Cigarette Tax Templates

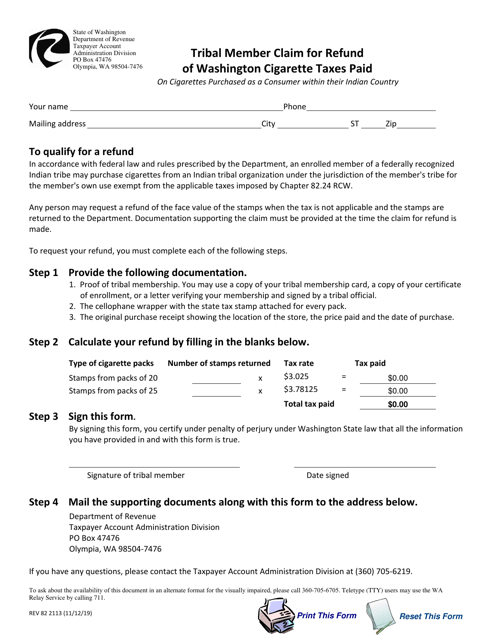

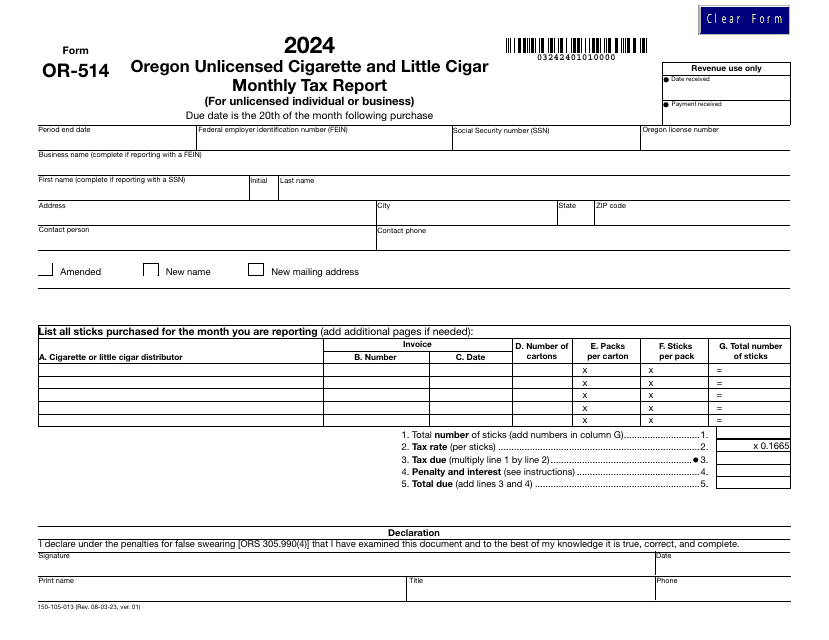

Documents:

149

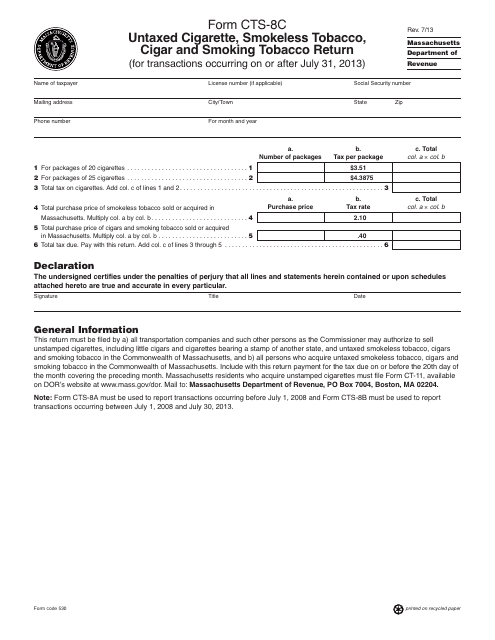

This form is used for reporting and paying taxes on untaxed cigarettes, smokeless tobacco, cigars, and smoking tobacco in Massachusetts.

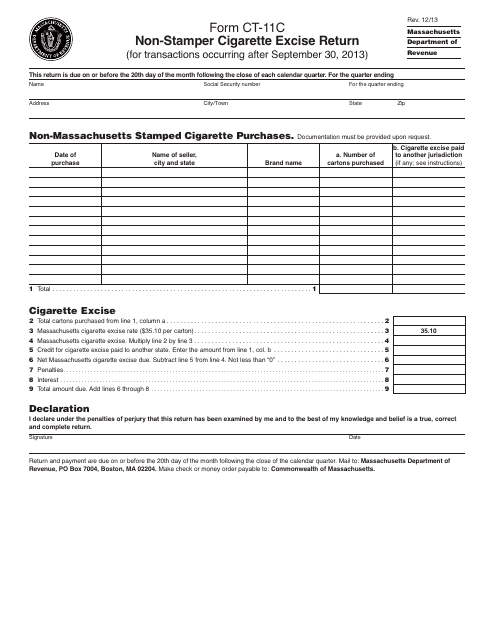

This form is used for reporting and paying excise taxes on non-stamper cigarettes in Massachusetts.

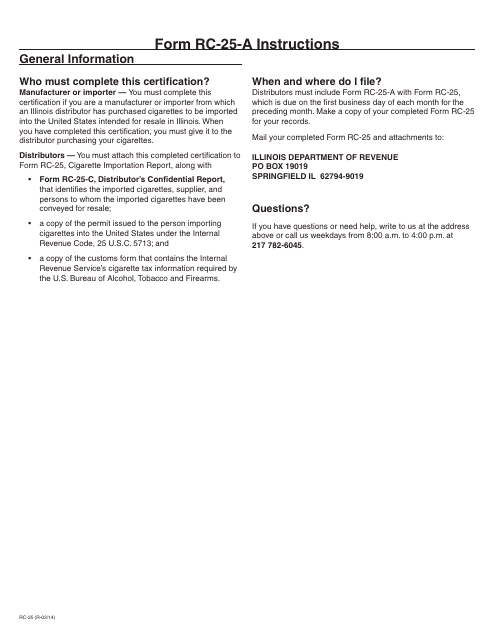

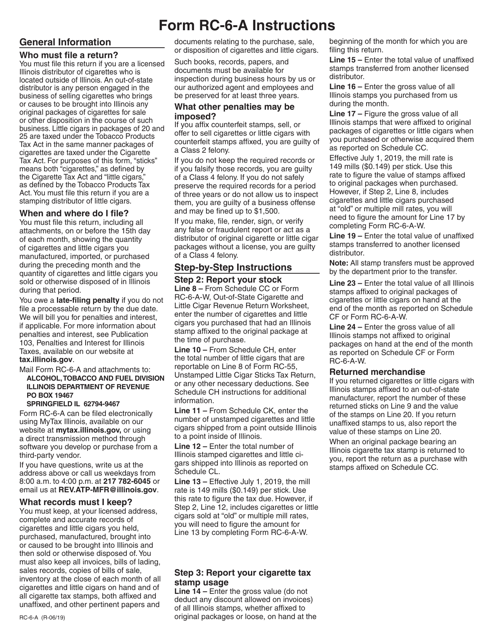

This form is used for cigarette manufacturers and importers in Illinois to certify compliance with state regulations. It provides instructions for completing and submitting Form RC-25-A.

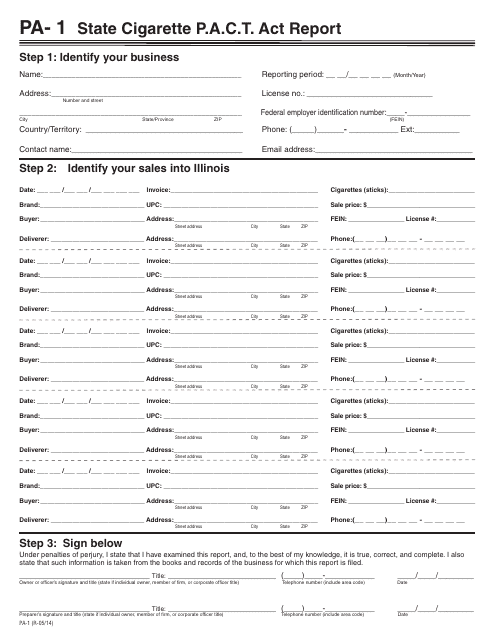

This form is used for reporting information related to the P.A.C.T. Act (Prevent All Cigarette Trafficking Act) for cigarette sales in the state of Illinois.

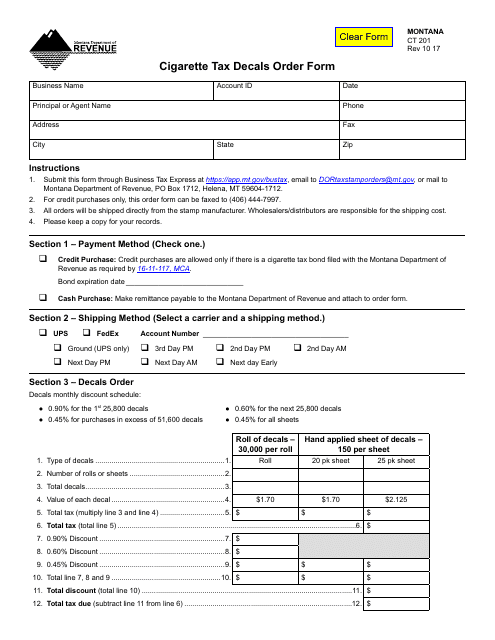

This Form is used for ordering cigarette tax decals in Montana. It facilitates the process of ensuring that appropriate taxes are paid on cigarette sales and helps monitor compliance with tax regulations.

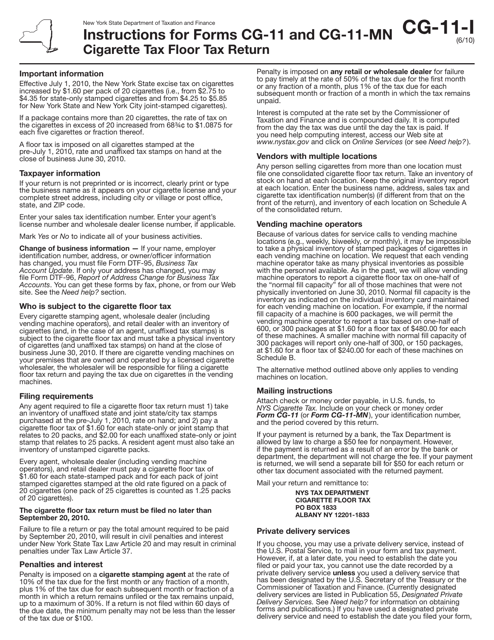

This form is used for filing the Cigarette Tax Floor Tax Return in the state of New York. It provides instructions on how to accurately report and calculate the tax owed on cigarettes.

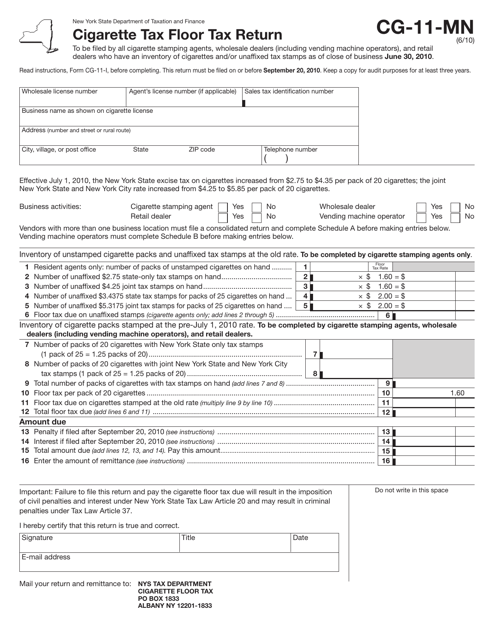

This form is used for reporting and paying the floor tax on cigarettes in New York.

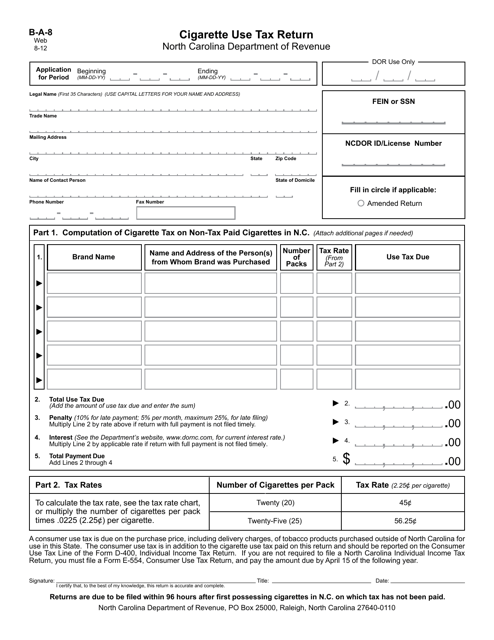

This document is used for reporting and paying cigarette use tax in North Carolina. It is required for individuals or businesses engaged in the sale, distribution, or importation of cigarettes in the state.

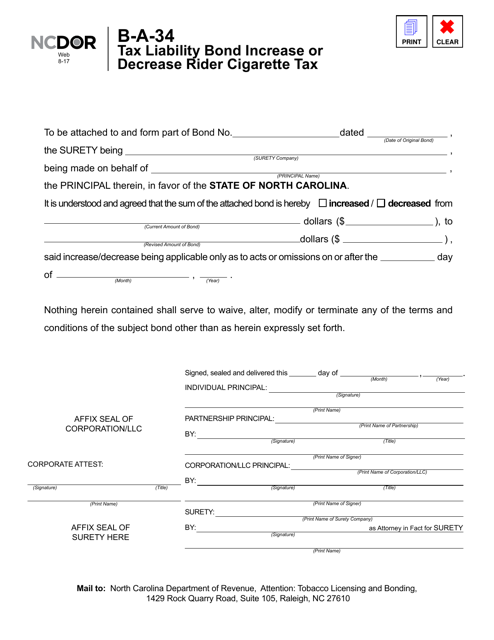

This form is used for increasing or decreasing the tax liability bond for cigarette taxes in North Carolina.

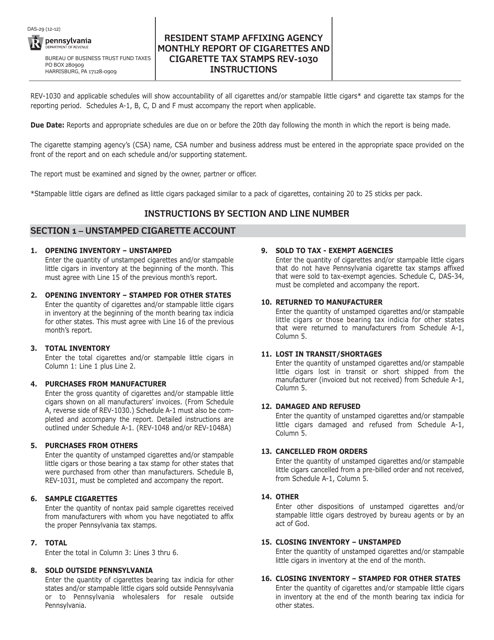

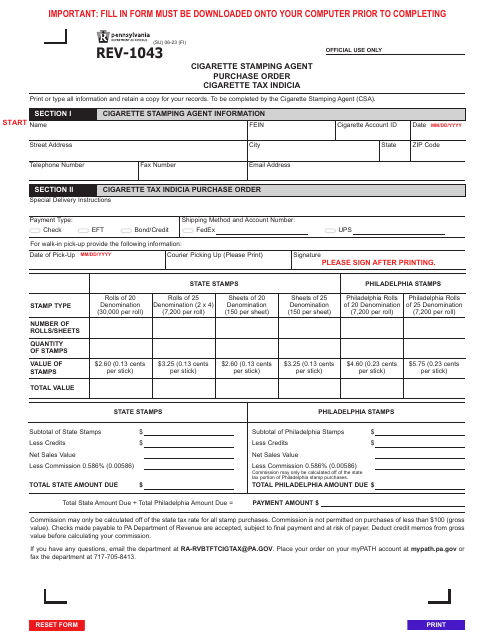

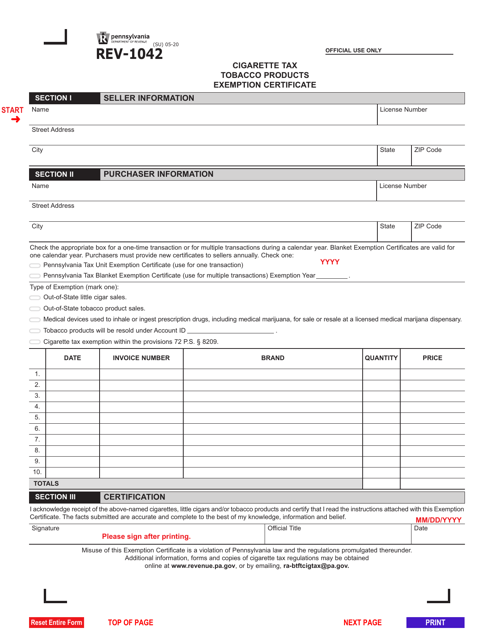

This form is used for the monthly reporting of cigarettes and cigarette tax stamps by resident stamp affixing agencies in Pennsylvania. Residents and agencies can submit this form to report their activities related to the sale and distribution of cigarettes and tax stamps.

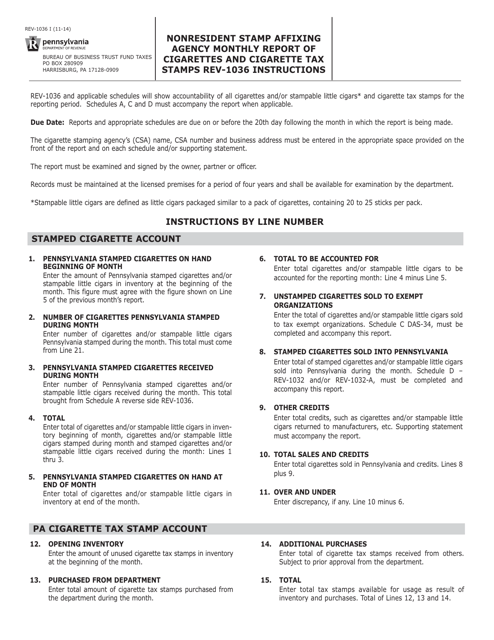

This Form is used for reporting the monthly sales and tax information for nonresident cigarette stamp affixing agencies in Pennsylvania.

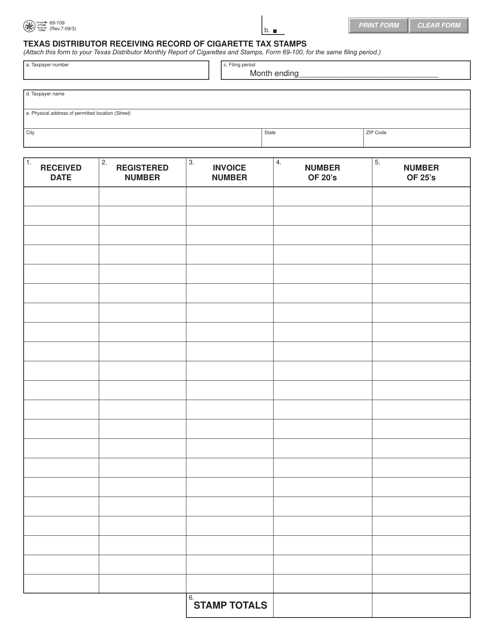

This form is used for recording the receipt of cigarette tax stamps by distributors in Texas.

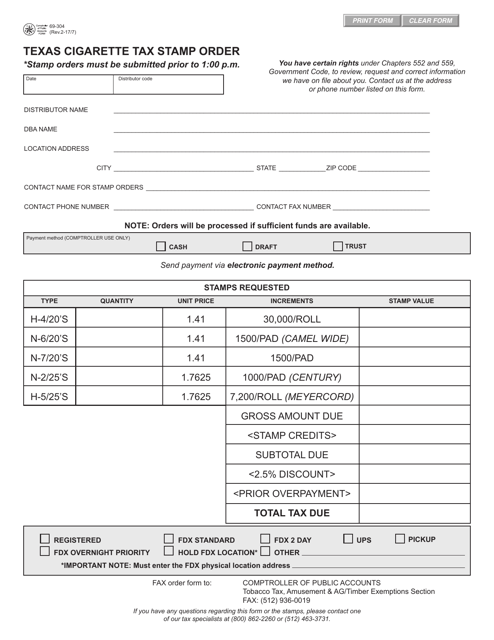

This form is used for ordering Texas cigarette tax stamps. The stamps are required for retailers to affix to each pack of cigarettes sold in Texas. This helps enforce the collection of cigarette taxes and ensures compliance with state regulations.

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.

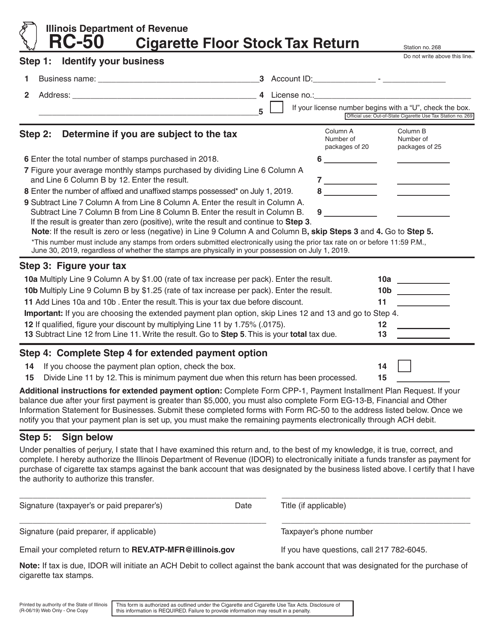

This Form is used for reporting and paying the cigarette floor stock tax in the state of Illinois. It is required for businesses that hold cigarettes for sale or distribution in the state.

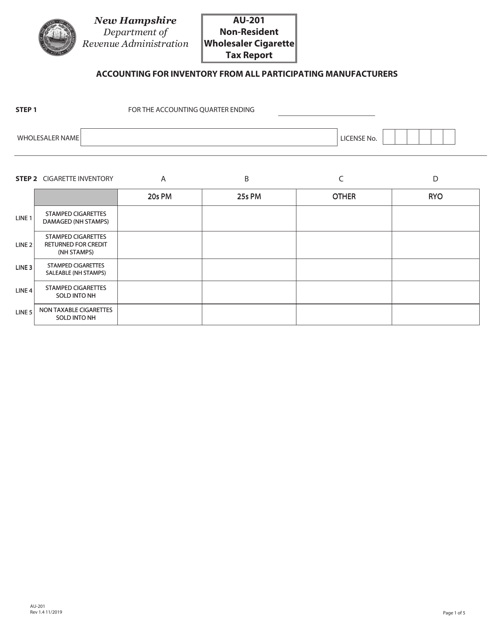

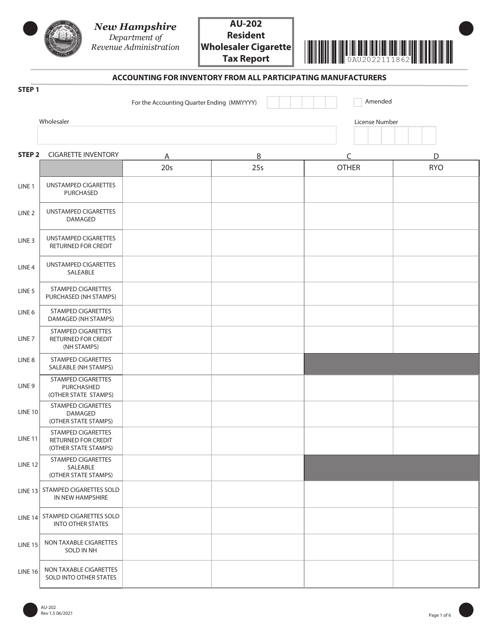

This Form is used for non-resident wholesalers to report cigarette tax in New Hampshire.

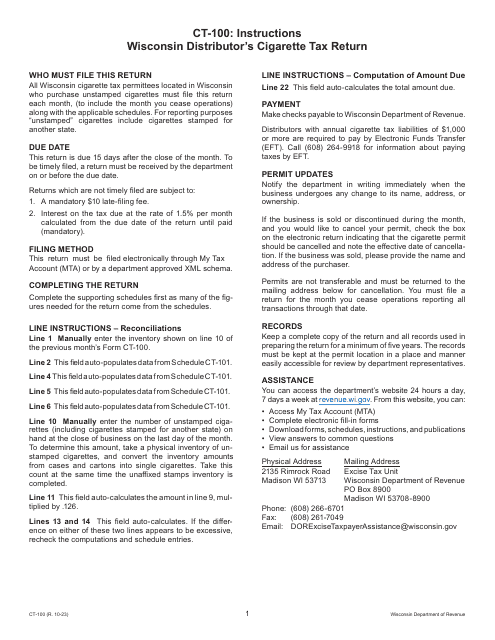

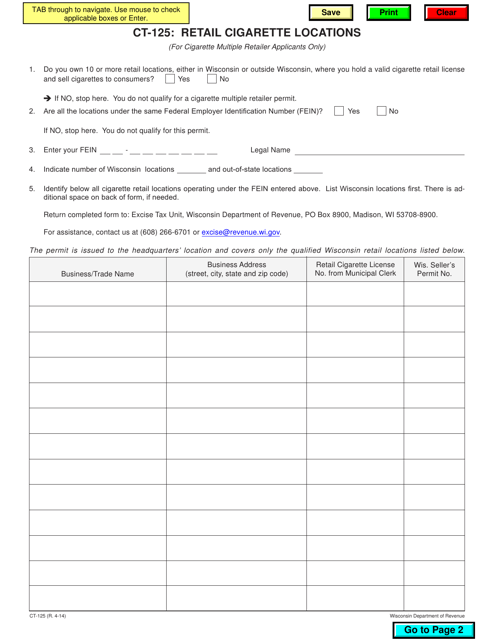

This form is used for registering retail cigarette locations in the state of Wisconsin.