Tax Templates

Documents:

2882

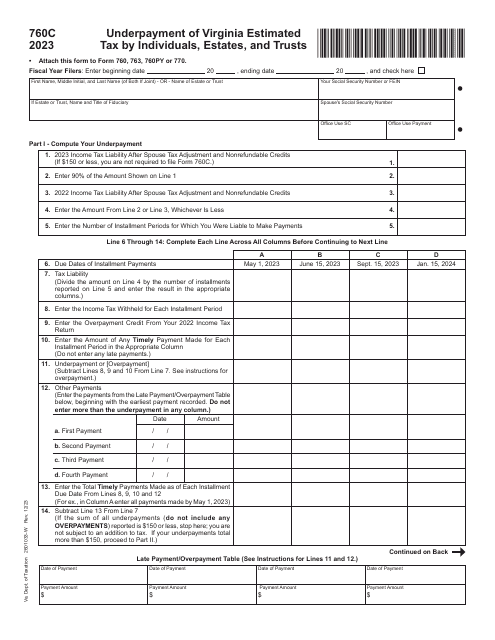

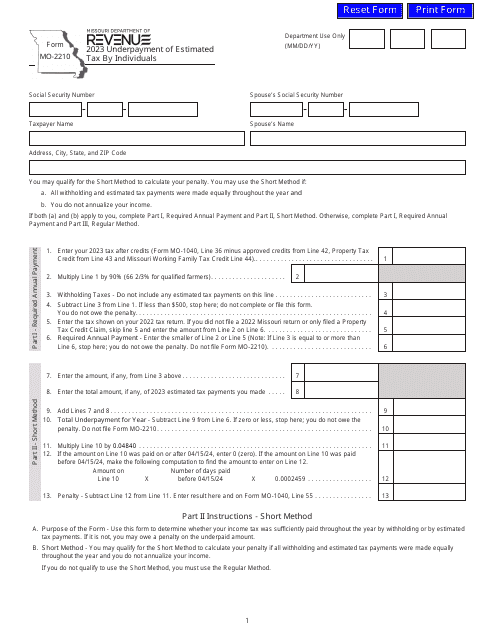

Form 760C Underpayment of Virginia Estimated Tax by Individuals, Estates and Trusts - Virginia, 2023

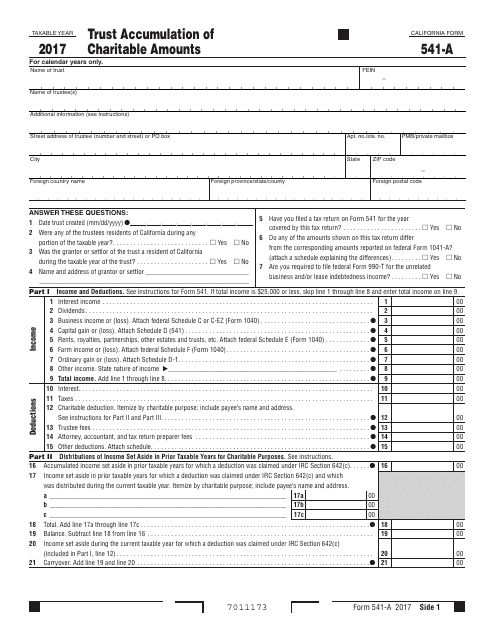

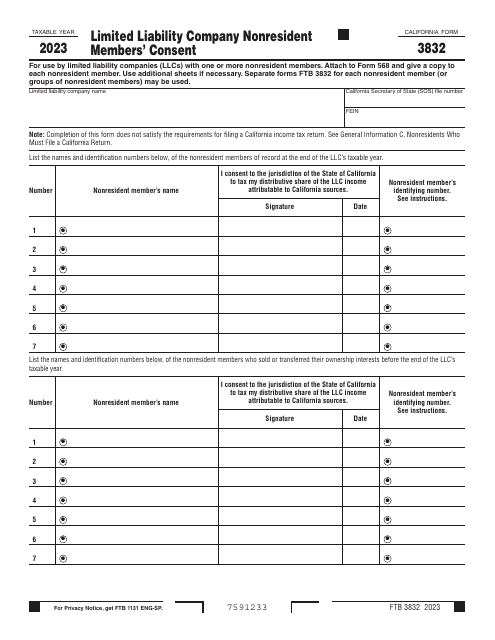

This Form is used for reporting the accumulation of charitable amounts in a trust in the state of California.

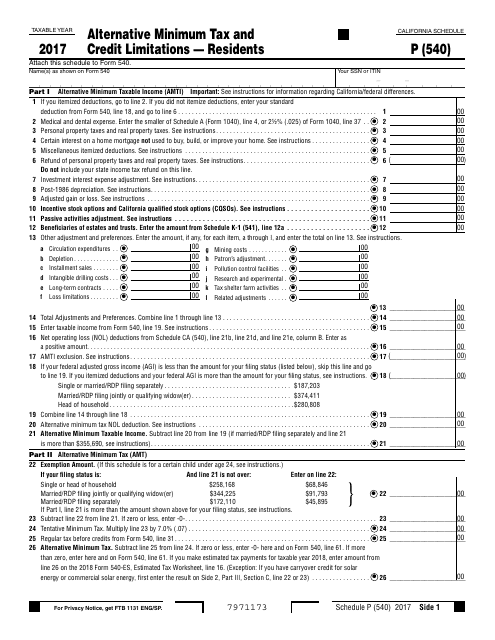

This form is used for calculating the alternative minimum tax and credit limitations for residents of California on their Form 540 tax return.

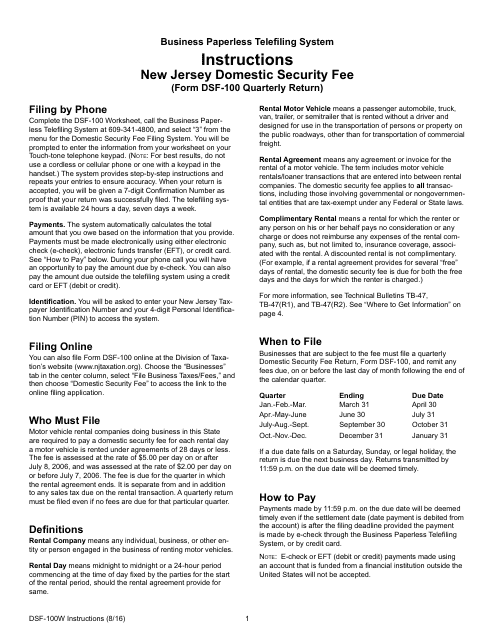

This document is used for submitting the quarterly return for businesses in New Jersey. It provides instructions on how to fill out and submit Form DSF-100.

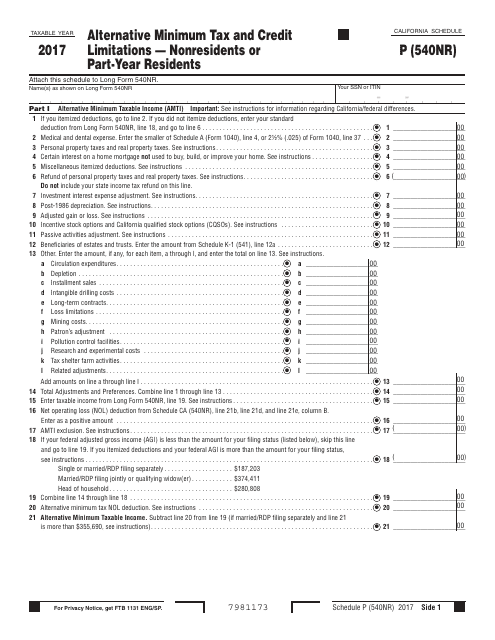

This Form is used for calculating the alternative minimum tax and credit limitations for nonresidents or part-year residents in California. It helps determine the amount of tax owed based on specific criteria and ensures that taxpayers are not subject to excessive tax burdens.

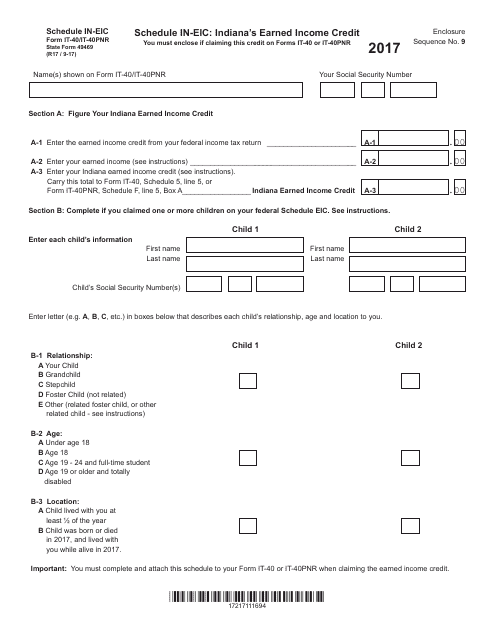

This form is used for claiming Indiana's Earned Income Credit on your state tax return if you are a resident or part-year resident of Indiana.

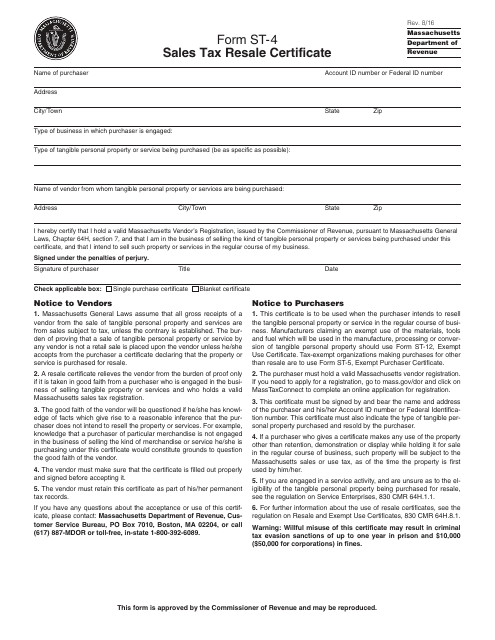

This is a Massachusetts legal document presented by a retailer to a merchant from whom the retailer is buying merchandise to resell it later in the regular course of business and is needed to avoid paying sales tax twice.

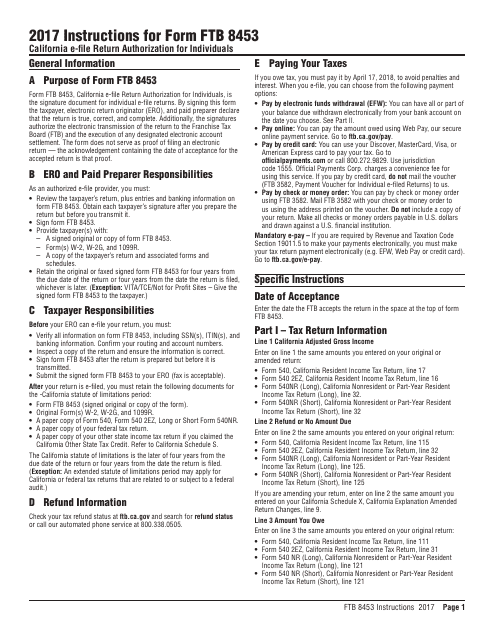

This document is for individuals who want to electronically file their tax returns in California. The form, FTB8453, is used to authorize the electronic filing of the return. It provides instructions on how to complete and submit the form.

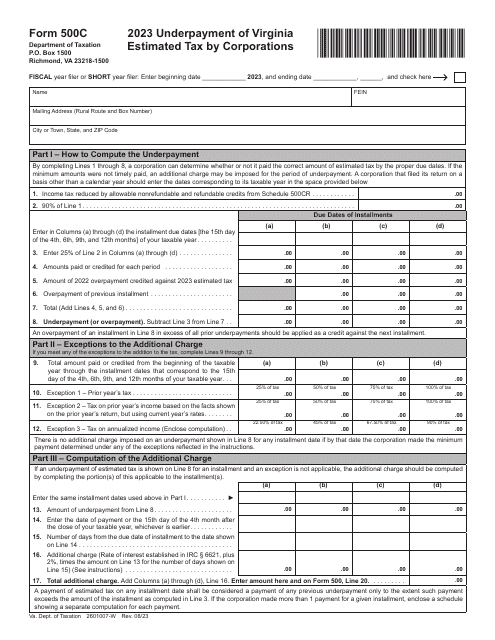

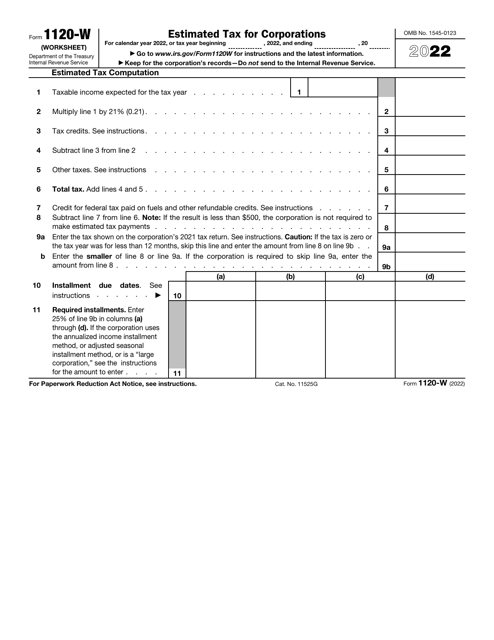

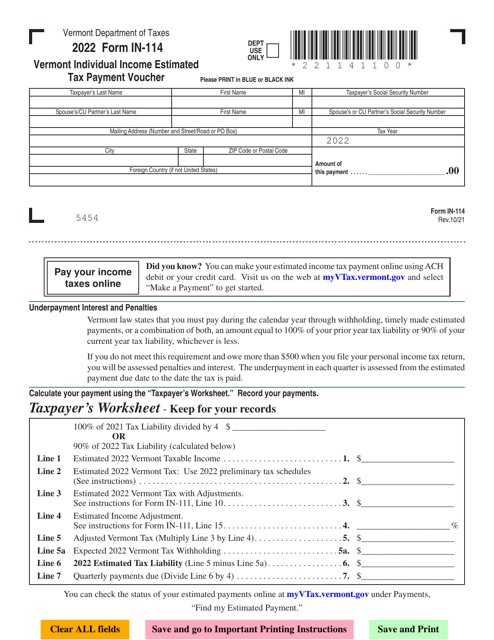

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

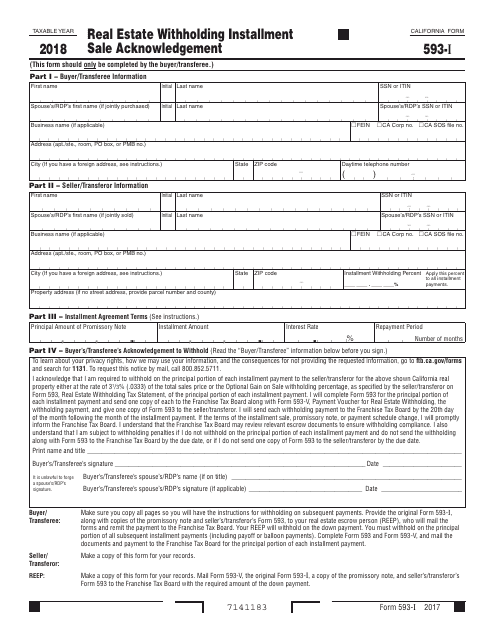

This form is used in California for acknowledging the installment sale of real estate properties and withholding taxes.

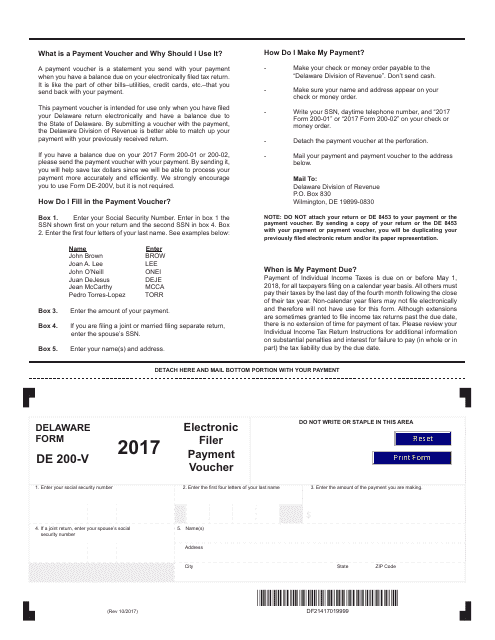

This form is used for making electronic payments for various taxes to the state of Delaware.

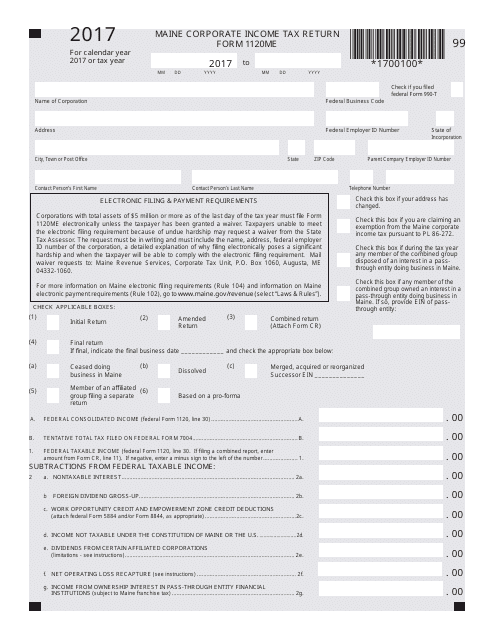

This form is used for filing the Maine Corporate Income Tax Return for businesses operating in Maine.