Tax Rates Templates

Are you looking for information on tax rates? Our website provides a comprehensive collection of documents and resources related to tax rates. Whether you are an individual, a business owner, or a tax professional, our documents can help you navigate the complexities of tax rate calculations, certifications, and approvals.

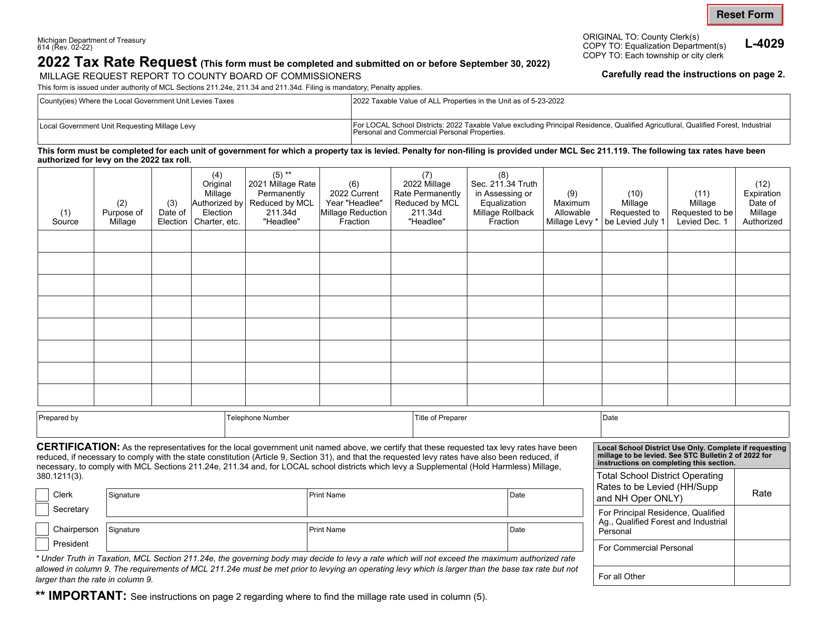

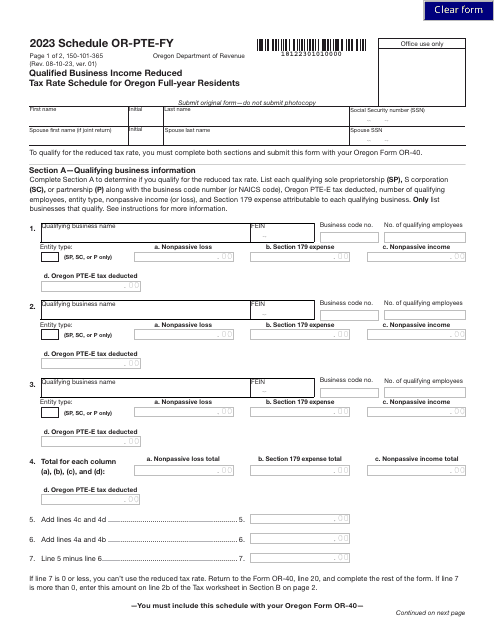

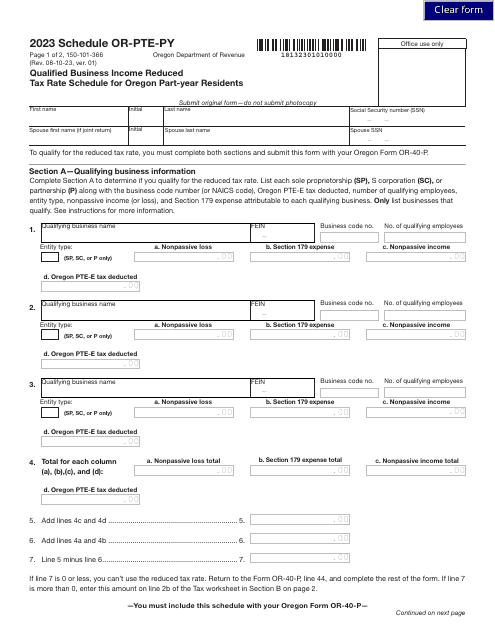

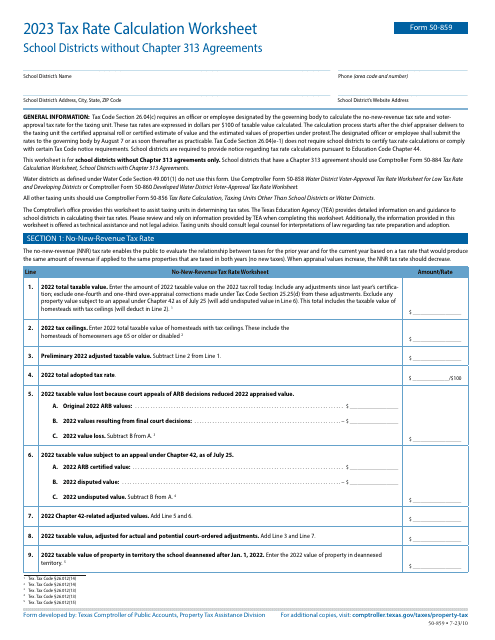

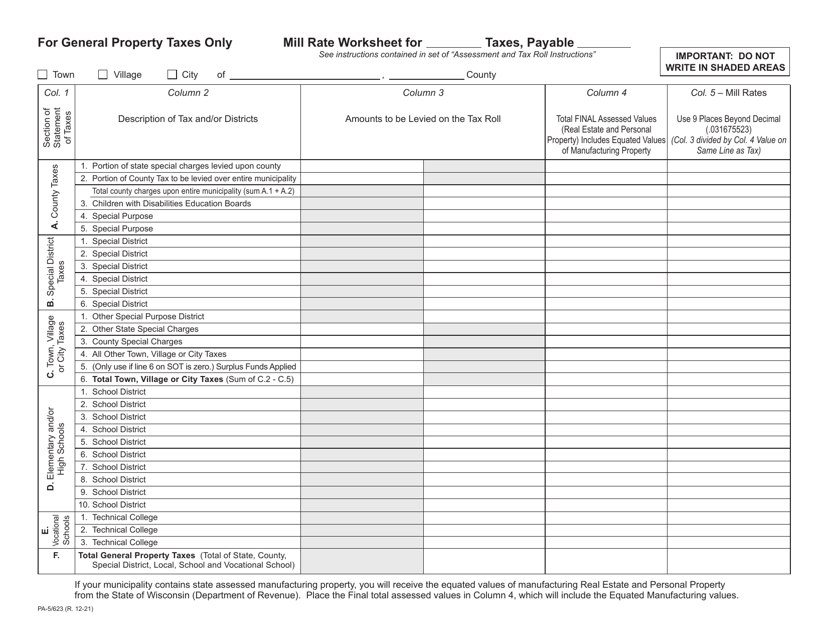

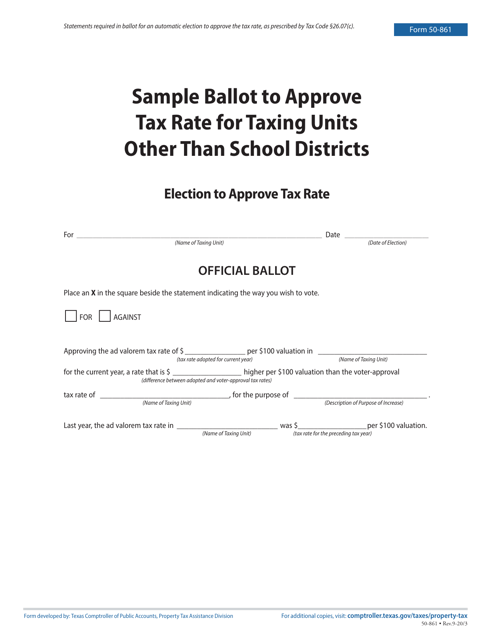

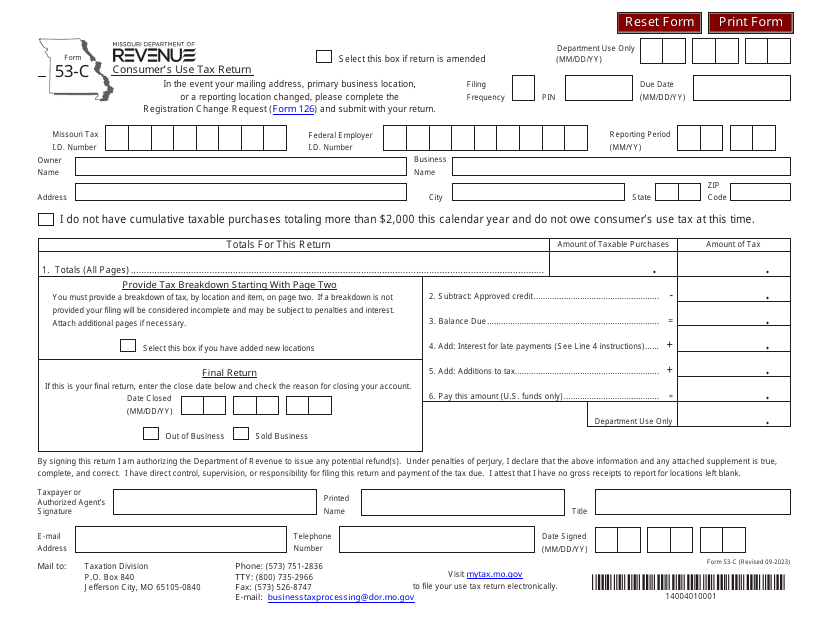

Some of the documents you can find in our tax rates collection include worksheets to calculate tax rates for specific forms or taxing authorities, requests to add or change taxonomies, sample ballots for approving tax rates, and worksheets for school districts without Chapter 313 agreements. These documents are sourced from various states across the United States, such as Ohio, North Dakota, Texas, and Missouri.

Our tax rates collection is designed to assist you in understanding and complying with tax regulations in your jurisdiction. You can use these documents to stay up-to-date with the latest tax rate changes, calculate your tax liability accurately, and make informed decisions about your tax planning strategies.

With our comprehensive selection of tax rate documents, you can streamline your tax-related processes and ensure compliance with the applicable tax laws. Whether you are an individual taxpayer or a business owner, our tax rates collection is a valuable resource for managing your tax obligations effectively.

Explore our tax rates collection today and access the information you need to understand, calculate, and comply with the tax rates in your jurisdiction. Don't let complicated tax calculations overwhelm you - let our documents be your guide.

Documents:

116

This Form is used for filing your income tax return in the City of Stow, Ohio.

This form is used for paying lodging tax in Amherst County, Virginia.

This research document explores the impact of corporate tax reform on economic growth and wages. It examines how changes in corporate taxes can affect these factors.

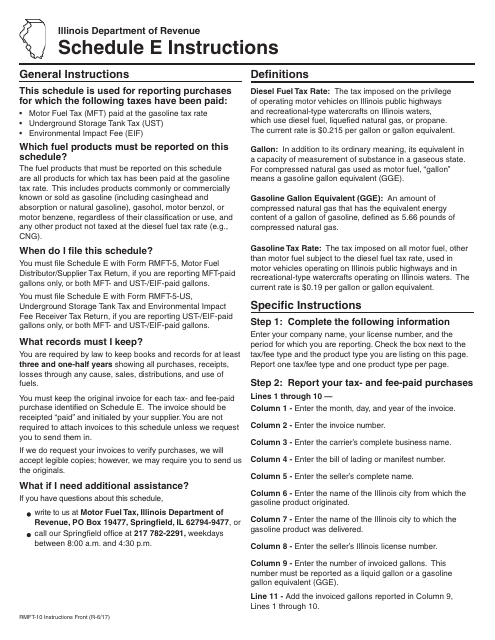

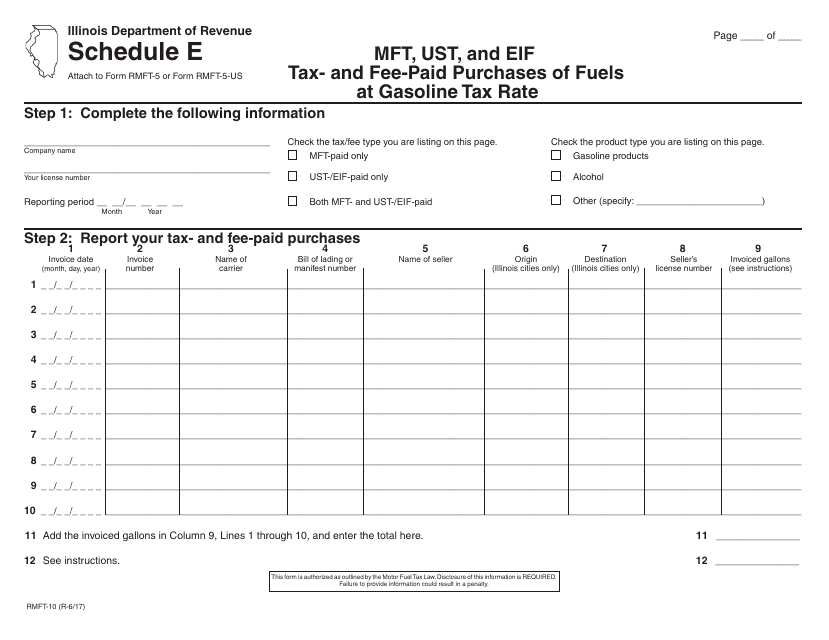

This Form is used for reporting and calculating the tax and fee-paid purchases of fuels, specifically gasoline, in Illinois.

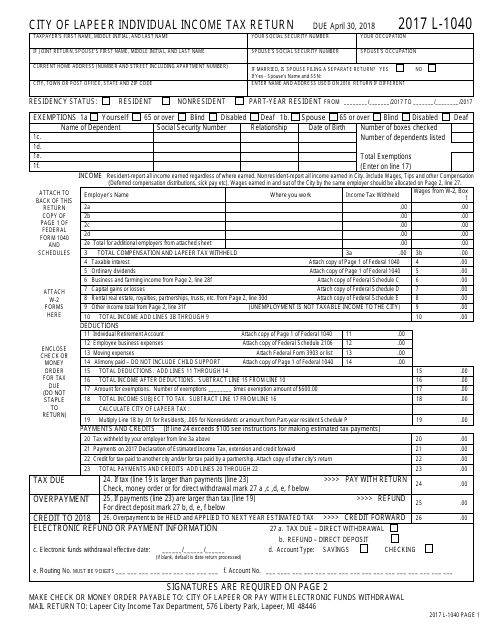

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

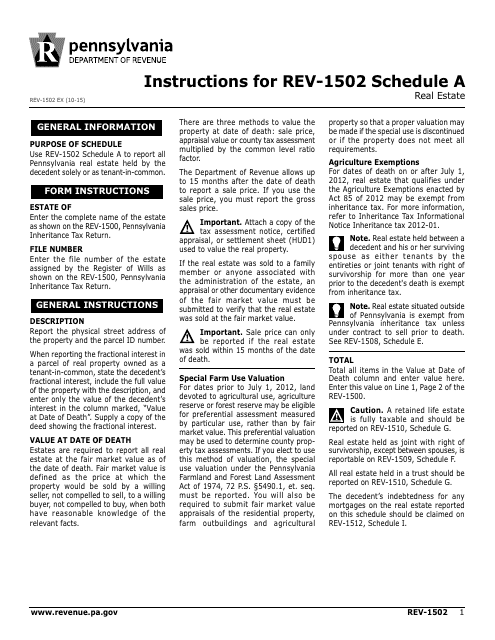

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

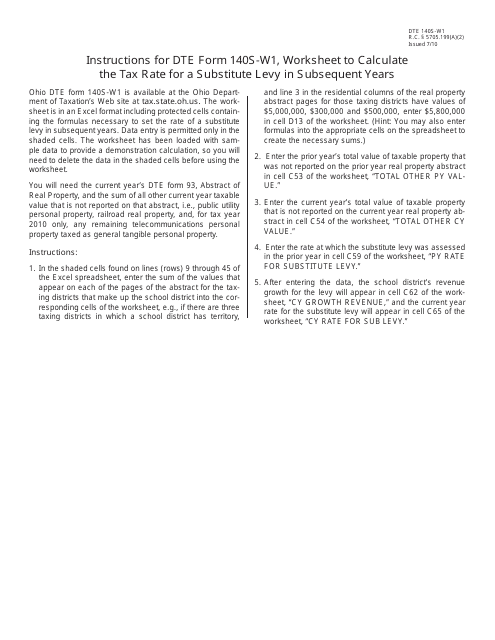

This document provides instructions on how to use Form DTE140S-W1 to calculate the tax rate for a substitute levy in subsequent years in Ohio.

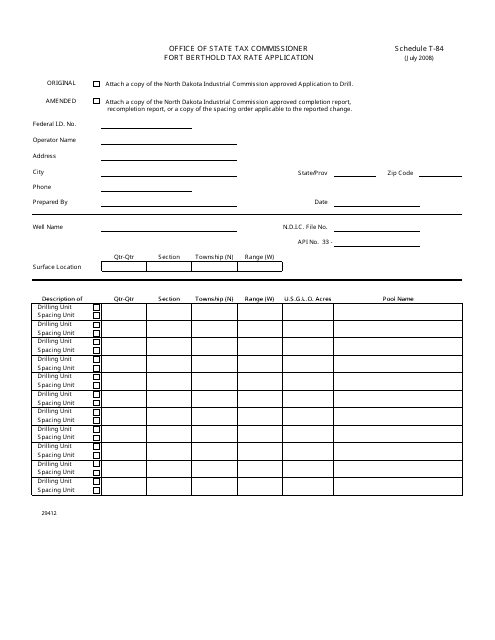

This document is used to apply for tax rates in Fort Berthold, North Dakota for Schedule T-84.

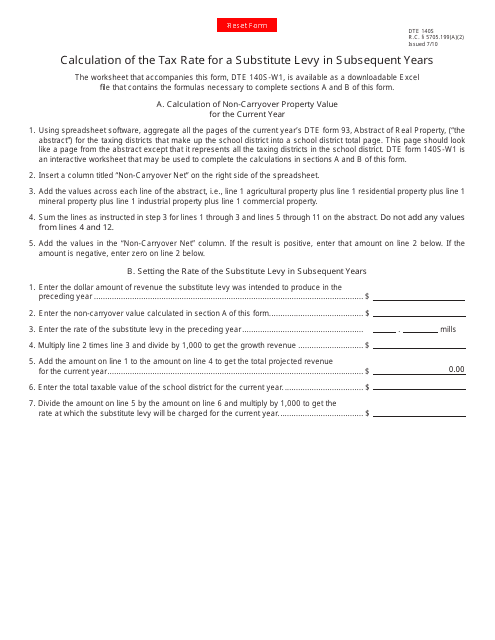

This form is used for calculating the tax rate for a substitute levy in subsequent years in the state of Ohio.

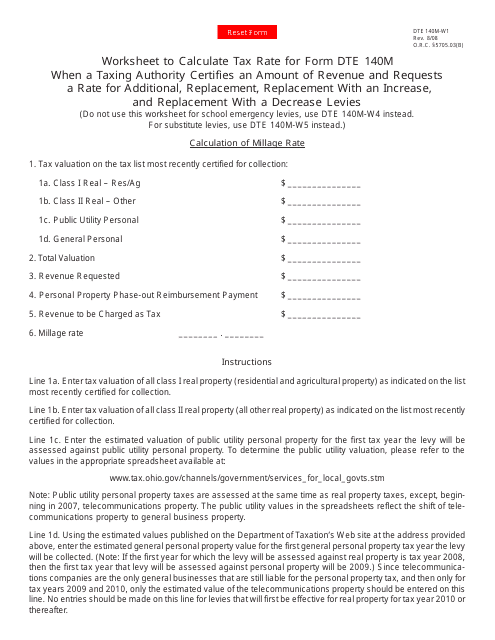

This form is used for calculating tax rates in Ohio when a taxing authority requests additional, replacement, or increased levies. It is used to determine the tax rate based on certified revenue amounts.

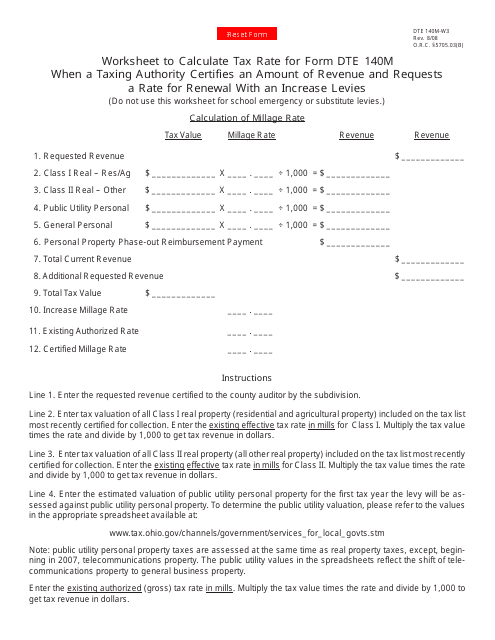

This form is used for calculating the tax rate when a taxing authority in Ohio certifies an amount of revenue and requests a rate for the renewal with an increase in levies.

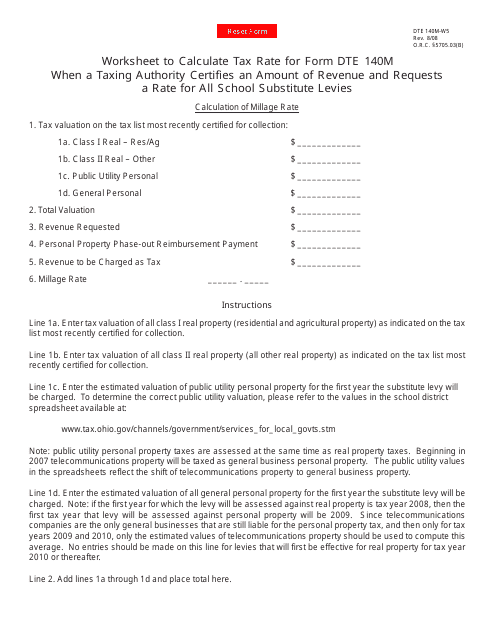

This form is used to calculate the tax rate for Form DTE 140M when a taxing authority certifies an amount of revenue and requests a rate for all school substitute levies in Ohio.

This form is used for reporting tax- and fee-paid purchases of fuels at the gasoline tax rate in Illinois. It is used by MFT, UST, and EIF taxpayers.

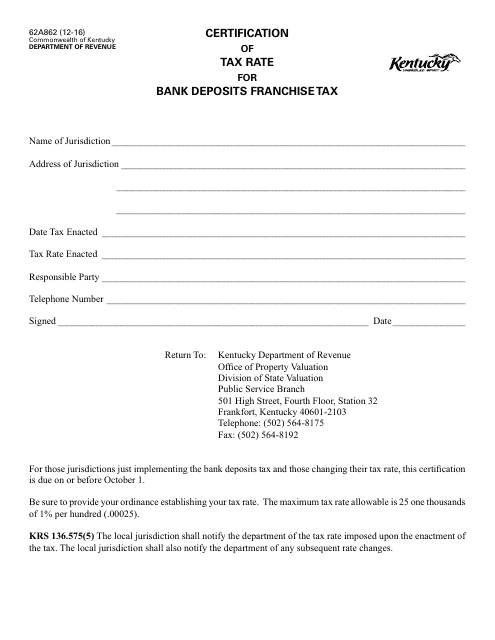

This form is used for certifying the tax rate for bank deposits franchise tax in the state of Kentucky.

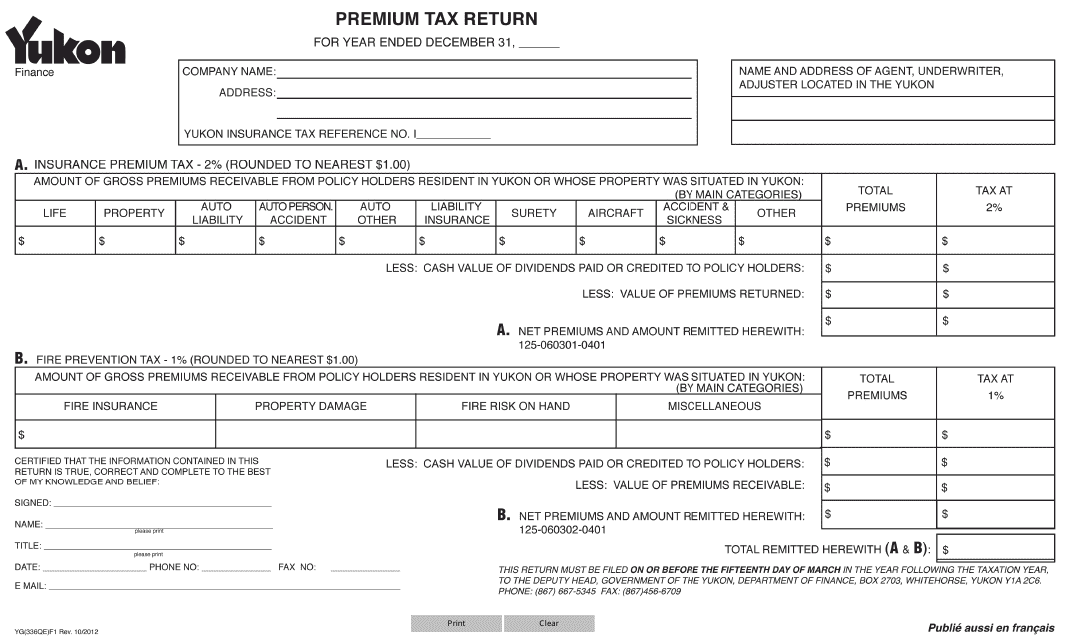

This form is used for filing premium tax returns in Yukon, Canada.

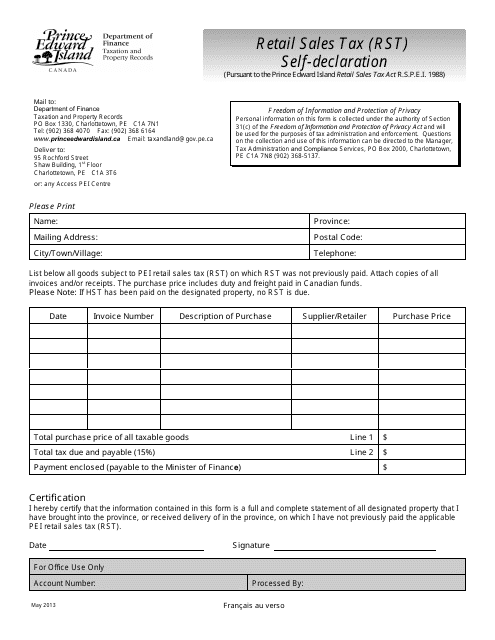

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

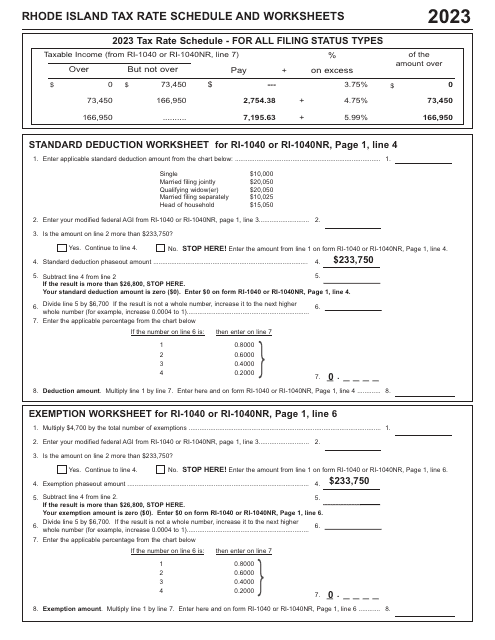

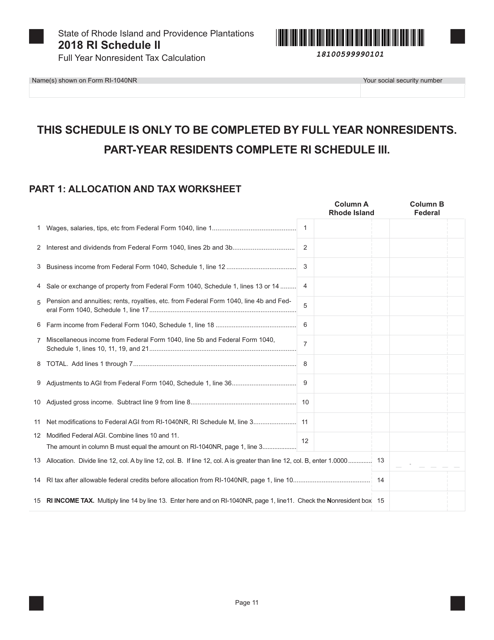

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

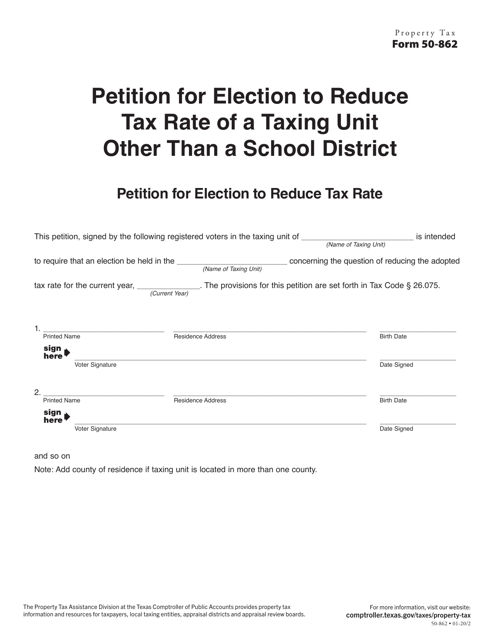

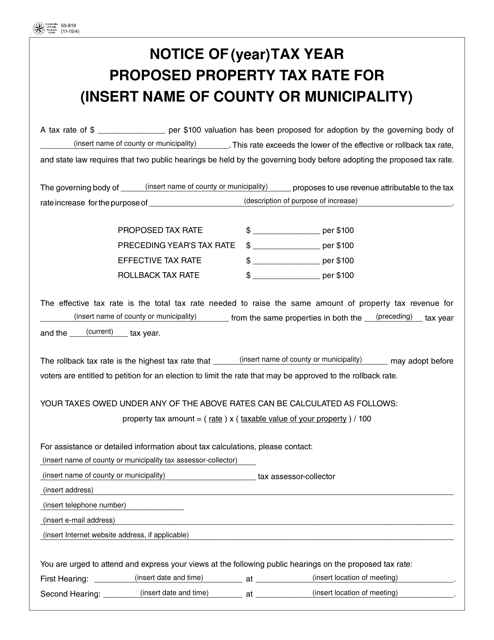

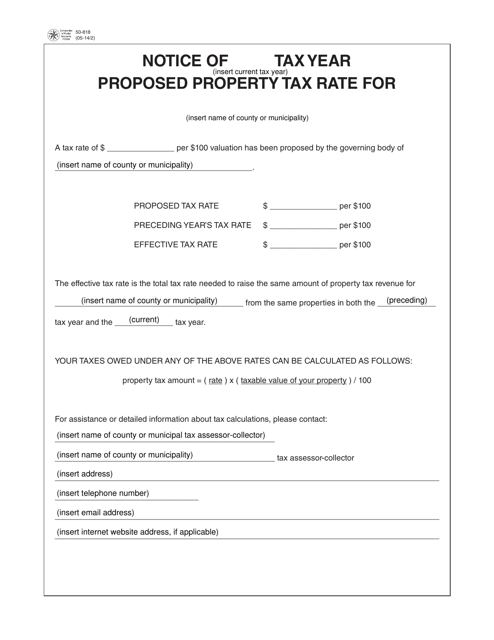

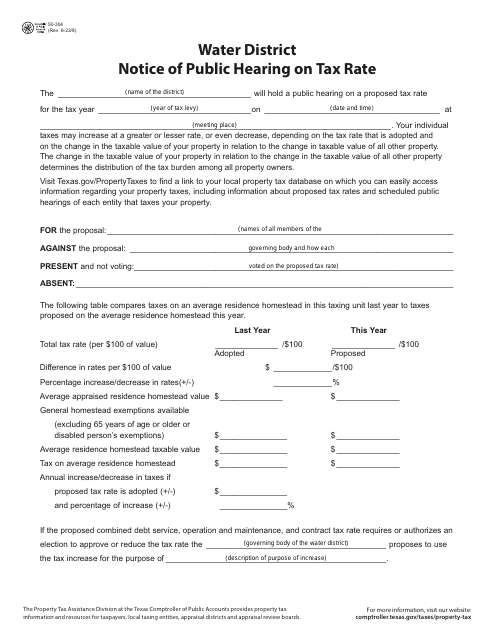

This form is used in Texas to notify residents about the proposed property tax rate for their property.

This form is used for notifying taxpayers in Texas about the proposed tax rate that may be applied.

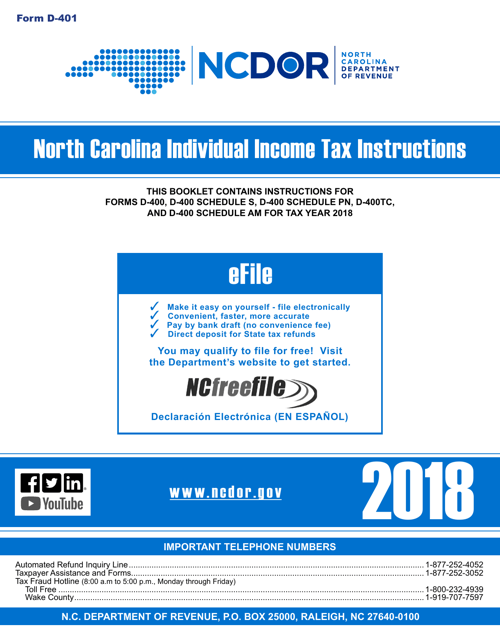

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

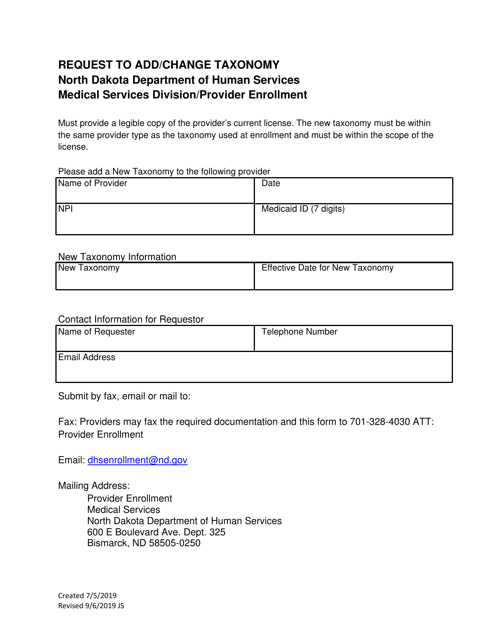

This document is a request form used in North Dakota to add or change a taxonomy.