Taxable Income Templates

Are you looking for information on taxable income? Look no further. Our comprehensive collection of documents provides all you need to know about taxable income and how it affects your finances.

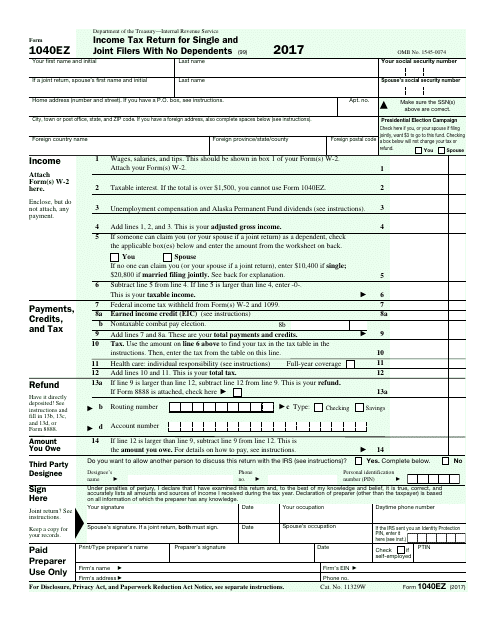

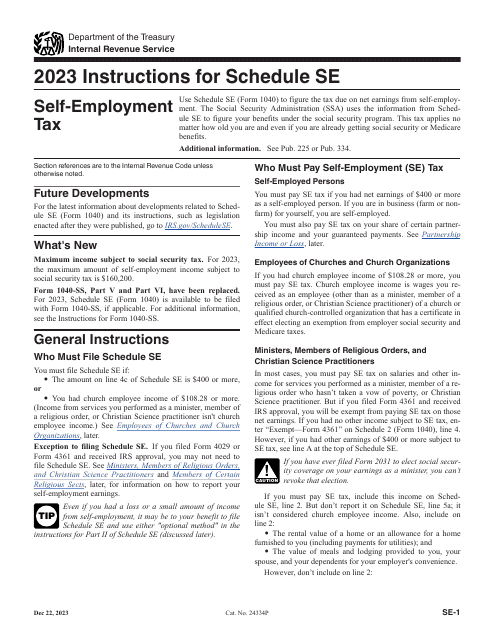

Taxable income refers to the amount of income that is subject to taxation, after deductions, exemptions, and credits have been taken into account. This includes income from various sources such as wages, salaries, self-employment earnings, rental income, and more.

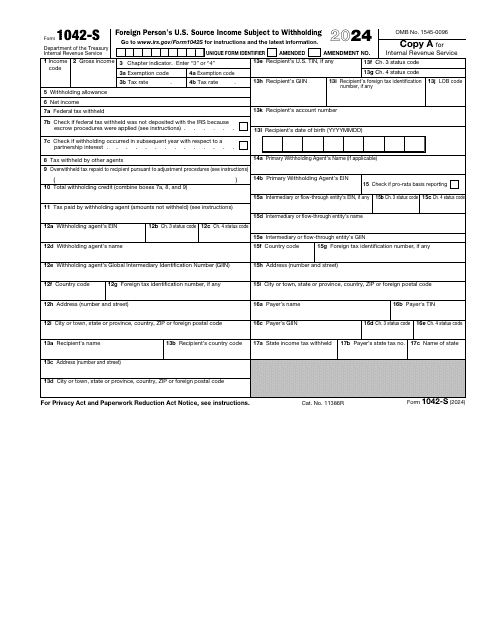

Our documents cover all aspects of taxable income, including important forms and instructions. For example, if you are a foreign person with U.S. source income subject to withholding, the IRS Form 1042-S is what you need. It provides detailed information on how to report your income and fulfill your tax obligations.

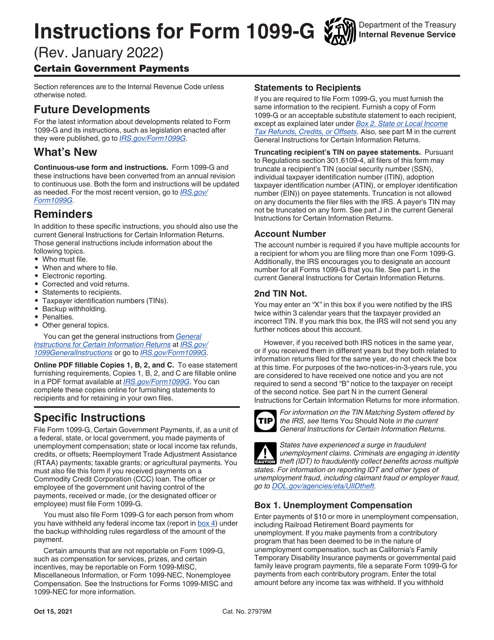

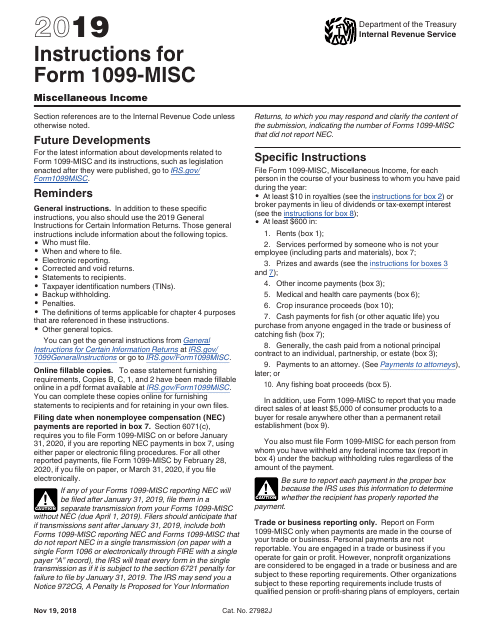

Another important document is the IRS Form 1099-MISC which relates to miscellaneous income. This document is used to report income that doesn't fit into other categories, such as freelance work or income from a side gig.

If you are in Canada, we have documents specific to your situation as well. The Form T3P is designed for reporting Employees' Pension Plan income tax return in Canada. It provides instructions on how to accurately report pension income and comply with Canadian tax laws.

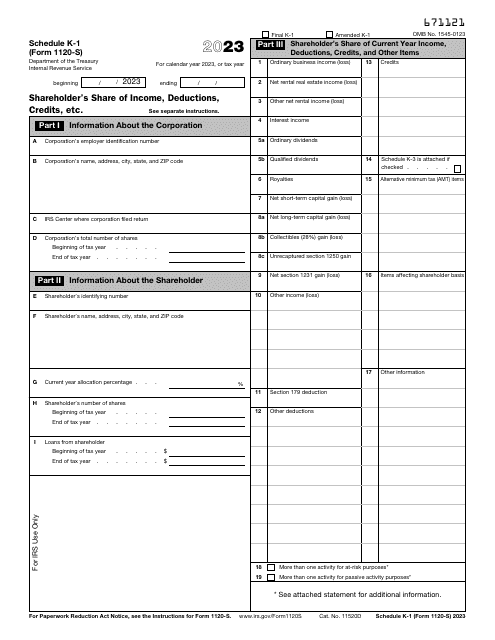

For partnerships and multi-member LLCs, the IRS Form 8865 Schedule K-2 and K-3 provide vital information on how to report income, deductions, and credits. These documents ensure that your partnership or LLC is in compliance with the tax laws of the United States.

Last but not least, if you are an estate or trust in Minnesota, the Form M2 is essential for reporting income tax returns. This document provides step-by-step instructions on reporting income, deductions, and credits for estates and trusts located in Minnesota.

Don't let taxable income be a mystery. With our extensive collection of documents, you can stay informed and make sure you are meeting your tax obligations. Whether you are an individual, a business owner, or a trustee, we have the resources you need to navigate the world of taxable income.

Documents:

186

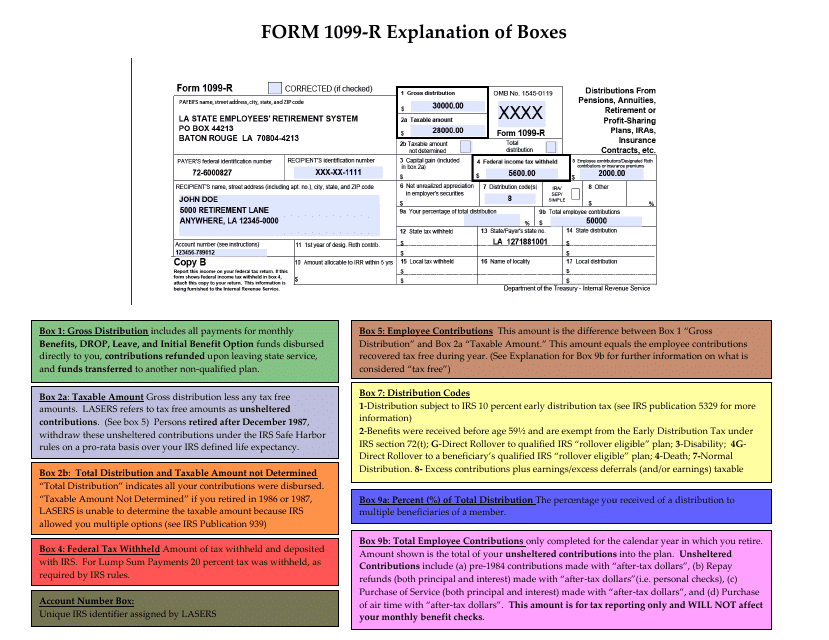

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

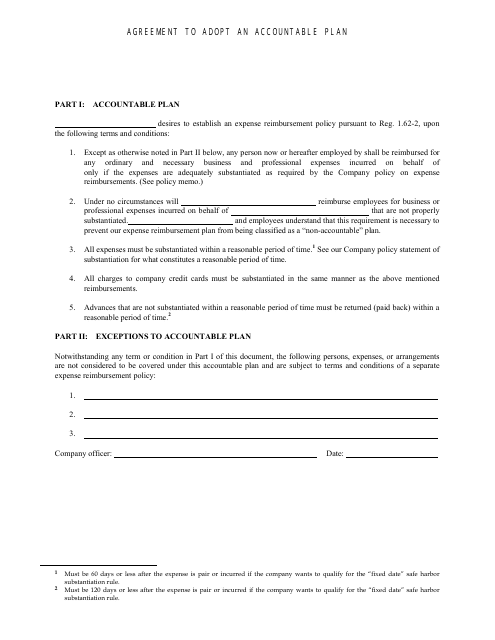

This document is used to establish an accountable plan for reimbursing business expenses incurred by employees.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

This is an IRS form that includes the details of an installment sale.

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

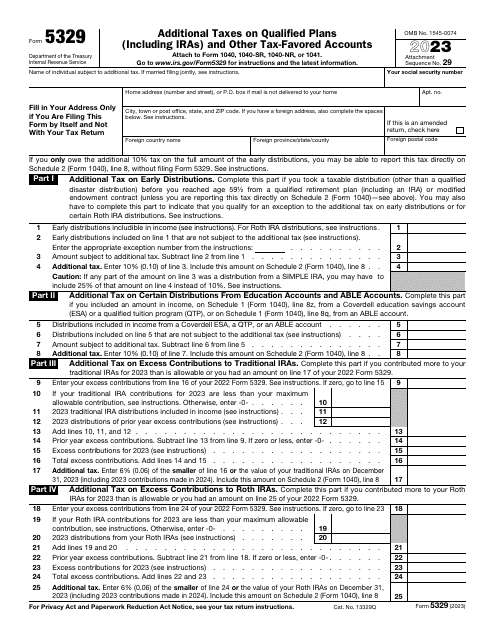

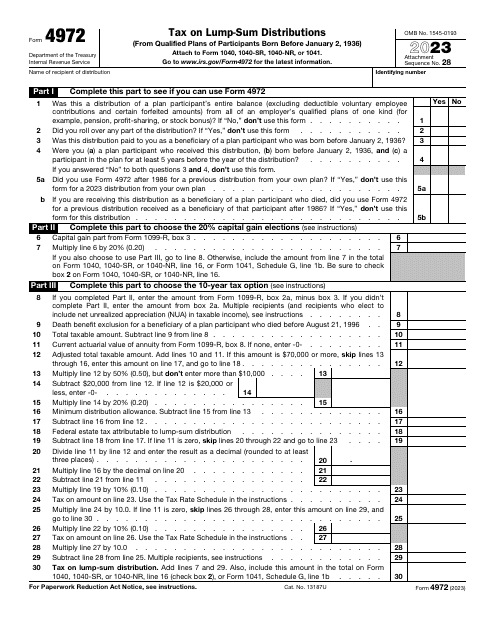

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

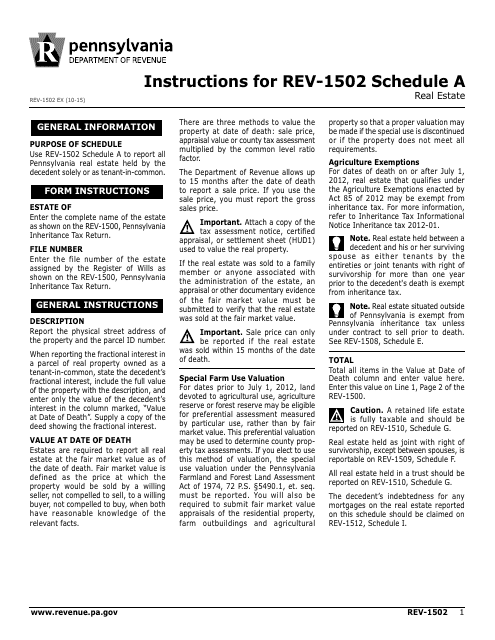

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

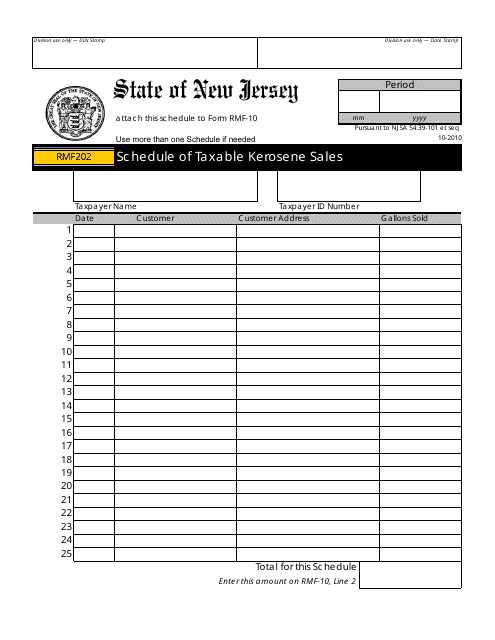

This Form is used for reporting and documenting the sales of taxable kerosene in the state of New Jersey. It is used by businesses to comply with tax regulations and provide accurate information to the government.

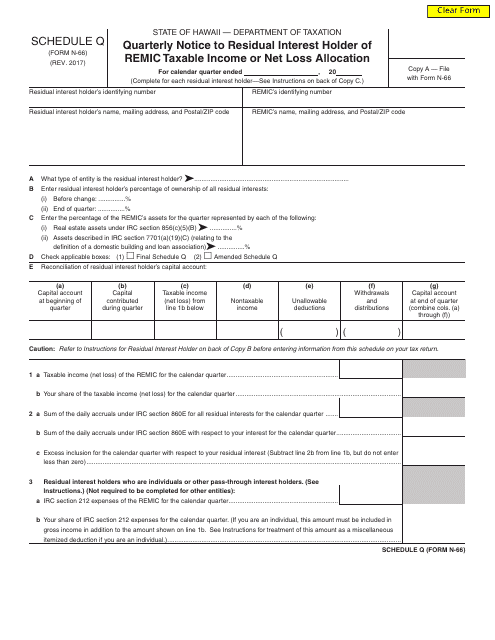

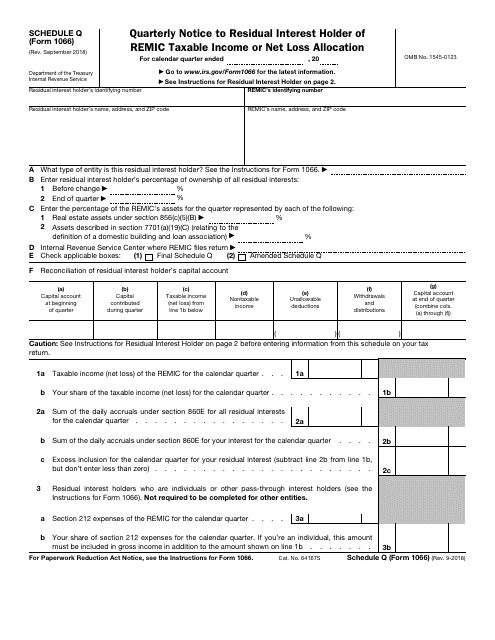

This form is used for providing quarterly notice to residual interest holders of REMIC taxable income or net loss allocation in Hawaii.

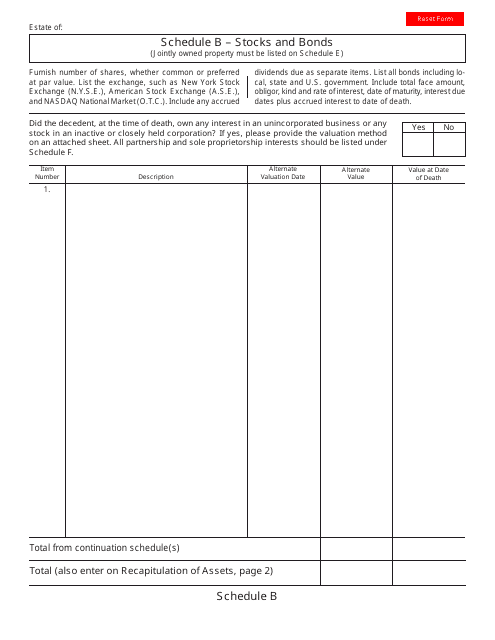

This document is used for reporting stocks and bonds owned by residents of Ohio on their Schedule B tax form.

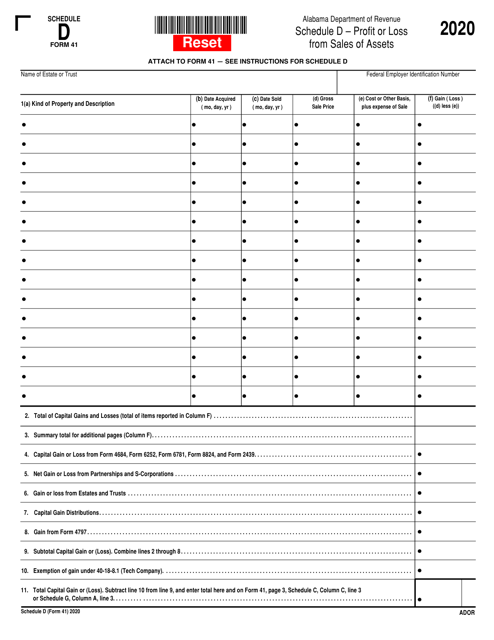

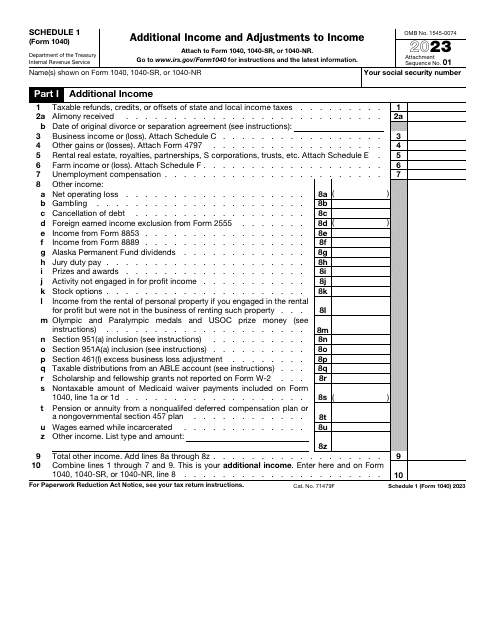

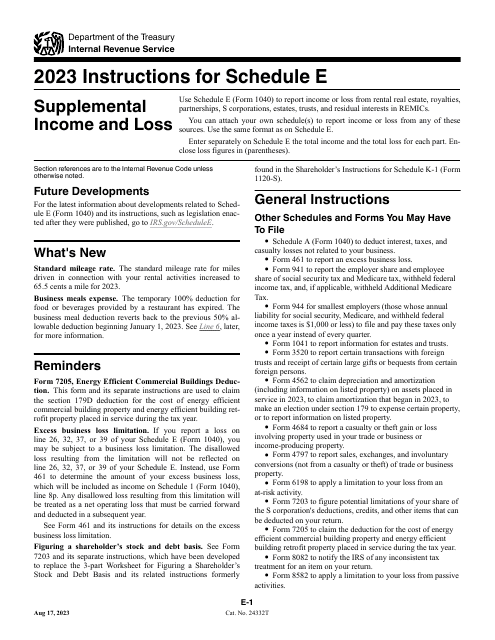

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This form is used for notifying the residual interest holder of a Real Estate Mortgage Investment Conduit (REMIC) about the taxable income or net loss allocation on a quarterly basis.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.