International Tax Templates

Documents:

135

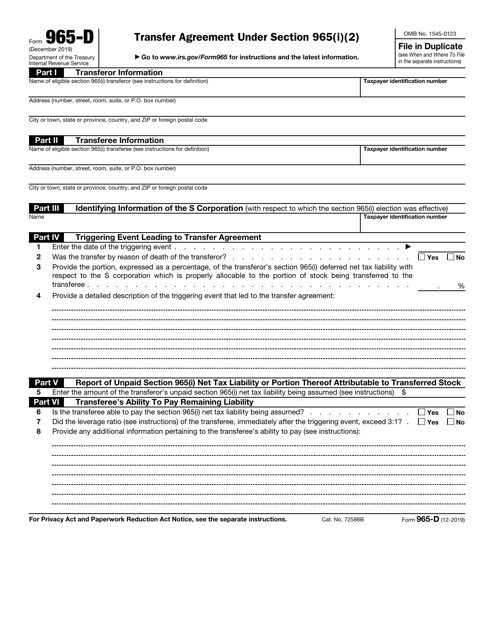

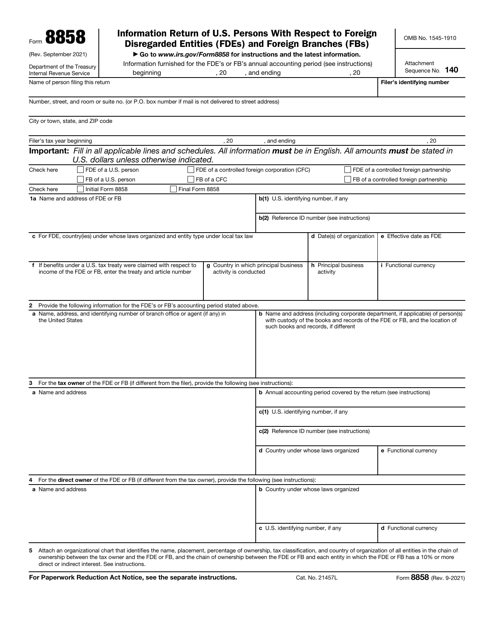

This form is used for transferring assets under Section 965(I)(2) of the IRS Code.

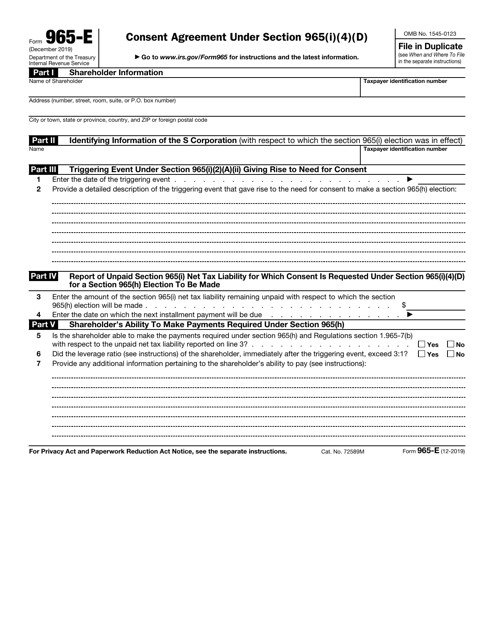

This form is used for entering into a consent agreement under Section 965(I)(4)(D) of the Internal Revenue Code.

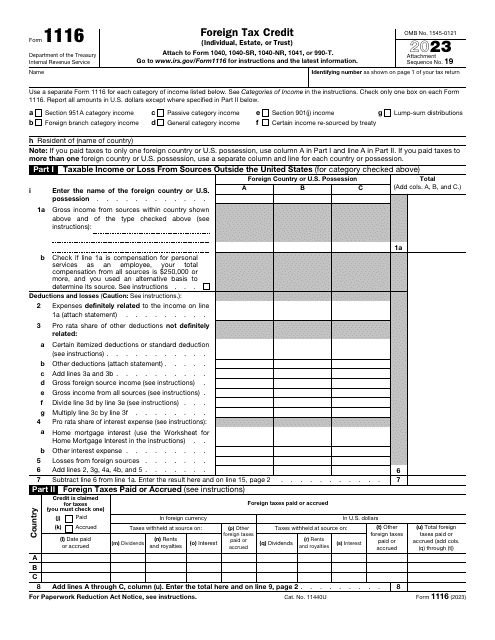

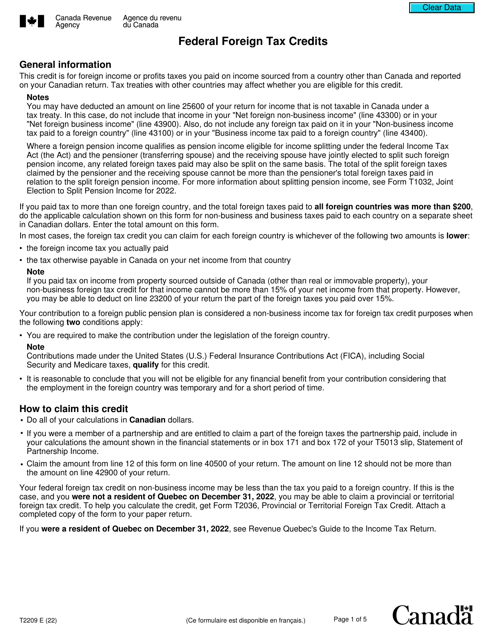

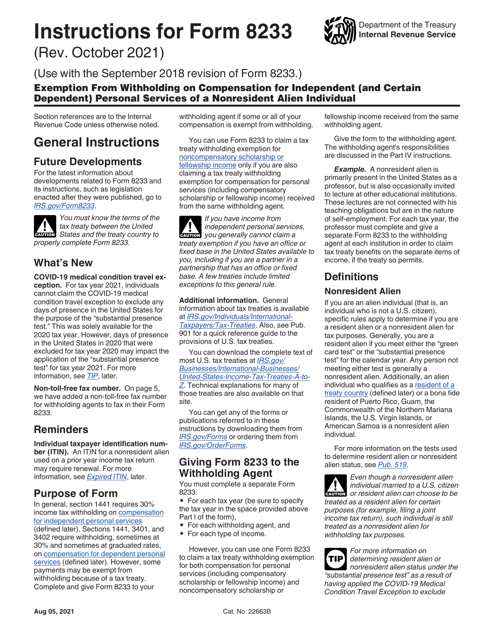

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

This form is used for reporting the transfer of deferred foreign income pursuant to Section 965(H)(3) of the Internal Revenue Code. It provides instructions for completing the Transfer Agreement Form 965-C.

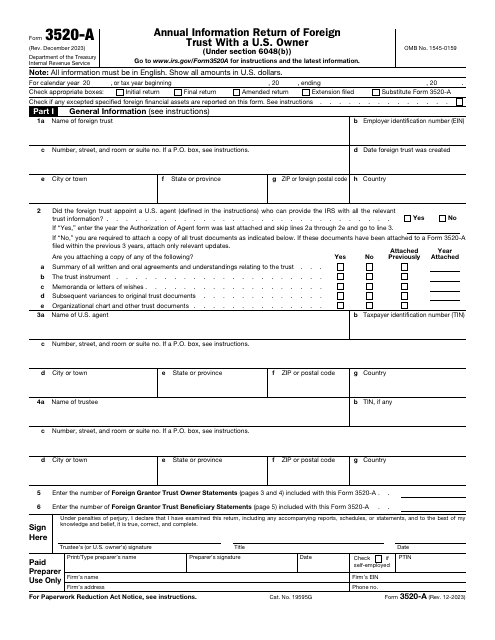

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

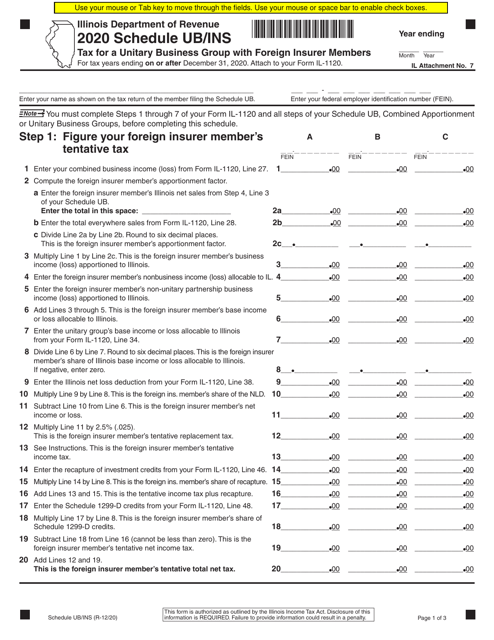

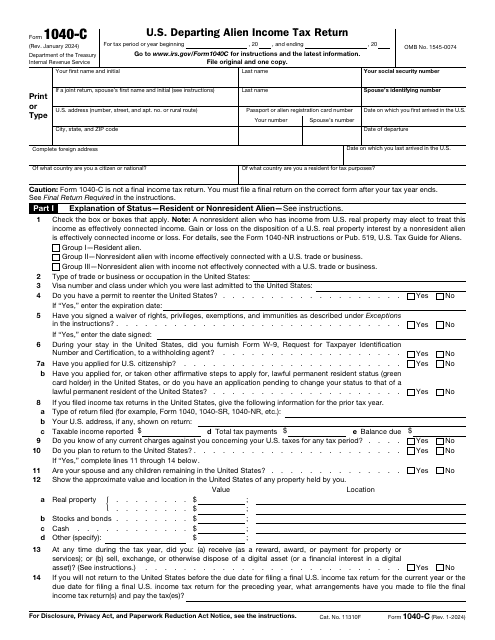

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).