Taxable Income Templates

Documents:

186

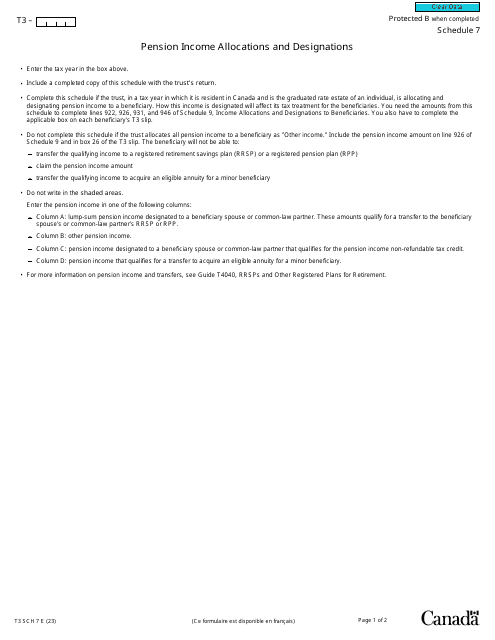

This document is used for applying for provincial tax credits in Prince Edward Island, Canada. It is used to claim potential tax deductions and benefits specific to the province.

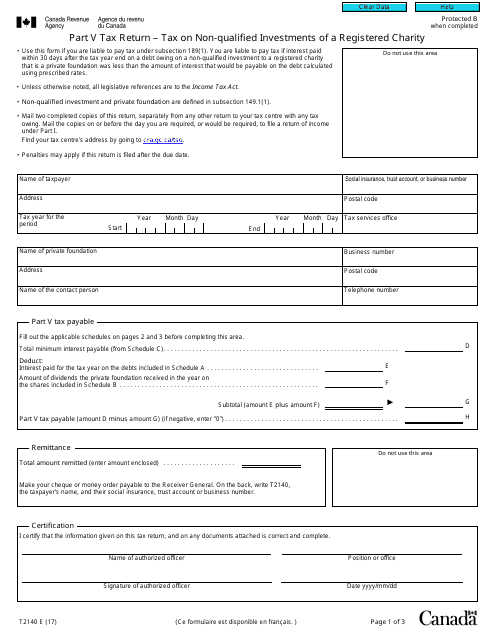

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

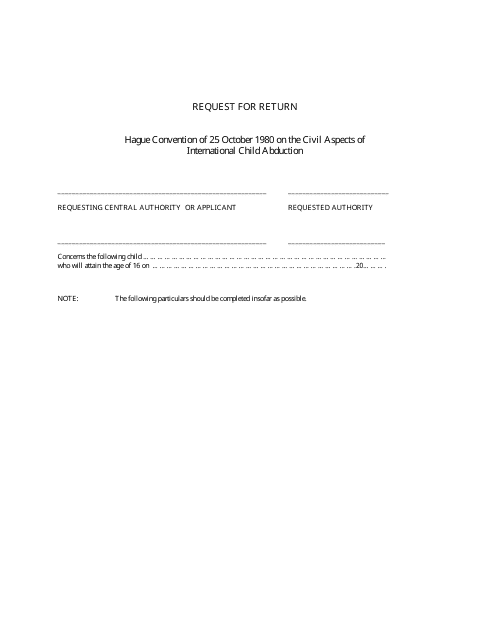

This document is used to request a return in the province of Saskatchewan, Canada.

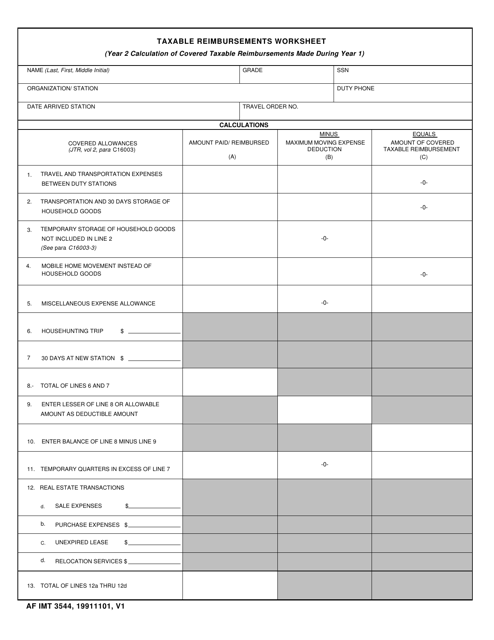

This form is used for calculating taxable reimbursements for expenses incurred during official Air Force duties.

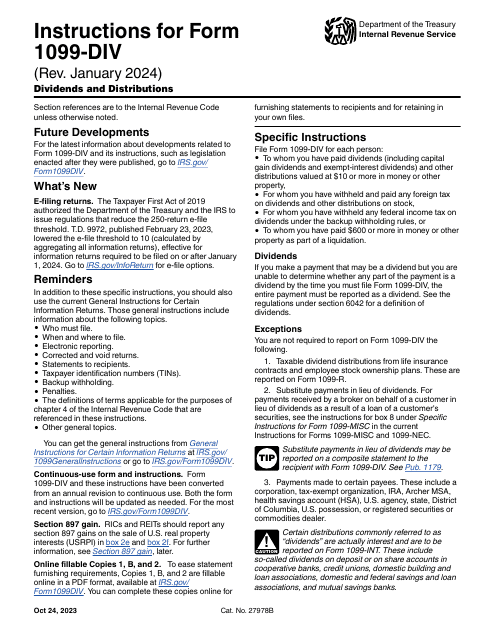

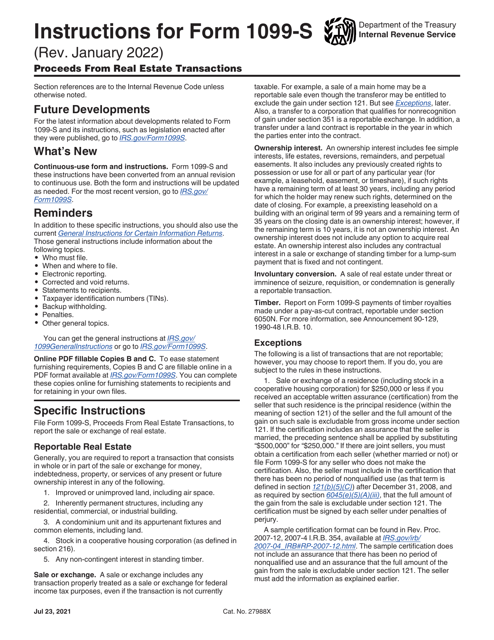

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

This is an IRS form that includes the details of an installment sale.

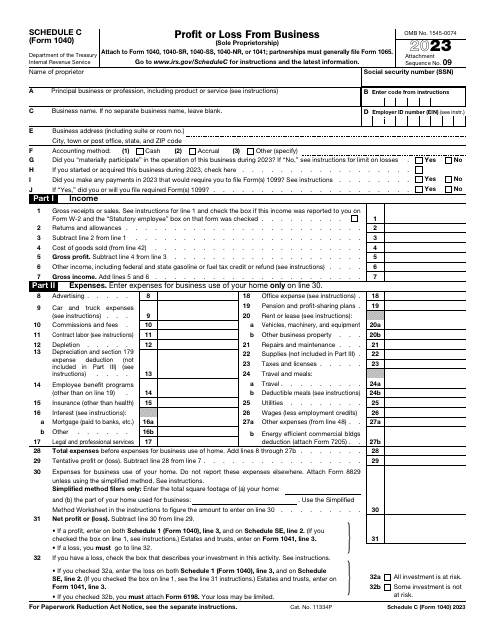

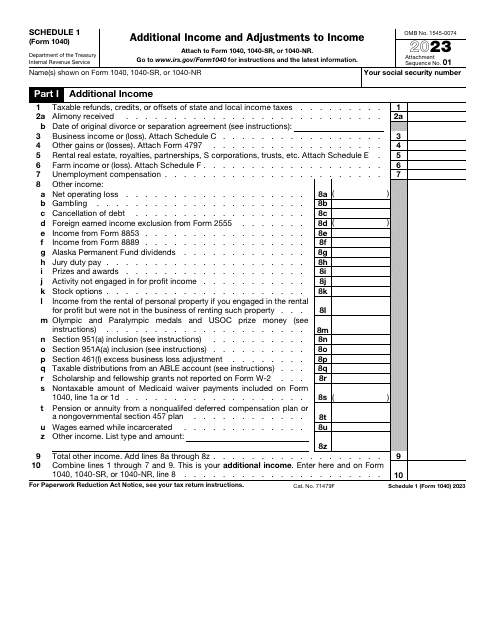

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.