International Tax Templates

Documents:

135

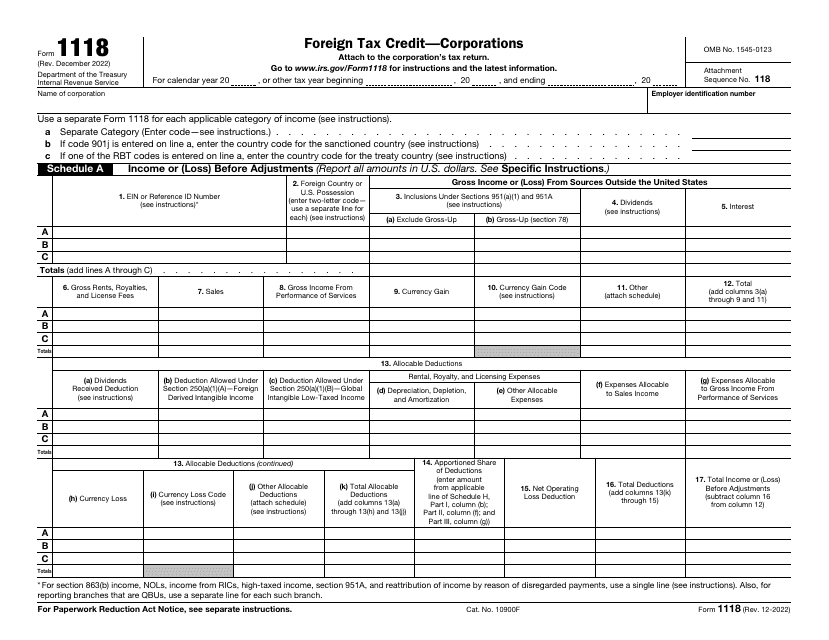

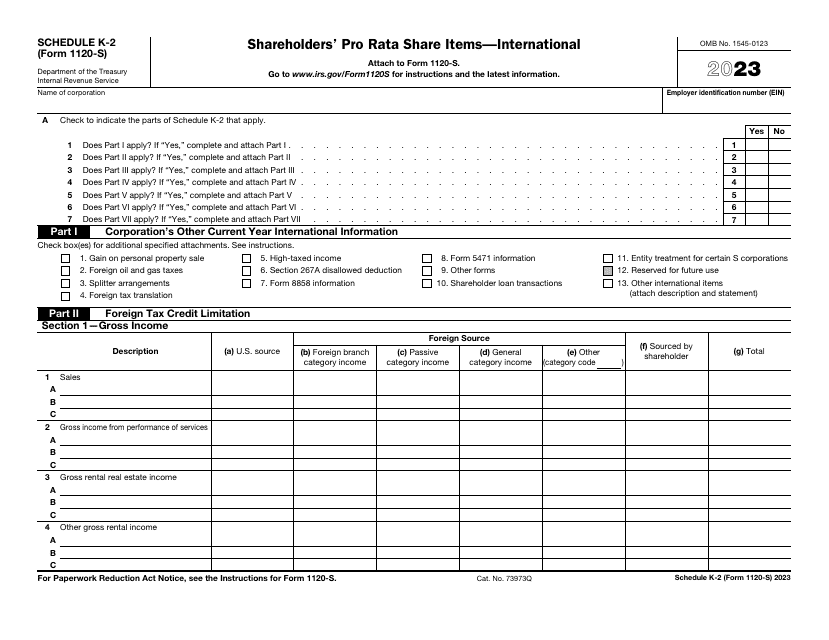

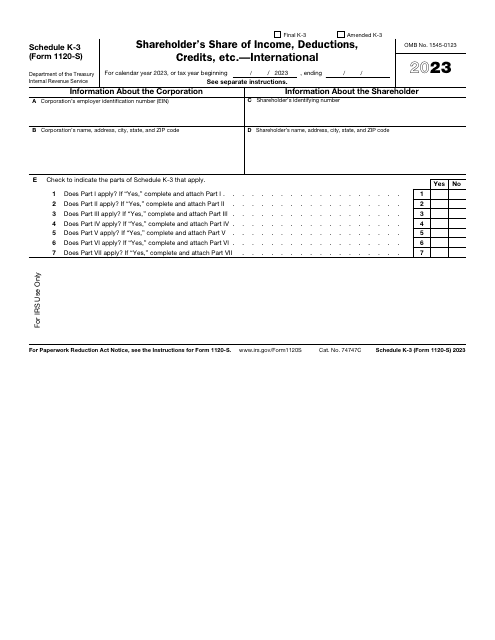

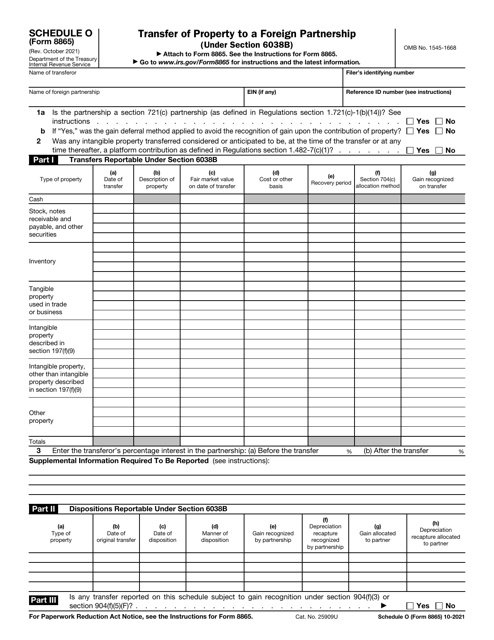

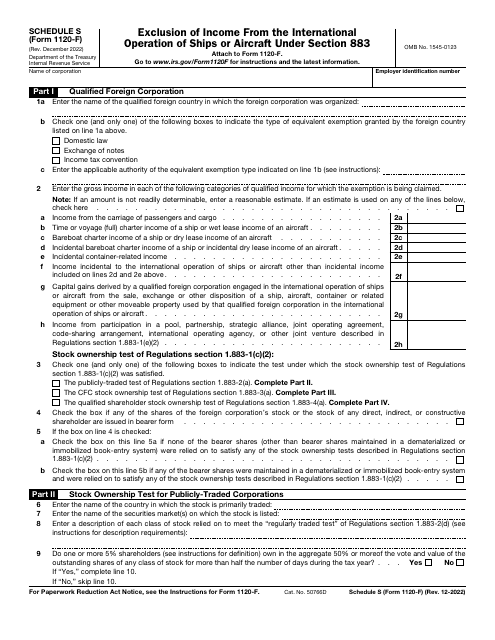

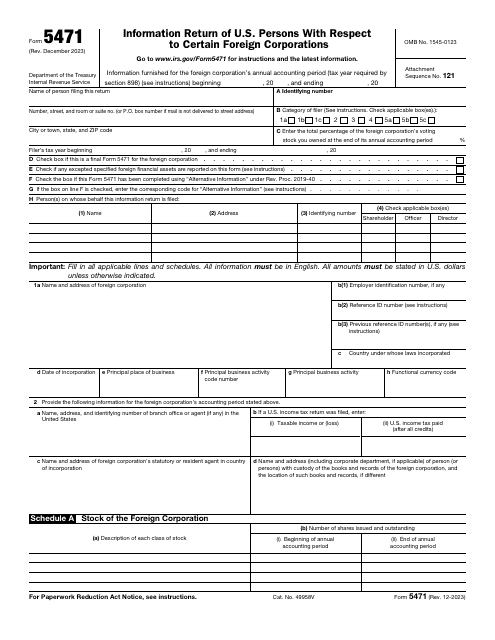

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.

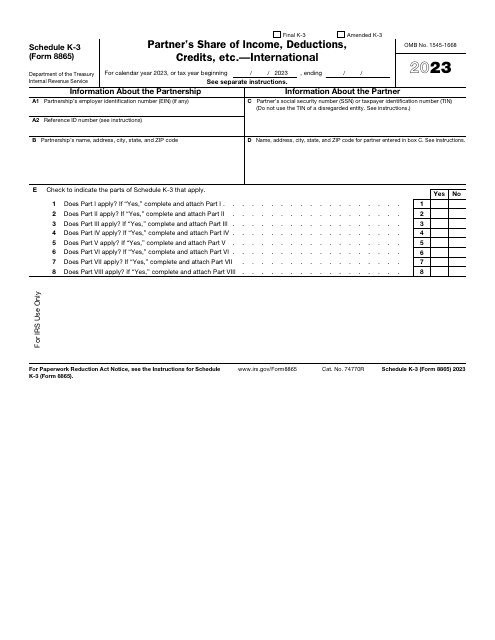

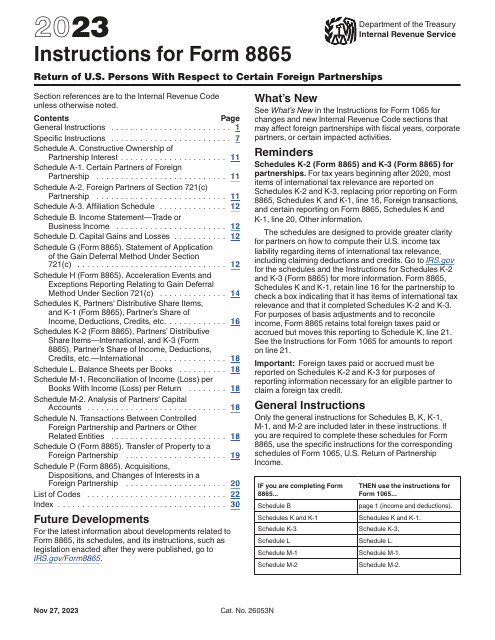

This document provides instructions for completing Schedule K-3 of IRS Form 1065, which calculates a partner's share of income, deductions, credits, etc. for international partnerships.

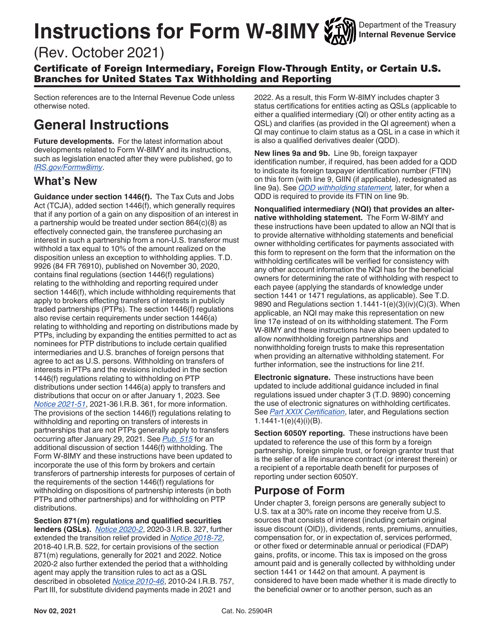

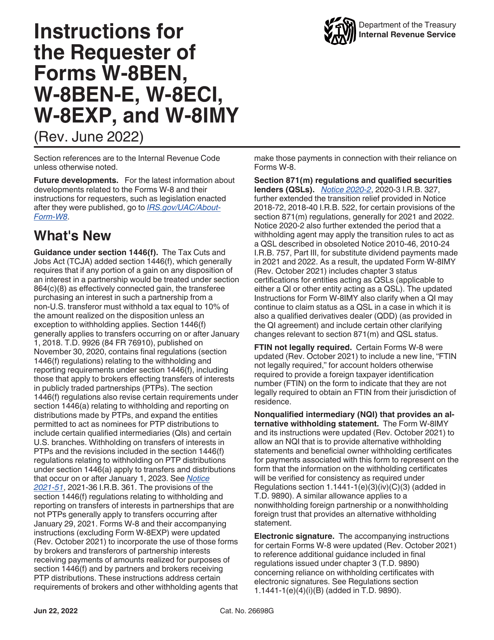

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.

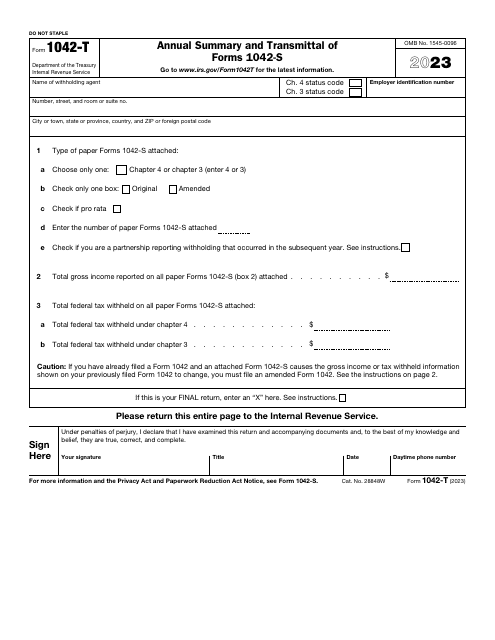

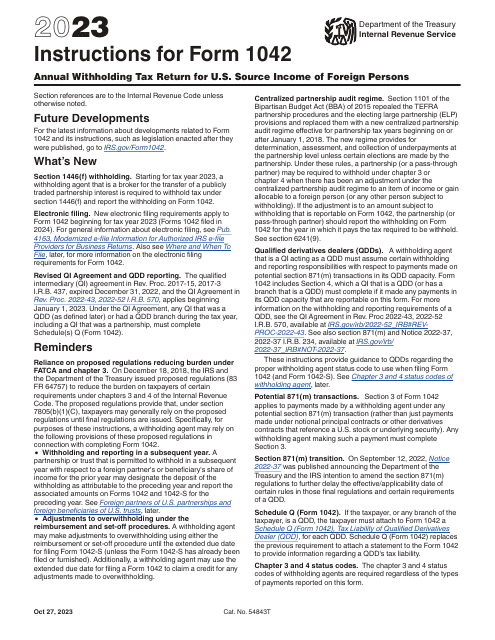

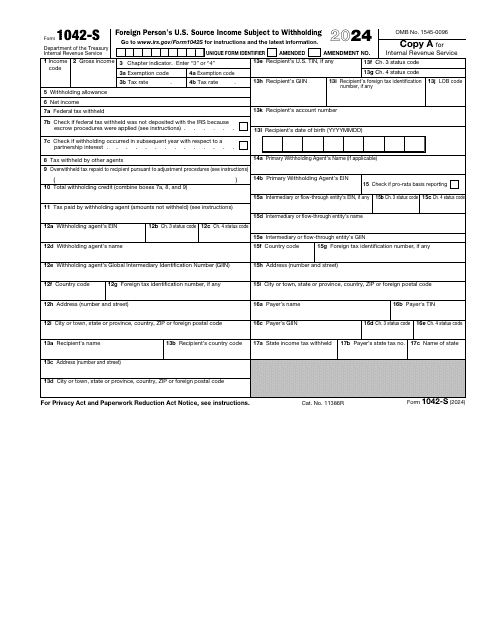

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

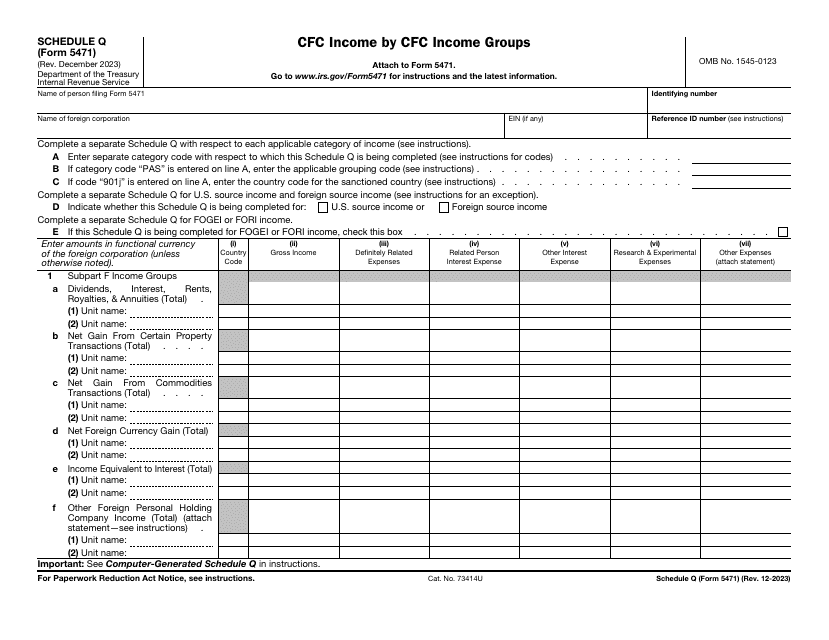

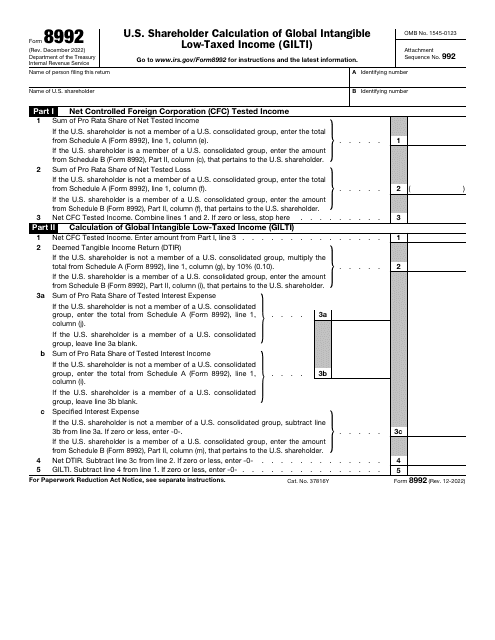

This form is used for U.S. shareholders to calculate their Global Intangible Low-Taxed Income (GILTI).