Tax Law Templates

Documents:

190

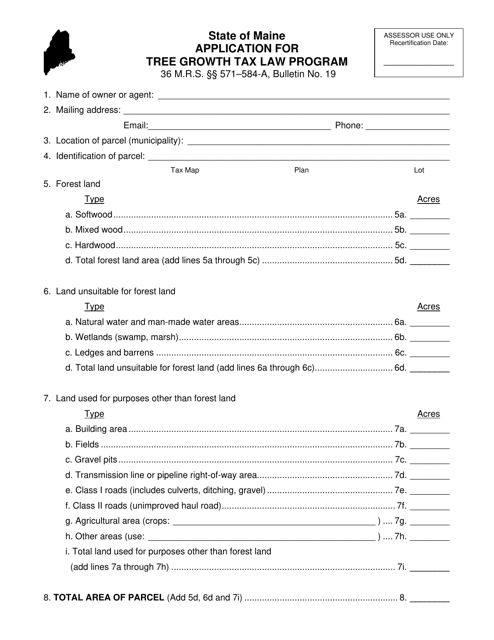

This document is an application for the Tree Growth Tax Law Program in Maine. The program provides tax benefits for landowners who engage in sustainable forestry practices.

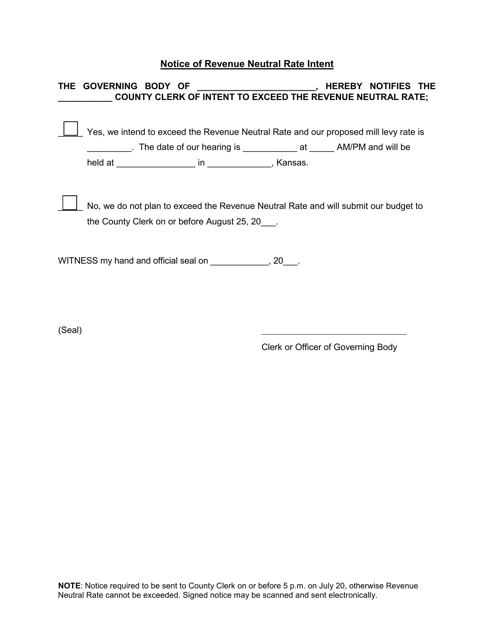

This type of document is a notice issued by the state of Kansas regarding their intent to determine a revenue neutral rate. It may contain information about how the state plans to maintain revenue neutrality in regards to taxes or any changes that may be made.

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

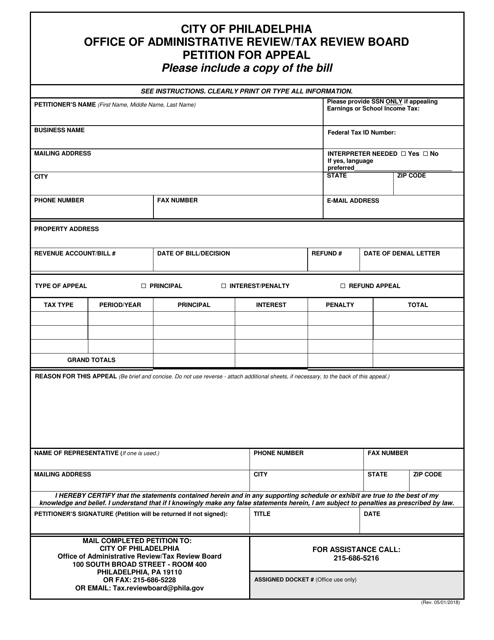

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

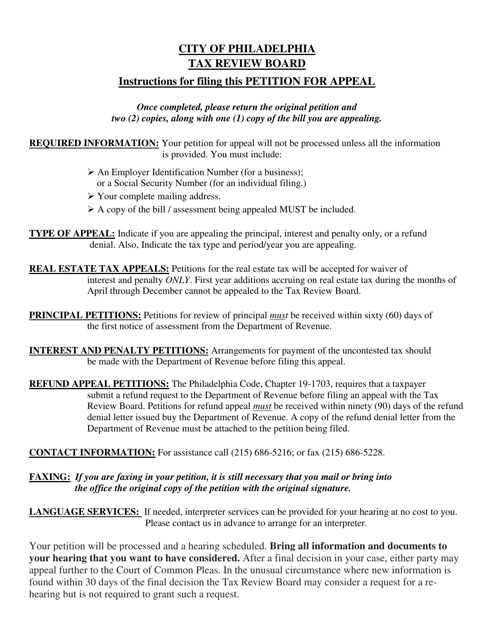

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.

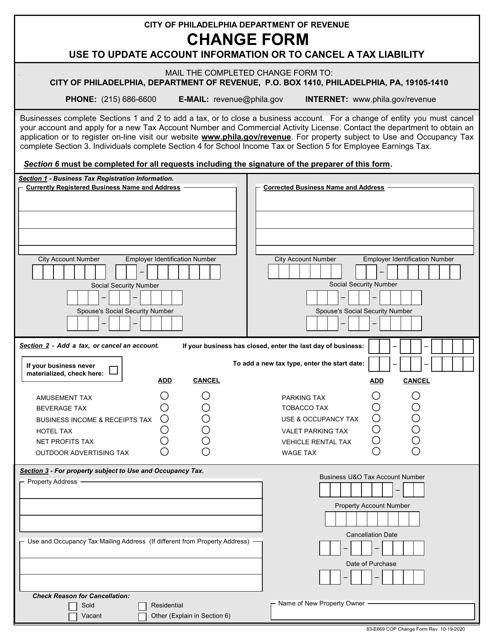

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

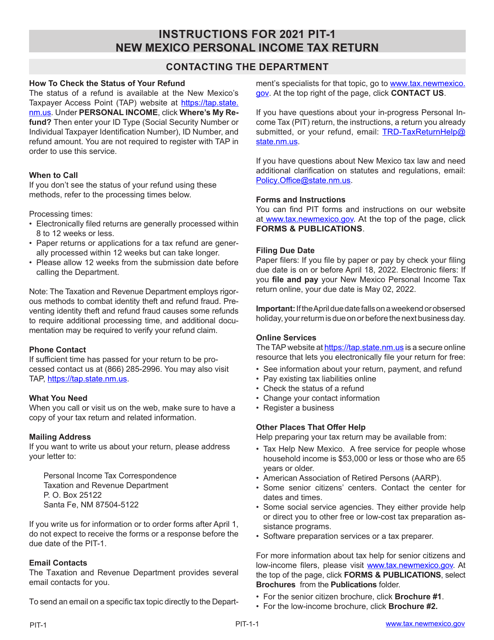

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

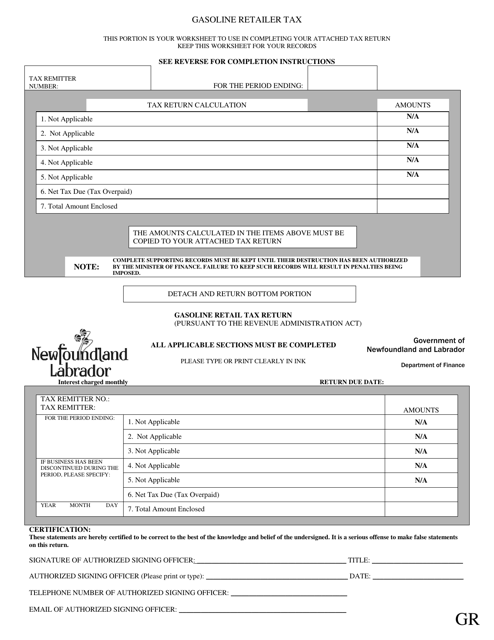

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.

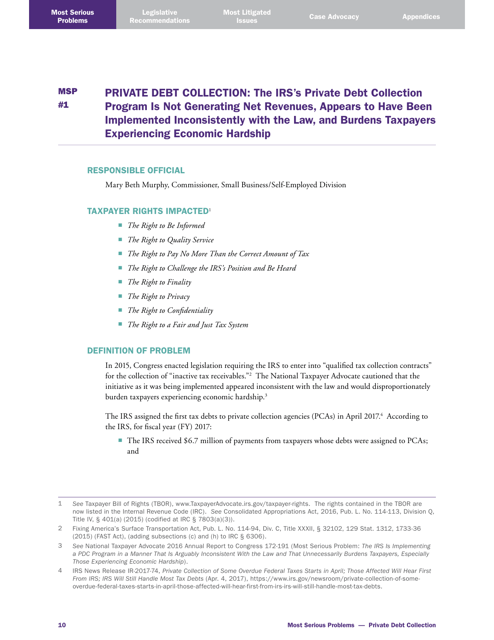

This document provides the Annual Report to Congress from the Taxpayer Advocate Service. It addresses various issues and concerns related to taxpayer rights and offers recommendations for improvement.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

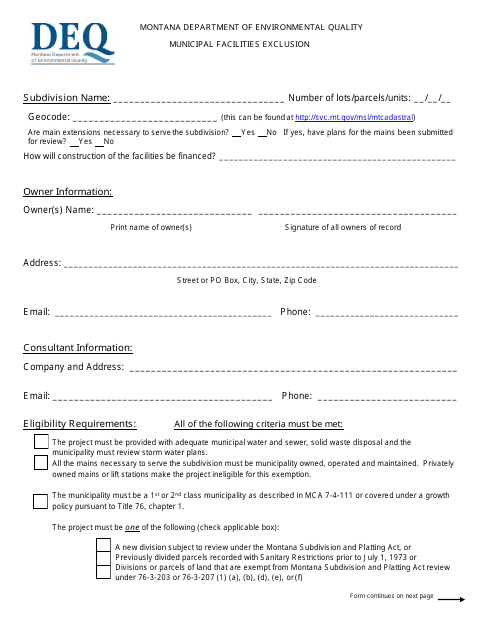

This document provides information about the Municipal Facilities Exclusion in Montana.

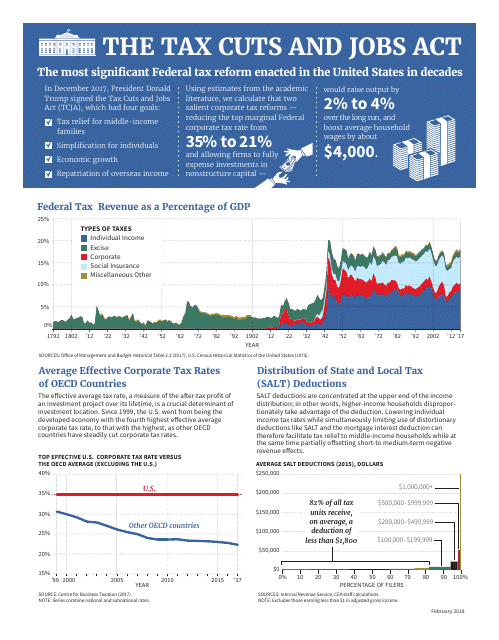

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

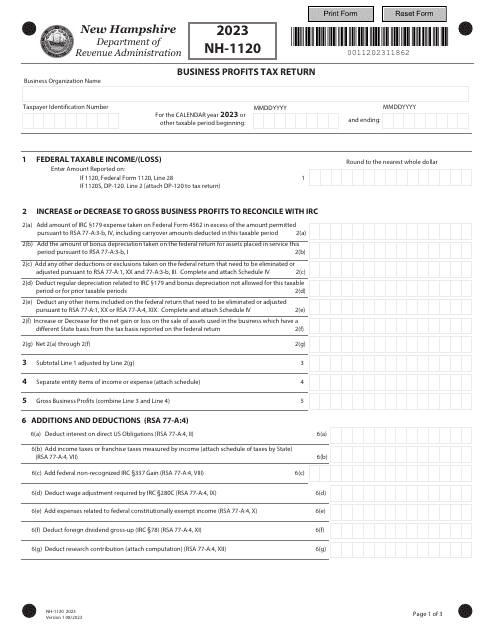

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.