Tax Year Templates

Documents:

302

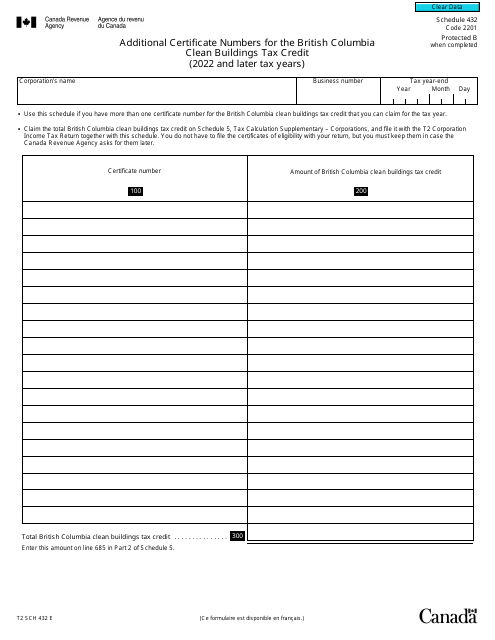

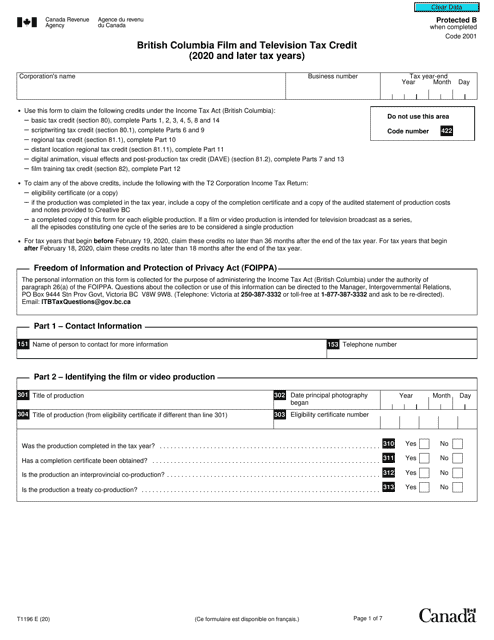

This form is used for adding additional certificate numbers to claim the British Columbia Clean Buildings Tax Credit for 2022 and later tax years in Canada.

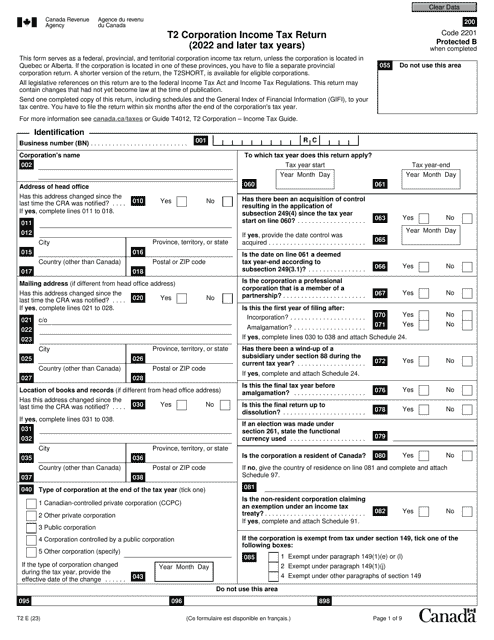

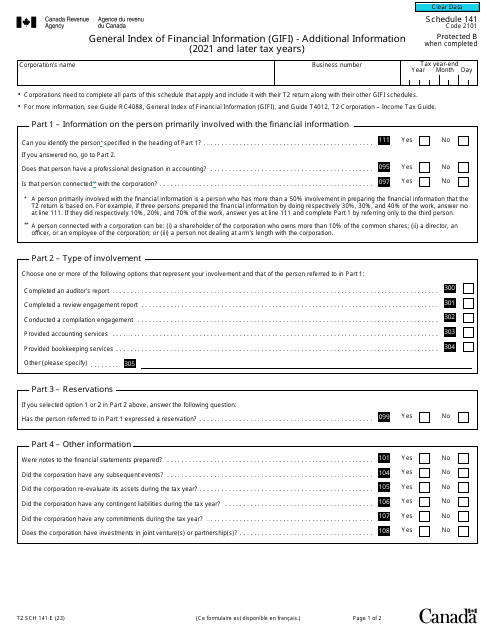

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

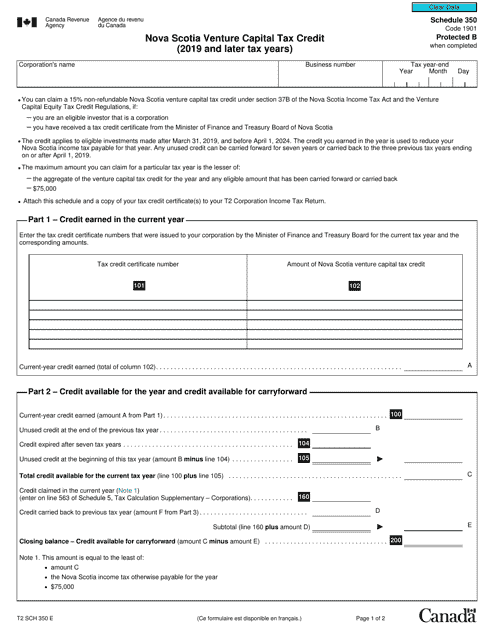

This form is used for claiming the Nova Scotia Venture Capital Tax Credit on the T2 corporate tax return for the 2019 and later tax years in Canada.

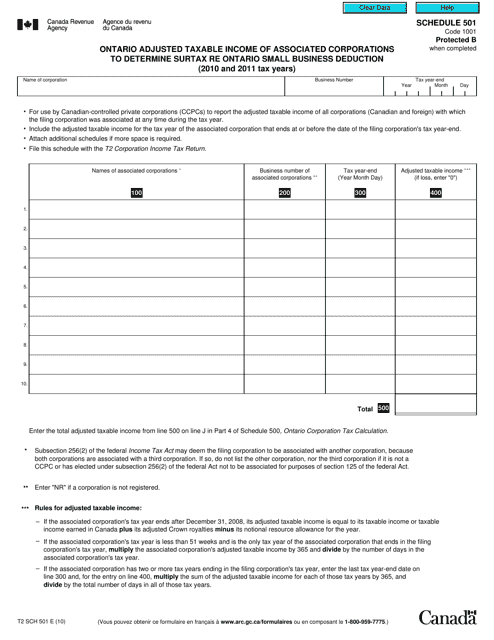

This form is used for calculating the adjusted taxable income of associated corporations in Ontario, Canada. It is specifically used to determine the surtax re Ontario Small Business Deduction for the 2010 and 2011 tax years.

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.