Economic Development Templates

Economic Development - Empowering Communities and Driving Growth

Welcome to our resource center dedicated to economic development, where we explore strategies, programs, and initiatives aimed at fostering job creation, enhancing prosperity, and nurturing vibrant communities. Our collection of documents provides insights into various aspects of economic development, offering valuable information for policymakers, entrepreneurs, and community leaders.

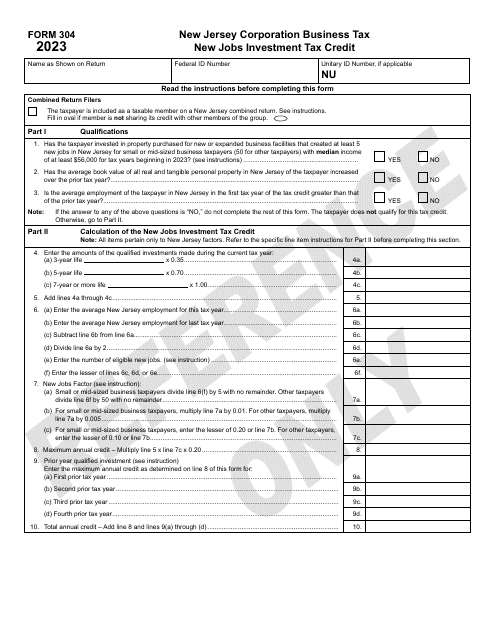

From tax credits and incentives to land use regulations and expansion programs, our documents cover a broad range of topics that can help guide economic development efforts in different regions across the United States and Canada. Whether you are a government official, a business owner, or an individual interested in driving economic growth, these resources will equip you with practical insights and actionable advice from experts in the field.

Discover how states like Maryland and Texas have leveraged tax credits and reports to spur job creation and attract investments. Dive into research conducted by the Urban Institute, shedding light on the barriers created by land use regulations and their impact on economic rents. Explore incentive programs like the Toledo Expansion Incentive Program in Ohio that are aimed at encouraging business growth and expansion. Learn about the Section 3 Business Concern Certification offered by the City of San Diego, California, to promote economic opportunities for individuals and businesses.

With alternate names such as economic development, our collection of documents represents an invaluable resource for anyone interested in understanding and actively participating in the economic growth and development of their community. These resources will provide you with the knowledge and tools necessary to navigate the complexities of economic development, empowering you to make informed decisions and contribute to the sustainable growth of your region.

Take a deep dive into our collection of documents on economic development and unlock the potential to transform your community into a thriving hub of opportunity and prosperity.

Documents:

174

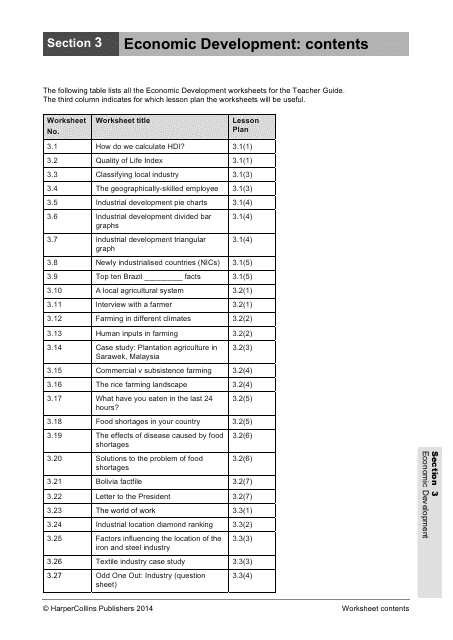

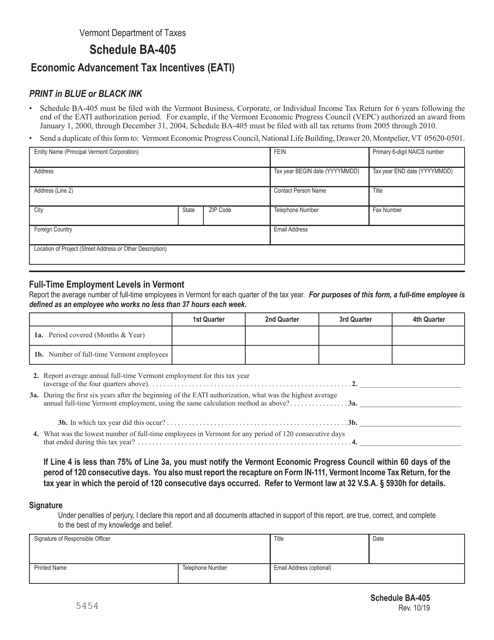

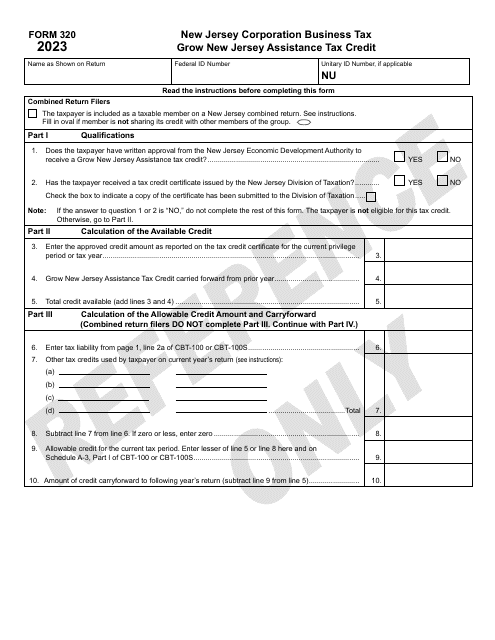

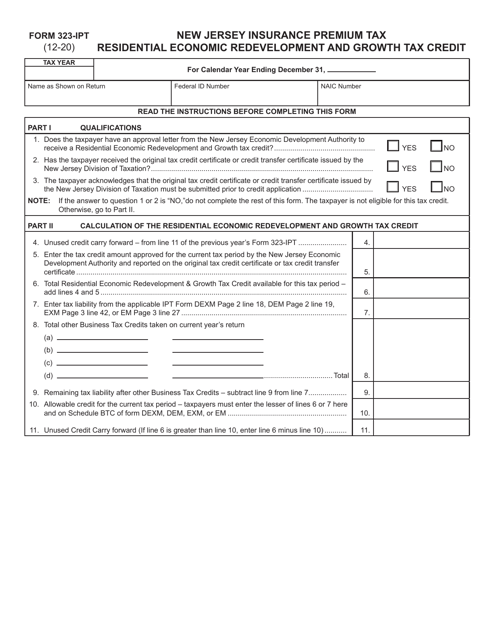

This document is used for assessing and tracking economic development activities and progress. It helps evaluate and plan strategies for promoting economic growth and improving the overall well-being of a community or region.

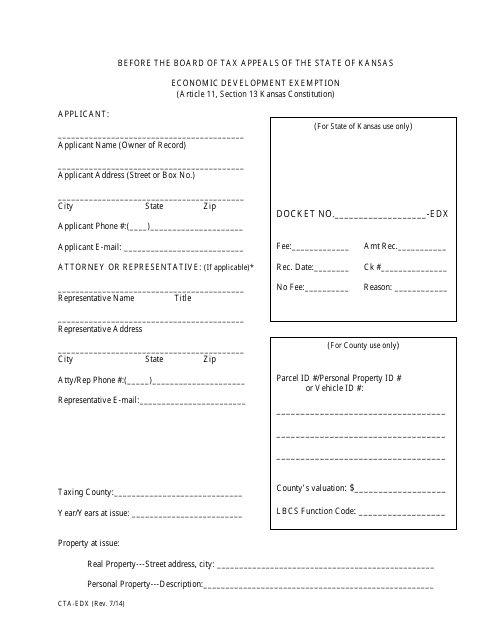

This type of document is used to apply for an economic development exemption in the state of Kansas. It allows businesses to potentially qualify for tax benefits and incentives in order to encourage job creation and investment in the local economy.

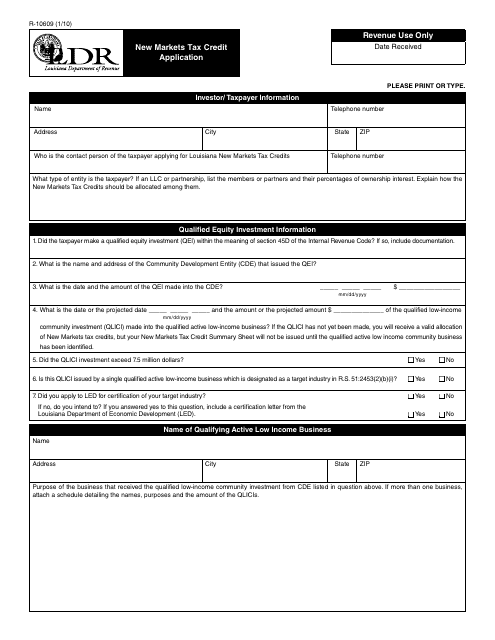

This form is used for applying for the New Markets Tax Credit program in Louisiana. It allows businesses to request tax credits for investments that benefit low-income communities in the state.

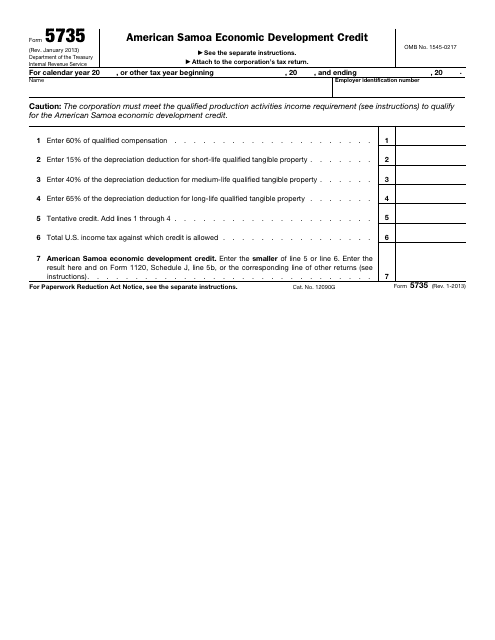

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

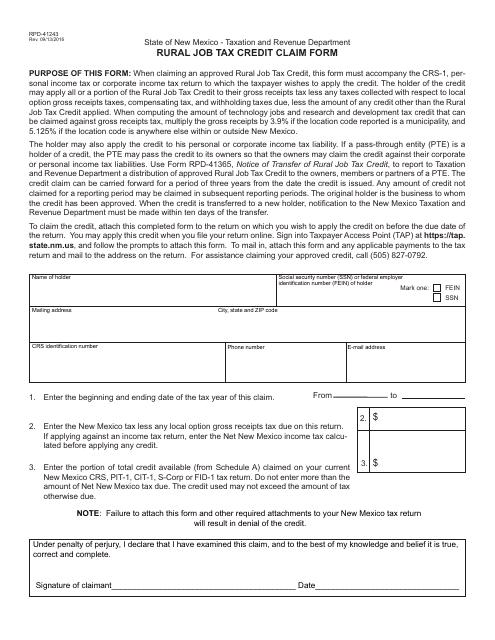

This form is used for claiming the rural job tax credit in the state of New Mexico. It is for businesses that have created jobs in rural areas and are eligible for this tax credit.

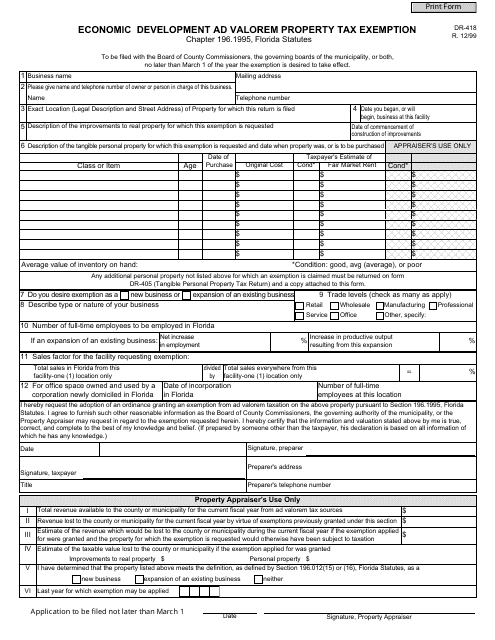

This form is used for applying for an economic development ad valorem property tax exemption in the state of Florida.

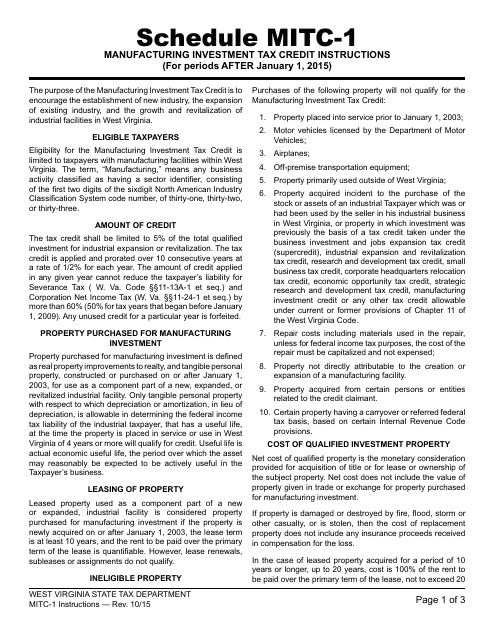

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

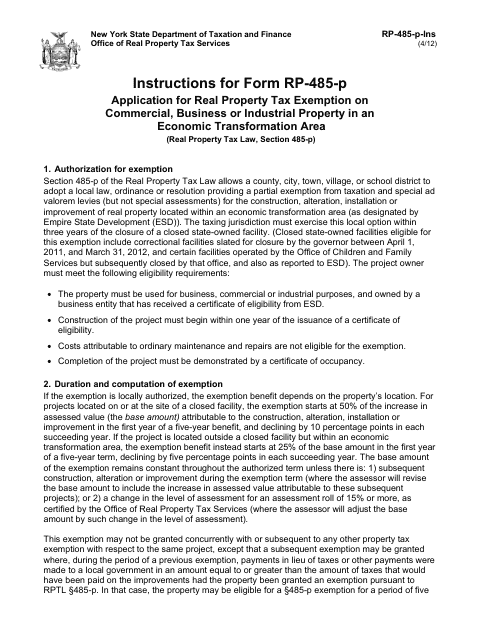

This Form is used for applying for a real property tax exemption on commercial, business or industrial property in an Economic Transformation Area in New York.

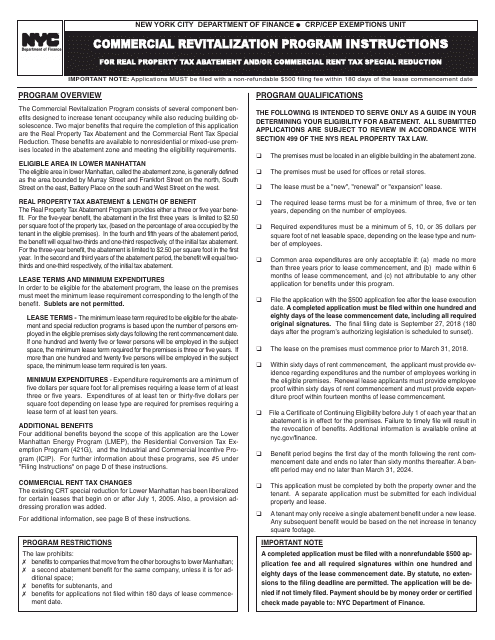

This document provides instructions for the Commercial Revitalization Program in New York City. It explains how to participate in the program and outlines the steps and requirements.

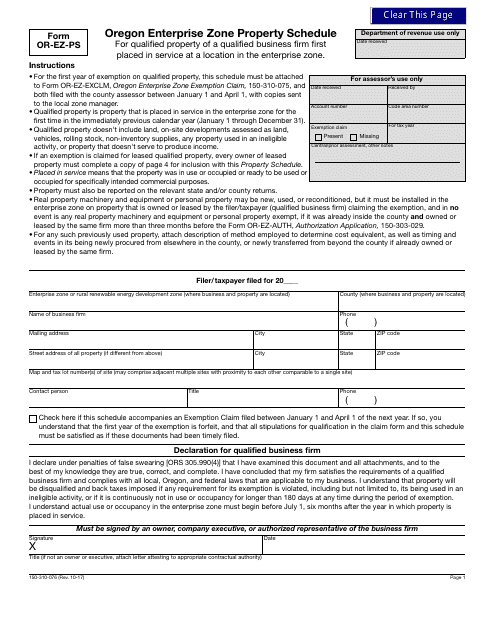

This Form is used for reporting property schedule information for the Oregon enterprise zone program.

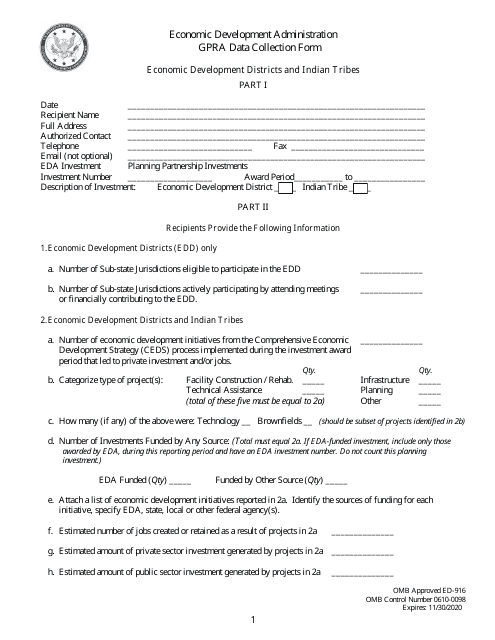

This form is used for collecting data on economic development districts and Indian tribes for the Government Performance and Results Act (GPRA).

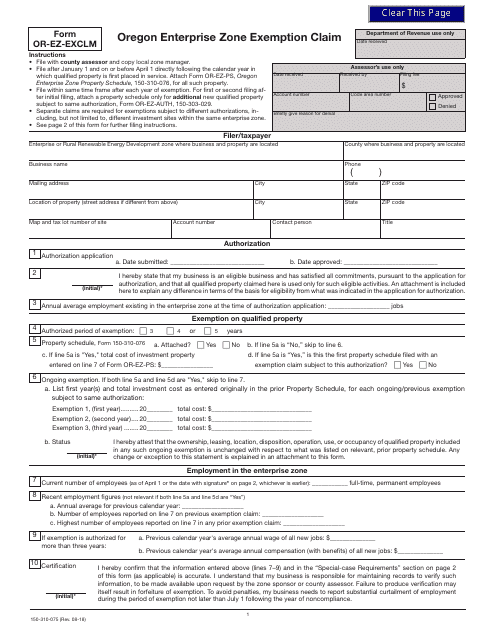

This form is used for claiming an enterprise zone exemption in Oregon. It is specifically for use by businesses to apply for tax incentives and benefits offered by the Oregon Enterprise Zone Program.

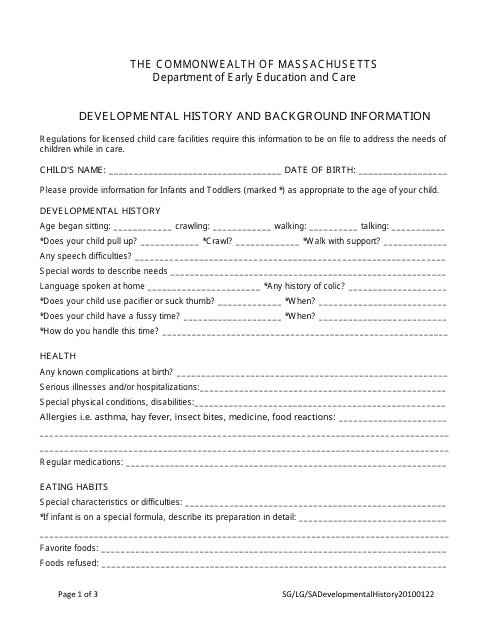

This document provides the developmental history and background information of Massachusetts.

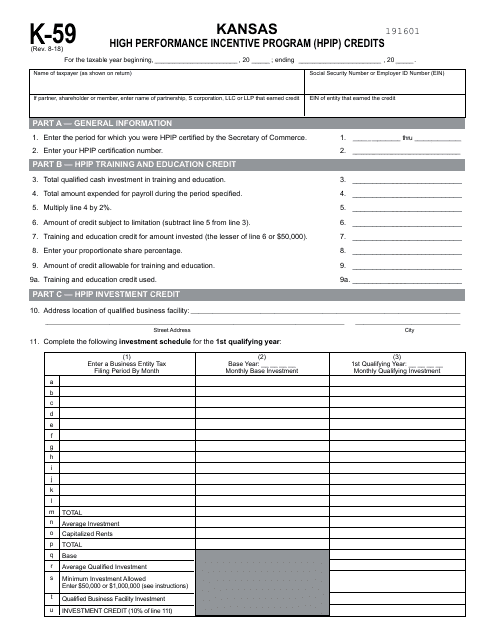

This form is used for claiming Kansas High Performance Incentive Program (HPIP) credits in the state of Kansas.

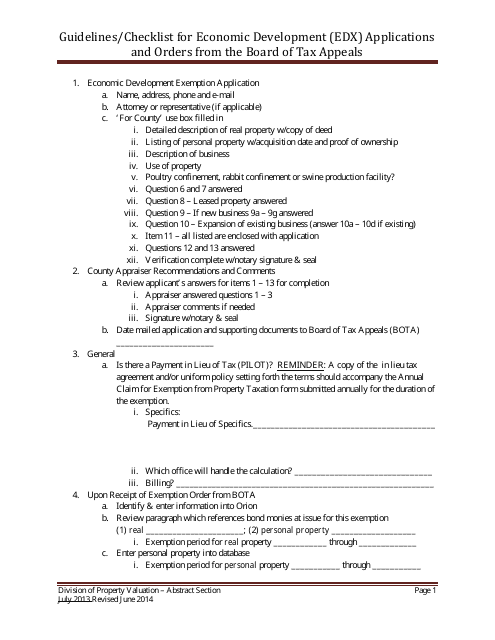

This checklist provides guidelines for economic development applications and orders from the Board of Tax Appeals in Kansas. It helps ensure proper documentation and compliance with the established procedures.

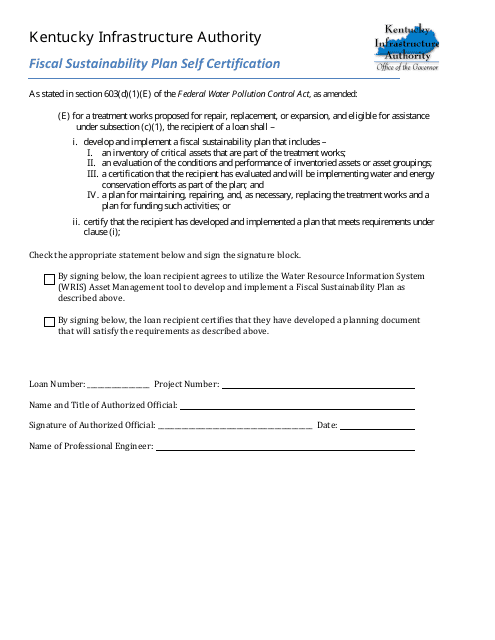

This document is for individuals in Kentucky to certify their compliance with the fiscal sustainability plan. It ensures financial responsibility and long-term stability.

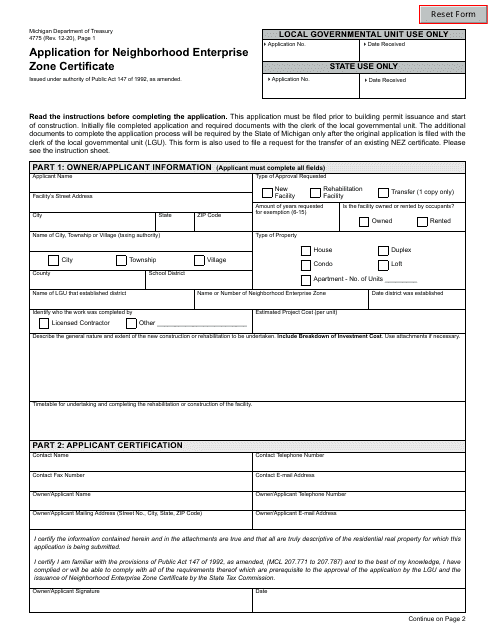

This Form is used for applying to the Michigan Rail Loan Assistance Program. The program provides financial assistance to individuals and organizations seeking to develop or improve rail infrastructure in Michigan.

This Form is used for conducting an economic impact survey in Michigan related to Bidco financing.

This document is used for applying veteran-owned preference in Minnesota. It is important for veterans who own a business and want to participate in government procurement opportunities in Minnesota.

This document is used for completing the final report for the Montana Main Street Grant program in the state of Montana.

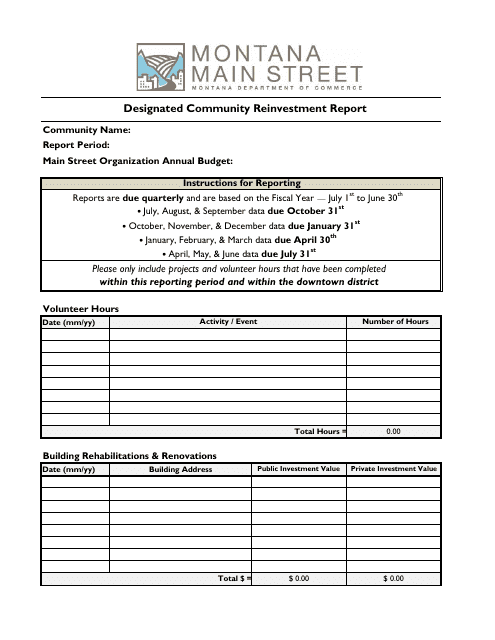

This document is used for reporting on community reinvestment efforts in the state of Montana. It provides information on projects and initiatives aimed at improving the economic conditions in designated areas.

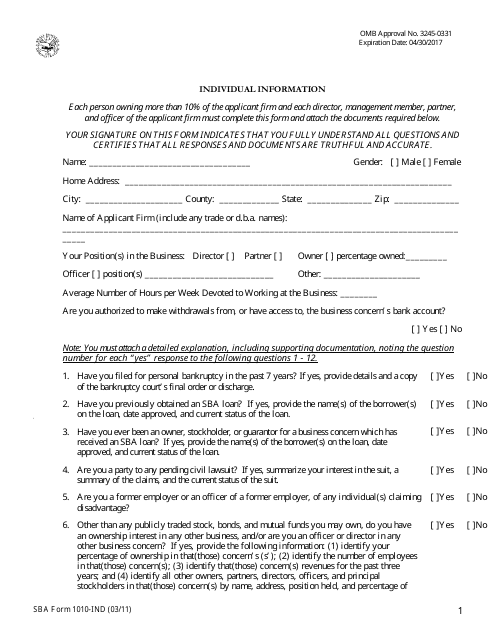

This form is completed by each individual who owes more than 10% of a business when applying for 8(a) Business Development Program.

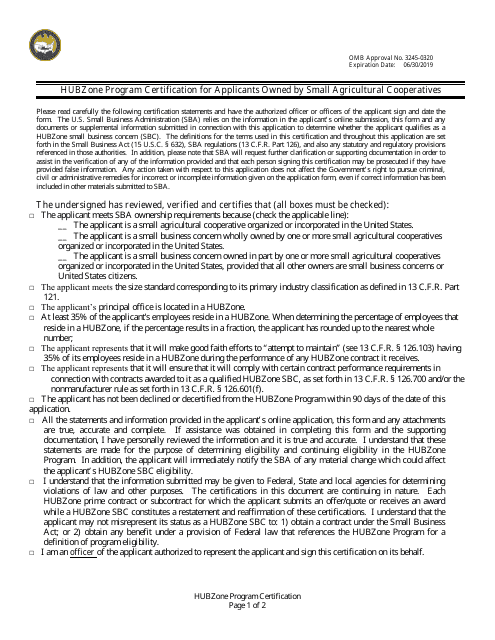

This document is for small agricultural cooperatives who want to apply for certification under the HUBZone Program. The HUBZone Program is a government initiative that helps small businesses in historically underutilized areas gain access to federal contracting opportunities.

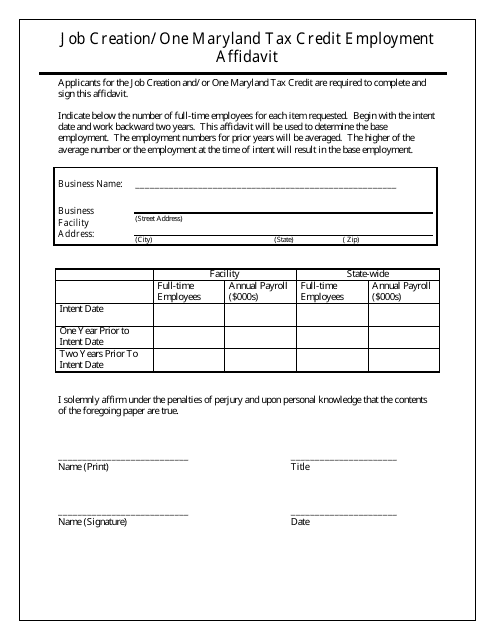

This Form is used for claiming the One Maryland Tax Credit Employment Affidavit, which encourages job creation in Maryland by providing tax credits to businesses that meet certain eligibility criteria.

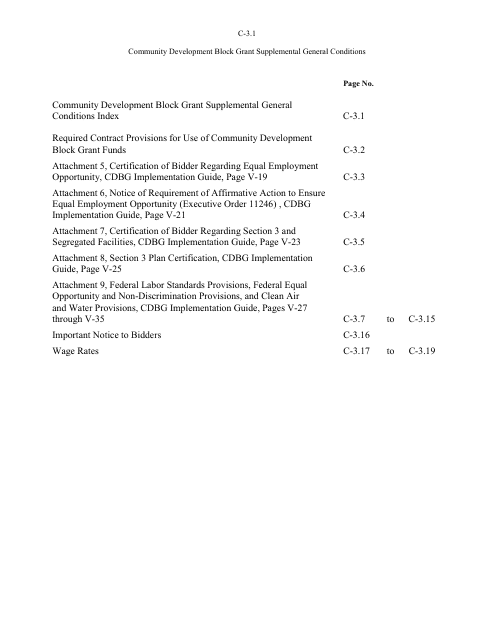

This document outlines the general conditions for the Community Development Block Grant Supplemental program in New Hampshire. It covers the requirements and guidelines for project funding and implementation.

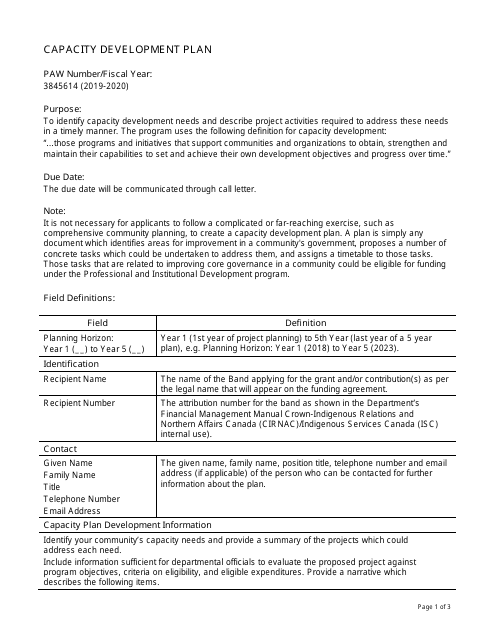

This document is used for creating a Capacity Development Plan in Canada. It provides instructions on how to fill out Form PAW3845614.

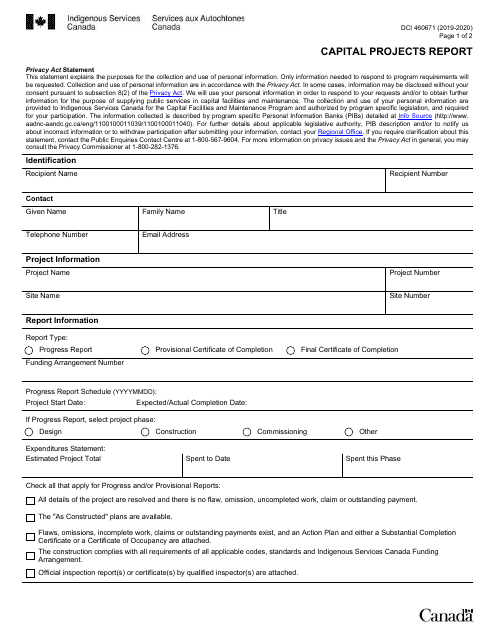

This form is used for submitting capital projects reports in Canada. It allows individuals or organizations to provide detailed information about their ongoing or planned projects, including project goals, timelines, budgets, and progress updates. This document is essential for tracking and managing capital projects effectively.

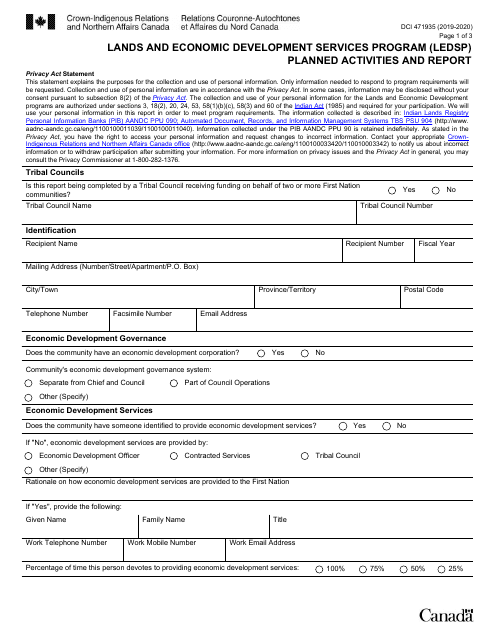

This Form is used for reporting planned activities and progress in the Lands and Economic Development Services Program (LEDSP). It is specific to Canada.

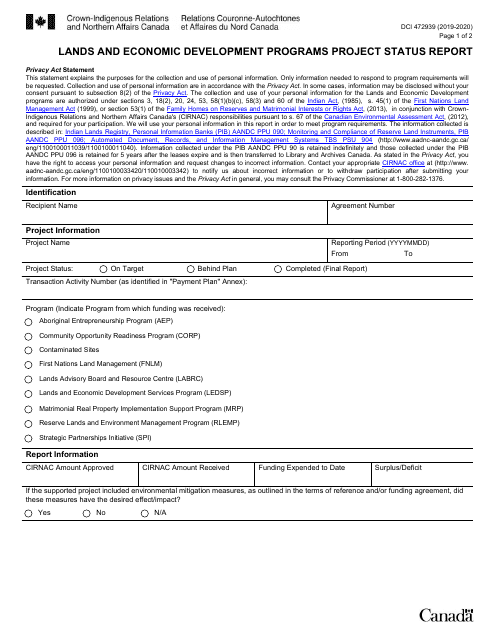

This Form is used for reporting the status of lands and economic development programs projects in Canada.

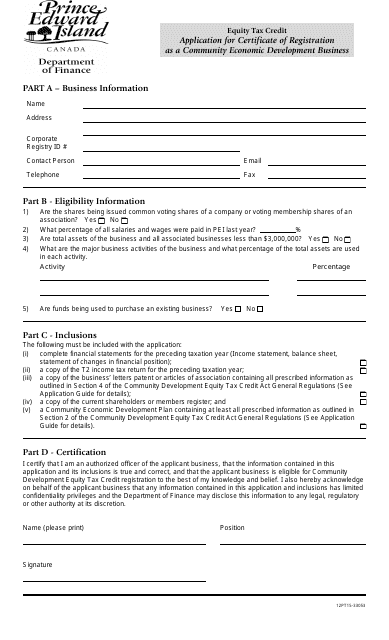

This document is an application form used by businesses in Prince Edward Island, Canada to apply for a Certificate of Registration as a Community Economic Development Business. It is a necessary step for businesses to access certain economic development programs and opportunities in the province.

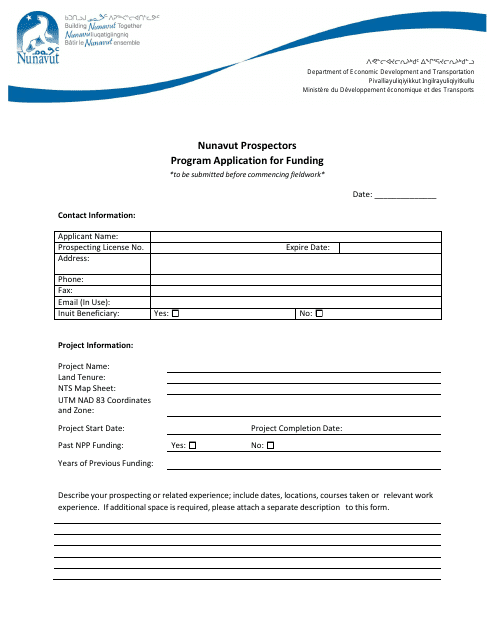

This document is an application form used for the Nunavut Prospectors Program in Canada. It is for individuals or organizations seeking funding for prospecting projects in the Nunavut region.

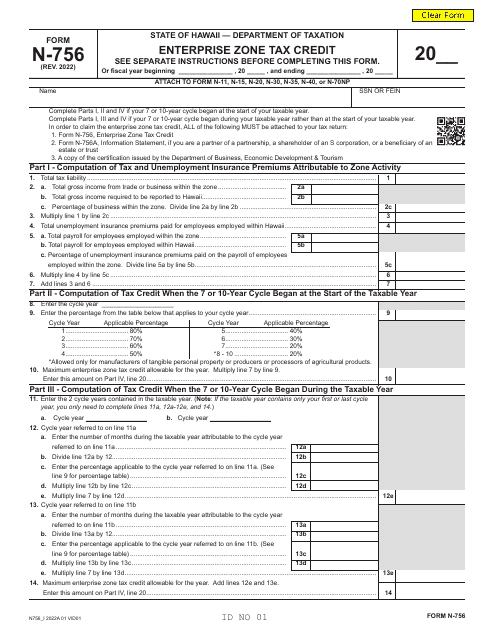

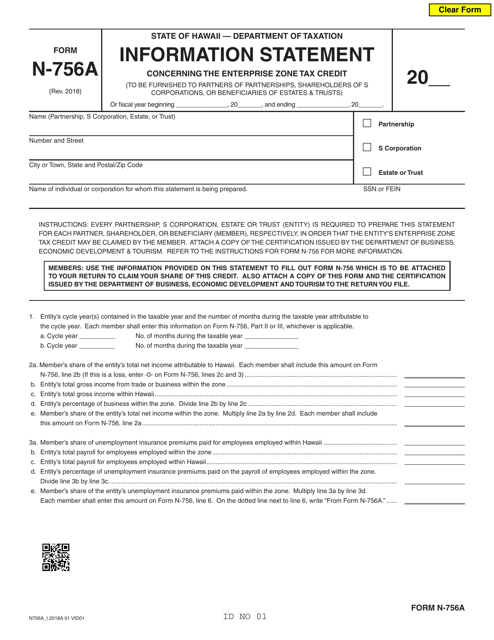

This document provides information about the Enterprise Zone Tax Credit specific to Hawaii. It includes details that individuals and businesses need to complete the Form N-756A.