Cigarette Tax Templates

Looking for information on cigarette tax? Look no further. Our webpage provides comprehensive resources on cigarette tax laws, regulations, and forms. Whether you're a taxpayer, a business owner, or a government official, we've got you covered.

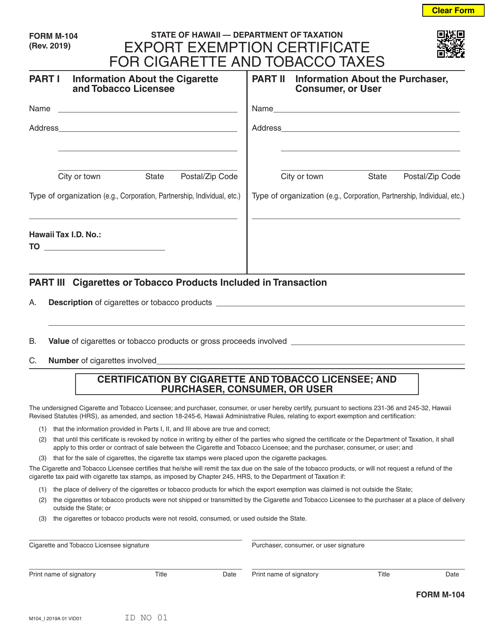

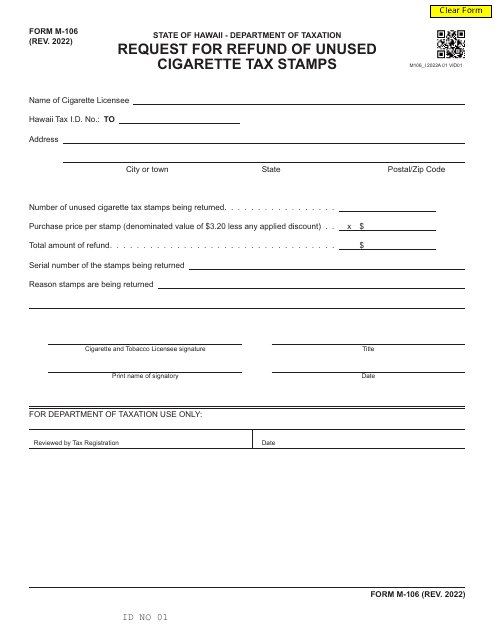

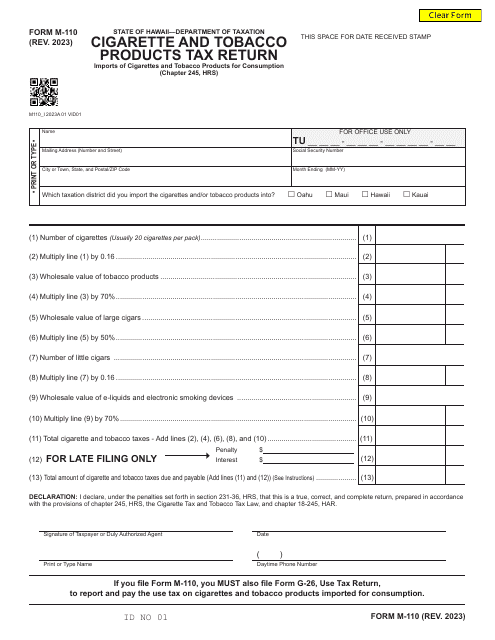

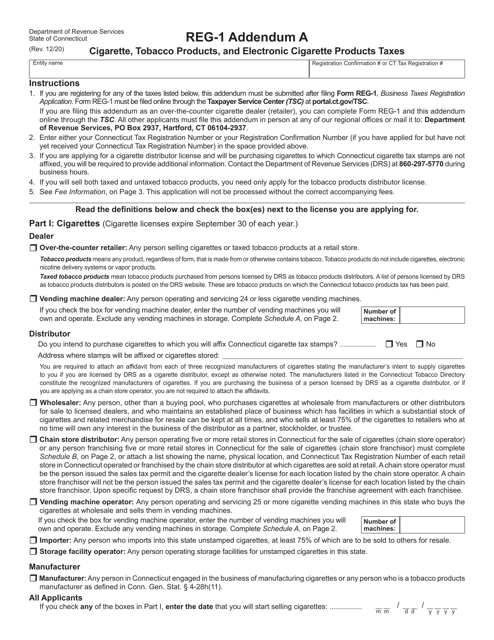

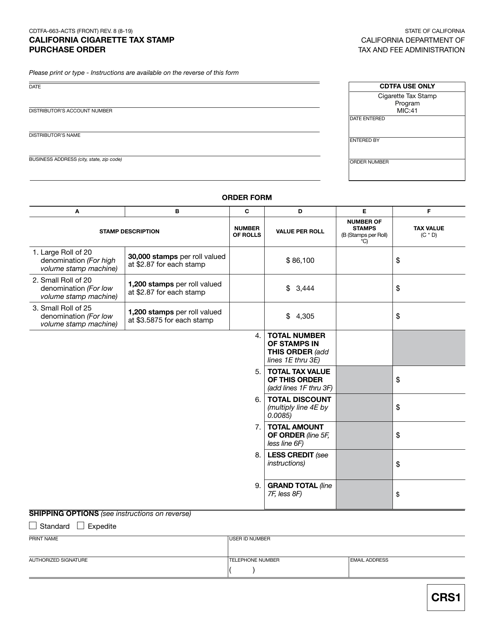

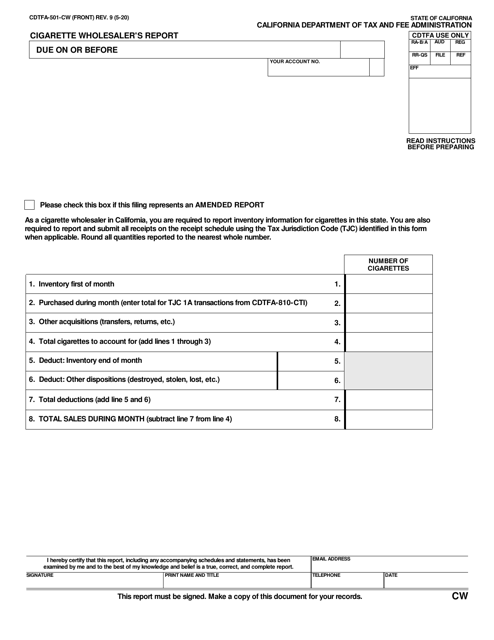

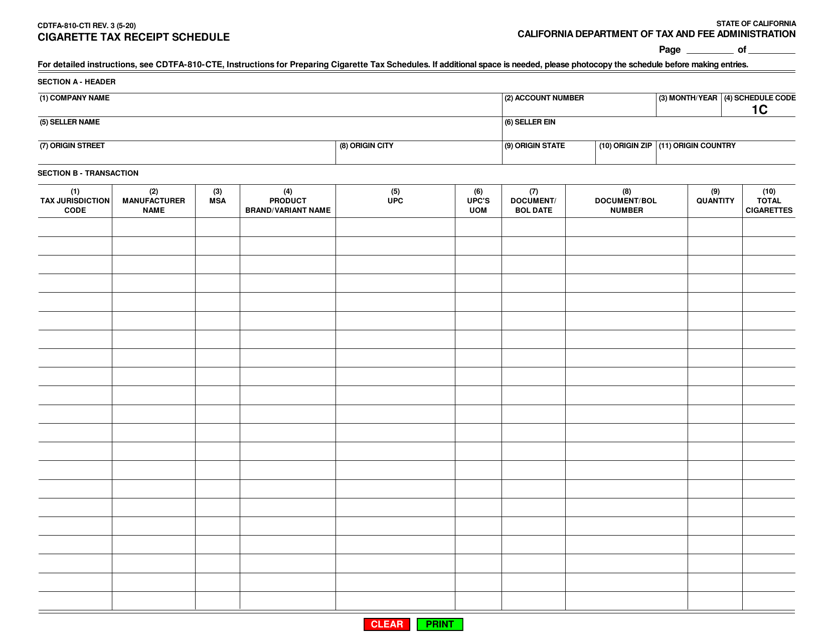

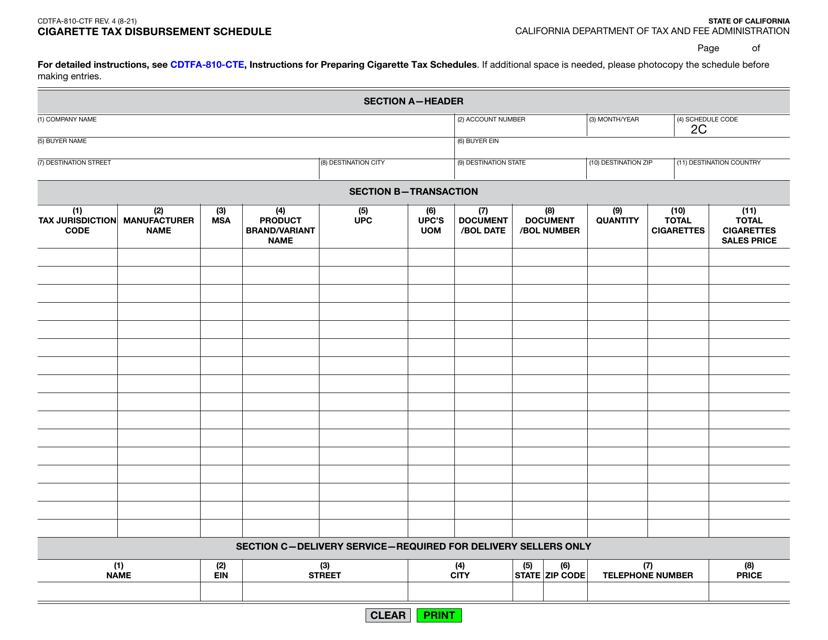

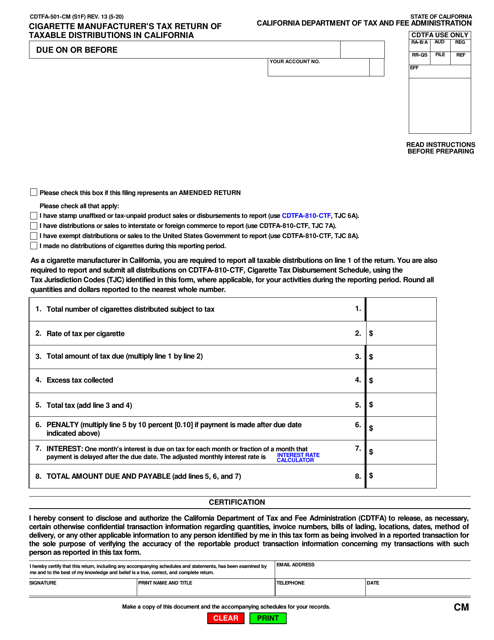

Our collection of documents includes the Cigarette Tax Disbursement Schedule, the Brand Specific Report for Cigarette, Little Cigar, and Roll-Your-Own Product, the Consumer Cigarette Tax Return, the Cigarette Floor Stock Tax Return, and the Schedule TOB Cigarette and Tobacco form. These forms are used by various states such as California, Iowa, Virginia, Illinois, and Utah to regulate cigarette tax collection and distribution.

Our webpage offers valuable insights into cigarette tax policies, exemptions, and enforcement procedures. Stay up to date with the latest changes in cigarette tax rates and forms, ensuring compliance with your state's requirements.

Whether you're a smoker, a retailer, or a government agency, understanding cigarette tax regulations is crucial. Our webpage aims to simplify this complex process by providing easy access to the necessary resources and forms. Explore our collection of cigarette tax documents today and stay informed about your obligations.

Documents:

149

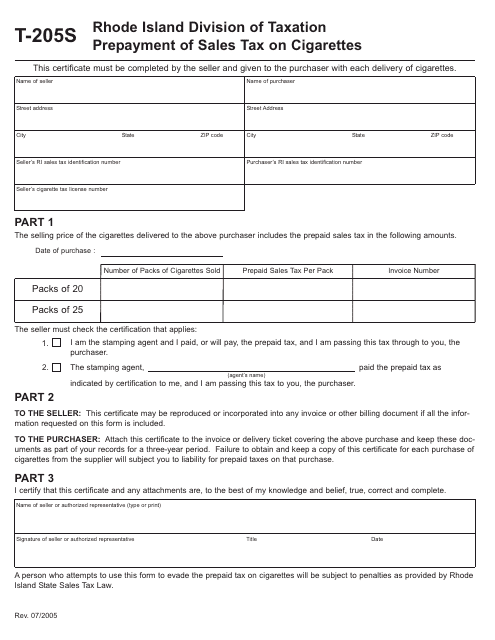

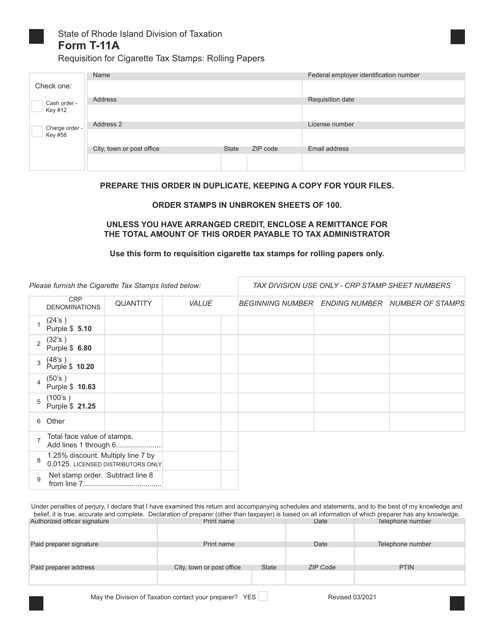

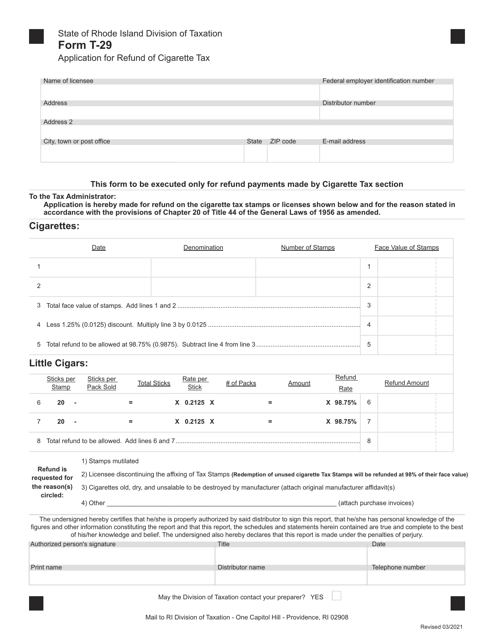

This form is used for prepaying sales tax on cigarettes in Rhode Island.

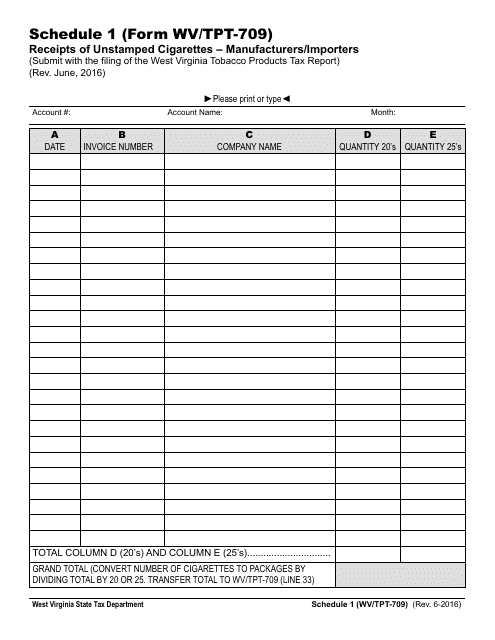

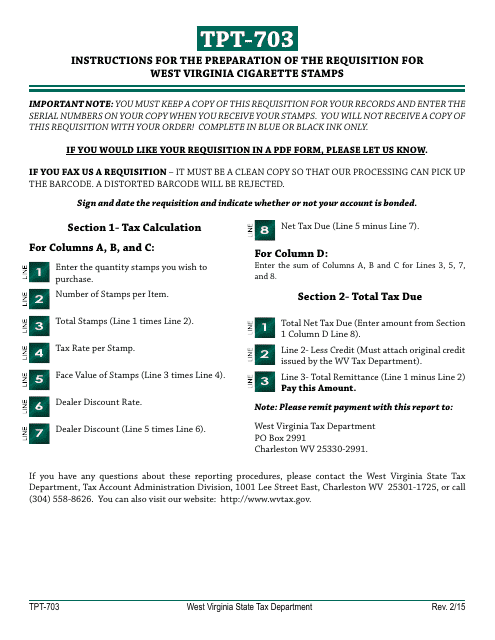

This form is used for reporting the receipts of unstamped cigarettes by manufacturers and importers in West Virginia.

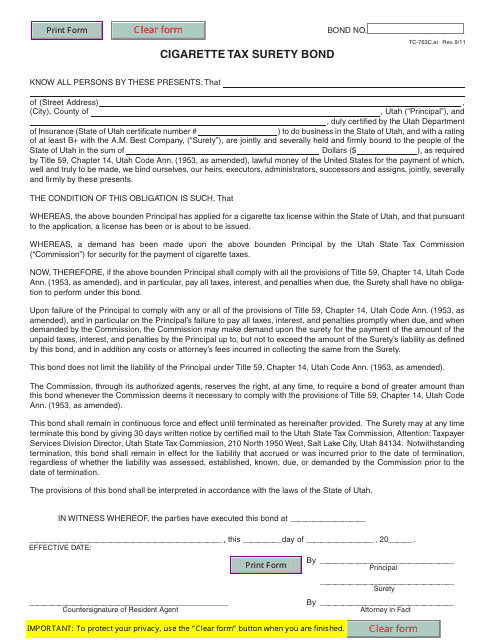

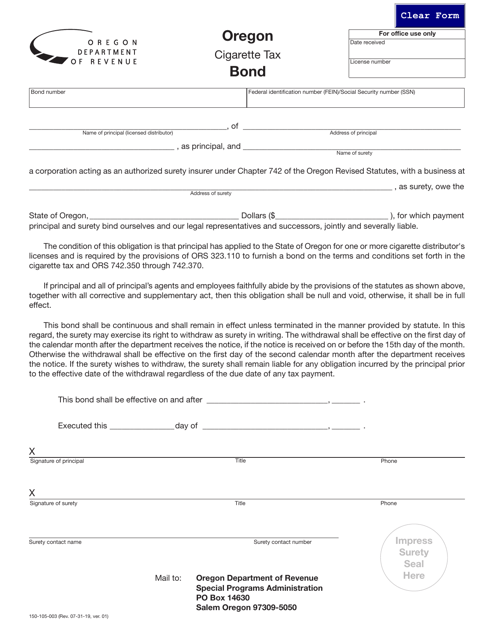

This form is used for obtaining a cigarette tax surety bond in the state of Utah. The bond ensures the payment of cigarette taxes by businesses.

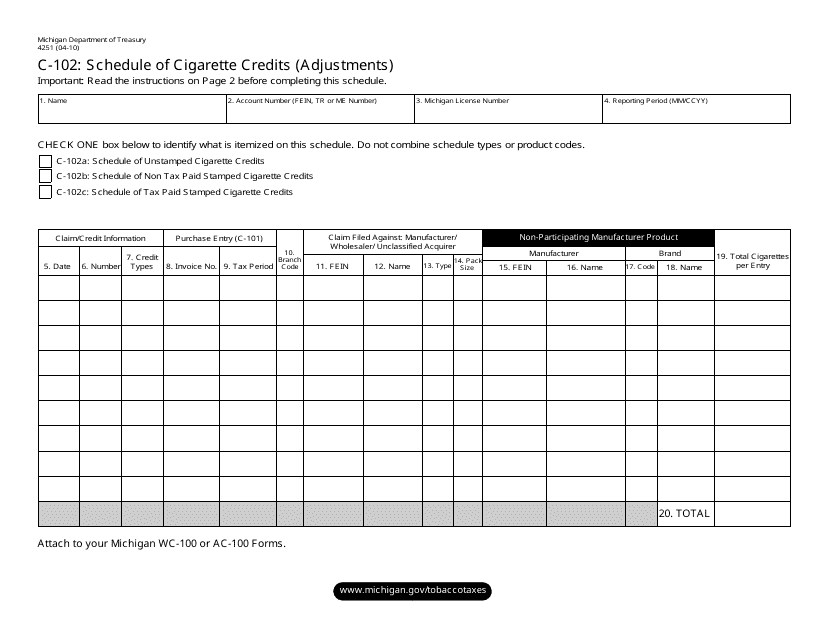

This form is used for reporting and adjusting cigarette credits in the state of Michigan.

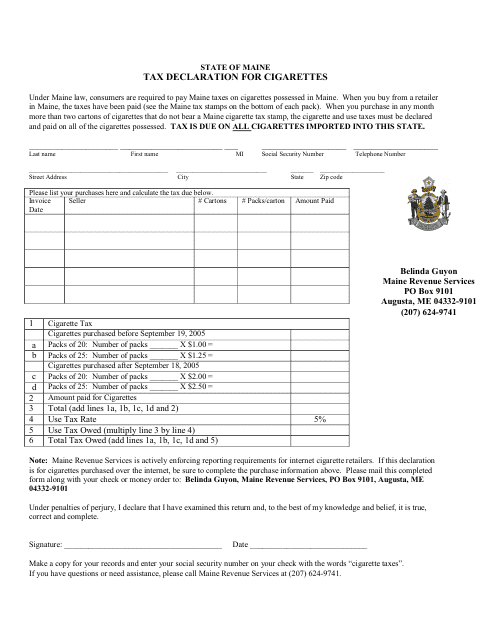

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

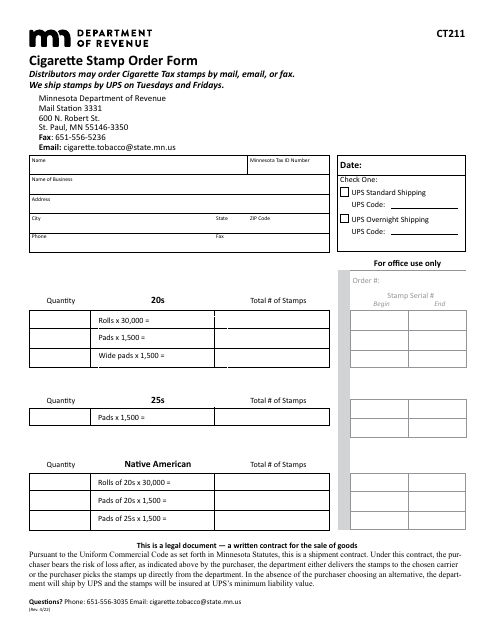

This Form is used for ordering cigarette tax stamps in Ohio.

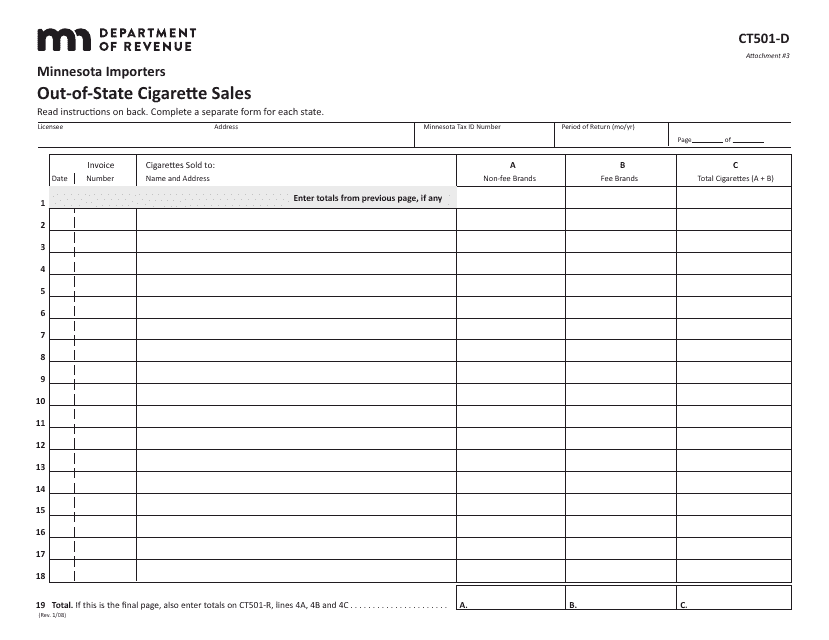

This Form is used for reporting out-of-state cigarette sales in Minnesota.

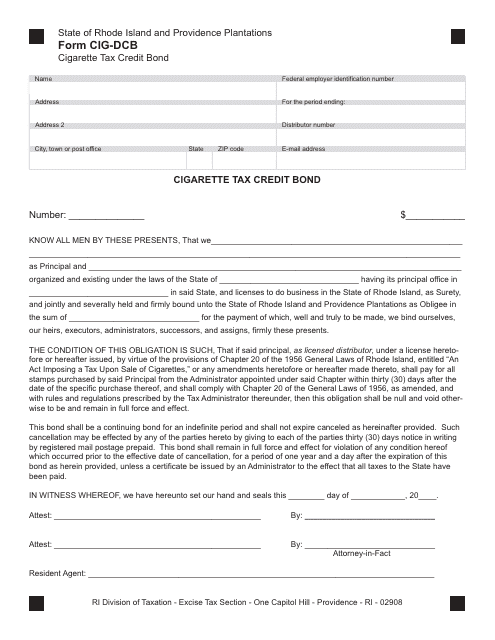

This form is used for applying for a cigarette tax credit bond in Rhode Island.

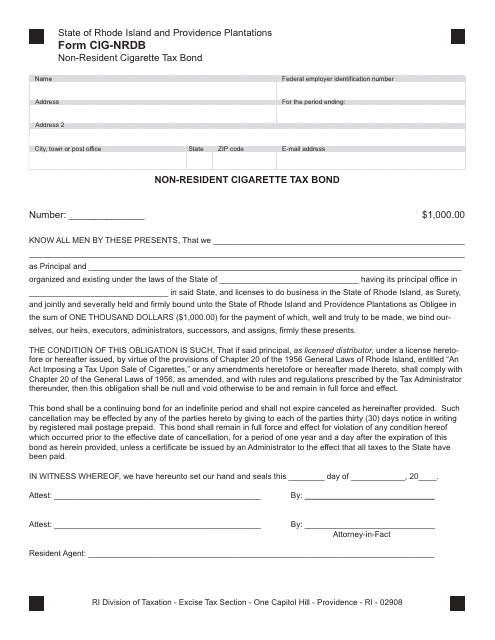

This type of document is used for obtaining a non-resident cigarette tax bond in Rhode Island.

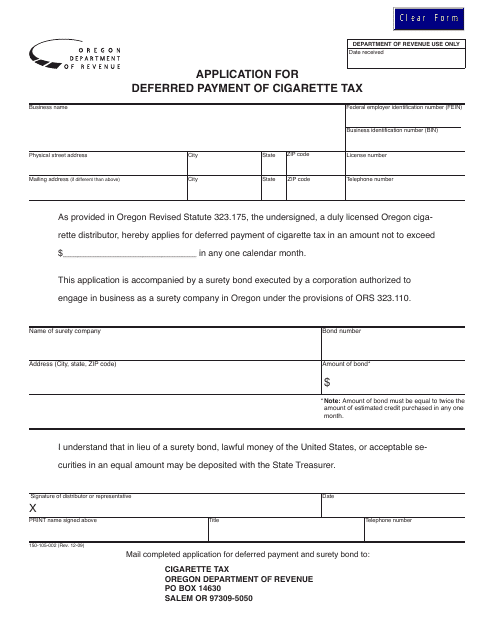

This form is used for applying for deferred payment of cigarette tax in the state of Oregon. It allows businesses to delay payment of their cigarette tax until a later date.

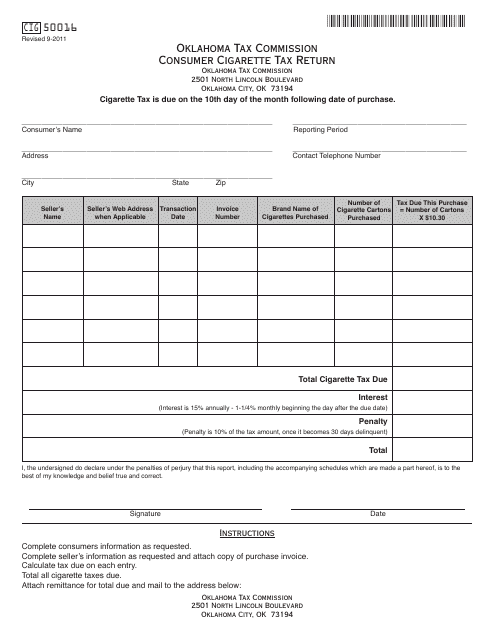

This Form is used for reporting and paying consumer cigarette tax in Oklahoma.

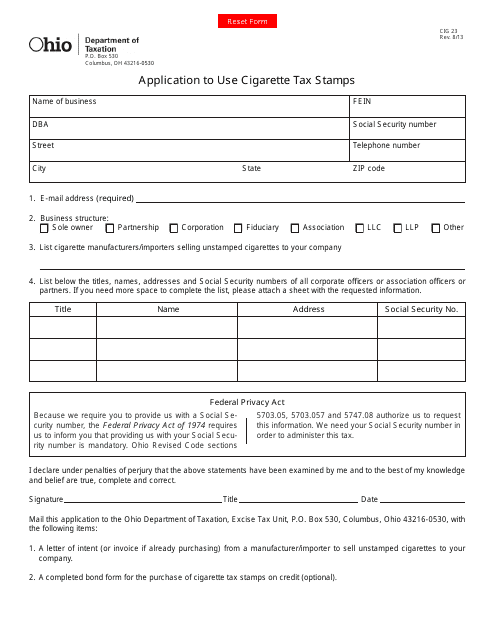

This Form is used for applying to use cigarette tax stamps in Ohio.

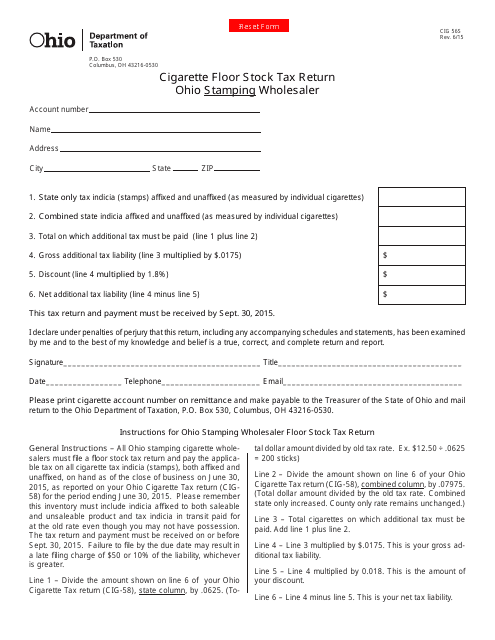

This Form is used for reporting and paying the Cigarette Floor Stock Tax for Ohio Stamping Wholesalers in Ohio.

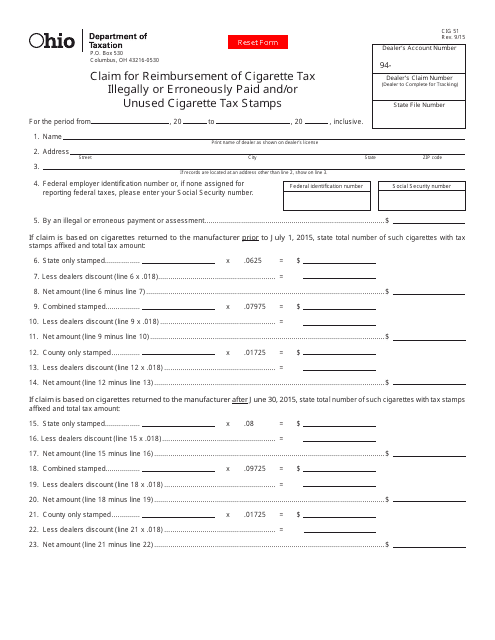

This Form is used for claiming reimbursement of cigarette tax illegally or erroneously paid and/or unused cigarette tax stamps in the state of Ohio.

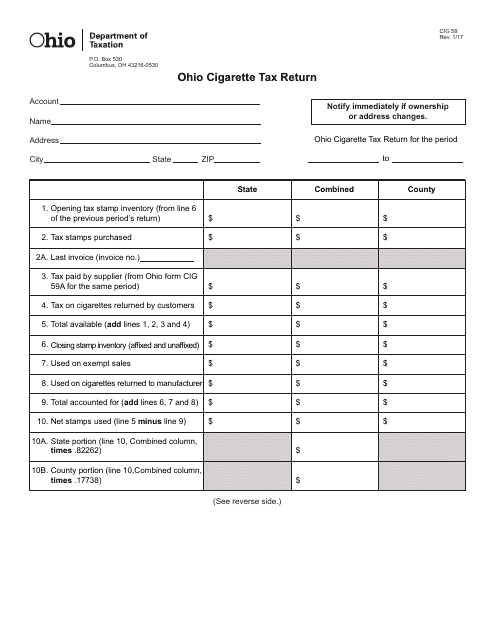

This Form is used for reporting and paying cigarette tax in the state of Ohio.

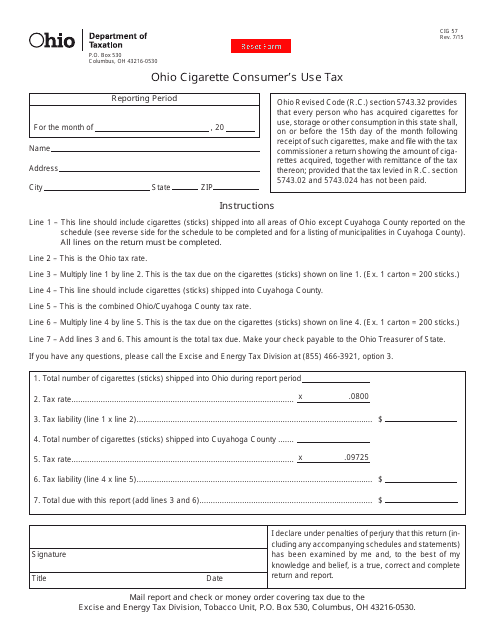

This Form is used for reporting and paying the Ohio Cigarette Consumer's Use Tax for consumers who have purchased cigarettes from out-of-state retailers.

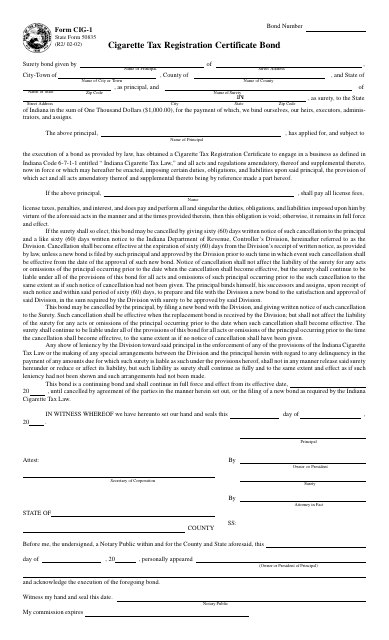

This form is used for obtaining a cigarette tax registration certificate bond in the state of Indiana.

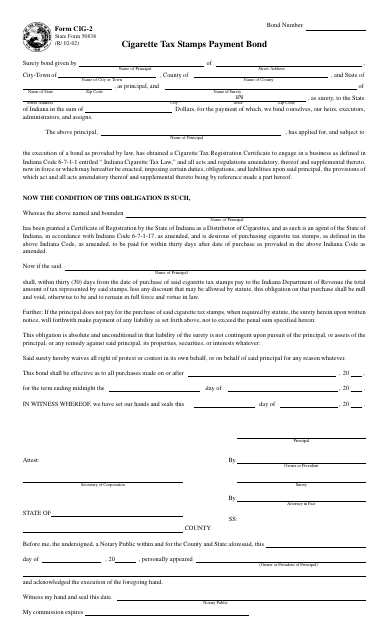

This document is a form used for submitting payment bonds for cigarette tax stamps in Indiana. It is specifically called Form CIG-2 (State Form 50838).

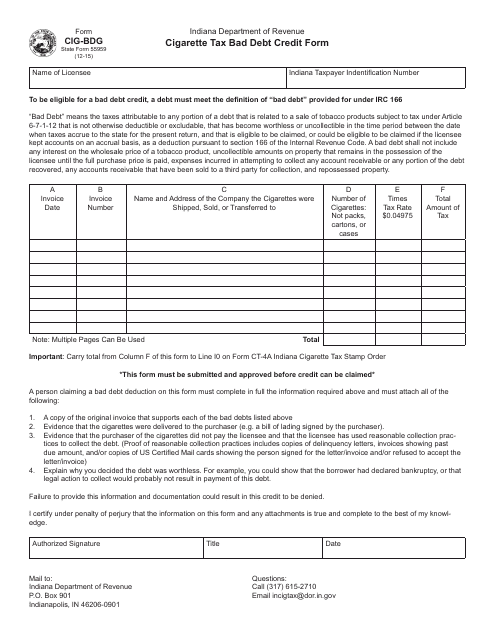

This form is used for claiming a bad debt credit related to cigarette taxes in Indiana.

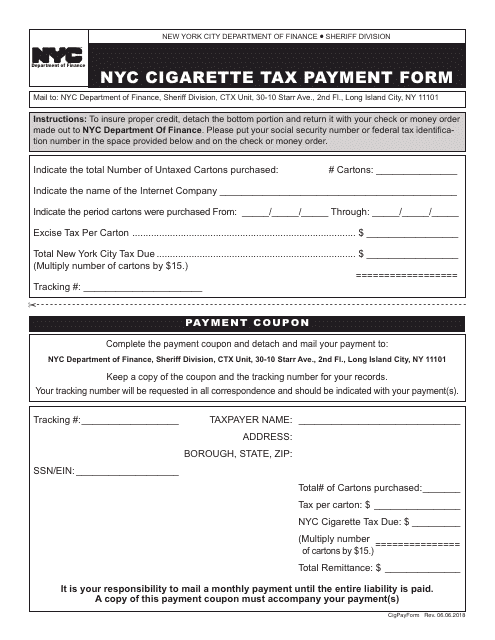

This form is used for making cigarette tax payments in New York City.

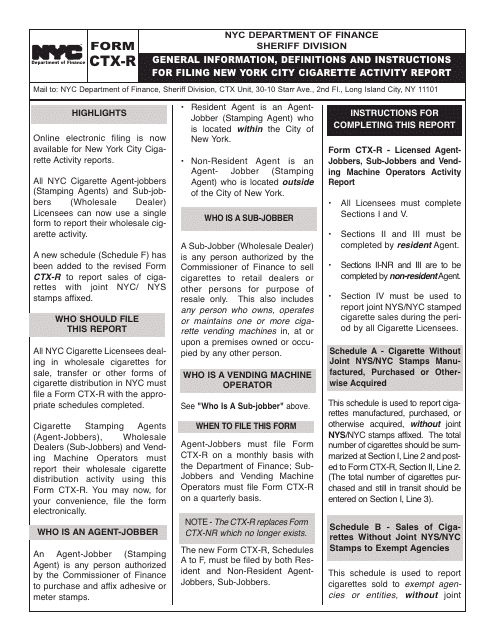

This form is used for reporting cigarette tax activity in New York City.

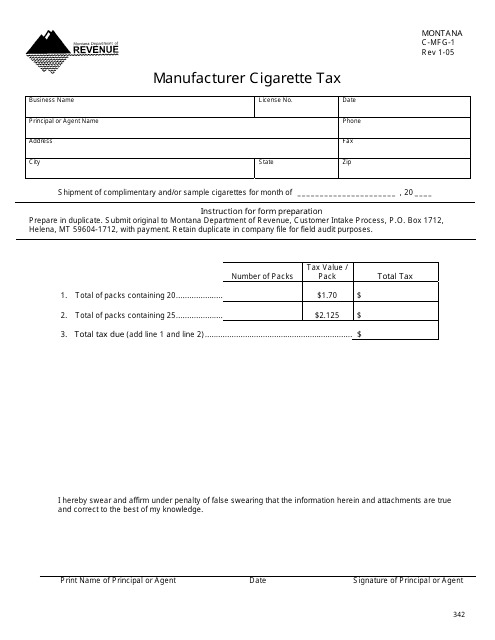

This form is used for reporting and paying the cigarette tax for manufacturers in the state of Montana.

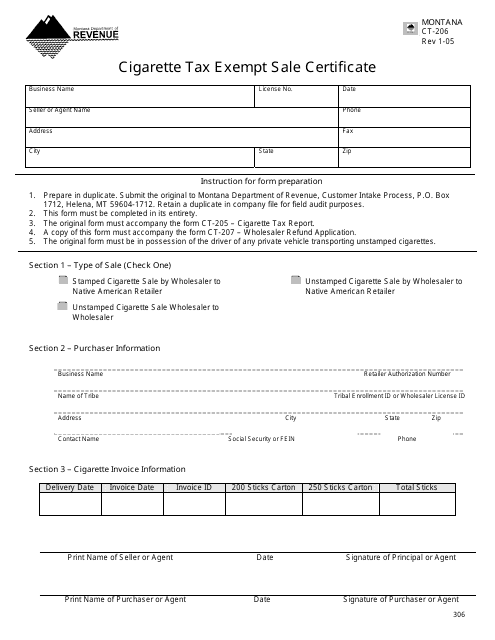

This form is used for claiming an exemption from cigarette tax for certain sales in Montana.

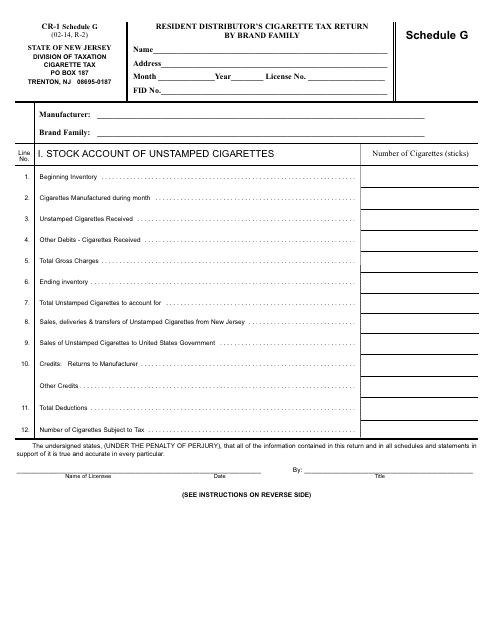

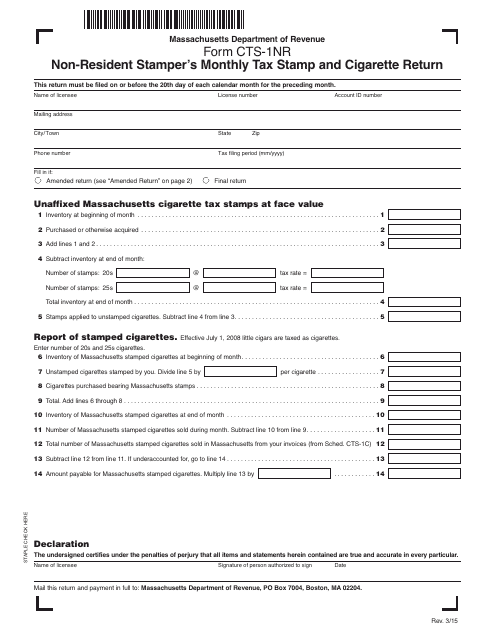

This form is used for non-resident stampers in Massachusetts to report monthly tax stamp and cigarette returns.