Taxable Income Templates

Documents:

186

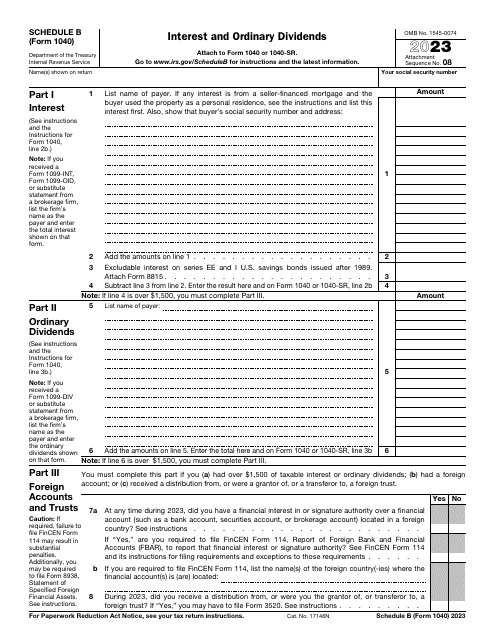

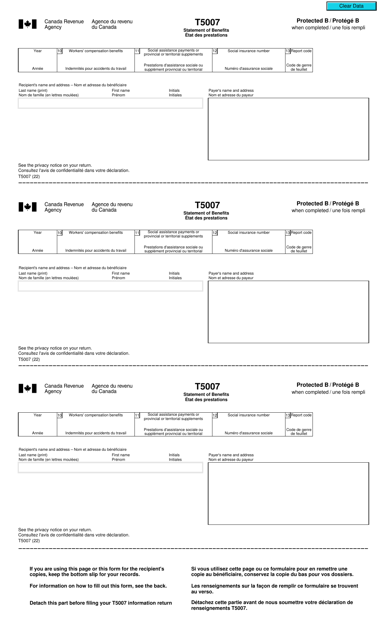

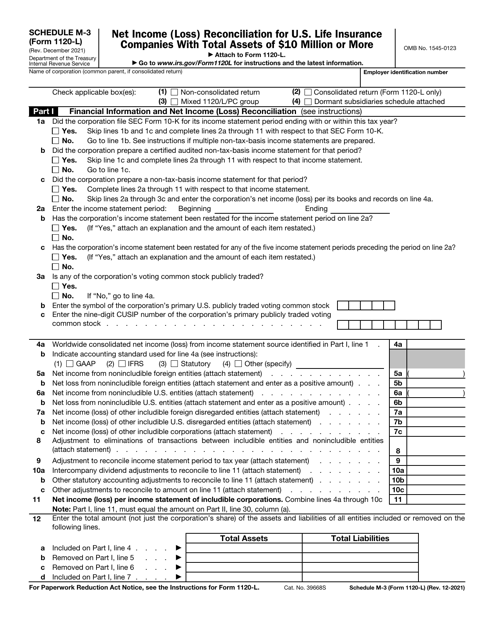

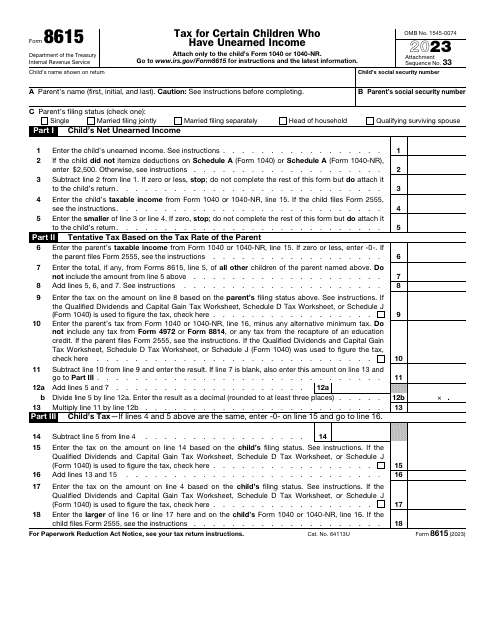

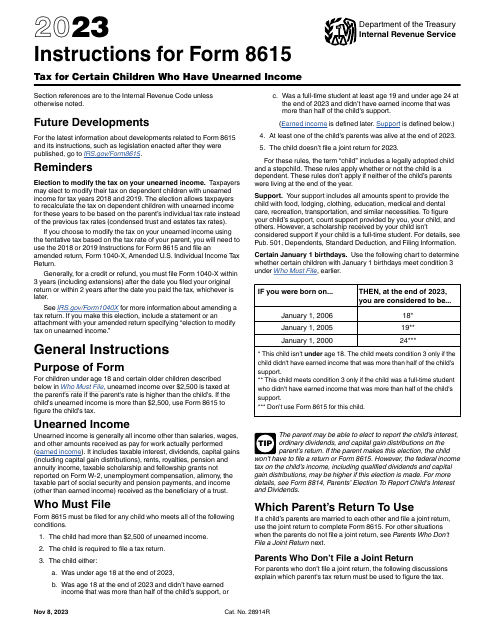

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

This is an IRS form that includes the details of an installment sale.

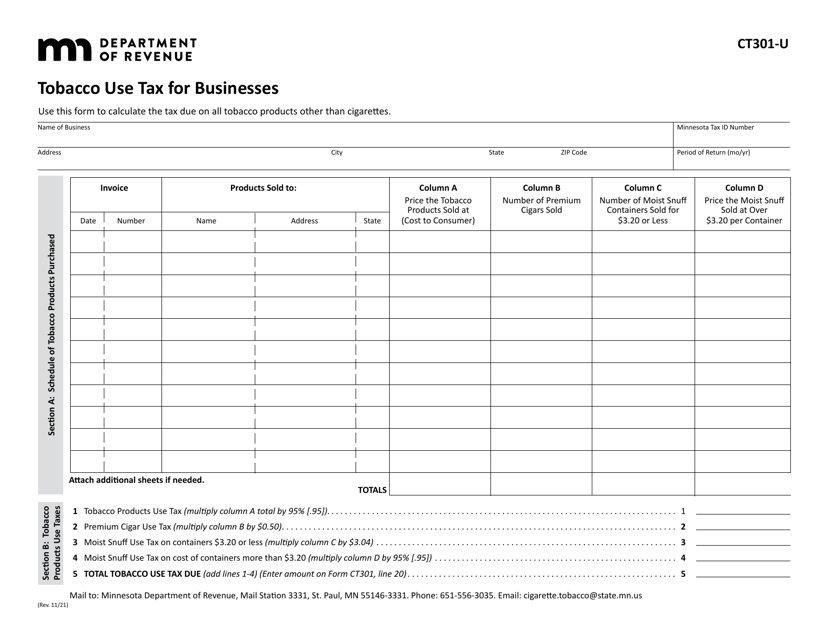

This form is used for businesses in Minnesota to report and pay tobacco use tax.

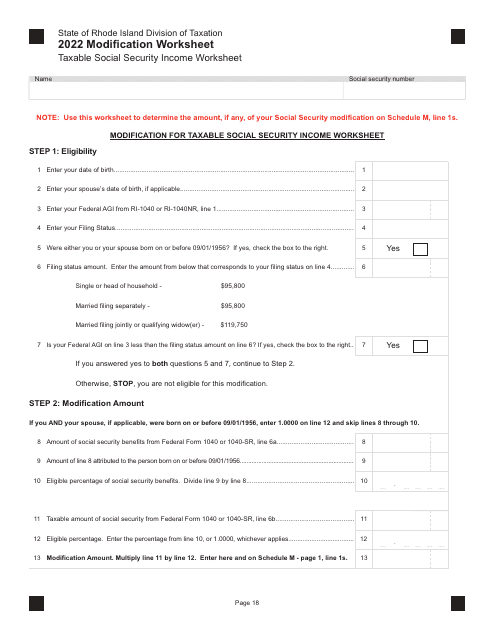

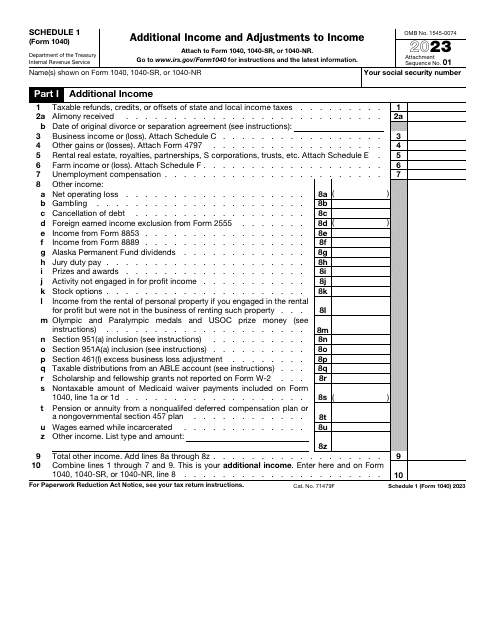

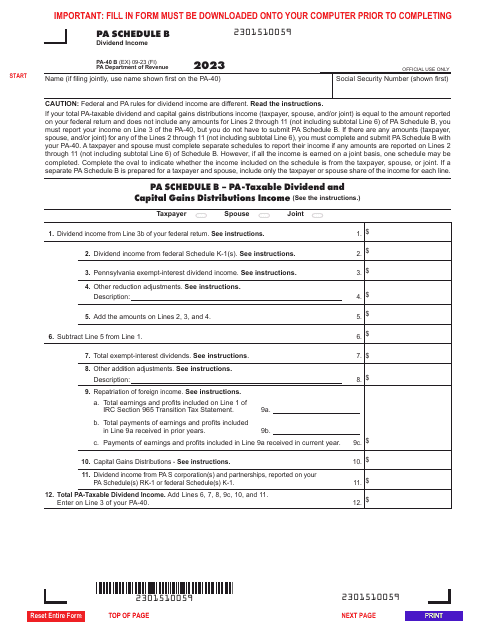

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

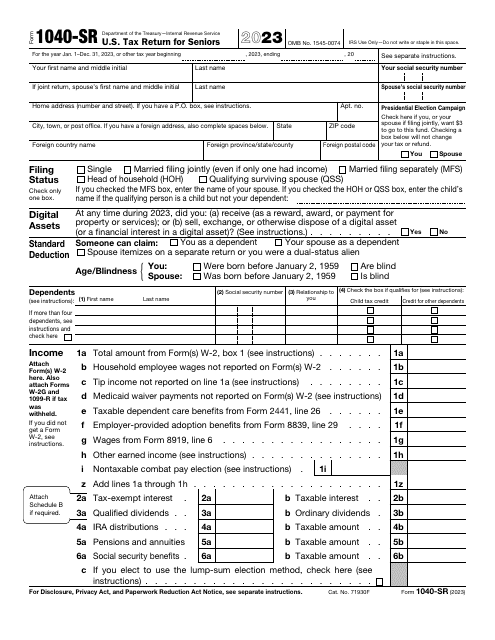

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

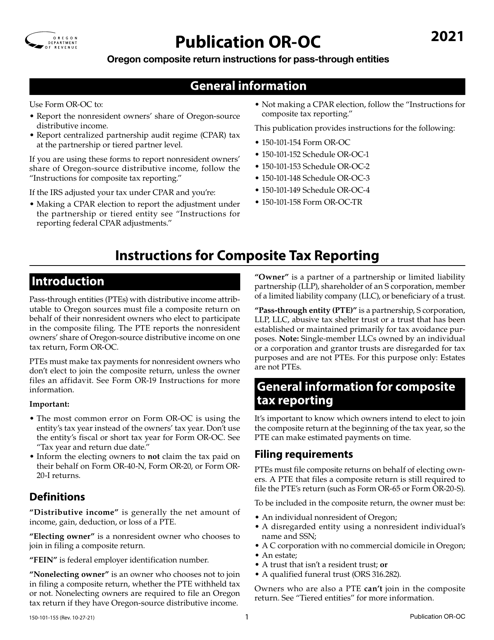

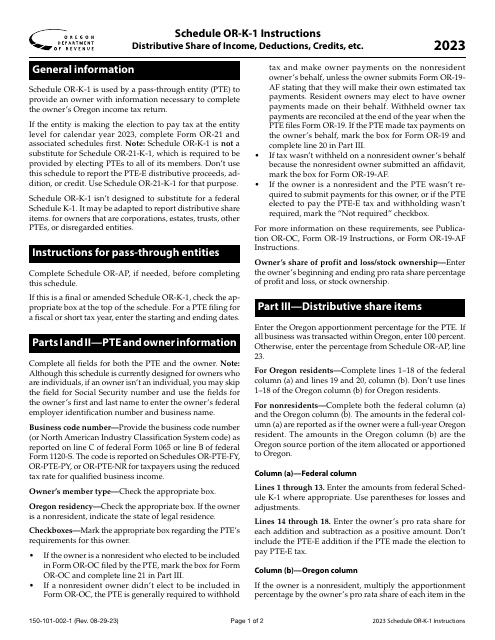

This document provides instructions for completing Form OR-OC, which is used by pass-through entities in Oregon to file their composite return.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

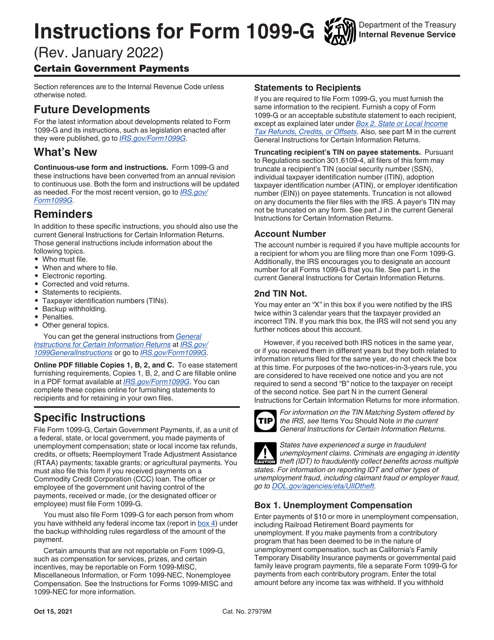

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

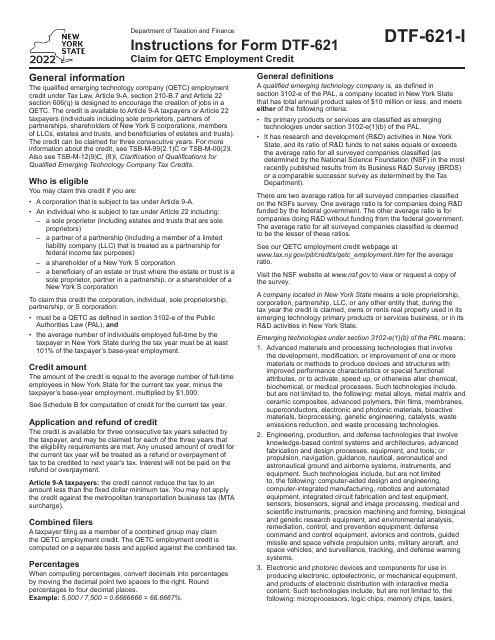

This Form is used for claiming the QETC Employment Credit in the state of New York. It provides instructions on how to fill out and submit the form to receive the credit.