Tax Law Templates

Documents:

190

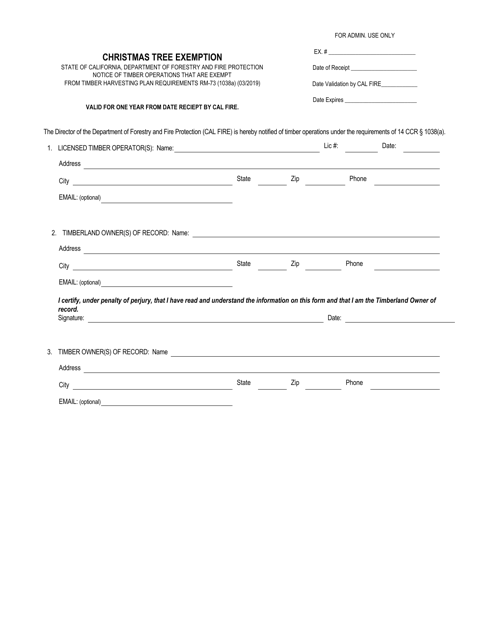

This form is used for requesting an exemption to cut down a Christmas tree in California.

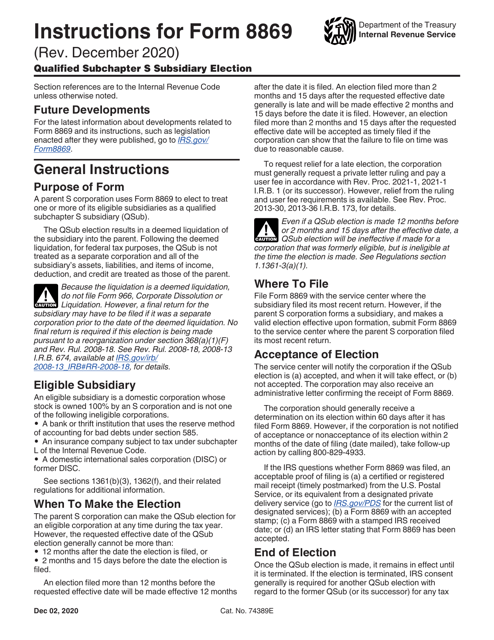

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

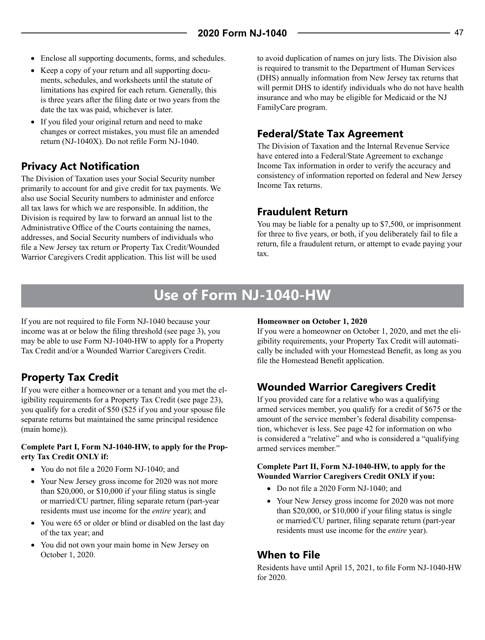

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

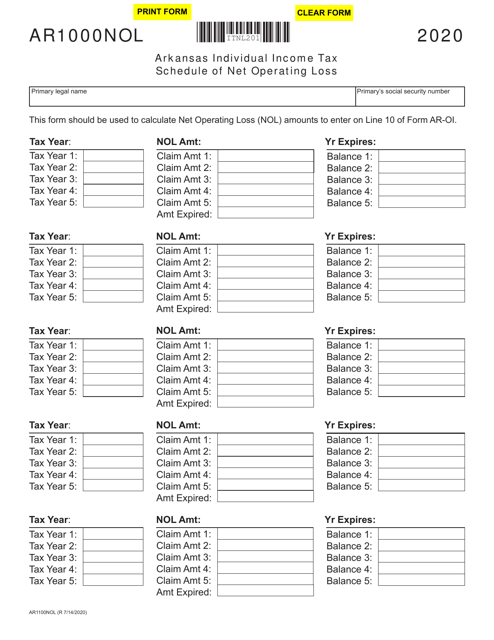

This form is used for reporting net operating losses in the state of Arkansas.

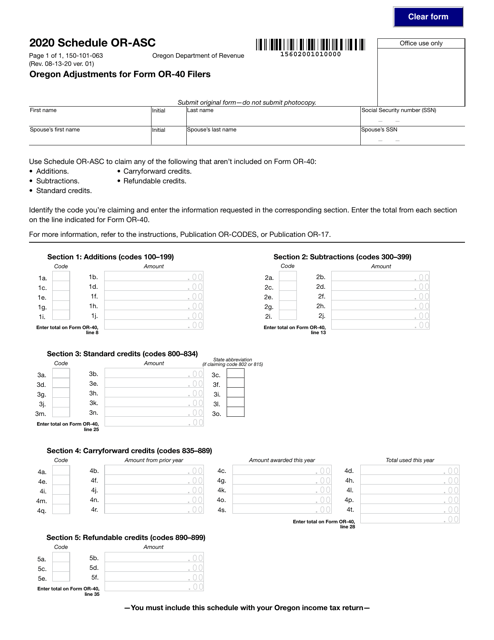

This form is used for making adjustments to the Oregon tax return (Form OR-40) filed by individuals in Oregon. It is specifically designed for Oregon residents and allows them to make corrections or additions to their original tax return. This form helps taxpayers in Oregon ensure that their tax returns are accurate and complete.

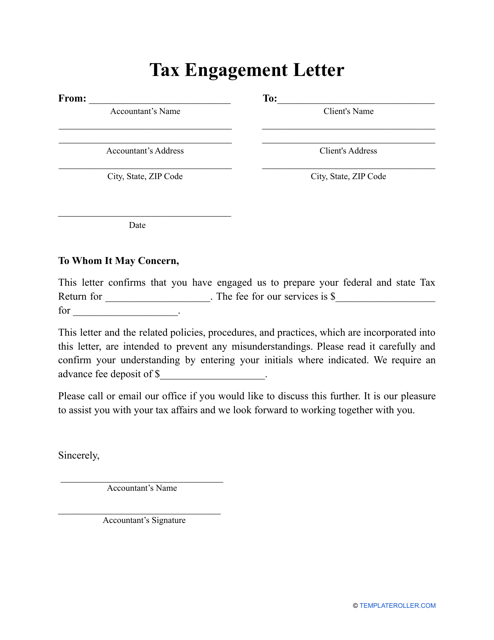

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

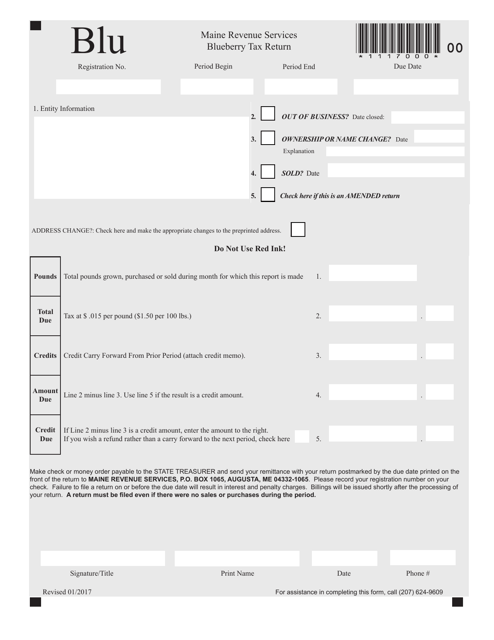

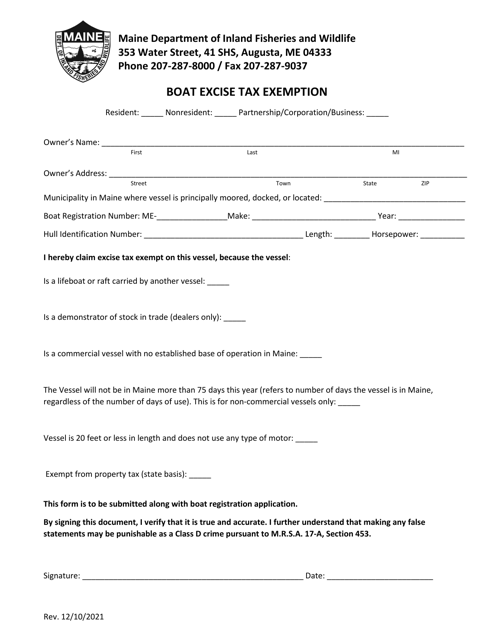

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

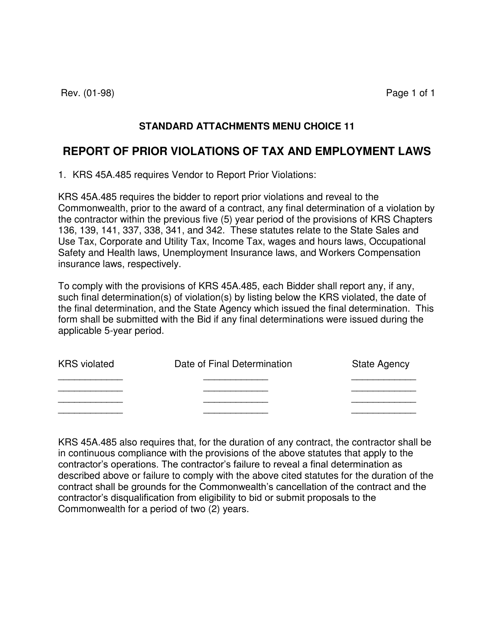

This document provides a report of prior violations of tax and employment laws in the state of Kentucky. It helps to identify any past non-compliance issues and ensures that the necessary actions are taken to rectify them.

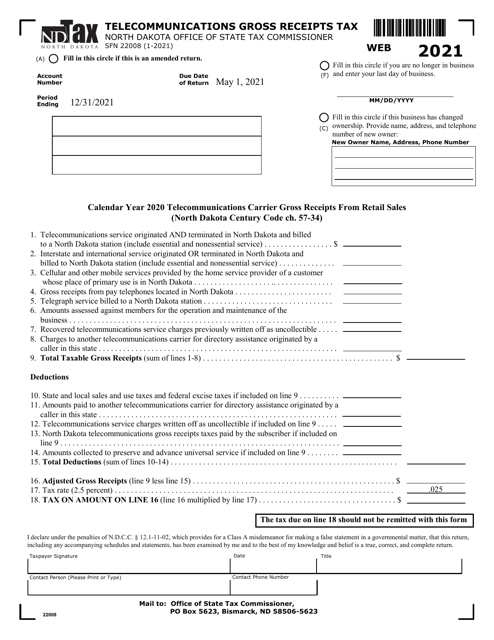

This form is used for calculating and reporting the telecommunications gross receipts tax in North Dakota.

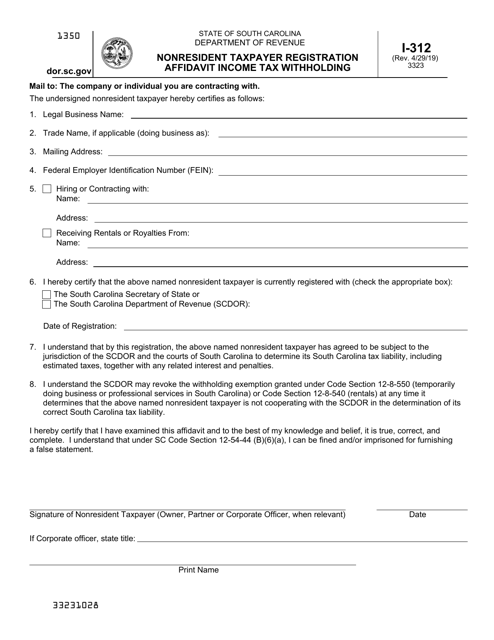

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

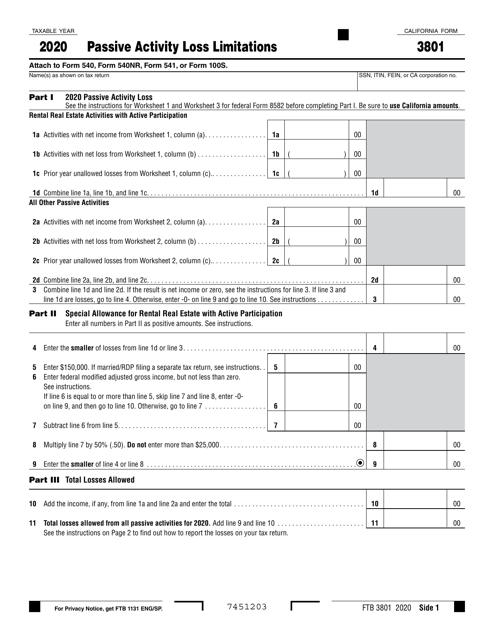

This form is used for reporting passive activity loss limitations in California.

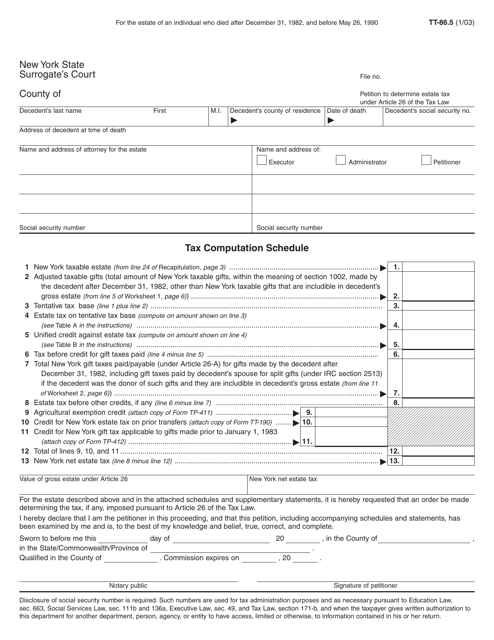

This form is used for petitioning the New York state to determine the estate tax for an individual who died between December 31, 1982, and May 26, 1990.

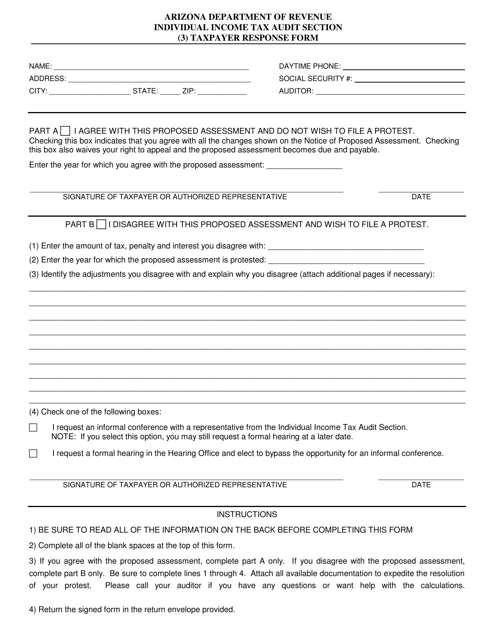

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

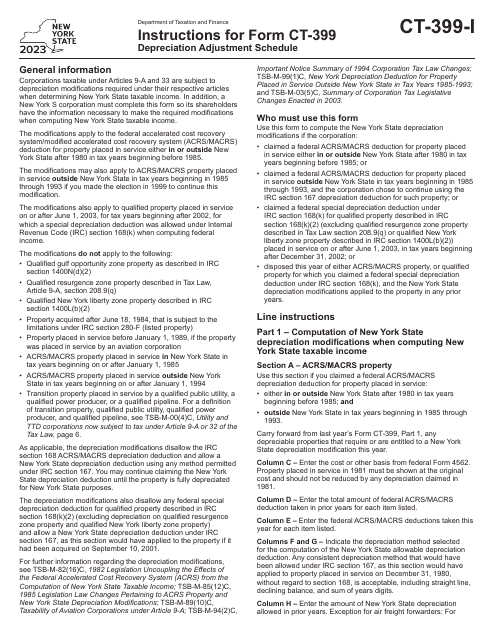

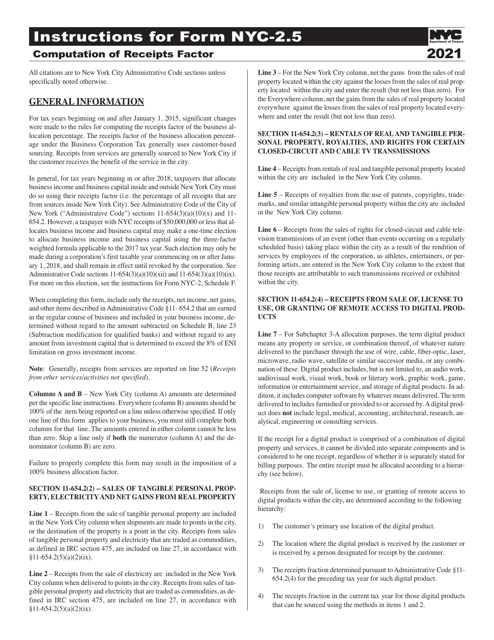

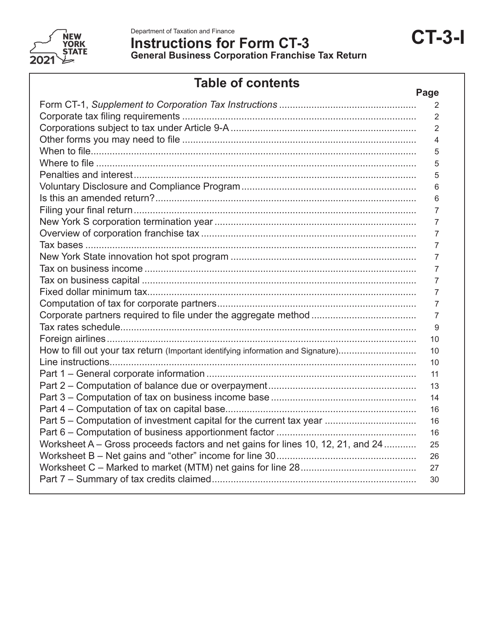

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

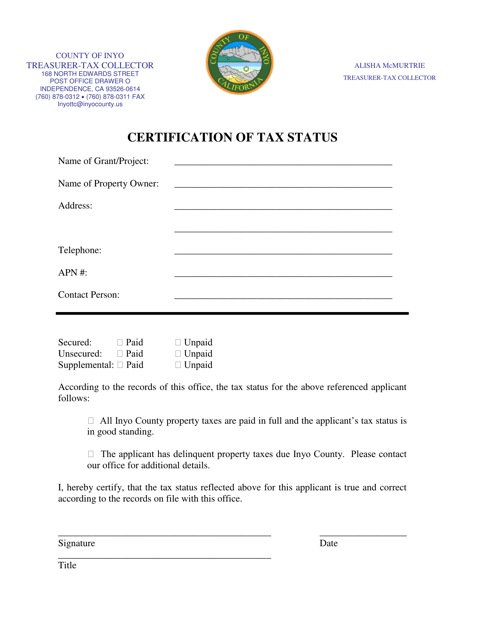

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.