Tax Templates

Documents:

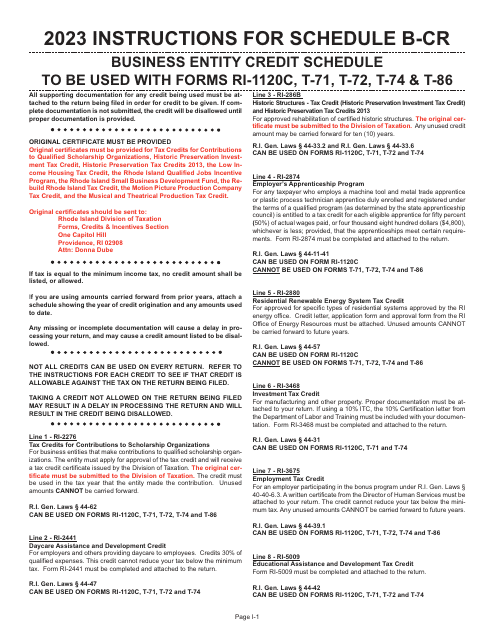

2882

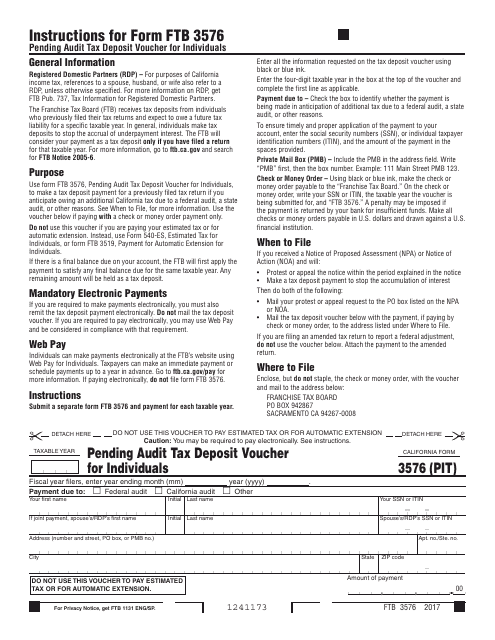

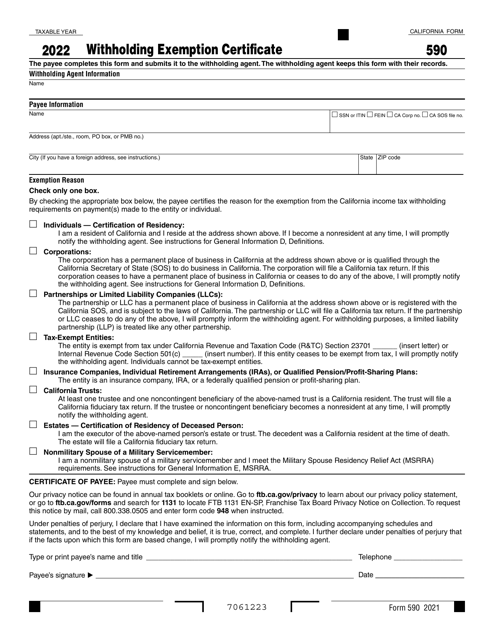

This form is used for making tax deposits for individuals who are under pending audit in the state of California. It serves as a voucher for the tax payment.

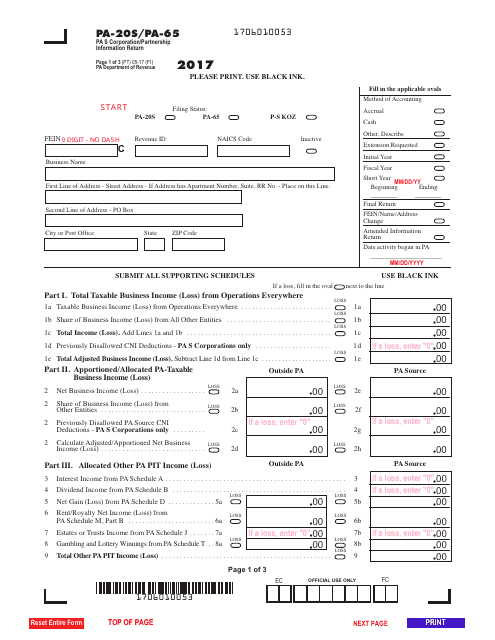

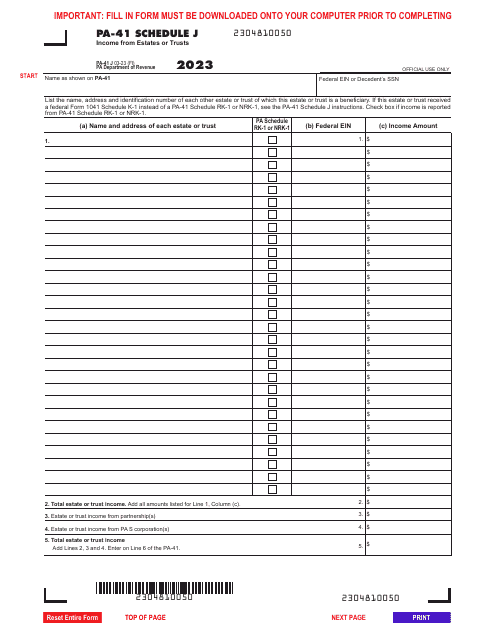

This Form is used for Pennsylvania S corporations and partnerships to file their annual information return.

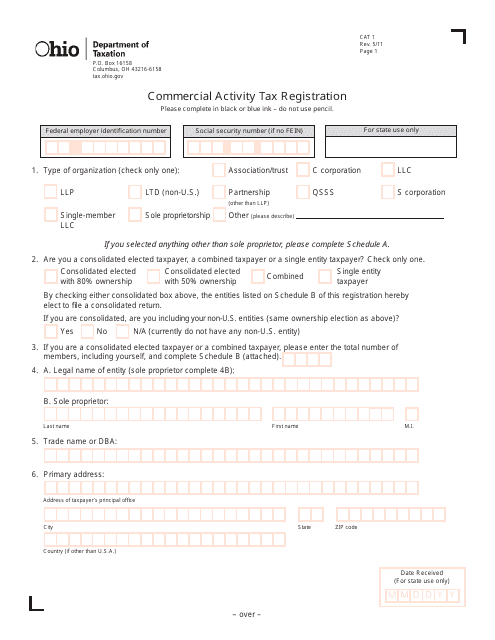

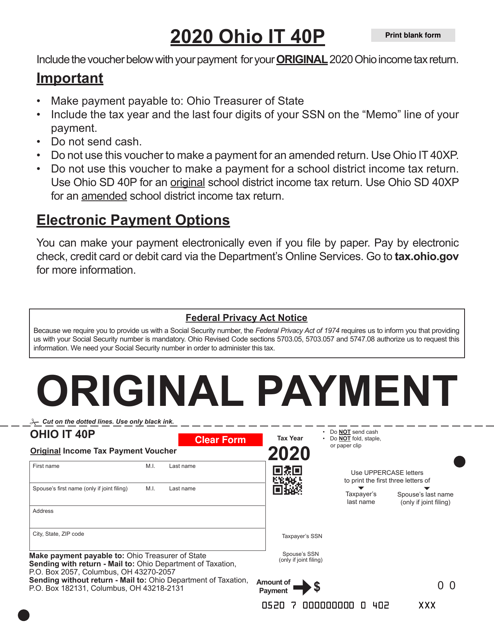

This Form is used for registering for the Commercial Activity Tax in the state of Ohio.

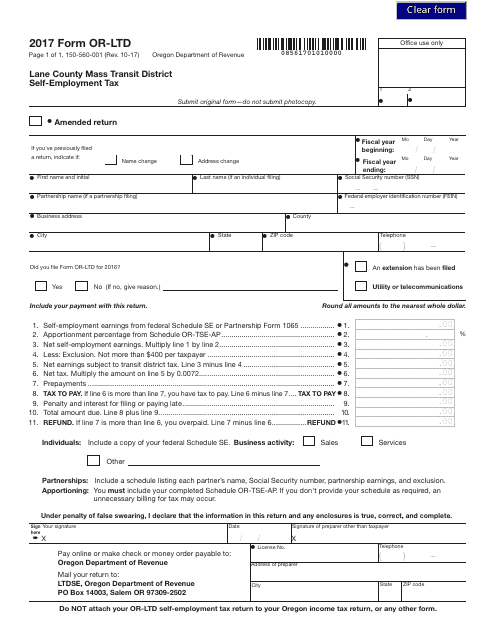

This Form is used for reporting self-employment tax for individuals who work in the Lane County Mass Transit District in Oregon.

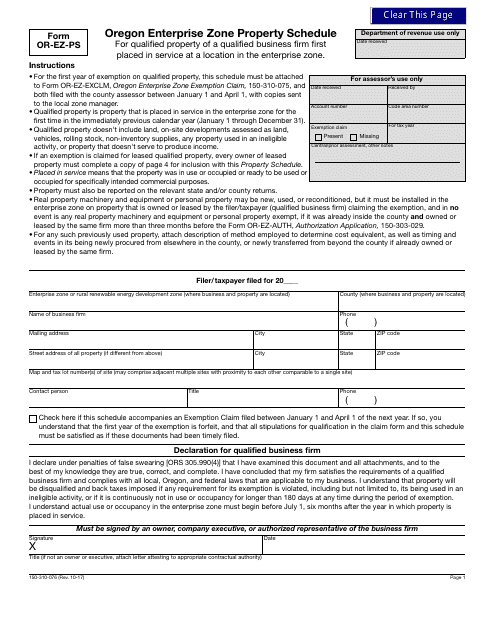

This Form is used for reporting property schedule information for the Oregon enterprise zone program.

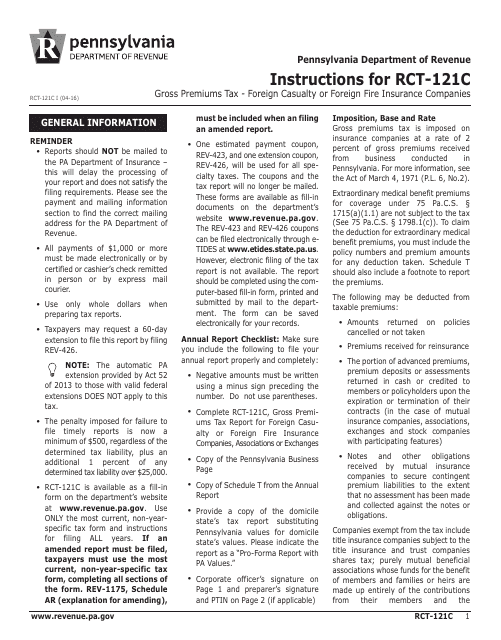

This Form is used for reporting the gross premiums tax for foreign casualty or foreign fire insurance companies operating in Pennsylvania. It provides instructions on how to fill out the RCT-121C Gross Premiums Tax Report accurately and comply with state regulations.

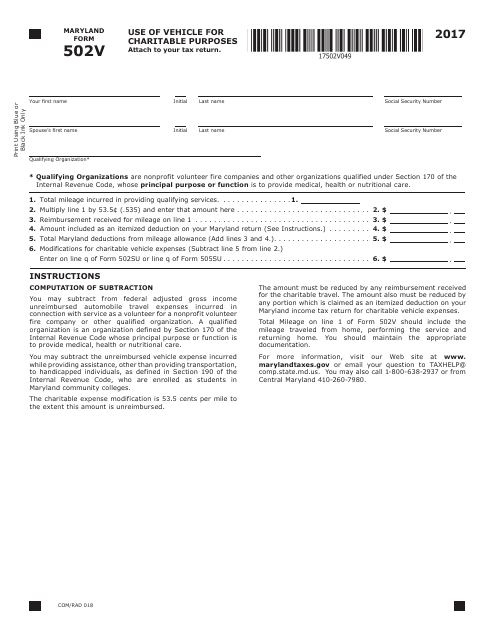

This form is used for reporting the use of a vehicle for charitable purposes in Maryland.

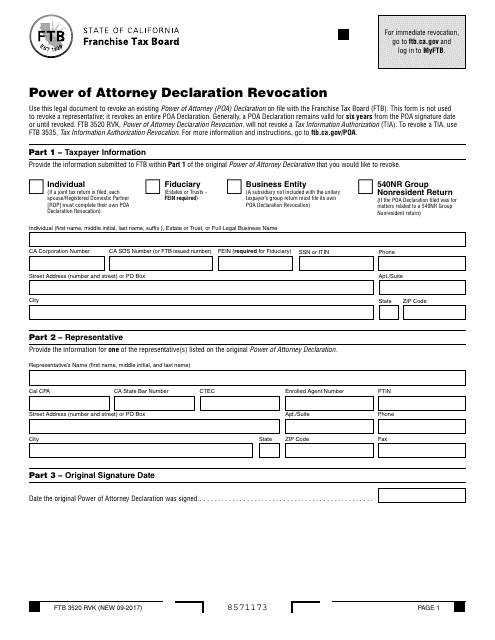

This form is used for revoking a Power of Attorney declaration in the state of California. It allows individuals to notify the Franchise Tax Board that they no longer grant another person the authority to act on their behalf in tax matters.

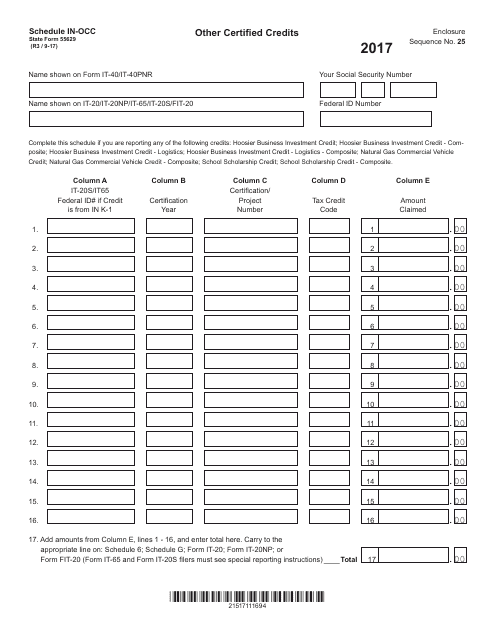

This form is used for reporting and claiming other certified credits in the state of Indiana.

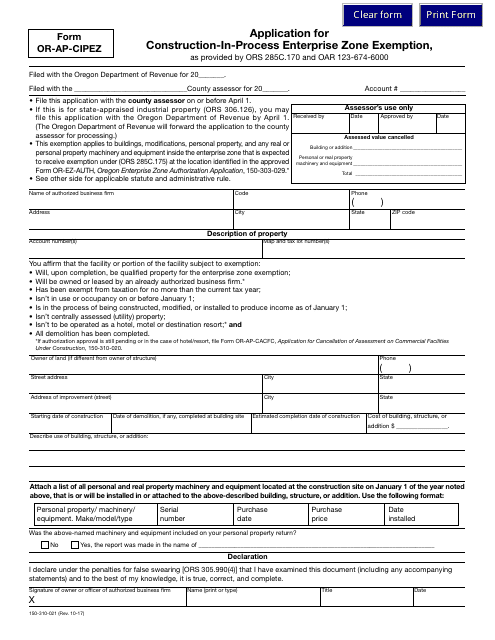

This form is used for applying for the Construction-In-Process Enterprise Zone Exemption in Oregon.

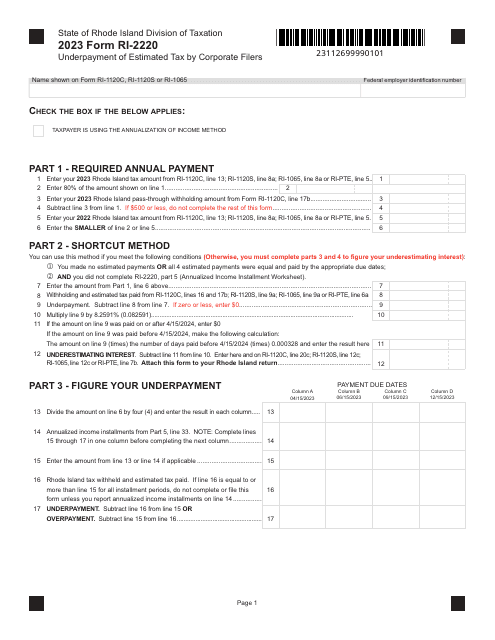

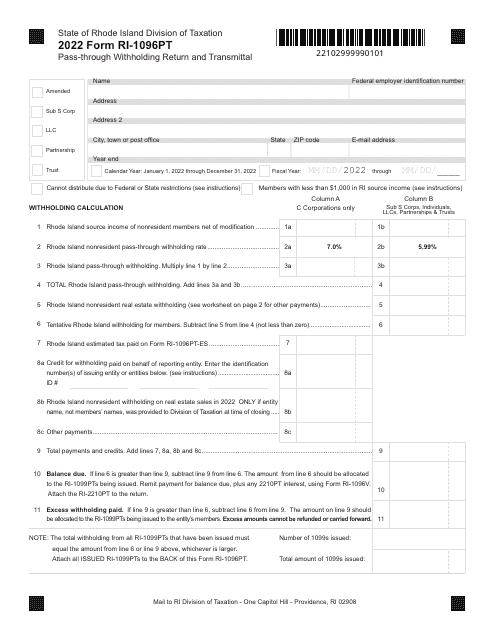

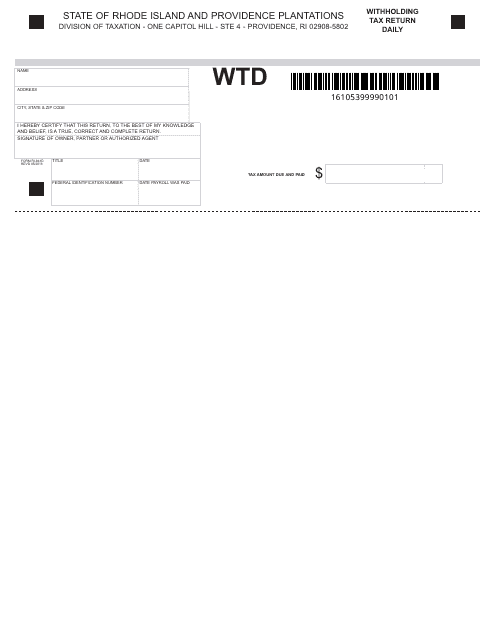

This Form is used for reporting and remitting the withholding tax withholdings made on a daily basis in the state of Rhode Island.

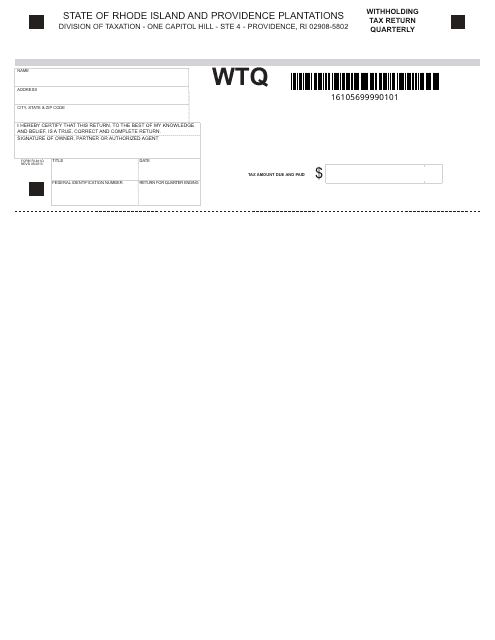

This form is used for filing quarterly withholding tax returns in the state of Rhode Island.

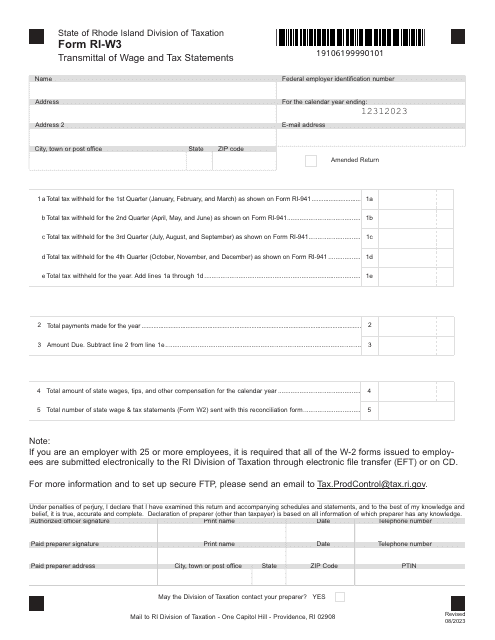

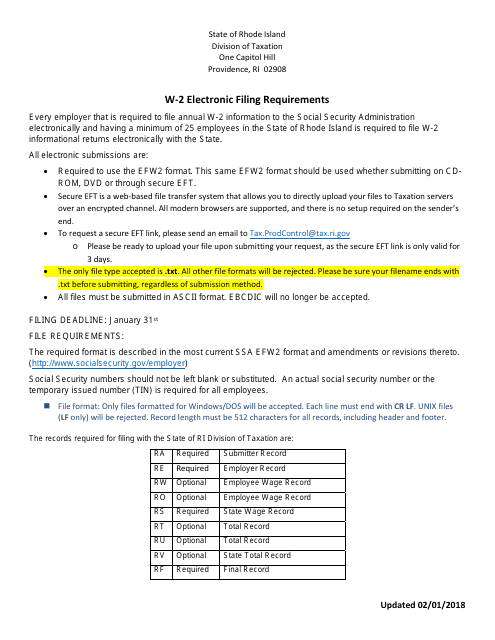

This document is used for reporting W-2 information on electronic media in Rhode Island.

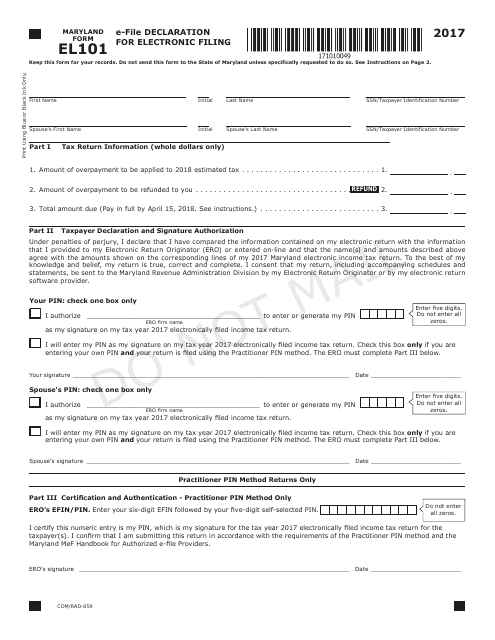

This form is used for declaring electronic filing in the state of Maryland. It is specifically for individuals who want to e-file their tax returns.

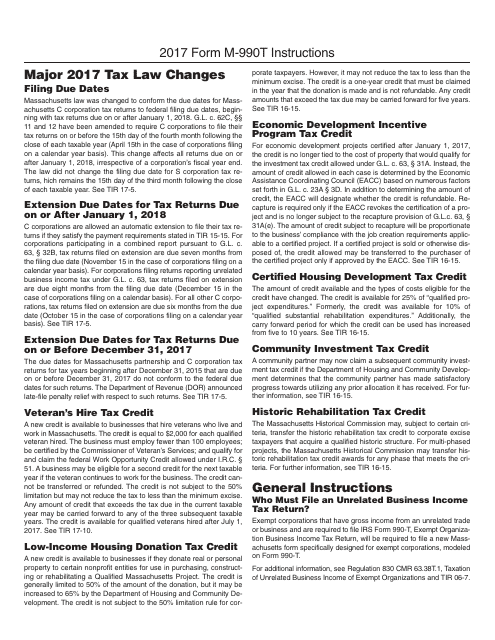

This Form is used for reporting and paying the Massachusetts Unrelated Business Income Tax. It applies to tax-exempt organizations that engage in unrelated business activities in Massachusetts. The form provides instructions on how to report and calculate the taxable income, exemptions, and credits for the tax year.

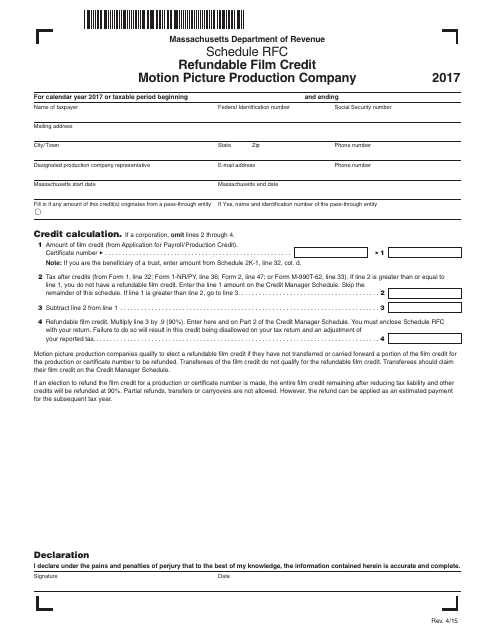

This document is for scheduling the refundable film credit for motion picture production companies in Massachusetts. It allows companies to plan and request refunds for eligible film production expenses.

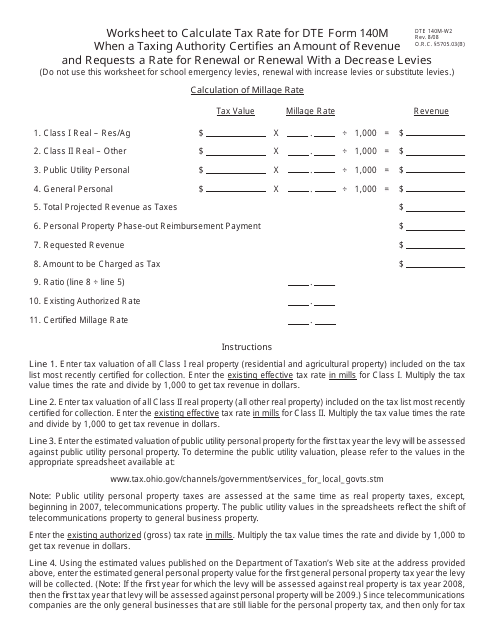

This form is used for calculating and documenting the necessary information for a property tax renewal or renewal with a decrease in levies in the state of Ohio.

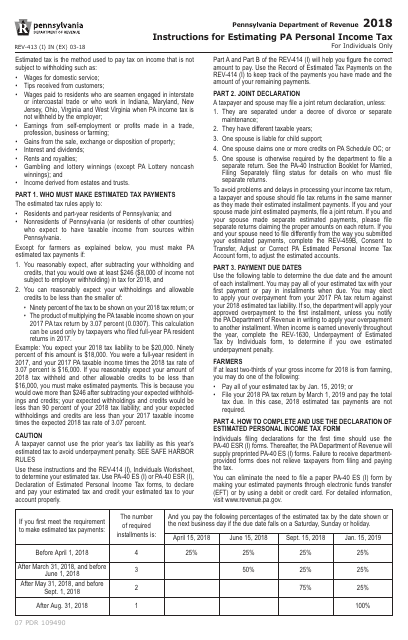

This document provides instructions for estimating Pennsylvania personal income tax. It guides taxpayers on how to accurately calculate and report their estimated tax liability.

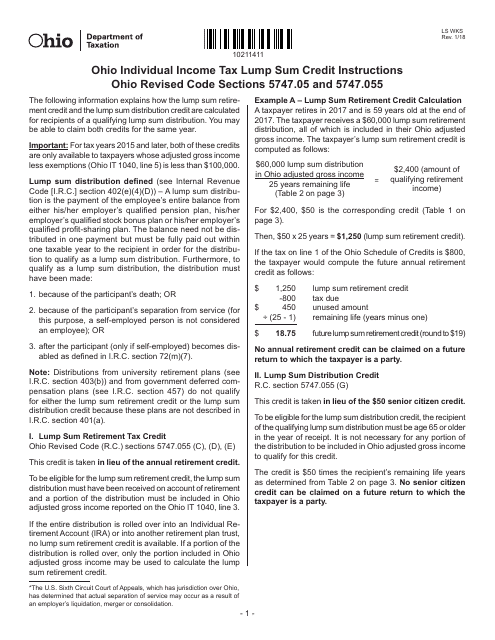

This document is a worksheet specific to Ohio residents. It is used for calculating the Lump Sum Retirement/Distribution Credit for taxes.

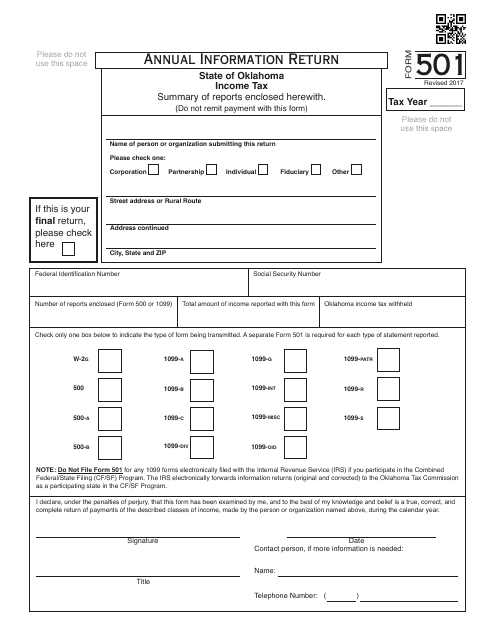

This form is used for filing the Annual Information Return in Oklahoma for OTC (Oklahoma Tax Commission). It is required for businesses to report their income and other relevant financial information for tax purposes.