Tax Incentives Templates

Looking to take advantage of tax incentives or looking for tax incentive forms? Our website provides a comprehensive collection of tax incentives available in various states. These incentives are designed to promote economic growth and provide financial incentives for specific activities such as property development, angel investments, economic recovery, renewable fuels production, and more.

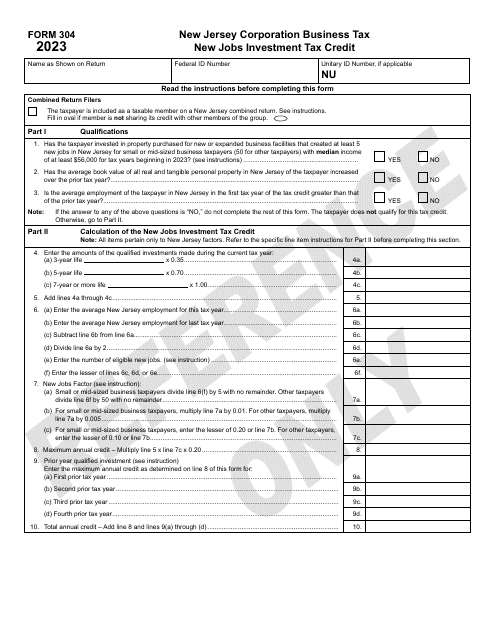

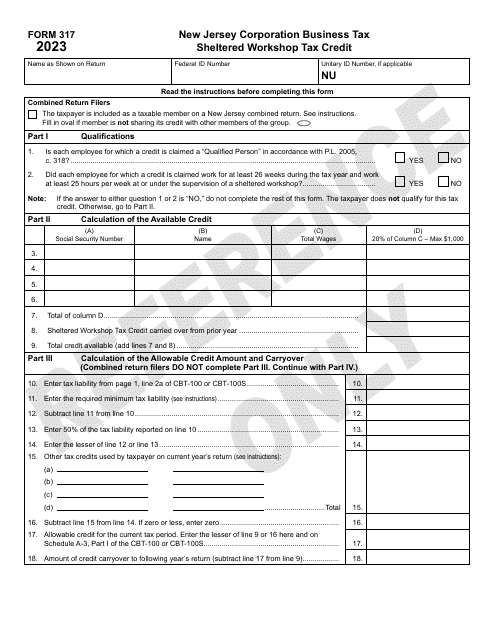

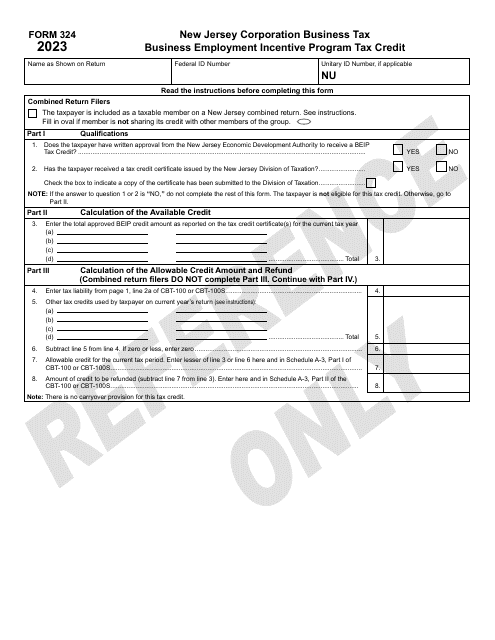

Explore our extensive range of tax incentives, including the Cooperative Property Tax Abatement Initial Application in New York City, the Form 321 Angel Investor Tax Credit in New Jersey, the Form 313 Economic RecoveryTax Credit in New Jersey, the Form N-360 Renewable Fuels Production Tax Credit in Hawaii, and the Instructions for Form I-053I Schedule M Additions to and Subtractions From Income in Wisconsin.

Our user-friendly website makes it easy to access and download the necessary forms to take advantage of these valuable tax incentives. Whether you represent a business or an individual, our collection of tax incentives can help you maximize your financial benefits. Don't miss out on potential deductions and credits - start exploring our tax incentives today!

Documents:

386

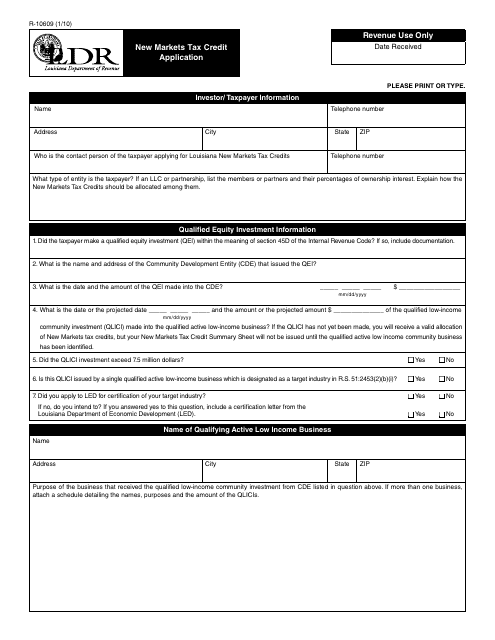

This form is used for applying for the New Markets Tax Credit program in Louisiana. It allows businesses to request tax credits for investments that benefit low-income communities in the state.

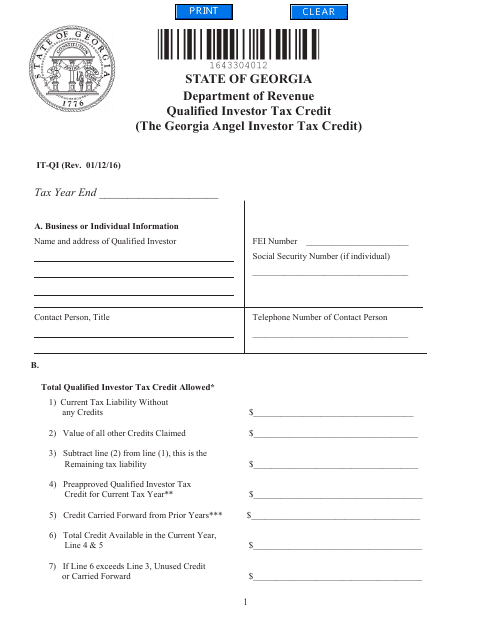

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

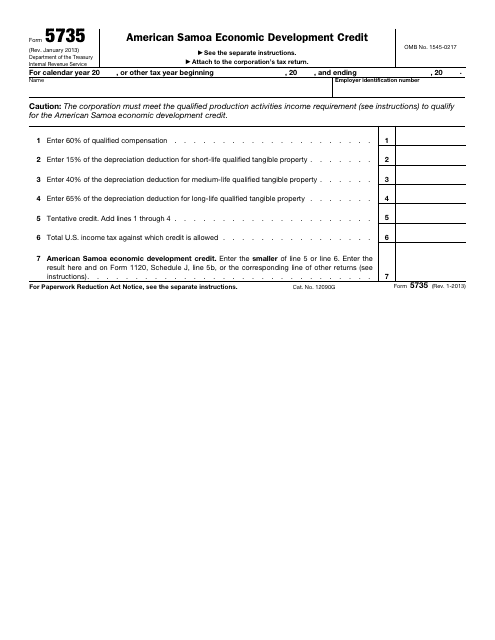

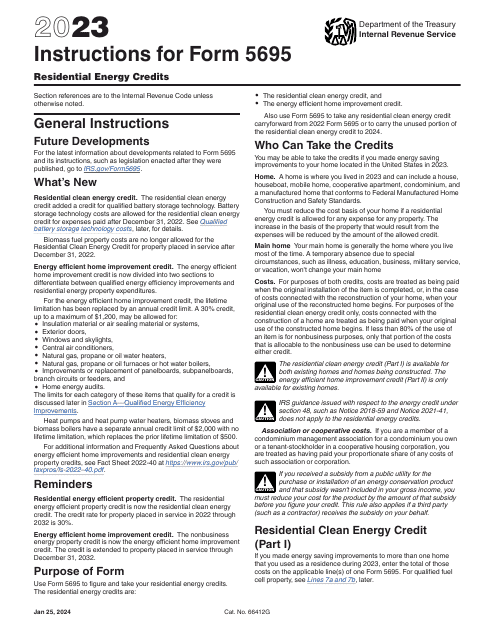

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

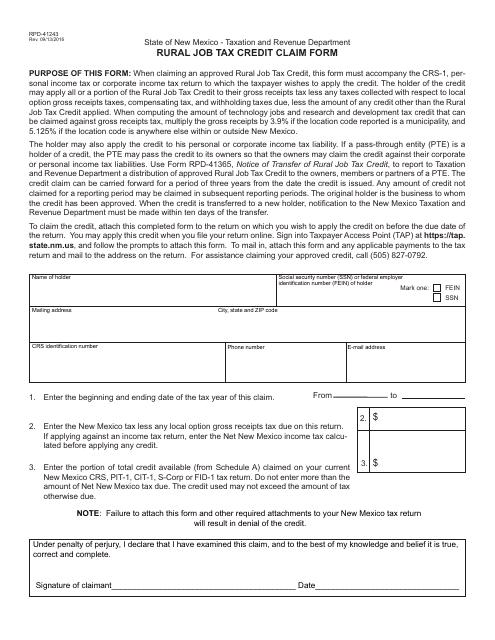

This form is used for claiming the rural job tax credit in the state of New Mexico. It is for businesses that have created jobs in rural areas and are eligible for this tax credit.

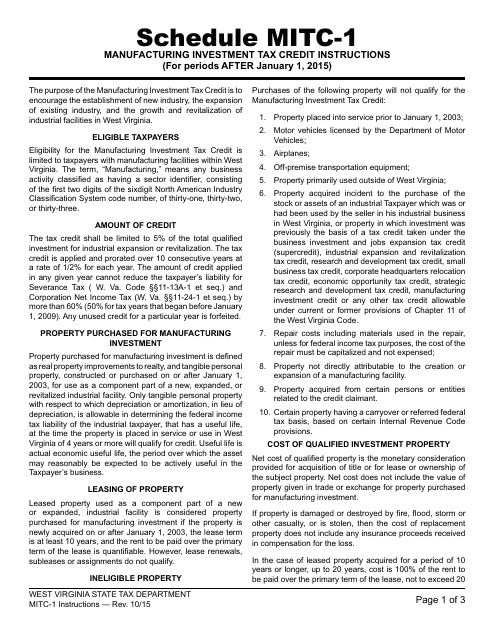

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

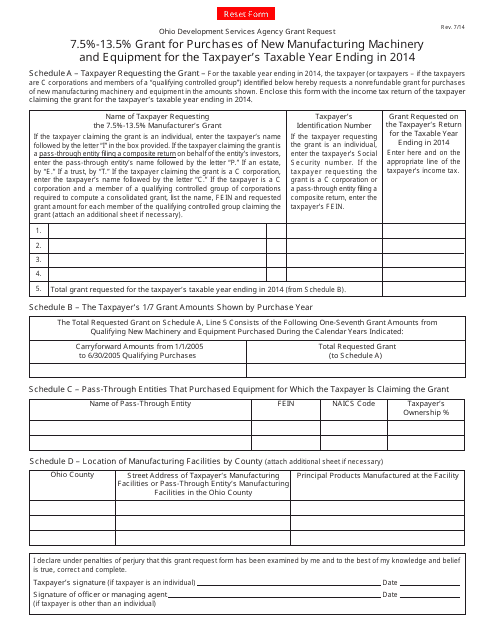

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

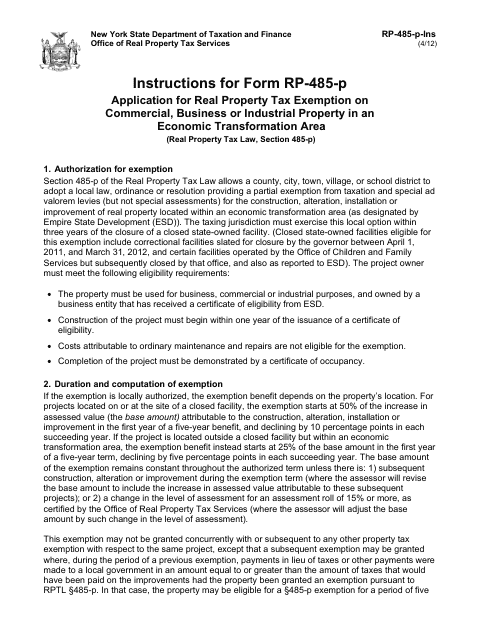

This Form is used for applying for a real property tax exemption on commercial, business or industrial property in an Economic Transformation Area in New York.

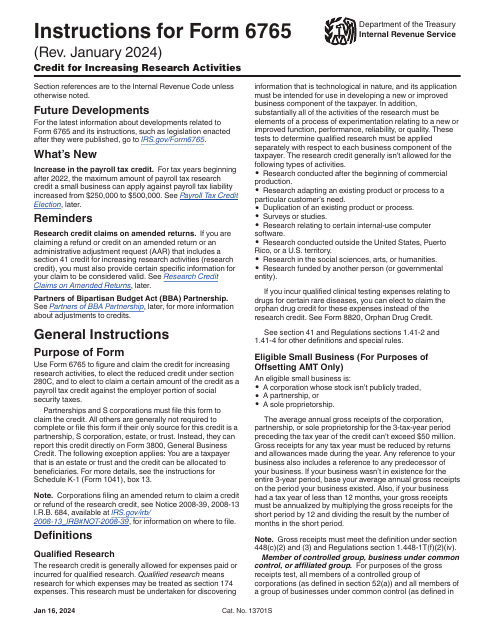

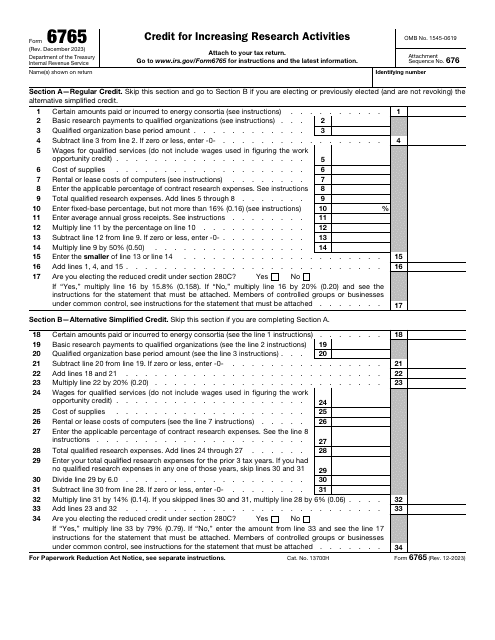

This is a document you may use to figure out how to properly complete IRS Form 6765

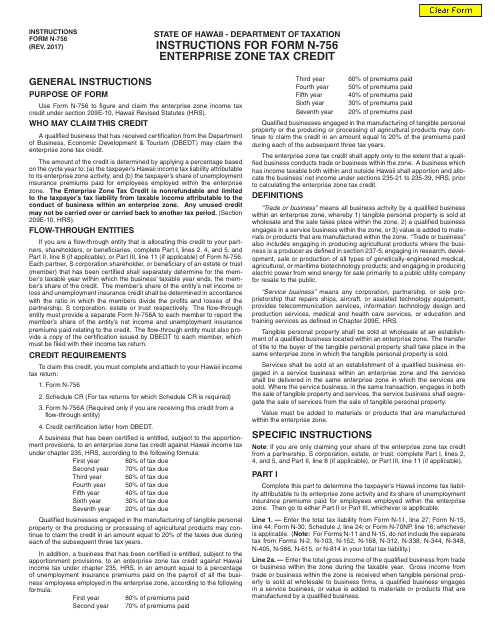

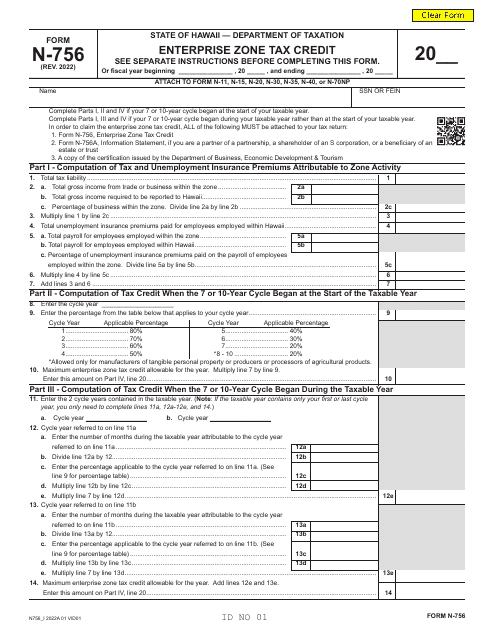

This form is used for claiming the Enterprise Zone Tax Credit in Hawaii. It provides instructions on how to accurately fill out the form and submit it to the appropriate authorities.

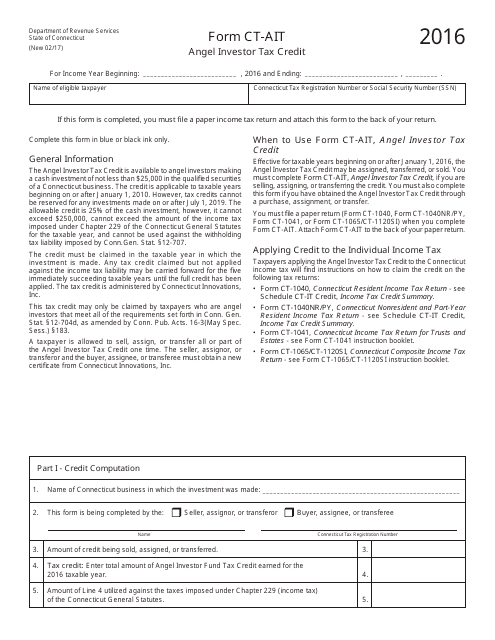

This form is used for claiming the Angel Investor Tax Credit in the state of Connecticut.

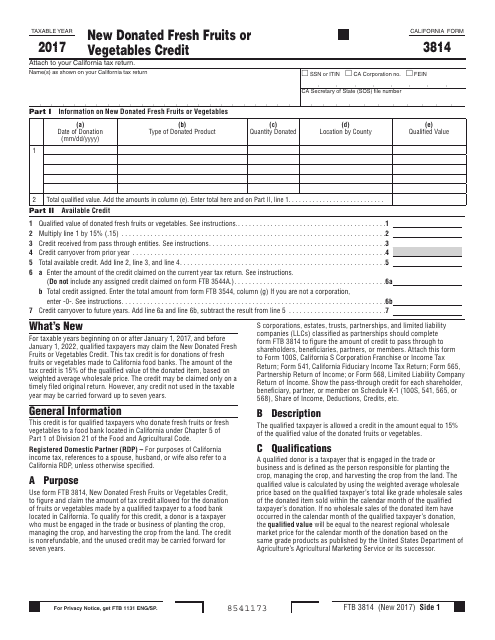

This form is used for claiming the New Donated Fresh Fruits or Vegetables Credit in California. It allows individuals or businesses to receive tax credits for donating fresh fruits or vegetables to California food banks or charitable organizations.

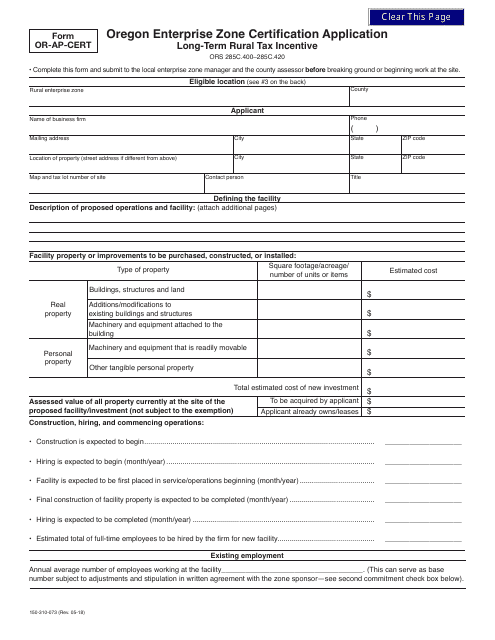

This document is used for applying for Enterprise Zone Certification in Oregon. It helps businesses determine their eligibility for certain tax incentives and benefits offered through the Enterprise Zone program.

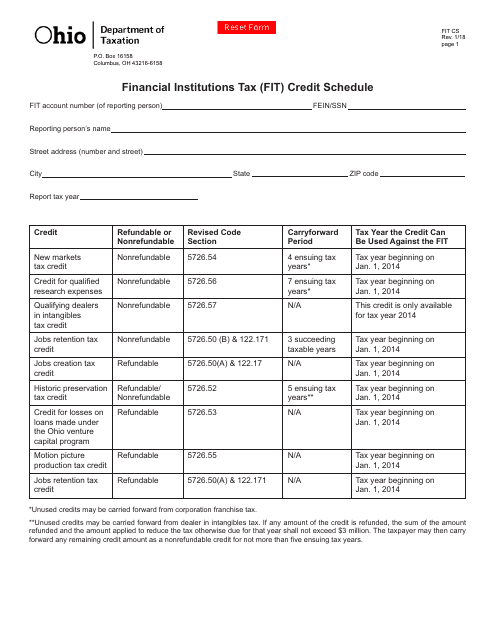

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.

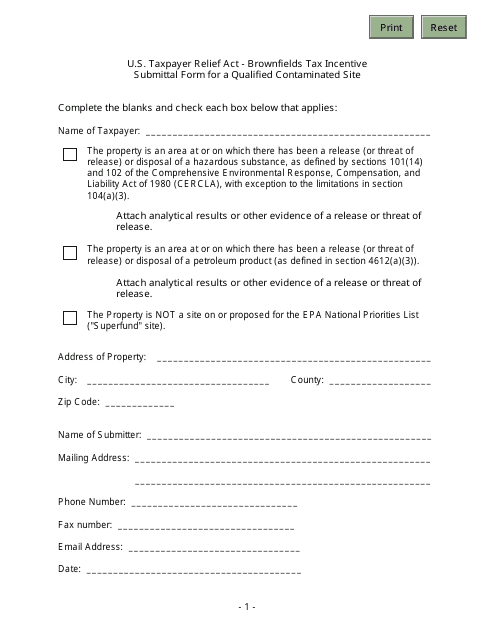

This Form is used for applying for tax incentives for a contaminated site in California that is eligible for the Brownfields program.