Tax Rates Templates

Documents:

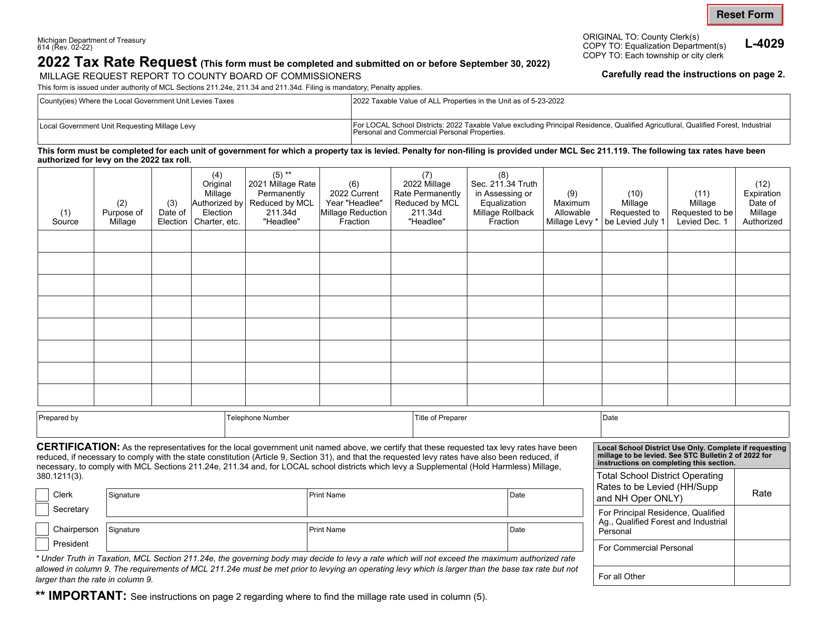

116

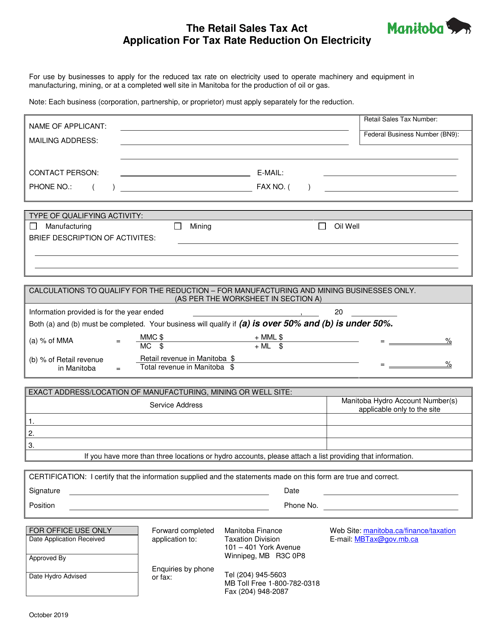

This form is used for applying for a tax rate reduction on electricity in Manitoba, Canada. It allows residents to potentially receive a lower tax rate on their electricity bills.

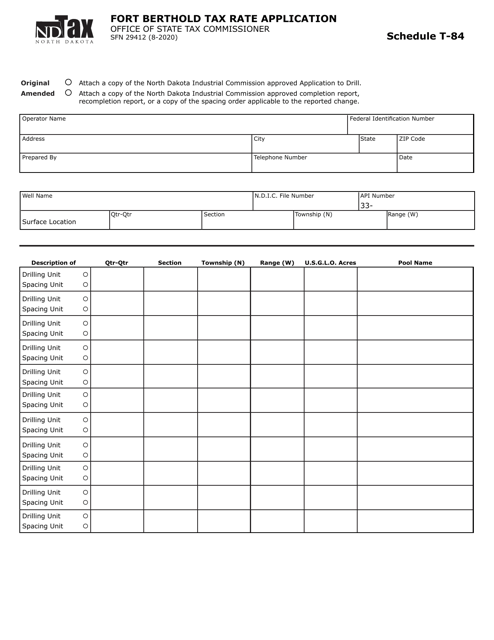

This form is used for applying for a tax rate on Fort Berthold in North Dakota.

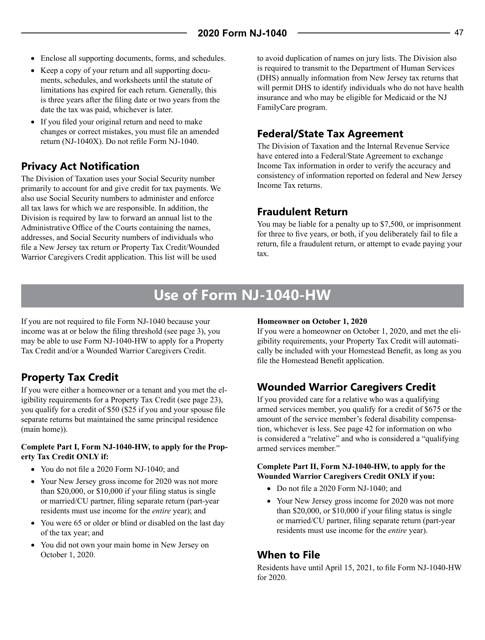

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

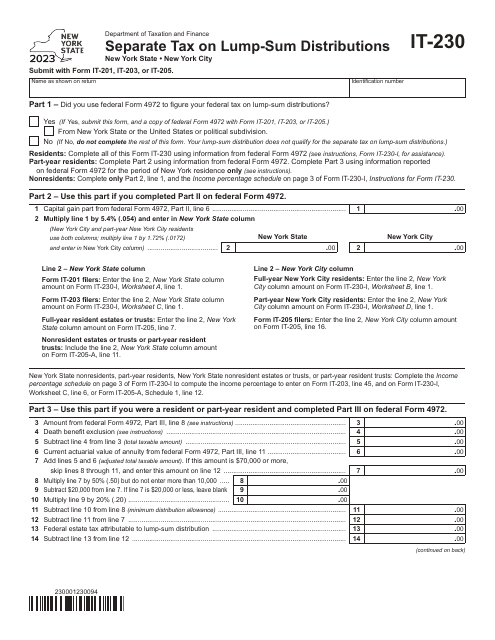

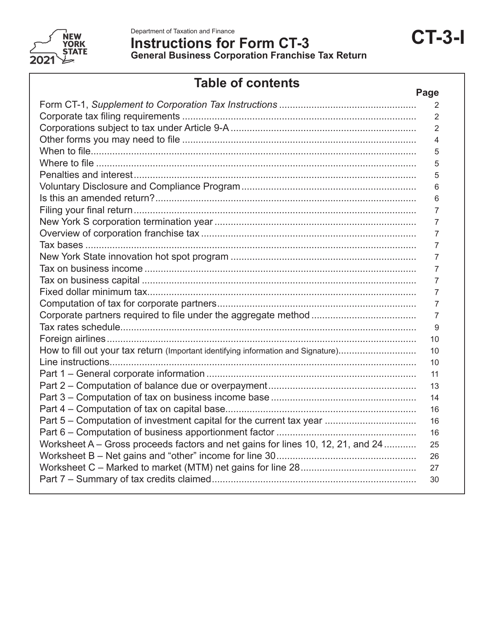

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

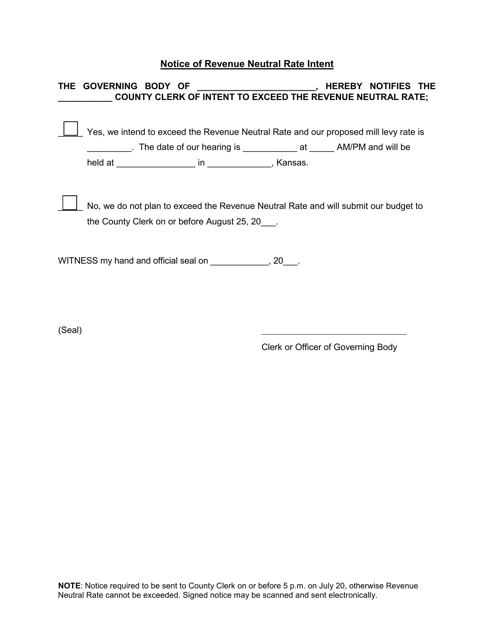

This type of document is a notice issued by the state of Kansas regarding their intent to determine a revenue neutral rate. It may contain information about how the state plans to maintain revenue neutrality in regards to taxes or any changes that may be made.

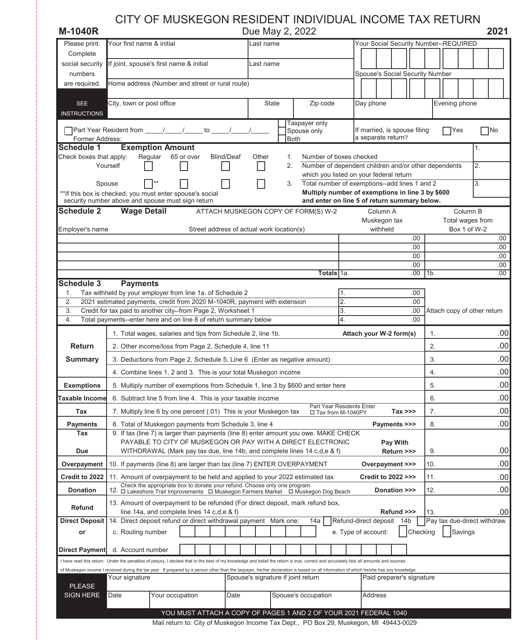

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.

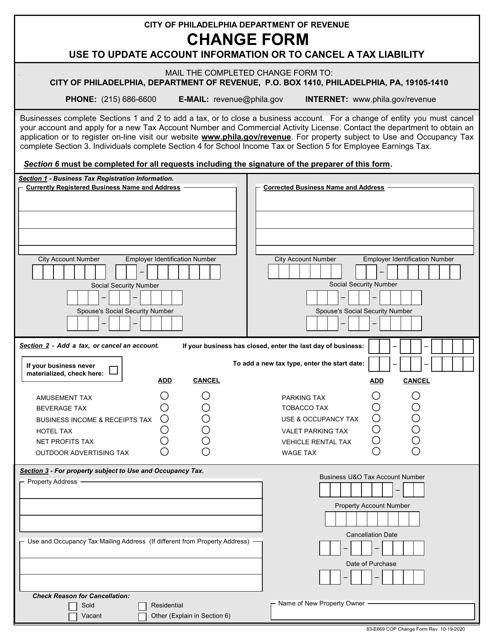

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

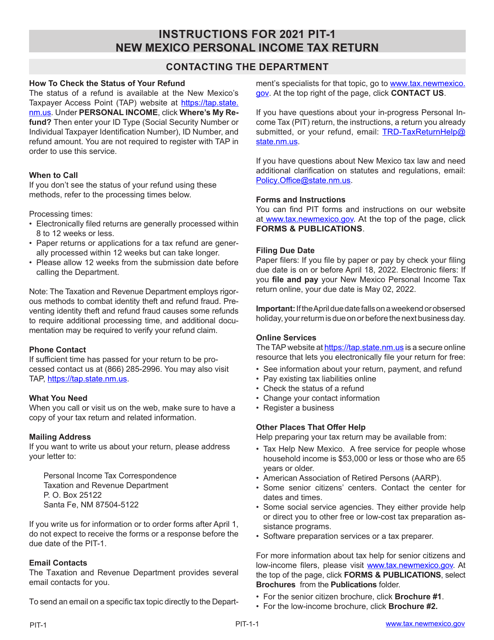

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

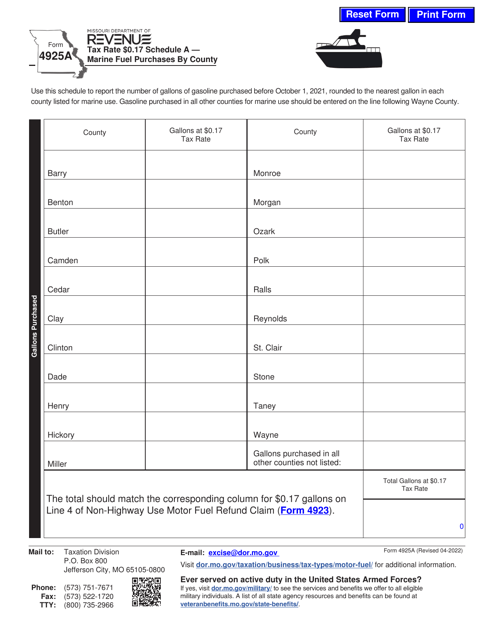

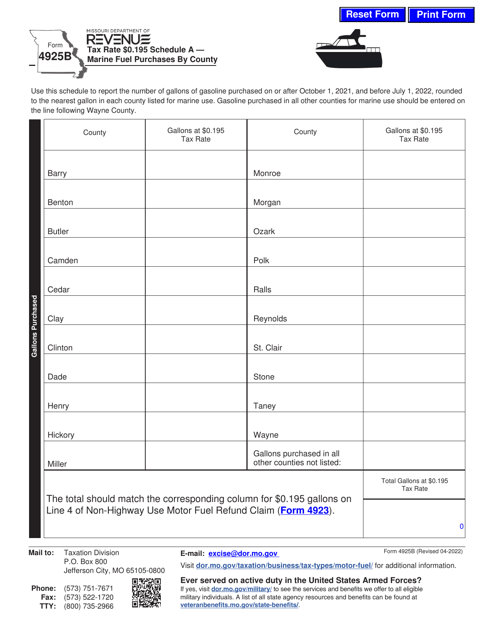

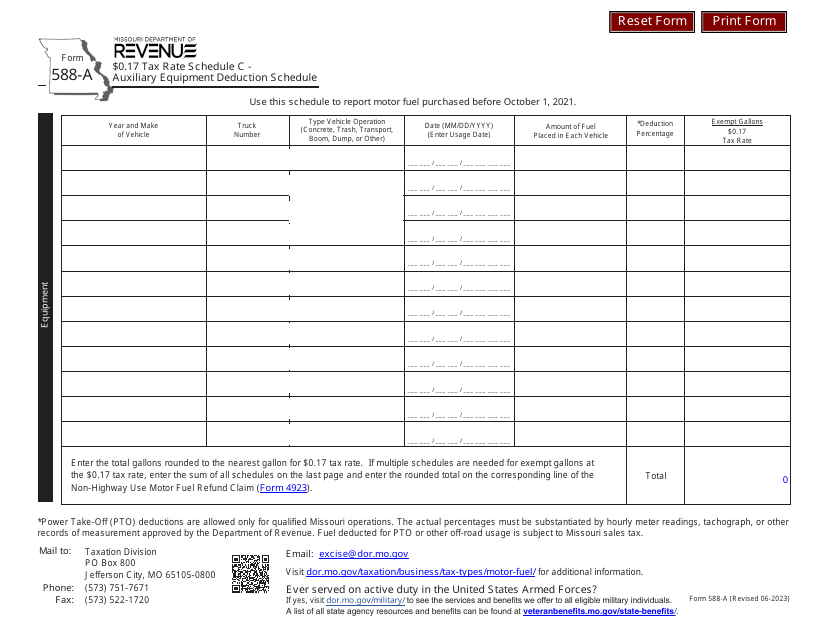

This Form is used for reporting marine fuel purchases by county in Missouri and the associated tax rate of $0.17.

This document is used to report marine fuel purchases by county in Missouri for tax purposes.

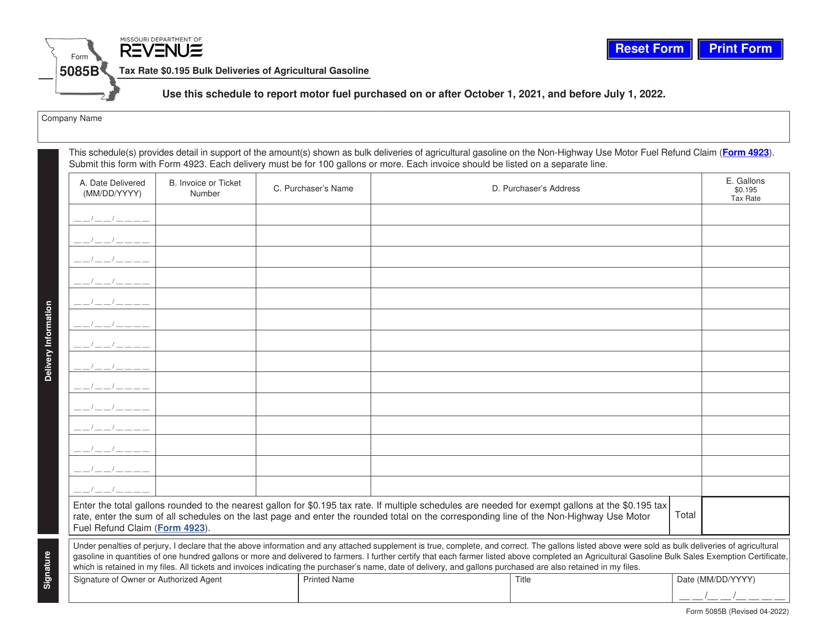

This form is used for reporting and paying a tax rate of $0.195 on bulk deliveries of agricultural gasoline in the state of Missouri.

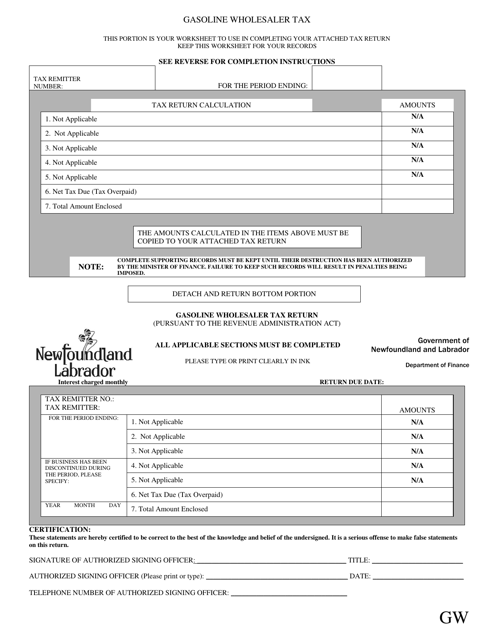

This document is for the Gasoline Wholesaler Tax in Newfoundland and Labrador, Canada. It explains the tax regulations for wholesalers who sell gasoline in the province.

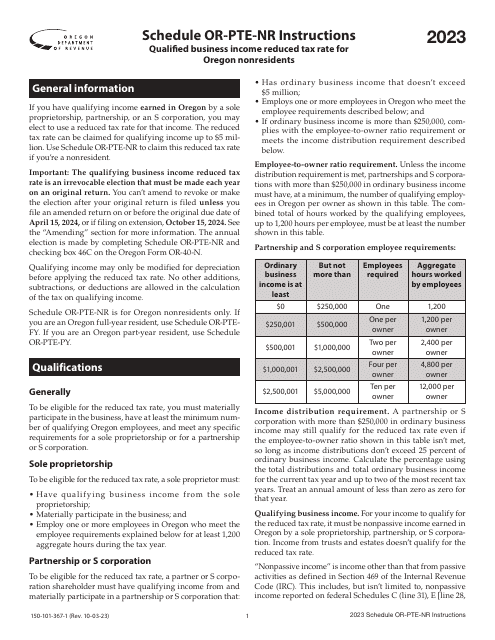

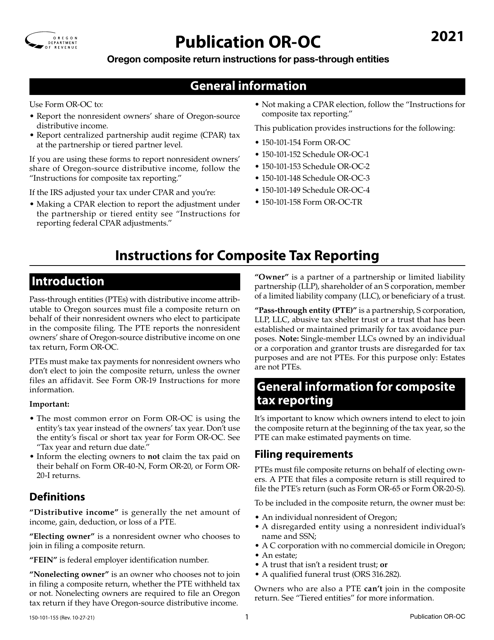

This document provides instructions for completing Form OR-OC, which is used by pass-through entities in Oregon to file their composite return.

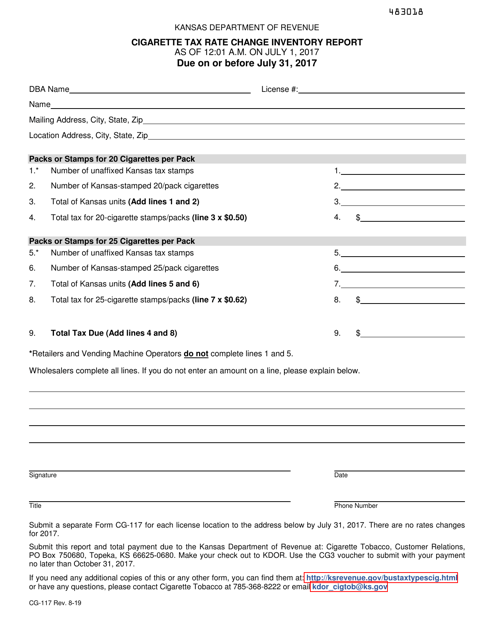

This form is used for reporting changes in cigarette tax rates in Kansas. It is used to inventory and track the updated tax rates for cigarettes in the state.