Tax Incentives Templates

Documents:

386

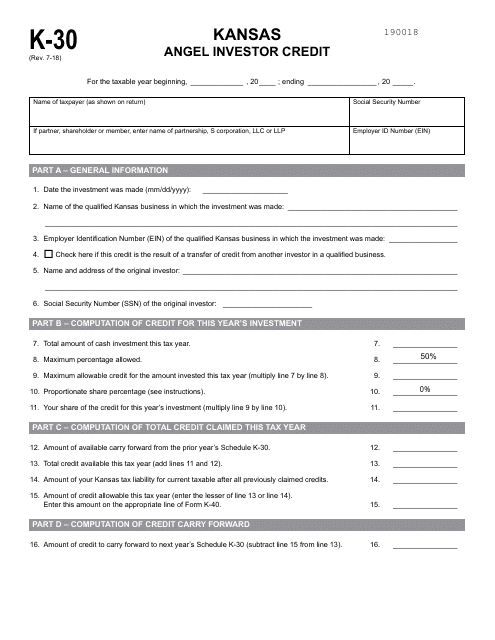

This form is used for claiming the Angel Investor Credit in Kansas. It helps individuals and businesses who invest in qualified Kansas businesses to claim a tax credit.

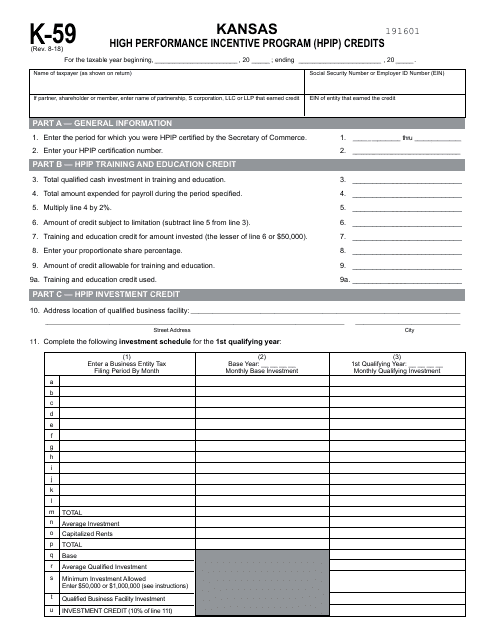

This form is used for claiming Kansas High Performance Incentive Program (HPIP) credits in the state of Kansas.

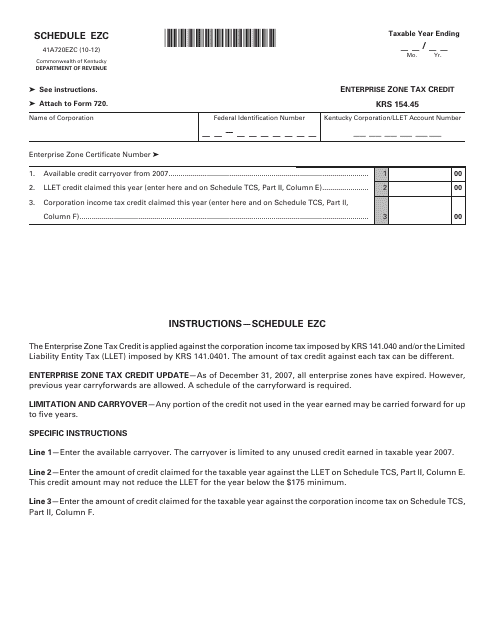

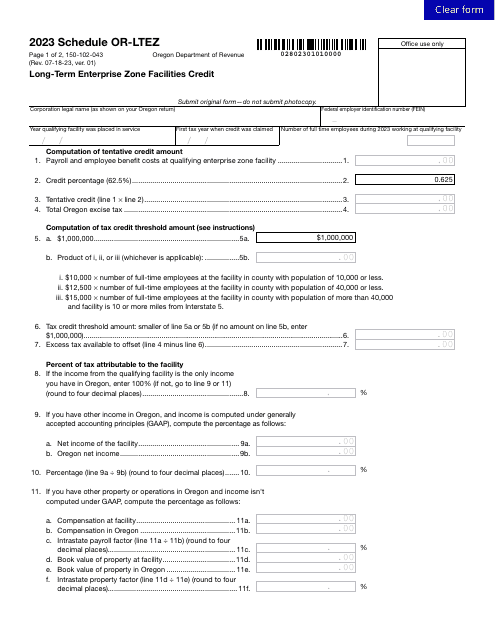

This form is used for claiming the Enterprise Zone tax credit in Kentucky.

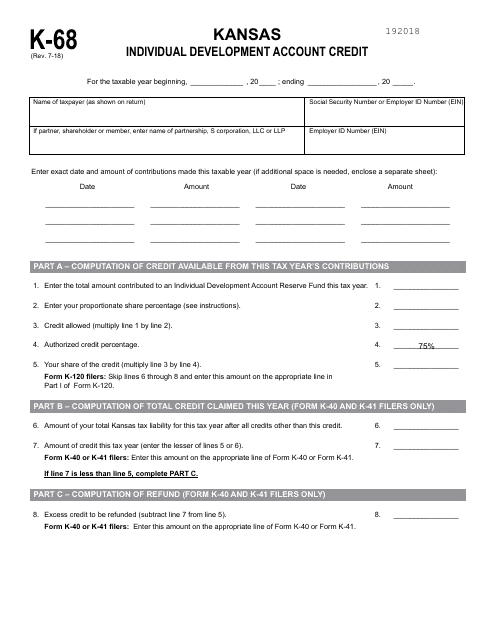

This form is used for claiming the Kansas Individual Development Account Credit.

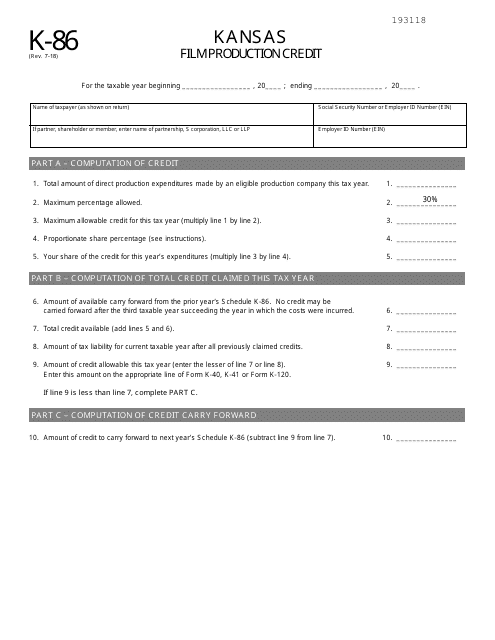

This Form is used to claim the Film Production Credit in the state of Kansas. It allows eligible film production companies to receive a tax credit for qualified production expenses incurred in Kansas.

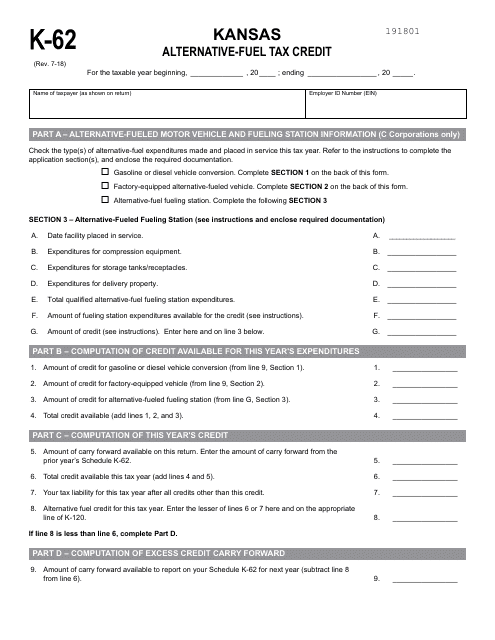

This Form is used for claiming the Alternative-Fuel Tax Credit in the state of Kansas.

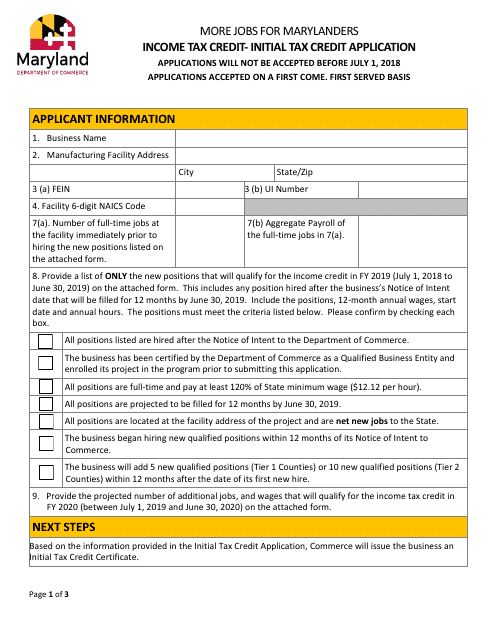

This Form is used for applying for the Initial Tax Credit in Maryland.

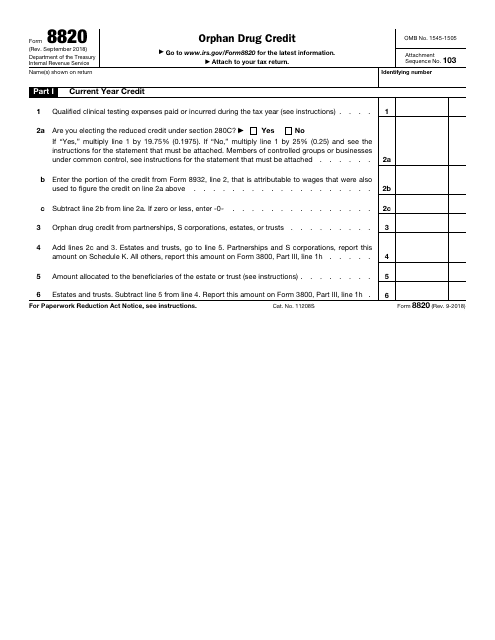

This Form is used for claiming the orphan drug credit on your tax return. It helps businesses calculate and report the tax credit they are eligible for when developing certain drugs for rare diseases.

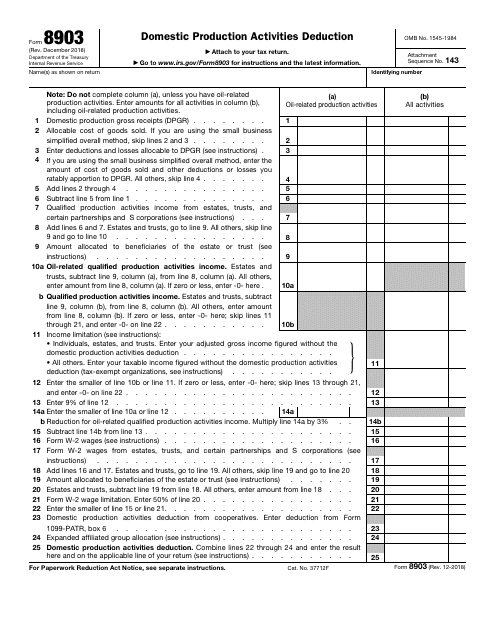

This Form is used for claiming the Domestic Production Activities Deduction on your federal tax return. It is for businesses that engage in certain qualified production activities within the United States.

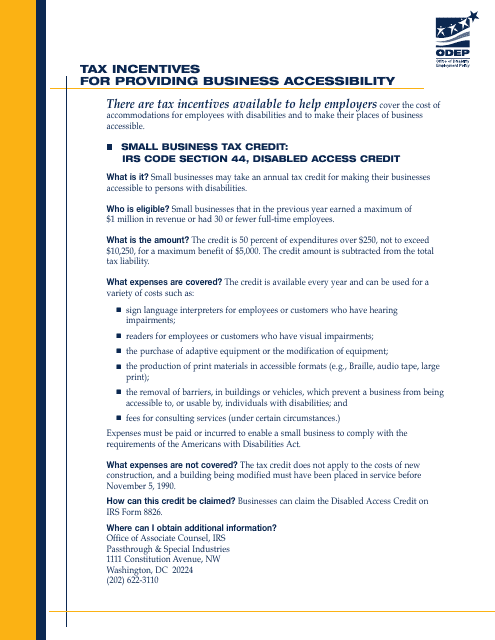

This document provides information on the tax incentives available for businesses that provide accessibility accommodations for individuals with disabilities. It outlines the potential tax benefits and requirements for businesses to qualify for these incentives.

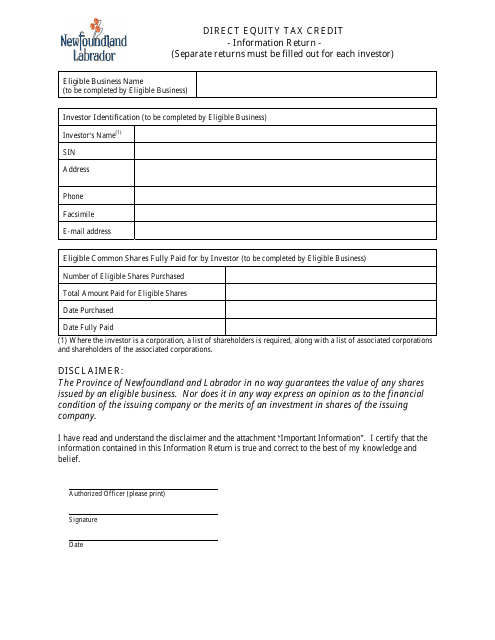

This document provides information on the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. The program offers tax credits for investments in eligible businesses.

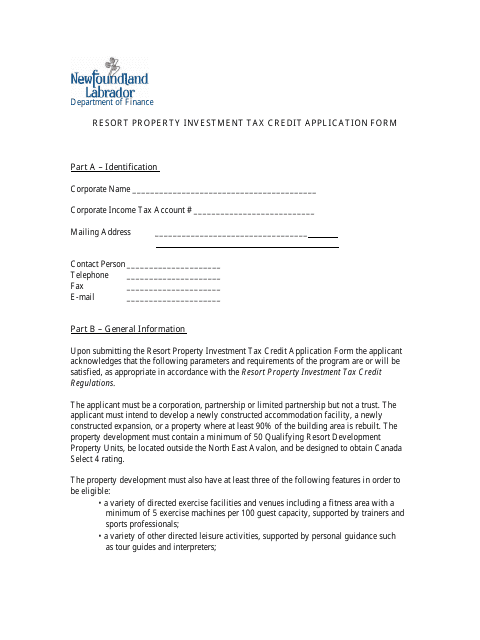

This Form is used for applying for the Resort Property Investment Tax Credit in Newfoundland and Labrador, Canada.

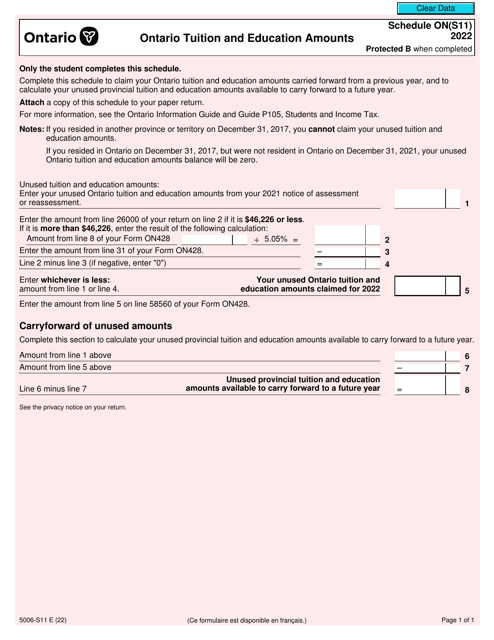

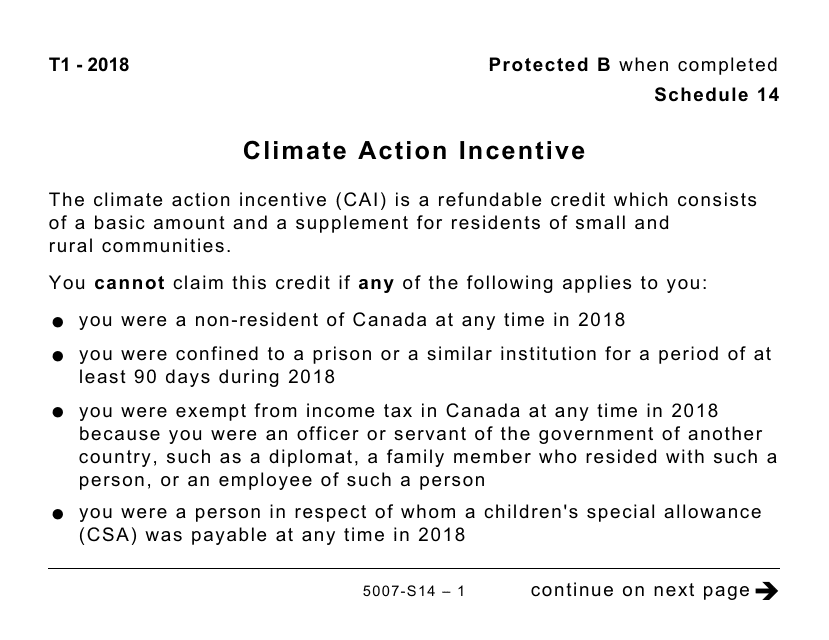

This form is used for reporting and claiming the Climate Action Incentive in Canada. It is a large print version of Schedule 14.