Property Assessment Forms and Templates

Documents:

237

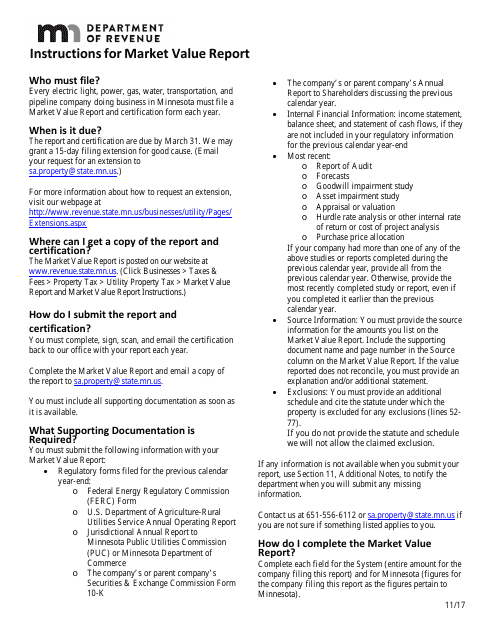

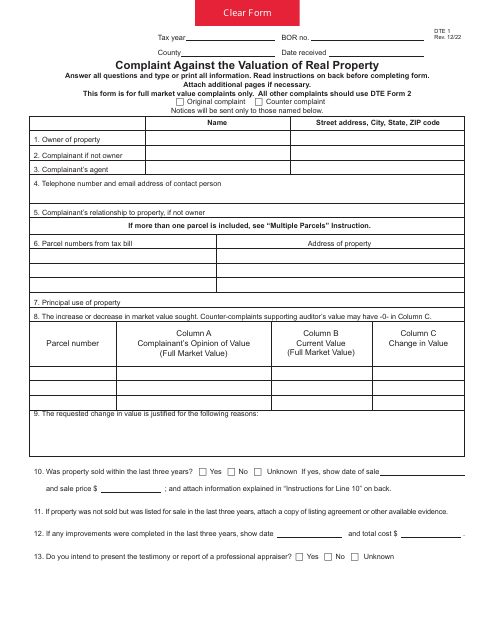

This form is used for reporting the market value of a property in Minnesota. It provides instructions on how to properly fill out the report and submit it to the relevant authorities.

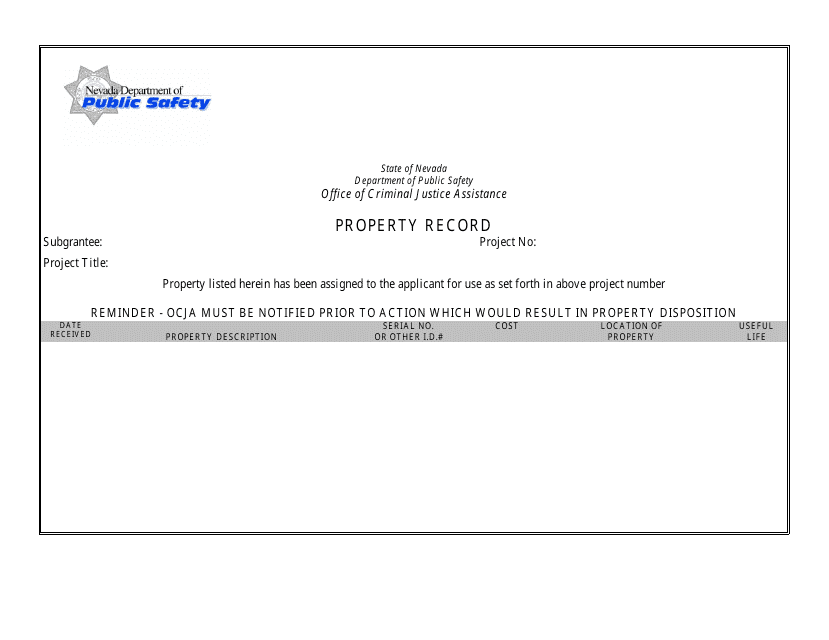

This type of document is used for recording property information in the state of Nevada. It includes details such as the property owner's name, address, and legal description.

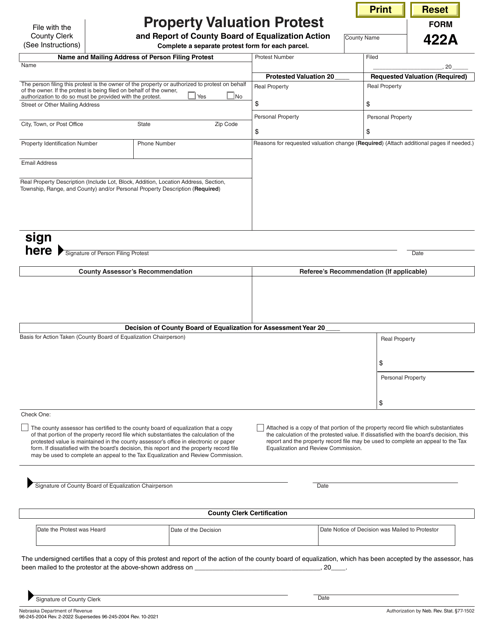

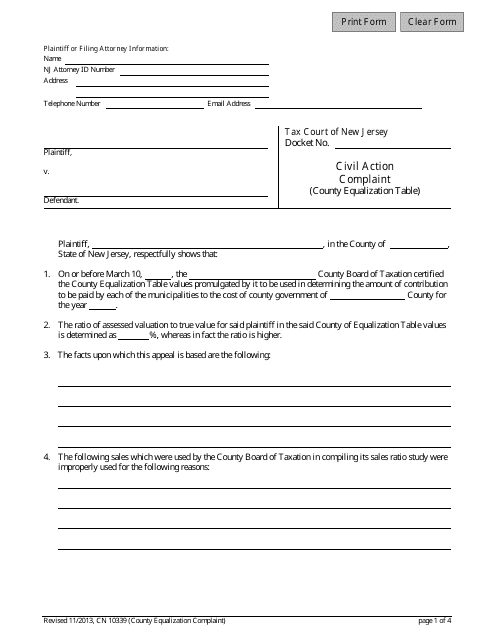

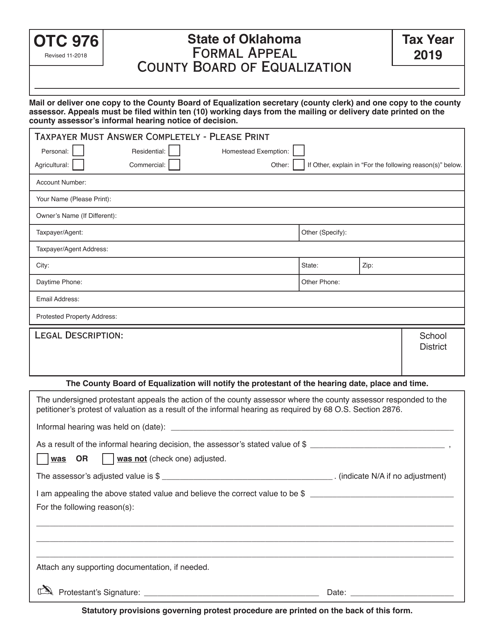

This form is used for filing a complaint regarding property value assessment with the County Equalization Board in New Jersey.

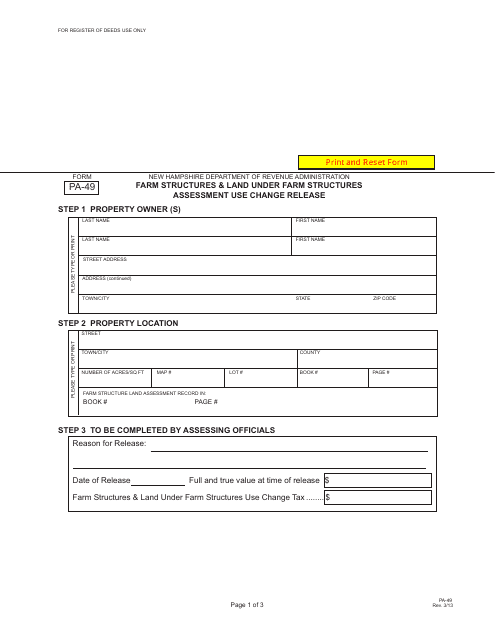

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.

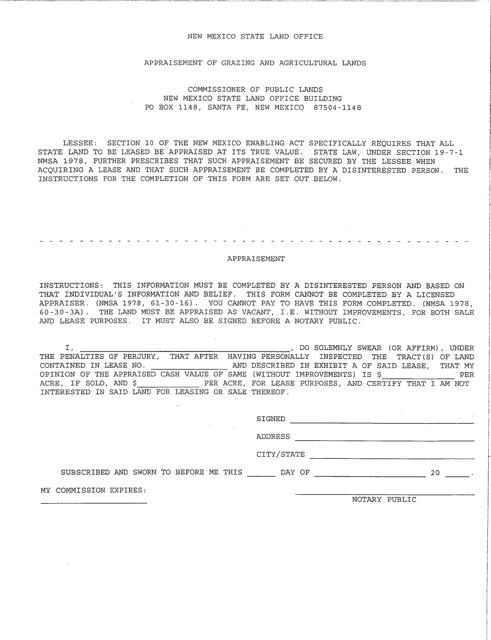

This document is used for appraising grazing and agricultural lands in the state of New Mexico. It provides a valuation of these types of properties for assessment and taxation purposes.

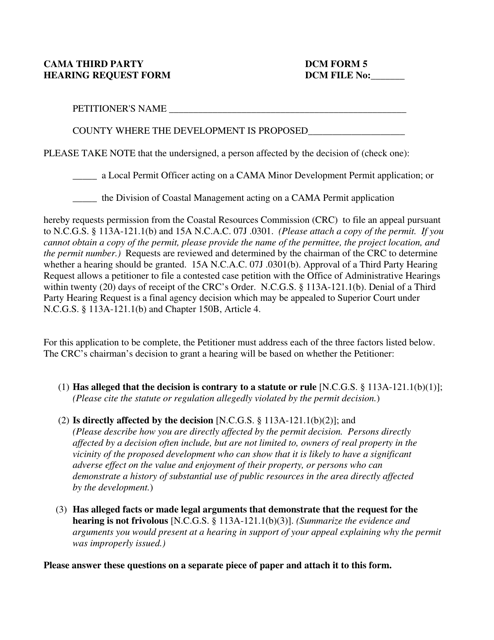

This form is used for requesting a third party hearing related to the DCM Form 5 CAMA in North Carolina.

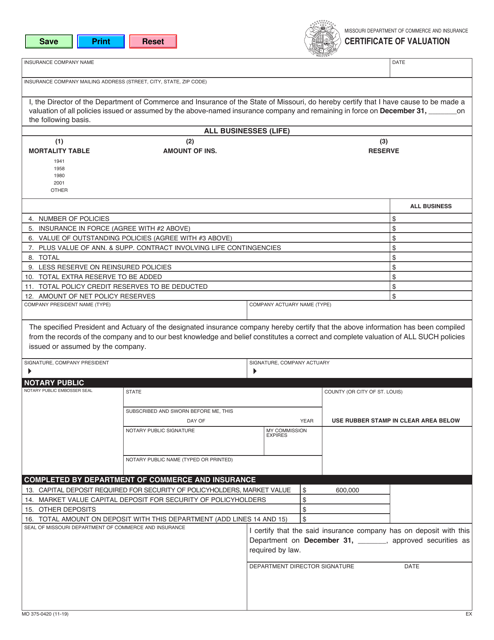

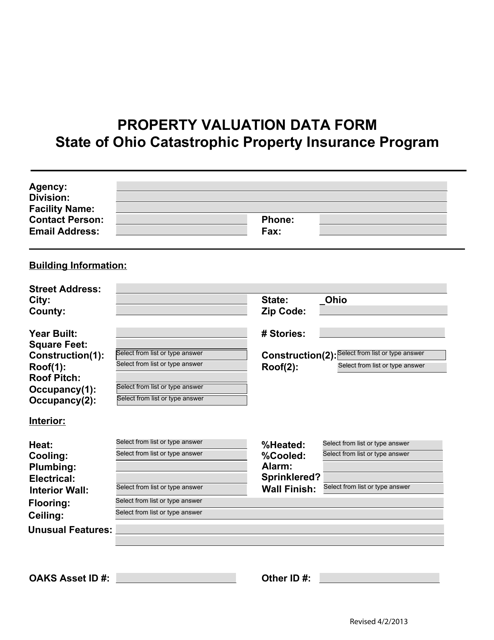

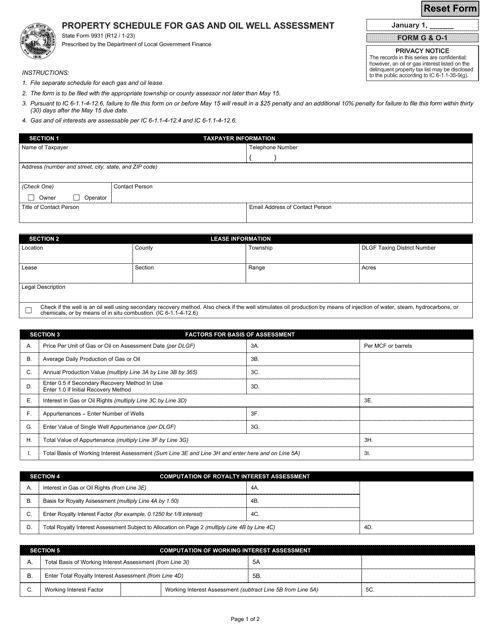

This Form is used for obtaining property valuation data in the state of Ohio.

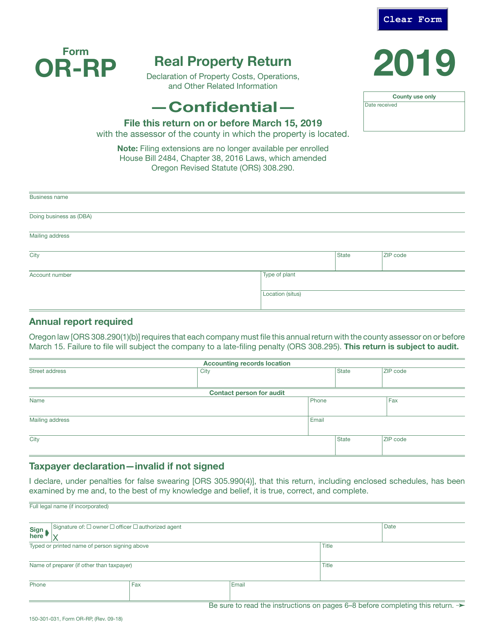

This form is used for filing a real property return in the state of Oregon. It is required by the Oregon Department of Revenue and must be completed by property owners to report their real estate holdings.

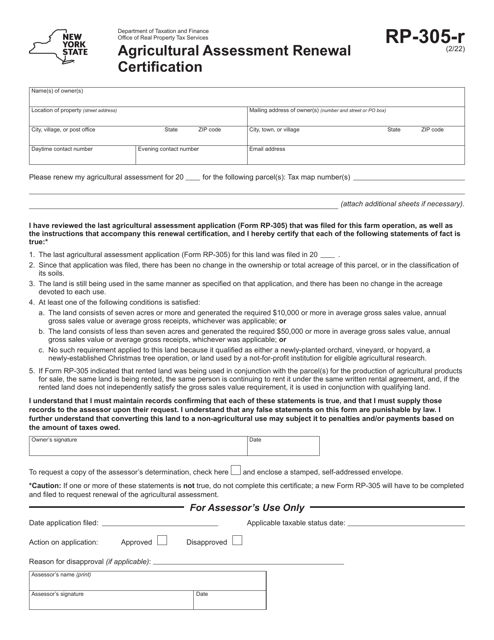

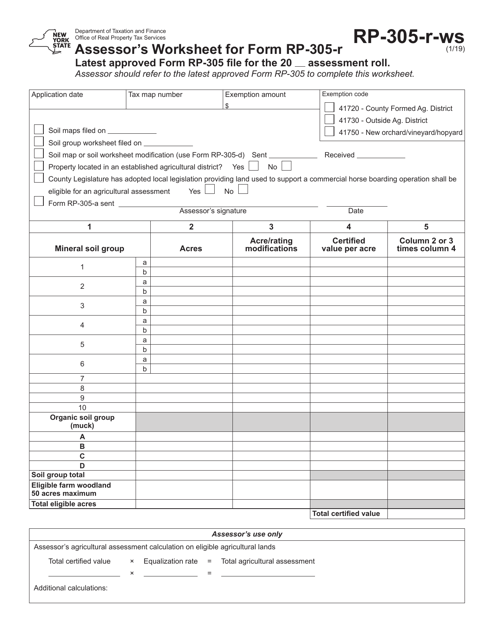

This Form is used by assessors in New York to complete the worksheet for Form RP-305-R. It helps in assessing property values in the state.

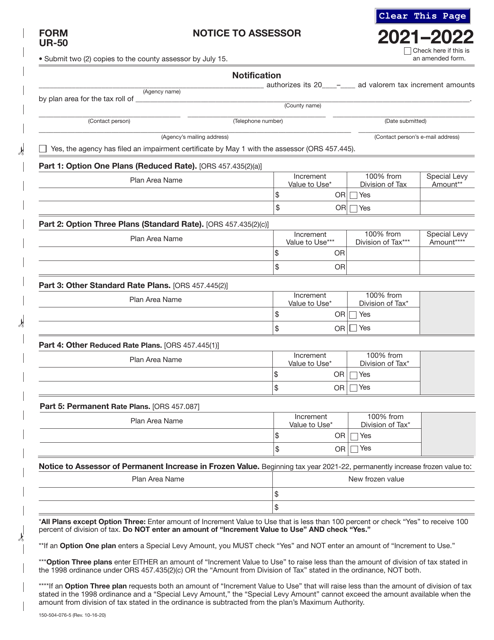

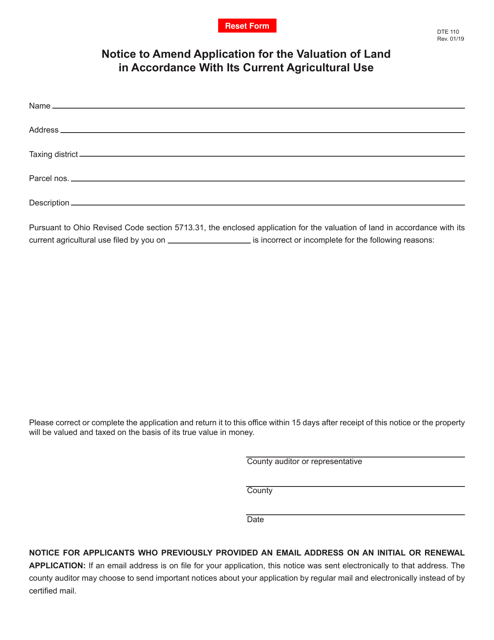

This form is used for notifying the Ohio Department of Taxation about changes in the application for the valuation of agricultural land.

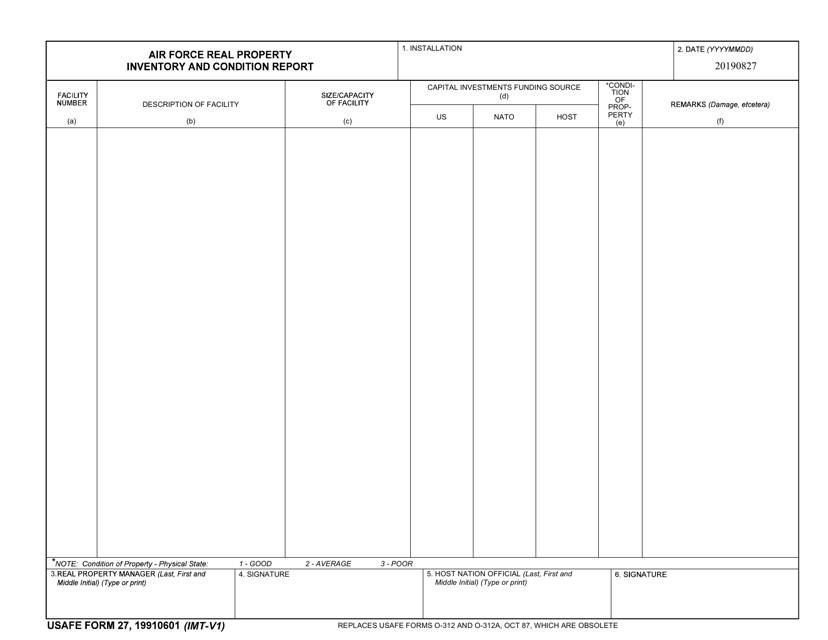

This Form is used for reporting the inventory and condition of Air Force real property.

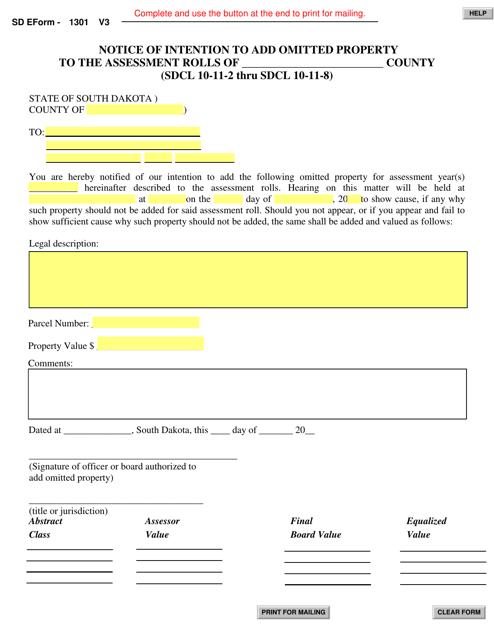

This document is used for notifying the assessor's office in South Dakota of any intention to add omitted property or valuation to the assessment rolls. It is important for property owners to make sure their property is correctly assessed for tax purposes.

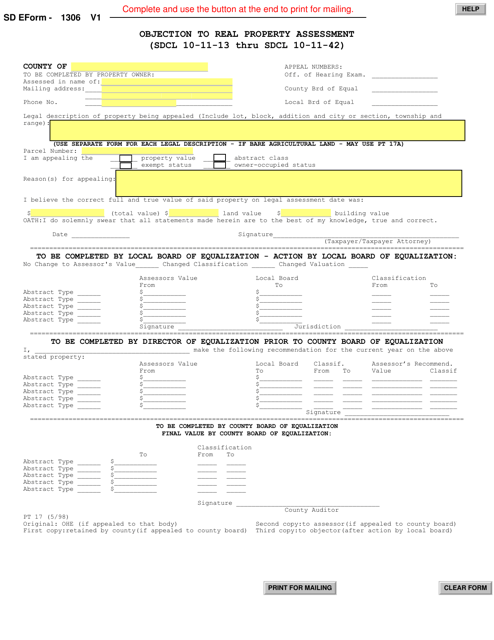

This form is used for filing an objection to the assessment of real property in South Dakota. It allows property owners to dispute the assessed value of their property for tax purposes.

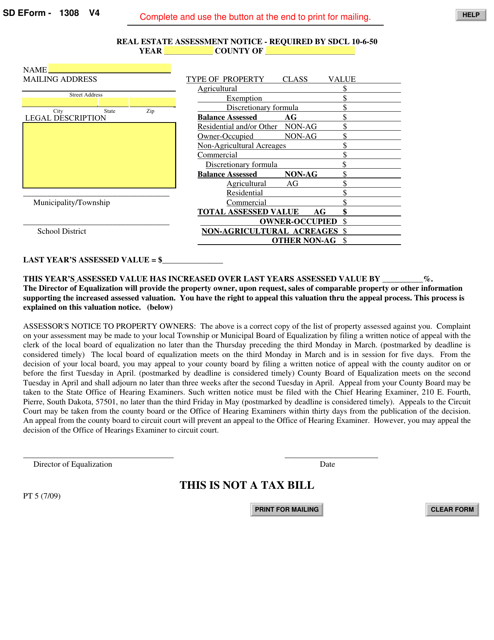

This document is a real estate assessment notice specific to South Dakota. It is used to inform property owners about the assessed value of their property for tax purposes.

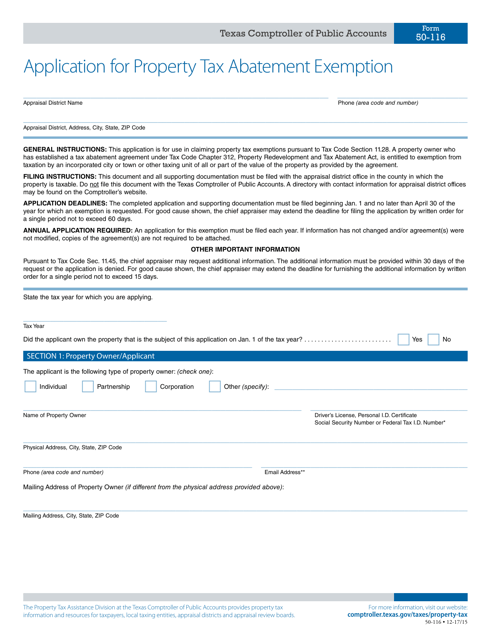

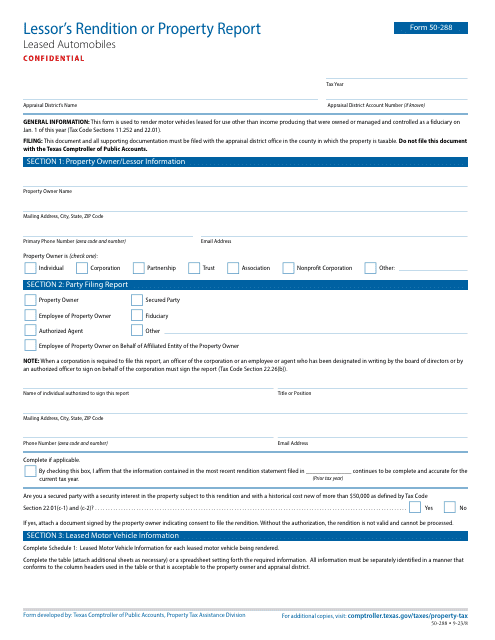

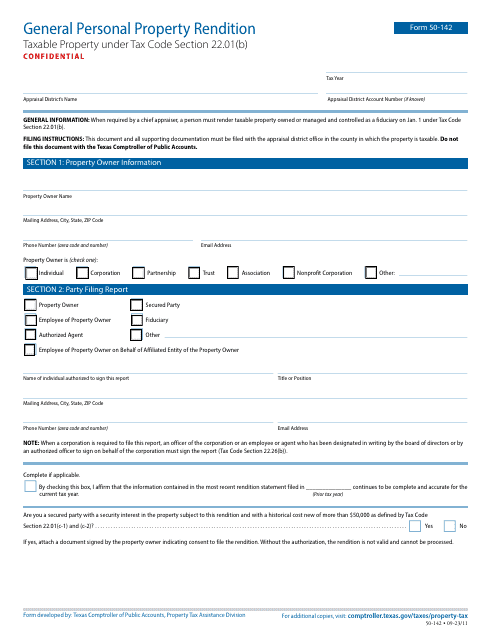

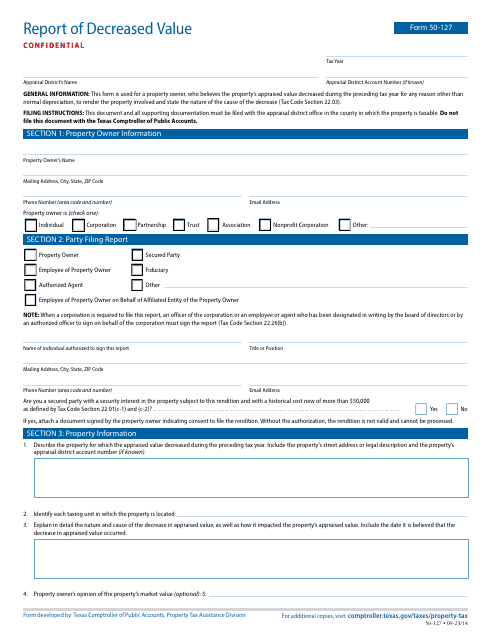

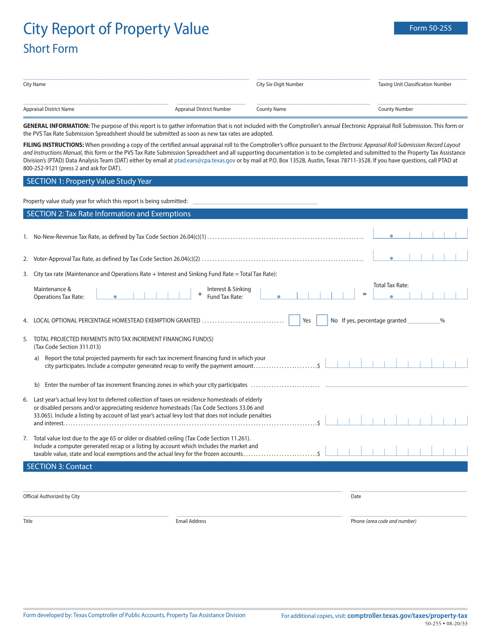

This form is used for applying for a property tax abatement exemption in Texas.

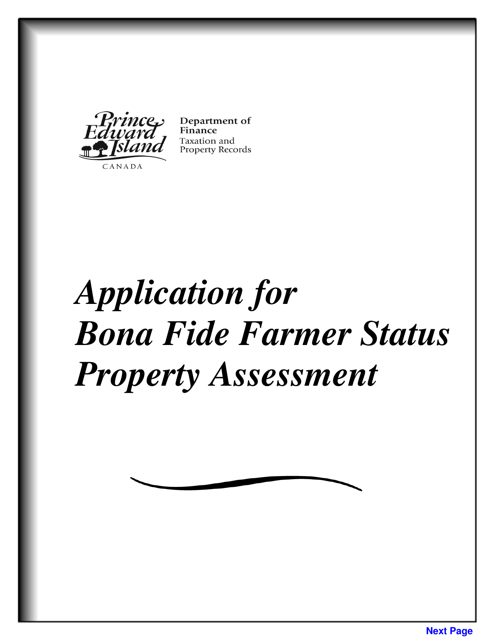

This document is for applying for Bona Fide Farmer Status Property Assessment in Prince Edward Island, Canada. It is used to determine if a property qualifies for special assessment as a bona fide farm.

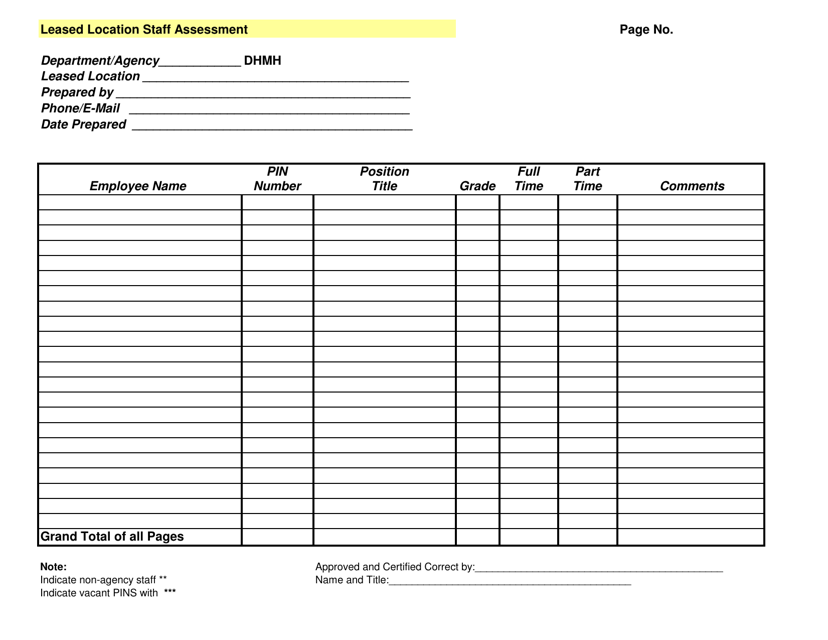

This document is used for assessing the staff at a leased location in Maryland. It helps evaluate the performance and requirements of the staff members in order to ensure smooth operations at the leased location.

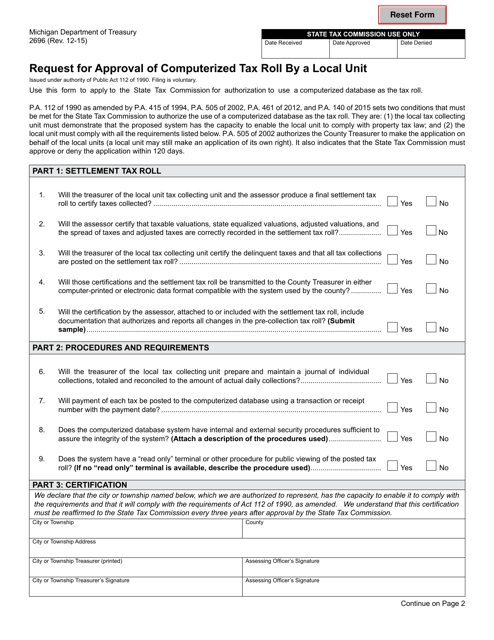

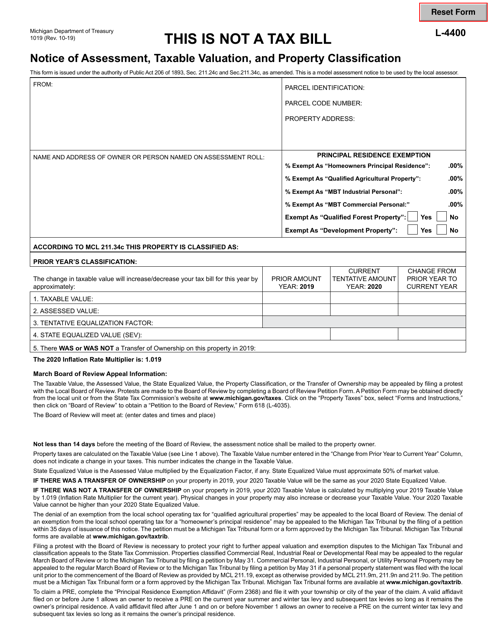

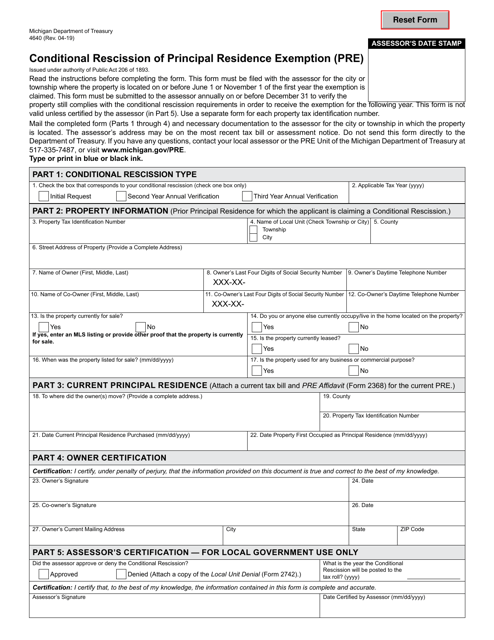

This form is used for a local unit in Michigan to request approval for a computerized tax roll. It helps streamline the tax collection process.

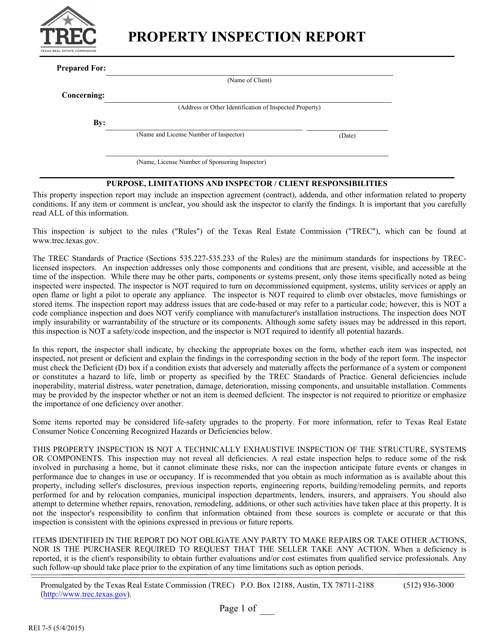

This document is a property inspection report specific to Texas. It is used to document the condition of a property and any issues found during an inspection.

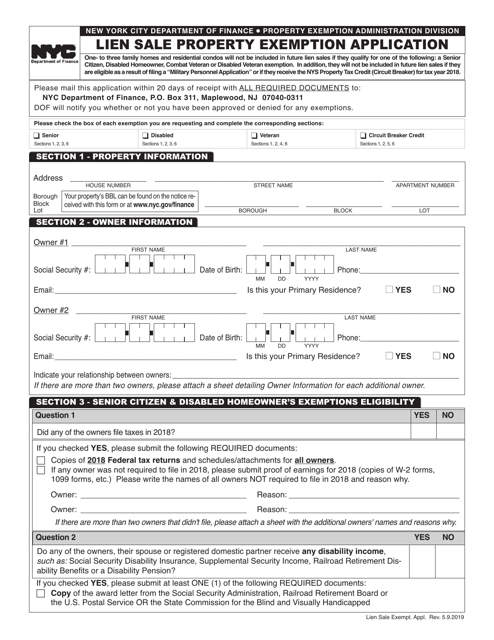

This document is for applying for an exemption on a property being sold through a lien sale in New York City.

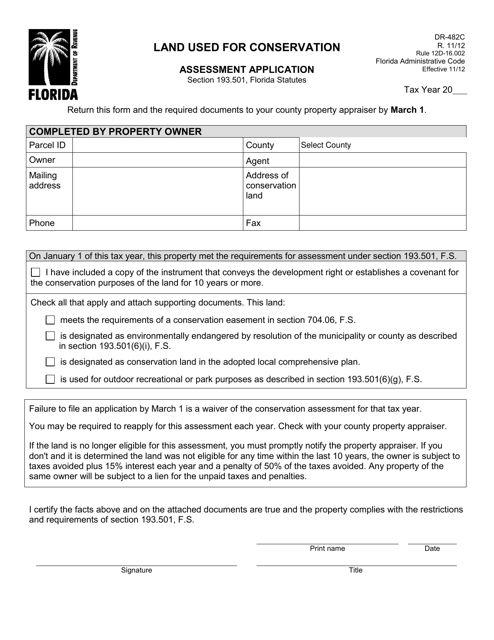

This form is used for applying for a conservation assessment on land in Florida. It is used to assess the property's eligibility for a reduced tax assessment based on conservation use.

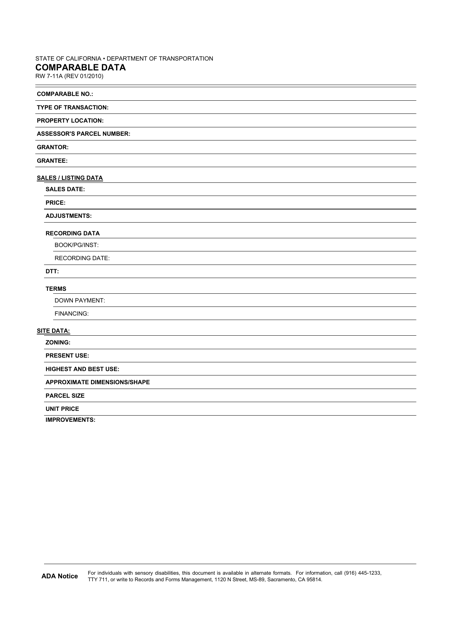

This Form is used for collecting and reporting comparable data for real estate properties in the state of California.

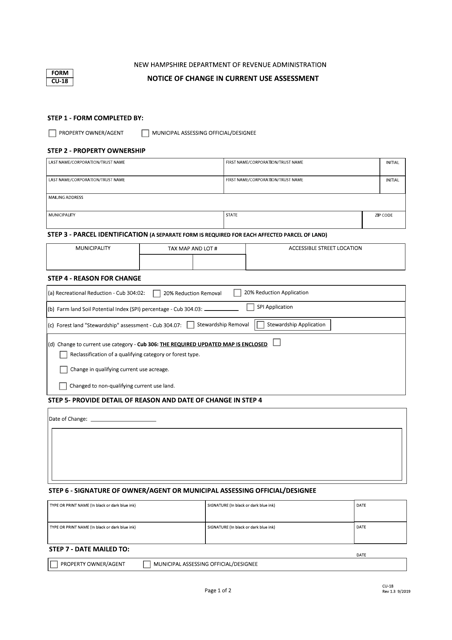

This form is used for notifying a change in the current use assessment in New Hampshire. It is used by property owners to inform the authorities about any changes in the use of their land for tax assessment purposes.