Tax Law Templates

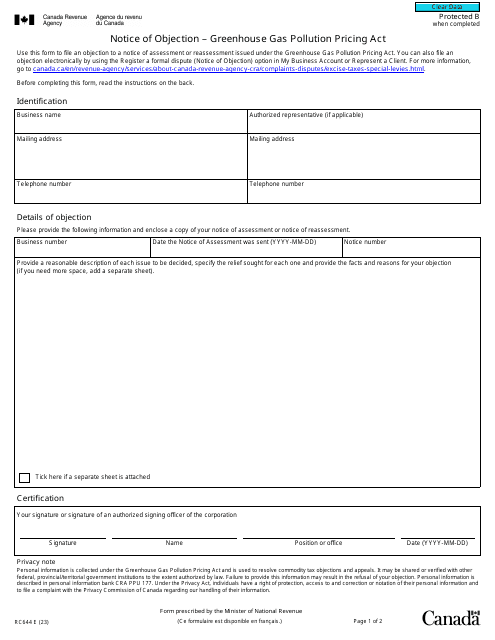

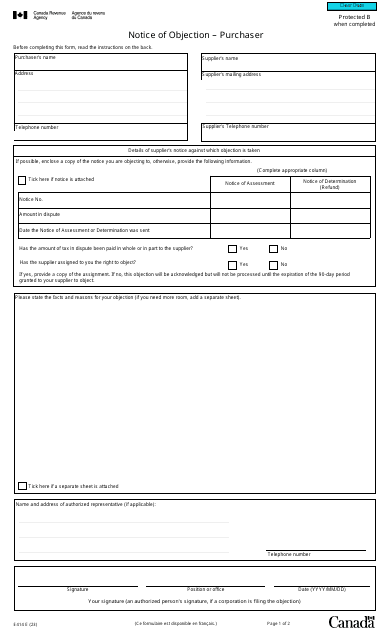

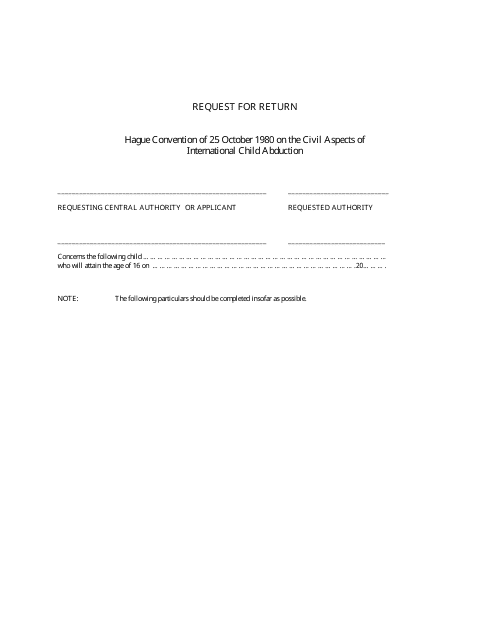

Are you looking for information on tax laws or tax regulations? Look no further! Our extensive collection of documents on tax law will provide you with the resources you need to navigate the complex world of taxation. From IRS forms such as Form 8582 Passive Activity Loss Limitations and Form 1040 Schedule A Itemized Deductions, to important notices like Form 56 Notice Concerning Fiduciary Relationship and Form 14568 Model Vcp Compliance Statement, we have it all. Whether you are an individual taxpayer, a business owner, or a tax professional, our tax law documents will help you understand the intricacies of the tax system and ensure compliance with the law. Stay updated with the latest tax regulations and make informed decisions by exploring our comprehensive collection of tax law documents.

Documents:

190

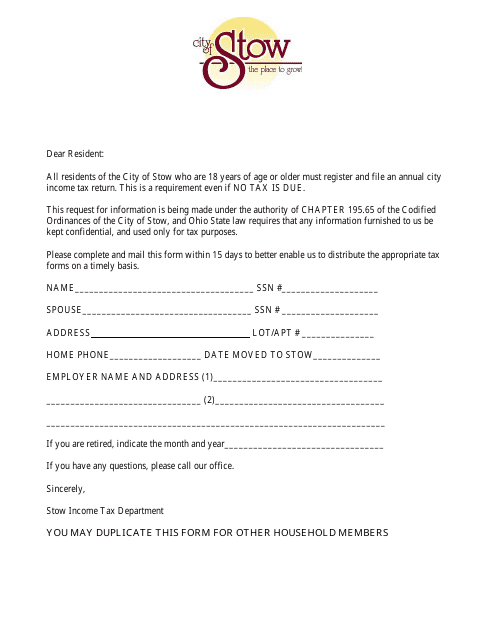

This Form is used for filing your income tax return in the City of Stow, Ohio.

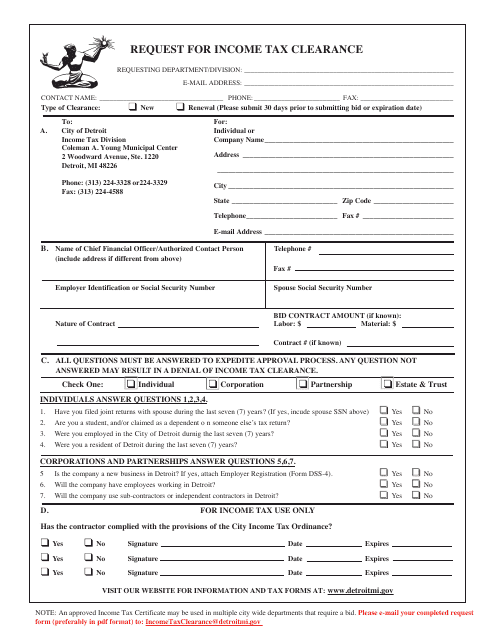

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

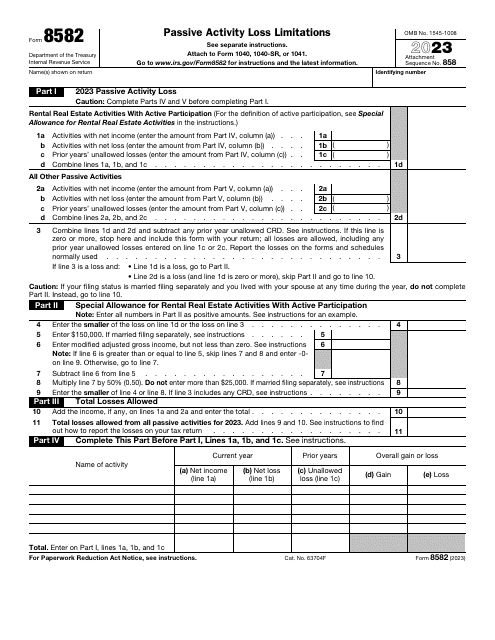

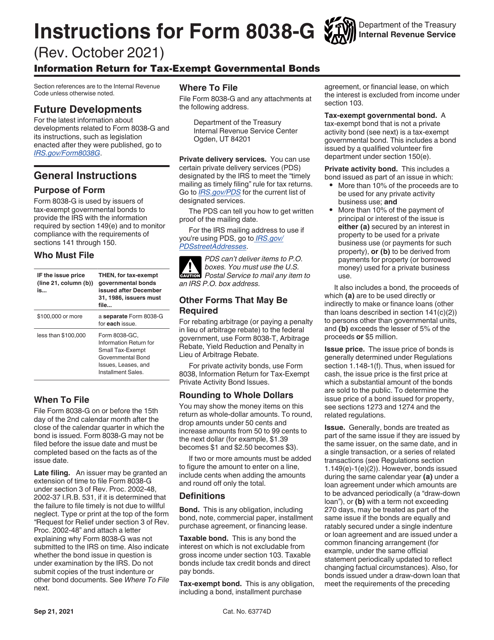

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

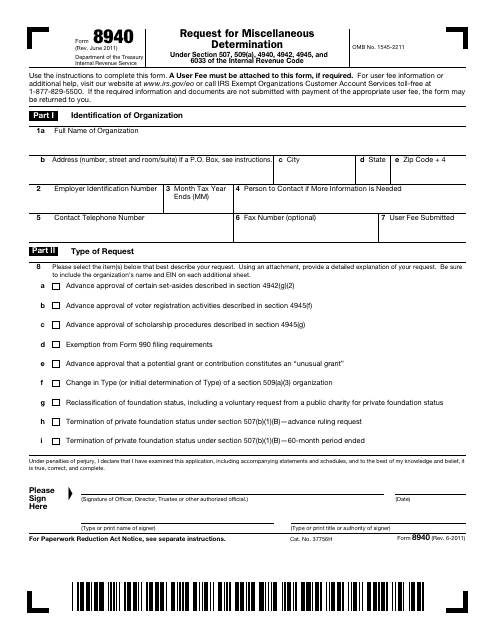

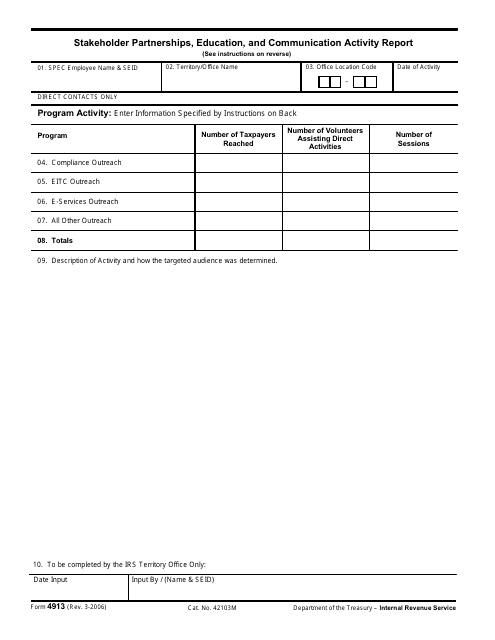

This form is used for requesting miscellaneous determinations from the IRS.

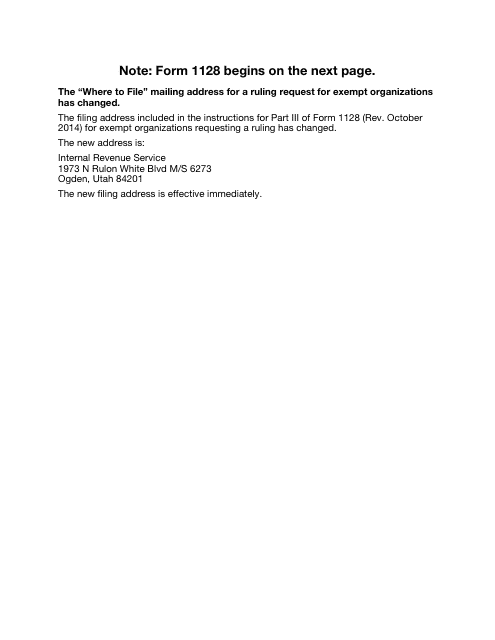

This Form is used for applying to adopt, change, or retain a tax year with the IRS. It is typically used by businesses or organizations that want to align their tax year with their fiscal year or have a specific reason for changing their tax year.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

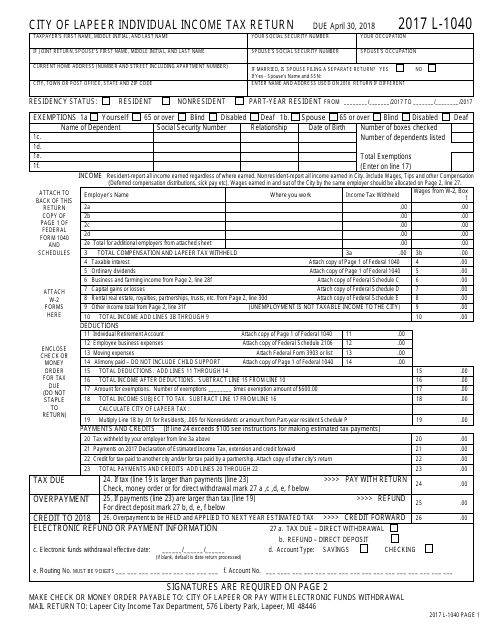

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

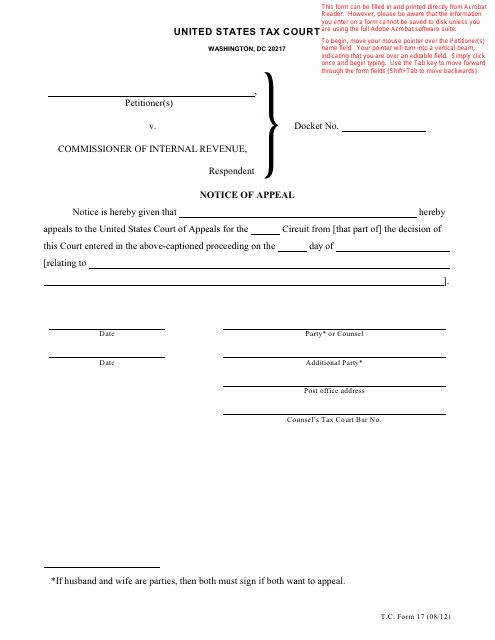

This Form is used for filing a Notice of Appeal in the T.C. Court.

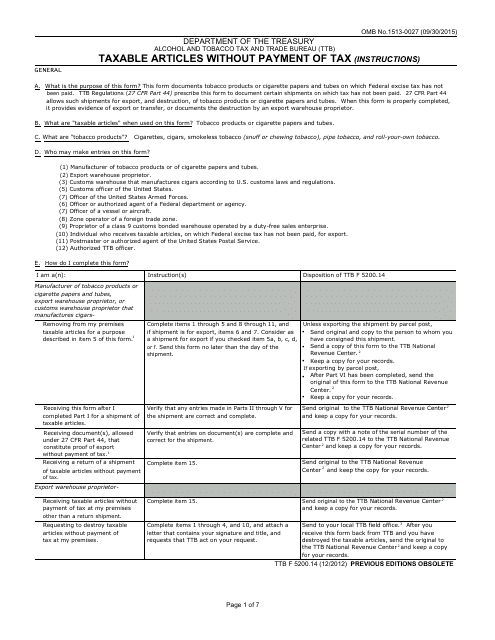

This document is used for reporting the taxable articles that are not paid for with tax.

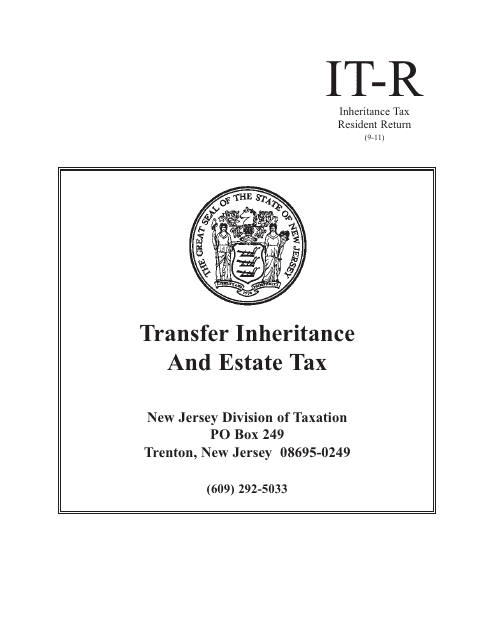

This form is used for reporting and paying inheritance tax for residents of New Jersey.

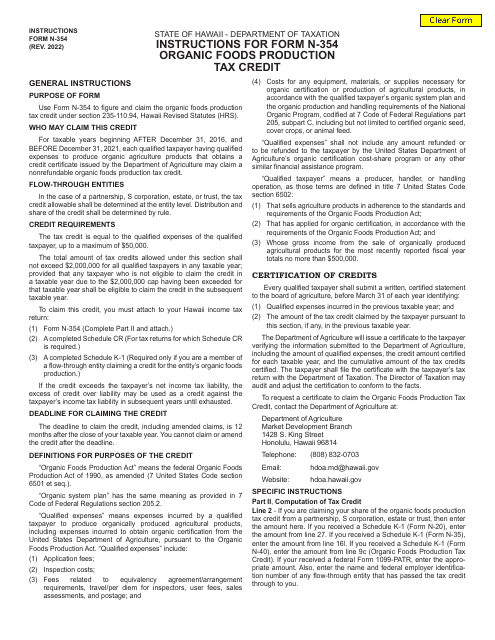

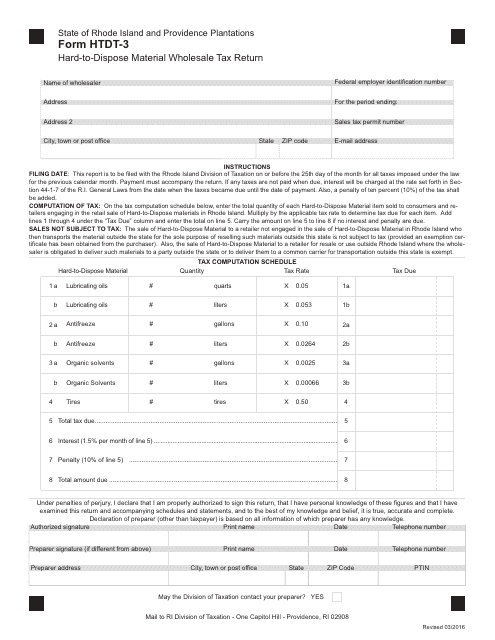

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

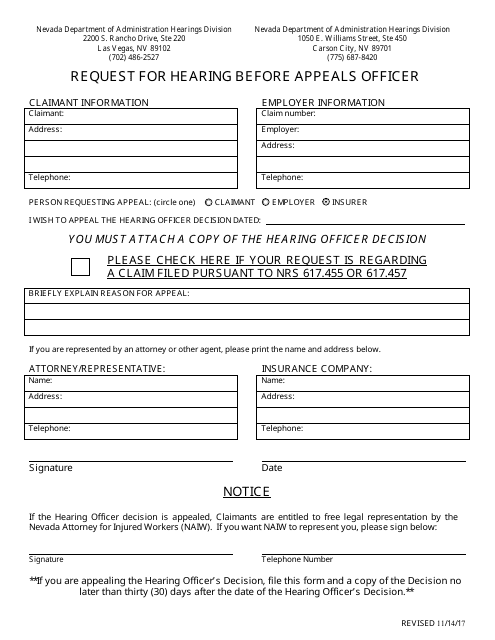

This document is used to request a hearing before an Appeals Officer in Nevada.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

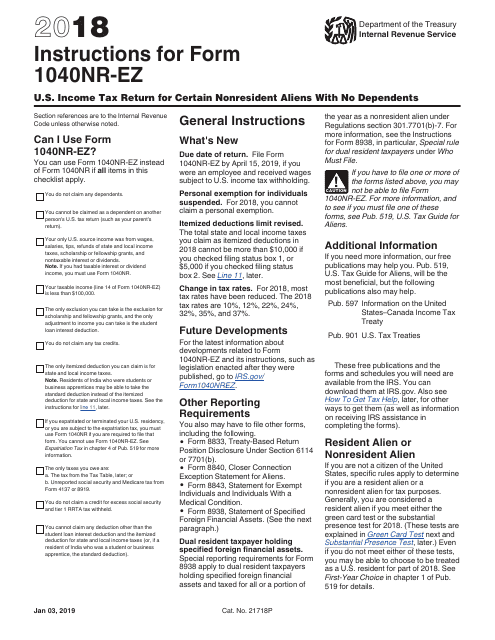

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

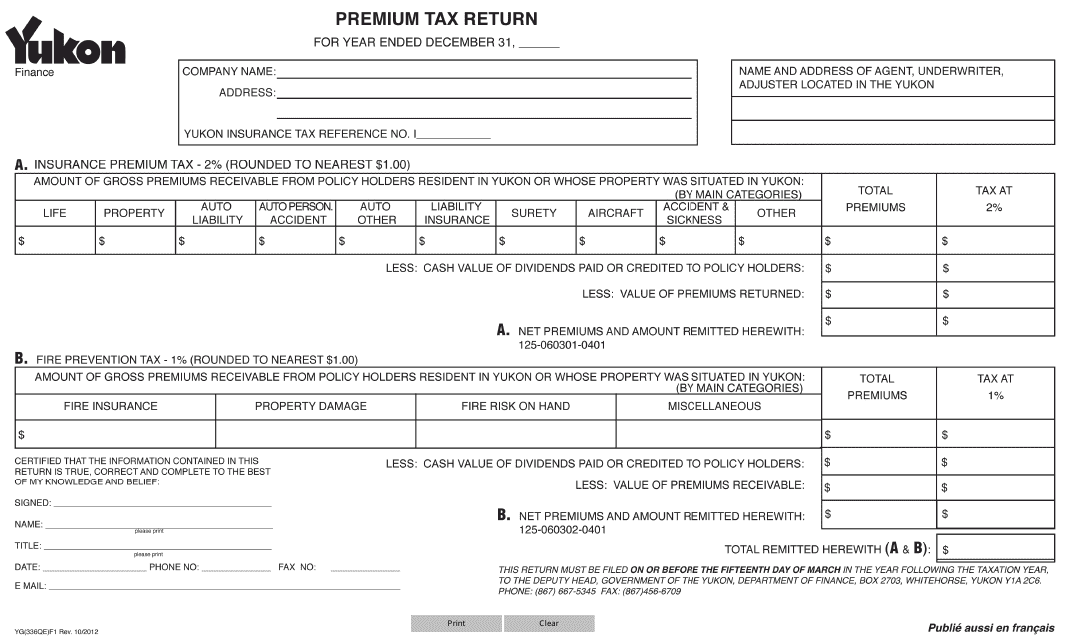

This form is used for filing premium tax returns in Yukon, Canada.

This document is used to request a return in the province of Saskatchewan, Canada.

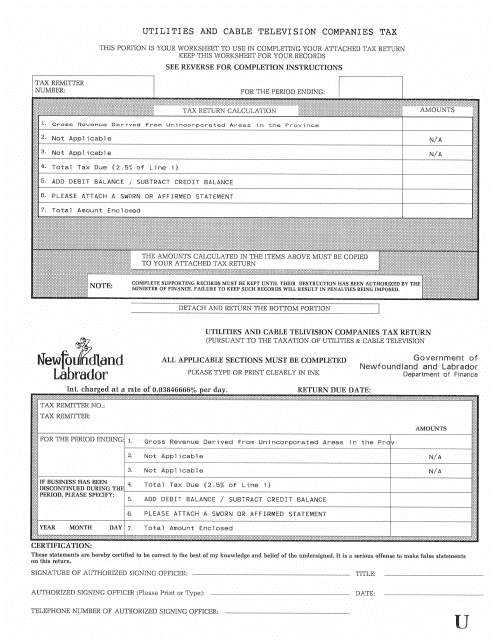

This document is for the tax regulations related to utilities and cable television companies in Newfoundland and Labrador, Canada. It provides information on the taxes applicable to these industries in the province.

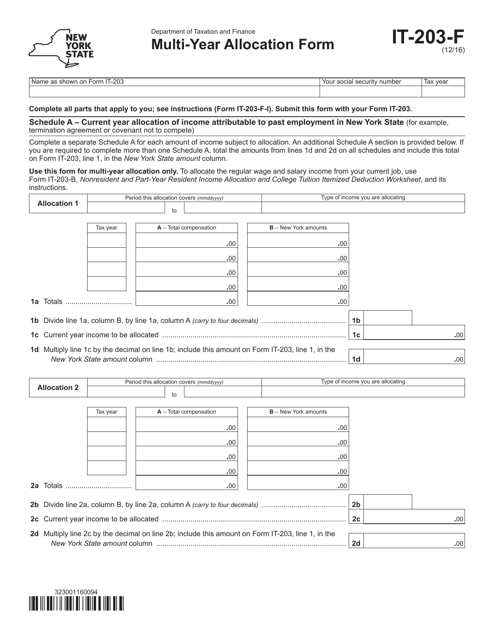

This Form is used for allocating income and deductions for multiple years in New York.