Tax Year Templates

Welcome to our webpage dedicated to tax years! Whether you're an individual or a business owner, understanding the tax year is crucial for accurate and timely tax filing. The tax year refers to the specific period for which the government calculates your income, expenses, and tax obligations.

At our comprehensive tax year resource, we provide valuable information and resources to help you navigate the complexities of tax seasons. Our collection of documents cover various tax jurisdictions, including the United States, Canada, and other countries. We aim to simplify the tax filing process and ensure compliance with tax laws.

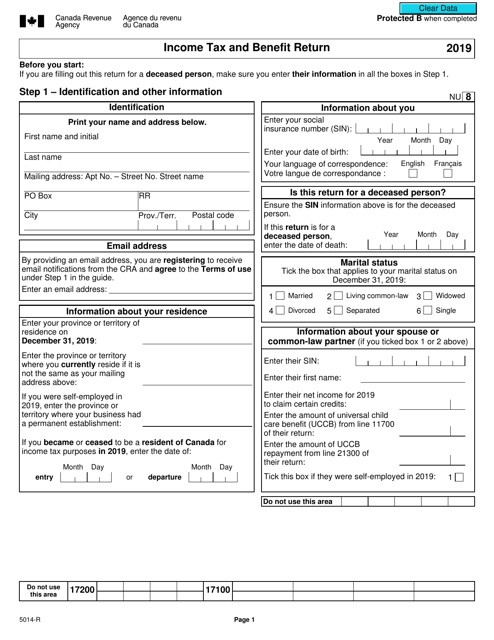

Explore our extensive range of tax year documents, which include estimated payment vouchers, shareholder information forms, net operating loss deductions, fiduciary declarations of estimated income tax, and more. Whether you're filing personal income tax or dealing with corporate tax matters, our documents cater to different tax years and are designed to meet the unique requirements of each jurisdiction.

We understand that tax jargon can be overwhelming, which is why we strive to make our resources accessible and user-friendly. Our webpage provides easy-to-understand explanations and step-by-step guides to help you determine the tax year that applies to your situation and make informed decisions when it comes to tax planning and preparation.

Whether you're a seasoned tax professional or just starting your journey in understanding tax years, our webpage is your go-to resource. Stay updated with the latest tax forms, regulations, and deadlines to ensure compliance and minimize the risk of penalties or audits.

Browse through our collection of tax year documents and arm yourself with the knowledge and tools you need to navigate the ever-changing landscape of tax seasons. Trust us to be your reliable source for tax-related information and resources.

Explore tax years with us today and take control of your tax obligations like never before!

Documents:

302

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

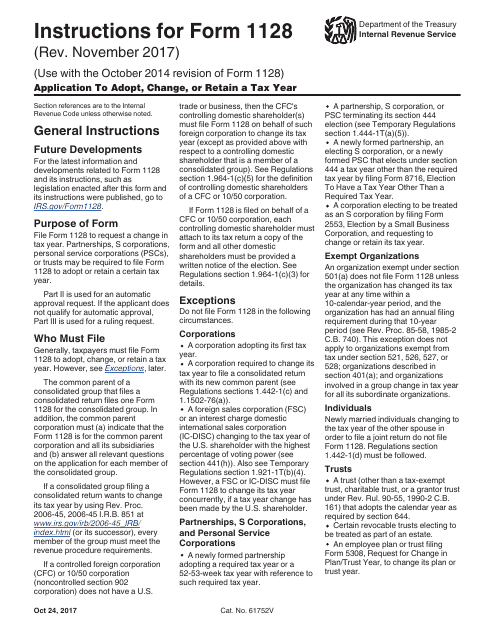

This Form is used for applying to adopt, change, or retain a tax year with the IRS. It is typically used by businesses or organizations that want to align their tax year with their fiscal year or have a specific reason for changing their tax year.

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

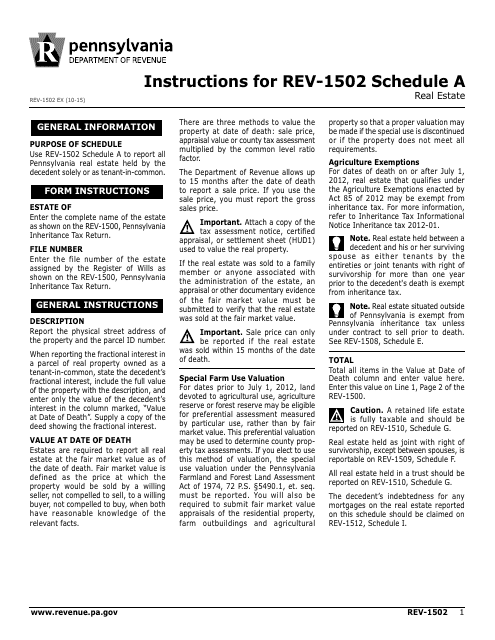

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

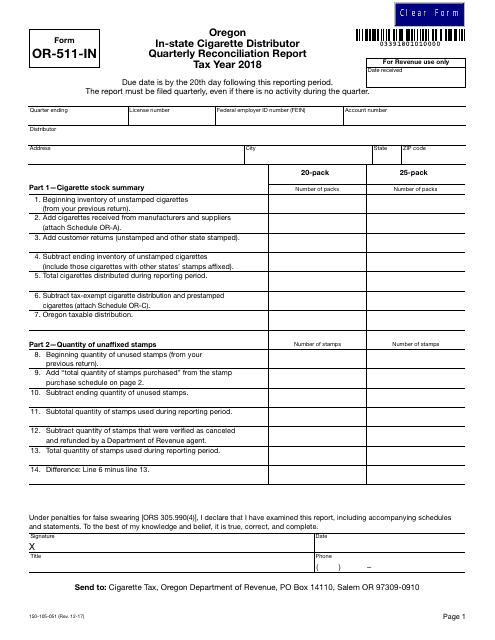

This Form is used for Oregon in-state cigarette distributors to reconcile their quarterly tax report for the tax year 2018.

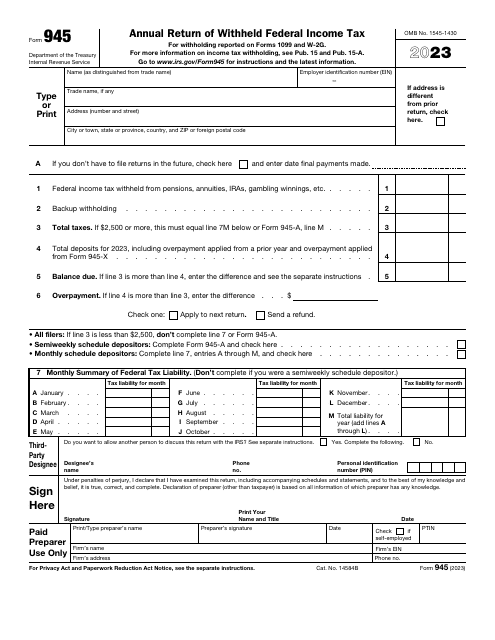

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

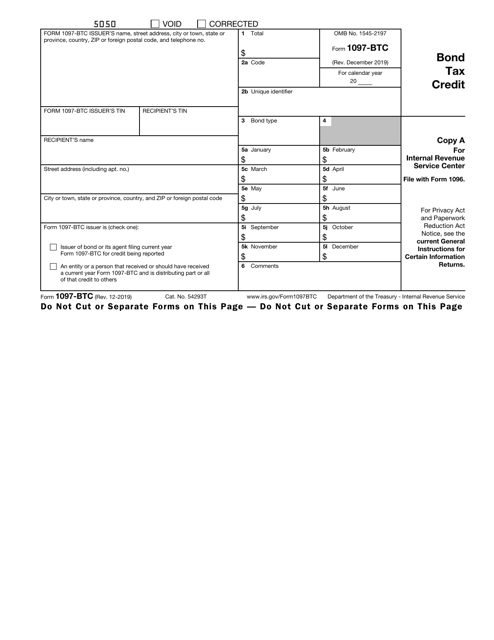

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

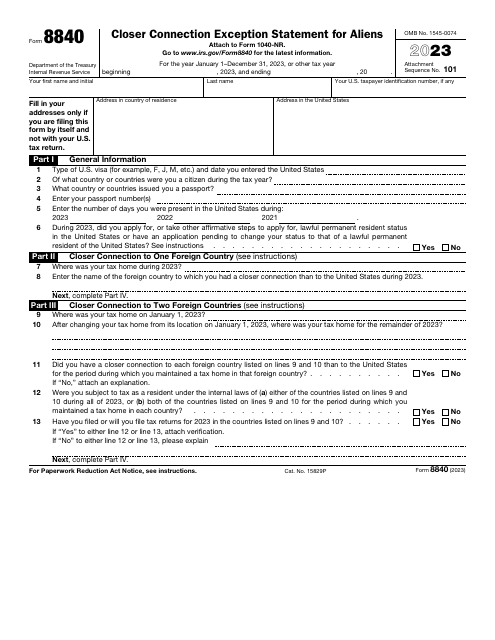

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

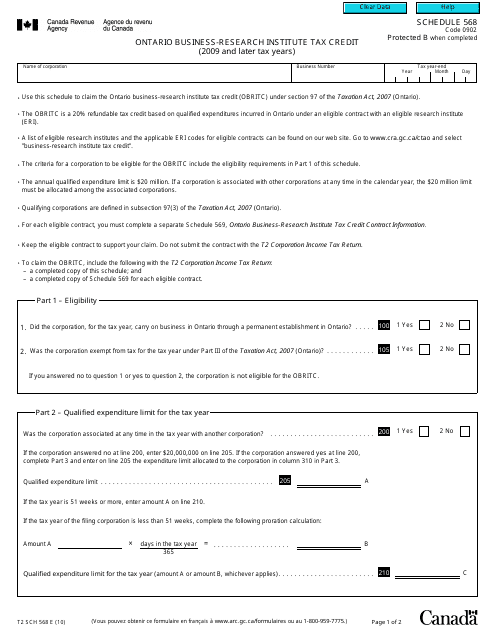

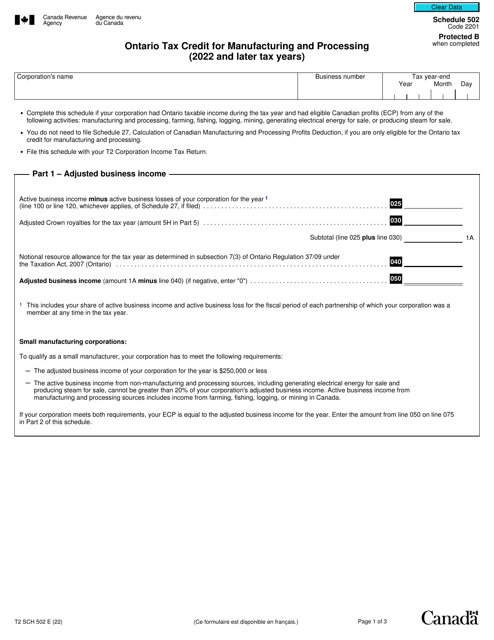

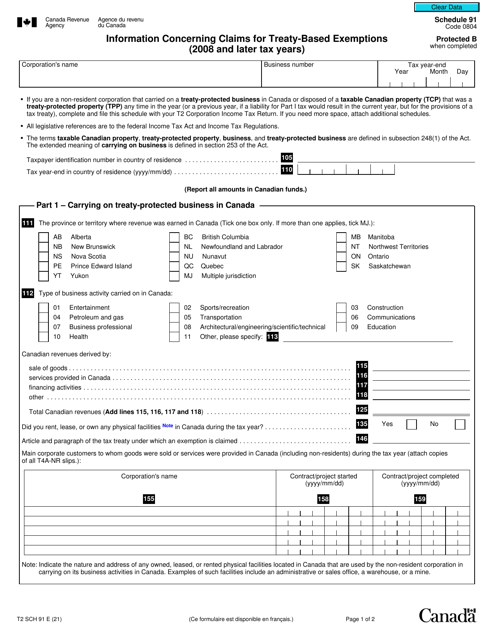

This form is used for claiming the Ontario Business-Research Institute Tax Credit for tax years 2009 and later in Ontario, Canada.

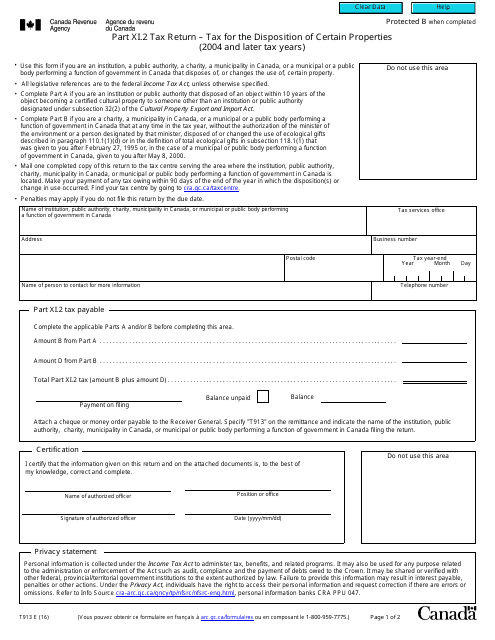

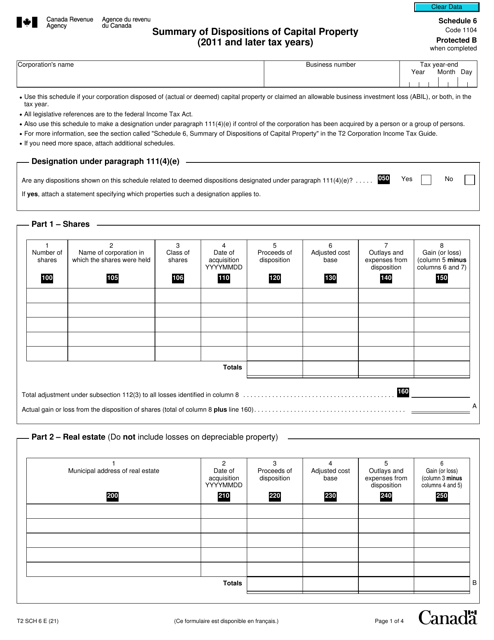

This Form is used for reporting tax on the sale of certain properties in Canada for the tax years 2004 and later.

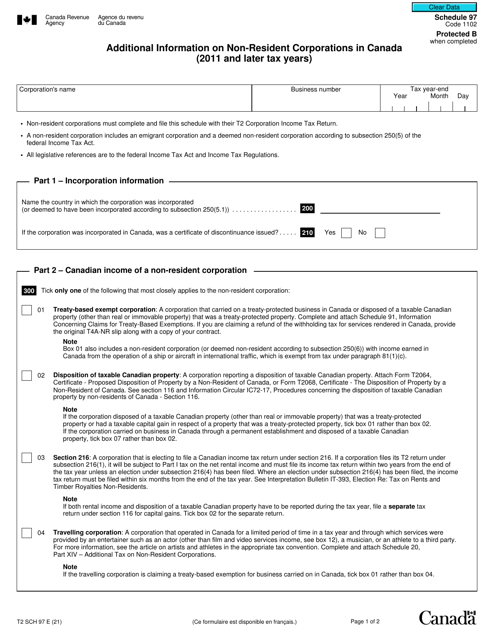

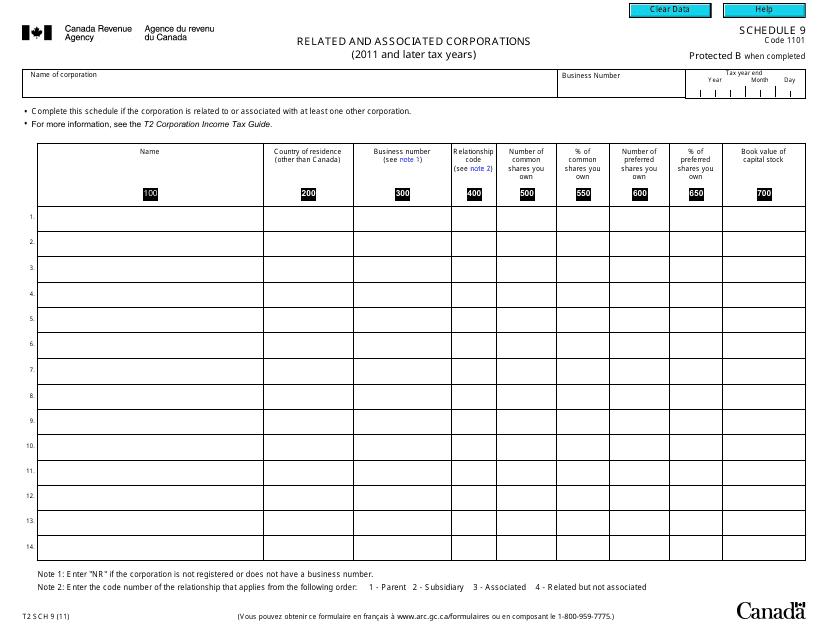

This form is used for reporting related and associated corporations for tax years 2011 and later in Canada.

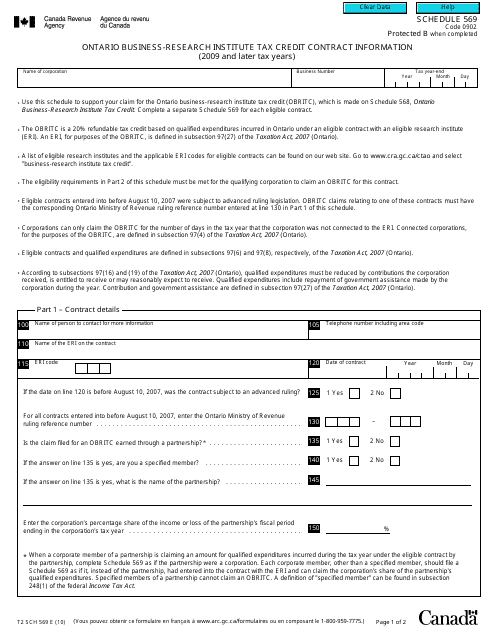

This form is used for providing contract information for claiming the Ontario Business-Research Institute Tax Credit for tax years 2009 and later in Canada.

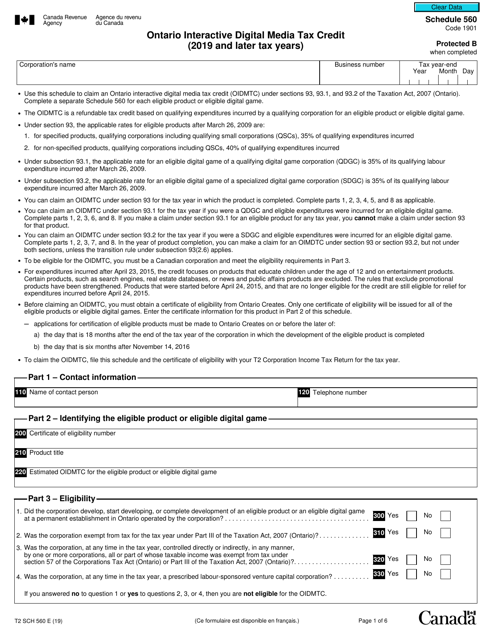

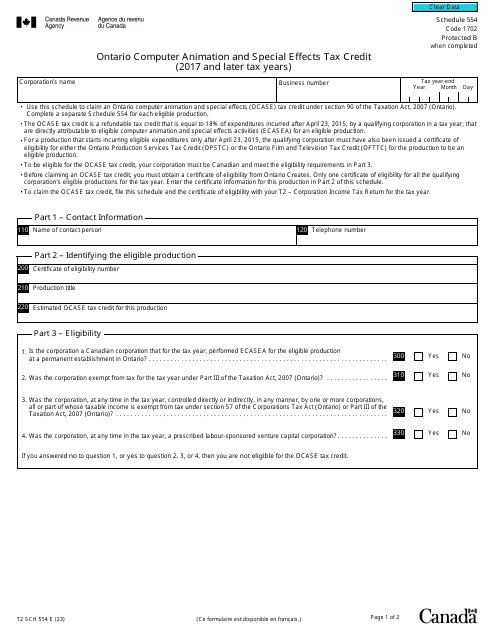

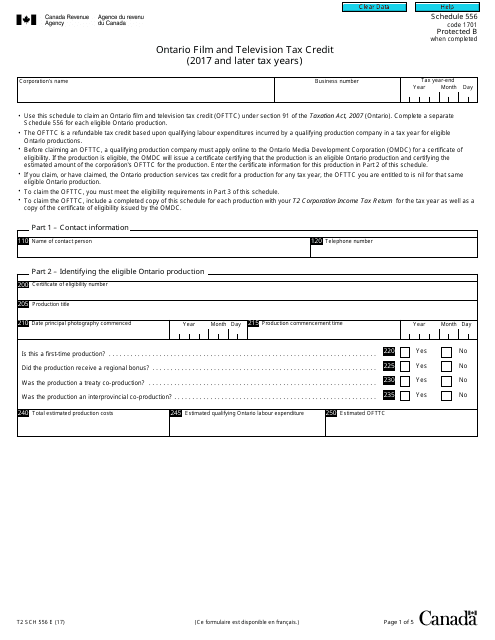

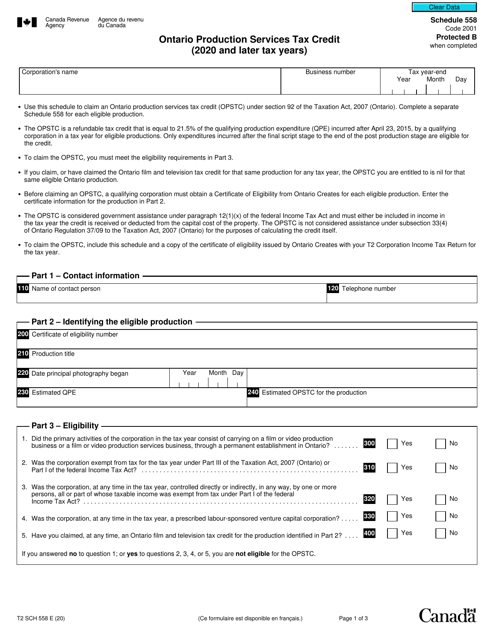

This form is used for claiming the Ontario Film and Television Tax Credit in Canada for the tax years 2017 and onwards.

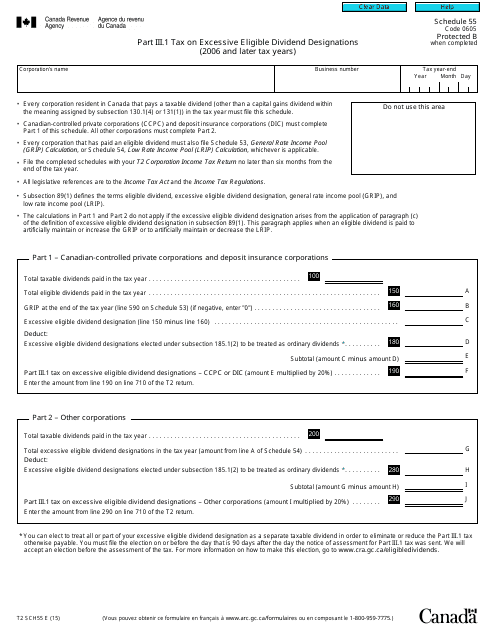

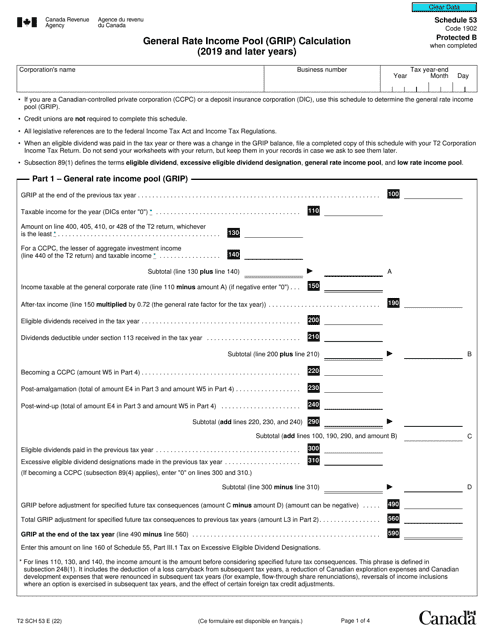

This form is used for reporting and paying tax on excessive eligible dividend designations for the 2006 tax year and later in Canada.

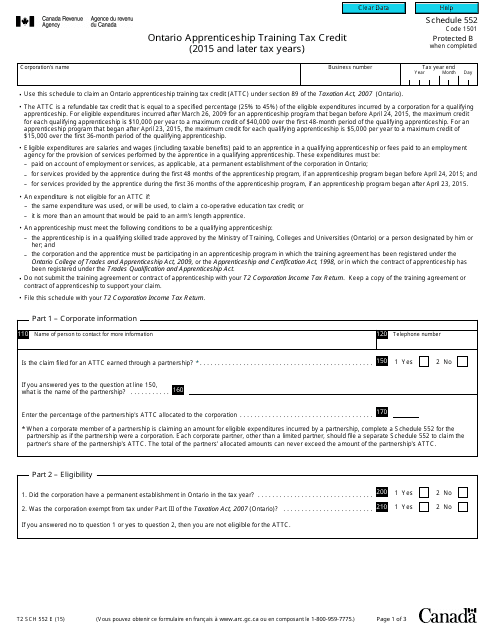

This form is used for claiming the Ontario Apprenticeship Training Tax Credit for tax years 2015 and later in Canada.

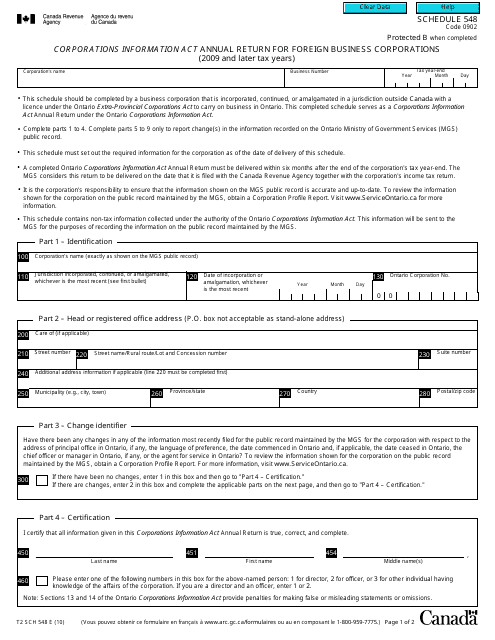

This form is used for foreign business corporations to file their annual return under the Corporations Information Act in Canada.

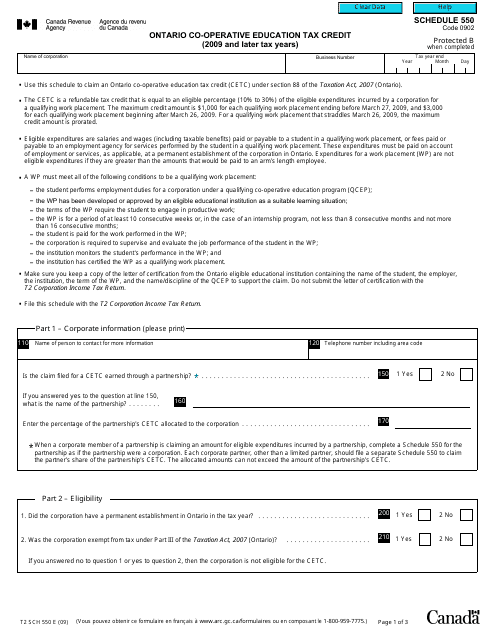

This form is used for claiming the Ontario Co-operative Education Tax Credit for tax years 2009 and later in Canada.

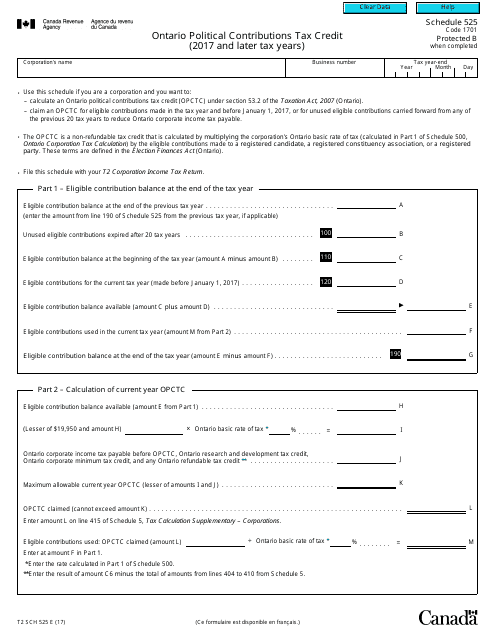

This Form is used for reporting and claiming the Ontario Political Contributions Tax Credit on your Canadian tax return.

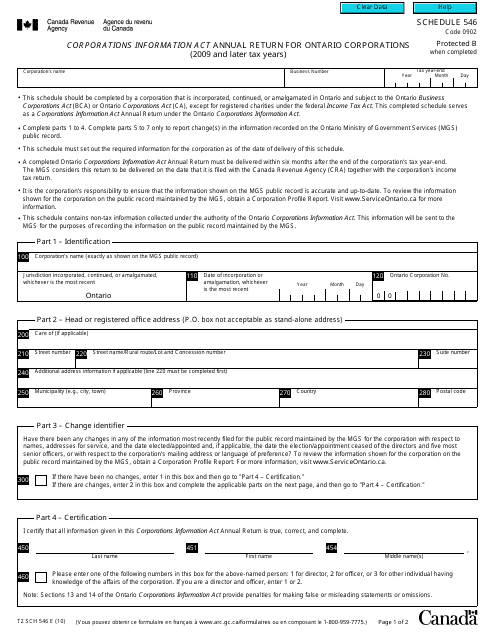

This form is used for Ontario corporations in Canada to file their annual return under the Corporations Information Act for the tax years 2009 and onwards.

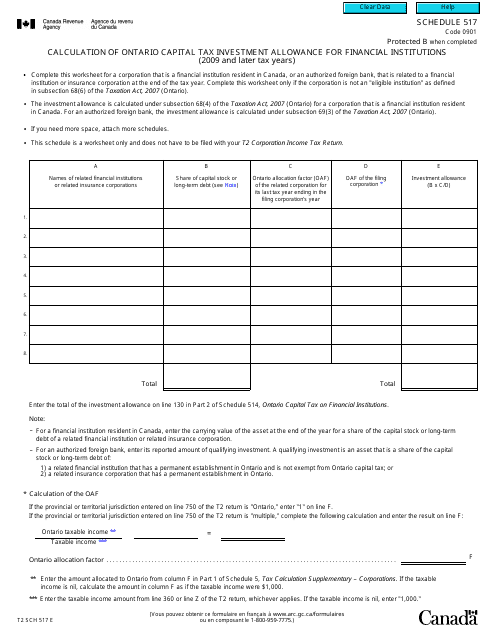

This form is used for calculating the Ontario Capital Tax Investment Allowance for financial institutions in Canada for tax years 2009 and later.

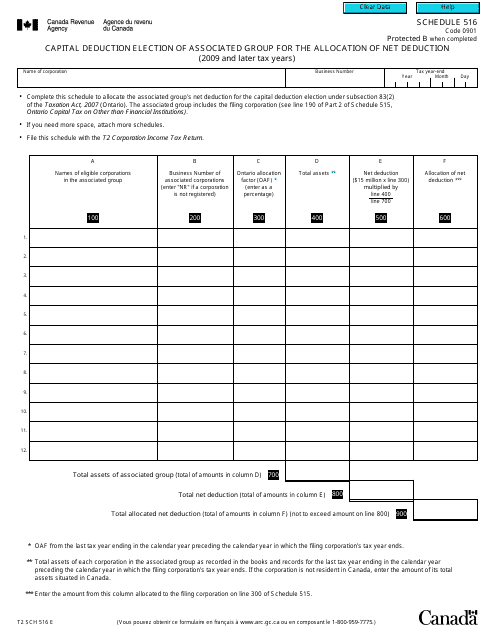

This form is used for making a capital deduction election of an associated group for the allocation of net deduction in Canada for tax years 2009 and later.

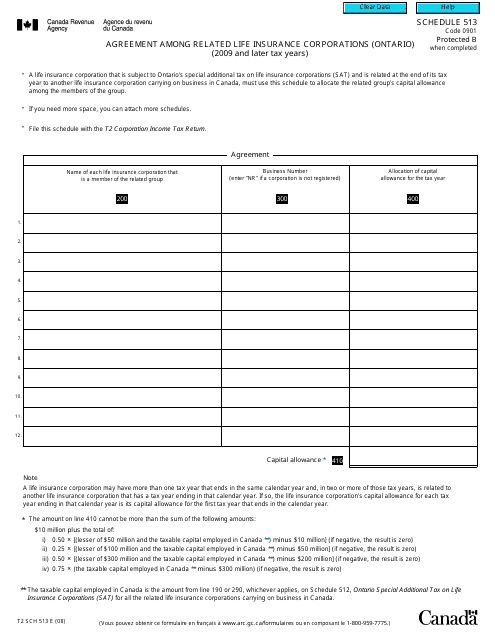

This form is used for reporting and documenting agreements among related life insurance corporations in Ontario for tax purposes in Canada. This document is specifically for the tax years 2009 and later.

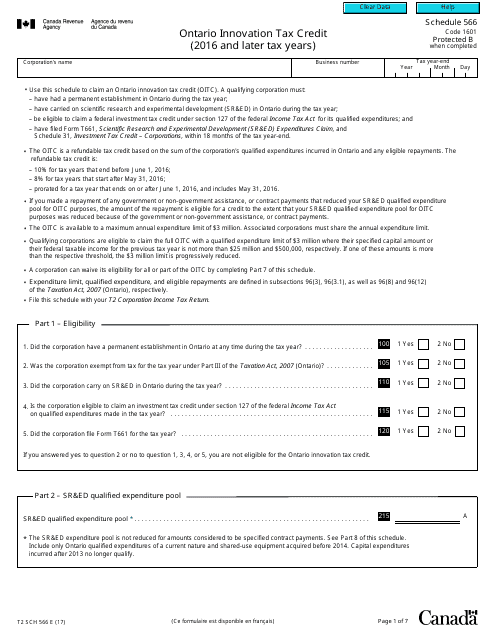

This Form is used for claiming the Ontario Innovation Tax Credit for businesses in Canada for the tax years of 2016 and later.

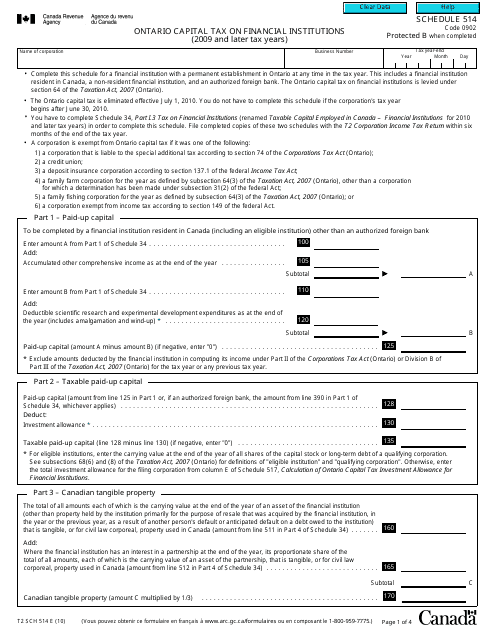

This form is used for reporting and calculating the Ontario Capital Tax on Financial Institutions for the tax years 2009 and later in Canada.