidavit that provides information about the property and its estimated value.

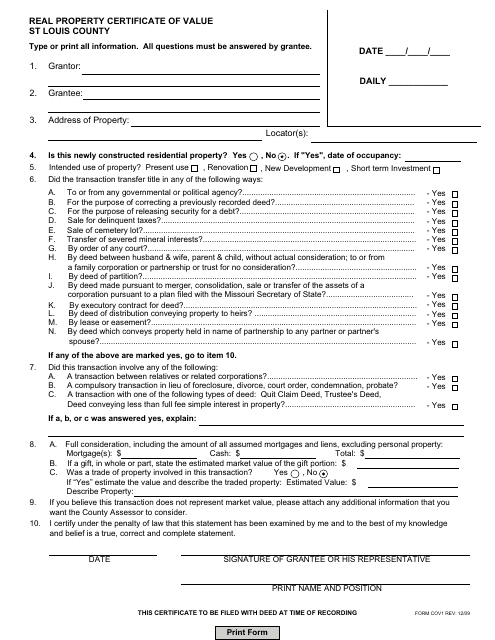

This Form is used for reporting the value of real property in St. Louis County, Missouri.

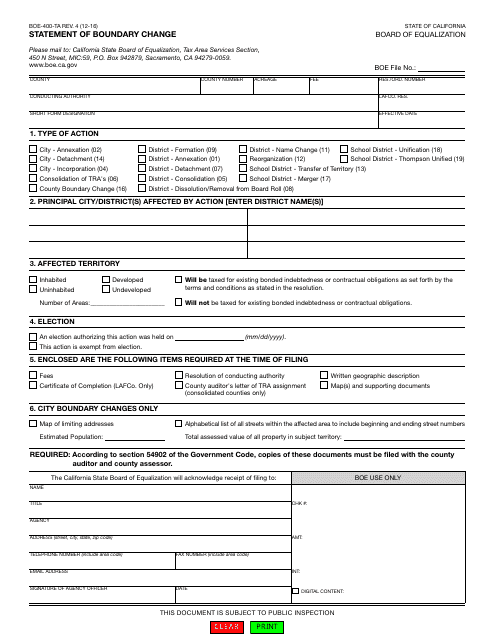

This form is used for reporting boundary changes in California.

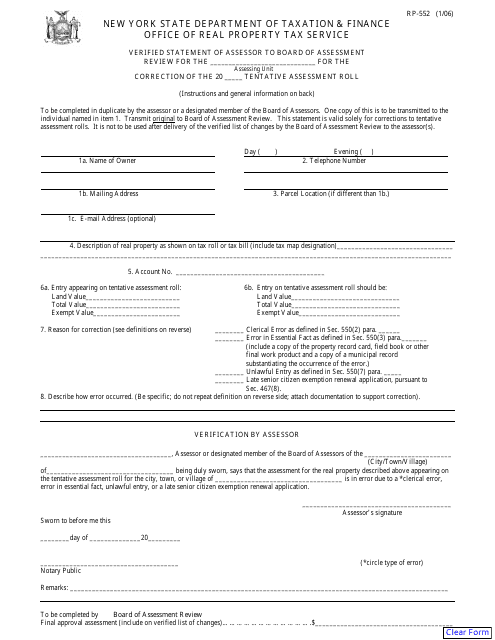

This form is used for the verified statement of the assessor to the Board of Assessment Review in New York. It is to provide accurate and verifiable information regarding assessments.

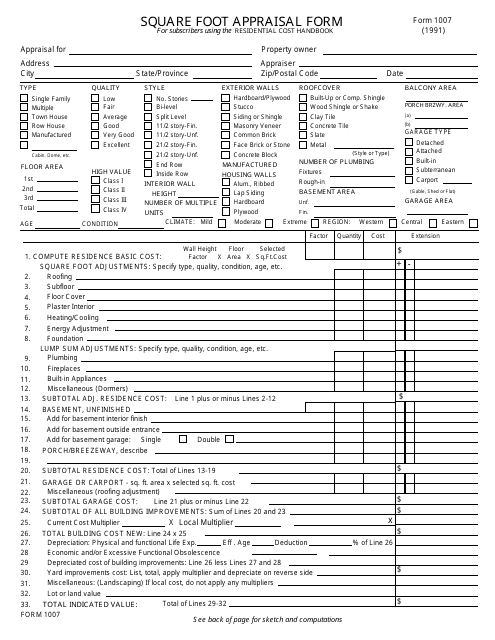

This form is used for assessing the value of a property based on its square footage.

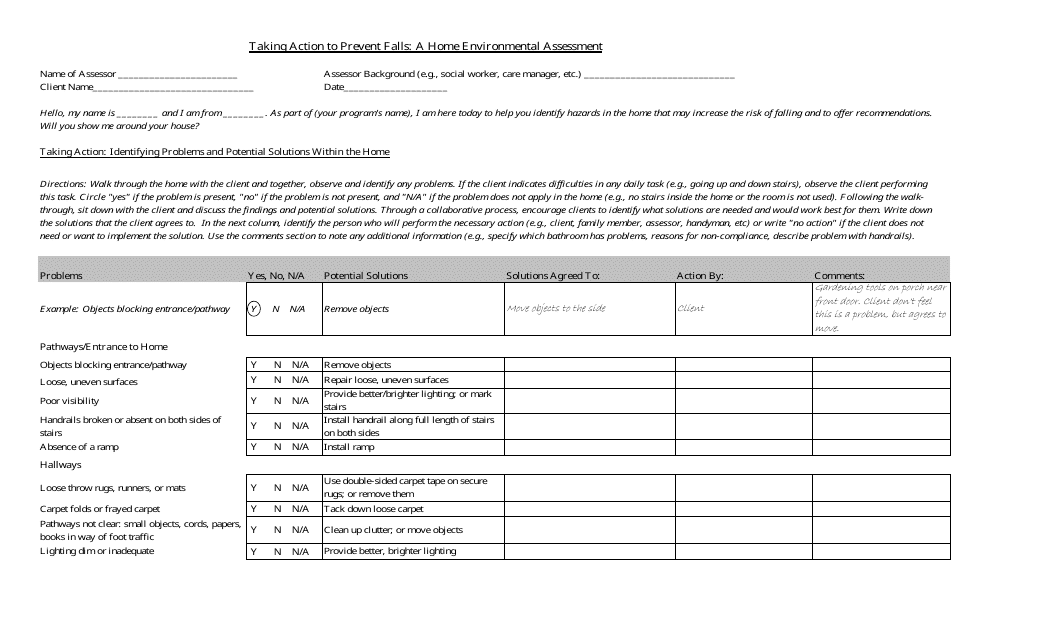

This Form is used for assessing the environmental conditions and potential hazards in a home. It helps identify areas that may need improvement for health and safety purposes.

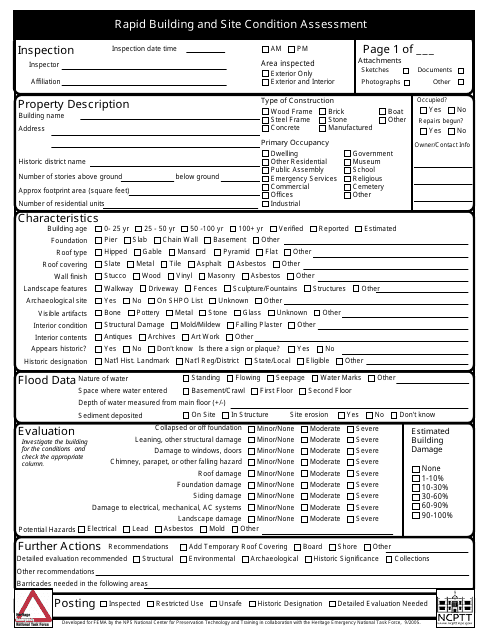

This form is used for quickly assessing the condition of buildings and sites. It helps gather important information about the condition of the property for future reference or purposes such as safety inspections or property evaluations.

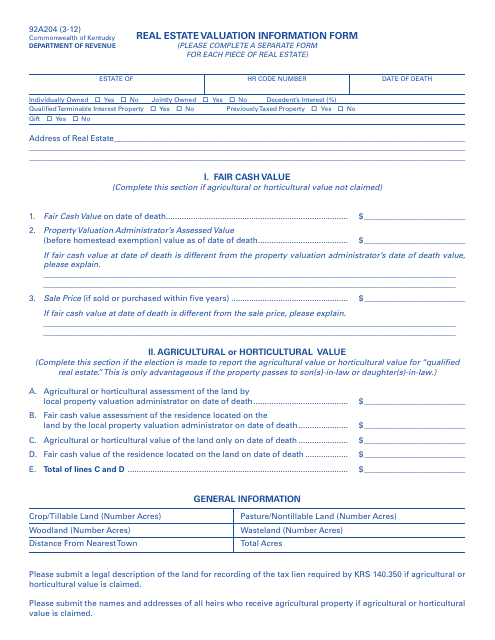

This form is used for providing real estate valuation information in the state of Kentucky.

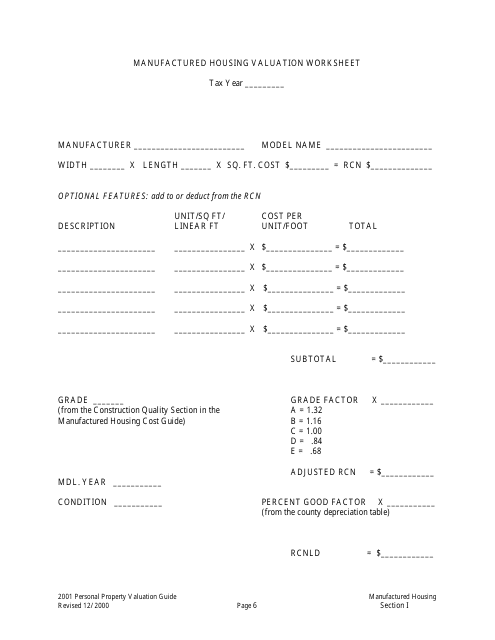

This document is used for evaluating the value of manufactured housing units. It helps in assessing the worth of mobile or prefabricated homes.

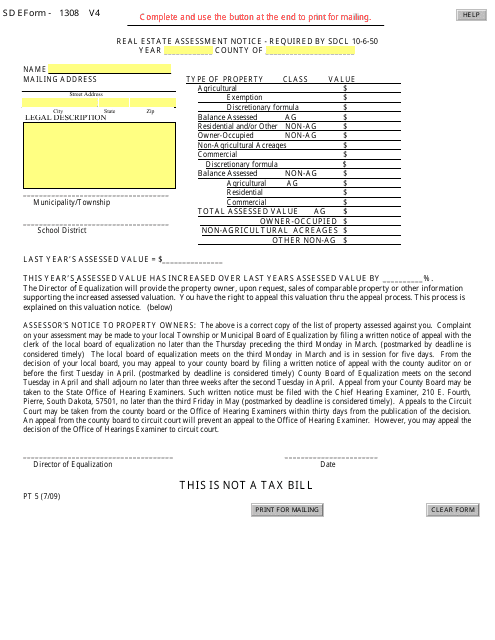

This Form is used for receiving a Real Estate Assessment Notice in South Dakota.

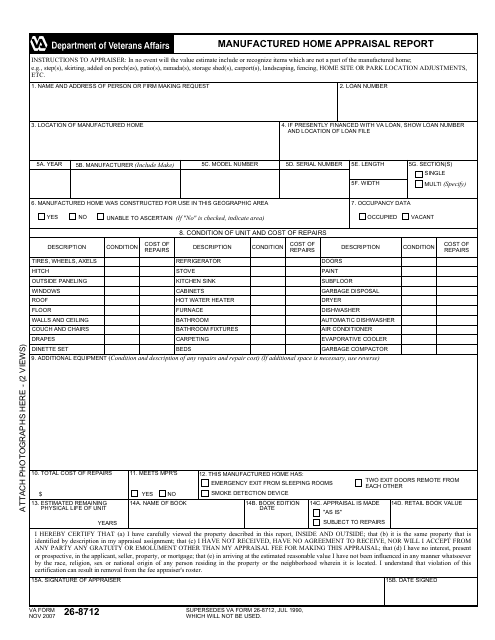

This form is used for completing an appraisal report for a manufactured home. It helps evaluate the value and condition of the home.

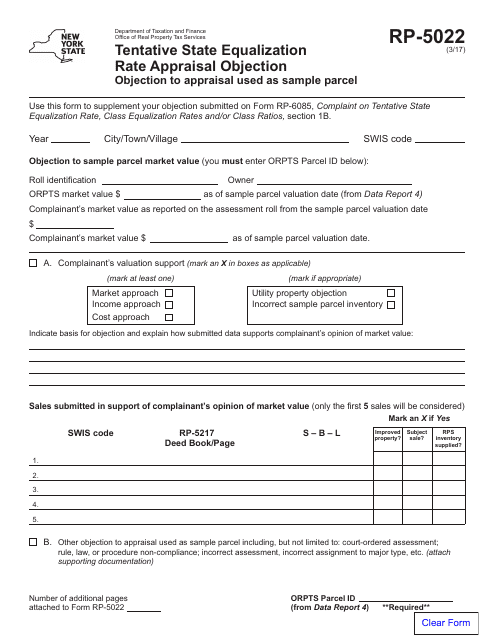

This form is used for filing an objection to the tentative state equalization rate in New York. It allows property owners to challenge the assessed value of their property for tax purposes.

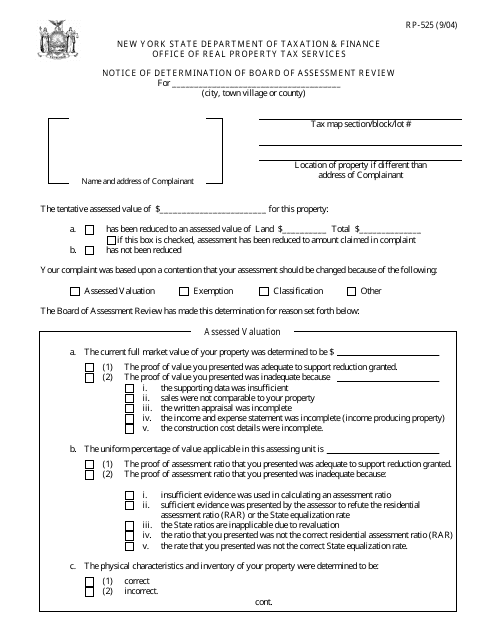

This form is used for notifying property owners in New York about the determination made by the Board of Assessment Review regarding their property assessment.

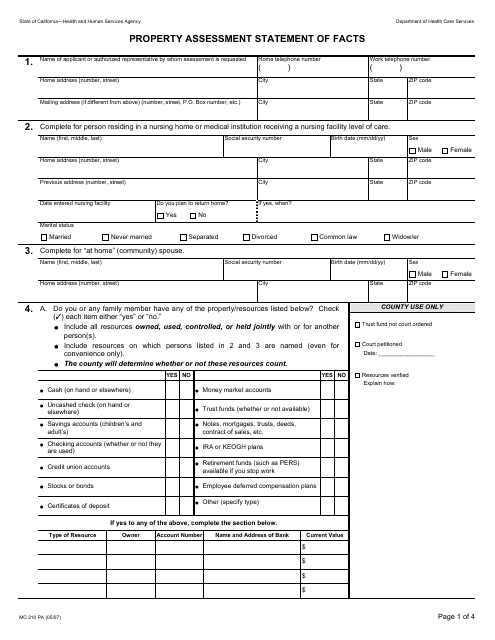

This form is used for property assessment in the state of California. It is used to provide factual information about the property.

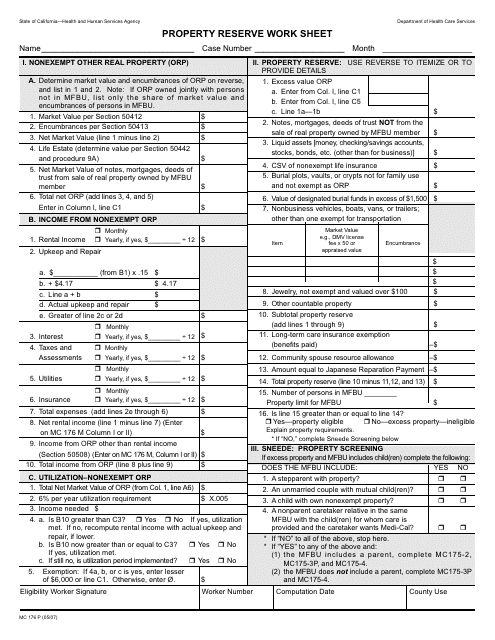

This form is used for property owners in California to keep track of reserve funds for maintenance and repairs. It helps in budgeting and planning for future property expenses.

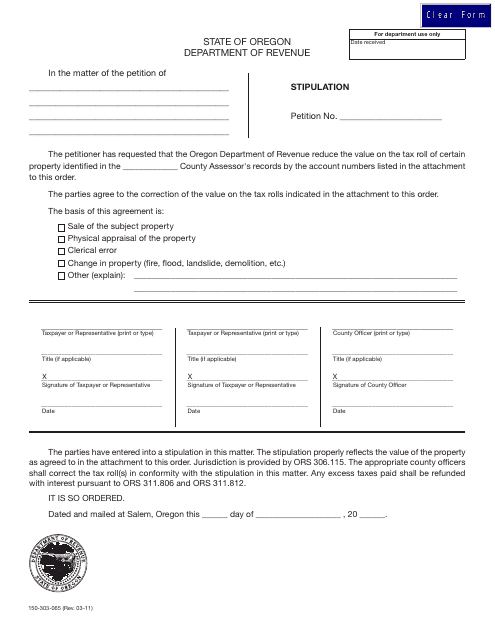

This Form is used for stipulating agreements with the County Assessor in Oregon.

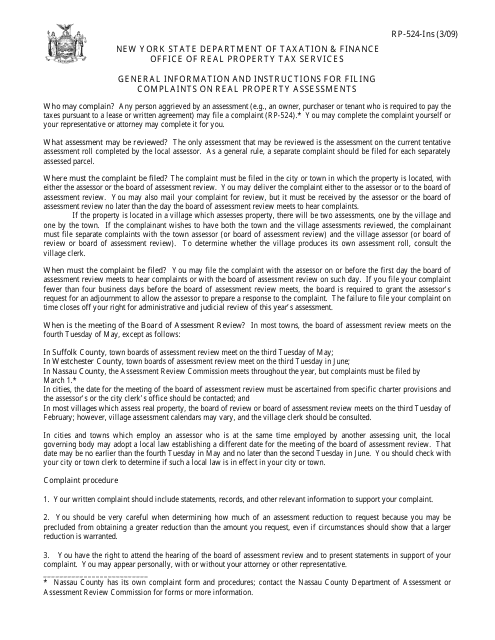

This Form is used for filing complaints regarding real property assessments in the state of New York. It provides instructions on how to submit a complaint and seek resolution for issues related to property assessments.

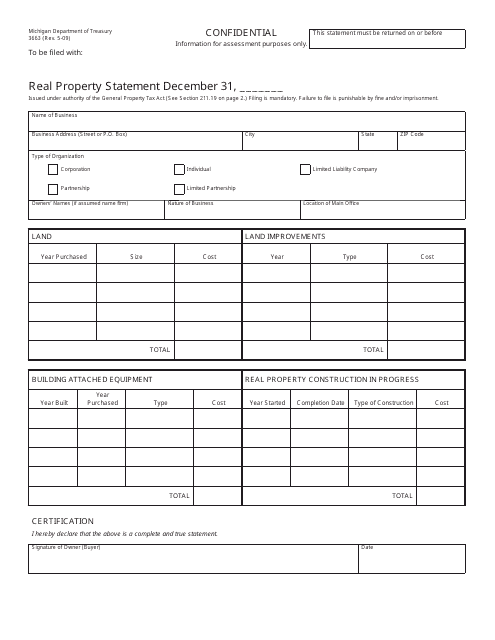

This form is used for reporting real property information in the state of Michigan. It is essential for property owners to provide accurate details about their real estate holdings to comply with state regulations.

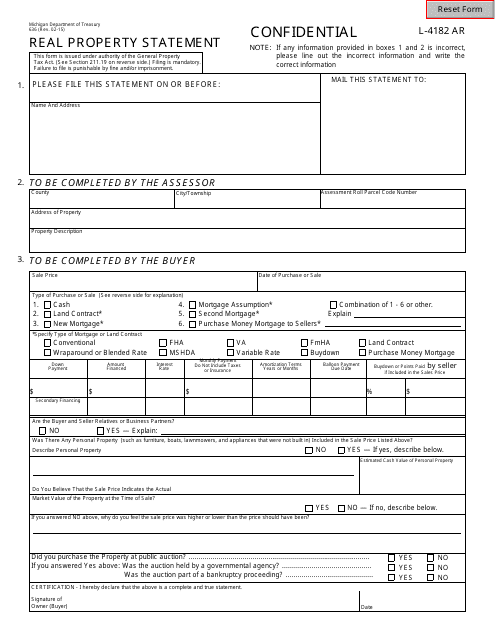

This Form is used for declaring real property in Michigan. It contains information about the property, its ownership, and its assessed value.

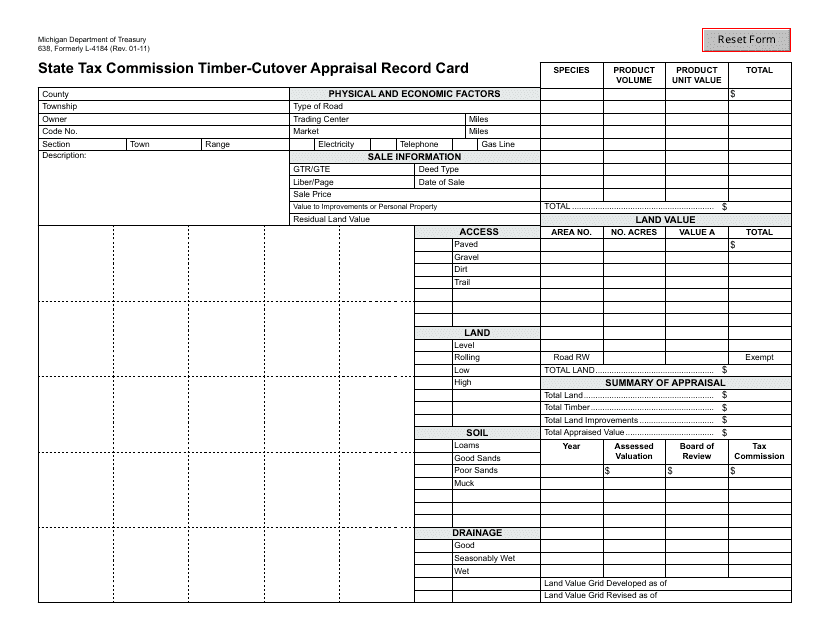

This form is used for recording information related to timber-cutover appraisal in Michigan for state tax commission purposes.

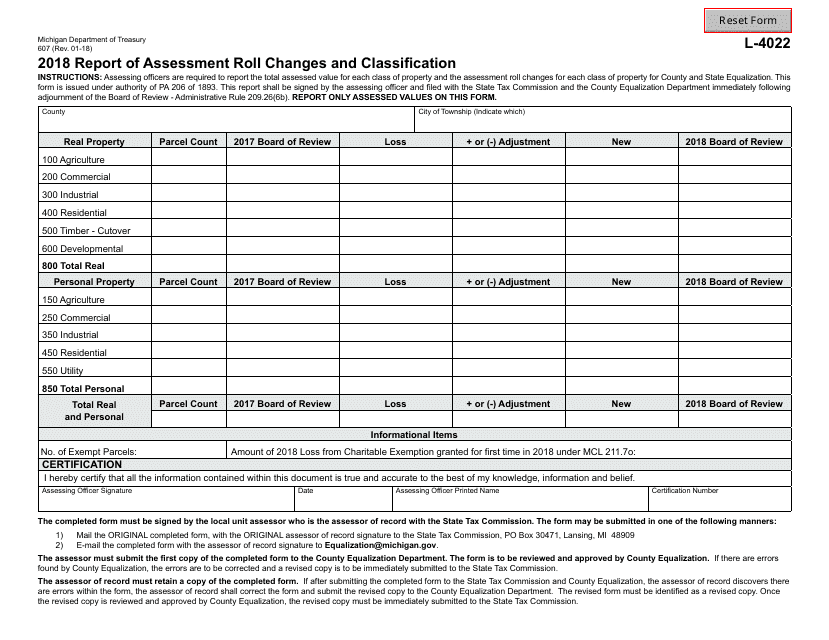

This Form is used for reporting assessment roll changes and classification in the state of Michigan.

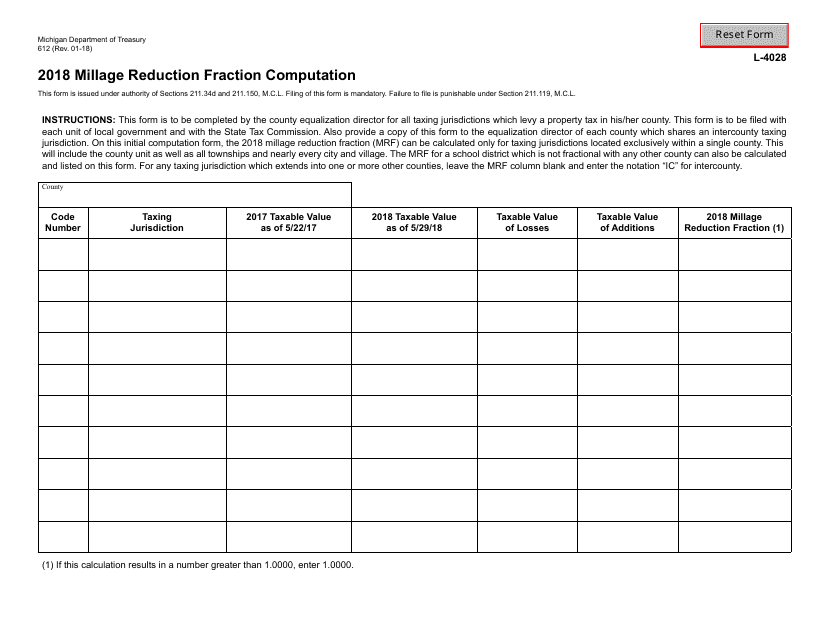

This form is used for calculating the millage reduction fraction in the state of Michigan.

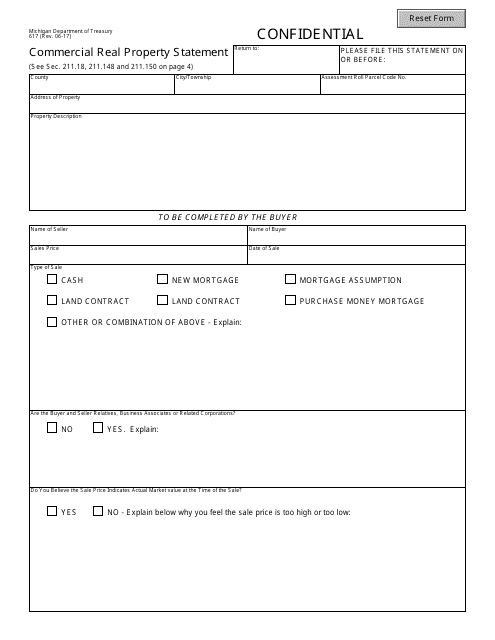

This Form is used for providing a statement of commercial real property in the state of Michigan. It is required for assessment and taxation purposes.

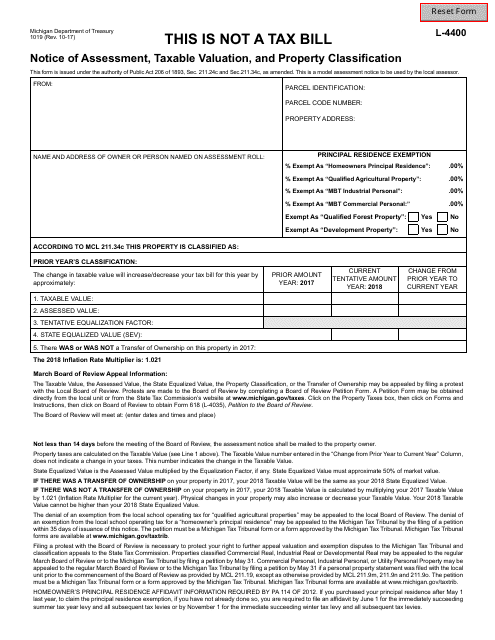

This form is used for notifying taxpayers in Michigan about the assessment, taxable valuation, and classification of their property for tax purposes. It provides information about the tax amount owed based on the property's value and classification.

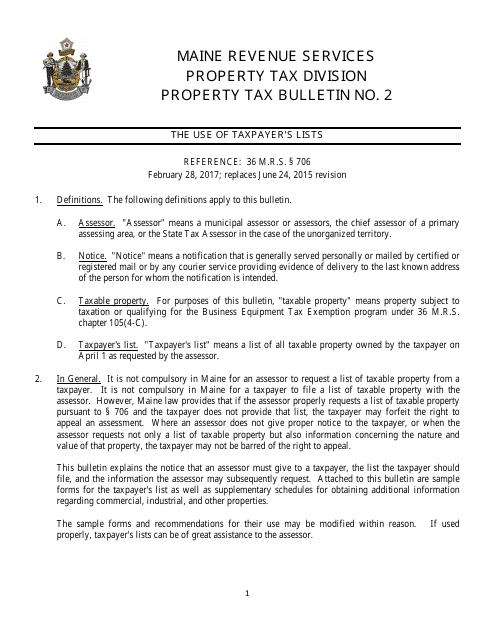

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

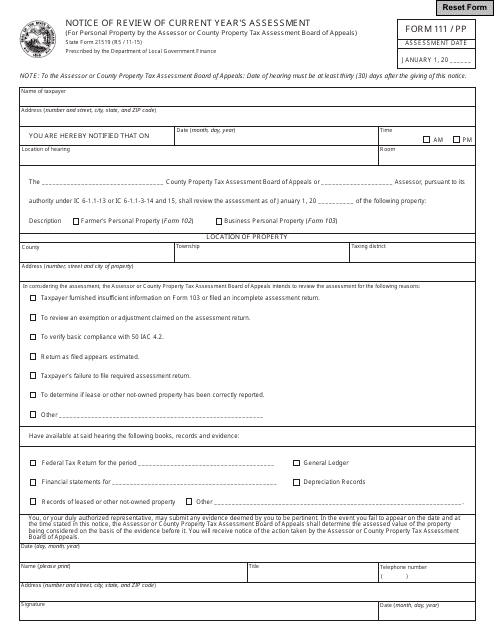

This form is used for notifying Indiana residents about the review of their current year's assessment.

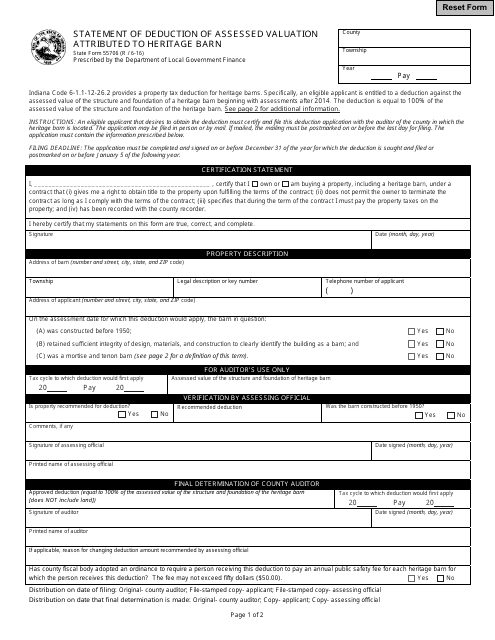

This document is used for recording the deduction of assessed valuation from a heritage barn in Indiana.

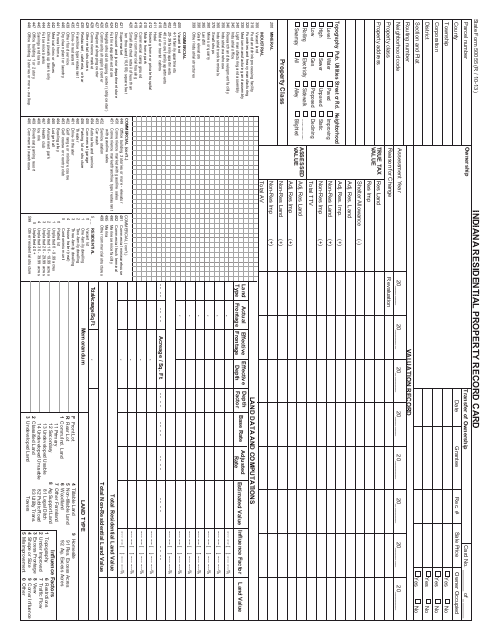

This form is used for recording and maintaining details of residential properties in the state of Indiana. It includes information such as property characteristics, ownership details, and assessment data. The Residential Property Record Card helps the Indiana government keep track of residential properties for taxation and administrative purposes.

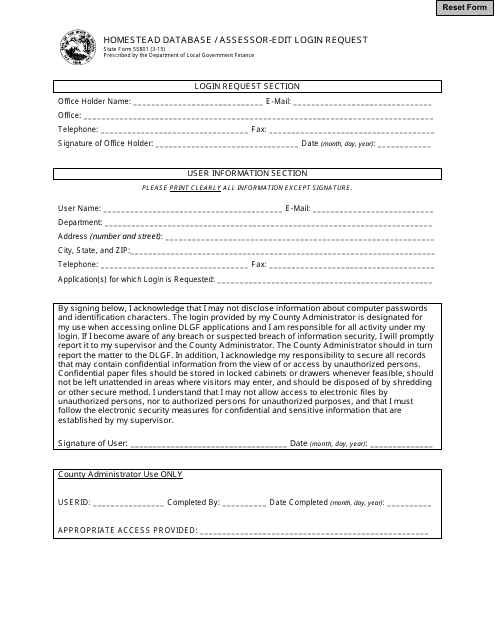

This document is used for requesting to edit login information in the Homestead Database for assessors in the state of Indiana.

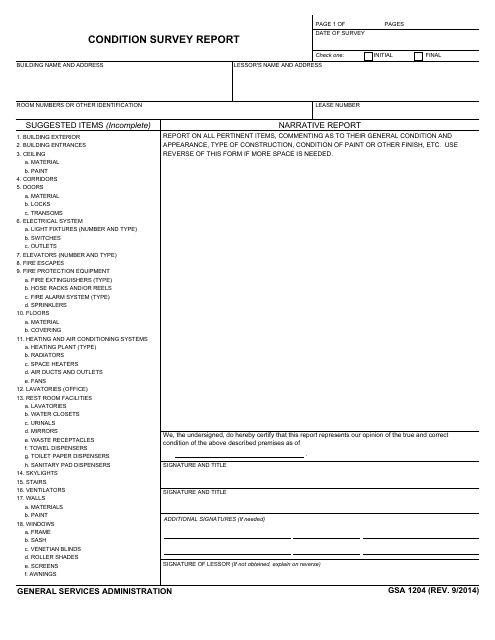

This document is used by the General Services Administration (GSA) to assess the condition of a property or asset. It includes a detailed report on the current condition and any necessary repairs or maintenance needed.

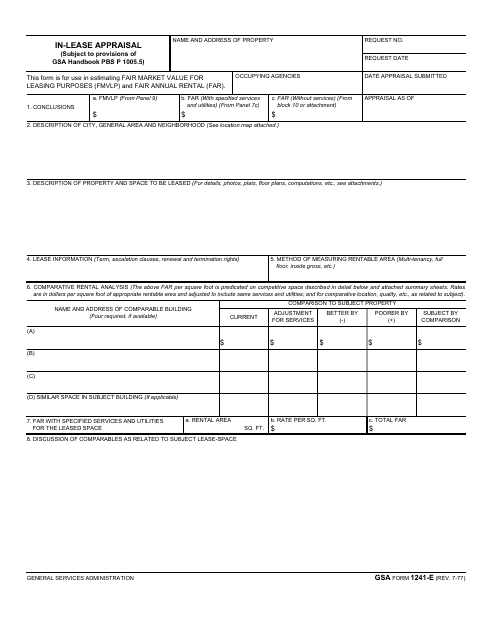

This Form is used for conducting an in-lease appraisal for the General Services Administration (GSA) in the United States. It helps evaluate the value of a leased property.

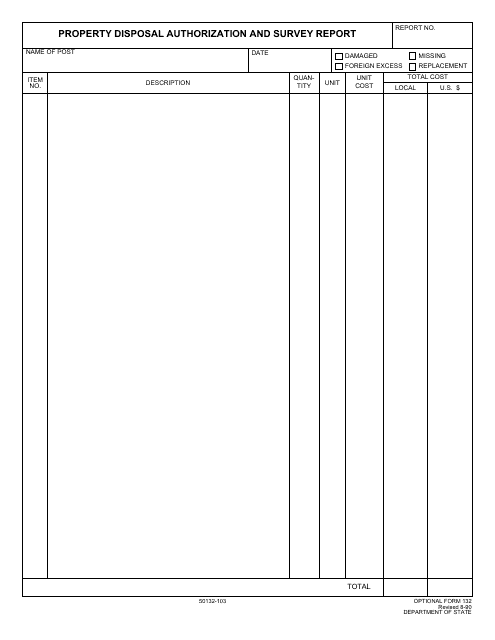

This form is used for authorizing the disposal of property and conducting a survey report. It allows for the proper documentation and oversight of property disposal activities.

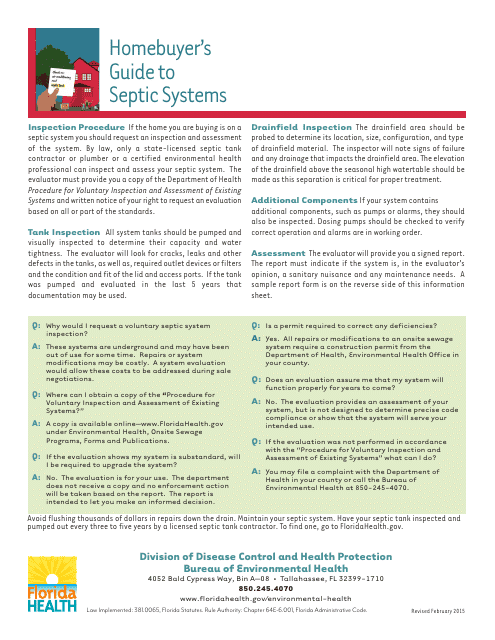

This type of document is used for voluntary inspection and assessment reports in the state of Florida.

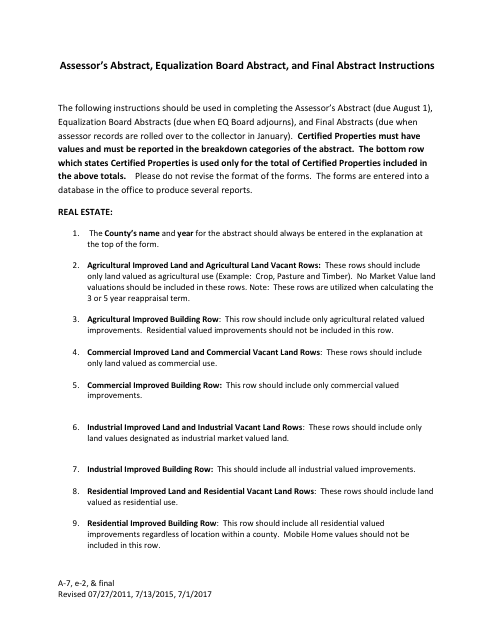

This document provides instructions for various forms used in Arkansas, including Form A-7, E-2, FINAL Assessor's Abstract, Equalization Board Abstract, and Final Abstract. These forms are related to assessing property values and equalization processes.